Energy Arbitrage: Analyzing Bitcoin Mining’s Historical Revenue per kWh

Bitcoin miners participate in an energy arbitrage game by expending energy to generate bitcoin. Therefore, when analyzing bitcoin mining profitability, it can be helpful to look at how much miners earn per unit of energy they consume. This metric is called the revenue per kWh.

In this article, I explain why the revenue per kWh is my favorite metric for analyzing bitcoin mining profitability. I also put the metric to work by showing how the bitcoin mining revenue per kWh has developed since 2011 and discussing whether we can use this metric to predict bear market bottoms and bull market tops.

What does the revenue per kWh tell us?

The revenue per kWh is one of several metrics for analyzing bitcoin mining profitability. It shows the bitcoin mining revenue per unit of electricity consumed - in this case, a kilowatt-hour (kWh). The metric differs between different mining rigs, as it depends on the energy efficiency of the specific machine. For example, an S19 XP currently generates a revenue per kWh of $0.15, while the less energy-efficient S9 only rakes in $0.03 per kWh consumed.

The revenue per kWh is also known as the break-even electricity price, as miners are disincentivized to run their machines if they make a lower revenue per kWh than their cost per kWh. Knowing their revenue per kWh is vital for miners to make the economic decision on whether to run their machines or not

This metric is particularly important for miners exposed to a variable electricity price, i.e., the spot price. Miners buying spot electricity can often drastically increase their profits by periodically curtailing during peak electricity prices. These miners calculate their revenue per kWh and curtail their operations if the spot electricity price rises above this level.

In addition, an increasing number of energy producers are using part of their electricity output to mine bitcoin. These companies must continuously decide whether to sell their electricity to the spot market or use it to mine bitcoin. The only way to make this decision is by knowing the bitcoin mining revenue per kWh. If the spot electricity price is higher than their bitcoin mining revenue per kWh, they will curtail the bitcoin operation and sell electricity to the grid. Otherwise, they will use the electricity to mine bitcoin.

While this metric is the most helpful for analyzing the profitability of individual mining operations, we can also use it to get a sense of the economic state of the entire bitcoin mining network. I do this analysis later in the article.

From my experience, miners with an energy background unanimously favor the revenue per kWh metric for measuring profitability, while the miners coming from within bitcoin often put more emphasis on their bitcoin production cost relative to the bitcoin price.

As I will soon show, bitcoin mining has gradually turned into an energy arbitrage, with the industry reaching its final stage, “the age of energy”, as coined by Sangha Systems. I’m confident that as the energy industry gets increasingly involved in bitcoin mining, the revenue per kWh will become an increasingly used metric and likely an industry standard.

Bitcoin mining has gradually turned into an energy arbitrage game

The revenue per kWh has become an increasingly important metric as the bitcoin mining industry has gradually become an energy arbitrage game.

The art of bitcoin mining has changed drastically from its humble beginnings a little more than a decade ago. During the first years, it was all about tech experimentation and hardware optimization, and most miners didn’t pay much attention to their electricity rates.

Enthusiasts first mined bitcoin with the CPUs of their personal computers before moving on to GPUs in late 2010 and FPGAs in 2011. In late 2013, Canaan released the first bitcoin mining ASIC, and these specially purposed devices quickly took over the network. By 2015, ASICs had become dominant. As I will soon show, the commoditization of hardware through the rollout of ASICs from 2015 paved the way for bitcoin mining to turn into an energy arbitrage game.

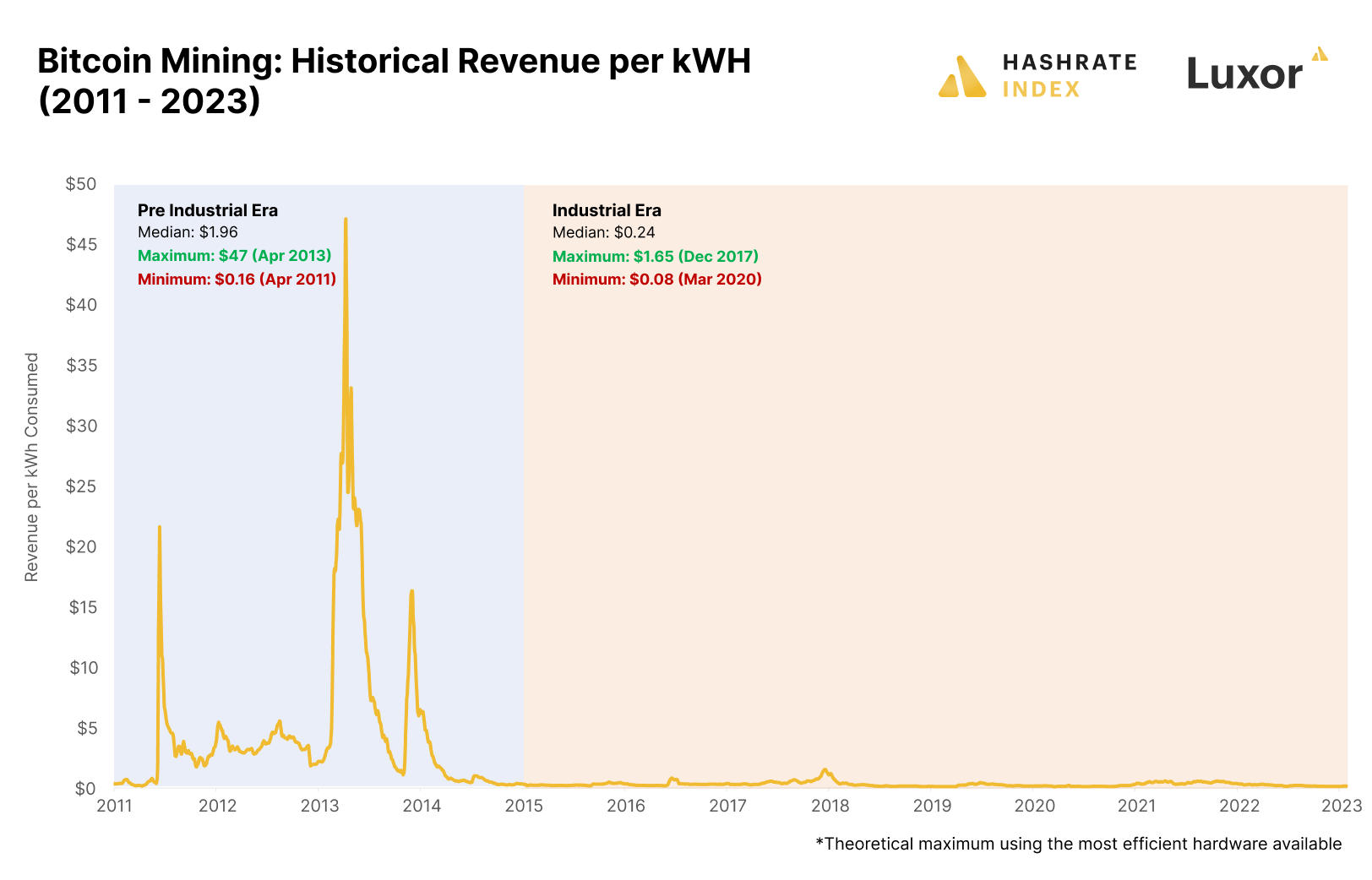

We can split the history of bitcoin mining into two distinct epochs: the pre-industrial era (2009 - 2015) and the industrial era (2015 - now). These two periods are characterized by exceptional differences in the bitcoin mining revenue per kWh.

The chart below shows how the bitcoin mining revenue per kWh has developed since 2011. It’s important to note that this is a theoretical maximum using the most efficient hardware available at any given time. For example, the hardware used to calculate the revenue per kWh today is the Antminer S19 XP Hydro, which is currently the most energy-efficient machine on the market.

As you can see on the chart, between 2011 and 2015, bitcoin miners printed a median of $1.96 worth of bitcoin for every kWh consumed. Considering a typical electricity price of $0.1 in most markets, a miner using the most efficient hardware on the market could have made a 20x return on its electricity by mining bitcoin. Quite the energy arbitrage!

The game would change forever in 2015, as the garage amateur setups gave way to the industrial era of bitcoin mining. Suddenly, the super profit party for mining enthusiasts was over, as the widespread usage of ASICs and increased competition pressured down the revenue per kWh.

Since 2015, the median bitcoin mining revenue per kWh using the most efficient machines available has been $0.24, dramatically lower than during the pre-industrial era. The only way to make a long-term profit in the industrial era of mining is to access exceptionally cheap electricity. As a result, we have seen hashrate generation gravitate away from tech enthusiasts’ garages and toward remote places with undervalued electricity, like West Texas, Sichuan, Quebec, and Iceland.

Let’s analyze the revenue per kWh during the industrial era of bitcoin mining

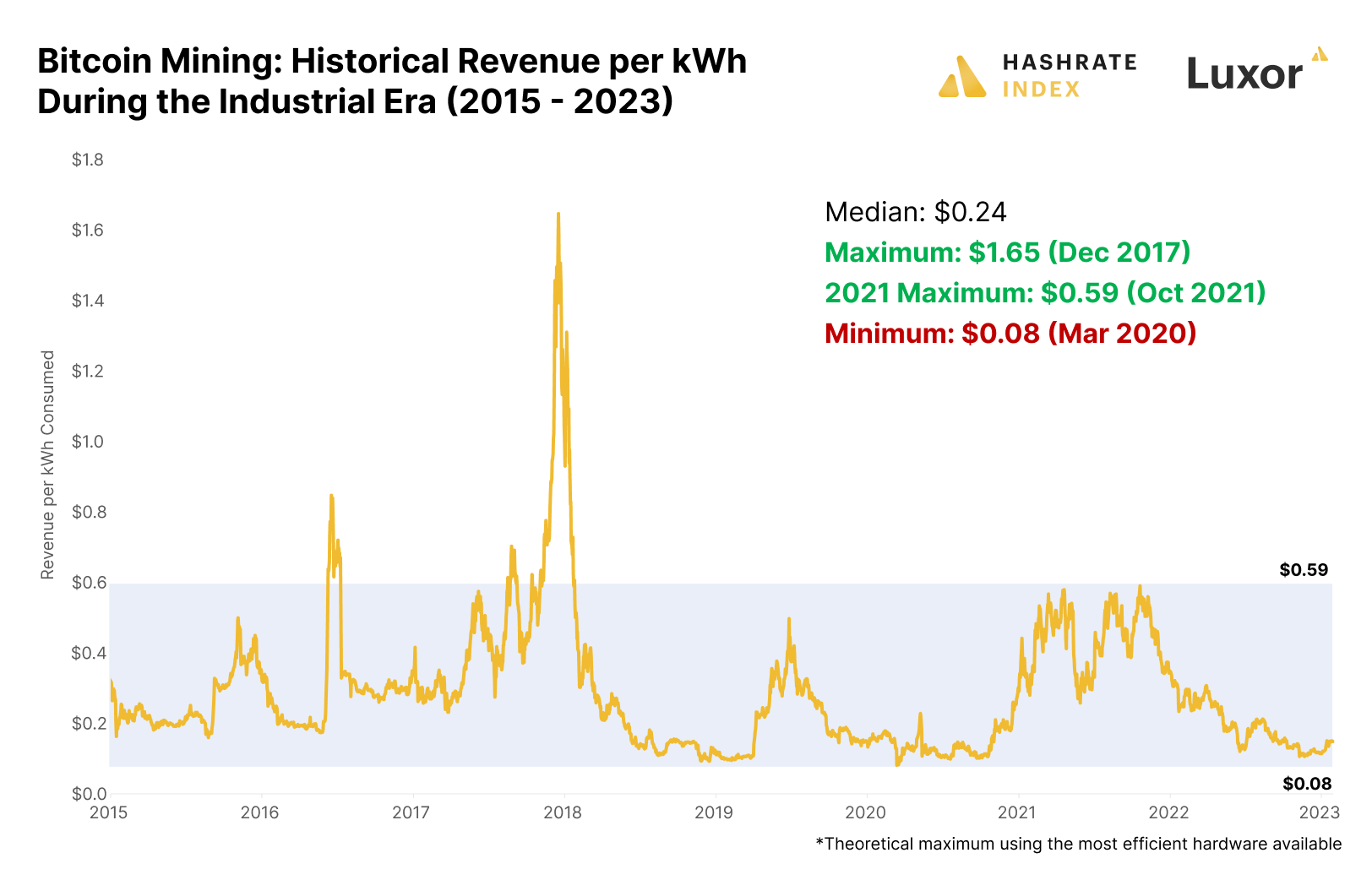

In the previous section, I established two widely different epochs of bitcoin mining, with the industrial era starting in 2015. Let’s zoom in on the chart to analyze the bitcoin mining revenue per kWh during the industrial era. What can we learn from this chart?

As you can see on the chart, during the previous 8 years, the bitcoin mining revenue per kWh using the most energy-efficient hardware available has mostly stayed between $0.08 and $0.59. This has been the case 95% of the time, with the only exceptions being two brief periods of super profits in 2016 and 2017.

The chart shows that the revenue per kWh has never dipped below $0.08, which served as a bottom during the horrific bitcoin crash of March 2020. Interestingly, the area just above $0.08 has served as resistance on several occasions, for example, in 2019, later in 2020, and now in late 2022.

I’m reasonably confident a revenue per kWh of $0.08 using the most energy-efficient hardware available will keep serving as a bear market bottom for the foreseeable future. Historically, many miners have withdrawn from the network when mining economics deteriorate to this level, reducing the difficulty and thus increasing the revenue per kWh.

Still, as we showed in our report “The Search for a Hashprice Floor”, there is theoretically no floor for bitcoin mining economics, as the bitcoin price could fall significantly faster than the difficulty. Therefore, it’s essential to understand that the revenue per kWh could very well fall below $0.08 in the case of a bear market armageddon. However, this didn’t even happen during the March 2020 crash when the bitcoin price fell to $5k.

At the same time as the revenue per kWh usually has bottomed at around $0.08 during bear markets, it has tended to peak at around $0.5 in bull markets. This peak indicator is much weaker than the $0.08 bear market bottom, and I’m confident we will see the revenue per kWh surpass $0.5 in future bull markets.

The bitcoin mining bull markets are more unpredictable than the bear markets. The bitcoin price can only fall to a certain level, but as we all know, it can suddenly shoot upward to heights unimaginable to any sane person. In addition, as it takes time to build out mining operations, the hashrate tends to lag behind bitcoin price increases. Meanwhile, the hashrate tends to immediately respond downward when the bitcoin price falls.

It’s also important to note that the revenue per kWh will likely trend downward in the long-term as bitcoin mining gets more competitive. As mentioned, bitcoin mining is an energy arbitrage game, and arbitrages tend to get “traded away” over time. As each bear cycle shaves away high-cost operations, the average electricity price in the industry will gradually fall. This will, of course, reduce the expected revenue per kWh.

Another important consideration is that it has historically been wiser to invest in bitcoin mining when the revenue per kWh is low than when it is high. For example, many investors threw money at public miners in 2021 when the revenue per kWh was at high levels. History has shown that the best time to invest in commodity-producing industries is usually not during a time of super profits but when the industry is in liquidation. Based on the revenue per kWh, the bitcoin mining industry is currently in this stage, which should make it attractive for contrarian commodity investors.

Conclusion

In this article, I explained why the revenue per kWh is my favorite metric for analyzing bitcoin mining profitability. I also put the metric to work by showing how the bitcoin mining revenue per kWh has developed since 2011 and discussed whether we could use this metric to predict bear market bottoms and bull market tops.

The revenue per kWh has become an increasingly important metric as the bitcoin mining industry has gradually become an energy arbitrage game. Since 2015, bitcoin mining has become a highly competitive industry, and we can see massive differences in the revenue per kWh before 2015 and after.

The revenue per kWh during the industrial era of mining (post-2015) has historically hovered between $0.08 and $0.5. The area just above $0.08 has served as a bear market bottom on several occasions, while super profitable periods have usually been close to ending when the revenue per kWh reaches $0.5.

In the long term, the revenue per kWh will likely trend downward as the bitcoin mining industry gets increasingly competitive. The only way to survive as a bitcoin miner in the long term is to have access to exceptionally cheap electricity.

Feel free to contact me on Twitter @jmellerud if you want help on optimizing and growing your mining operation.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.