Bitcoin Mining Meets DeFi

As the mining industry matures, the financialization of hashrate becomes increasingly vital.

DeFi Landscape

Decentralized Finance (DeFi) took 2020 by storm. Developers and companies are re-building the financial system in a new way with entirely novel economic incentives and monetary policies. It is the ultimate sandbox, where products can be built within weeks and continuously iterated. Borrowing, lending, leveraging, exchanging, wrapping are just some of the many enthralling areas of DeFi.

Governance Tokens

In 2017 MakerDAO launched the decentralized stablecoin, Dai. To govern the project, they offered a governance token known as MKR. This token was used to help holders get a direct line of influence over the direction of the protocol. Token holders could propose new changes and decide on key proposals. The purpose of the governance token was to allow for more user control along with the themes of decentralization.

Generally, governance tokens do not have utility outside of the governance. The tokens don’t grant holders royalties nor access to returns. Critics believe that they can be used to maintain an appearance of decentralized governance when in reality they are just a way to collect community feedback. During large decisions, the project team could implement something without the community support, depending on how the system is built.

That being said governance tokens have exploded in growth. The DeFi projects that launched governance tokens saw an incredible amount of user adoption and token appreciation. Many now believe that the projects with tokenized patronage have a stronger value proposition than those that don’t.

Hashrate Tokens

As the mining industry matures, the financialization of hashrate becomes increasingly vital.

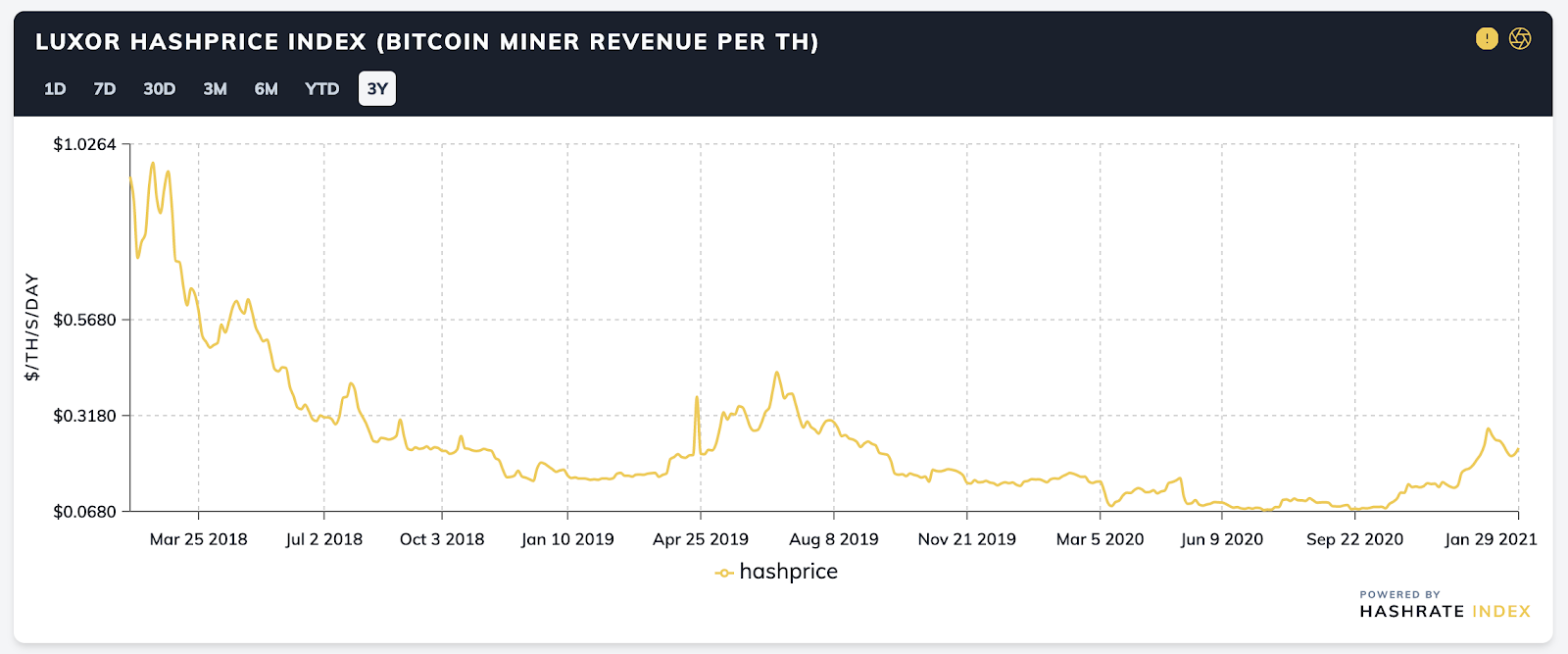

The value of hashrate (hashprice) is extremely volatile, and miners take the full brunt of it in the current system. The ability to transfer risk will aid miners greatly in a quest to build stable, long-term businesses. This part is particularly paramount for institutions entering the space. At the same time, hashrate is an asset that is based on many strong macro fundamental factors. The fundamental component mixed with the volatility makes hashrate an attractive asset class for traders to engage with.

To date, there have been a few forms of hashrate derivatives, including OTC hashrate contracts, cloud mining contracts, and network difficulty futures. This year we saw a new product enter the space, hashrate tokens.

By purchasing and then staking hashrate tokens, holders receive daily Bitcoin rewards that correspond to the number of tokens (hashrate) they stake. This allows anyone to enter the mining space with lower barriers to entry than setting up their own mining operations. Where success as a mining operator is largely determined by the ability to acquire low-cost power, expertise in equipment procurement, and sell hashrate at the highest point, hashrate tokens bypass this. For some this is a positive, for others, this is a downside as their ability to execute is why they are in the mining business.

Differences between Hashrate Tokens and Cloud Mining

Similar to cloud mining contracts, hashrate tokens provide buyers an easy way to earn the output of hashrate. However, there are a few key differences.

On-exchange liquidity - by creating a token, buyers can easily enter and exit their positions. Tokens bring exchange-grade liquidity to Bitcoin mining whereas cloud mining contracts have to be held until expiry, unless a bilateral agreement takes place.

Governance protocol - some hashrate tokens such as Poolin’s pBTC35A also have a governance token (MARS) that is used to gather holders’ feedback on how the platform should be developed, adding a more decentralized aspect to the process.

Counterparty risk - with cloud mining contracts your counterparty is the platform itself. In the case of hashrate tokens that source hashrate from a multitude of different miners, your counterparty risk may be tied to a few miners and to the platform.

Physical delivery - in the case of certain cloud mining contracts, buyers can take physical control of the hashrate and direct it how they please. Hashrate tokens don’t touch the physical side of the asset.

Valuation Framework for Hashrate Tokens

Discounted Cash Flow Model

Understanding the Cost

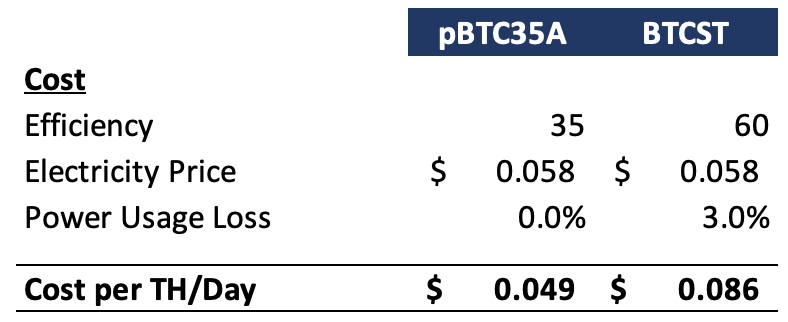

Unlike physical mining, purchasing hashrate tokens has a constant and standardized cost structure. This cost structure should stay intact for the lifetime of the investment.

Depending on the token being offered there are some standard inputs that dictate the cost.

The Cost per TH should equal:

(((Efficiency J/TH) x (1+power loss)) / 1,000) _ Electricity Price \$kWh _ 24 hours/day

As seen below, both the efficiency and the electricity price are big drivers of the cost per TH.

Estimating Revenue

With hashrate tokens buyers don’t receive physical hashrate rather just the Bitcoin output of that hashrate determined by a centralized party. So they can’t use strategies such as profit switching. For pBTC35A it is based on Poolin’s FPPS method and a 2.5% pool fee. So the revenue they pay out is the Full-Pay-Per-Share Method, using the past UTC day to calculate transaction fees, and reduced by 2.5%. For Binance it is also a FPPS method, but no stated pool fee. The current value of hashrate in a FPPS method is here.

Estimating future revenue is the hardest part of the analysis. As history has shown, hashprice experiences a decline in value over time. As more hashrate gets added to the network the existing hashrate loses value. This part of the model can be really sophisticated but is also easy to over-engineer.

If the hashrate token has annual downtime, such as BTCST you need to factor this into the model. There is no great way to do it given it's not clear when that downtime occurs, but a simple approach would be to reduce revenue and cost by 10% each.

Discount Rate

To discount cashflows back to the present you need a discount rate based on your cost of capital or opportunity cost. This rate will be different for everyone but needs to take into consideration the risks associated with hashprice.

Building the Model

So now that we have the costs, expected revenue and discount rate you can plug them into your model to get the present value of the token’s cashflows.

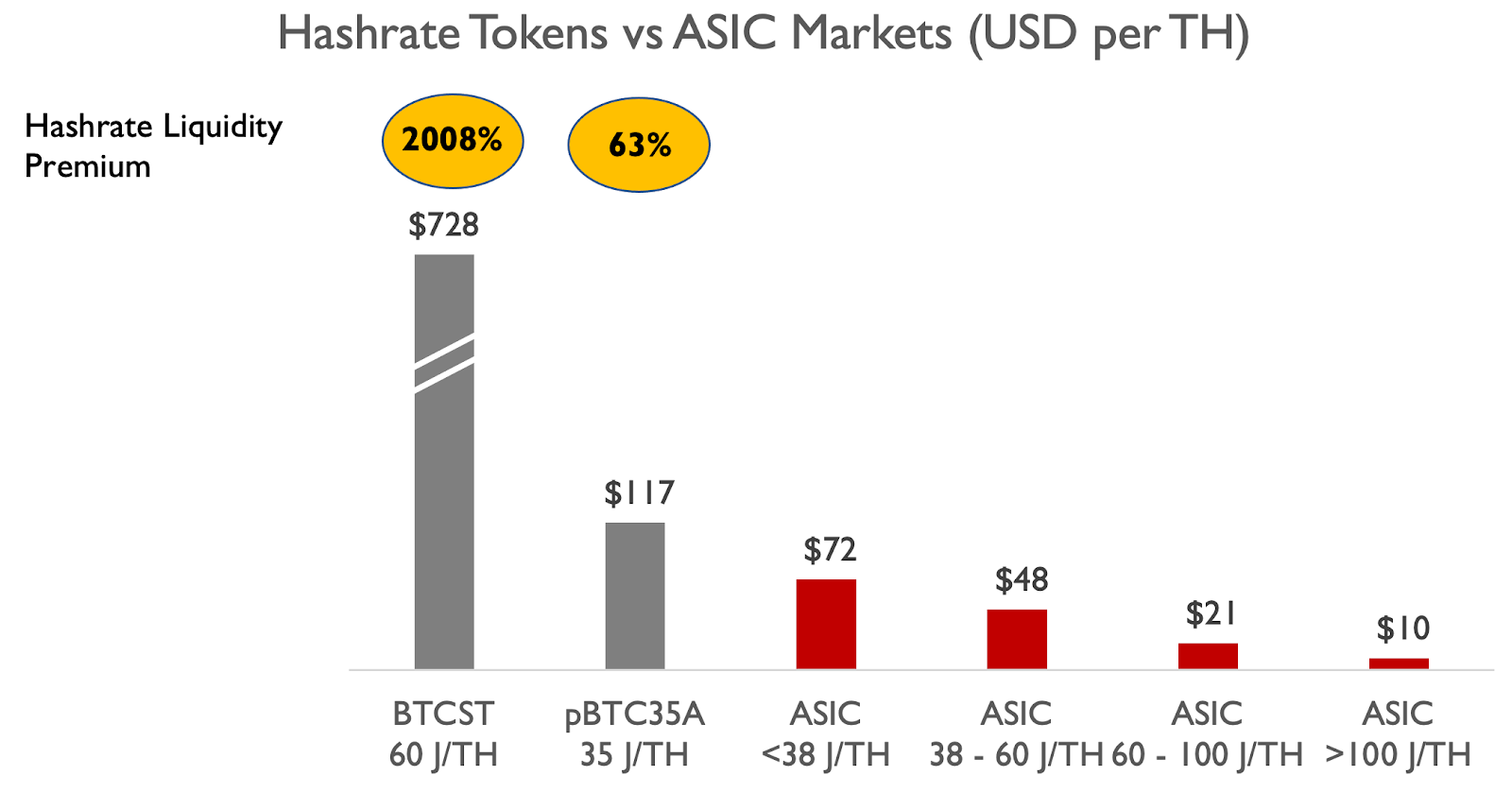

ASIC Markets

Given hashrate tokens are bridges to the real world, it's important to compare them to ASIC prices. You can buy latest-gen equipment for around \$66/TH right now. Hashrate token markets should trade at a slight premium to ASICs given their liquidity. We refer to this as the Hashrate Liquidity Premium.

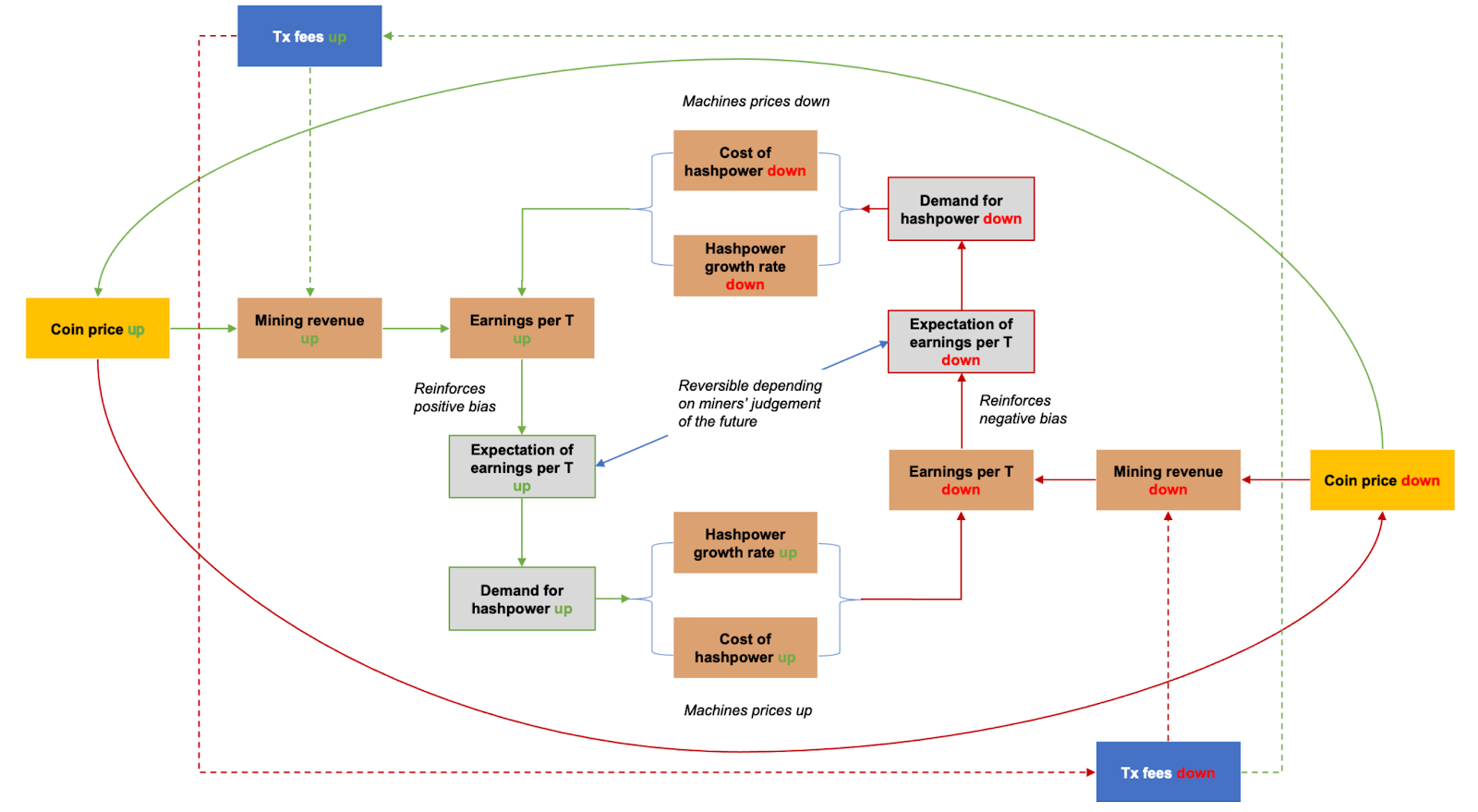

Reflexivity in Hashpower

The hashpower reflexivity theory proposed by Annica Research is a useful framework for assessing the value of hashrate tokens. Changes in mining inputs alter expectations, and thus it recursively influences the current value of hashrate. Every participant, including hashrate token buyers, in the hashpower market constantly changes the rest of the market.

Binance Hashrate Token (BTCST)

In January Binance partnered with a mining farm to offer a new hashrate token called BTCST.

Each BTCST token represents 0.1 TH of hashrate and is backed by physical hashrate that is verified by Binance’s mining pool. The output is paid in Bitcoin and also comes through the Binance mining pool. BTCST has an electricity fee of \$0.058/kWh, efficiency of 60 j/TH, power usage efficiency loss of 3%, and an annual downtime of 10%.

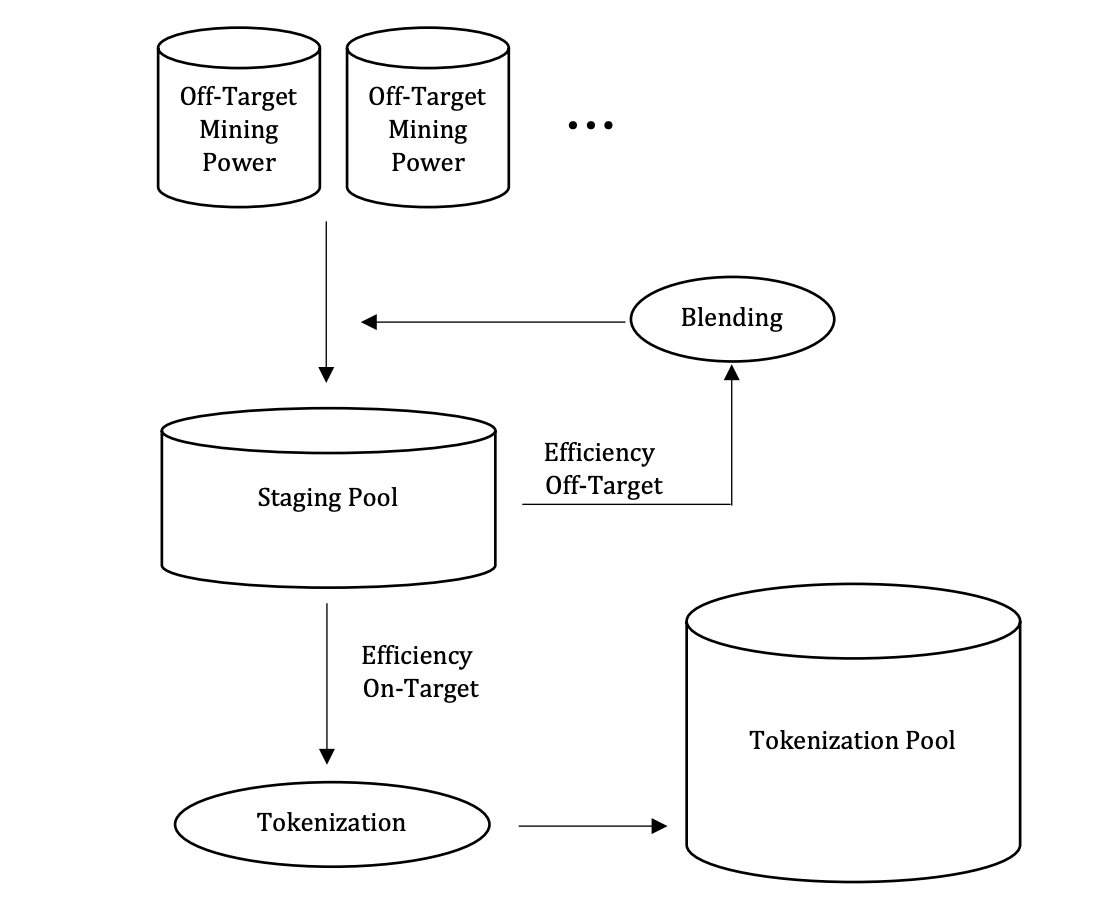

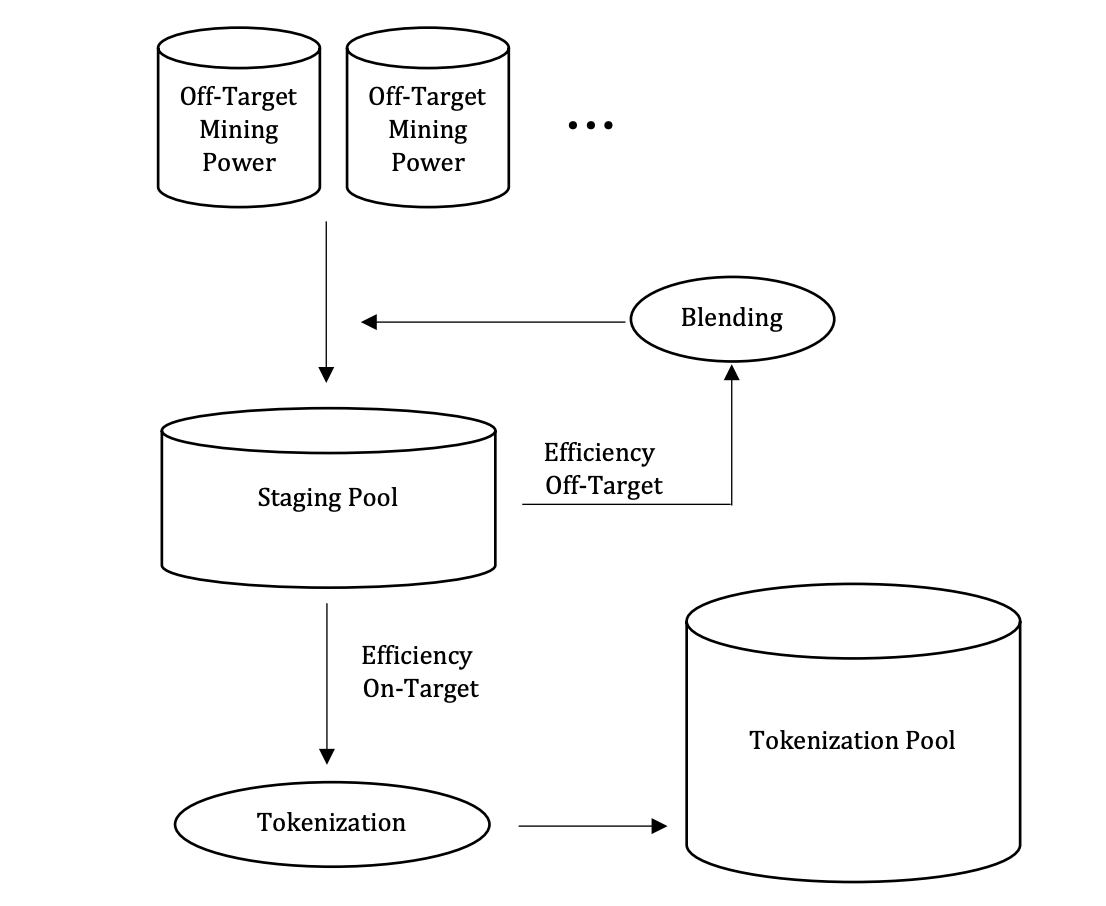

When hashrate is supplied to the project, it is sent to a staging pool which only gets added once it has been verified that the efficiency of that hashrate is at the target (60 j/TH) as seen below.

Binance mining pool acts as the auditor and periodically publishes reports to demonstrate mining reward sufficiency and to prove that BTCST is fully collateralized by real hashrate.

This part of the process is centralized to Binance. It is justified for increased feasibility and accountability. The project team also acts as the market-maker. This is pretty common with DeFi projects at the start. Without leadership it's hard for a company or project to get off the ground. It’s easier to start decentralizing components of the project once it's up and running.

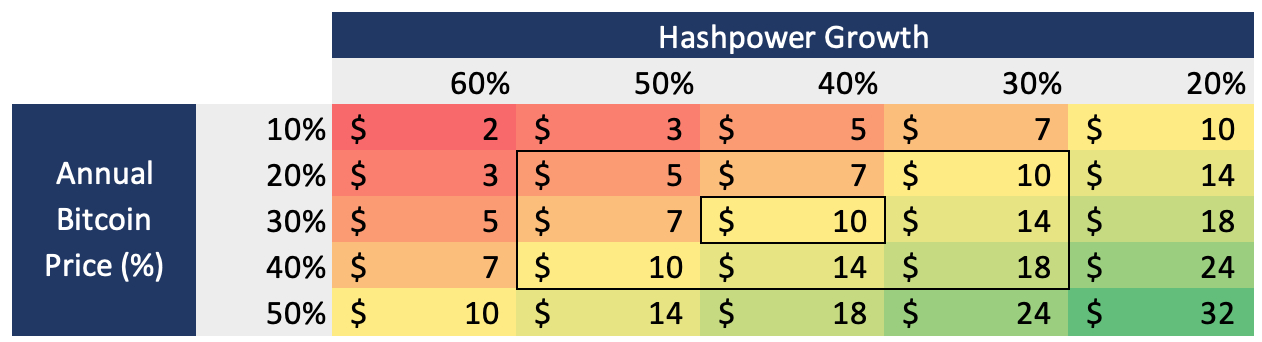

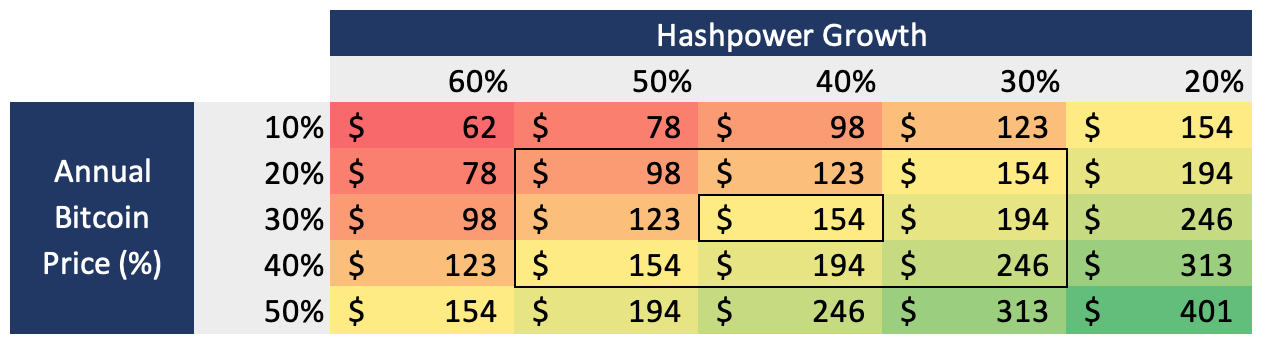

Performing a discounted cashflow analysis on BTCST (0.1 TH), using a 15% cost of capital and 4 year investment period we get the following sensitivity table on the token value. Of course, this valuation method should be taken into consideration with some of the other methods mentioned above. At a current price of \$72 (Feb-2-2021), BTCST seems overvalued.

Poolin’s Hashrate Token (pBTC35A)

Poolin launched a hashrate token called pBTC35A in January, representing 1 TH. The token has an electricity fee of \$0.0583/kWh, efficiency of 35 j/TH, and pool fee of 2.5% FPPS.

Similar to BTCST there is also centralization in this process as the project team is trusted to gather hashrate, audit hashrate, verify efficiency and issue tokens and payouts (wBTC).

Instead of the project doing the market making, pBTC35A is listed on Uniswap taking advantage of the automated market makers, and pool liquidity.

To buy the token you need to head over to use Uniswap (full guide here). You add your pBTC35A and USDT as liquidity on Uniswap as shown below, then take the pBTC35A USDT-UNI-LP v2 to get paid out wBTC and MARS token.

Performing a discounted cashflow analysis on pBTC35A (1 TH), using a 15% cost of capital and 4 year investment period we get the following sensitivity table on the token value. At a current price of \$117 (Feb-2-2021), pBTC35A seems fairly valued.

Hashrate Token Adoption

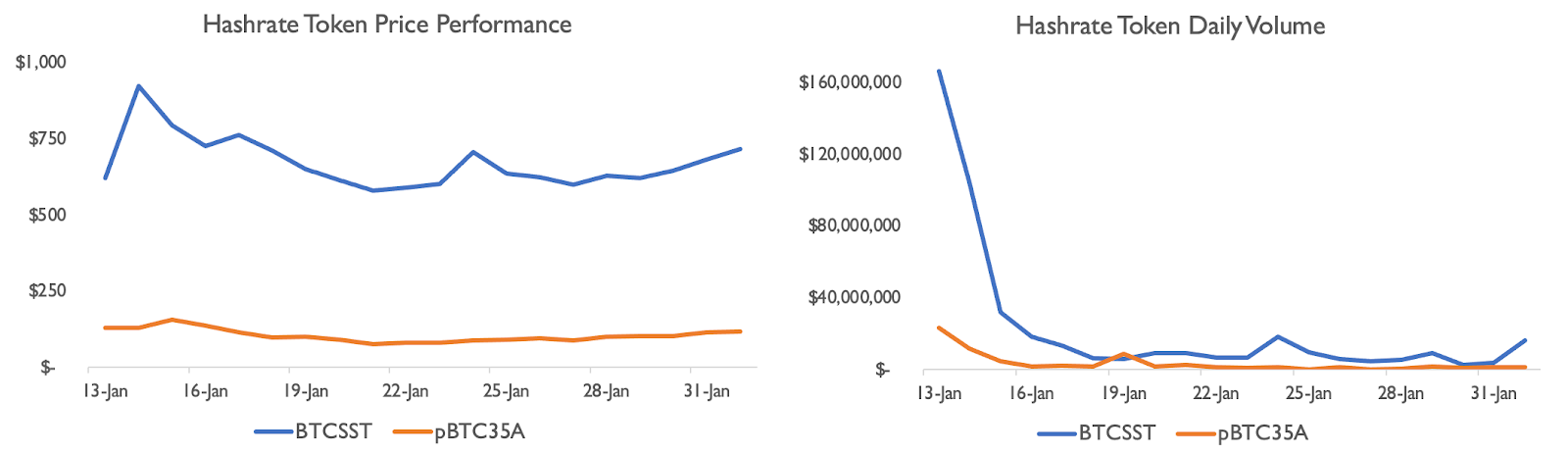

Since Jan-13th, pBTC35A is down 11% and has had an average daily trading volume of $3.4mm. BTCST is up 15% and has had an average daily trading volume of $22.6mm.

Given the tokens have only been released for a month this is pretty impressive volume. Mining derivatives are a new asset class so in order for the tokens to grow in volume it will require a continuous effort of educating investors and onboarding them to trade it.

Poolin’s Governance Token (MARS)

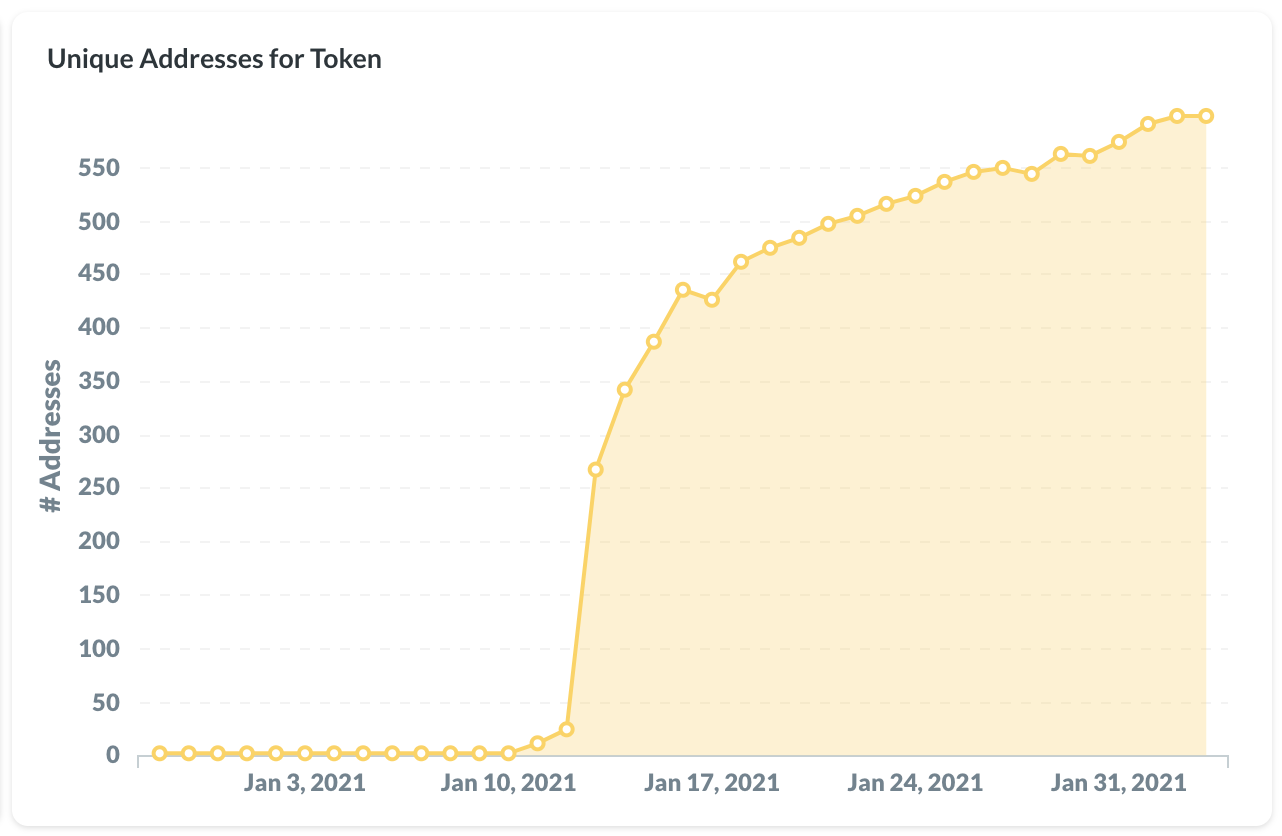

Alongside their hashrate token (pBTC35A), Poolin launched a governance token. The token can be purchased or earned through staking on the platform. There are currently around 600 unique token holders of MARS.

Having a governance token for the entire project makes sense as they can now release other hashrate tokens, such as pBTC30A that is still governed by the MARS token.

Bridging the physical world to DeFi is tough. There needs to be a central entity that actually gathers the hashrate, verifies the efficiency and issues the tokens. Doing that decentralized would require new technology that hasn't been developed yet.

As of now the MARS token feels a bit like a glorified community feedback mechanism, but in the future, it could have more power over the network. A good story of a transition to better decentralization is Synthetix.

Future Outlook

There has been a lot of criticism of hashrate tokens from the traditional mining industry, and praise from the DeFi community. While hashrate tokens and DeFi in general still have ample room for improvements, Poolin and Binance have released these products out in the open. They can now be iterated on, and improved.

Hashrate financialization is here to stay. Hashrate tokens will play a role along with physically delivered spot, forwards and futures and cash-settled futures and swaps.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.