Hashrate Index Roundup (December 17, 2023)

Hashprice is at its highest point of the year as miners feast on transaction fees from blocks plump with inscriptions.

Just when you think hashprice can't possibly pump any higher, it does.

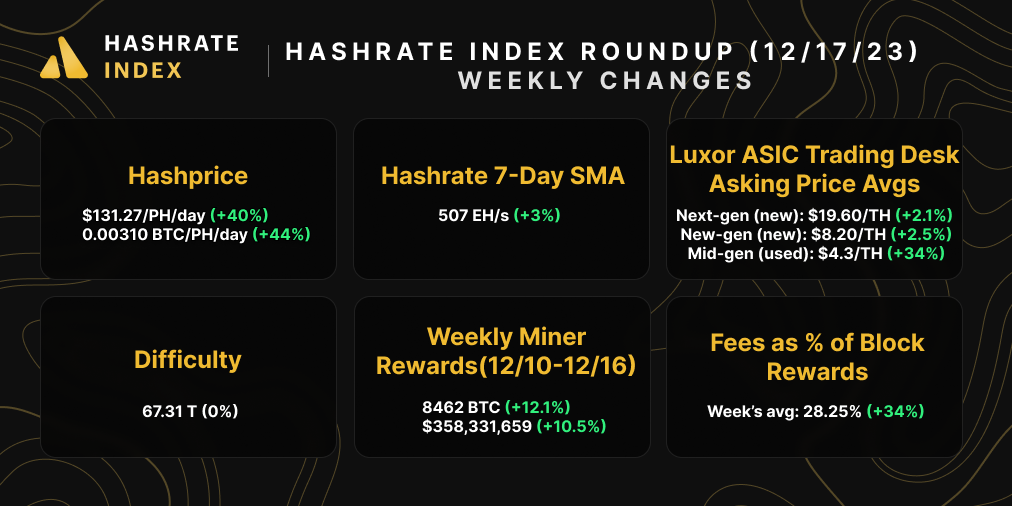

Hashprice hit a new yearly high in the wee hours of the morning today, rising to $136/PH/day – 7% higher than its prior yearly high of $127/PH/day on May 8. As a result of the current rally, Hashprice is up 40% this week, 45% month-over-month, 108% in three months, and 111% year-over-year.

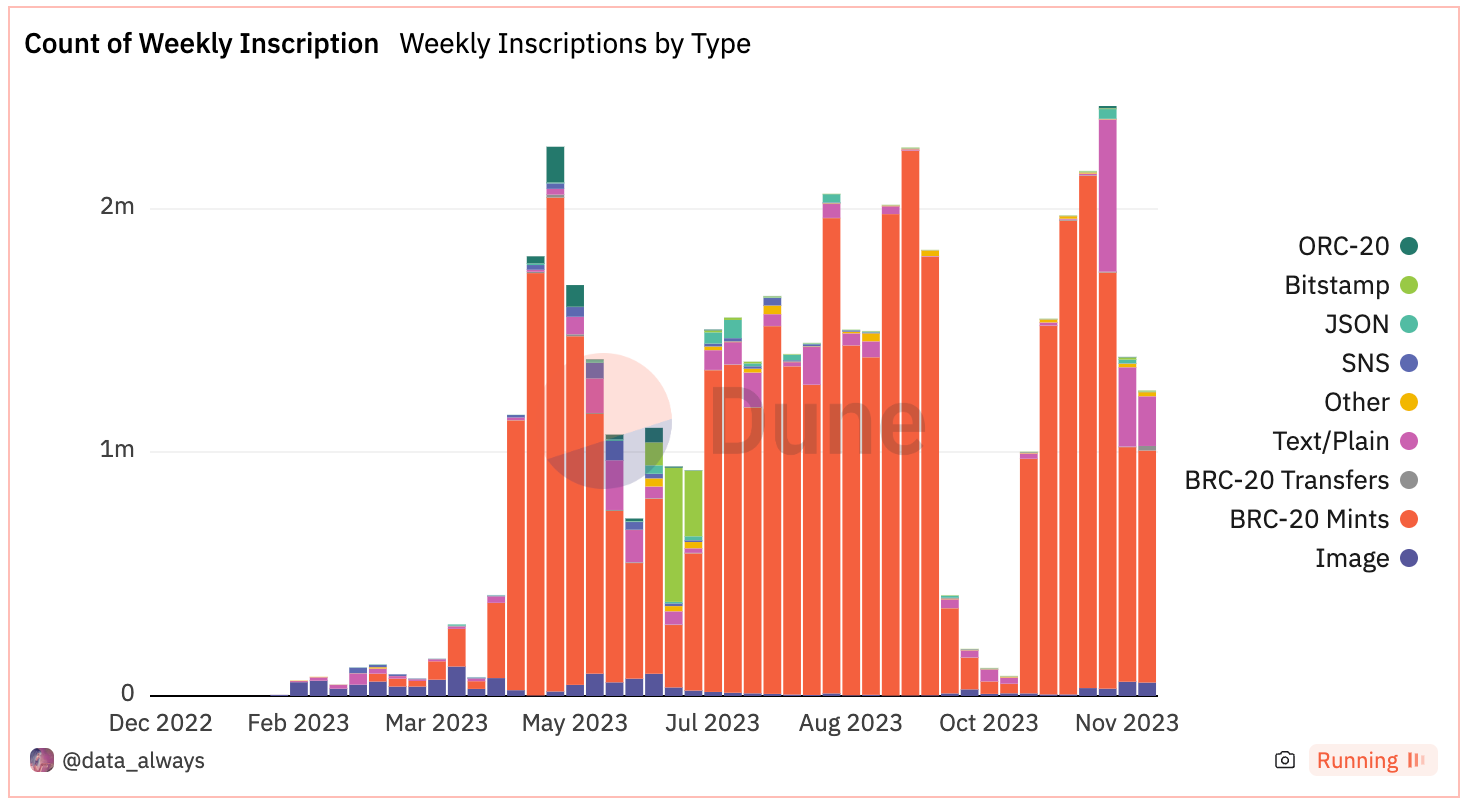

Miners have inscriptions to thank for that. In the last 24-hours, fees have constituted an astonishing 70% of block rewards as inscriptions exert pressure on transaction fees. Per usual, these inscriptions are predominately BRC-20 mints, as the graph from data_always below demonstrates.

The current BRC-20 minting rush has been the most intense yet. Yesterday (December 16), inscribers paid $10 million in transaction fees, and they've already paid $6.5 million today (UTC time). The previous record for daily transaction fee spending on inscriptions was $7.2 million on May 8, the first time that inscriptions juiced transaction fees and, by extension, hashprice.

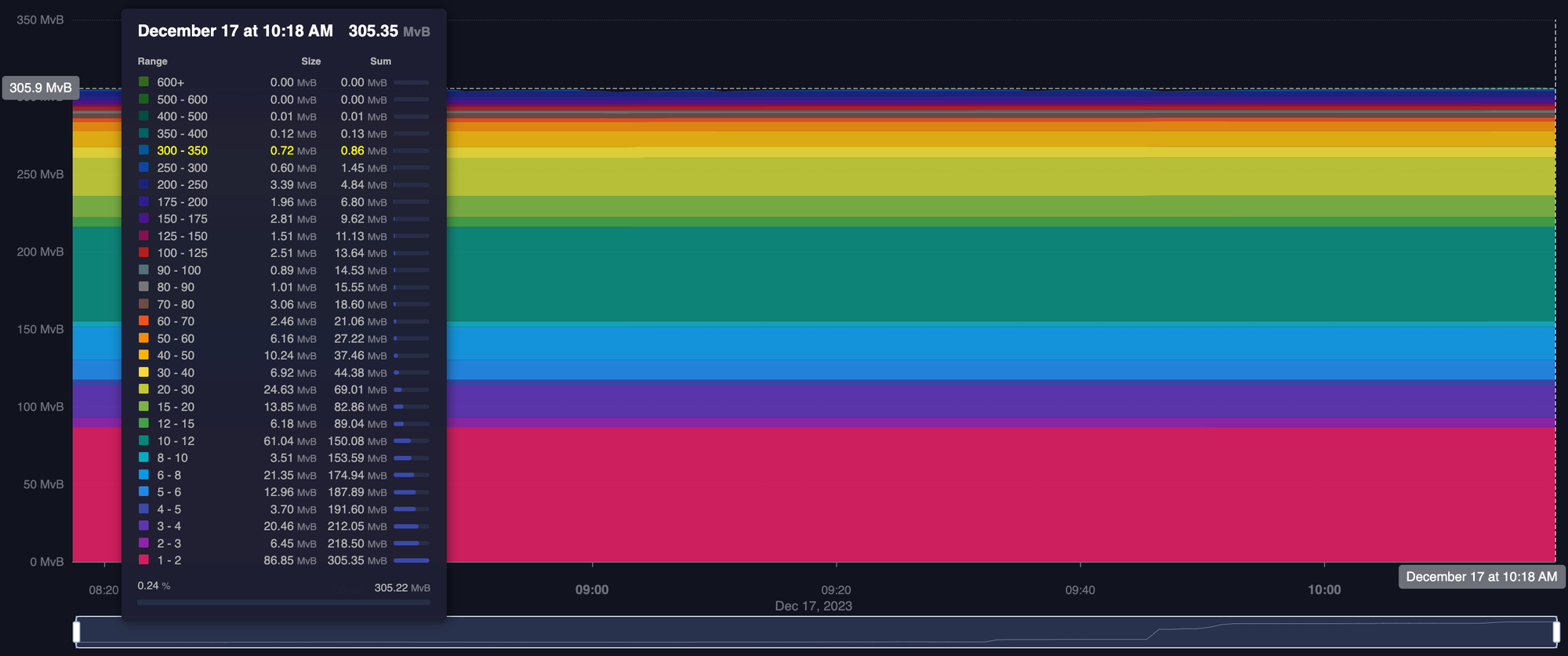

With all of this activity, the mempool is jam packed and the BRC-20 frenzy has placed significant pressure on fees for all other transactions, which is contributing to the current glut in fees. Per mempool.space, there are over 304,000 unconfirmed transactions in Bitcoin's mempool currently, and the medium priority transaction costs 257 sats/vbyte (~$15).

This weekend, there have been multiple blocks where transaction fees were greater than the current block subsidy (6.25 BTC). Miners are obviously relishing in the current fee splurge, but this latest chapter in BRC-20 mania has reignited the year's hottest debate over the use of blockspace – specifically, whether or not inscriptions are a net good or net negative for Bitcoin given the congestion they cause.

Whether good or bad for Bitcoin as a whole, they have certainly been good for miners, and as they've raised profitability, they've no-doubt kept more hashrate online than not throughout the year.

Case and point: Bitcoin's 30-day average hashrate hit an all-time of 497 EH/s today, and blocks are coming in on average at 9 minutes and 36 seconds. So just as inscriptions have been good for boosting miner revenues, they're also ironically good for boosting Bitcoin's mining difficulty, which is set to increase by ~4% in about 6 days.

Sponsored by Luxor RFQ

The Antminer S21 is here, and Luxor's ASIC Trading Desk is accepting preorders for this model right now! If you'd like to place a preorder for the Antminer S21, please fill out this form. Secure your order for Bitmain's most efficient and powerful ASIC miner today!

Bitcoin Mining Market Update

It's green across the board for this week's market update. This week's transaction fee average added on to an already high average from last week. As hashprice rallies, the ASIC miner market continues to see a swift recovery, with rigs of all calibers rising over the week.

Bitcoin Mining News

Here are last week's top headlines for Bitcoin mining news:

- Russia toys with bill for mined crypto to become export product

- Hut 8 Set to Acquire 310 MW Power Plants with ‘Successful’ Bid

- Bitcoin Miner Raised $15M to Use Energy from Argentina’s Vaca Muerta Oil Field

- Finance titan BlackRock is actively investing in Bitcoin mining companies – report

- Arkansas legislator urges special session to repeal controversial crypto-mining law as 2 new facilities set up shop in Pope County

Bitcoin Mining Stocks Update

Bitcoin mining stocks continued to rally over the week, with most all of the stocks in our update adding to their impressive gains over the last month. This week, our Crypto Mining Stock Index rose 9.2%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $15.63 (+5.64%)

- HUT: $10.46 (+7.85%)

- BITF: $2.97 (+28.02%)

- HIVE: $3.68 (-7.07%)

- MARA: $18.29 (+16.87%)

- CLSK: $10.64 (+12.47%)

- IREN: $6.01 (+7.71%)

- WULF: $1.78 (+4.71%)

- CIFR: $2.60 (-8.45%)

- BTDR: $7.90 (+33.90%)

- SDIG: $5.00 (+2.01%)

New From Hashrate Index

Luxor RFQ November 2023 Insights: Up and to the Right

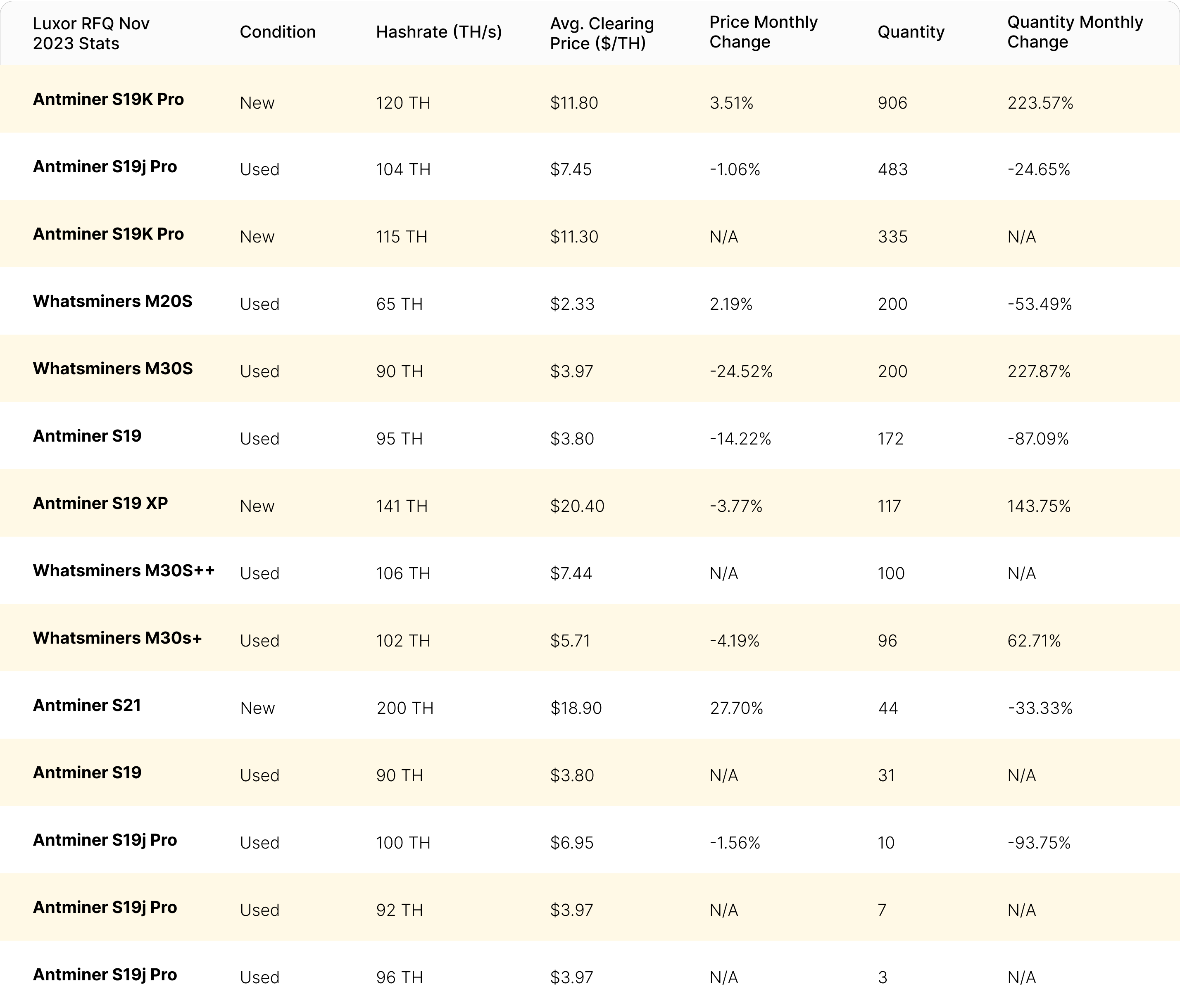

Bitcoin and hashprice ripped in November, and as a result, ASIC prices for the newest models continued to rise last month from yearly lows. All of the trading activity kept the Luxor ASIC Trading Desk team busy. Luxor's RFQ marketplace hit another milestone last month, successfully settling over 10,000 rigs and bringing total year-to-date volume to 4.4 EH/s.

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.