Bitcoin Mining Hashrate Futures: What They Are, Why They Matter, How to Trade Them

Luxor's Hashrate Futures are live -- here's how to start trading them.

In partnership with Bitnomial, a CFTC-regulated Bitcoin and derivatives exchange, Luxor Technology Corporation has launched the first ever Bitcoin Mining Hashrate Futures. These regulated derivatives contracts are the next evolution of Luxor’s Hashrate Forwards, an over-the-counter Bitcoin mining derivative that Luxor launched at the end of 2022. The Hashrate Futures are exchange-traded and fully-regulated by the CFTC, and they will provide market participants with greater market transparency, deeper liquidity, and reduced counterparty risk.

From corn to crude oil, futures are crucial financial instruments that allow commodity producers to hedge their income and plan for the future. Luxor and Bitnomial’s Hashrate Futures provide the most robust hedging tool on the market for Bitcoin miners to hedge their (often volatile) revenue, while also offering institutional investors exposure to the Bitcoin mining market.

Here’s a quick breakdown of what Hashrate Futures are, why they matter, and how institutional investors can trade them.

What Are Bitcoin Mining Hashrate Futures?

A futures contract is a financial derivative wherein two parties agree to buy and sell a financial asset at a future date for an agreed-upon price. For Hashrate Futures, the asset that these parties agree to buy and sell is hashrate (the digital commodity that powers the Bitcoin network), which is priced according to hashprice (a measure of Bitcoin mining revenue potential).

Just as the value of crude oil is measured according to its price per barrel, Bitcoin miners and hashrate traders use hashprice to measure the value of hashrate. Hashprice can be denominated in USD or BTC and it dictates how much revenue a Bitcoin miners can earn per petahash (PH) of computing power over a one day period, so it is denoted as USD/PH/Day or BTC/PH/Day.

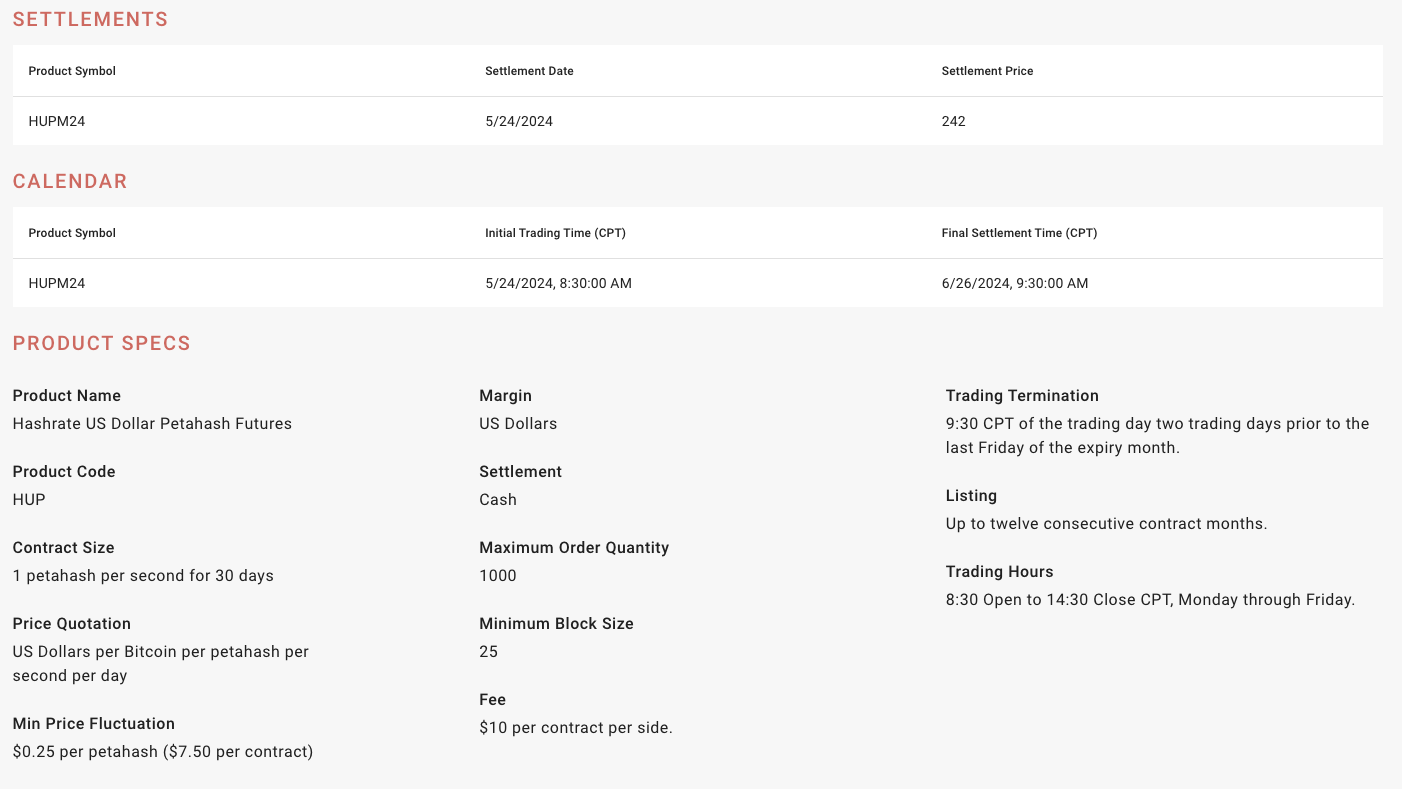

The contract size for Luxor’s Hashrate Futures is 1 PH and contracts trade for monthly duration. Contracts are marked-to-market daily based on trading activity on Bitnomial with final settlement to Luxor’s Bitcoin Hashprice Index.

What Are the Benefits of Bitcoin Mining Hashrate Futures?

Futures contracts offer numerous key benefits, including:

- Standardization: The contract size, expiration dates, and other key facets of the Hashrate Futures contracts, making them easier to trade and understand.

- Liquidity: The Hashrate Futures contracts are traded on Bitnomial’s regulated exchange, which entails higher liquidity than OTC-traded forward contracts. This will make it easier for traders to enter and exit positions.

- Lower Counterparty Risk: Hashrate Futures are cleared through a central, regulated clearinghouse, which acts as an intermediary and ensures that both parties fulfill their obligations. This significantly reduces the risk of counterparty default.

- Daily Settlement: Hashrate Futures are marked to market daily, meaning gains and losses are settled at the end of each trading day. This helps manage and reduce credit risk.

- Transparency: The trading of Hashrate Futures contracts on exchanges provides greater price transparency, as prices are publicly available and updated in real-time.

- Regulation: Hashrate Futures markets are regulated by the Commodity Futures Trading Commission (CFTC) in the United States. This regulation enhances market integrity and investor protection.

- Accessibility: Luxor and Bitnomial’s Hashrate Futures operate on Bitnomial’s CFTC-regulated exchange with a smooth onboarding process.

Before Luxor’s Hashrate Forwards, Bitcoin miners had no direct method for hedging their mining revenue – they could only hedge power prices and bitcoin price. Now, with Luxor and Bitnomial’s Hashrate Futures, miners will have an additional tool to hedge their revenue with the benefits of greater liquidity, lower counterparty risk, easier onboarding, reduced margin requirements, greater transparency, regulatory benefits, and more.

How to Trade Luxor and Bitnomial’s Hashrate Futures

To get started with Luxor and Bitnomial’s Hashrate Futures, please head over the Luxor’s Derivatives Desk website, where Luxor’s Introducing Broker business can help you onboard with a qualifying Futures Commission Merchant (FCM). If you already have an FCM account, please let them know that you are interested in trading Hashrate Derivatives on Bitnomial.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.