Hashrate Index Roundup (April 8, 2024)

The Fourth Bitcoin Halving is 11 days away, and we're getting a clearer picture for what hashprice may be after the event.

Happy Monday, y'all!

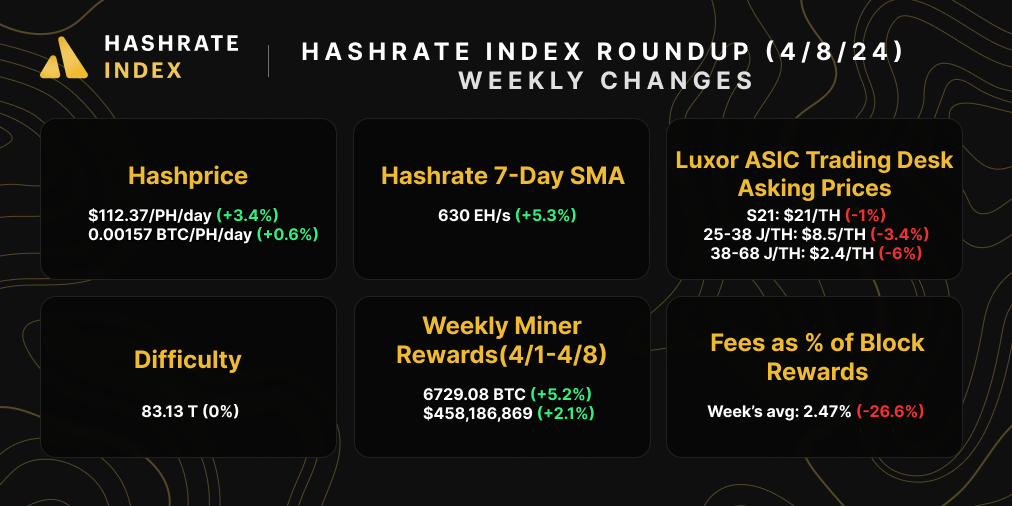

It's T-minus 11 days to the Fourth Bitcoin Halving, and bitcoin is up 3.55% over the last week to $71,400 at the time of writing.

The weekly increase to bitcoin's price has slung hashprice back above $110/PH/day, and miners are competing doggedly for every last bit of the current 6.25 BTC block subsidy. Case-in-point: Bitcoin's 7-day average hashrate is up 5.3% to 630 EH/s over the past week and nearly on-par with its all-time high, while the 30-day average is up 0.05% to an all-time high of 611 EH/s.

With miners sprinting into the final two weeks before the Halving, it's looking like the last difficulty adjustment before the event will be an increase. Right now, with 86% of this current difficulty epoch concluded, we're estimating an adjustment in the +4% range, which could bring hashprice down to roughly $107/PH/day.

With regards to forecasting hashprice in the weeks immediately after the Fourth Bitcoin Halving, if Bitcoin's price holds its current level and transaction fees do not increase substantially, we can expect something in the ballpark of $50-55/PH/day, which is roughly aligned with the flat case we lay out in our 2024 Bitcoin Halving Report and slightly less than our base case.

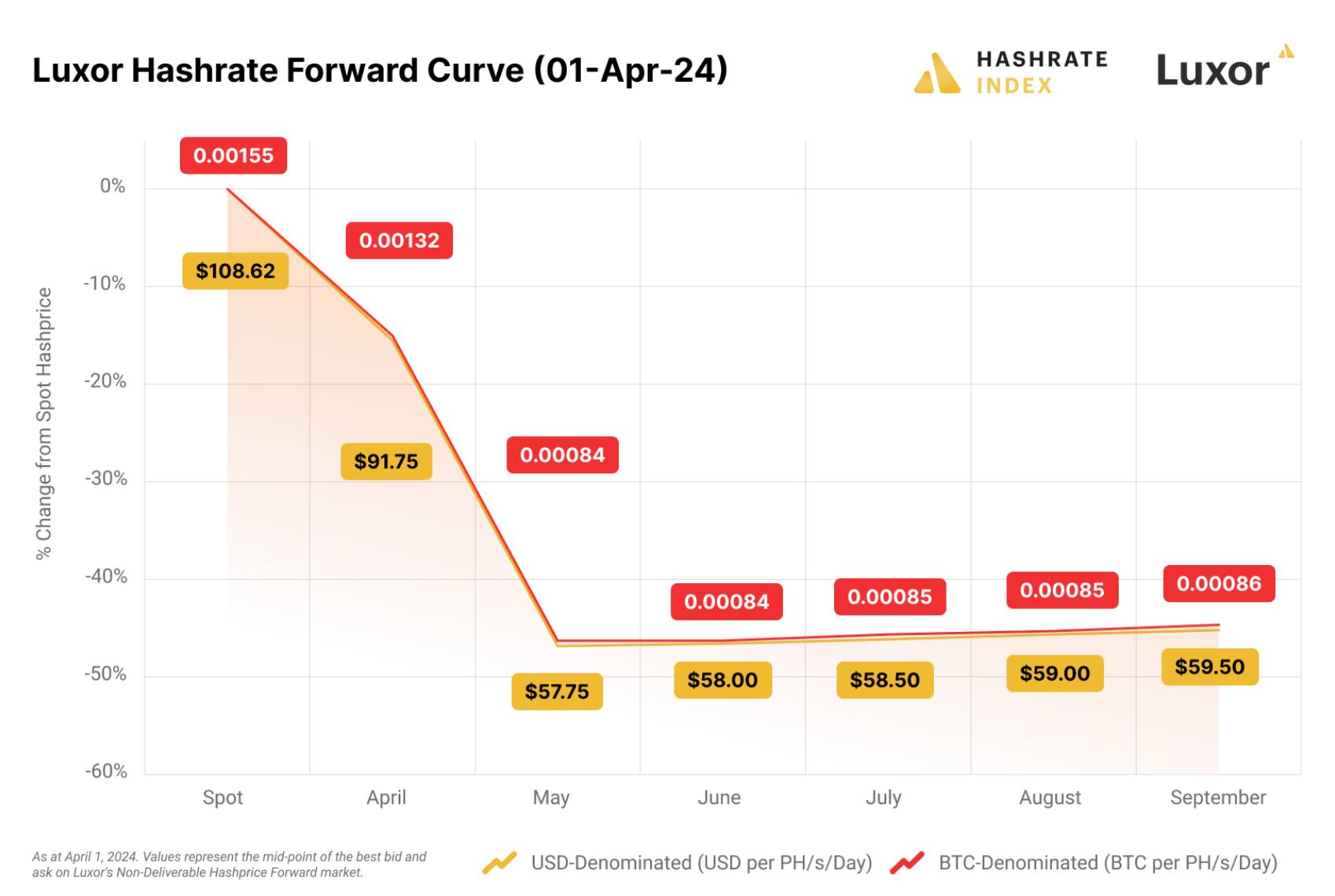

We can also look at the latest forward curve from Luxor's Derivatives Desk to see how Luxor Hashrate Forward traders are pricing in the Halving. The pricing for May according to this curve is $57.75/PH/day. The forward curve looks at the average price for asks and bids for Hashrate Forwards on Luxor's Hashrate Forwards Market, and we can use it as a lodestar to point to market expectations for what hashprice could be in the coming months.

In BTC denominated terms, the May forward curve reflects expectations for 0.00084/BTC/PH/day, which is greater than the BTC hashprice we can forecast for after the Halving (~0.00075 BTC/PH/day) if we take the current BTC hashprice (0.00157 BTC/PH/day), subtract out an estimated drop after the next difficulty adjustment (which could drop it to 0.00150/PH/day), and divide it in half to account for the Halving's 50% reduction to the block subsidy.

Hashrate traders are factoring in the almost-certain possibility of a negative difficulty adjustment after the Halving (which would improve BTC-denominated hashprice), but they are also likely factoring in positive transaction fee increases from a new inscription standard called Runes. Created Casey Rodamor, the man who birthed the ordinal / inscription standard for Bitcoin, Runes are a highly anticipated inscription standard that has the potential to create the same transaction fee gold rush that we saw in May and Q4 of last year. Rodamor and co. are looking to launch the Runes standard at block 840,000 – the same block that triggers the Fourth Halving.

You don't need to understand how Runes work or even what they are to understand that, if they see even a fraction of the trading and minting activity that BRC-20 tokens cultivated, then they could significantly move the needle for transaction fee revenue. As such, the Runes launch remains the number one wildcard that could completely alter the dynamics of hashprice (and thus, how much hashrate comes offline) after the Fourth Halving.

Sponsored by Luxor RFQ

The Antminer S21 is here, and Luxor's ASIC Trading Desk is accepting orders for this model right now! If you'd like to place a preorder for the Antminer S21, please fill out this form. Secure your order for Bitmain's most efficient and powerful ASIC miner today!

Bitcoin Mining Market Update

We've got a balance of green and red for our mining update this week. Transaction fees are still creeping downward, and ASIC prices continue to get hammered ahead of the Halving. Meanwhile, USD-denominated mining rewards are up with bitcoin's price, and BTC-denominated rewards are up on account of the fact that block times are an average of 9 minutes and 37 seconds this difficulty epoch.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Luxor Looks to Help Bitcoin Miners Hedge Halving Risk With New Hashrate Futures

- Paraguay Considers Tightening Regulations On Bitcoin Mining

- Bhutan to Upgrade Bitcoin Mining in Himalayas as 'Halving' Looms

- Bitcoin Mining's Boon for Small Town America

Bitcoin Mining Stocks Update

Monday bloody Monday for Bitcoin mining stocks. Week-over-week, basically every stock in our update is in the red, and our benchmark Crypto Mining Stock Index fell 4.5% over the week. Are investors starting to price in the revenue reduction that the Halving will force onto miners? Sure looks like it.

Weekly changes to Bitcoin mining stocks:

- RIOT: $10.05 (-7.63%)

- HUT: $9.00(-10%)

- BITF: $2.03 (-7.31%)

- HIVE: $3.17 (-1.25%)

- MARA: $17.95 (-12.05%)

- CLSK: $15.36 (-14.24%)

- IREN: $5.41 (-9.08%)

- CORZ: $3.38 (+0.6%)

- WULF: $2.23 (-3.04%)

- CIFR: $4.29 (-1.38%)

- BTDR: $7.10(+5.34%)

- SDIG: $3.54 (-6.6%)

New From Hashrate Index

How LuxOS Can Maximize Your ASIC Miner’s Power Consumption and Revenue

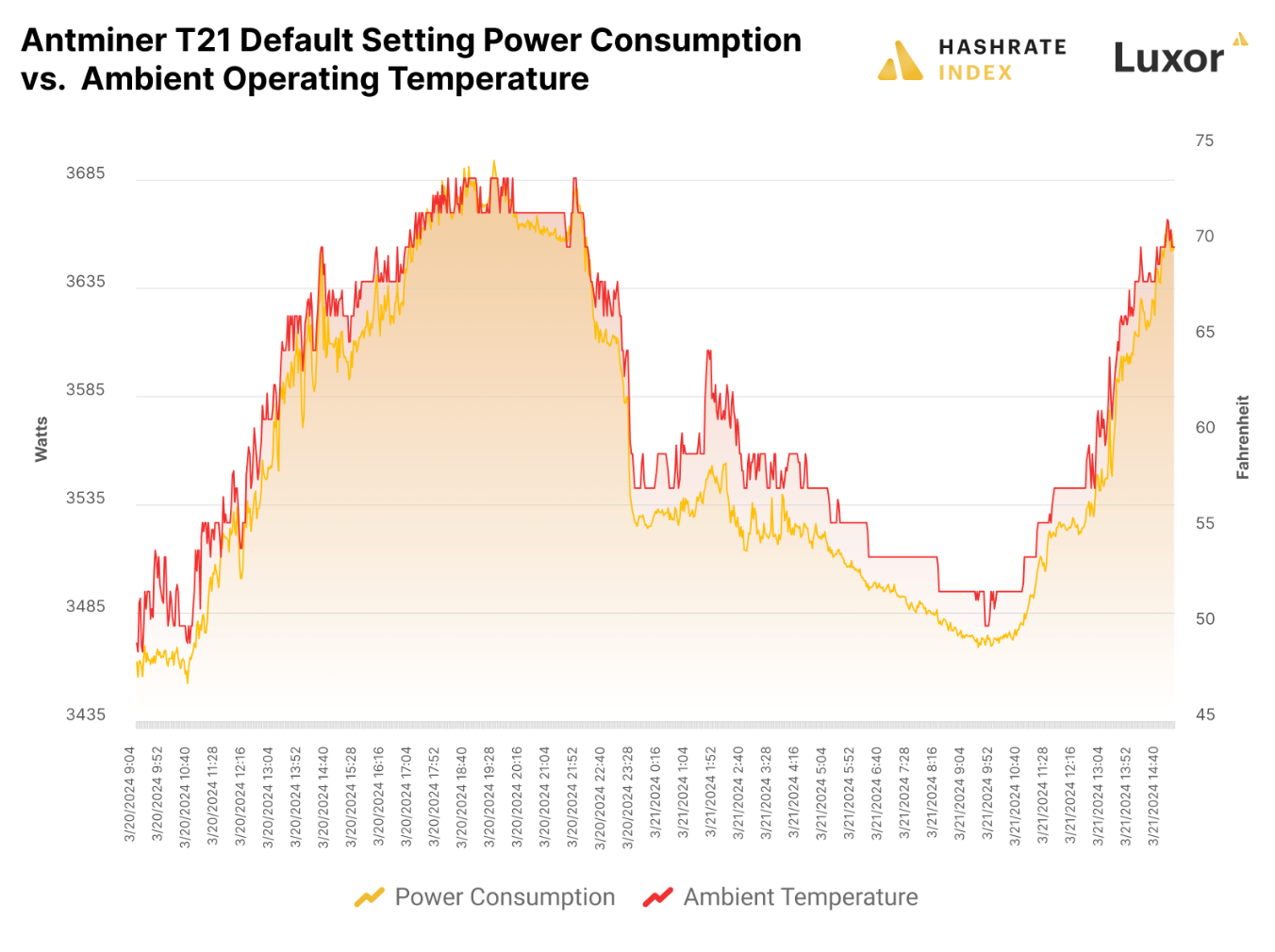

ASIC miners are extremely sensitive to temperature fluctuations. Temperature is strongly correlated with power consumption, so increases in ambient temperature lead to increases in power consumption, which reduces machine efficiency. Conversely, decreases in temperature lead to decreases in power consumption, resulting in improvements to machine efficiency.

If they are not employing after-market firmware, Bitcoin miners are leaving revenue on the table. We cover the efficiency and hashrate gains miners can experience with LuxOS in our latest for Hashrate Index.

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.