End of the Crypto Mining Pool Era and the Future of Mining Pools

Single chain crypto mining pools will be replaced by chain-agnostic switchers.

In 2017 we were looking at the crypto space and wondering how we could best play. We were intrigued by the Sia project and noticed that only one mining pool existed, which is a clear centralization risk. So we learned stratum from scratch and built a competing mining pool from ground-up. Since then we have built 15 mining pools supporting thousand of miners globally.

Crypto Mining Pool History

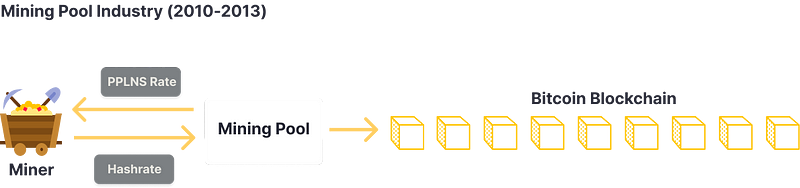

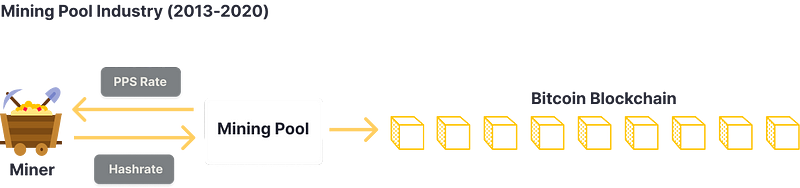

The first mining pool, Slush Pool, started in 2010 as a way to reduce variance in mining revenue by combining hashrate between multiple miners. Reward was then split up based on the work contributed by each participant. Mining was done to a single chain such as Bitcoin.

In 2013, a pivotal change happened in the ecosystem. BitPenny started paying out miners on the expected value of their hashrate rather than the actual value. This meant that as a pool operator you effectively buy hashrate from miners and take on the variance of mining luck. This method is known as Pay-Per-Share (PPS). PPS changed the game. It created a sophisticated mechanism to transfer risk and paved the way for hashrate as a tradable commodity.

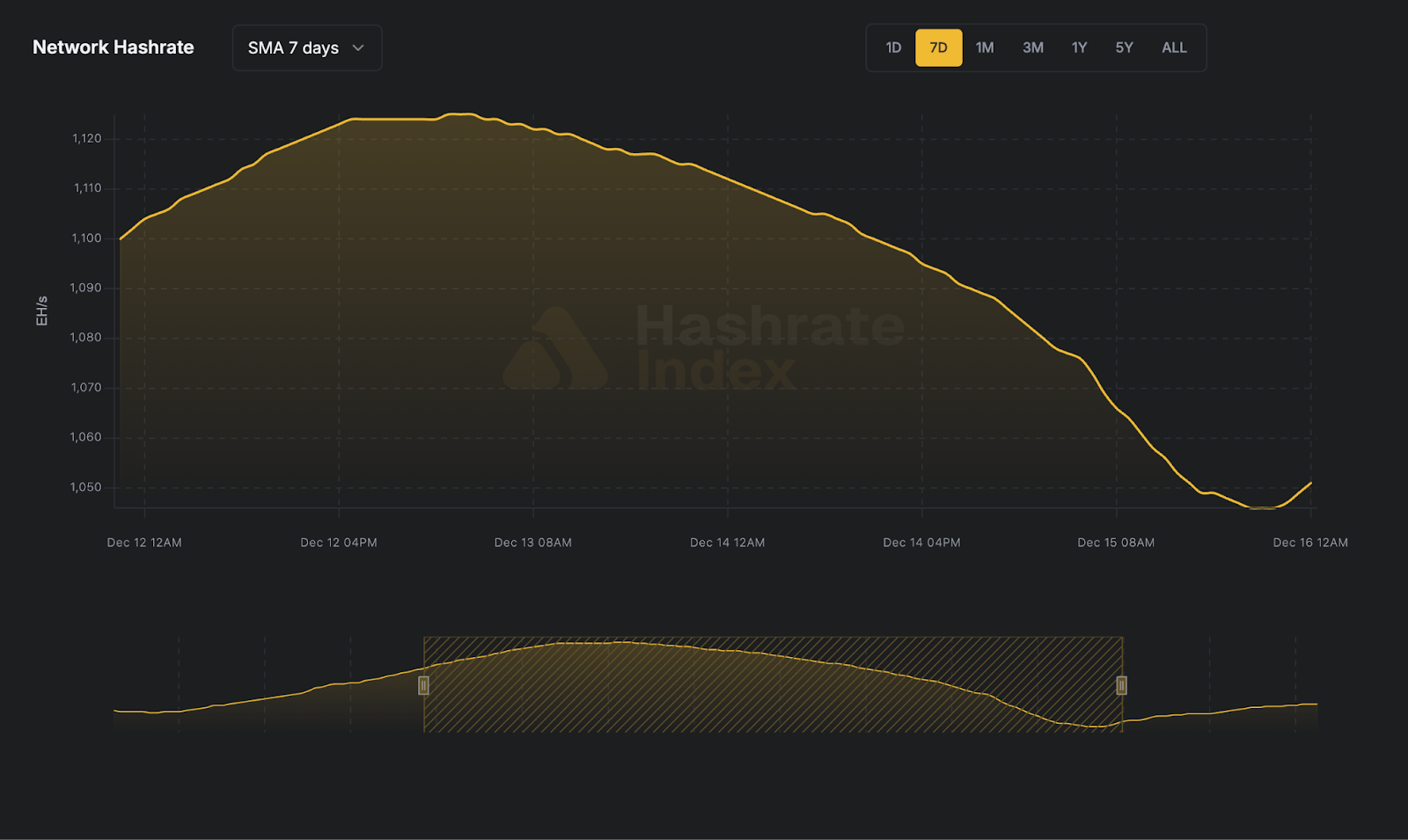

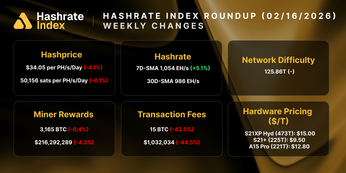

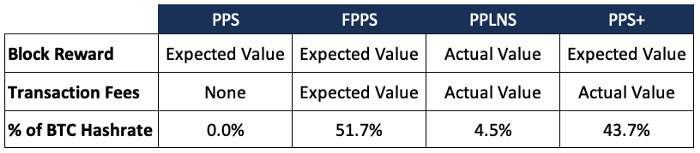

PPS pools have been growing in dominance. Today around 95% of the industry works on this form of payment method. FPPS and PPS+ being modern-day equivalents of PPS. Miners clearly value getting paid upfront for their hashrate and not being exposed to any mining luck risk.

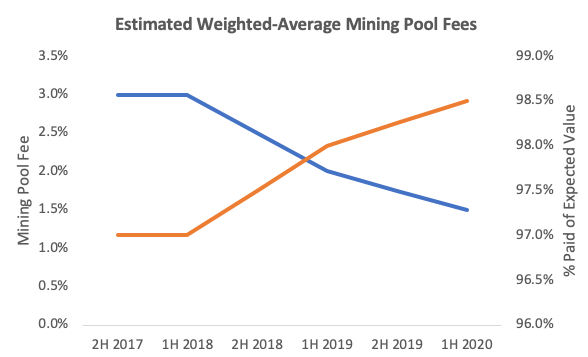

Over the past few years, the industry has seen significant pool-fee compression. Today, miners with above 50PH can negotiate with mining pools to get a special rate. So the weighted average is really a rough estimate from what we have seen across pools & miners. What fee compression really means is that the value of hashrate is increasing. Mining pools are now willing to pay higher for hashrate (~98.5% of the expected value when applied to the Bitcoin Network).

This is important to understand because it demonstrates that in its most simple form, mining pools are simply purchasers of hashrate. Miners don’t actually desire low fees, they desire the side-effect, which is more earnings for their hashrate.

Enter best-price-execution (AKA profit-switching) to the mining industry.

A New Crypto Mining Pool Era

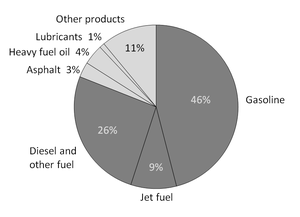

Much like oil, hashrate does not have a single use-case. Oil is mostly used to make gasoline but is also turned into a few other types of fuels and byproducts. When an oil producer sells their oil to a refinery they typically don’t specify what the refinery does with it. The producer chooses which refinery to sell to largely based on the price they are willing to pay (and have access to).

Similar to oil producers, miners are largely profit-driven. By being chain-agnostic, and selling hashrate based on profitability, mining pools can maximize the amount in which they buy that hashrate from miners.

Best-Price-Execution for Hashrate

In 6–12 months, we will see the majority of the industry change over from a pure Bitcoin pool model to profit-switching algorithms. Of course, the majority of hashrate (95%+) will still end up on the Bitcoin network but the delivery mechanism will be very different.

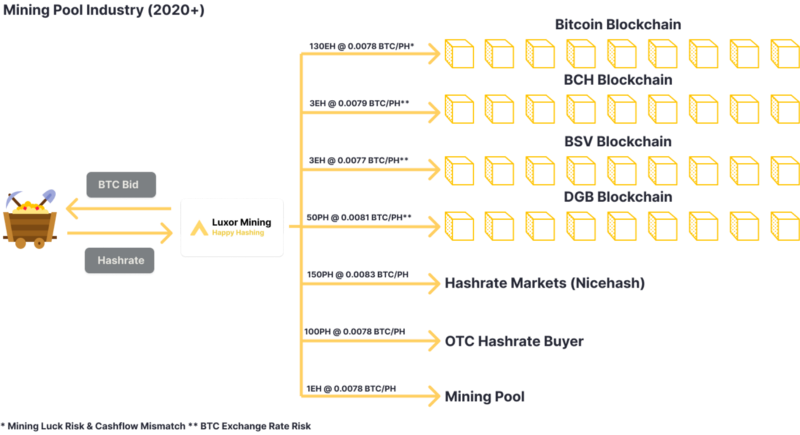

In the example below a profit-switching algorithm will measure the expected profitability of applying hashrate to multiple chains and/or selling to other counter-parties. Based on the expected value the algorithm will allocate hashrate in the most profitable manner, passing on the benefits to miners.

The hashrate on the pool would likely first be allocated to Nicehash (150PH) as it has the highest bid (BTC/PH) and has no mining luck risk. Then it would go to DGB chain (50PH) which has the second-highest bid but does come with mining luck risk & exchange risk.

What this visualization shows is that a profit-switching algorithm is very similar to the best price execution platform, such as FalconX, which has become popular in crypto trading. Profit-switching algorithms can access deeper hashrate liquidity and use superior execution technology to get best point-in-time execution for miners.

Shifting Incentives

Mining pools have historically operated with management fees, charging a flat rate to miners. This was an acceptable method for the days of mining to a single chain. But in an era of profit-switching, pools will be differentiated and will get compensated differently as a result. Likely the industry will change to performance fees, where the pool takes a % of the uplift over a base chain PPS rate. The rationale for performance fees in this system is that it aligns the interests of the switching algorithm and their miners.

In the hedge fund industry, fund managers usually cap the size of their fund. Even though they would make more money by managing a bigger fund they realize that operating a large fund may impact their ability to maximize returns. A couple of reasons for this include moving markets (i.e. if they invest too much then they could move the market) and not having the ability to liquidate quickly especially for smaller stocks. We believe the same is true for profit-switching. Larger profit switching pools will move the market (i.e. increase the difficulty) which will lead to lower profitability. In addition, they may have a harder time selling a smaller cap coin if the market is not very liquid. So larger pools will be forced to implement higher profitability switching thresholds in their algorithms (i.e. only switch between coins when they are 5% higher than the rest). Whereas smaller pools are more nimble and could switch at much lower rates (i.e. when a coin is 2% higher than the rest).

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.