Firmware Flexibility: Maximizing Mining Margins

Understand how to optimize your mining operation.

Introduction

Bitcoin mining is a high-stakes game where profitability hinges on strategic decisions. From volatile hashprice to rising energy costs and aging hardware, miners face constant challenges. However, staying competitive doesn’t require magic — just smarter tools. Enter Luxor Firmware: a solution that optimizes performance, cuts costs, and boosts profitability.

Here’s how dynamic fleet management through Luxor Firmware can redefine your mining margins.

Why Passive Mining Doesn’t Cut It Anymore

Many miners rely on stock firmware: running machines in default, low, or high-energy modes. This passive approach leaves money on the table. Here’s why:

- Missed overclocking opportunities:

Stock firmware prioritizes stability over performance, meaning miners can’t safely push their machines beyond default settings. Overclocking — safely increasing a machine’s hashrate — can significantly boost revenue, especially when hashprice spikes.

- No underclocking (undervolting):

Energy efficiency is king in mining. Stock settings often waste power, increasing costs. Underclocking reduces a machine’s energy consumption per terahash, cutting electricity bills and protecting margins even when Bitcoin’s price dips.

- Rigid response to market conditions:

With hashprice and network difficulty constantly changing, passive miners lack the flexibility to adapt. Active management allows miners to adjust in real-time, seizing profitable windows or mitigating losses.

- Faster hardware degradation:

Inefficient power use and lack of thermal management can wear out ASIC machines faster. Firmware-driven optimizations extend hardware lifespan, saving repair and replacement costs.

Energy Costs: A Bitcoin Miner’s Biggest Expense

Electricity accounts for 70-80% of a miner’s operating expense. High energy prices can crush margins, especially for inefficient machines burning more watts per terahash (W/TH). Improving energy efficiency with underclocking can make all the difference. For instance, compare two miners facing a power cost of $0.07/kWh, generating 1,000 TH/s of hashrate daily:

Miner A runs at 30 W/TH, consuming 30,000 watts (30 kW).

- Daily electricity cost: $50.40 (30 kW × 24 hours × $0.07/kWh).

Miner B runs at 25 W/TH, consuming 25,000 watts (25 kW).

- Daily electricity cost: $42.00 (25 kW × 24 hours × $0.07/kWh).

Savings: $8.40/day — or $252/month. For larger operations, this scales dramatically, keeping Miner B competitive even during low hashprice periods.

From Passive to Active Strategies

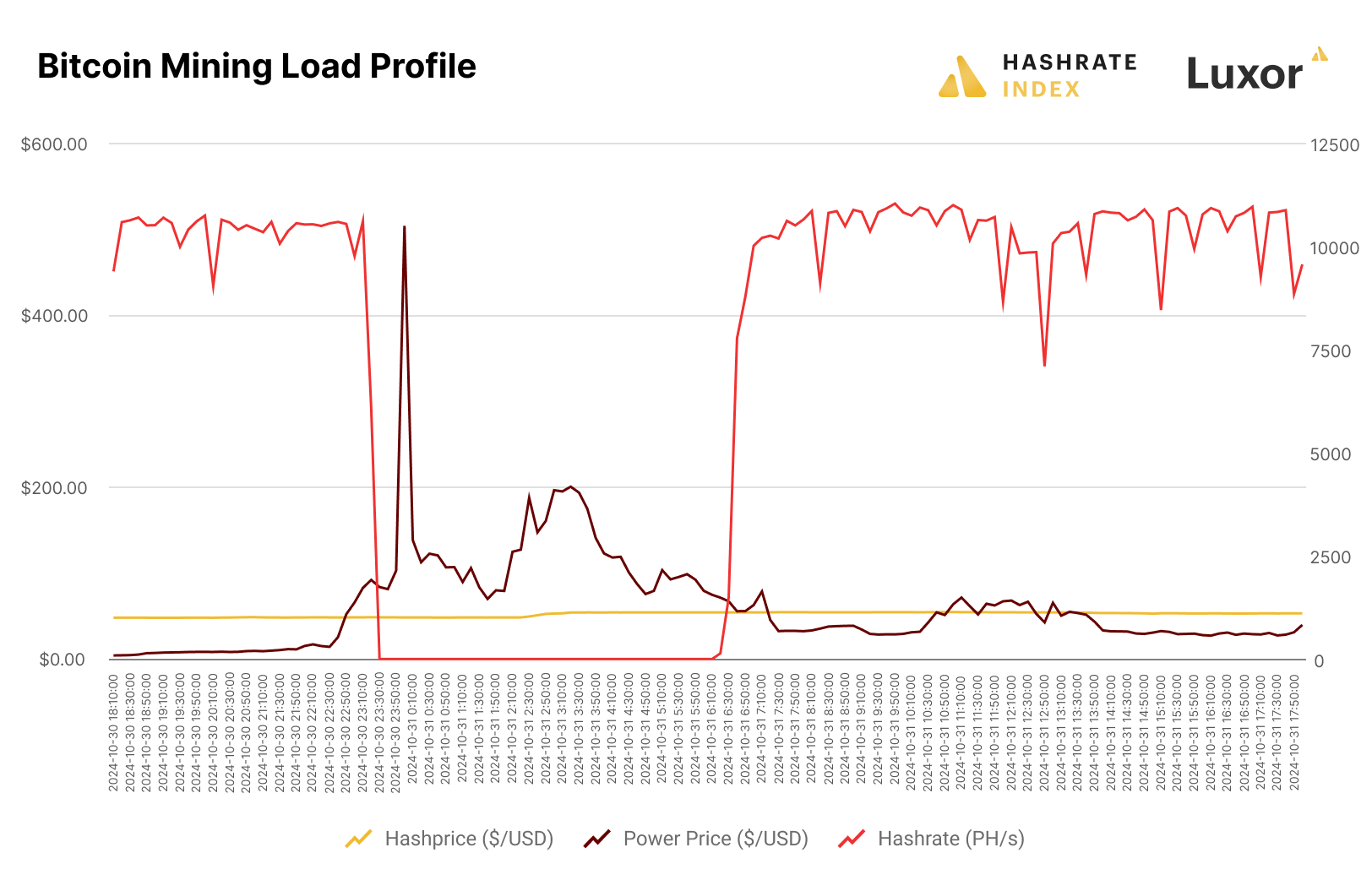

Bitcoin mining operations have increasingly become Large Flexible Loads (LFL) and continue to increase their participation through Demand Response and Ancillary Service programs. These strategies focus on breakeven strike prices — the minimum hashprice required to cover costs. When power prices exceed this threshold, miners shut down machines to avoid losses. While this approach limits downside risk, it also caps revenue potential.

Figure 1 below illustrates the ‘strike price’ or breakeven strategy. Depending on its fleet efficiency and operational strategy, a miner will simply shutdown when their power price exceeds hashprice:

Active operational strategies offer a better way. Luxor Firmware empowers miners to respond dynamically to real-time conditions, yielding a 10-15% boost in profitability. Here’s how:

- Dynamic Profiles for Efficiency

Stock firmware offers limited settings — default, low power, or high power. Luxor Firmware introduces a much broader range of profiles, letting miners overclock during low electricity prices and underclock when costs rise.

- Real-Time Adjustments

With active management, miners can optimize their hashrate and power consumption in real-time based on hashprice and electricity rates, ensuring maximum profitability under any market condition.

- Improved Uptime

By leveraging efficiency gains, miners can extend operations during periods of moderate power prices instead of shutting down entirely.

Case Study: Dynamic Mining in Action

To demonstrate the case, let’s take a miner operating with the following fleet:

- 100 x S19 (95 TH/s)

- 100 x S19j Pro (100 TH/s)

- 100 x S19j Pro (104 TH/s)

- 100 x S19 XP (141 TH/s)

- 100 x S21 (200 TH/s)

Fleet Total

- Units: 500

- Hashrate: 63.9 PH/s

- Efficiency: 26.4 W/TH

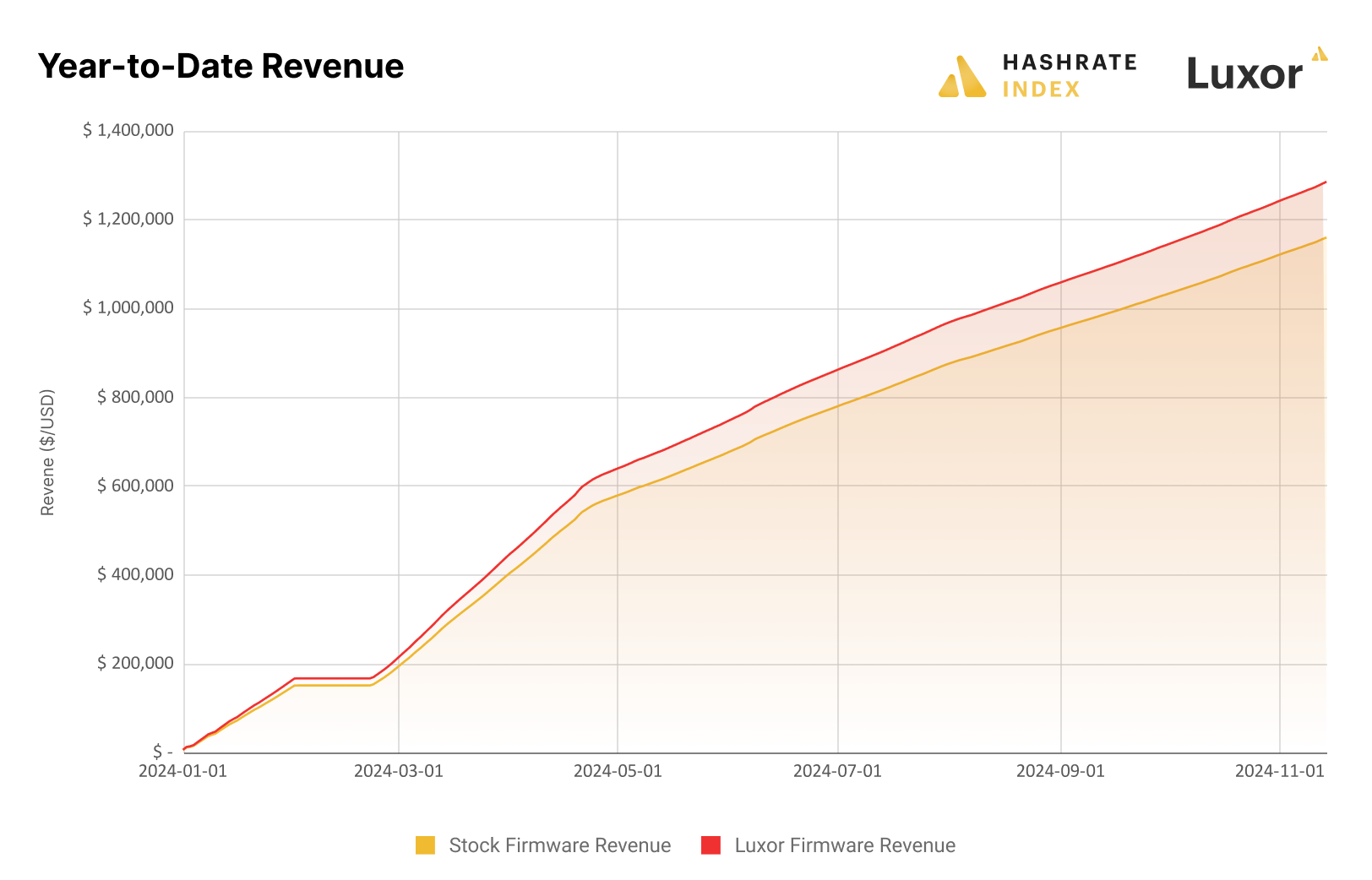

Using historical hashprice and power price data from ERCOT’s Load Zone West (LZW), we calculated 2024 year-to-date revenue earned by the miner’s fleet under two scenarios, stock firmware vs. Luxor Firmware. Stock firmware maintained a passive strike price strategy, whereas Luxor Firmware unlocked an active operational strategy.

Figure 2 below summarizes the results, highlighting that miners who adopt a dynamic operating strategy are able to optimize operating conditions in real-time based on the profitability environment, yielding ~10% higher returns:

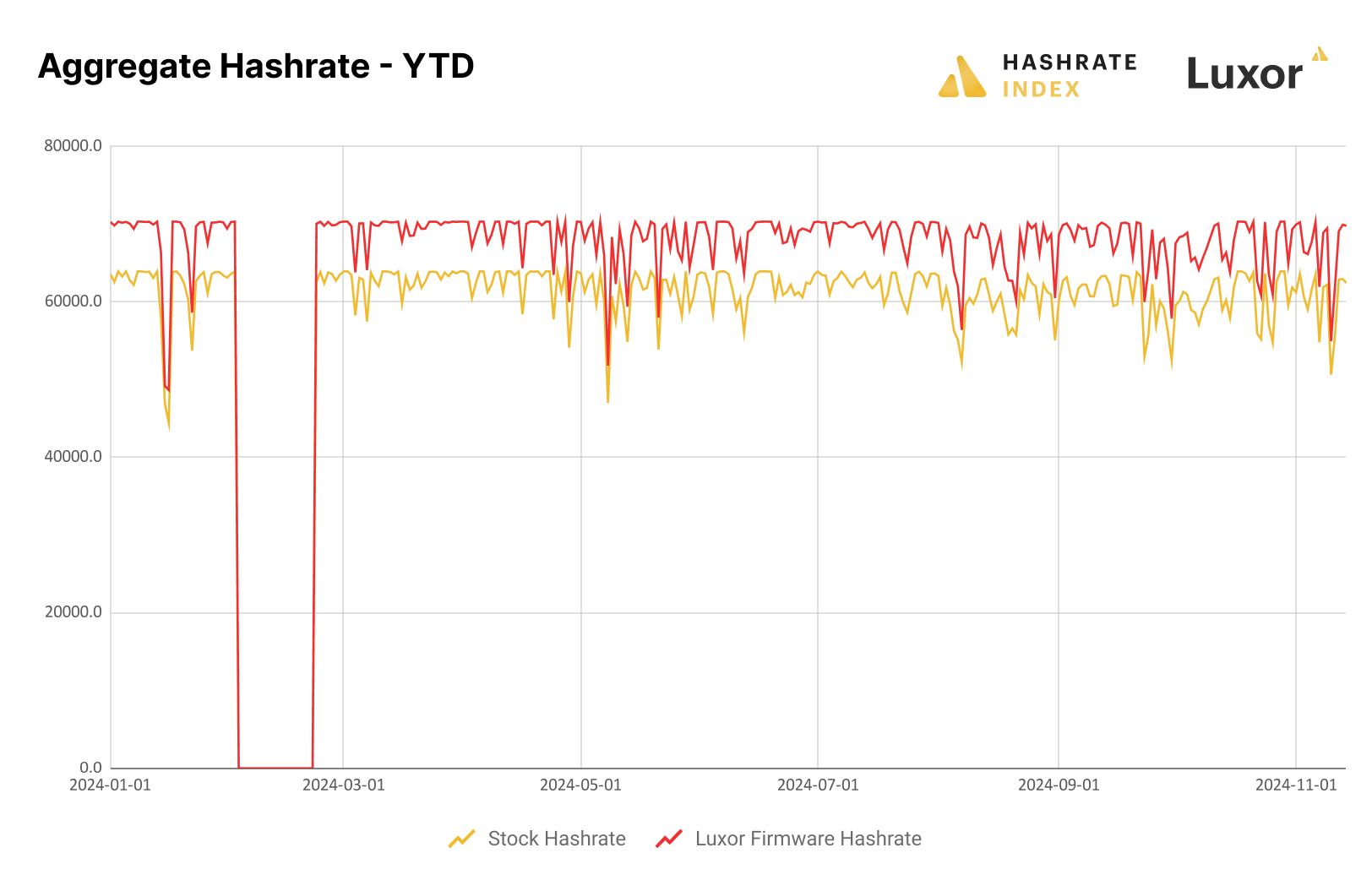

How was this achieved? First, Luxor Firmware enabled the miner’s fleet to produce 11% more hashrate through overclocking, specifically during high hashprice periods. Figure 3 below illustrates that due to a wider operating range through profiles, hashrate production is increased:

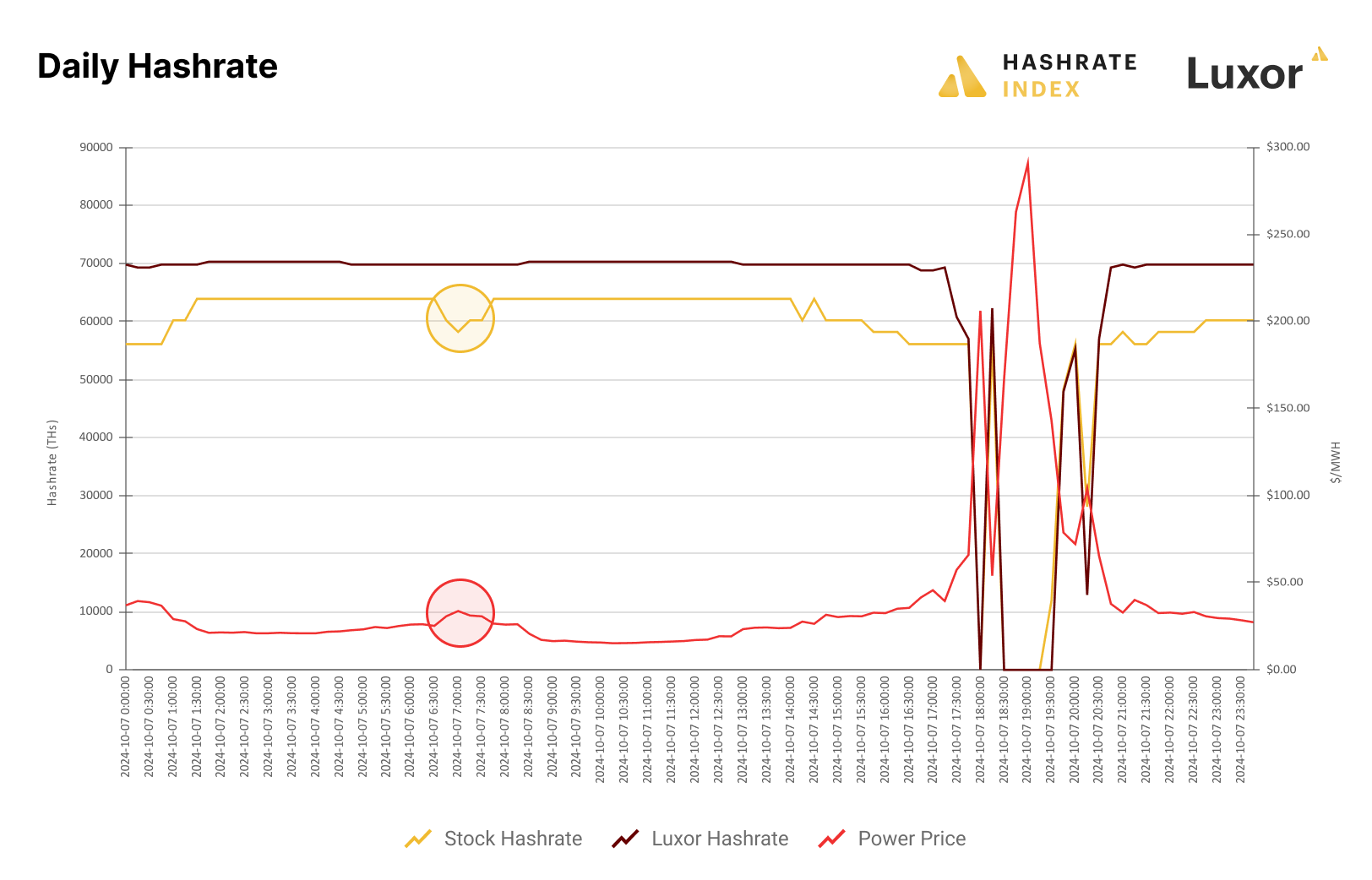

Zooming in to a particular day, we can see how a wider operating range improves hashrate production at a granular level. In Figure 4 below, the stock firmware fleet was required to move to low power mode during higher power price periods (see highlighted area), whereas the active strategy miner stayed at a higher hashrate for longer, due to profile changes increasing its fleet efficiency. Both fleets were eventually forced to curtail as the power price spiked, but the active miner was able to produce more hashrate until then:

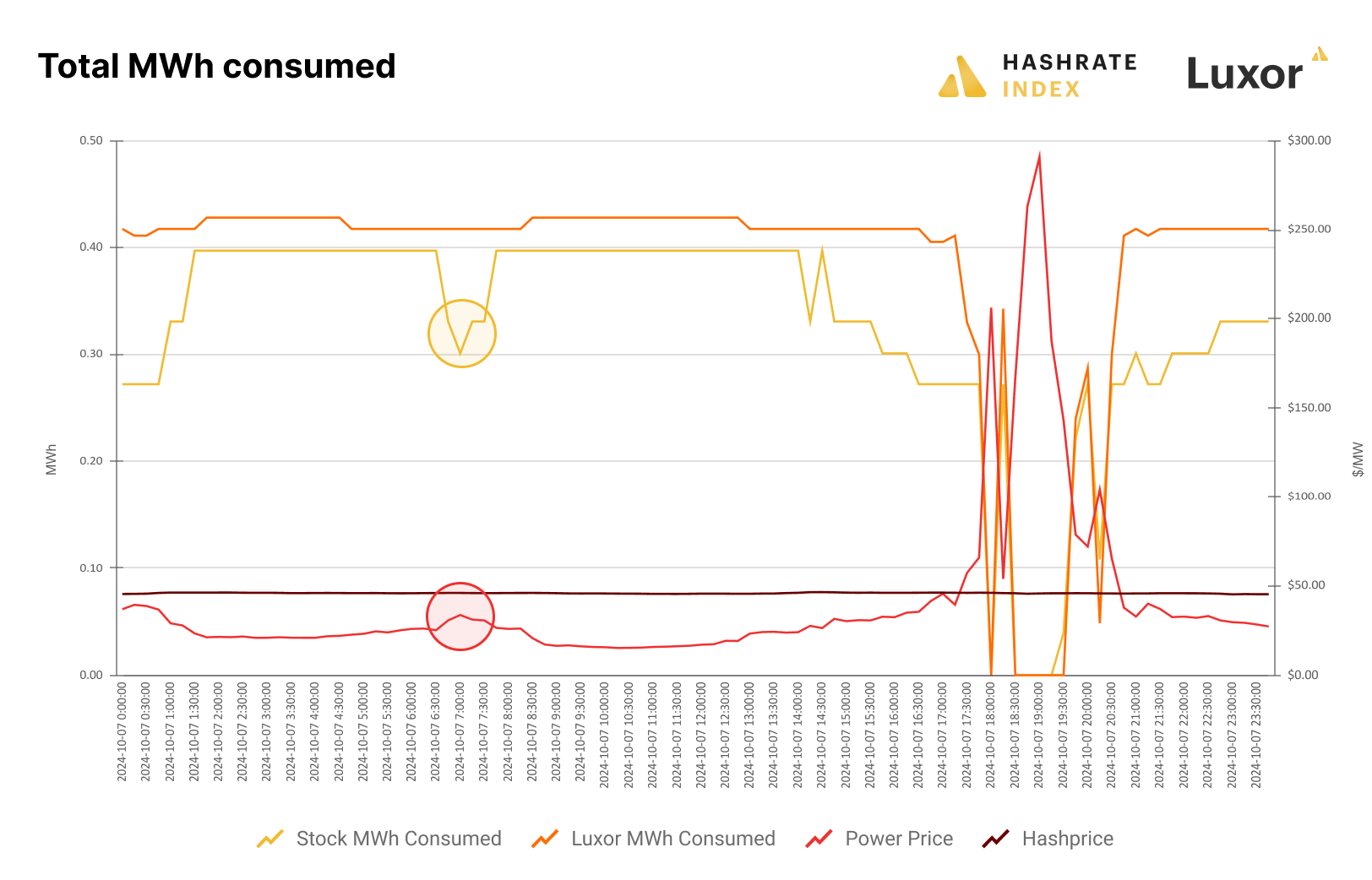

Second, Luxor Firmware enabled the miner’s fleet to consume 11% more electricity, specifically during low power cost periods. This is highlighted in Figure 5 below when looking at the MWh consumed during the same day:

In summary, using Luxor Firmware enabled the active mining operation to dynamically adjust its fleet settings and maximize returns. Here’s what they achieved:

- Higher Hashrate

During low electricity prices, overclocking boosted hashrate, driving up revenue.

- Optimized Power Consumption

By underclocking when electricity prices rose, unprofitable energy use was avoided.

- Lower Capital Costs

With overclocking capabilities, higher hashrate production was achieved without buying additional machines.

In aggregate, this unlocked an additional 11% in revenue for the mining operation.

*Bonus: hosting providers billing on a per-kWh-used basis would realize a benefit from improved hosting revenues as clients’ machines use more power during profitable periods, creating a win-win scenario.

Caveat: Machines Matter

As a final note, through Luxor's research and development back-testing results, we’ve observed that not all ASICs are created equally.

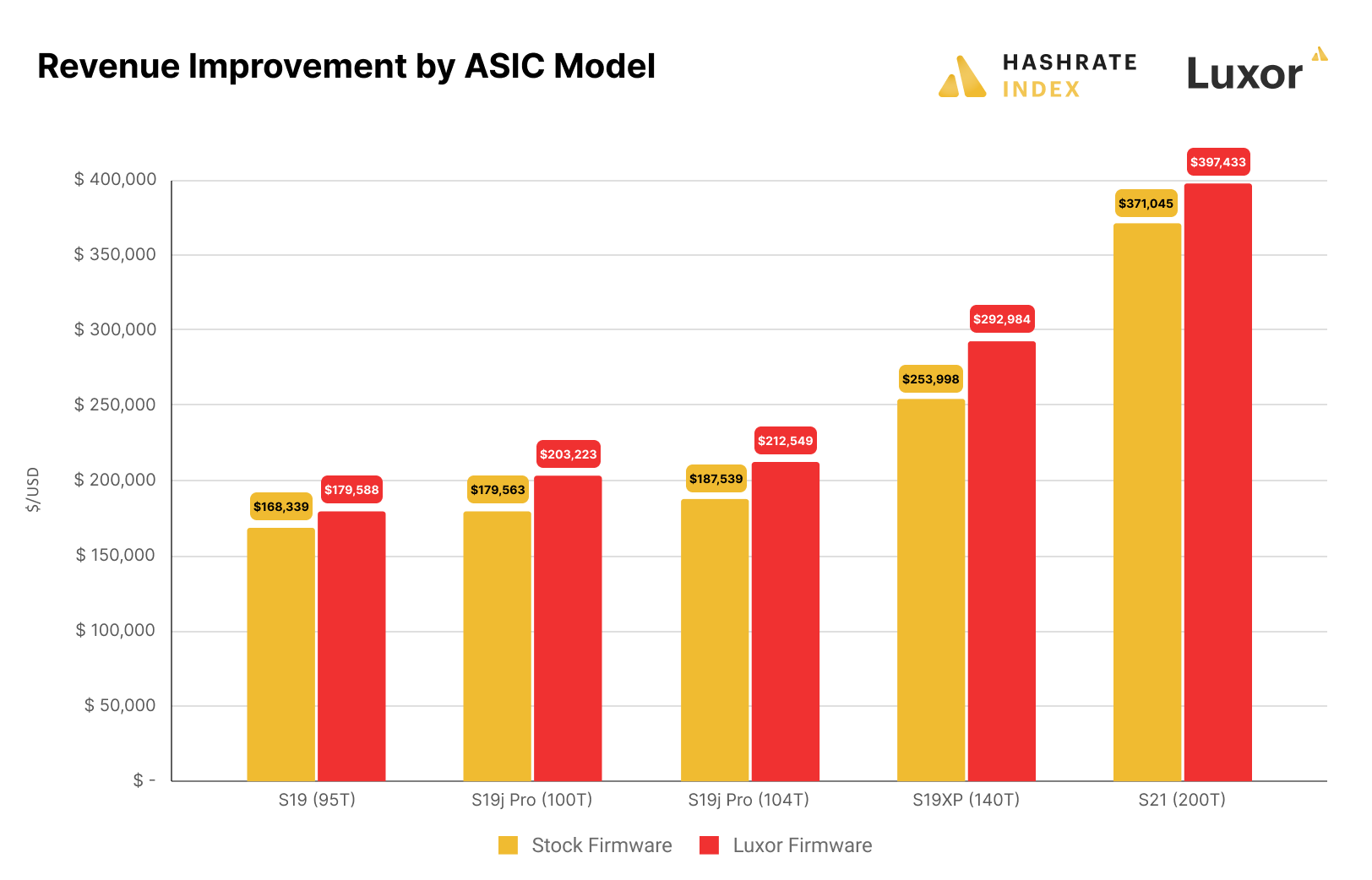

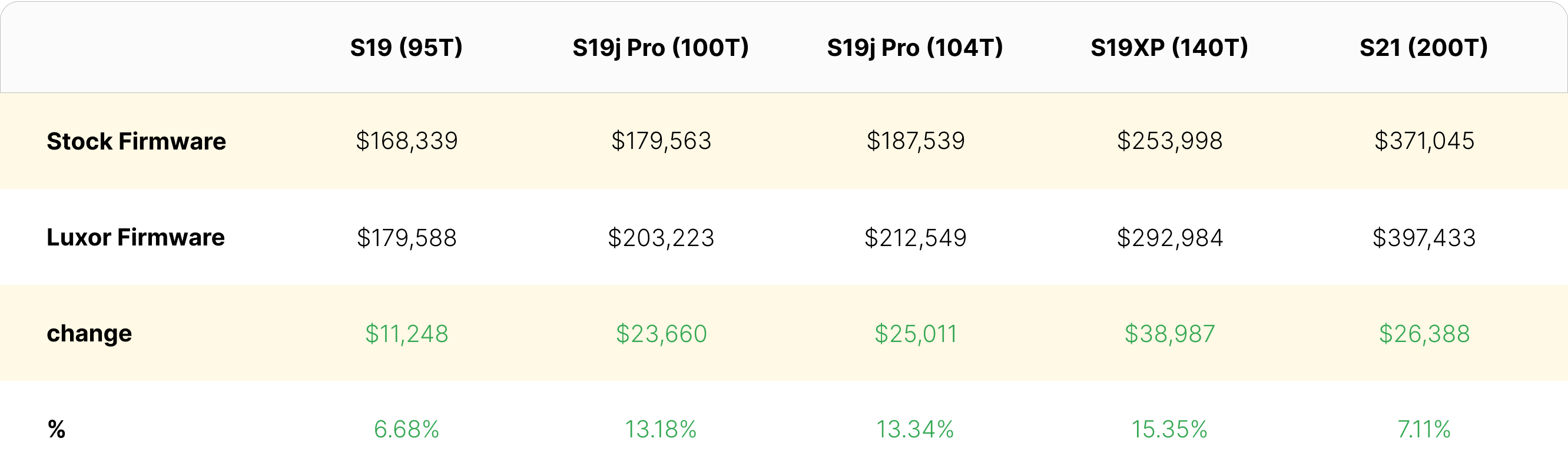

In Figure 6 below, we used the same fleet mix from our case study and observed that, year-to-date, certain ASIC models performed better than others using an active operational strategy:

This is mainly due to two factors:

1) ASIC models are idiosyncratic — the S19 series (specifically the S19 model) are relatively more receptive to under/overclocking and adjustments to frequency & voltage. The S21 series ASICs have “less room for improvement” in comparison.

2) Efficiency has limits — An ASIC machine’s efficiency will hit a ceiling, meaning that the machine can only achieve so much efficiency per unit. This is also known as an efficiency curve. While we see greater efficiency improvements on relatively older generation units, the reality is that as a mining operation’s power price increases, old-gen ASICs will rationally be curtailed first in a fleet mix of newer, more efficient ASIC machines.

While year-over-year improvements in unit efficiency have subsidized miners’ capital expenditure budgets, aftermarket firmware offers an alternative for unlocking significant efficiency improvements without additional capital outlay.

Conclusion

The next phase of Bitcoin mining demands active management. Passive strategies focused on breakeven strike prices leave too many sats on the table. Active approaches powered by Luxor Firmware unlock 10-15% higher profits, greater efficiency, and business sustainability during bearish markets.

In an increasingly competitive environment, staying ahead requires smarter tools and strategies. Luxor Firmware empowers miners to do just that — optimize operations, extend hardware life, and maximize returns.

The future belongs to those who manage their fleets actively and adapt to the ever-changing dynamics of Bitcoin mining.

Have Questions?

Check out Luxor Firmware documentation for more details.

Contact our Firmware team through this form to get started.

Find us on Telegram to stay in touch.

Want to Learn more? Explore the links below:

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.