Hashrate Index Roundup (June 10, 2024)

Transaction fees went wild over the weekend, but not for the reason you might think.

Happy Monday, y'all!

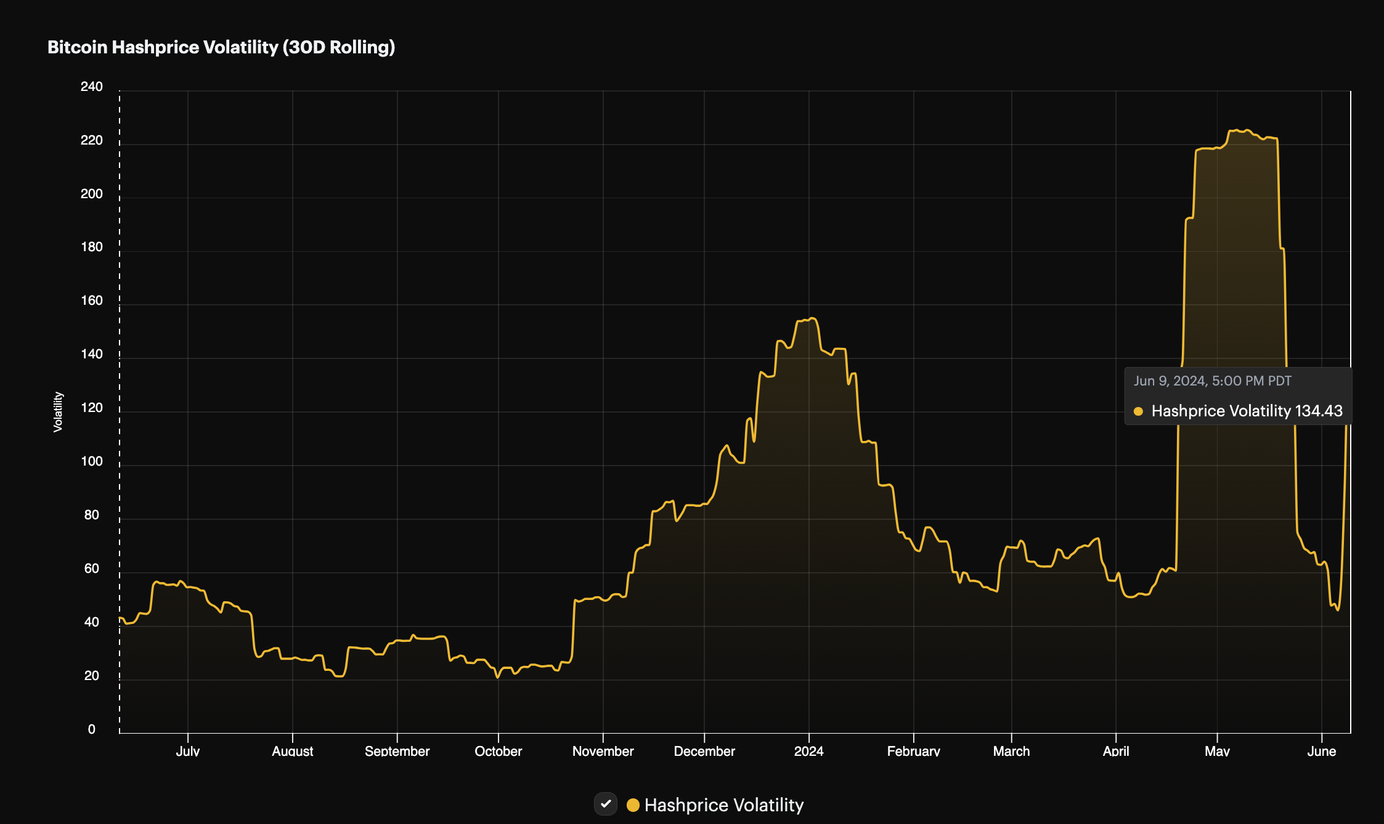

It's getting volatile on the timeline. Last week, this volatility came from Bitcoin's hashrate (which is back above 600 EH/s on the 7-day average, by the way). This week, though, volatility has possessed Bitcoin's hashprice by way of transaction fees.

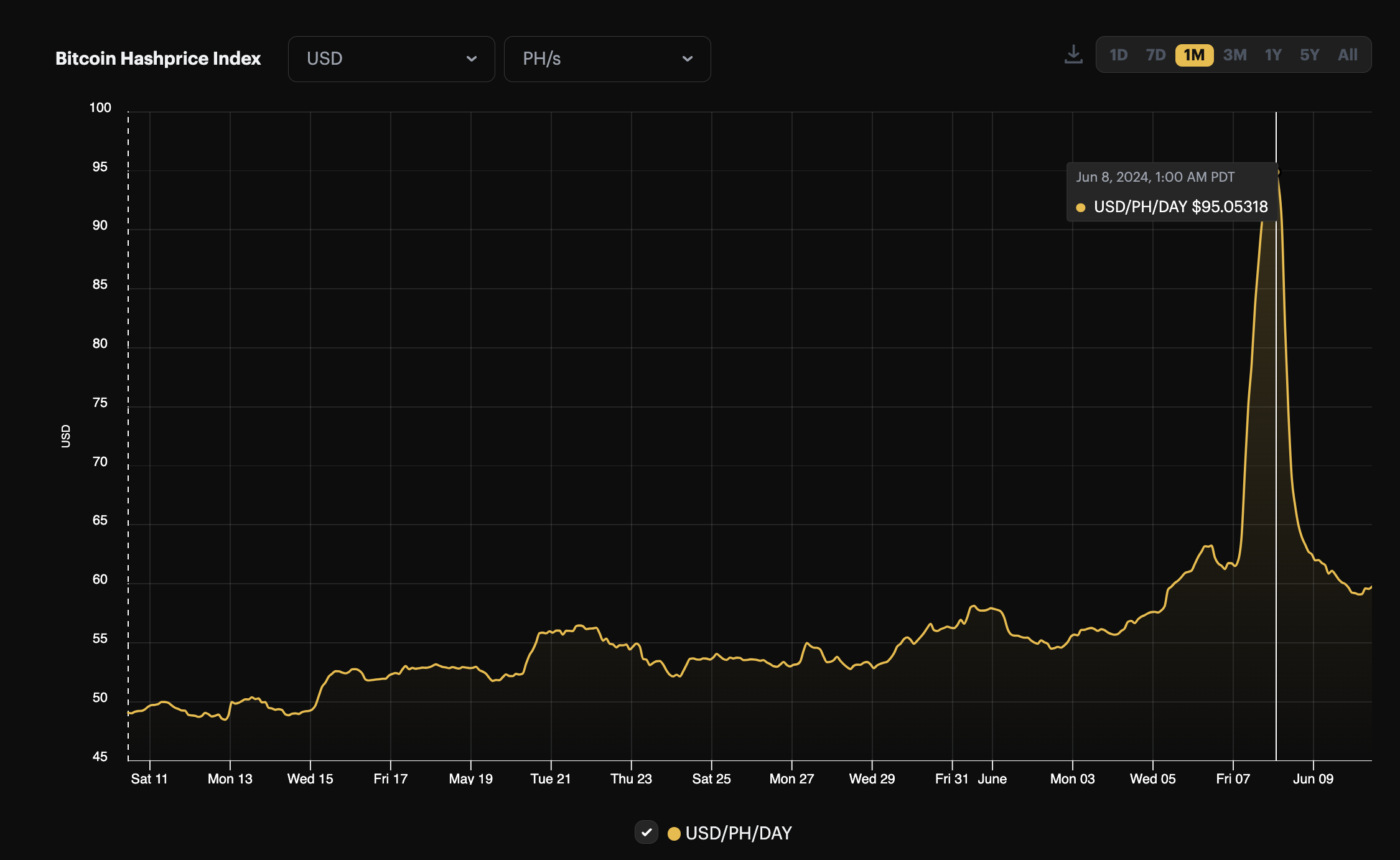

Over the weekend, Bitcoin's hashprice surged to as high as $95/PH/Day thanks to a spate of high transaction fees. At $95/PH/Day, the rally marked the highest point for hashprice since April 21, a time when blocks were plumped up with fees from Runes trading.

In the past year or so, basically every single notable increase in transaction fees resulted from minting and trading of inscriptions, ordinals, and/or (more recently) Runes. This past weekend's transaction fee activity bucked that trend, and we explain why in the transaction fee section of the newsletter.

Before we get to that and more in the remainder of today's post, we should also point out that hashprice has been improving thanks to Bitcoin's rally to $70,000 and last week's negative difficulty adjustment. This adjustment wasn't much to write home about (it was only -0.79%), but it still positively impacted hashprice. It was the fifth negative adjustment of the year out of 12 total.

Hashrate is back on the rise though, and while it's probably too early to say for sure, the next difficulty adjustment could very likely be a positive one – so miners should enjoy the reprieve while they can.

Sponsored by Luxor Firmware

At $60/PH/Day, hashprice is close to breakeven for many miners. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

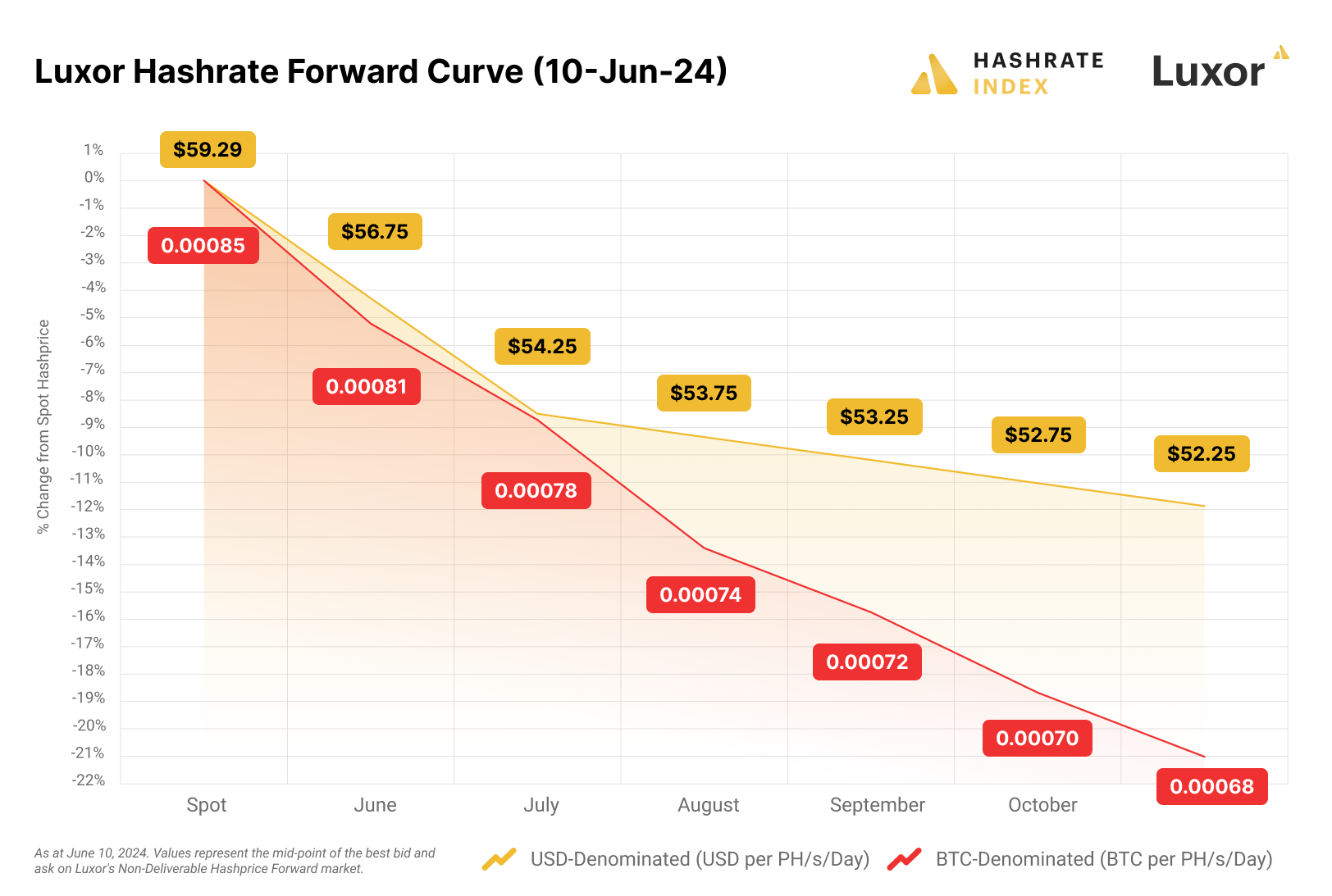

Luxor Hashrate Forwards Market Update

Luxor's Hashrate Forwards markets are still trading in serious backwardation. Notably, as we can see in this week's Hashrate Market update, forward curves for BTC-denominated and USD-denominated contracts begin to diverge significantly in August, with BTC contracts seeing a greater decrease versus spot prices compared to USD contracts. This suggests that traders are bullish on Bitcoin's price in Q3 and October, which makes expectations for USD hashprice higher than otherwise since traders are also expecting BTC hashprice to decline from hashrate growth and rising difficulty.

Bitcoin Mining Market Update

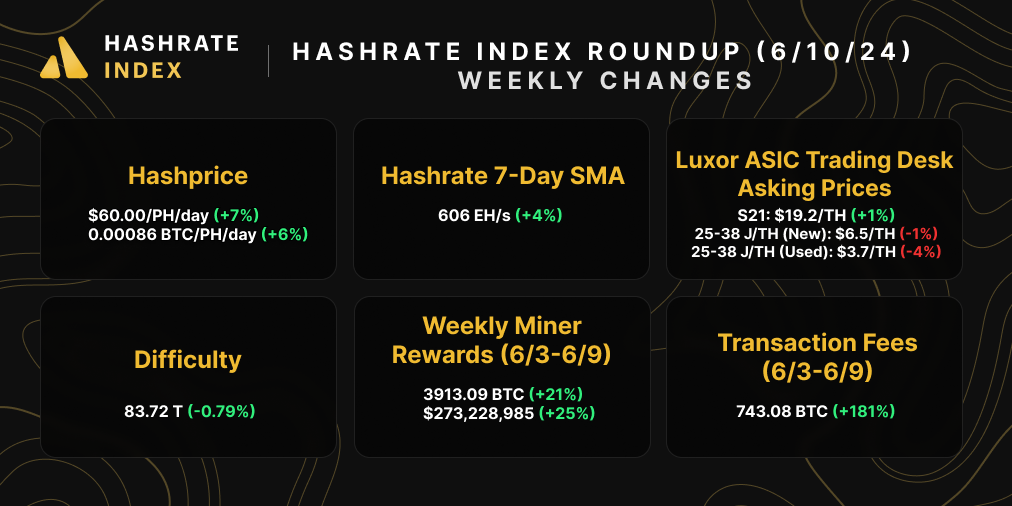

It's a sea of green for this week's market update. Hashprice is up, transaction fees are up, mining rewards are up, and hashrate is up, too. In the ASIC market, prices for next-generation rigs like the S21 are still climbing, while older models continue to fall.

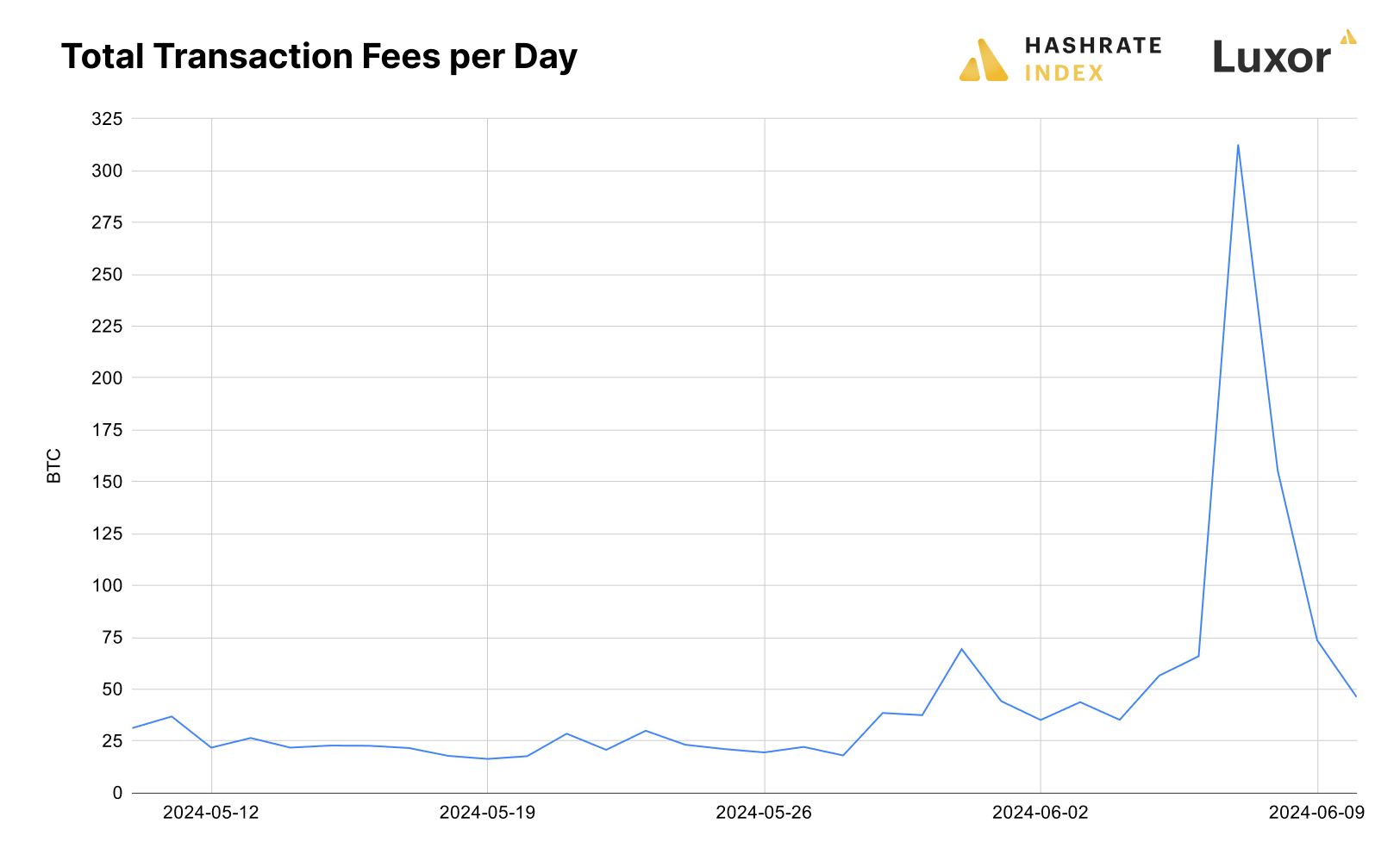

Bitcoin Transaction Fee Update

Transaction fees spiked substantially at the end of last week and into the weekend. But this time, inscriptions/ordinals/runes weren't to blame for the rise in fees. The culprit is OKX and its clumsy UTXO consolidation, which the exchange said was the result of its testing a new program. The TLDR: OKX's code for transaction fee estimation was buggy and it resulted in the exchange bidding up fees against its own transactions, which created a vicious cycle that drove up the fee rate for its UTXO consolidation.

OKX now has 974 consolidation transactions left in the mempool, with the following combined stats:

— mononaut (tx/acc) (@mononautical) June 7, 2024

- 42.4 MvB total vsize

- 146100 inputs

- over 57 BTC in fees

- recovered value of 730 BTC https://t.co/GR2HIRXs9q

OKX's transaction consolidation led to the largest increase in transaction fees since the Runes-related splurge during and directly after the April Halving.

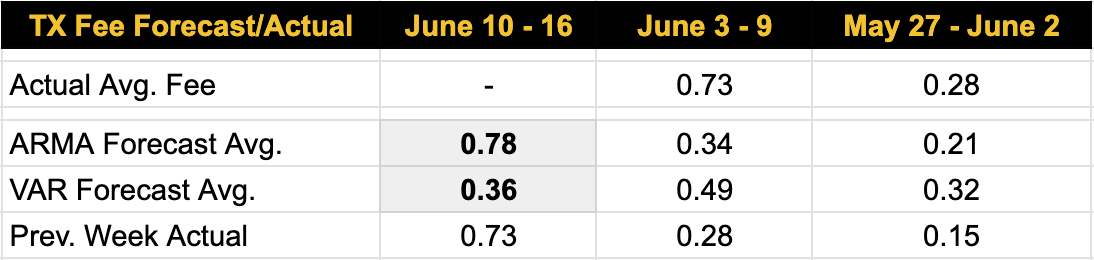

Last week, our ARMA model for transaction fees per block projected 0.34 BTC, the VAR model projected 0.49 BTC, and the actual number was 0.73 BTC. We've run the model again for this week, and we'll continue to post these weekly projections along with the actual numbers for each week going forward.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Bitcoin Miner Bitdeer to Buy ASIC Chip Designer Desiweminer for $140M in All-Stock Deal

- In the first full month after halving, who mined the most BTC?

- Bitfarms to adopt 'poison pill' amid Riot takeover attempt

- Rapid Fluctuations in Bitcoin Fees Cause Brief Spike in Hashprice

- OKX burns $17 million in fees consolidating UTXOs

Bitcoin Mining Stocks Update

It's mostly green for our Bitcoin mining stock update this week, with the exception of a few tickers, and our Crypto Mining Stock Index is up 6%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $9.90 (+2.22%)

- HUT: $9.85 (+9.69%)

- BITF: $2.30 (-0.43%)

- HIVE: $2.91 (+12.36%)

- MARA: $19.46 (-0.66%)

- CLSK: $15.70 (-0.76%)

- IREN: $10.31 (+24.82%)

- CORZ: $8.21 (+31.36%)

- WULF: $3.09 (+42.40%)

- CIFR: $4.18 (+14.52%)

- BTDR: $7.29 (+13.02%)

- SDIG: $3.58 (+22.18%)

Have a great week, and Happy Hashing!

New From Hashrate Index

How to Increase Bitcoin Mining Production with Hashrate Forwards and Futures

A key objective for many Bitcoin mining companies is increasing total BTC production. Until recently, that meant sourcing data center sites, hiring operators, building operations, negotiating power agreements, and purchasing ASICs. But with growing liquidity in Luxor’s OTC Hashrate Forwards markets and more recently, Hashrate Futures market, large public Bitcoin miners and small-medium private miners can use forwards and futures to increase Bitcoin mining production over a short or long time period.

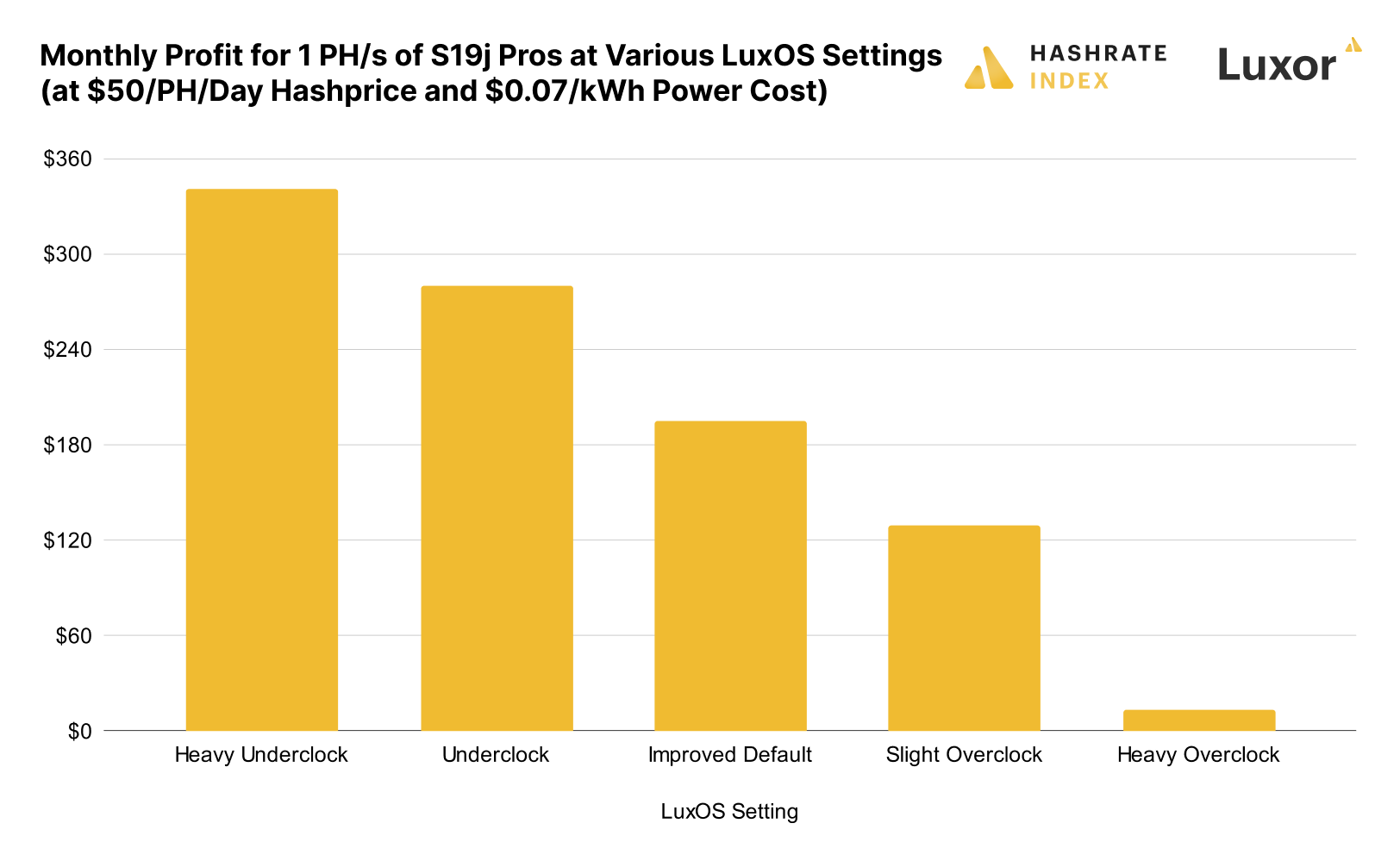

How Underclocking ASICs With LuxOS Can Help Hosts and Clients in Low Hashprice Environments

The Fourth Bitcoin Halving has come to pass, and hashprice is the worse for it. With Bitcoin mining profit margins compressed, Bitcoin miners around the world are searching for ways to cut cost and boost efficiency. Improving an ASIC fleet’s efficiency could mean buying new equipment, but there’s a more affordable method to do this without spending CAPEX on new machines: running after-market firmware.

After-market firmware like LuxOS can help miners increase their profit margins by improving their ASIC fleet’s efficiency. For hosting providers specifically, operating Firmware on behalf of their clients can help retain those clients that are near breakeven or underwater.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.