Hashrate Index Roundup (August 11, 2025)

Your weekly mining metrics.

Hello world, happy Monday!

TLDR

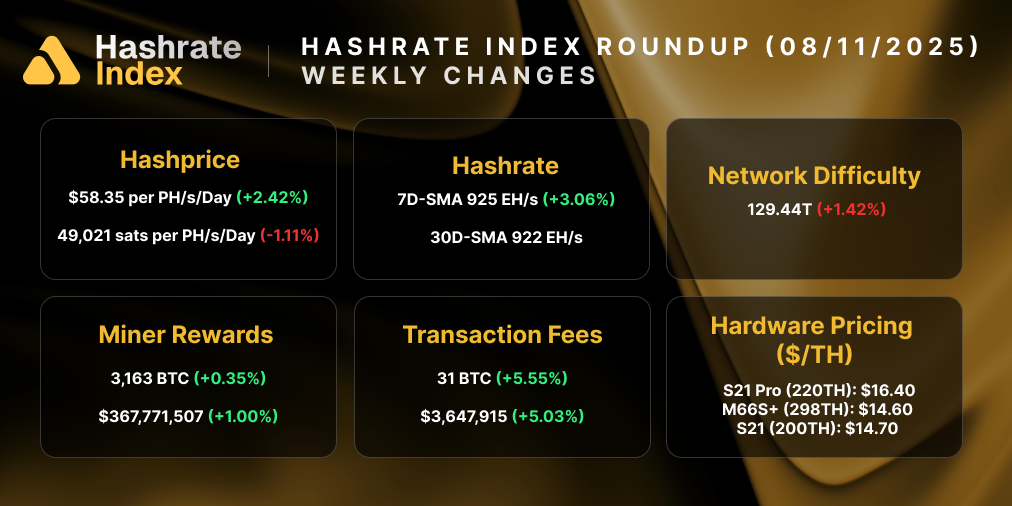

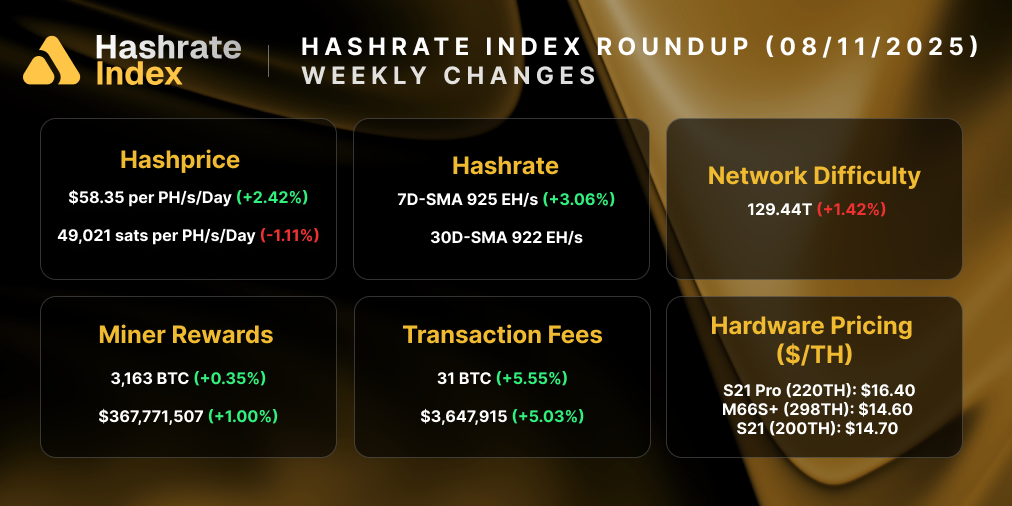

A green bag for this week's update: Bitcoin is up, hashrate is stable, difficulty is stable, fees are up; hashprice is up.

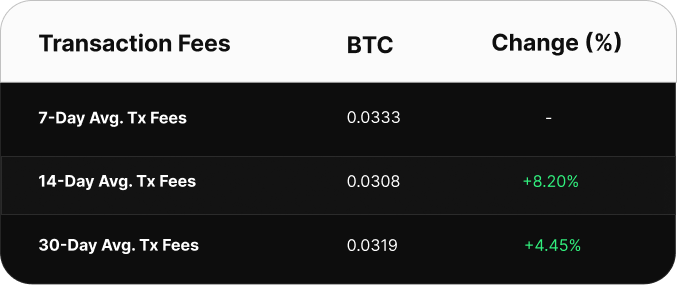

Over the past week, miners collected a total of ~3,163 BTC in block rewards, equivalent to ~$368 million. Transaction fees constituted 0.99% of block rewards totalling 31 BTC, equivalent to ~$3.65 million.

Bitcoin

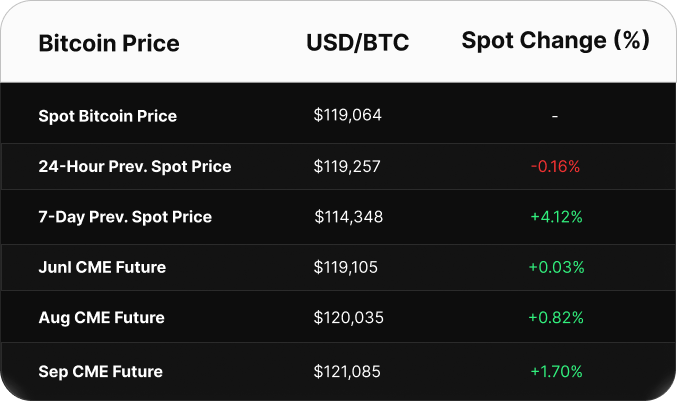

Bitcoin trended up throughout the past week, increasing by 4.12% from ~114,348 to a current price of ~$119,064. Year-to-date performance stands at +26.33%.

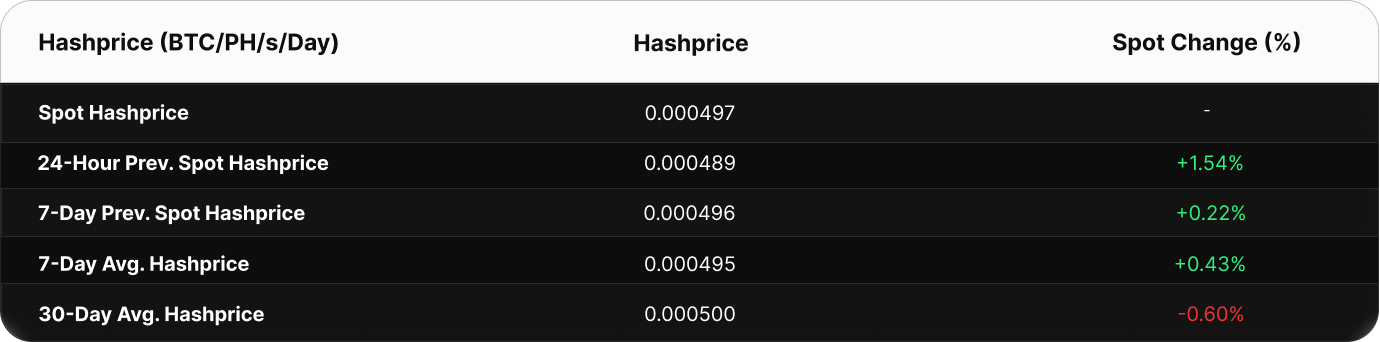

Hashprice

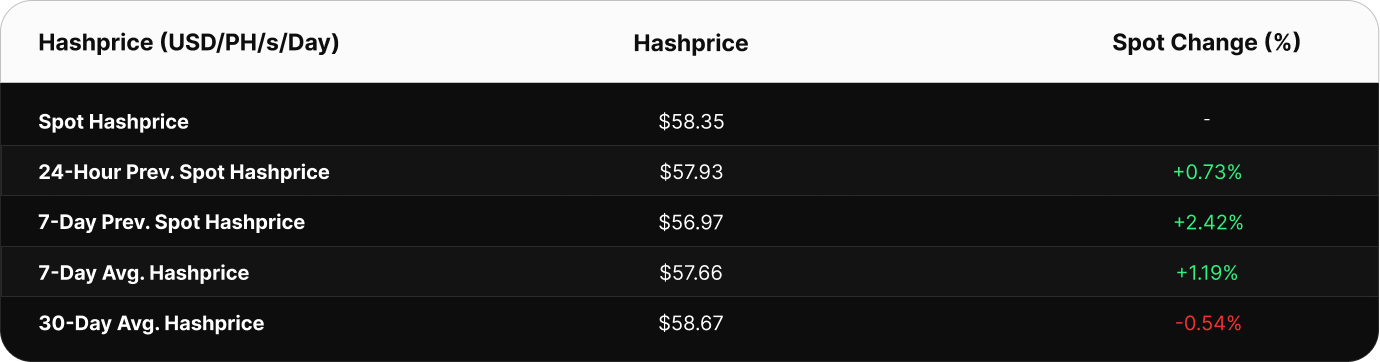

USD hashprice increased by 2.42% from $56.97 per PH/s/Day to a current $58.35 per PH/s/Day.

BTC hashprice decreased by 1.11% from 0.00049569 BTC per PH/s/Day to 0.00049021 BTC per PH/s/Day.

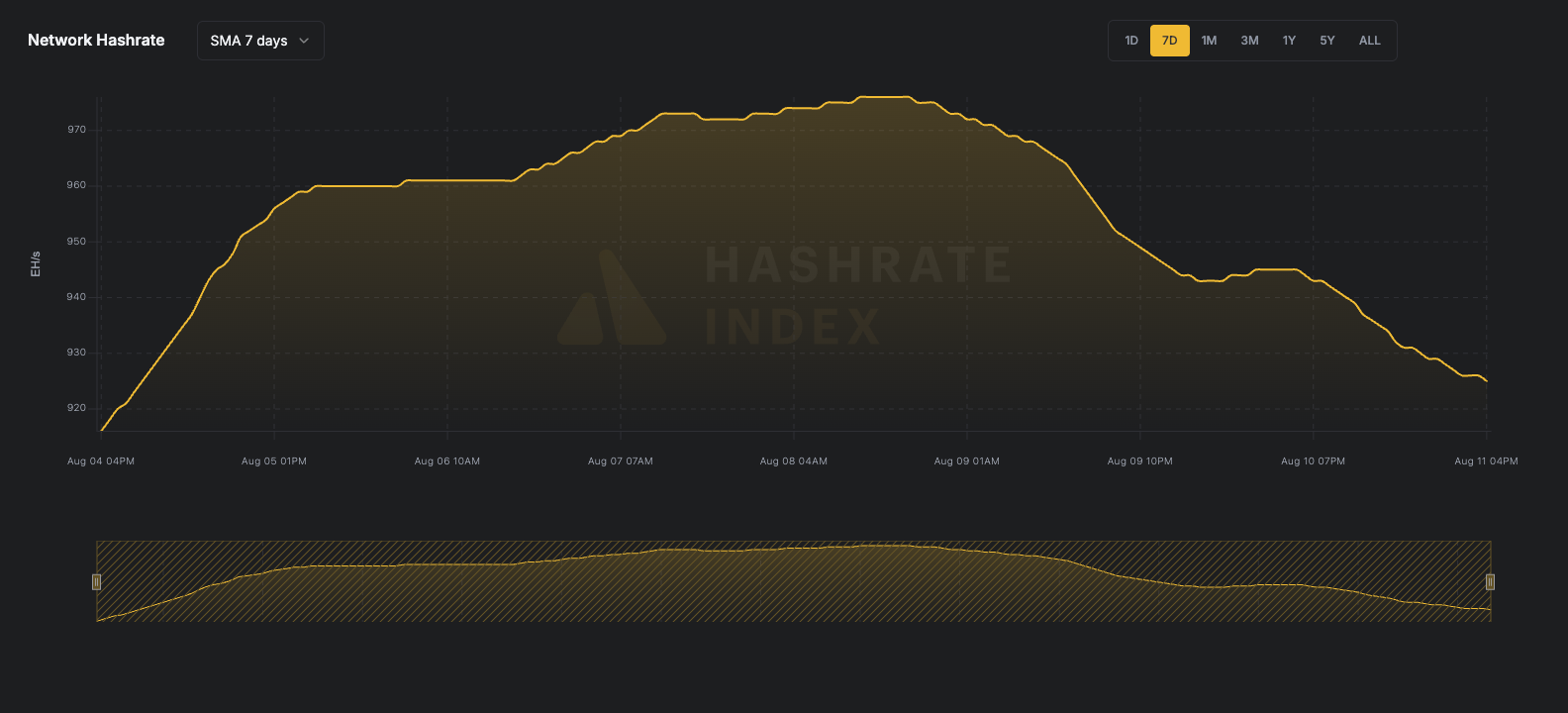

Hashrate & Difficulty

Network hashrate rose by 0.98%, with the 7-day simple moving average (SMA) moving from 916EH/s to 925EH/s. The 30-day SMA currently stands at 922 EH/s.

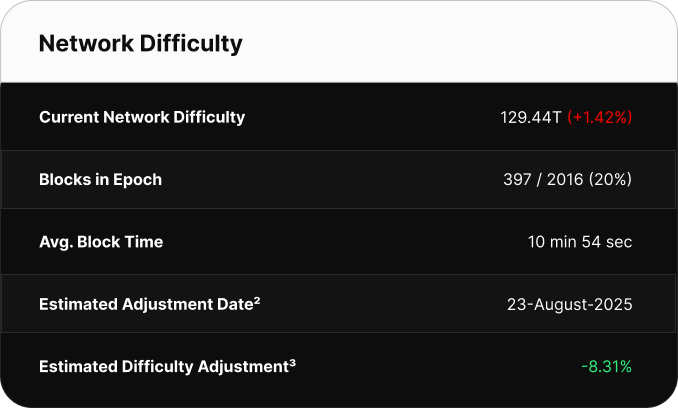

The latest difficulty adjustment took place on August 8, increasing network difficulty by 1.42% to 129.44T.

Blocks were found at an average time of around 10 minutes 54 seconds over the past 24 hours.

We currently estimate* a decrease of ~8.31% for the upcoming adjustment, expected to occur on August 23.

*This estimate should be taken with a grain of salt given that we are so early into a difficulty epoch. Early on, difficulty predictions are relatively shaky because of short-term variance. However, as time (or blocks) pass, the noise fades and the signal sharpens.

Sponsored by Luxor Firmware

At $58 per PH/s/Day, hashprice is close to – or at – breakeven for many miners depending on operating cost and machine model type. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

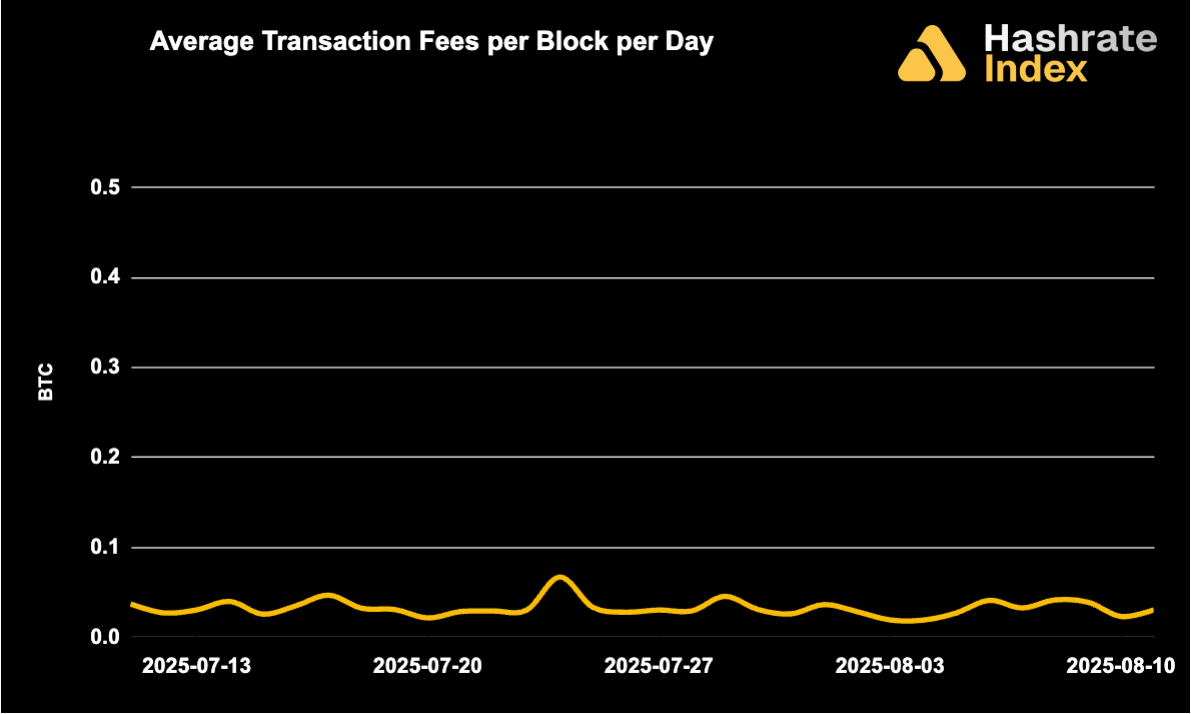

Transaction Fees

Over the past week, miners collected an average of 0.0333 BTC (per block per day) in transaction fees, compared to the prior week's 0.0291 BTC, a 14% increase.

Looking Forward

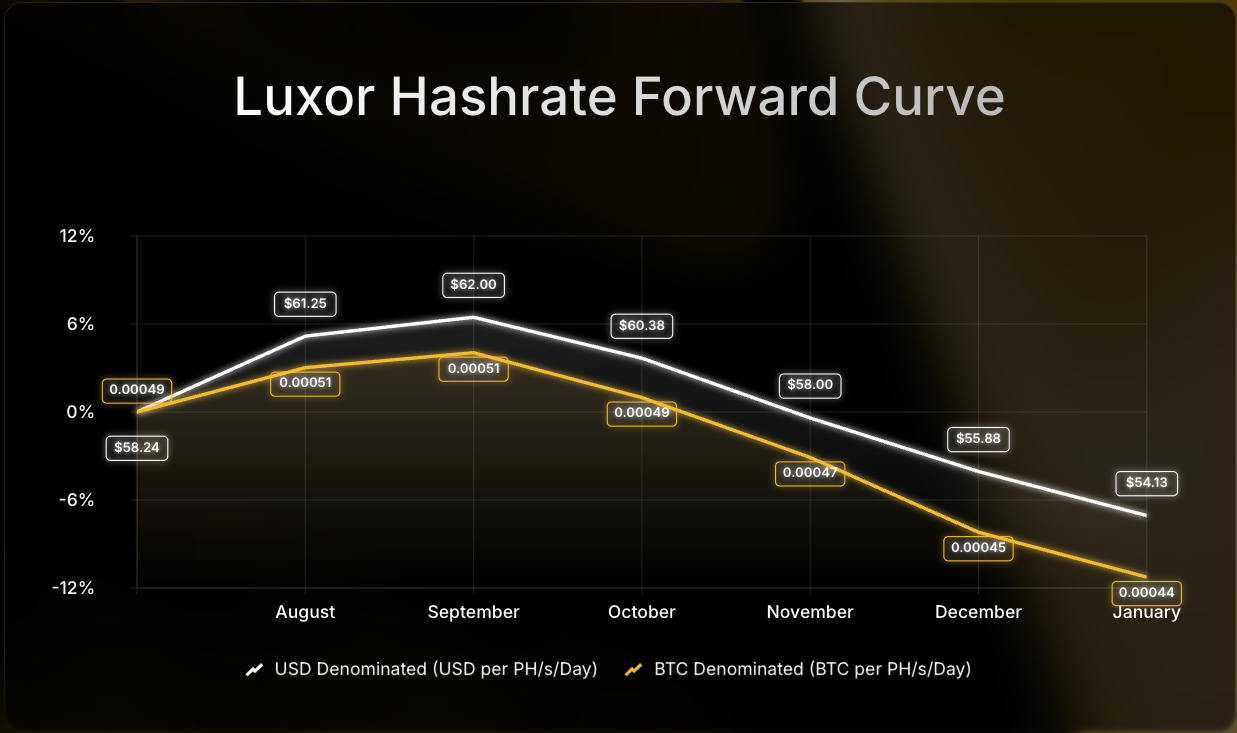

For this week's Hashrate Forward Market update, the forward market is pricing in an average hashprice of $58.61 or 0.00048 BTC over the next six months.

Bitcoin Mining Stocks

Bitcoin mining stock trends were up throughout the past week, reflecting a 4.90% decrease in our Bitcoin Mining Stock Index.

5-day changes to Bitcoin mining stocks as of last week's market close:

- BTDR: $12.57 (+1.45%) | Mkt Cap: $2.47B

- BITF: $1.24 (+4.20%) | Mkt Cap: $0.69B

- CIFR: $4.75 (-5.00%) | Mkt Cap: $1.59B

- CLSK: $10.07 (-5.36%) | Mkt Cap: $2.83B

- CORZ: $14.41 (+12.31%) | Mkt Cap: $4.38B

- HIVE: $2.07 (+0.98%) | Mkt Cap: $0.47B

- HUT: $19.45 (-2.60%) | Mkt Cap: $2.03B

- IREN: $18.45 (+17.14%) | Mkt Cap: $4.14B

- MARA: $18.83 (-1.10%) | Mkt Cap: $6.63B

- RIOT: $14.02 (+14.92%) | Mkt Cap: $5.01B

- WULF: $4.99 (-0.99%) | Mkt Cap: $1.91B

- FUFU: $4.17 (+11.20%) | Mkt Cap: $0.68B

- CAN: $0.81 (-11.96%) | Mkt Cap: $0.34B

- GREE: $1.92 (+9.71%) | Mkt Cap: $0.03B

- SLNH: $0.61 (-45.54%) | Mkt Cap: $0.03B

Have a great week, and Happy Hashing!

Footnotes

- As of August 11, 2025 UTC 21:00. Values are subject to change.

- Luxor estimates the adjustment date using average block times and blocks remaining in the epoch. Values are subject to change.

- Luxor estimates the difficulty adjustment using average block times. Values are subject to change.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.