Hashrate Index Roundup (June 3, 2024)

What the hell is going on with Bitcoin's hashrate?

Happy Monday, y'all!

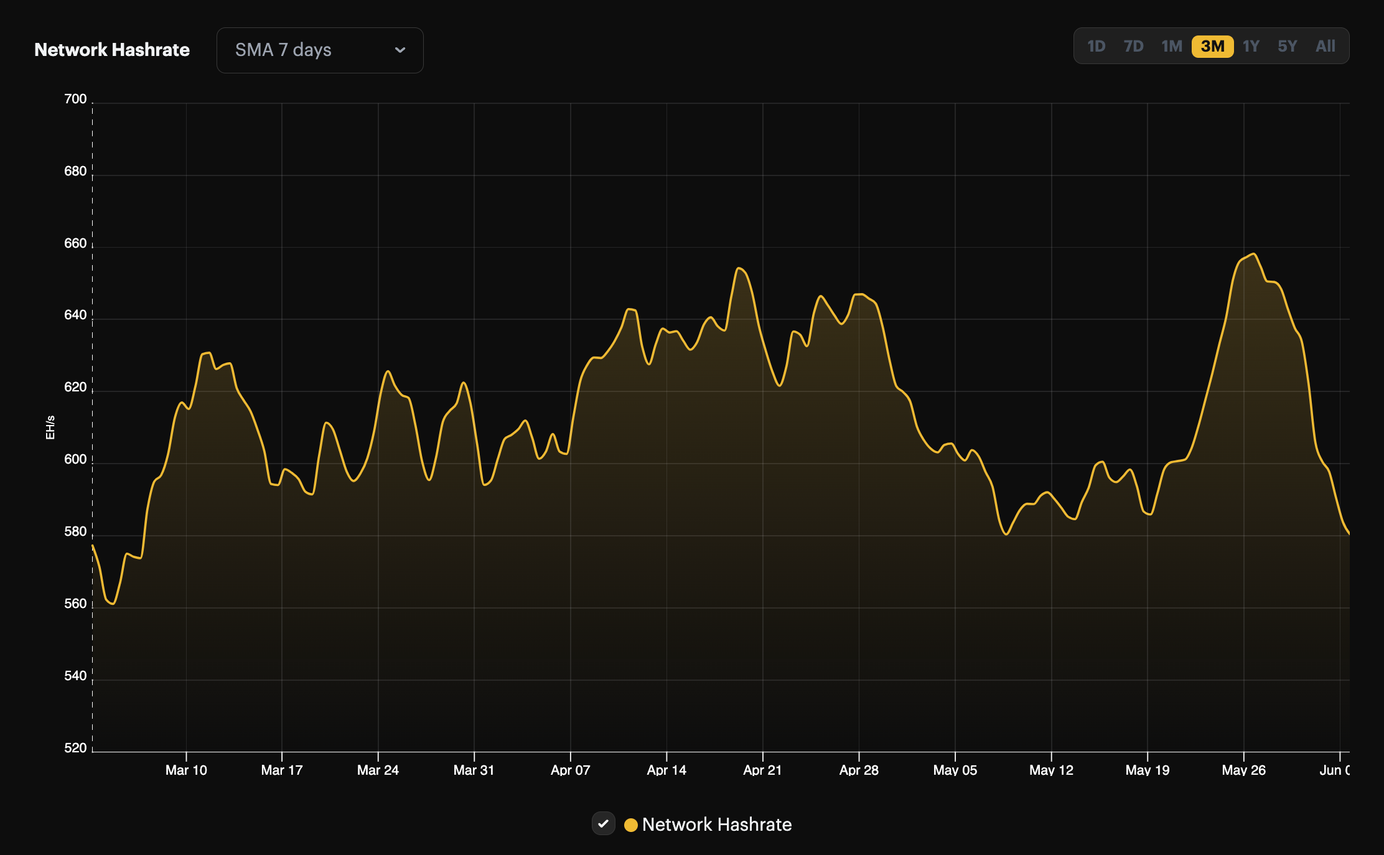

We're in the month of Gemini, folks, the star sign associated with dual personalities and mercurial natures. And if you didn't know that from reading star charts, you might be able to divine it from looking at Bitcoin's hashrate chart, which has been all over the place as of late.

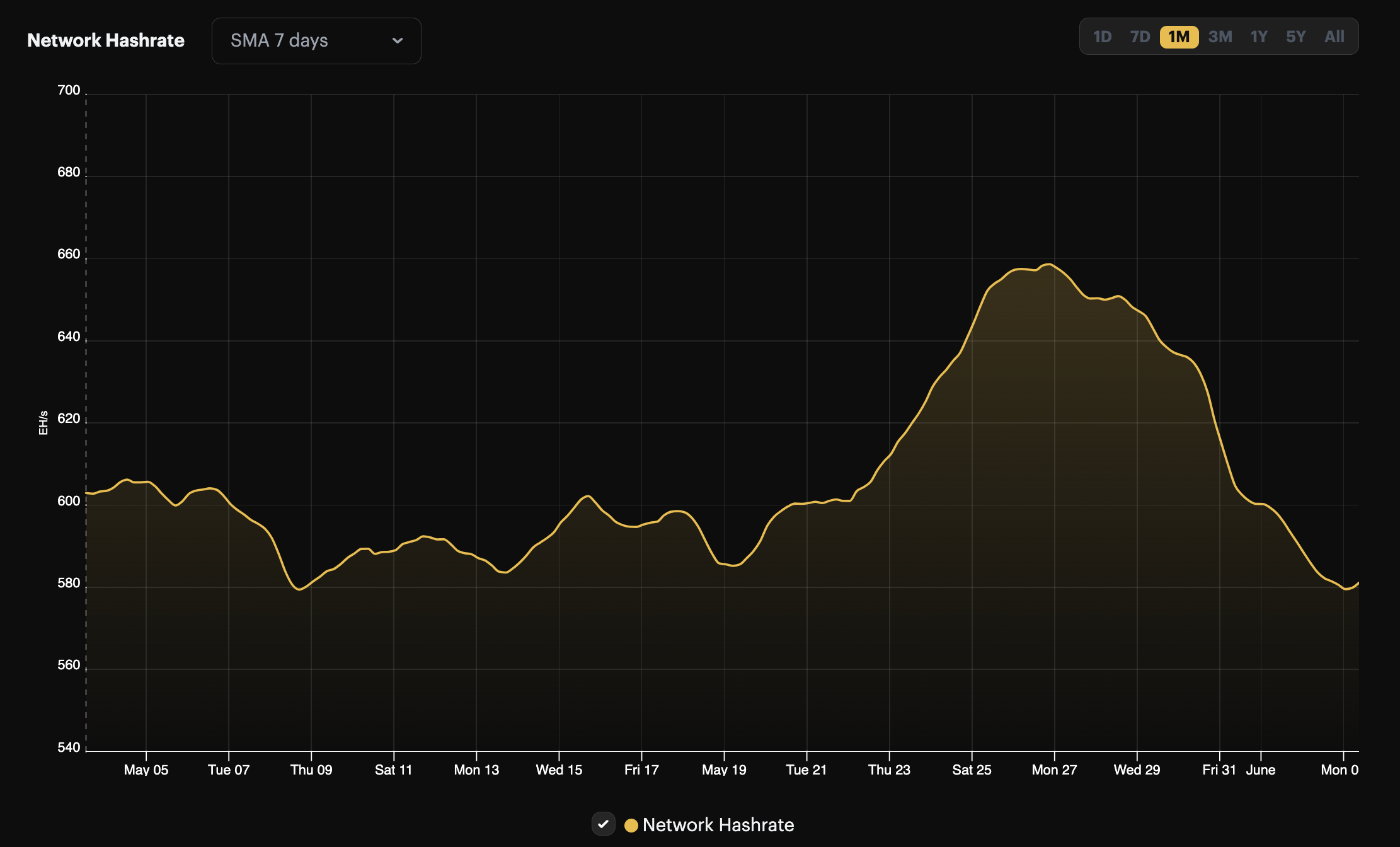

Since the halving, hashrate has been janus-faced, oscillating wildly between bullish surges and bearish tumbles. As we wrote last week, Bitcoin's 7-day average hashrate recently hit an all-time high of 659 EH/s. Since then, it's declined an incredible 11% to 585 EH/s at the time of writing.

All of this yo-yoing spells uncertainty for hashprice. Last week, our difficulty adjustment estimator was projecting a 5-6% increase. Now, that estimate has fallen to 1.6% and could fall farther if hashrate continues to taper off the network. Of course, this is good news for miners because hashprice won't be as negatively impacted by the next adjustment as we previously thought.

The question still remains: What the hell is going on with Bitcoin's hashrate? Was the sudden surge last week from miners plugging in new machines? And was this off set by other miners unplugging roughly 70 EH/s worth of equipment in the aftermath of the Halving?

We're not totally sure, but with one month left to go in Q2, we're curious to see if Bitcoin's hashrate closes the quarter with negative growth, something that last happened in Q3-2023 as summer heatwaves stifled mining operations in North America.

The hotspots for Bitcoin mining (the US and, notably, Texas) are entering their hottest months once again. When you couple the deflationary pressure that summer can exert on hashprice with the Halving's impact on margins, it's possible that the recent all-time high of 659 EH/s could be a temporary ceiling for Bitcoin's hashrate – at least until summer cools off.

Sponsored by Luxor Firmware

At $53/PH/Day, hashprice is close to breakeven for many miners. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

Luxor Hashrate Forwards Market Update

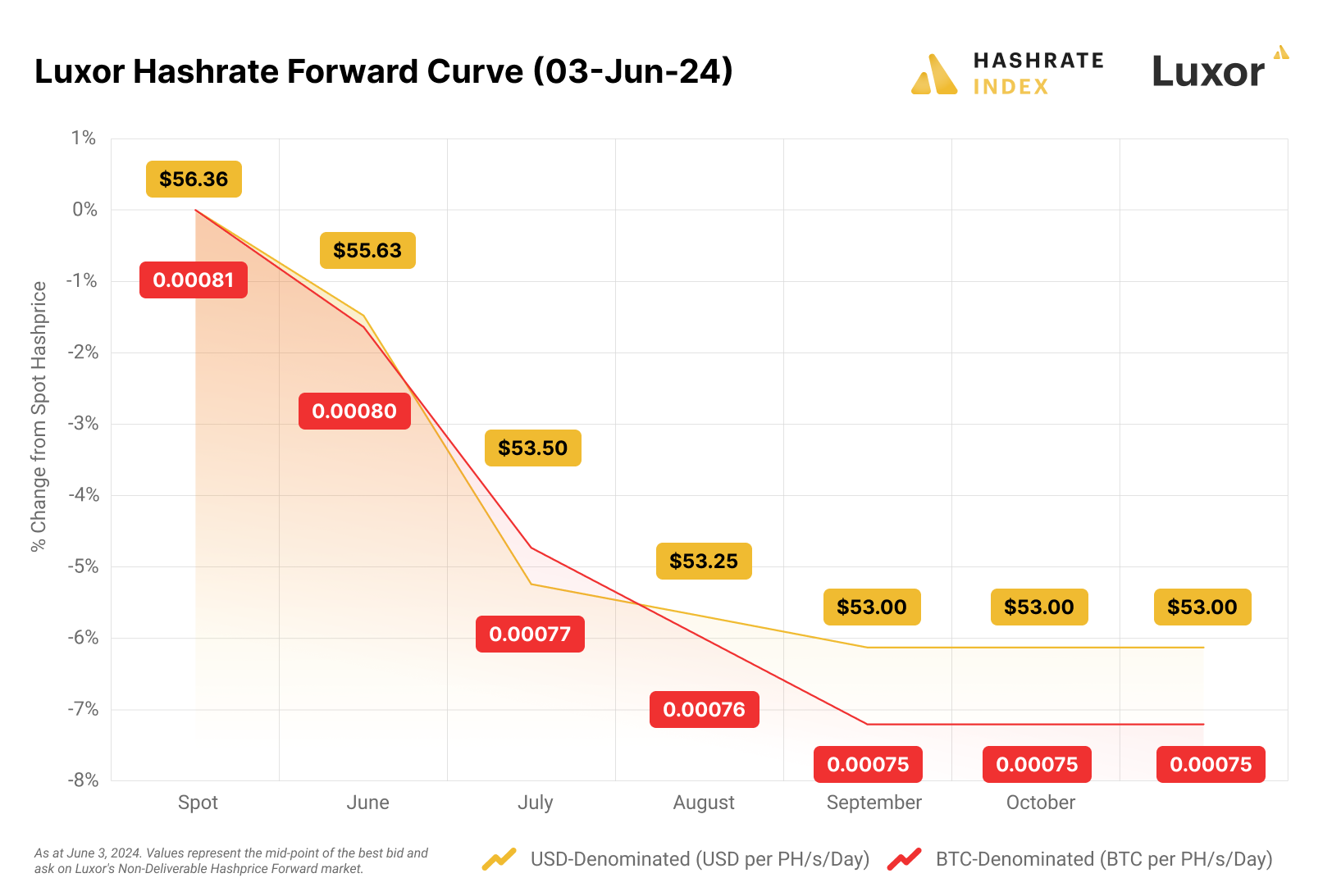

After trading in contango since the Halving, Luxor's Hashrate Forwards markets are once again trading in backwardation, which means that the future price of hashrate is lower than the current spot price.

The month of May is behind us, which means we have an updated chart for the monthly Hashrate Forward Curves versus spot hashprice averages.

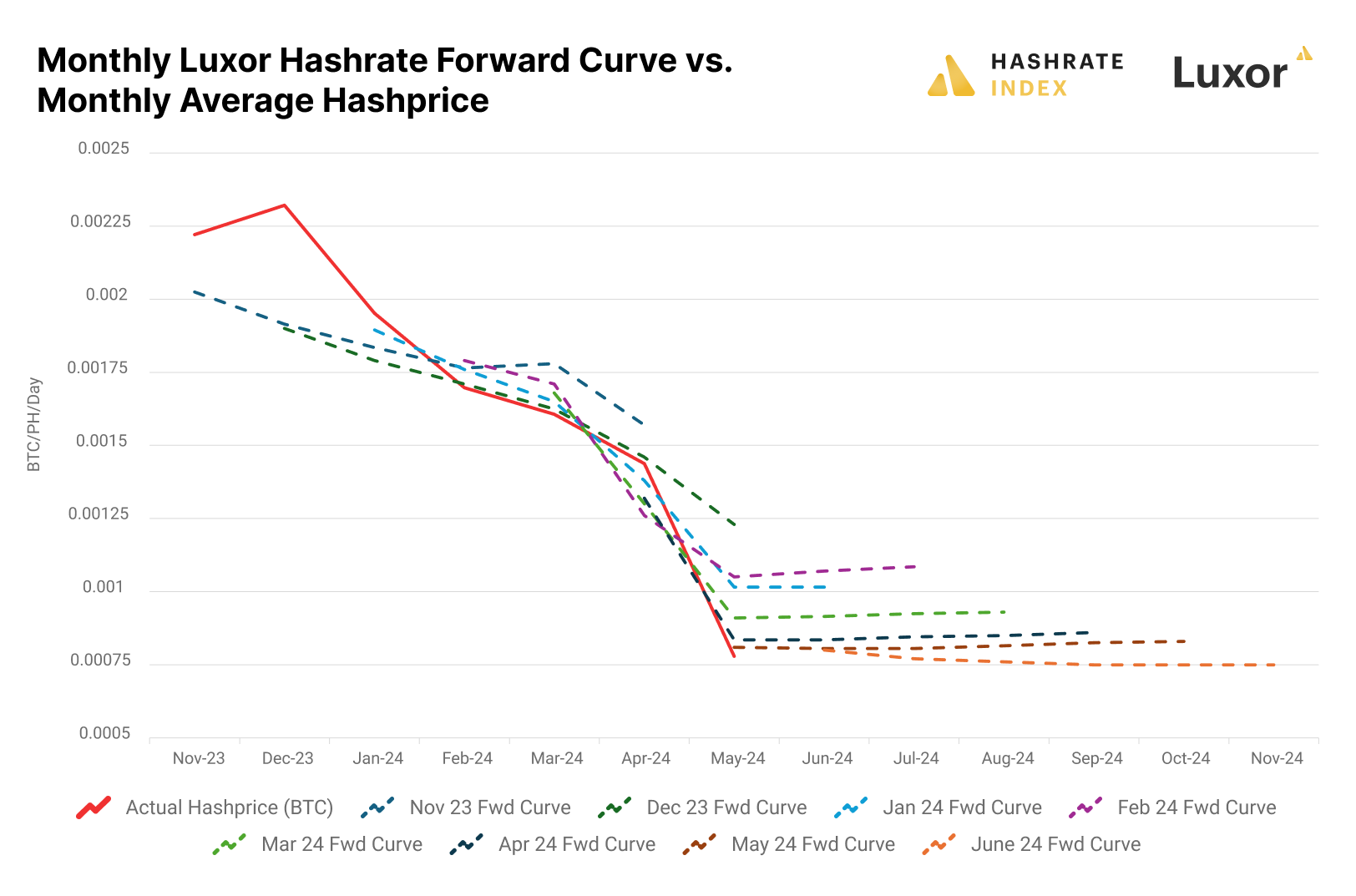

We derive this curve by taking an average of the lowest ask and highest bid on Luxor’s Hashrate Forward order book on the first trading week of each calendar month for each Forward contract month. So for example, for the November data point, we take the ask-bid average for forward contracts in the first week of November for November, December, January, February, March, and April forward contracts. We then compare these forward prices to monthly average spot prices for hashprice.

Looking at the chart, we can see that hashrate traders have generally been proficient at anticipating hashprice movements. For the month of May, the average BTC hashprice was 0.00078 BTC/PH/Day, whereas the forward curves for May 2024 forward contracts for the first weeks of April and May were 0.00084 BTC/PH/Day and 0.00081 BTC/PH/Day, respectively; miners who locked in these April and May forward curve rates, then, would have earned more by selling their hashrate than if they had mined spot.

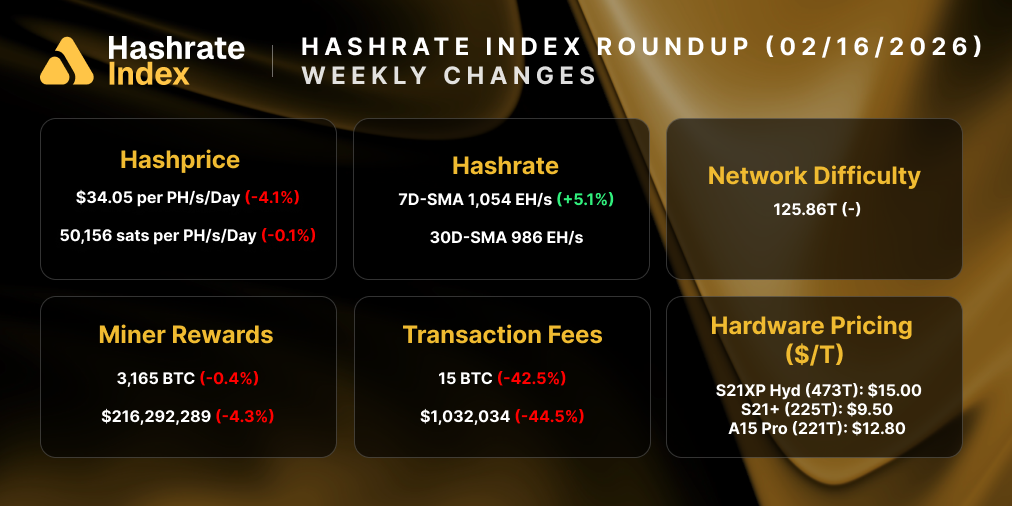

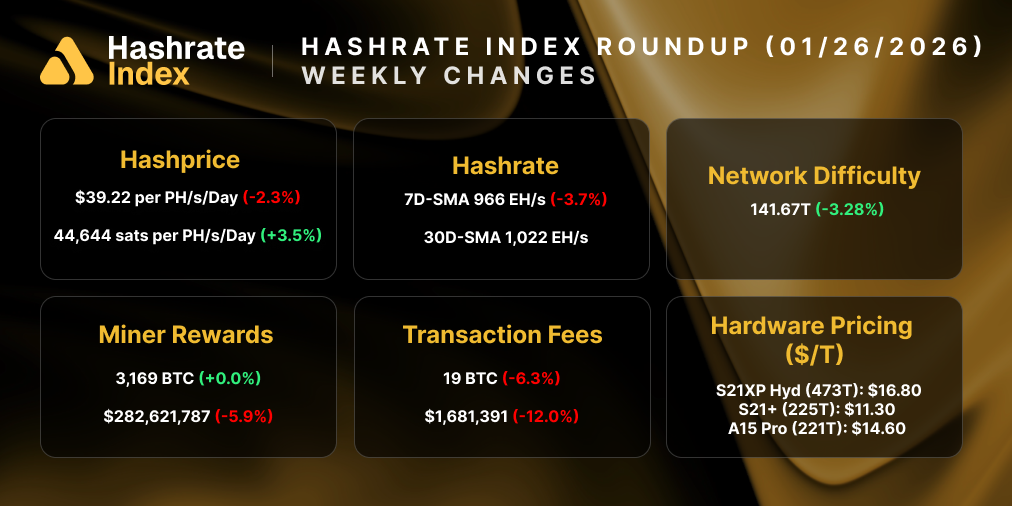

Bitcoin Mining Market Update

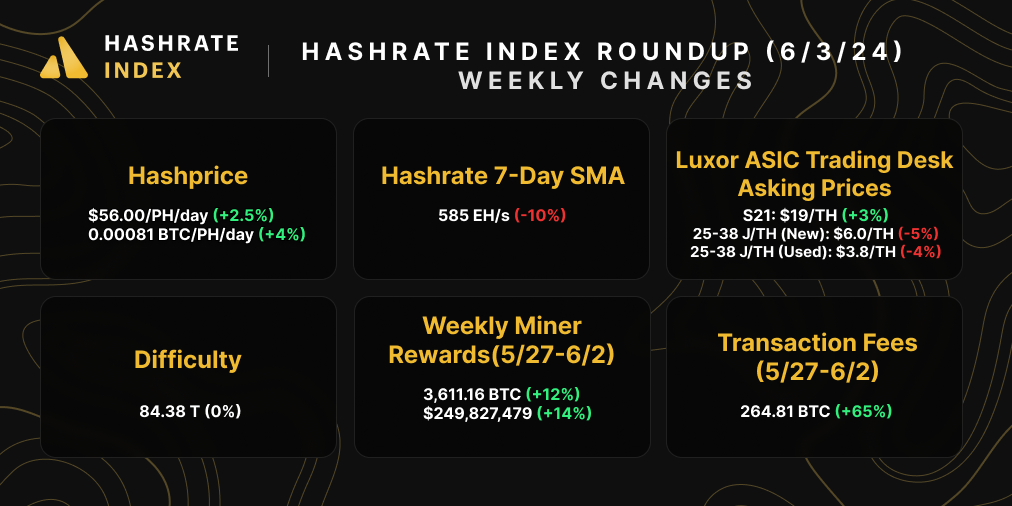

For this week's market update, hashprice is up in both USD and BTC terms, which should make miners happy. More in the happy department: hashrate is getting obliterated and transaction fees continue to climb. In the ASIC market, prices for next-generation rigs like the S21 are seeing price increases, while older models continue to fall.

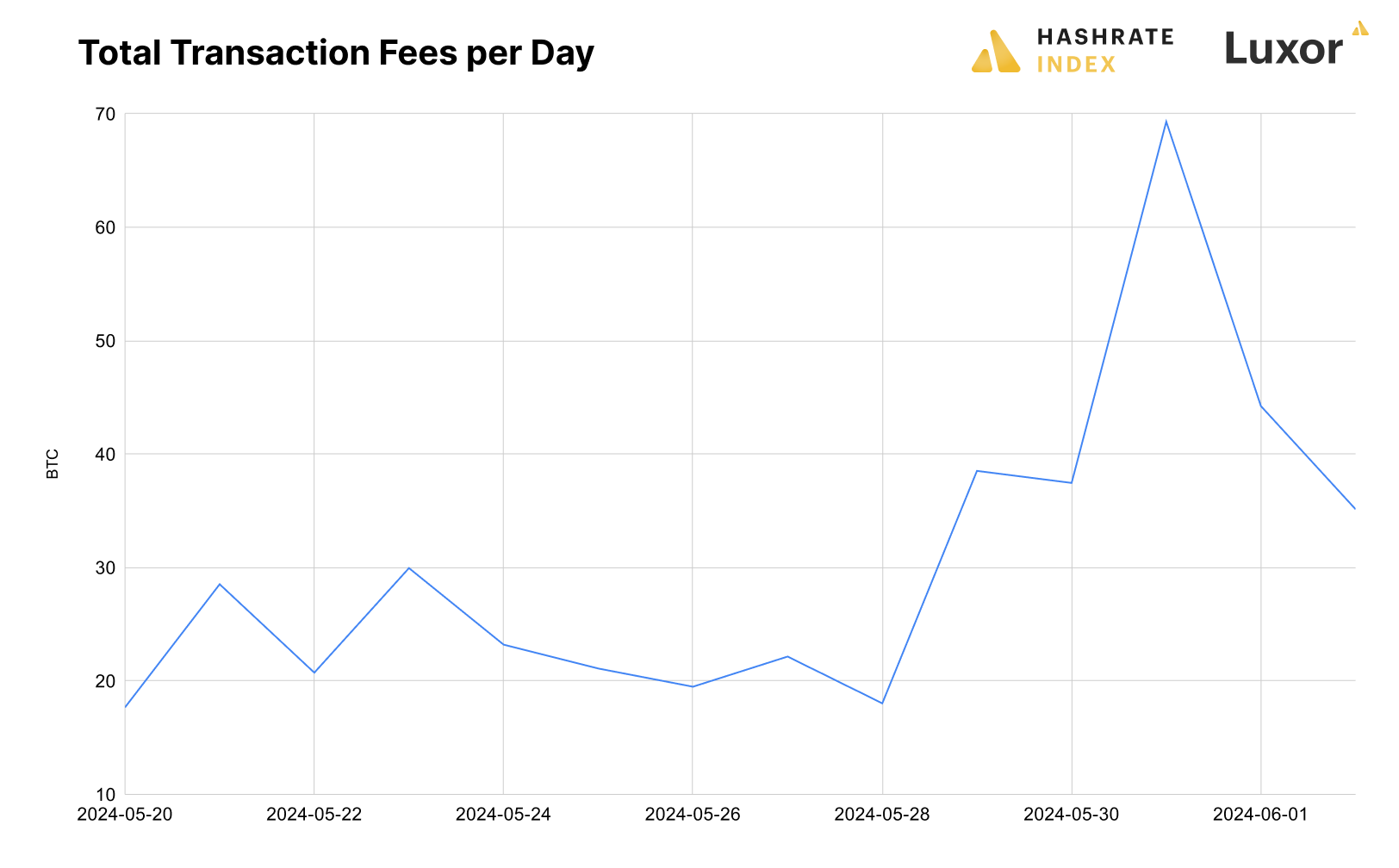

Bitcoin Transaction Fee Update

Transaction fees fell significantly in May when compared to March and April, but they are picking up again as we enter June. The increase is nominal and nowhere near the eye-popping volumes we've seen in the past year, but it's still enough to lift up hashprice by a few bucks. As ever, ordinals/inscriptions are behind the rise – more specifically, renewed BRC-20 trading activity.

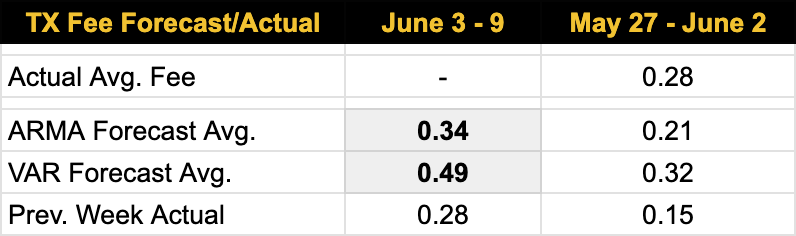

Last week, we ran an autoregressive moving-average model (ARMA) and a vector autoregressive model (VAR) to forecast the average transaction fee per block for the week ahead. The ARMA model projected 0.21 BTC, the VAR projected 0.32 BTC, and the actual number was 0.28 BTC. We've run the model again for this week, and we'll continue to post these weekly projections along with the actual numbers for each week going forward.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- U.S. President Biden Vetoes Resolution Overturning SEC Guidance

- Tether Buys $100M Worth of Bitdeer Shares With Option to Purchase $50M More

- Soluna Secures $30M from Spring Lane Capital to Fuel Project Dorothy 2

Bitcoin Mining Stocks Update

It's all red for our Bitcoin mining stock update this week, with the exception of two tickers. By contrast, our Crypto Mining Stock Index is up 0.2%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $9.65 (-7.48%)

- HUT: $8.96 (-3.45%)

- BITF: $2.33 (+6.39%)

- HIVE: $2.58 (-1.90%)

- MARA: $19.58 (-7.45%)

- CLSK: $15.66 (-12.54%)

- IREN: $8.00 (-0.37%)

- CORZ: $4.87 (-1.02%)

- WULF: $2.05 (-1.44%)

- CIFR: $3.64 (-10.12%)

- BTDR: $6.34 (+4.79%)

- SDIG: $2.84 (-6.89%)

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.