Hashprice At All Time Lows

How Can Miners Utilize the Hashrate Forward Curve?

Introduction

On November 22, 2025, mining economics cracked under pressure. With a steep and enduring decline in Bitcoin prices, a doubling in mining difficulty since the last hashprice bottom, and transaction fee rewards at near all-time lows, hashprice settled at $35.06 per PH/s/Day.

In response, miners are faced with critical decisions. Should they hedge against hashprice risk to protect mining margins, seize the opportunity to buy more hashrate at lower prices, or curtail mining operations and seek alternative revenue streams? These decisions will have significant financial consequences.

Fortunately, miners can now use Luxor’s Hashrate Forward Curve to manage hashprice risk and capitalize on hashrate opportunities as the market moves. Here's the case for selling or buying future hashrate at today’s all-time low levels.

The Case For Selling Hashrate Forward

1. Protecting Mid-Gen Fleets from Shutdown

The case is clear for mid-gen miners to consider selling hashrate forward at current hashprice levels. Dollar-denominated hashprice is at an all-time low, but that does not mean it won’t go even lower. At this point, mid-gen miners are facing imminent shutdown risk.

In Q4-2025, Bitcoin prices took a turn, wiping out year-to-date (YTD) gains. From an all-time high of $124,485 on October 6, BTC began to decline by an average of -1% per day to $84,348 on November 22, a 32.2% dip overall. Another 10% from here, and we are in the 20’s for hashprice. In such a scenario, a locked-in hashprice could literally save a mining operation from shutting down and keeping cash flowing.

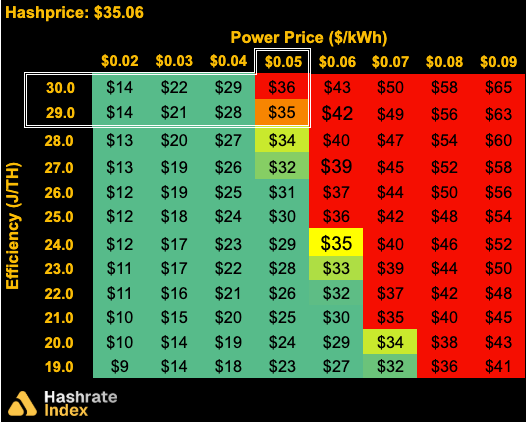

To illustrate, take a look at the hashcost curve below. Each cell value represents the daily cost incurred by a mining operation based on its fleetwide efficiency (J/TH) and power price ($/kWh) profile. At a $35.06 hashprice, miners with 5-cent power can only justify hashing with fleets below 29 J/TH:

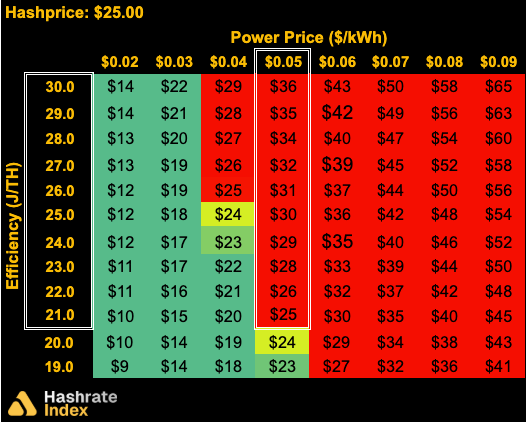

If hashprice moves to $25 per PH/s/Day, fleets all the way down to 21 J/TH would be forced to shutdown, pushing air-cooled Antminer S19 series machines out of the network:

At 5-cent power prices, every single-dollar-decline in hashprice essentially demands a fleetwide efficiency improvement of 1 J/TH in order to continue mining profitably, demonstrating the precarious nature of remaining exposed to spot hashprice (FPPS).

At this time, unhedged mid-gen miners are risking their business on unpredictable market moves.

2. Locking In Healthy Margins for New-Gen Fleets

Older-generation machines are facing obsolescence risk, but newer-generation (i.e., more efficient) machines are in fact still earning healthy revenues per unit of electricity.

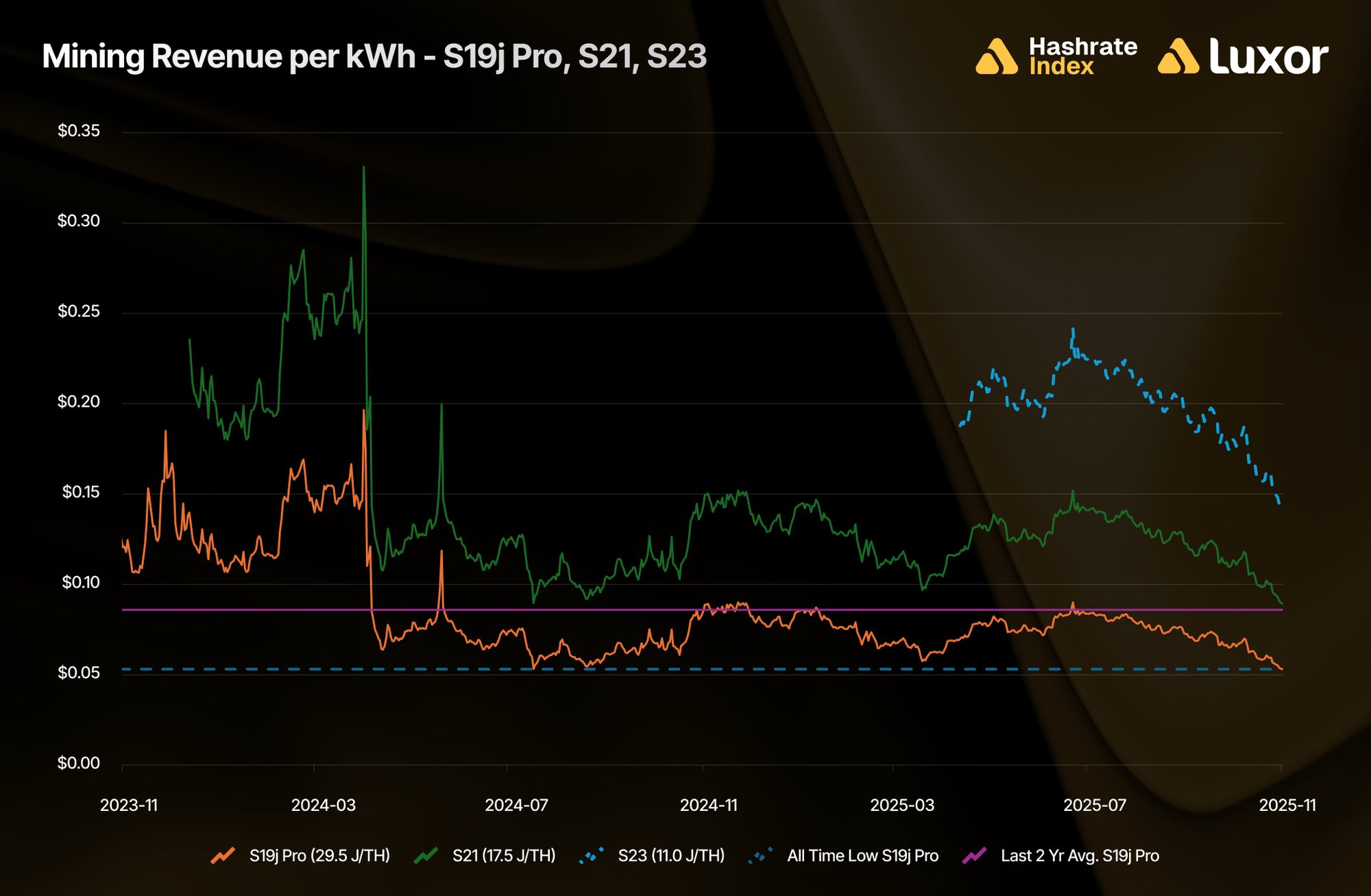

On a kWh basis, operations running Antminer S21 fleets can hedge their hashrate production for six months at approximately $0.09-0.10 per kWh. This revenue is in line with the average S19j Pro hashprice per kWh over the last two years, and 69% higher than today’s all time lows for the S19j Pro, currently at around $0.05 per kWh. Taking it one step further, a state-of-the-art machine such as the S23 would earn approximately $0.14-0.15 per kWh, 66% more than the 2-year average S19j Pro hashprice per kWh:

Even at the dollar-denominated hashprice bottom, there are meaningful margins for newer generation fleets to lock in.

The Case For Buying More Hashrate

3. Speculating on a Hashprice Bounce-Back

For risk-takers in the Bitcoin mining game, buying hashrate at rock-bottom hashprices could be a strategic move. If hashrate market participants want to express a bullish hashprice view — e.g., if they believe Bitcoin’s price will bounce back, mining difficulty will decrease as miners drop off the network, or transaction fees will jump — buying forward hashrate is currently the most efficient, cost-effective way.

Buying forward hashrate also simplifies the process of scaling. Physical mining operations entail challenges such as logistics, electrical infrastructure, power contracts, and project delays, all of which can disrupt production while leaving operating capital idle. In contrast, hashrate forwards enable miners to deploy capital and generate BTC instantly, without the complexities associated with mining operations.

4. Securing a Lower Hashcost

For operators with outdated gear or high electricity costs resulting in an operational hashcost above mid-market hashprices (i.e., the hashrate forward curve), buying hashrate from the forward market instead would immediately reduce their hashcost, resulting in the same amount of BTC mining rewards at a lower cost.

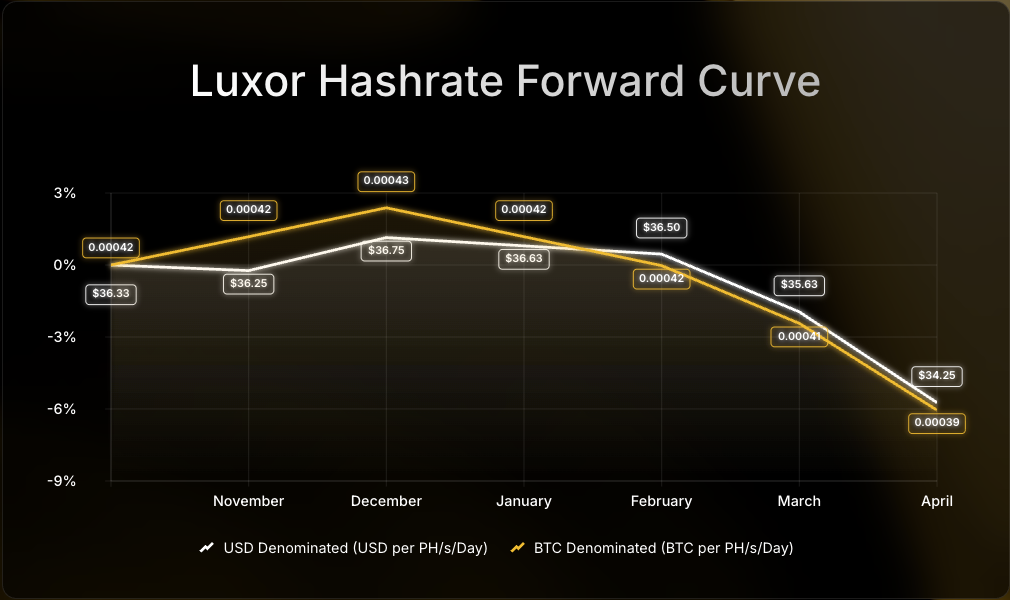

Looking forward, Luxor’s Hashrate Forward Market is pricing in an average hashprice of $36.00 or 0.00041 BTC per PH/s/Day over the next six months. Sellers can currently secure this hashprice while buyers have the opportunity to lock in the same hashcost through April 2026.

If you’d like to learn more about Luxor’s Bitcoin mining derivatives, please reach out to [email protected] or visit https://www.luxor.tech/derivatives.

About Luxor Technology Corporation

Luxor delivers hardware, software, and financial services that power the global compute and energy industry. Its product suite spans Bitcoin Mining Pools, ASIC Firmware, Hardware trading, Hashrate Derivatives, Energy services, and a bitcoin mining data platform, Hashrate Index.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.