Hardware Review: Canaan’s A16 Series

Analyzing Canaan’s latest Bitcoin mining hardware.

In this post, we dive into Canaan’s latest Bitcoin mining hardware — the Avalon A16 Series — covering physical components, performance testing, and financial analysis.

Preamble

Founded in 2013, Canaan delivered the world’s first commercial bitcoin mining ASIC, establishing the Avalon brand as a cornerstone of industrial mining. Over the next decade, the company released fifteen generations of Avalon miners and built a global footprint spanning over 85 countries, backed by nearly 500 patents and a growing reputation for performance and reliability. Following its 2019 IPO, the company expanded beyond machine manufacturing into self-mining, now operating over 7.5 EH/s across multiple continents.

Introduction

In October 2025, Canaan Inc. introduced the Avalon A16 series, featuring two new ASIC models — the Avalon A16 (282 TH/s | 13.8 J/TH) and Avalon A16 XP (300 TH/s | 12.8 J/TH) — representing the company’s most efficient bitcoin mining machines to date. Both models mark a decisive leap forward in hashrate-per-watt, narrowing the efficiency gap with other major manufacturers in the industry.

TLDR

A16 Series At A Glance

- Machine Models: A16, A16 XP

- Manufacturer: Canaan

- Release Date: October 2025

- Cooling Method(s): Air

Stock Specifications

A16

- Hashrate: 282 TH/s (± ~5%)

- Power Consumption: 3,900W (± ~10%)

- Nameplate Efficiency: 13.8 J/TH (± ~5%)

A16XP

- Hashrate: 300 TH/s (± ~5%)

- Power Consumption: 3,850W (± ~10%)

- Nameplate Efficiency: 12.8 J/TH (± ~5%)

Mining Economics

Hardware Components

Bitcoin mining machines consist of four core functional systems that work together to convert electrical power into SHA-256 hashes.

- Cooling System: manages thermal load to maintain optimal operating temperatures.

- Power Supply Unit (PSU): converts Alternating Current (AC) power into regulated Direct Current (DC) power that ASIC chips require to work.

- Control Board: serves as the central processor “brain” that coordinates machine operations, firmware management, and network connectivity.

Hashboards: contain the application-specific integrated circuit (ASIC) chips which perform the work: SHA-256 computations for earning mining rewards.

1. Cooling System

Canaan’s air-cooled Avalon A16 Series uses two single-sided axial fans for directional airflow through the hashboard tunnel. These fans are engineered for industrial duty cycles, rated at 7,900 RPM with 48 V power inputs, and configured via the control board for dynamic speed adjustment. The A16 Series introduces a new 14 cm high-static-pressure fan delivering 500 CFM at full speed, representing a 25% airflow increase over the A15’s 400 CFM and improving thermal stability across the hashboard tunnel.

Canaan designs and manufactures its own custom aluminum heatsinks for Avalon hashboards. The heatsinks are extruded or die-cast aluminum blocks with high fin density to maximize surface area, optimized for the directional airflow produced by Avalon’s fan configuration. For air-cooled units, these heatsinks are typically soldered or bonded directly to ASIC packages using high-conductivity thermal adhesive.

Canaan’s heatsink designs favor longitudinal fin alignment — running parallel to the airflow path — to minimize backpressure while maintaining thermal efficiency. For the A16 Series, the internal structure has been redesigned to better withstand high-humidity and dust-heavy operating environments, making Avalon machines capable of stable operation across a temperature range from -5°C to 35°C. This in-house engineering capability enables tight integration between ASIC, hashboard, and cooling system, allowing Avalon machines to maintain consistent junction temperatures across hundreds of chips per board, reducing thermal cycling stress, and ultimately improving long-term reliability.

2. Power Supply Unit (PSU)

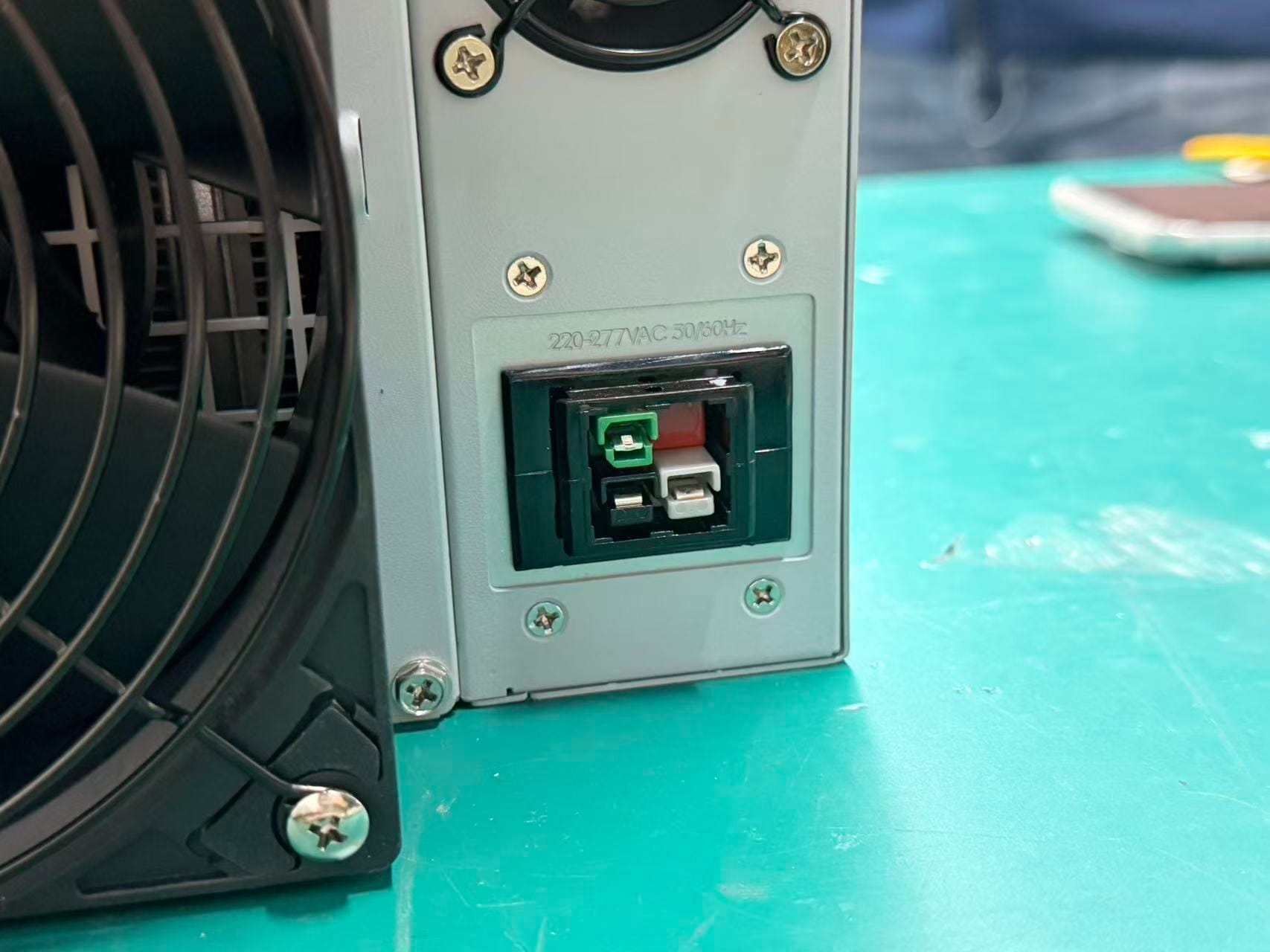

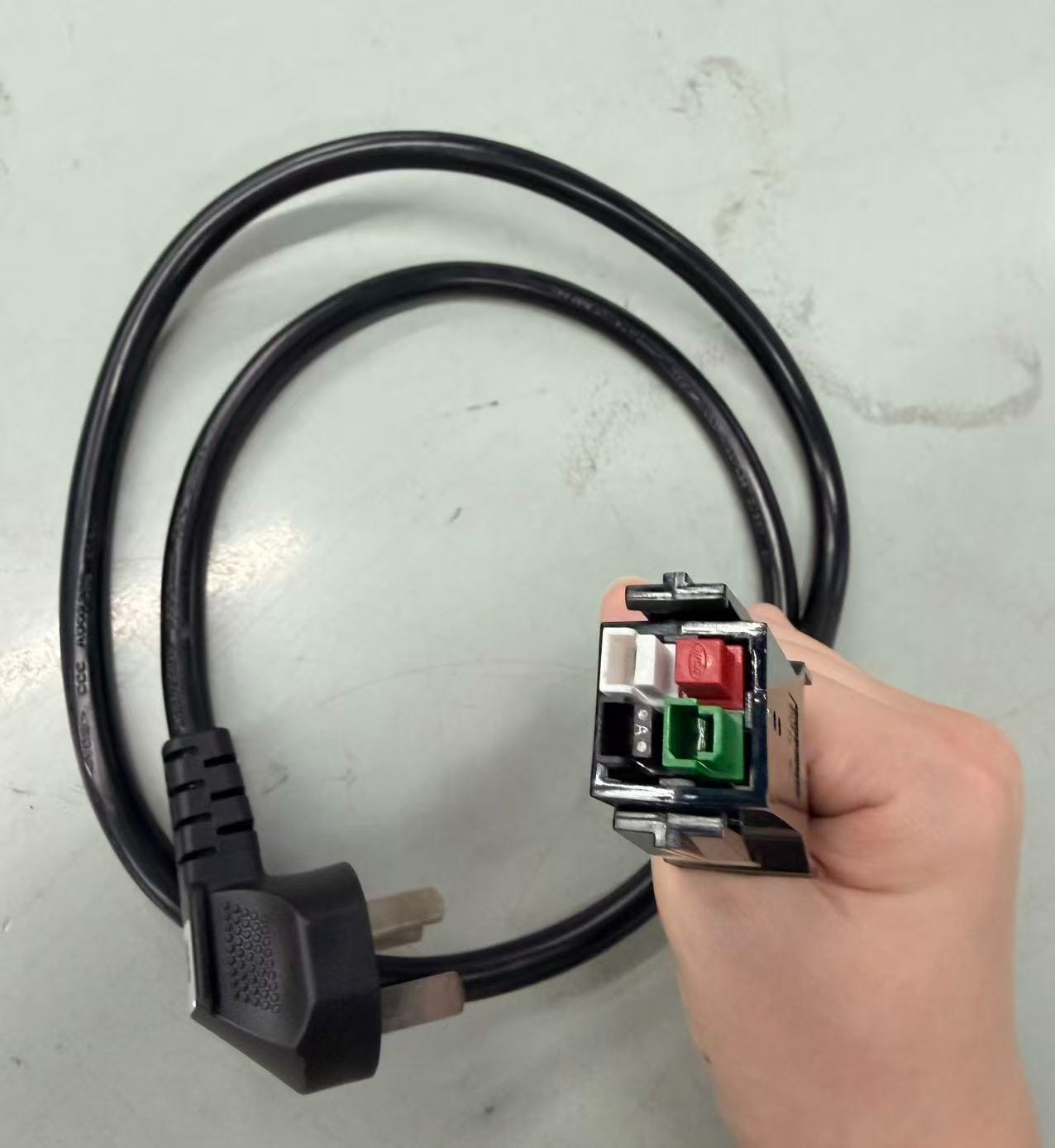

The Avalon A16 Series has the following PSU specifications:

- Model: Avalon PSU3900-01

- Rated Input: 220–277 V AC, 50/60 Hz, 23.1 A max

- Rated Output: 20–26 V DC @ 4100 W and 48 V DC @ 300 W

- Max Output Power: 4,350 W

- Connector: PowerPole 4-pin receptacle

- Notable: A new on/off switch prevents accidental activation or shutdown of the PSU during operation, improving safety and reducing the risk of power interruption in live environments.

3. Control Board

Canaan designs and manufactures its control boards as part of its vertically integrated ASIC production stack. These proprietary boards run Canaan’s Avalon Controller firmware and management interface. Notably, Avalon’s A16 Series introduces a relocated control board position above the PSU, improving wiring access, and reducing time spent on installation & maintenance.

Control board production has historically been conducted alongside hashboard and ASIC assembly in Canaan’s facilities in China and Malaysia, with final system integration at other global manufacturing sites, including a production line in California.

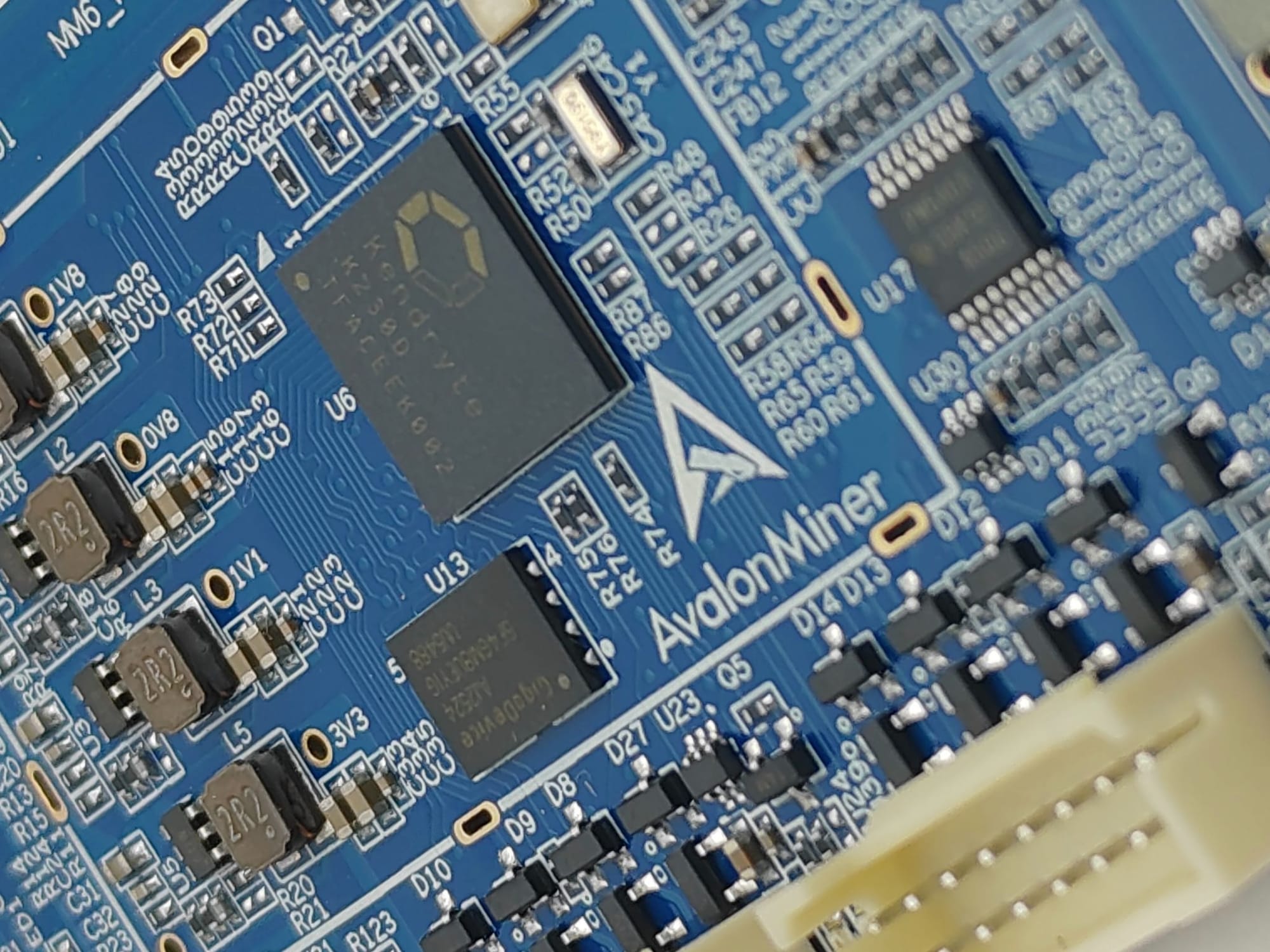

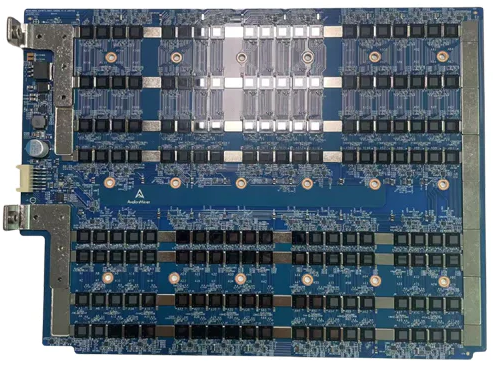

4. Hashboards & ASICs

Canaan designs and manufactures hashboards in-house for every Avalon generation. Each hashboard utilizes Canaan’s proprietary ASIC chips. Avalon hashboards are purpose-built to match the machine’s cooling system, with dedicated voltage domains, thermal sensors, and power delivery circuits tuned for Avalon firmware. Although details on hashboard and ASIC specifications for the A16 Series are not yet publicly available, industry consensus places chip production at Samsung, and Hashrate Index will be on notice to report on any specifics once they are made public.

Compatibility Considerations

Despite the numerous internal upgrades introduced in the A16 Series, Canaan has intentionally maintained the machine’s external chassis dimensions at 366 mm × 213 mm × 300 mm, ensuring full compatibility with existing mining infrastructure. This consistency allows operators to replace or expand fleets without modifying racks, airflow channels, or container layouts. By preserving cross-generation physical compatibility, the A16 Series reduces deployment friction and eliminates the need for costly infrastructure adjustments, lowering total upgrade costs for industrial mining sites.

Performance Testing

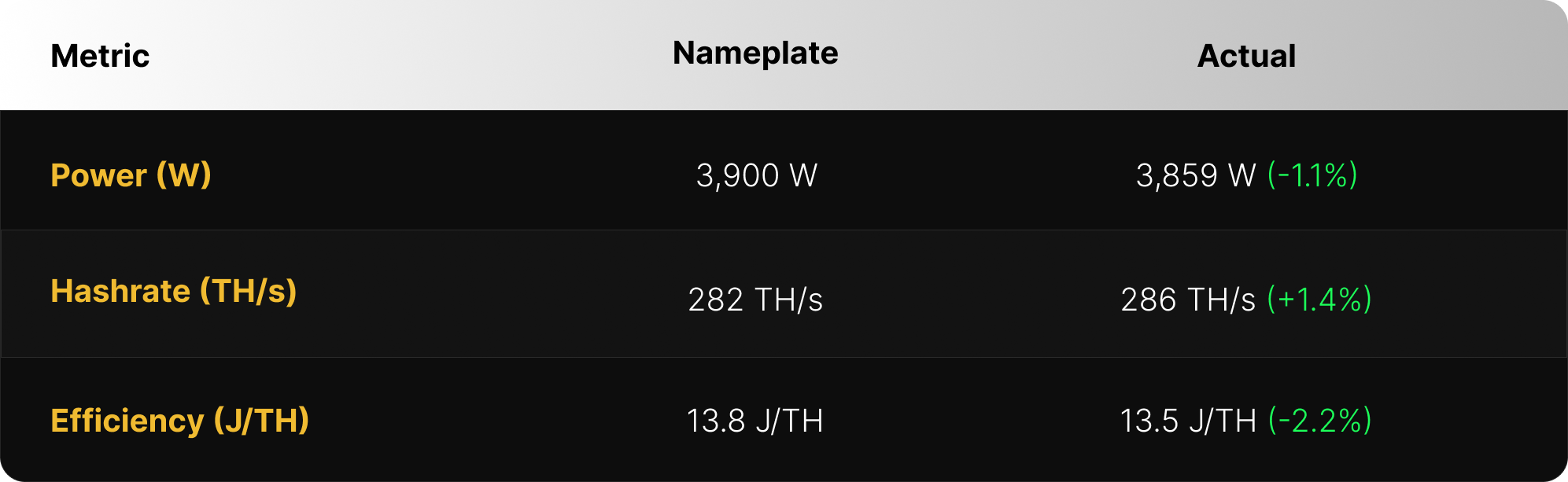

Avalon A16: Nameplate vs. Actual

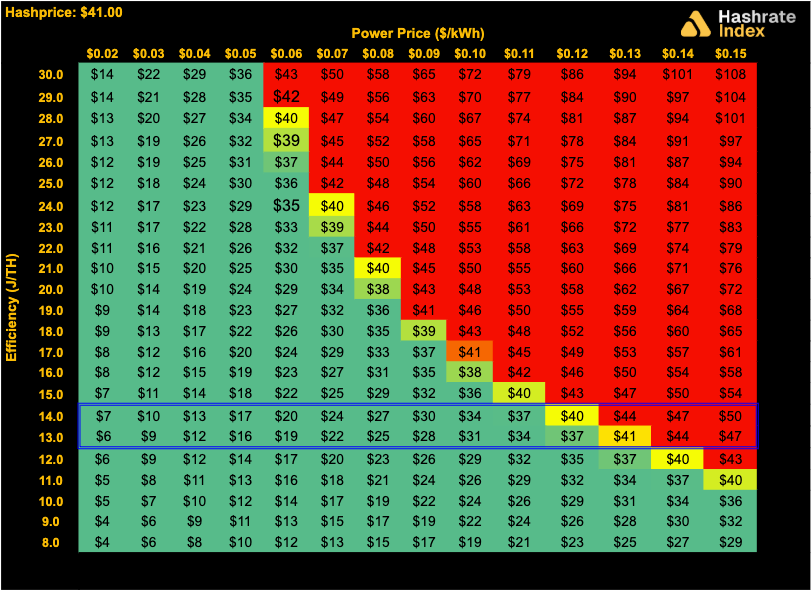

The hashcost curve below shows where the A16 Series sits relative to the range of fleet efficiency (J/TH) & power price ($/kWh) combinations associated with bitcoin mining operations at current hashprice levels:

Financial Analysis

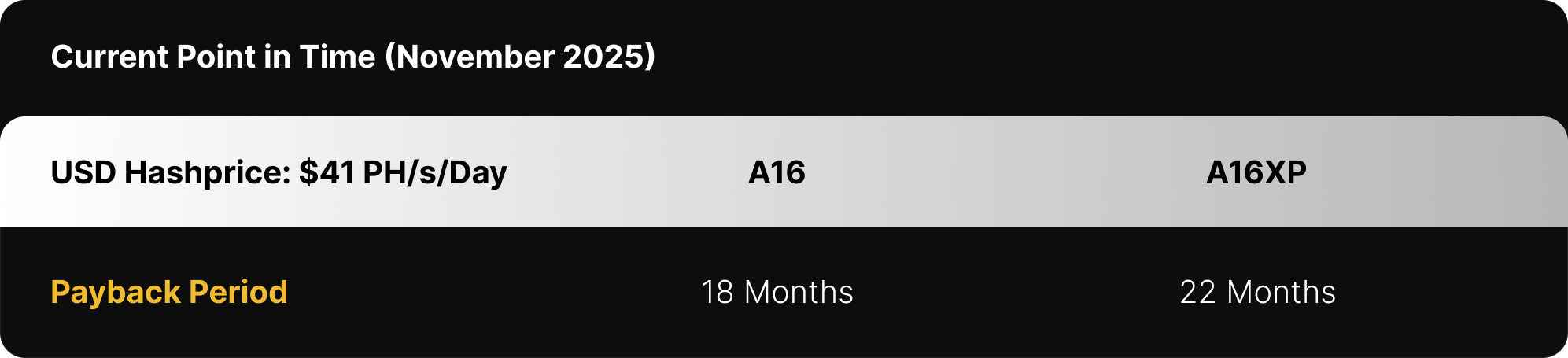

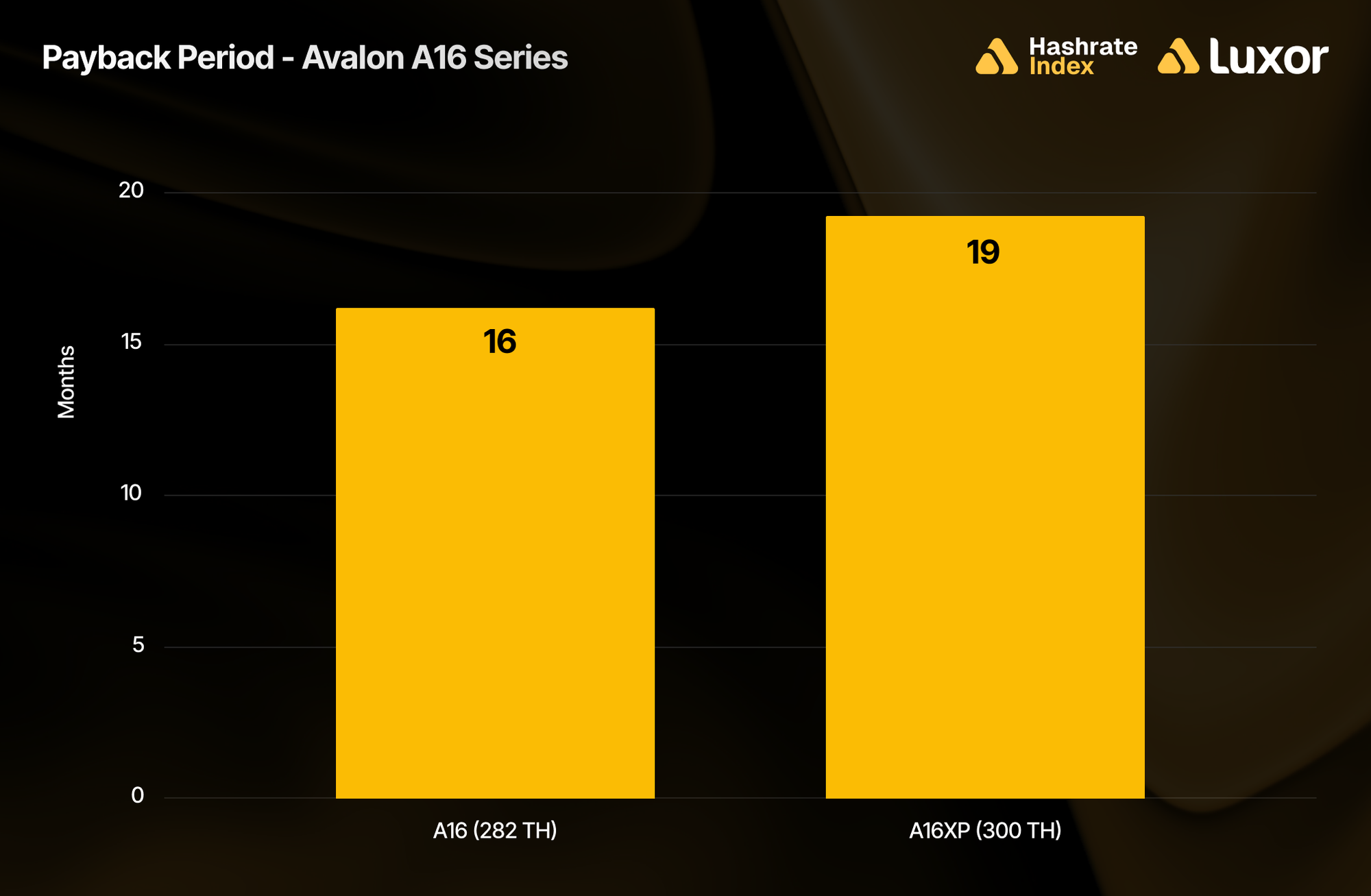

Payback Period

Inputs:

- Hashprice: $41.00

- Power Cost: $0.04/kWh

- Uptime: 100%

- Machine Models: A16 (282 TH/s | 13.8 J/TH), A16XP (300 TH/s | 12.8 J/TH)

- Purchase Prices:

- A16 — $13.14/T or $3,705/unit

- A16XP — $16.74/T or $5,022/unit

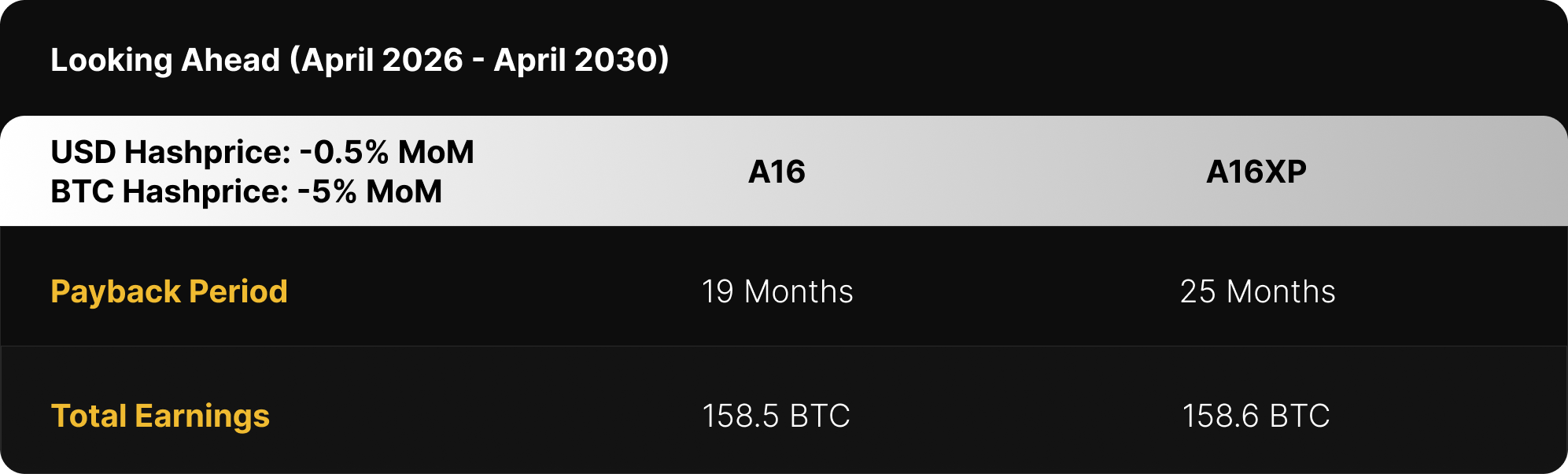

Projection Scenario

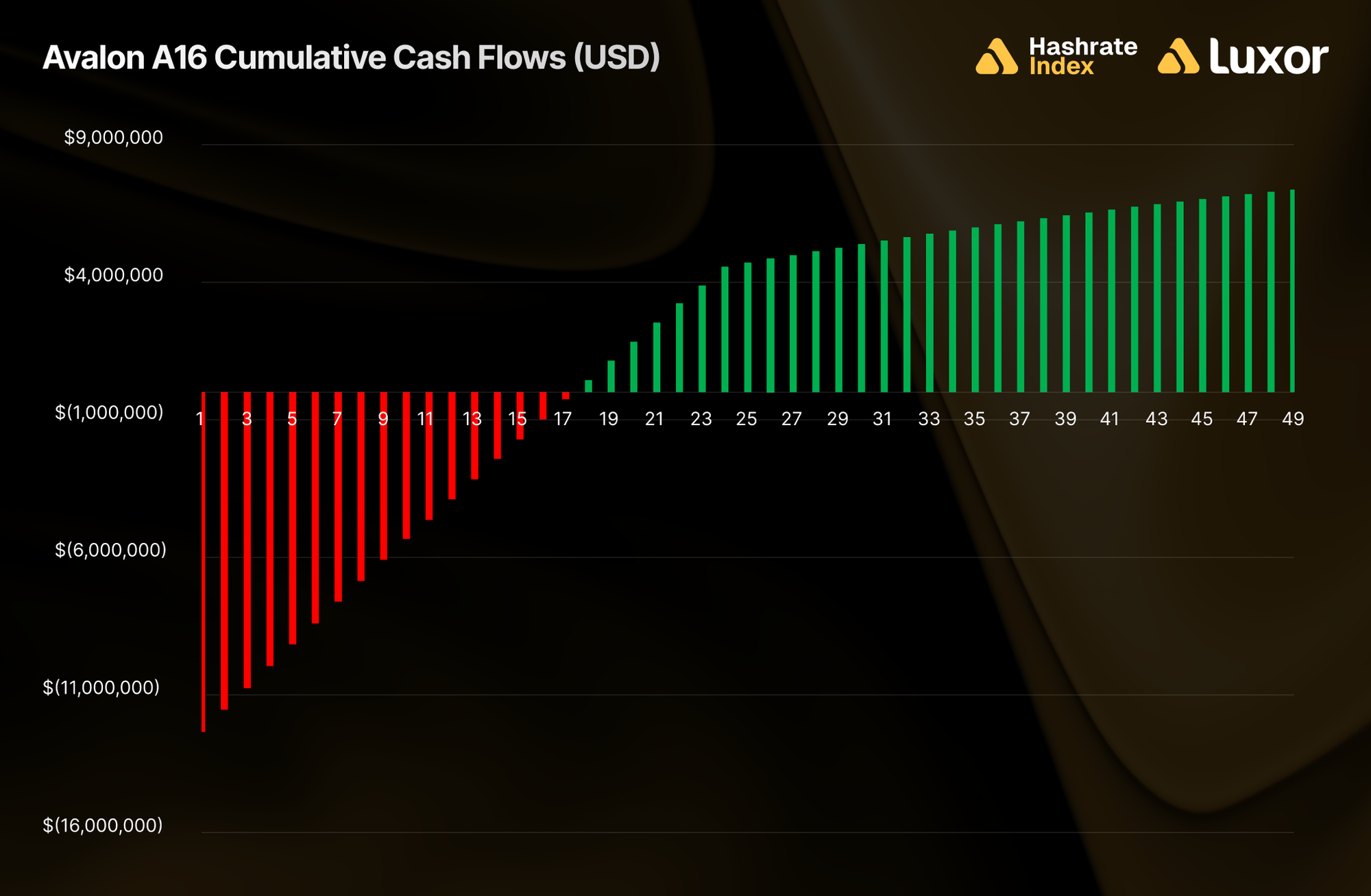

This model evaluates the projected performance and payback period of a 3,545-unit Avalon A16 fleet, representing 1 EH/s of hashrate capacity. Each unit delivers 282 TH/s at 13.8 J/TH, consuming approximately 3.9 kW at the wall. The total capital expenditure is $13.1 million, or $3,705 per unit ($13.14/T). Operations assume 95% uptime and a fixed power cost of $40/MWh ($0.040/kWh).

Inputs:

- Fleet Composition: 3,545 x A16 (282 TH/s | 13.8 J/TH)

- Capital Expenditure: $13,135,927 ($13.14/T or $3,705/unit)

- Power Cost ($/MWh): $40, flat rate

- Uptime: 95%

- Hashprice Scenario(s):

- USD Hashprice Monthly % Change: -0.5%

- Start (April 2026): $39.00 per PH/s/Day

- End (April 2030): $15.41 per PH/s/Day

- BTC Hashprice Monthly % Change: -5%

- Start (April 2026): 0.00032000 BTC per PH/s/Day

- End (April 2030): 0.00001436 BTC per PH/s/Day

- USD Hashprice Monthly % Change: -0.5%

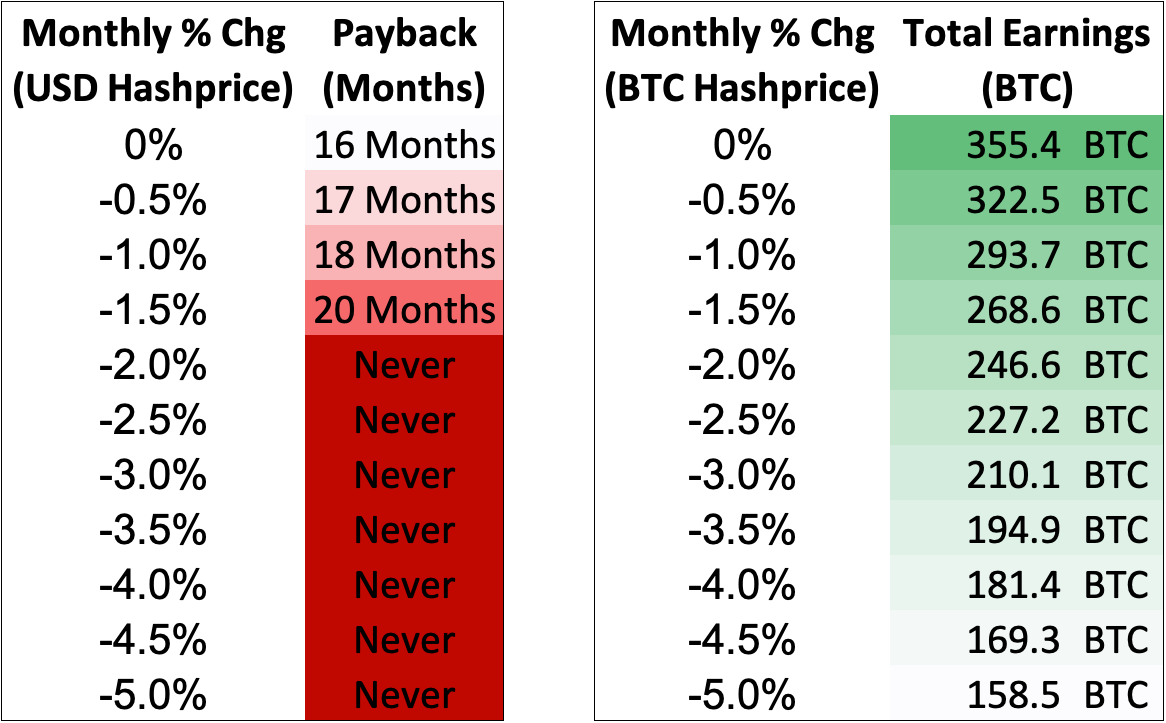

Hashprice trajectories are modeled using empirical month-over-month (MoM) percentage changes derived from historical data on Luxor’s Hashprice Index since 2021. This method provides a simple and realistic framework for projecting long-term mining economics without relying on separate assumptions for BTC price, transaction fees, and network difficulty. Starting hashprice values are derived from the latest Base Case scenario for Hashrate Index Premium’s quarterly Bitcoin Mining Economics Projections Report.

In this model, USD hashprice declines 0.5% per month — from roughly $39 to $15 per PH/s/Day between April 2026 and April 2030 — while BTC hashprice falls 5% per month, reflecting expected compression from network difficulty growth alongside the incoming 2028 halving.

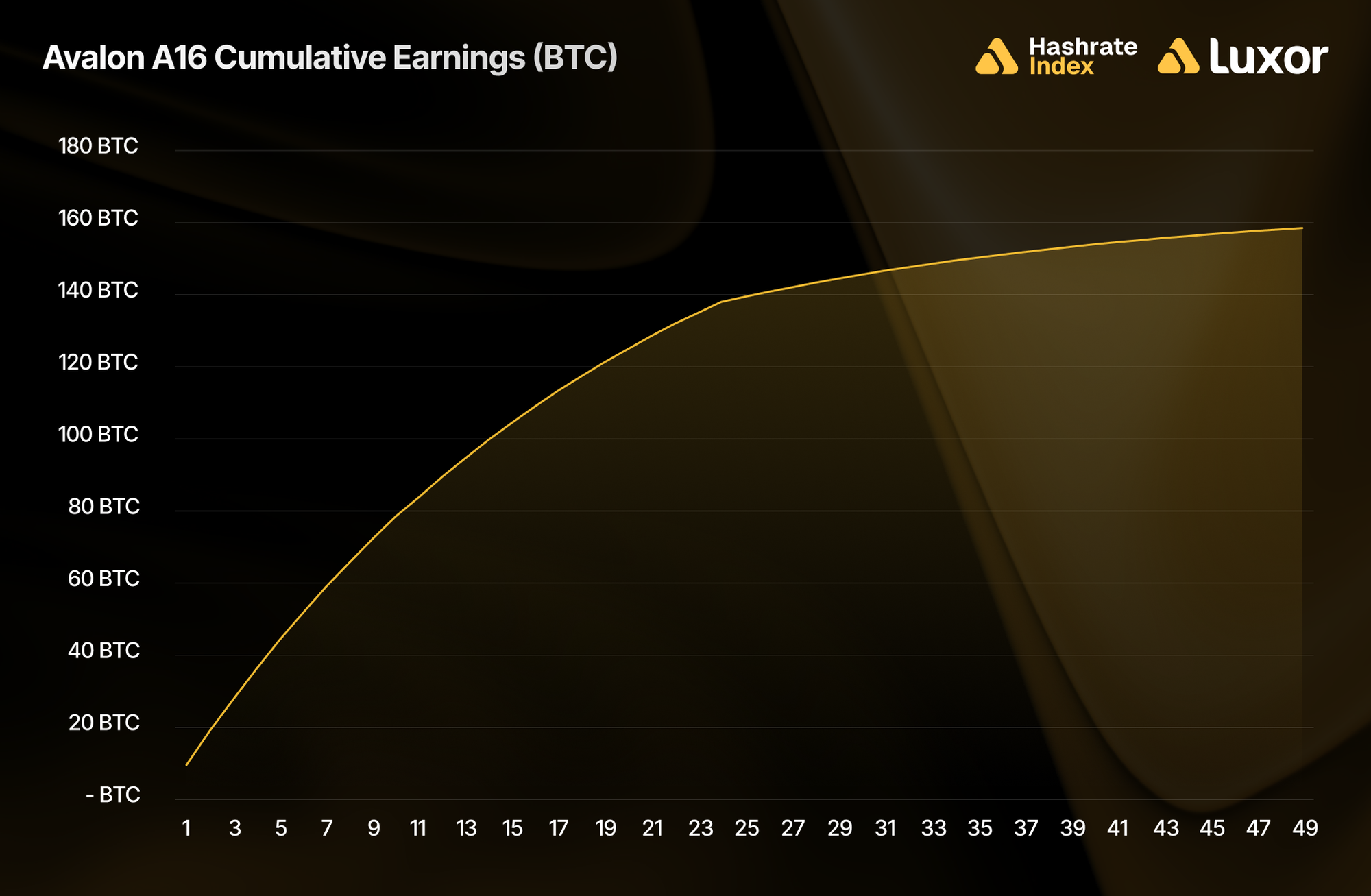

Under these assumptions, the modeled fleet projects the following results:

- Payback period: 17 months (September 2027)

- Cumulative earnings: ~158.5 BTC (April 2026 – April 2030)

Cumulative cash flow analysis (USD) shows an initial $13.1M CapEx drawdown, followed by steadily recovering revenues through mid-2027 and full capital recovery by month 17 (September 2027). Despite the projected 2028 halving, an estimated 60% decline in USD hashprice, and an estimated 96% decline in BTC hashprice across the four-year horizon, the Avalon A16 fleet remains profitable through the full projection period, earning a total of 158.5 BTC.

Hashprice sensitivity analysis shows that the Avalon A16 fleet remains resilient under moderate compression, with payback periods ranging from 16–20 months as USD hashprice decay ranges between 0% and -1.5% per month. Beyond this range, capital recovery becomes unviable. In BTC terms, cumulative production varies up to ~355.5 BTC at a flat BTC hashprice, versus ~158.5 BTC at a -5% monthly decay.

In terms of power cost sensitivity, even with a 25% higher power rate ($0.050/kWh), the A16 fleet’s payback period extends by only two months (from 16 to 18), underscoring the Avalon A16’s efficiency in tight-margin environments. However, beyond $0.060/kWh, capital recovery becomes unviable.

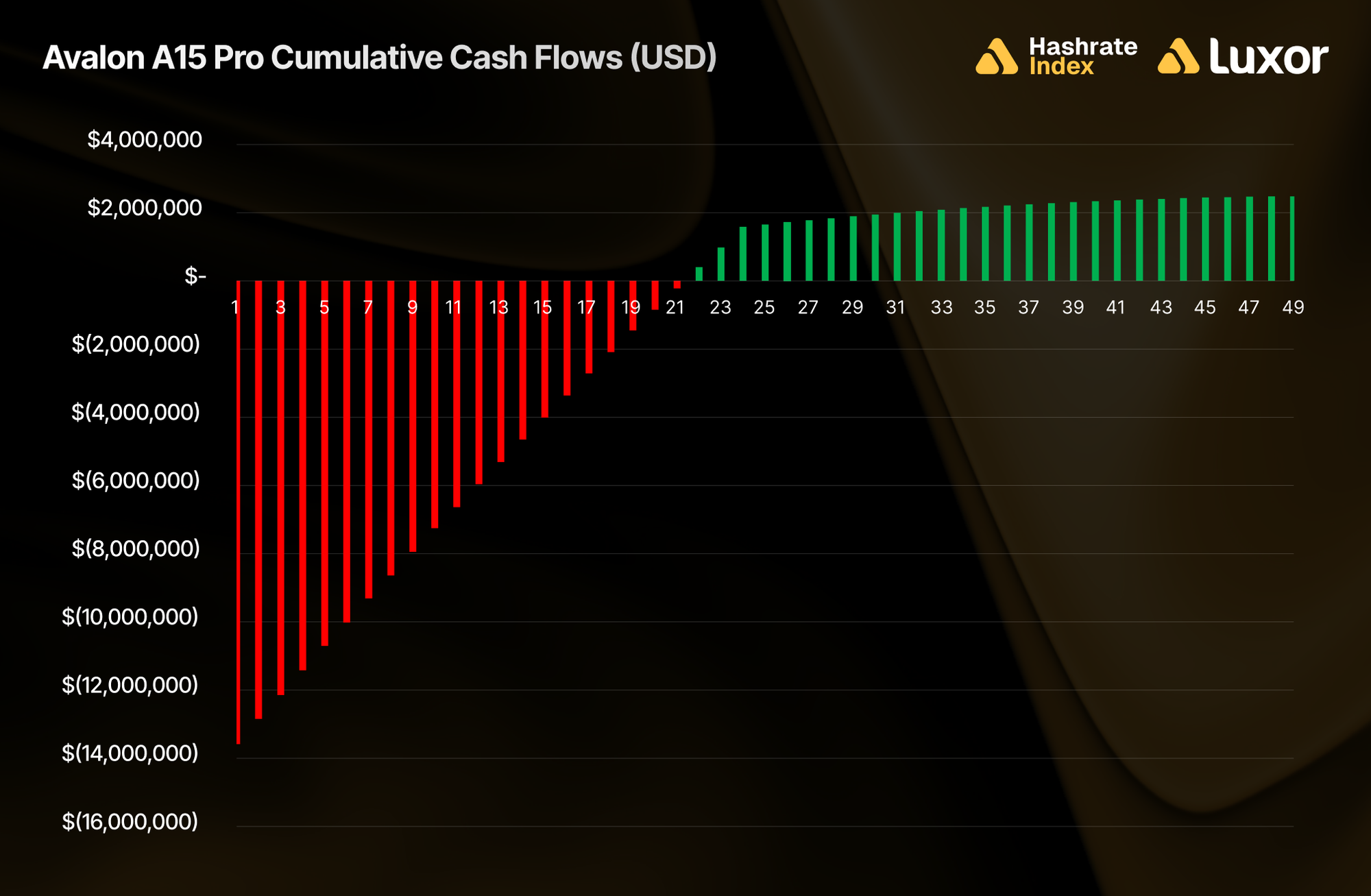

For comparison, we repeated the same exercise for a 4,525-unit (1 EH/s) Avalon A15 Pro fleet. Each unit delivers 221 TH/s at 16.8 J/TH, consuming approximately 3.7 kW at the wall. The total capital expenditure is $14.3 million, or $3,160 per unit ($14.30/T).

Cumulative cash flow analysis (USD) marks a 21-month (January 2028) payback period for the Avalon A15 Pro (vs. 19 months for A16). Hashprice sensitivity shows payback periods ranging from 19–23 months as USD hashprice decay ranges between 0% and -1% per month. Capital recovery becomes unviable beyond that range.

Conclusion

The Avalon A16 Series is Canaan’s most efficient air-cooled ASIC mining machine to date, combining 282–300 TH/s of output with sub-14 J/TH power efficiency. It demonstrates resilience under realistic hashprice decay scenarios, achieving payback in under or around two years. Based on our findings, The A16 Series is best suited for:

- Industrial-scale deployments

- Operations targeting sub-$0.055/kWh power costs

If you’d like to learn more about Luxor’s Bitcoin Mining Hardware services, please reach out to [email protected] or visit https://luxor.tech.

About Luxor Technology Corporation

Luxor delivers hardware, software, and financial services that power the global compute and energy industry. Its product suite spans Bitcoin Mining Pools, ASIC Firmware, Hardware trading, Hashrate Derivatives, Energy services, and a bitcoin mining data platform, Hashrate Index.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.