Hashrate Index Roundup: July 9, 2021

Introducing a week-end roundup of the latest data from Luxor's Hashrate Index.

Happy Friday Luxor Mining fam!

We’re happy to introduce the inaugural version of our new weekly newsletter, Hashrate Index Roundup! You’ll still receive our beginning-of-the-week newsletter with data points from Hashrate Index and latest mining news, but we’ll also be sharing numbers and analysis from our proprietary data sets at the end of each week so you never have to miss a beat on the ever-metamorphosing mining industry.

So to hop right to it, let’s look at some data.

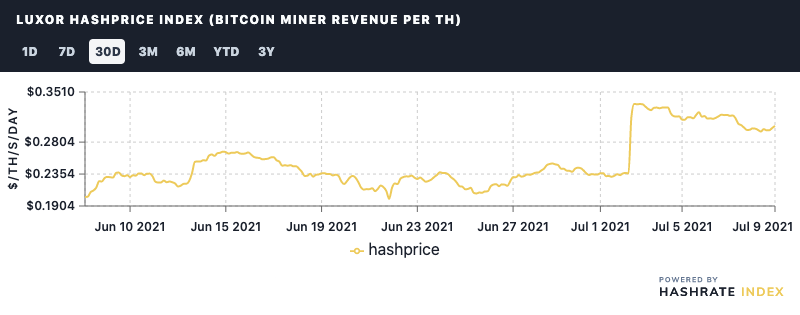

Hashprice Index

Hashprice

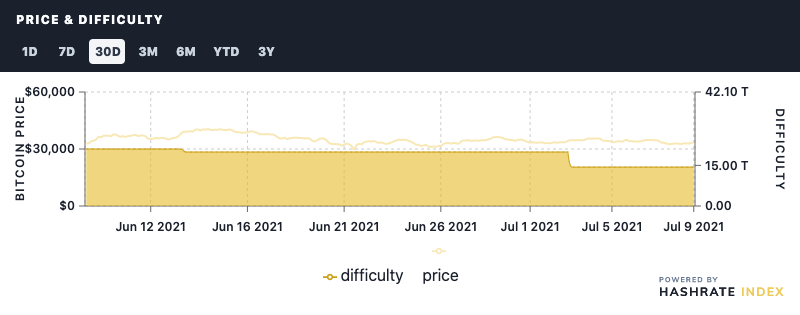

Bitcoin’s Hashprice has recovered thanks to last weekend’s downward difficulty adjustment to 14.36T, gaining 26% over the week at a current price of $0.30/TH.

Roughly half of the network’s miners are offline as a result of China’s mining exodus. To contextualize this, the last time Bitcoin’s difficulty was this low last June, Bitcoin’s price was under $10,000; now, Bitcoin’s price is 3x higher, but total network hashrate (93EH) is 15% less than the roughly 115EH that were online in June of 2020.

Put another way, plugged-in miners should be rolling in it for the next few months, and assuming bitcoin’s price doesn’t tank, for the foreseeable future. It will take the rest of the year if not longer for many big miners to move machines, source rack space, and turn on their operations before the network’s hashrate rebounds to pre-ban levels.

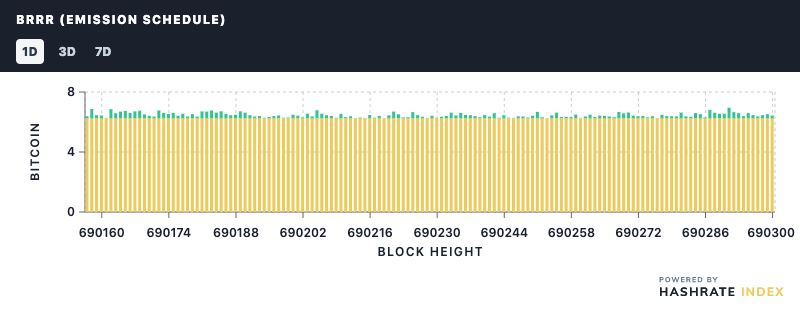

BRRR (Emission Schedule)

Basically everything in the Bitcoin world follows bitcoin’s price, so it stands to reason that miners made substantially less in fees in June when the price was tanking and fewer folks were sending transactions.

Transaction fees accounted for 6.1% of miner revenue in the month of June, down from 10% in May, and 15% in April.

We’ve seen a bump in transaction fees to ring in July, but that was due to transaction congestion caused by the Chinese hashrate migration and Bitcoin’s lagging difficulty. The July 3rd adjustment cleared this up some, but fees as a percentage of block rewards are still low--roughly 7.6% so far in July.

Notably, miners only netted 24k bitcoin in June verses the 30k+ they were earning in the months before the hashrate exodus (before the recent adjustment, since half of the network’s miners went offline, plugged-in miners were working under a pre-ban difficulty so block times were longer, resulting in less daily revenue for the same amount of work).

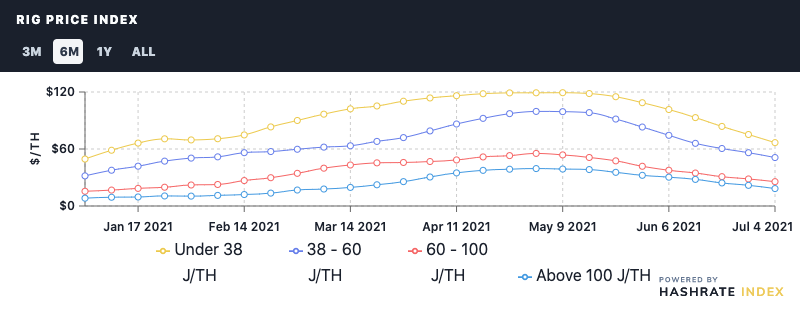

Rig Index

Rig Price Index

The price per TH for rigs of all efficiencies fell last week as mass liquidations of ASICs continue across various secondary markets.

Over the month of June, prices for some of the most popular SHA-256 machines fell for the third month in a row:

- S9: $362 (-23%)

- S17: $3,033 (-18%)

- S19: $6,945 (-23%)

- M20: $2,669 (-34%)

- M30: $3,482 (-21%)

There could be more selling still as warehouse/rack space continues to be a major obstacle when relocating Chinese hardware, but we’re also seeing signs of prices rising in the secondary market following the recent adjustment.

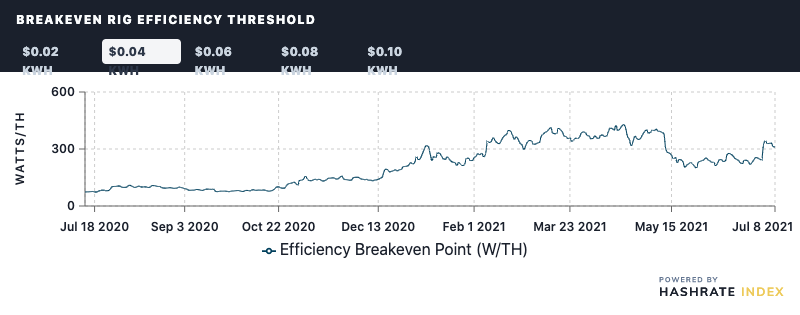

Breakeven Rig Efficiency Threshold

Miners’ breakeven thresholds rose in step with hashprice after this difficulty adjustment across all buckets:

$0.02 kWh: 620.24 W/TH

$0.04 kWh: 310.12 W/TH

$0.06 kWh: 206.75 W/TH

$0.08 kWh: 155.06 W/TH

$0.10 kWh : 124.05 W/TH

Profitability of Popular SHA-256 ASIC

The current daily rewards of the more popular bitcoin miners are:

- Antminer S19 Pro: $33.39

- Antminer S19: $28.84

- Whatsminer M30: $26.71

- Antminer S17+: $22.156

- Whatsminer M20S-65TH: $19.73

- Antminer S9: $3.49

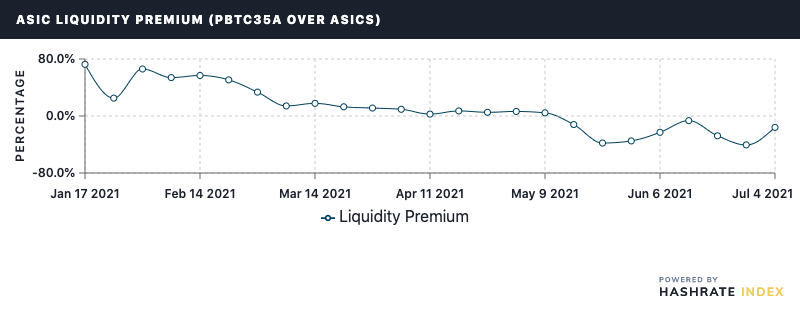

ASIC LIQUIDITY PREMIUM (PBTC35A OVER ASICS)

Poolin’s hashrate token is sitting at an 18% discount to new generation ASICs, up from its 40% discount last update. The mining pool suspended payouts to token holders on June 25 in response to the discount, one of many ripple effects from China’s ban. The company said in a blog post that payouts may resume within a 60 day window, but this is contingent on how fast Poolin can migrate its equipment from China to new centers in the US and elsewhere.

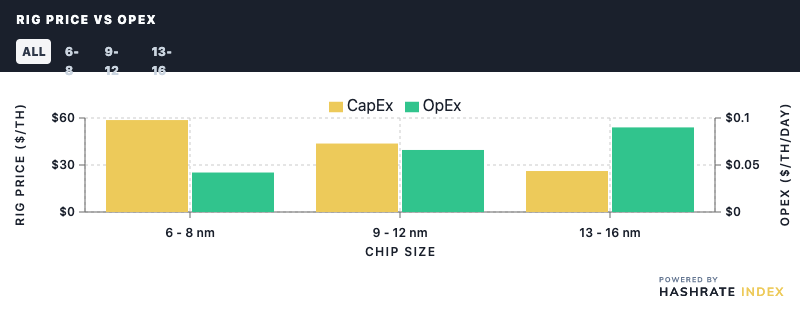

Rig Price Vs. OpEx

Capital expenditures for new generation machines is almost double their current operational expenditures, while the inverse is true for older rigs. Mid-tier machines have roughly the same CapEx and OpEx costs with a slight bias towards CapEx.

Happy hashing, and have a great weekend!

-Luxor Team

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.