Hashrate Index 2023 Bitcoin Mining Year in Review: In the Shadow of the Halving

2023 was a comeback year for a beleaguered Bitcoin Mining industry. We cover the highlights in our 2023 Bitcoin Mining Year in Review.

Hashrate Index's 2023 Year in Review is here!

2023 was a comeback year for the Bitcoin mining industry.

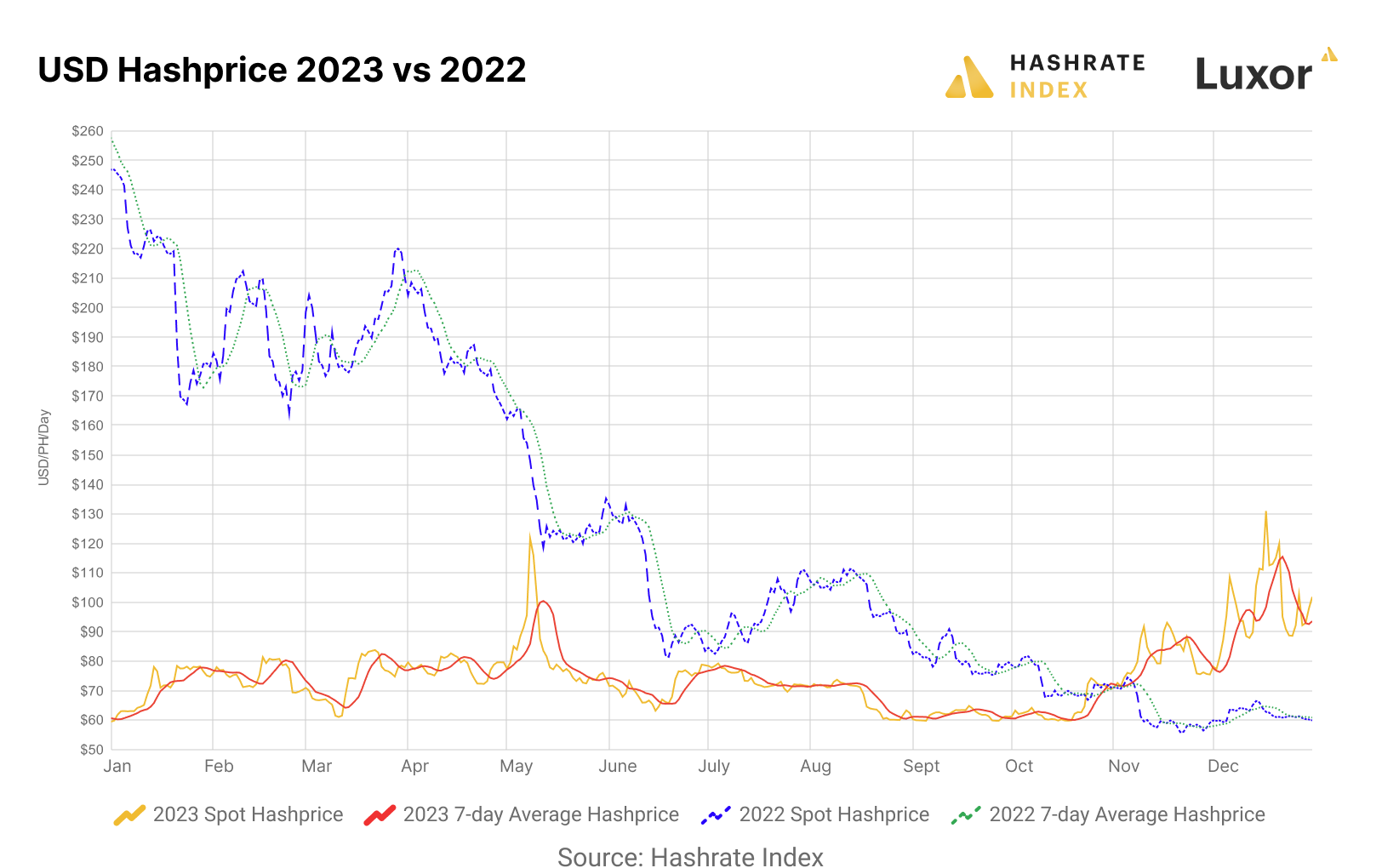

Bitcoin entered the year just under $17,000 in the aftermath of a market implosion that was precipitated by the folding of FTX’s paper empire. Hashprice was treading in all-time low territory below $60/PH/day. The largest public Bitcoin miner, Core Scientific, was undergoing bankruptcy proceedings, while many other public miners like Iris, Greenidge, and Argo went through debt restructurings, and it looked like many other miners would soon be joining them. With hashprice compressed and power rates inflating, many miners in the North American context were facing breakeven thresholds – if they weren’t there already.

Then 2023 threw everyone for a surprising ride. Bitcoin’s price recovered swiftly from its post-FTX-fallout lows and gained 149% over the course of 2023. Hashprice rose 71% over 2023, a much-welcomed reverse from 2022’s 76% decline; this recovery was aided as much – if not more so – by a bull market in transaction fees from inscriptions and ordinals, a new form of Bitcoin-based NFT/digital collectibles standard that generated record levels of dollar-denominated transaction fee revenue for miners. 2023, by most markers, was a complete reversal of fortune from 2022’s market ruin.

The free version of the report is available for download below. The premium version is available to Hashrate Index Premium subscribers. If you find the report useful, please share and feel free to give us your feedback!

For the remainder of today's newsletter, we've included a small sample of the data and analysis we packed into the report.

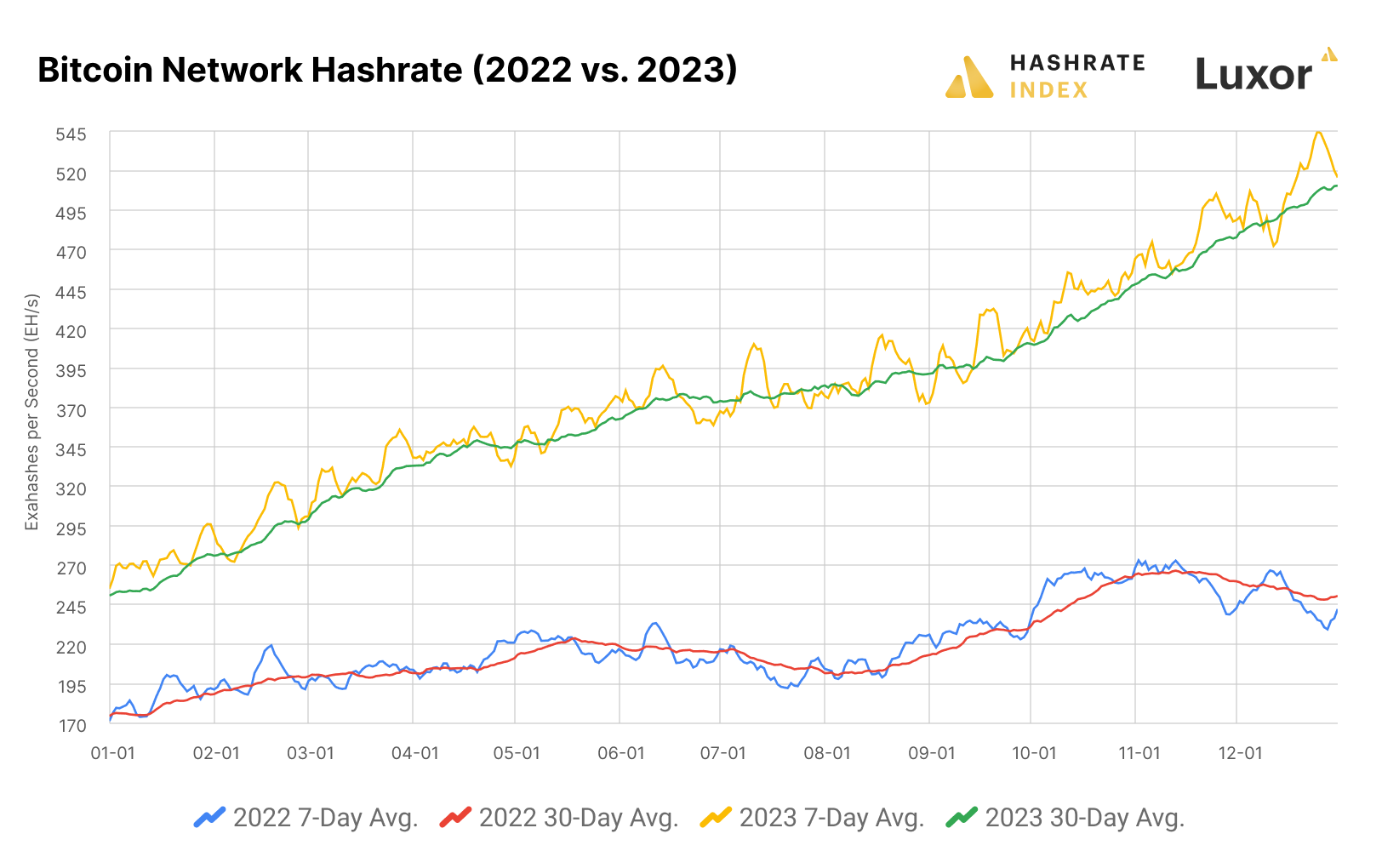

Bitcoin's Hashrate Doubles

Bitcoin’s hashrate experienced explosive growth in 2023. Bitcoin’s 7-day average hashrate swelled from 255 EH/s to 516 EH/s over 2023, a 102% increase that dwarfs 2021 and 2022’s relatively modest increases of 18% and 41%. 2023’s average for Bitcoin’s 7-day average hashrate was 382 EH/s, a 73% increase from 2022’s average of 220 EH/s. Bitcoin’s hashrate hit all-time highs of 545 EH/s on the 7-day average and 510 EH/s on the 30-day average in 2023, as well.

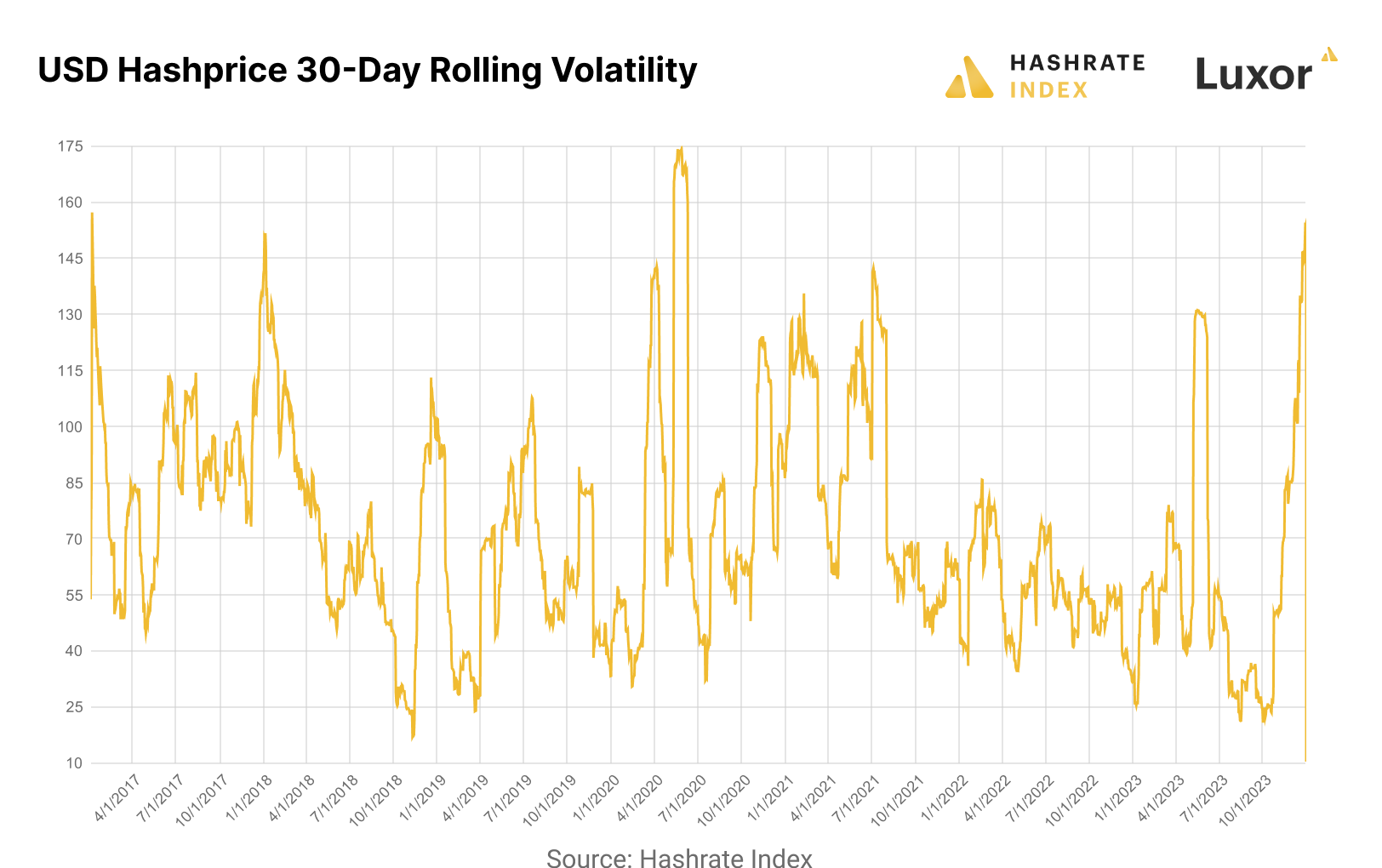

Hashprice Volatility Hits Multi-Year High

Hashprice entered 2023 near all-time lows, and most indicators pointed to it either trending lower or remaining flat for the year. But along with bitcoin, USD hashprice exceeded market expectations in 2023, rising an impressive 71% over the course of the year from $59.42/PH/day to $101.78/day; compare this to 2022, where hashprice declined 76% from $246.85/PH/day to $59.42/PH/day. Still, 2023’s average hashprice was $74.73/PH/day versus $123.87/PH/day in 2022, a 40% decrease.

Largely as a result of inscriptions-induced swings to transaction fees, hashprice had a significantly more volatile year in 2023 than 2022.

2022’s hahsprice volatility was marked by bitcoin’s eroding price. When bitcoin found a floor as 2022 turned to 2023, volatility dropped to its lowest level since July 2020, and it dropped again to a multi-year low on the first day of October, reaching its lowest point since November 2018. By the end of the year, the transaction fee bull run tossed hashprice volatility to its highest level since May 2020, a time when hashprice was reacting to Bitcoin’s third halving. (When measuring volatility, the higher the number, the more volatile an asset over the 30-day rolling period and vice versa for a low score).

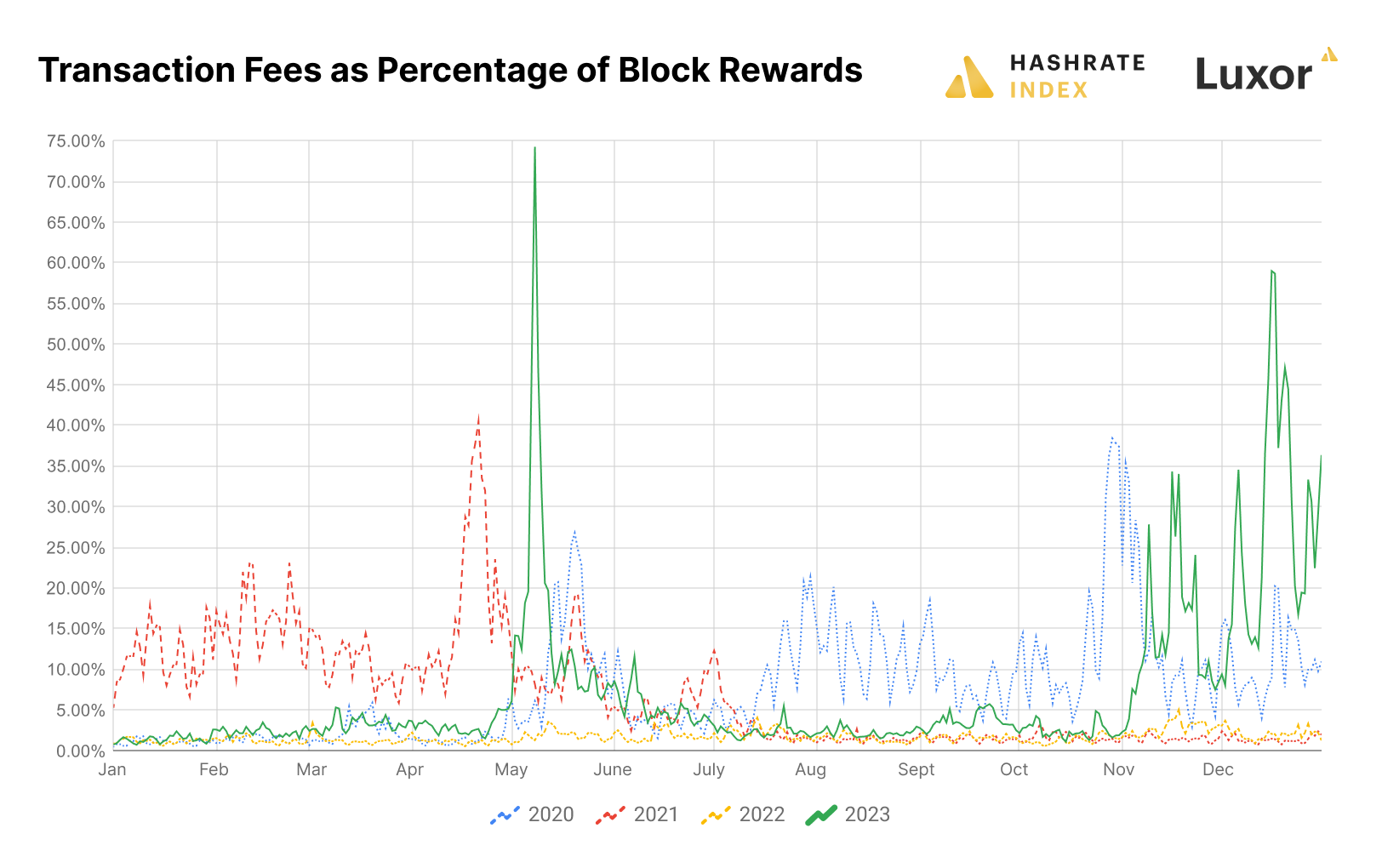

Inscriptions and Ordinals Juice Transaction Fees

The biggest dark horse of 2023 galloped into the market on the back of a new technical standard for Bitcoin-based non-fungible tokens (NFTs): ordinals and inscriptions. This new method for creating digital artifacts / art on Bitcoin revived transaction fees as a substantial source of mining revenue.

In fact, 2023 was the penultimate year for transaction fee rewards in Bitcoin’s history; miners earned $797,867,915 in transaction fees in 2023, a haul that is second only to 2021’s record of $1,019,725,113. Fees constituted 7.6% of block rewards in 2023, compared to 1.5% in 2022.

ASIC Market Finds a Bottom

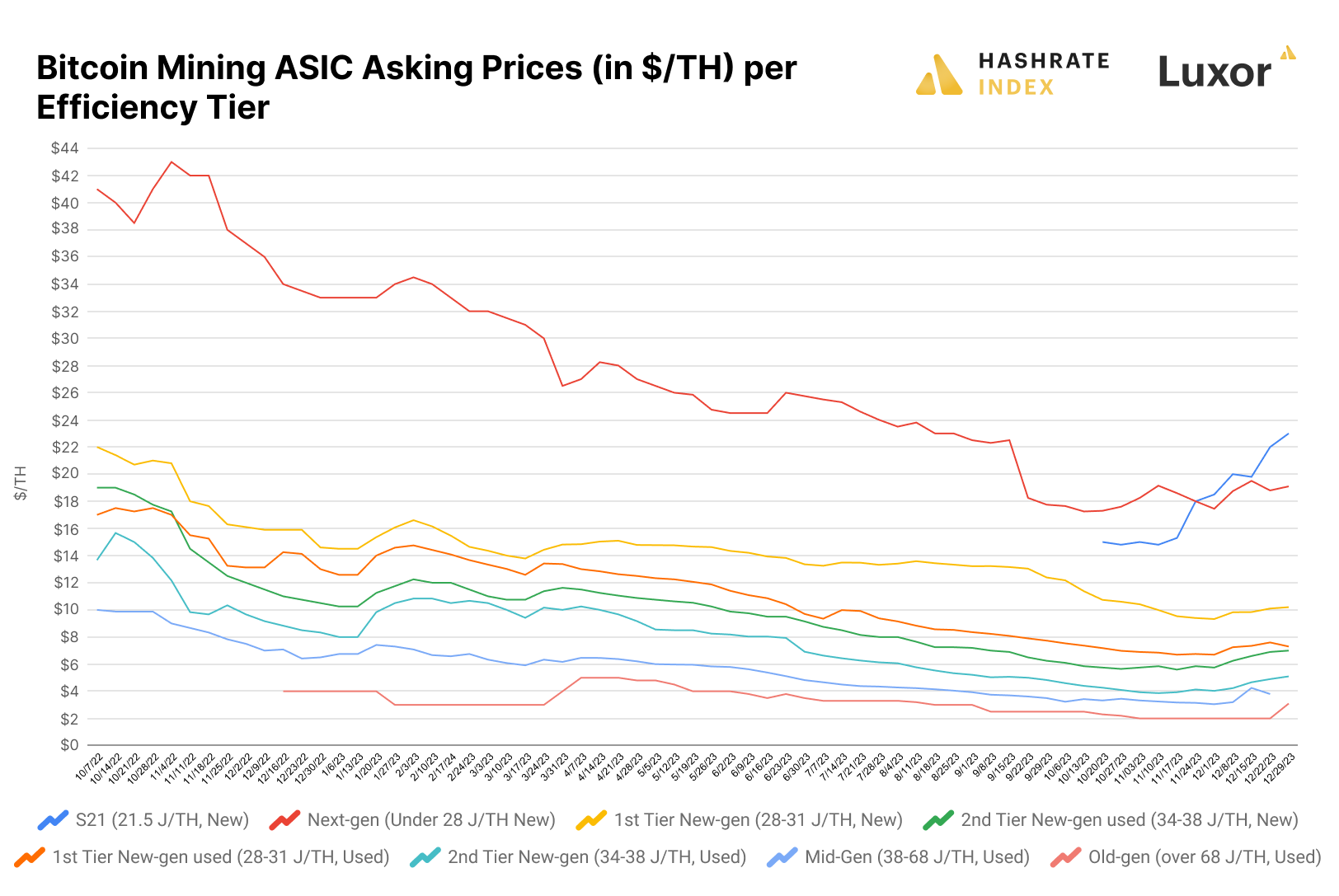

ASIC miner prices entered 2023 in a downtrend. That downtrend finally found a bottom in Q4-2023.

ASIC prices popped from 2022’s lows in the first quarter of 2023 as Bitcoin’s price recovered from $16,000, only to continue to backslide through Q2 and Q3 after their brief price recovery at the beginning of the year. (It’s worth noting that the gradual rise in hashprice over 2023 kept valuations higher than they would have been). For now at least, next-gen ASIC prices hit lows in October and new-gen ASICs hit lows in late November / early December; since then, they’ve bounced in response to Q4’s impressive hashprice rally.

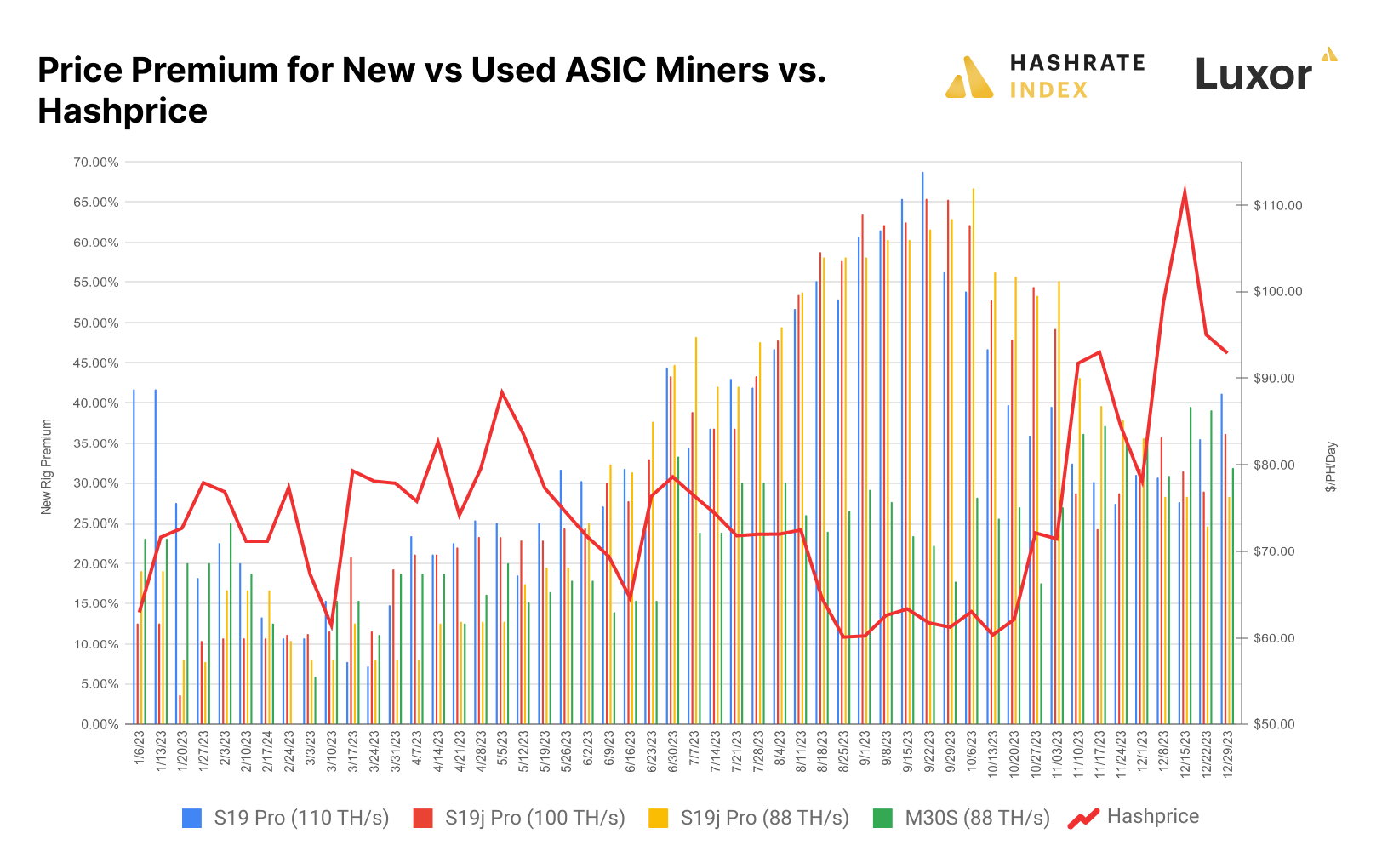

Taking a close look at new and used ASIC models, we can see that premiums for new ASIC models rose as 2023 wore on. The chart below shows the percentage difference in $/TH between new and used ASIC from 1-200 MOQ orders from Luxor’s ASIC Trading Desk market data.

Power Prices Fall – But Only Slightly

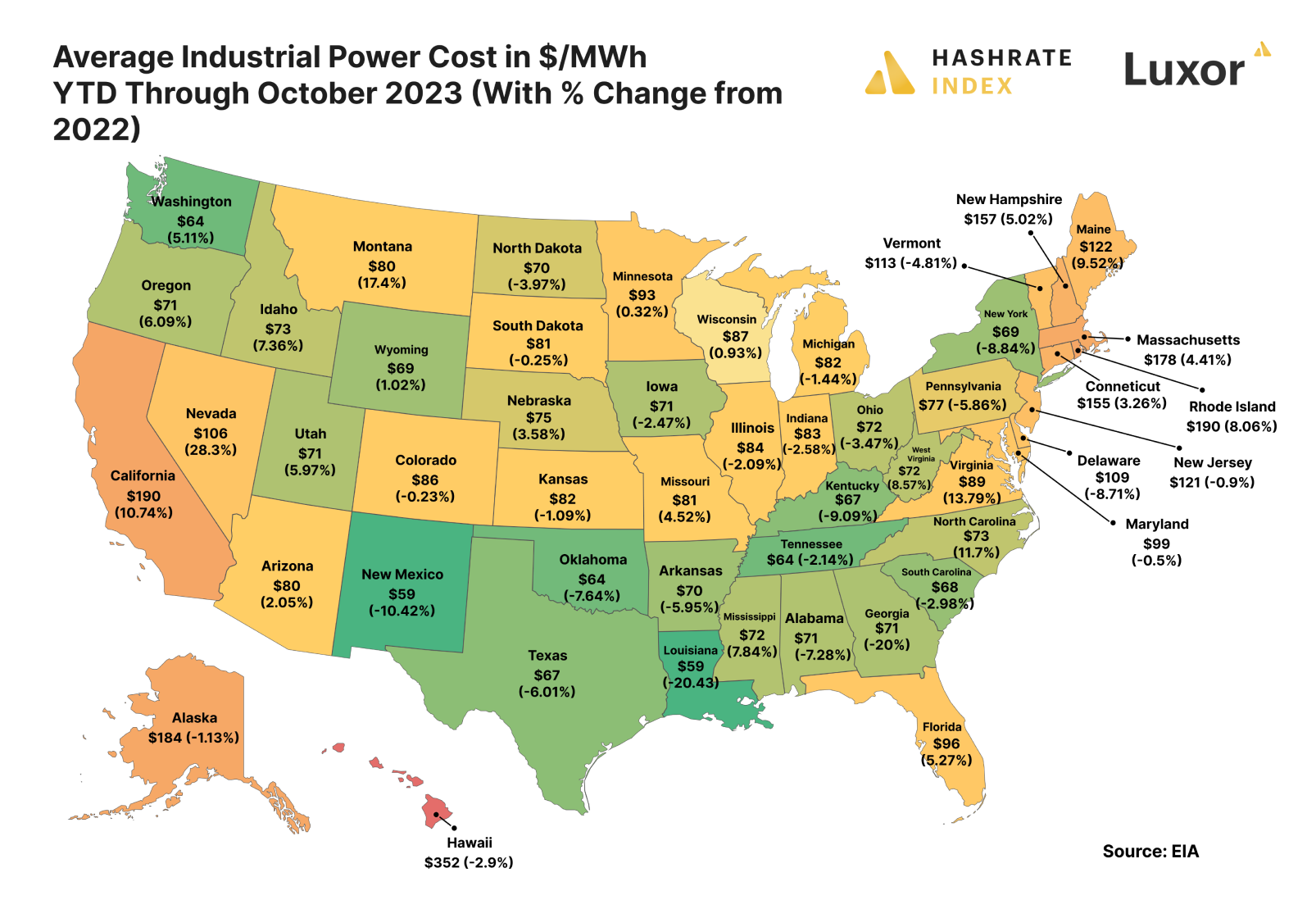

In the US, electricity and fuel prices experienced record inflation in 2022. 2023 delivered some relief to this inflationary onslaught– but only slightly, and only to industrial power consumers.

From January through October 2023 (the most up-to-date data), the average industrial price of electricity in the US was $81.3/MWh, a 2.3% decrease from $83.2/MWh during the same period in 2022. Over the same period, the average commercial electricity cost rose 3.1% from $124.3/MWh in 2022 to $128.1/MWh in 2023, and the average residential cost rose from $0.15/kWh in 2022 to $0.16/kWh in 2023.

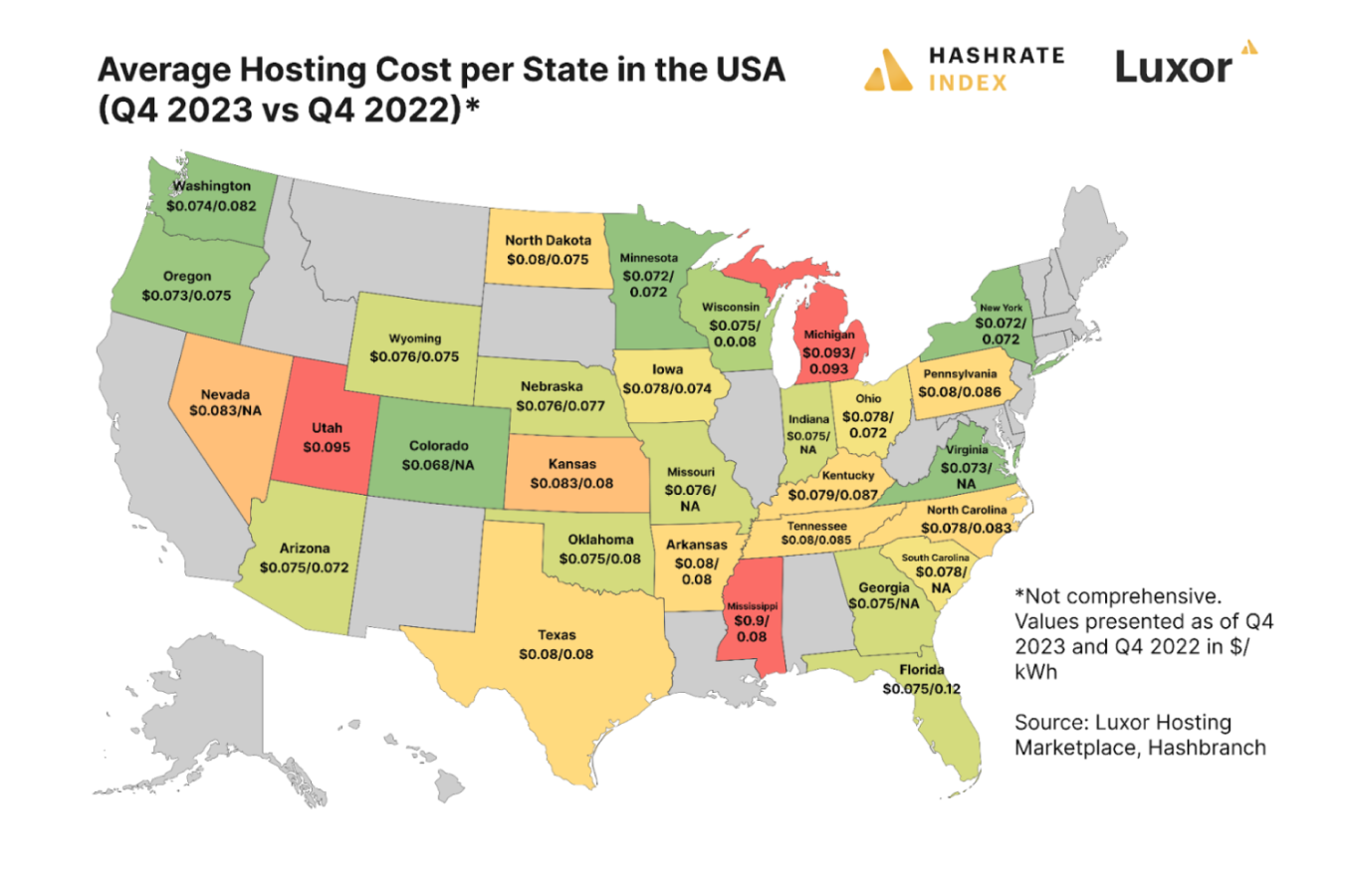

Hosting Rates Fall

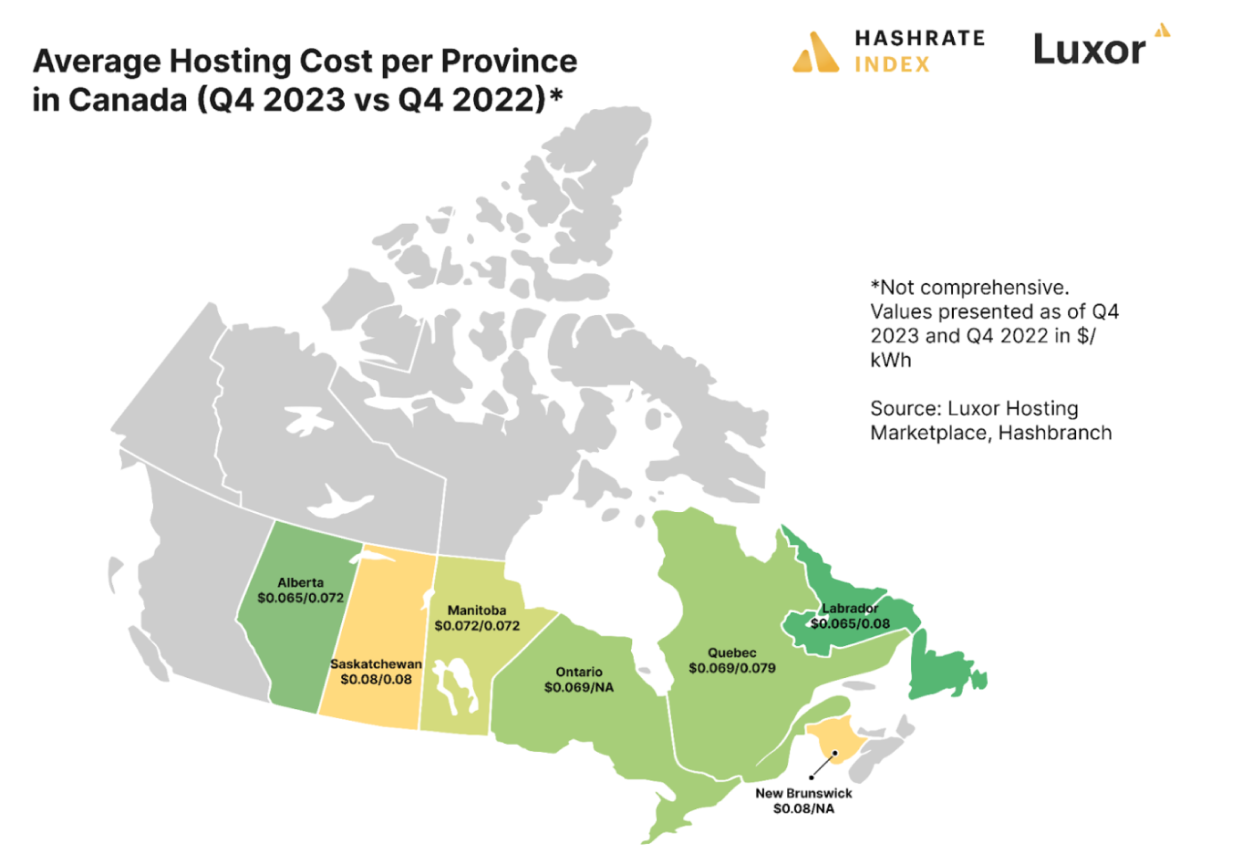

In aggregate, Bitcoin mining hosting rates fell over the course of 2023.

While there is no one-size-fits-all approach to Bitcoin mining hosting, rates typically move up or down according to energy markets. Indeed, we saw hosting rates balloon in 2022 as energy and electricity prices inflated, so much so that the average all-in hosting rate according to our hosting index reached $0.082/kWh in Q4-2022; with hahsprice trading in a range between $55-62/PH/day at the time, this average hosting rate would have rendered many miners unprofitable unless they had next-generation equipment.

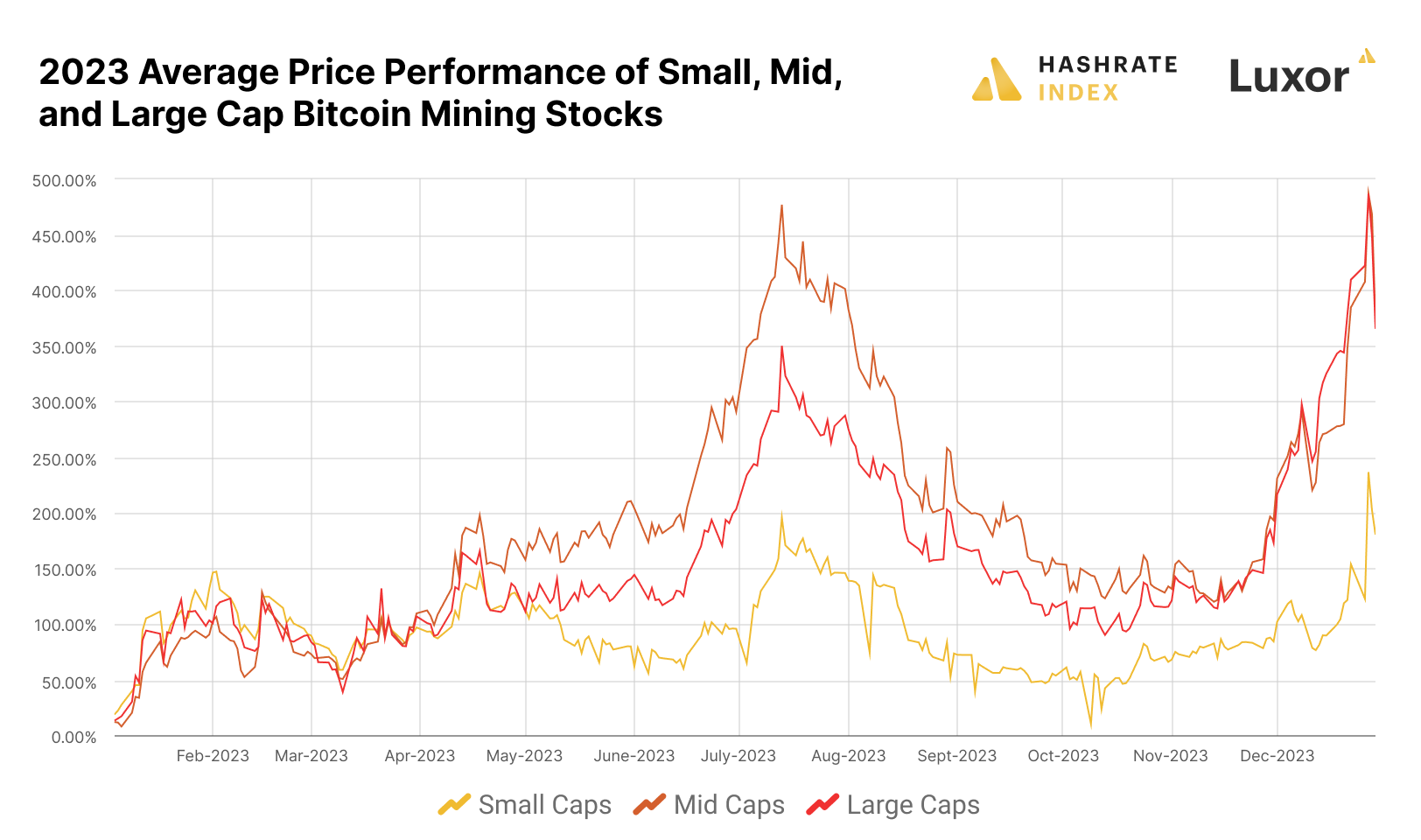

Bitcoin Mining Stocks Make a Comeback

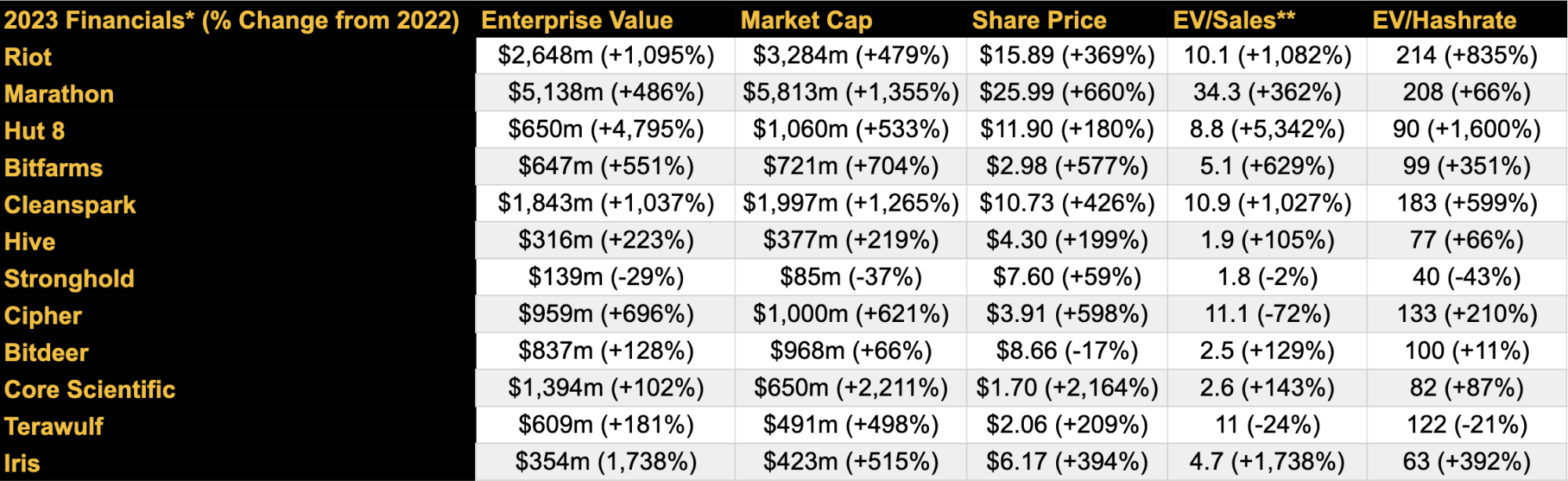

2023 was a comeback year for Bitcoin and its mining industry, and Bitcoin mining stocks were certainly no exception to the revival.

Investors treat Bitcoin mining stocks as high-beta vehicles for Bitcoin exposure, so with Bitcoin and hashprice rebounding, Bitcoin mining stocks rebounded even harder. Many stocks saw triple digit returns over the course of 2023.

As a result of the superb share price increases almost every public miner enjoyed in 2023, these companies were much more healthy financially at the end of 2023 than 2022.

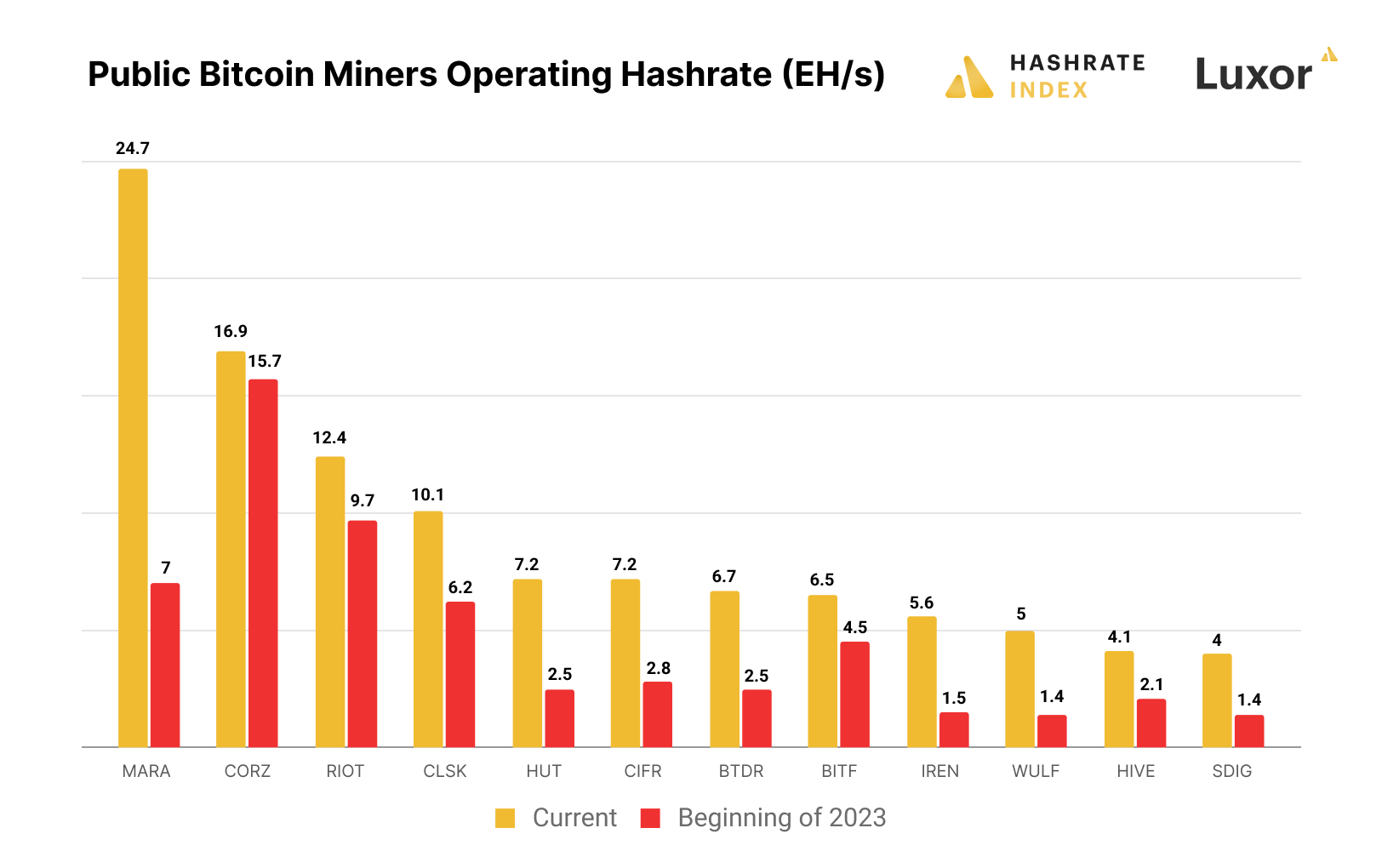

2023 was a year of great expansion for most public miners. Of the 12 miners we track, 7 of them more than doubled their hashrate over the year. Marathon saw the most growth, expanding its hashrate from 7 EH/s to 24.7 EH/s.

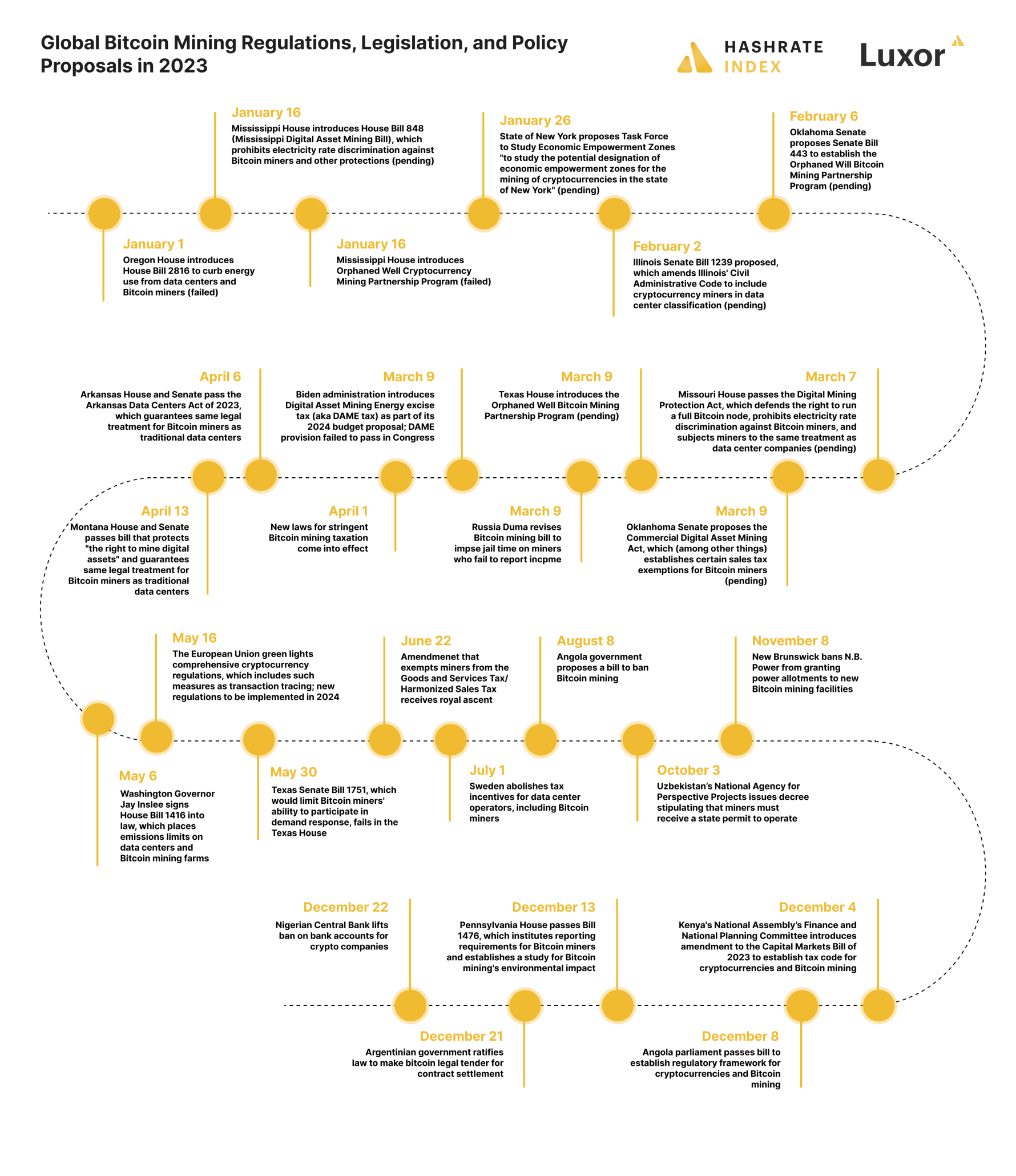

Significant Regulatory and Legislative Action in 2023

2023 was perhaps one of the most active years for policy proposals and formal government action directed toward the Bitcoin mining industry. In the US, 2023 was marked by significant state-level action to regulate the industry, including so-called “right to mine” laws that sought (and sometimes succeeded) to establish legal protection for Bitcoin mining entities by treating them like data centers.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.