Bitcoin Mining Uses Less Energy Than Christmas Lights—A Breakdown of Bitcoin Mining Council's Q3 Report

The Bitcoin Mining Council's Q3 report gave us some solid estimates to work with when quantifying Bitcoin's energy appetite.

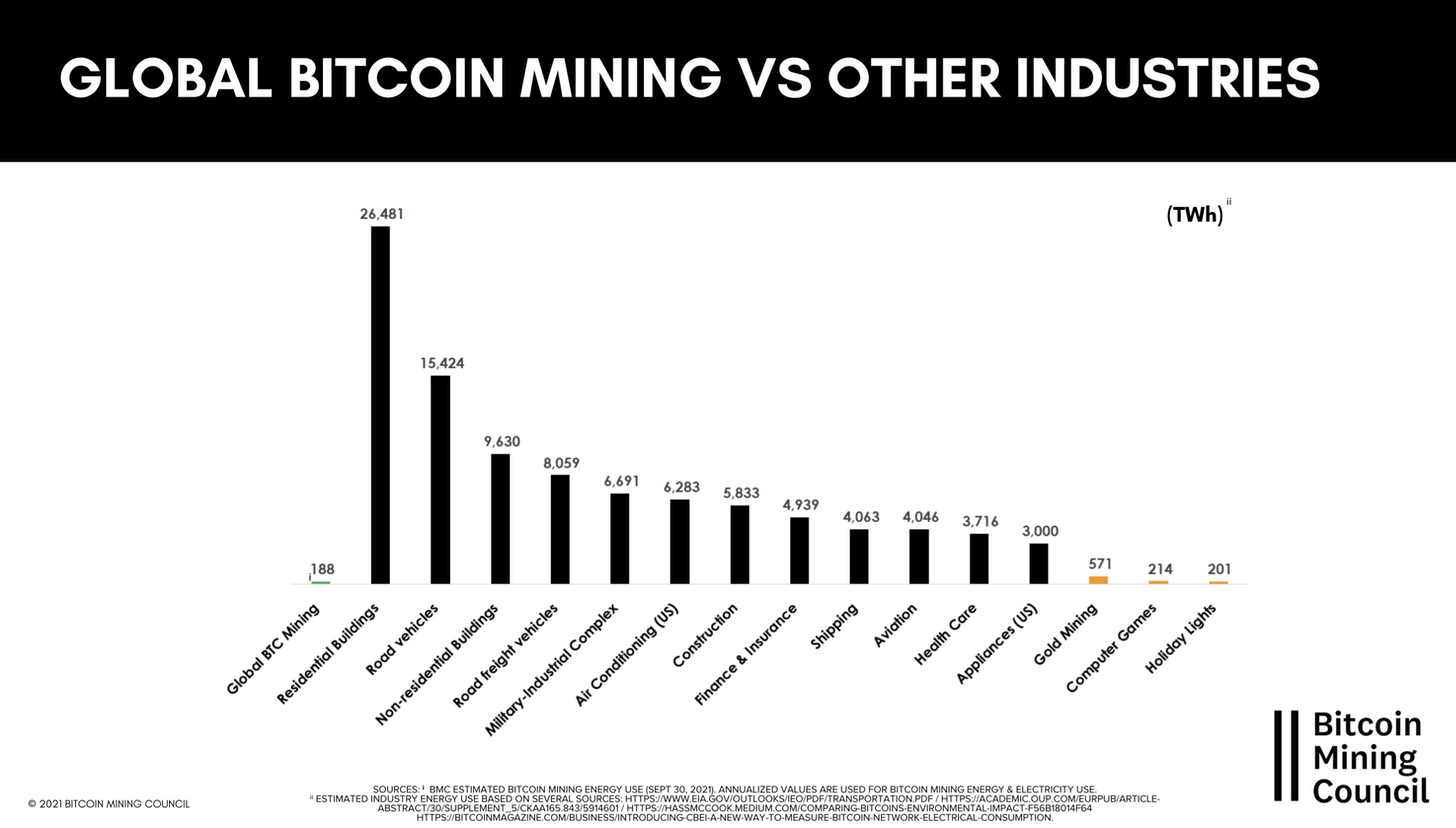

Christmas lights, video games, gold mining—all of these things consume more energy per year than Bitcoin mining.

This is according to the Bitcoin Mining Council’s Q3 report. Released this week, the report focused primarily on Bitcoin’s energy use and mining hardware efficiency, including forecasts for where ASIC efficiency will be in 8 years and an overview of the mining industry's landscape post-China ban. The council's ring-leader, Michael Saylor, presented the report during a Youtube livestream on Tuesday, and invited 8 industry to give individual presentations on different aspects of the mining industry and to answer questions in a live Q&A.

In short, the report gives us some solid estimates to work with when quantifying Bitcoin's energy appetite, and the presentations gave a wonderfully lucid view into how miner financing, ASIC manufacturing, hashrate distribution, and other key mining dynamics are shifting as we near the new year.

Bitcoin Mining Council Q3 Report

Before getting to the specifics discussed in the livestream and the Q&A, here are some quick-take highlights from the presentations and the Bitcoin Mining Council’s report:

- In terms of annual revenue, Bitcoin mining has become a $15-20 billion industry in 2021, a 4x increase from 2020.

- The council estimates that Bitcoin mining currently consumes 188 TWh of energy, or 0.12% of the world’s total energy output (154k TWh) and 0.32% of its wasted energy (50k TWh).

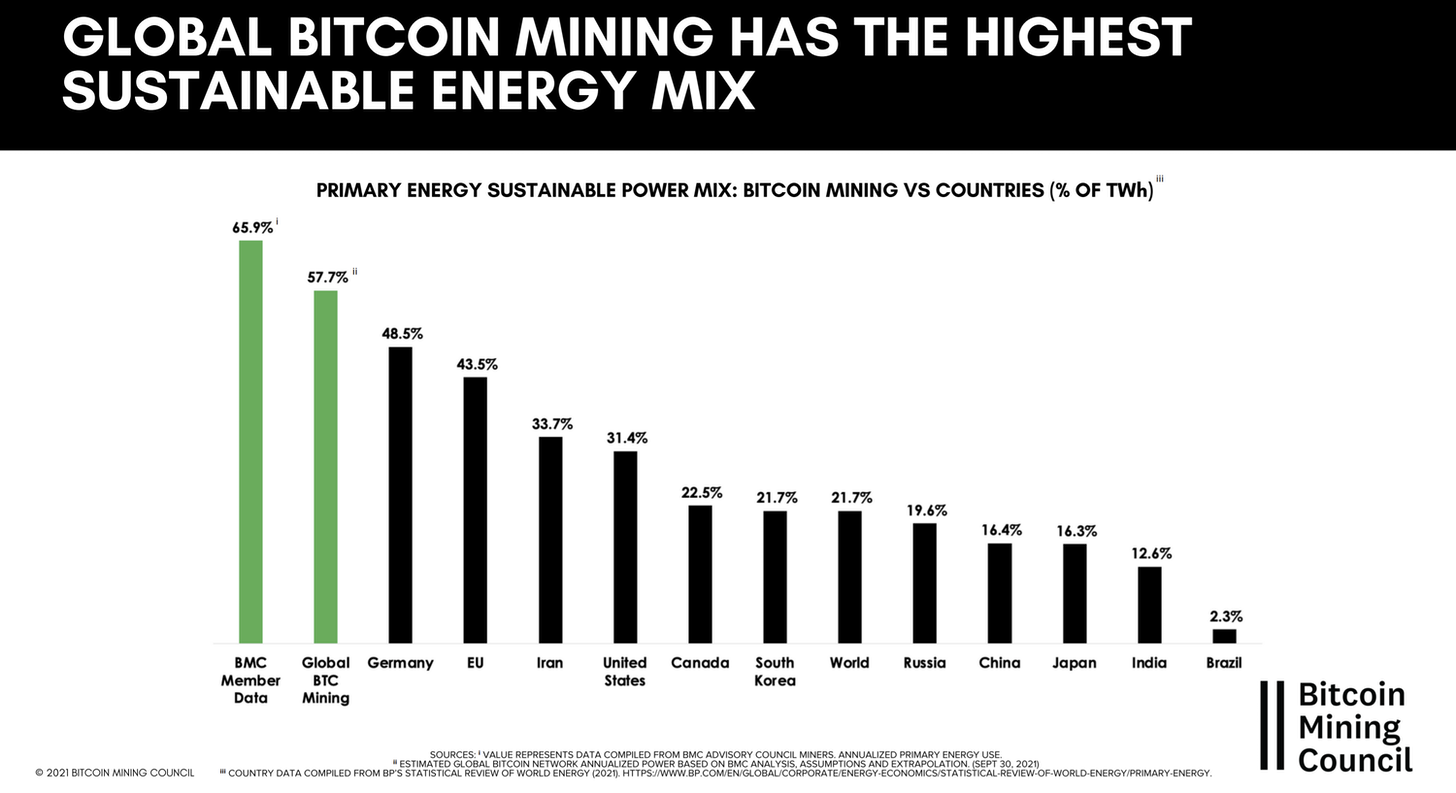

- Renewable energy powers roughly 57% of Bitcoin’s global mining industry, according to Bitcoin Mining Council estimates.

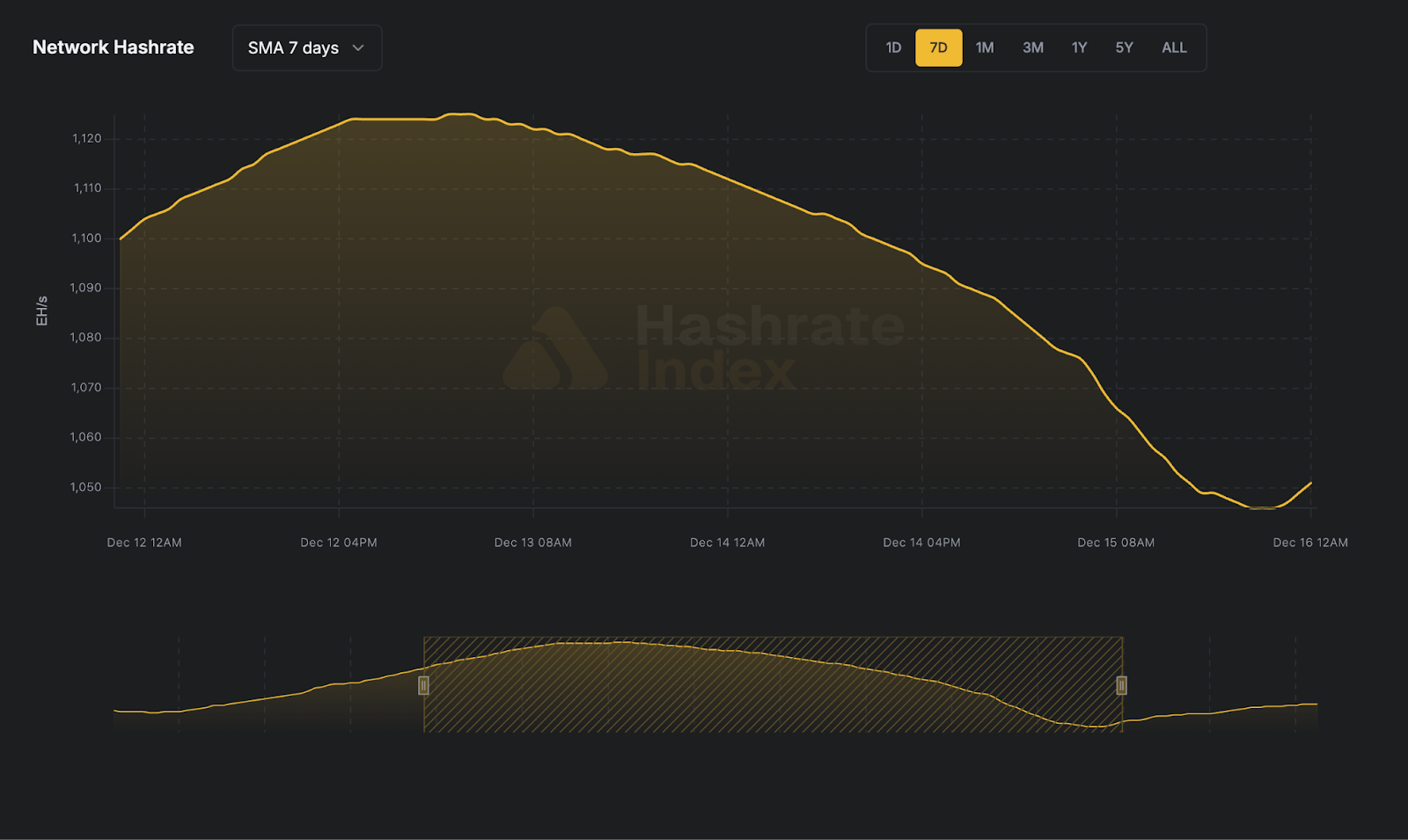

- Bitcoin’s hashrate increased 48% over Q3 following its post-China ban lows, though the council estimates that its energy appetite only increased by 21% over the same timeframe; this is largely due to the deployment of newer, more efficient hardware like the Antminer S19 and Whatsminer M30 series

- The council forecasts that ASICs, which have improved the joule-per-terahash efficiency of mining hardware by 42x since the days of CPU mining, will see a 3x increase in efficiency over the next four years and a 2x increase in efficiency from 2025 to 2029.

- Bitcoin mining uses less energy than Christmas lights (in case you needed a fun fact for Halloween parties or need a handy stat next time you’re trying to quash energy FUD).

With those quicktakes covered, here’s a synopsis of some of the more interesting tidbits from the presentations and the livestream Q&A.

“Texas is Bitcoin country”

The above quote is from Texas governor Greg Abbott, and when you look at the figures coming out of Q3, it’s hard to disagree.

Argo CEO Peter Wall was the first council member to present during the livestream, and his 5 minute talk was basically an energy porn presentation on why the Lone Star state is perfect for mining.

To star, Wall figured that Texas currently houses 14% of Bitcoin’s hashrate. If that didn’t impress you (it should), he estimated further that the US’s hashrate share in Q3 of 2019 was 3%; now, it’s 35%, according to Cambridge’s most recent figures (and it’s likely even be a bit higher, considering Cambridge’s data leans on reporting from Foundry, BTC.com, ViaBTC, and Poolin, and not other mining pools like Luxor or independent miners like Riot, Argo, and Marathon).

Wall continued to say that Bitcoin mining consumes roughly 1 GW of energy in Texas, and he believes this consumption will grow to 5 GW by 2025.

By Argo’s estimates, there’s currently 23 GW of renewable energy (primarily solar and wind) operating in Texas and another 10 GW coming online in the next few years. Bitcoin mining is perfect for these projects, Wall said, because miners are a consistent consumer of this energy, which otherwise is difficult to transport to market in its totality and is subject to varying demand from the grid. Additionally, Texas’ power authority, ERCOT, does not ship electricity out of state, meaning there’s plenty of excess sloshing around for miners to mop up.

Energy Providers Are Paying Attention

Speaking of energy producers and grid operators like ERCOT, these folks are starting to pay attention.

Wall said that ERCOT is currently in talks with Bitcoin miners, something Marathon Digital Holdings CEO, Fred Thiel, echoed in his presentation and in the livestream Q&A.

“We believe that power companies will become some of the largest bitcoin miners in the future,” Thiel said in his presentation, adding in the Q&A that power providers around the world are formulating Bitcoin strategies.

“In the conversations we’ve had with 4 of the top 6 power groups in America, they are talking about load balancing, collocating,” he expounded further in the Q&A, continuing to sat that some power companies have dedicated teams looking into this while others are forming joint-ventures with miners to host machines or even self-mine.

DMG’s CEO, Sheldon Bennett, added that his company “sent some containers to utility companies” 2 years ago and that the pilots were an overall success.

Miners are Finding More Ways to Finance And Hodling More Than Ever

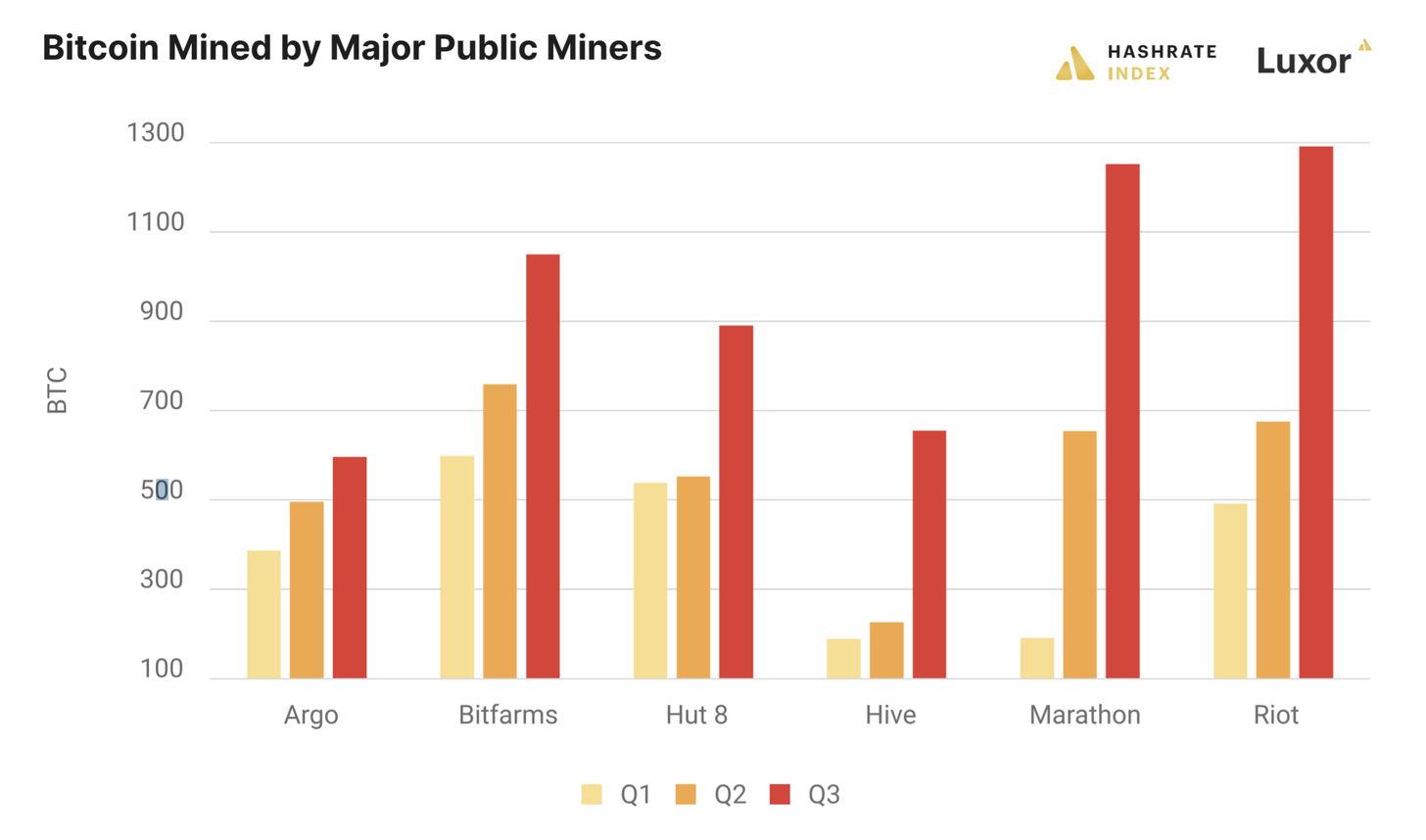

North American public mining companies are making bank in the wake of China’s mining ban, and they’re using they’re using their beefed-up balance sheets to leverage more financial tools than before.

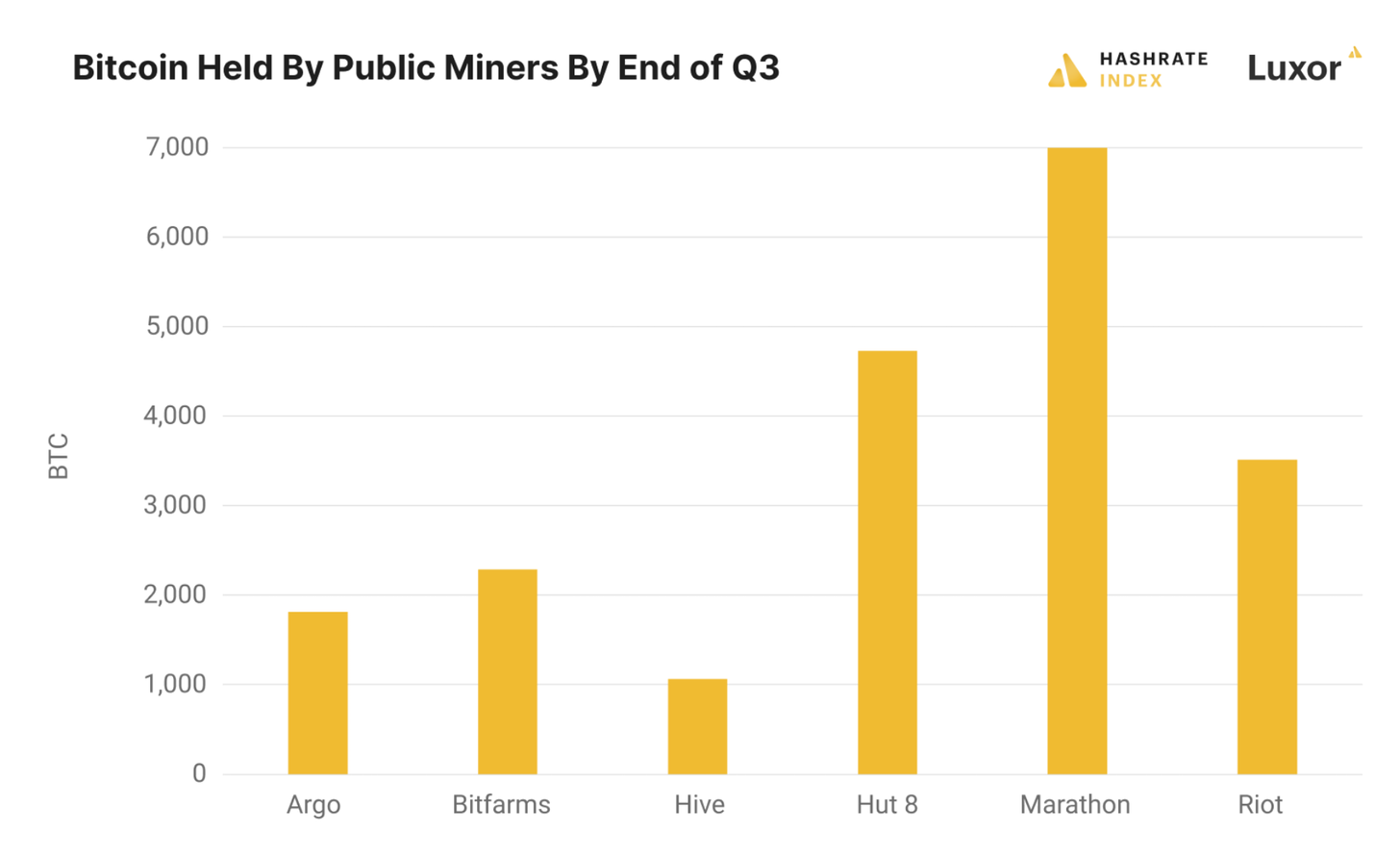

“The ability for public mining companies to hodl is directly attributable to their ability to fundraise,” Hut 8 CEO Jamie Leverton said in her presentation on miner financing.

Leverton’s Hut 8, whose bitcoin treasury is second only to Marathon Digital Holdings’ own, earns 4% yield on some 1,000 BTC it lends to crypto prime-broker Genesis. In her talk, Leverton said that lending tactics like this allowed Hut 8 to hodl through the last bear market and pay bills without liquidating its coins.

“During last bitcoin winter we were able to use the BTC on our balance sheet to not sell down bitcoin and secure a loan.”

Basically every public miner is using their bitcoin to generate cashflow by either borrowing against it or lending it out for yield. And with these miners holding more bitcoin than ever (and new entrants from traditional finance increasingly willing to offer services to these miners) this trend will only continue, Bitfarms Chief Mining Officers Ben Gagnon said during the Q&A.

Bitcoin held by public miners based on latest available information from public financials.

In yet another fundraising method, Hut 8 sold some $172 million of common shares in an offering in September.

Hut 8 isn’t the only miner financing, of course. Hive also sold off some common shares in September to bag a little over $19 million. Additionally, Marathon Digital Holdings recently secured a $100 million revolving line of credit from Silvergate to fund its current operations and expand its hashrate, and Argo secured a $25 million loan from Galaxy Digital in September using its bitcoin as collateral.

As these miners grow and become more entrenched, we expect them to seize every opportunity available to leverage the bitcoin on their balance sheets and their own equity to fundraise. Moreover, with institutional investor financing becoming more of a “how” rather than an “if,” as Gagnon put it, more money from traditional financial circles is waiting on the horizon.

Life After China

Lastly, a few of the council’s panelists spent a little time addressing the 100 terahash elephant in the room: what China’s mining ban has meant for global mining dynamics.

Gagnon touched on the migration in a Q&A answer, saying that some miners are sitting on equipment waiting to see if the ban blows over—something he thinks is unlikely, adding that these miners are hemorrhaging potential profits in the meantime.

Thiel reinforced that this ban is the “real deal” in one of his own responses, saying that China’s social credit apps now have an option to report mining and crypto activity. He continued to say that he “wouldn’t be surprised if there’s less than 2 EH currently operating in China.”

Taking a look beyond North America for where some of China’s hashrate share has gone, Fiorenzo Manganiello of Cowa Mining estimates that Europe currently sports 8% of the network’s mining power. A small percentage, Manganiello admitted, but countries like Norway and Sweden show promise for this to grow, though thick red tape may constrict miners who wish to do business in these regions.

Finally, panelists fielded a question regarding whether or not the industry will be reliant on Chinese companies in the years to come. In the realm of ASIC manufacturing, Gagnon said that bitcoin mining is increasingly becoming an industry that chip manufacturers like Intel can’t ignore, and that business from the industry will drive innovation for the fabrication of 5nm chips in the Americas.

Taking this a step further, Theil added, “I think you’re going to see at least 4 new mining machine manufacturers come to market in 2022.” We know of at least one of these players already: Blockstream, which purchased Spondoolies this year with the stated aim of producing ASICs.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.