Hashrate Index Roundup (June 17, 2024)

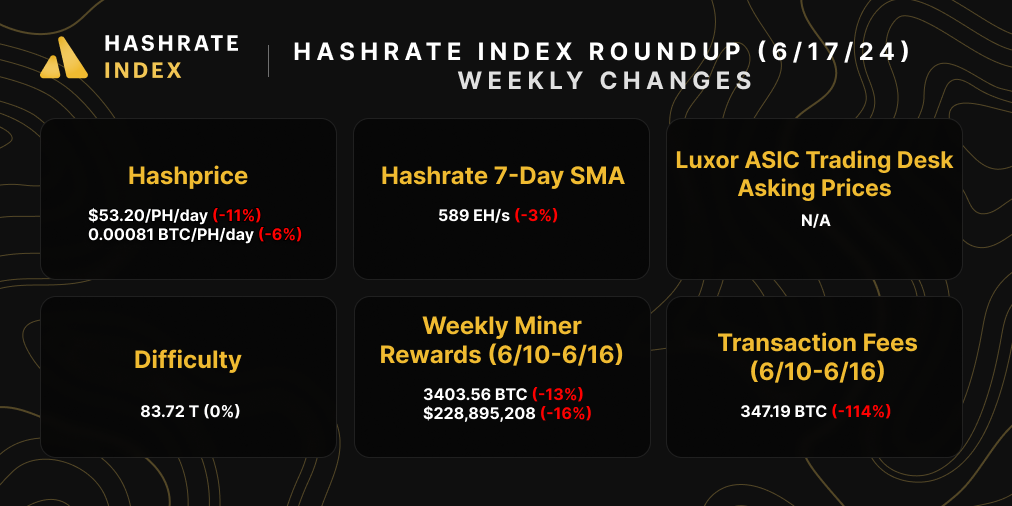

Hashrate and hashprice are both down this week, and the next difficulty adjustment could be in miners' favor.

Happy Monday, y'all!

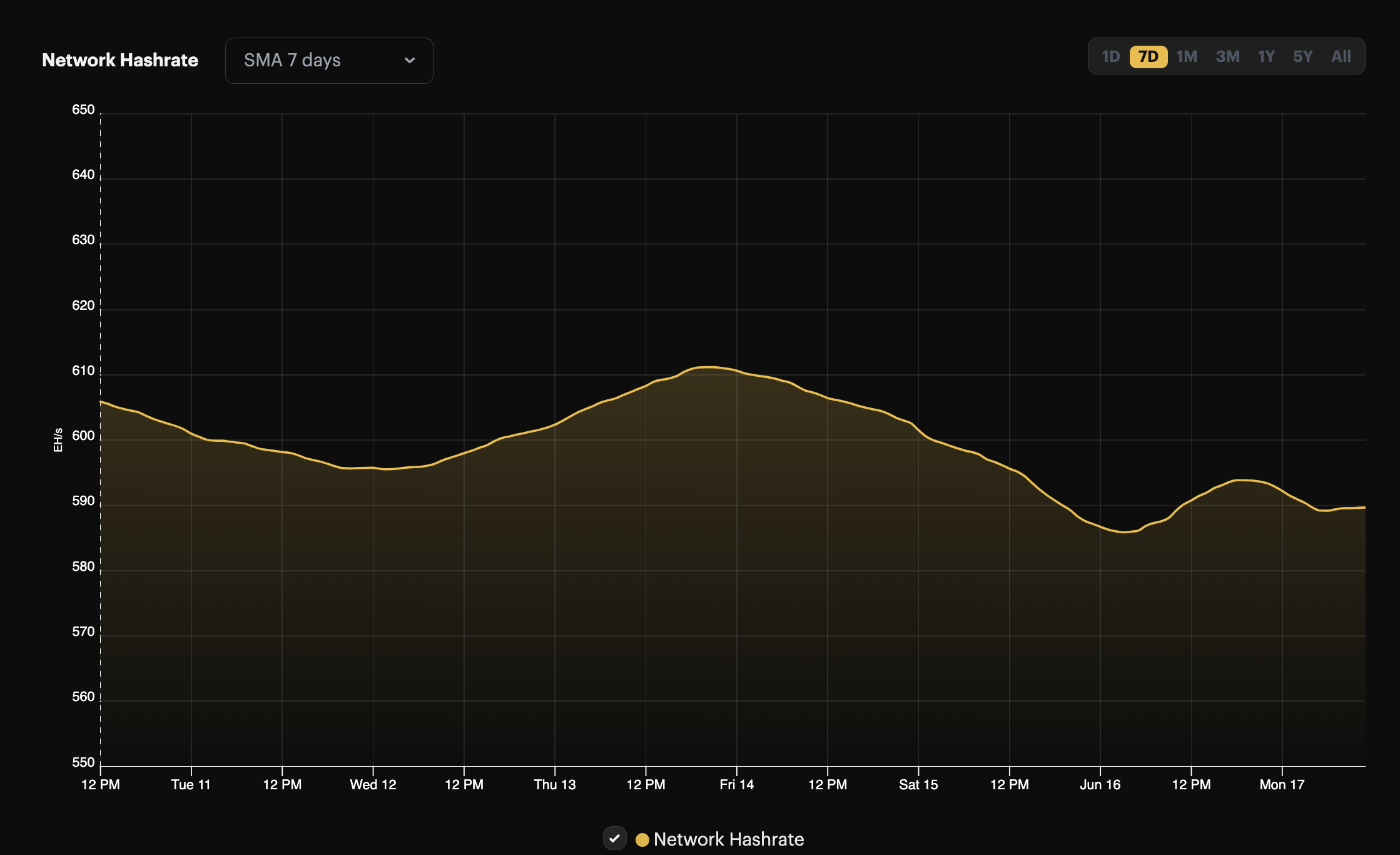

Bitcoin's hashrate continues to yo-yo along. During our update last week, it was above 600 EH/s, but now it's fallen back below to 589 EH/s at the time of writing. For the miners who are still online, this should be welcomed news, because block times have slowed to 9 minutes and 56 seconds, and our difficulty forecast is estimating a minor upward adjustment of 0.66%. If hashrate continues to stoop, then miners may be graced with a negative adjustment this week – here's to hoping!

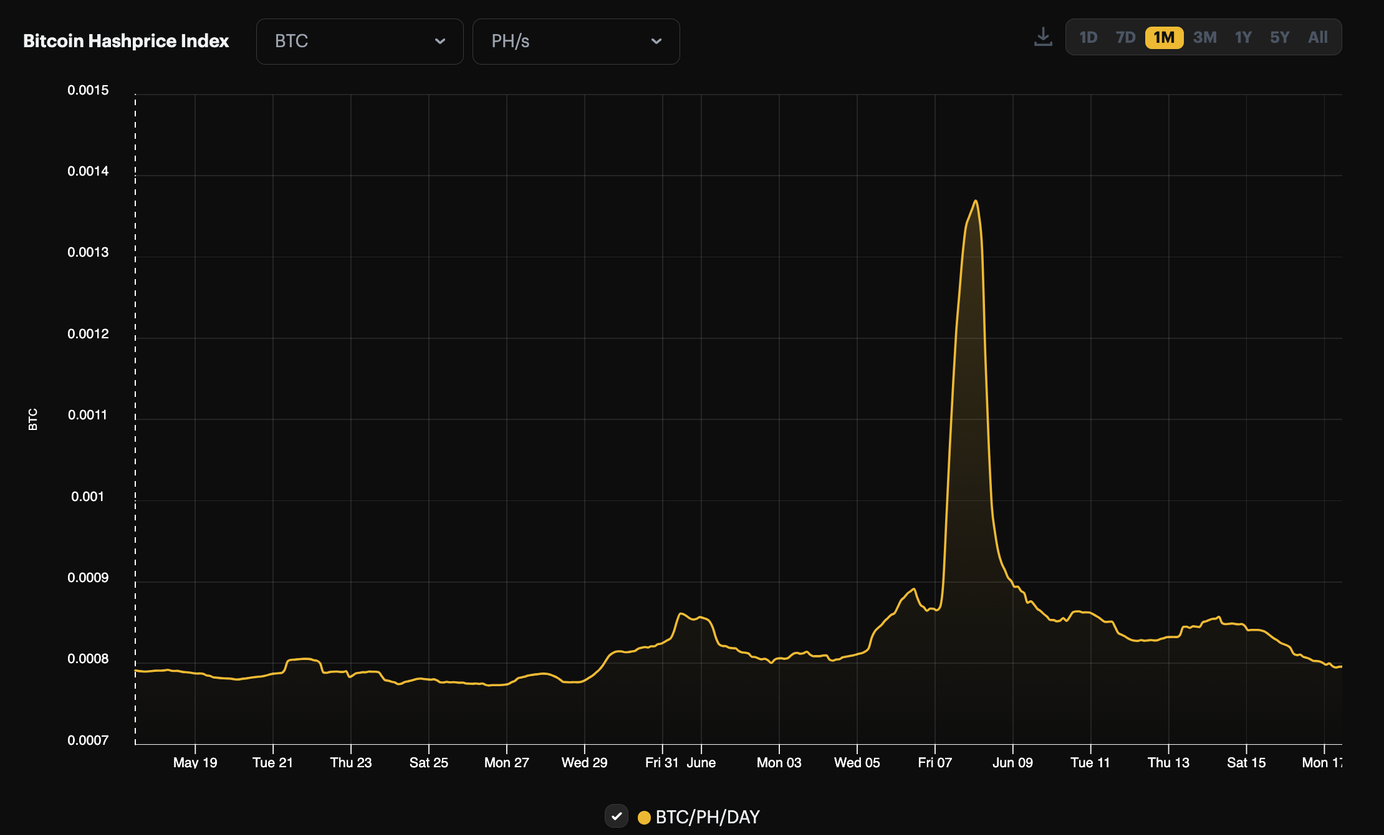

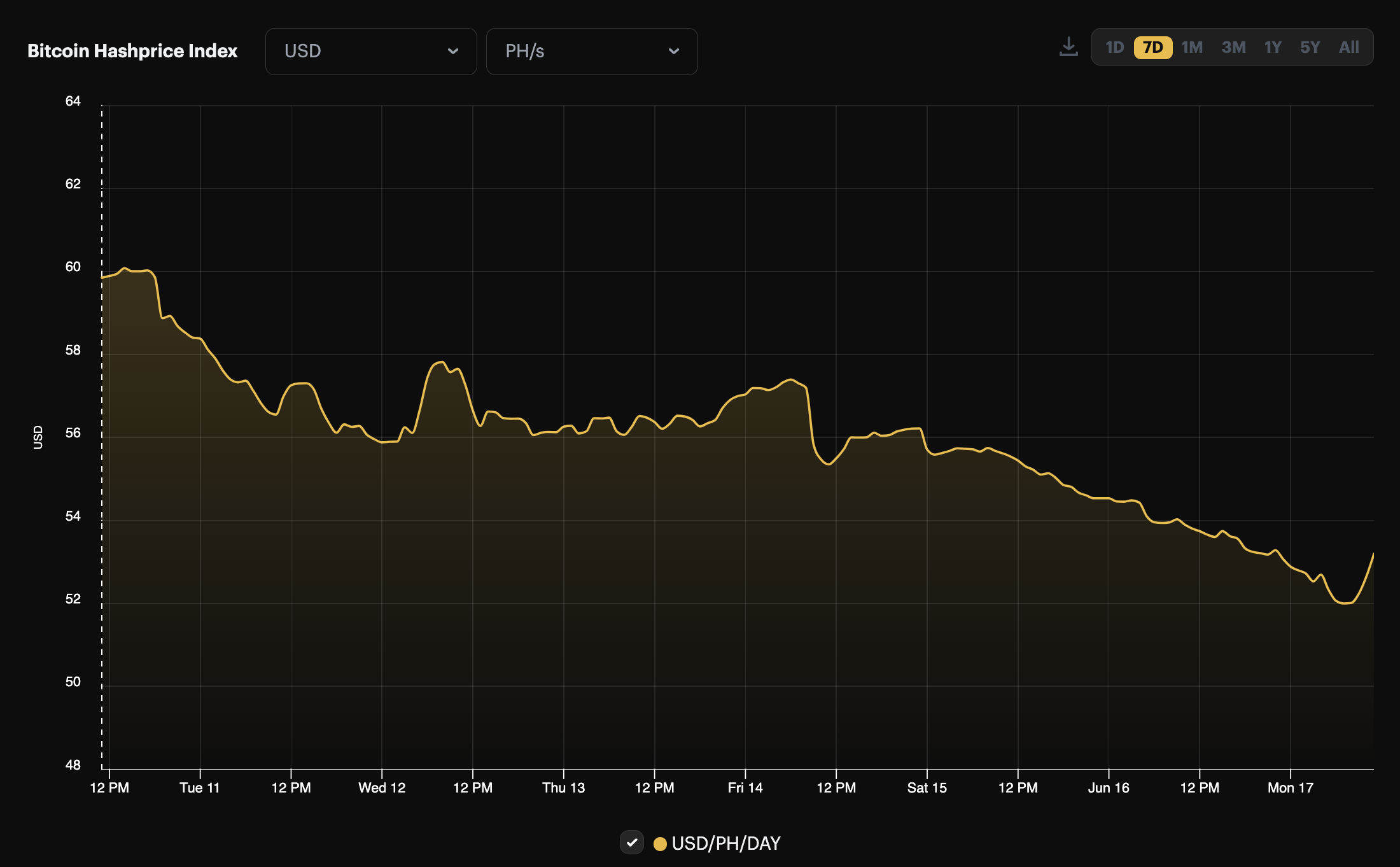

Unfortunately, hashprice is also down this week, hovering just above $50/PH/Day. This isn't surprising given that last week's elevated hashprice resulted from an anomaly where fees were driven up from a technical hiccup OKX encountered when consolidating UTXOs. In addition to the decline in transaction fees, Bitcoin's price – which is down 4% week-over-week – is also weighing down hashprice.

As we enter the summer months in the United States, we're keen to see if hot weather will force miners to curtail and thus suppress hashrate growth as we saw in 2022 and 2023. Assuming the trend repeats itself, this seasonality would create additional headwinds for network growth and compound the Halving's chilling effect on Bitcoin's hashrate.

Sponsored by Luxor Firmware

At $60/PH/Day, hashprice is close to breakeven for many miners. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

Luxor Hashrate Forwards Market Update

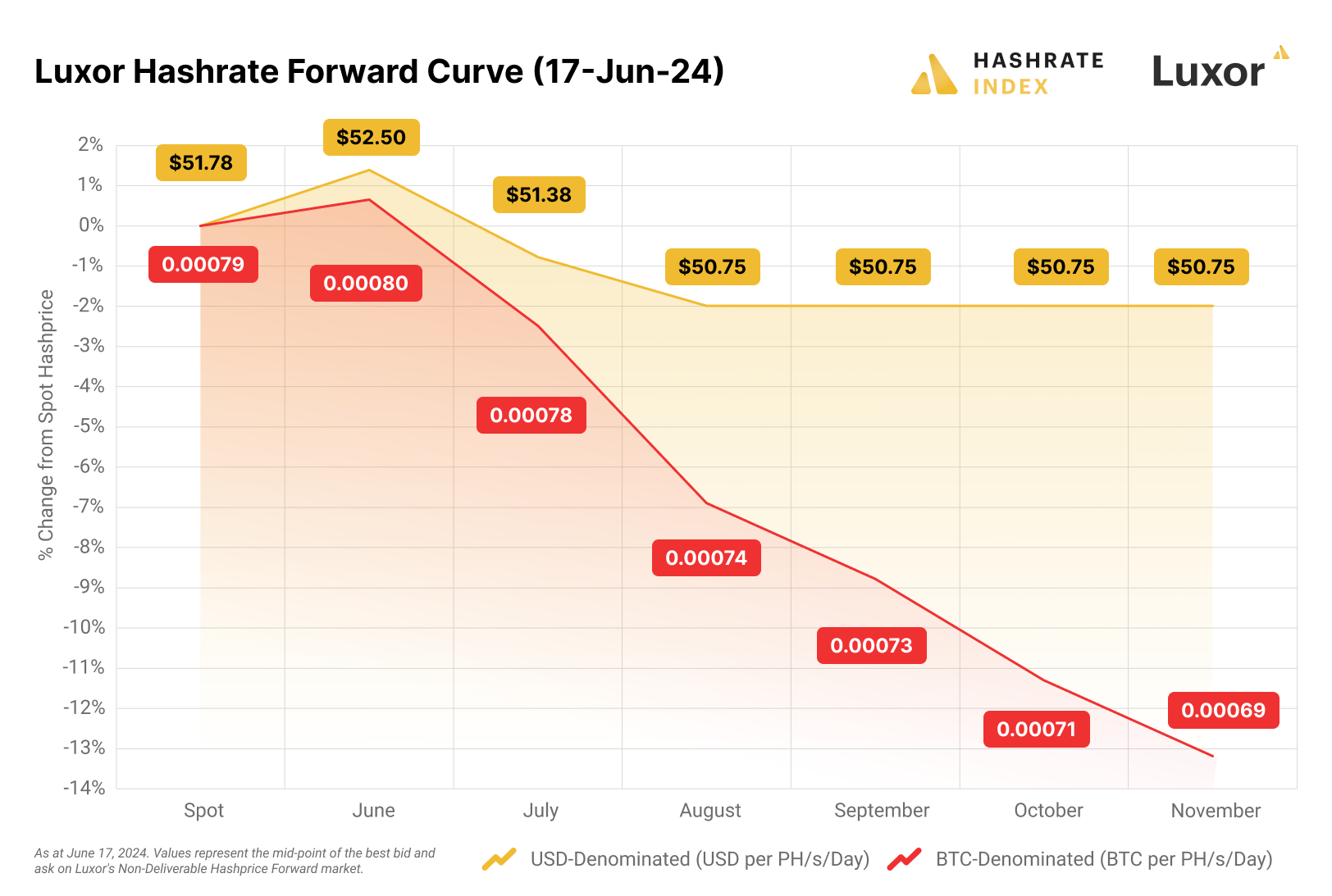

Luxor's Hashrate Forwards markets are trading in backwardation from July through November. Notably, as we can see in this week's Hashrate Market update (and as we saw last week), the gap between BTC and USD denominated hashprice on the forward curve indicates that traders are betting on higher BTC prices in the second half of the year. Additionally, market participants are betting on a bottom of ~$50/PH/Day for the next six months.

Bitcoin Mining Market Update

Nothing but red this week for our market update. Hashprice is down, transaction fees are (way) down, mining rewards are down, and hashrate is (thankfully) down, too. We don't have an update for ASIC prices this week, but we will next week.

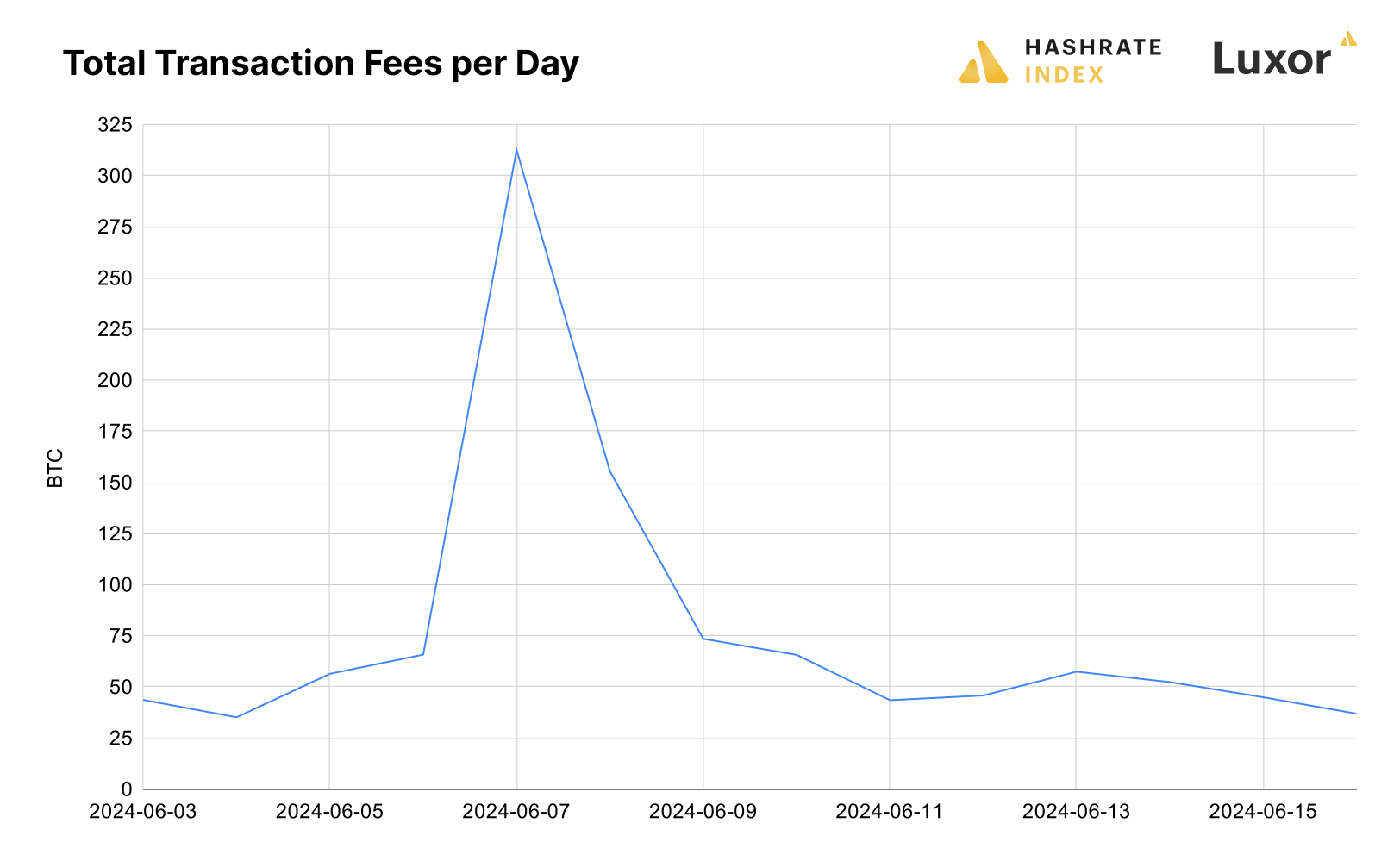

Bitcoin Transaction Fee Update

Transaction fees calmed down last week following an aberrant increase the week prior from OKX's bungled UTXO consolidation.

OKX's transaction consolidation led to the largest increase in transaction fees since the Runes-related splurge during and directly after the April Halving, but now transaction fees have normalized to a lower levels.

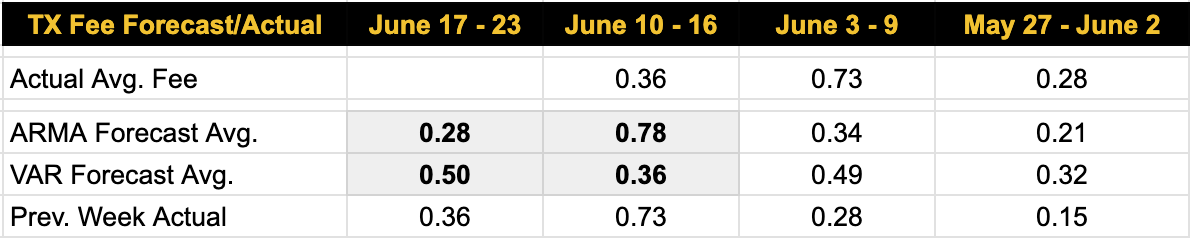

Last week, our VAR model for transaction fee forecasting was dead on. The model projected a 0.36 BTC per block average, and the actual was 0.36 BTC. Our ARMA model projected 0.78.

For this week, the VAR model forecasts 0.50 BTC per block – the ARMA, 0.28 BTC.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- U.S.-Listed Bitcoin Miners Reached Record Total Market Cap of $22.8B in June: JPMorgan

- Bitcoin Miners Pivot to Southeast Asia After China Crackdown

- ERCOT CEO: Texas' Power Grid Needs Larger Increase Than Expected to Handle AI, Bitcoin Mining

- On the Margin Newsletter: Inside Trump’s ‘monumental’ meeting with BTC miners

Bitcoin Mining Stocks Update

Bitcoin mining stocks are RIPPING this week following news that Bitcoin miners sat down with presidential-hopeful Trump to discuss Bitcoin mining policy. All of the stocks in our update are in the green, and our Crypto Mining Stock Index is up 9%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $10.88 (+13.08%)

- HUT: $12.27 (+29.16%)

- BITF: $3.15 (+41.89%)

- HIVE: $3.26 (+18.98%)

- MARA: $20.02 (+6.43%)

- CLSK: $19.24 (+26.58%)

- IREN: $14.45 (+43.64%)

- CORZ: $9.69 (+19.78%)

- WULF: $4.39 (+50.34%)

- CIFR: $5.00 (+23.46%)

- BTDR: $9.38 (+32.20%)

- SDIG: $4.03 (+21.02%)

Have a great week, and Happy Hashing!

New From Hashrate Index

Avalon A1566 ASIC Miner Testing and Review

Last month at the Bitcoin Asia 2024 conference, Canaan Inc. (NASDAQ: CAN) announced its newest Bitcoin mining machine: the air-cooled Avalon A1566 from the Avalon Miner A15 series. The Avalon A1566 boasts an impressive 185 TH/s hashrate and a power efficiency of 18.5 J/TH with a power consumption of 3420W. Its nameplate efficiency and hashrate are 5.1% and 8.8% improvements over the A1466I, respectively. Canaan said that it will begin delivering the Avalon A1566 in Q4 2024.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.