2022: The Toughest Year Ever for Public Bitcoin Miners

In 2022, more bitcoin mining stocks traded on public markets than ever since public mining companies began cropping up in 2017. For some, it was their first full trading year - and it could also be their last.

This article analyzes performances, news, and trends regarding public miners in 2022. It's a direct excerpt from our recently published year-end 2022 report, which you can access below.

2022 was a horrible year for bitcoin mining stocks

It’s hard to imagine how 2022 could have been any worse for bitcoin mining stocks. It was a year of severe margin compression for mining companies due to a lethal combination of bitcoin’s falling price, growing hashrate, rising energy costs, and deteriorating access to capital. It ultimately resulted in several public miners almost going belly up, and the biggest of them going bankrupt.

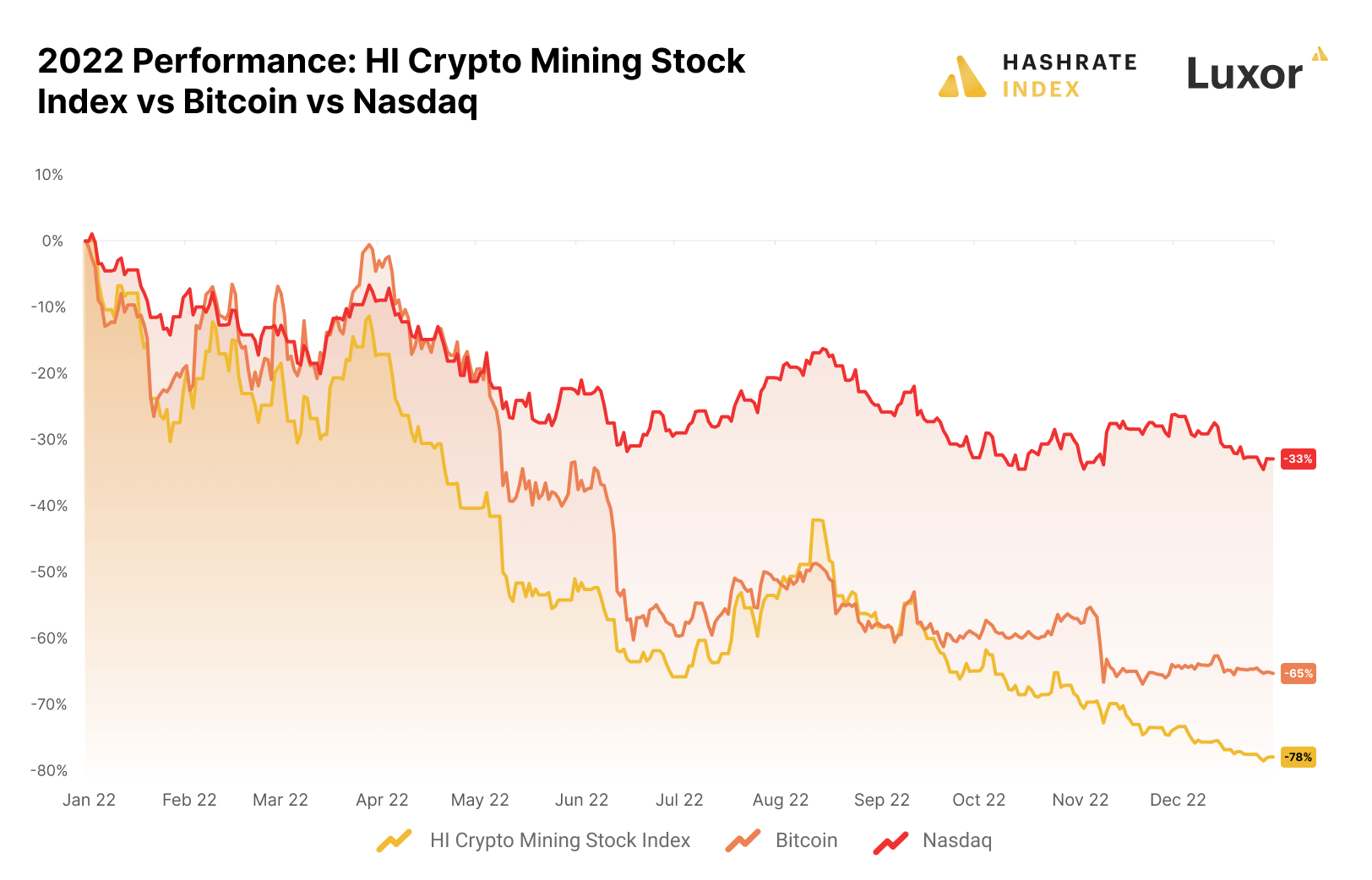

Hashrate Index’s Crypto Mining Stock Index fell by a staggering 78% in 2022, compared to a 65% drop in the bitcoin price and a 33% decline of the Nasdaq. It’s well known that mining stocks can give investors high beta exposure to bitcoin. Unfortunately, this high beta property also holds true during the worst of bitcoin bear markets, meaning that the severe underperformance of mining stocks relative to bitcoin in 2022 was not unexpected. In 2022, the daily correlation between the Hashrate Index Crypto Mining Stock Index and bitcoin was 0.96.

Let’s look at the individual performances of bitcoin mining stocks. While our Crypto Mining Stock Index fell by 78% in 2022, the harsh reality is that most bitcoin mining stocks declined by more than that. The Crypto Mining Stock Index has significant holdings of chip manufacturers, which have performed considerably better than the companies whose business models are solely focused on bitcoin mining.

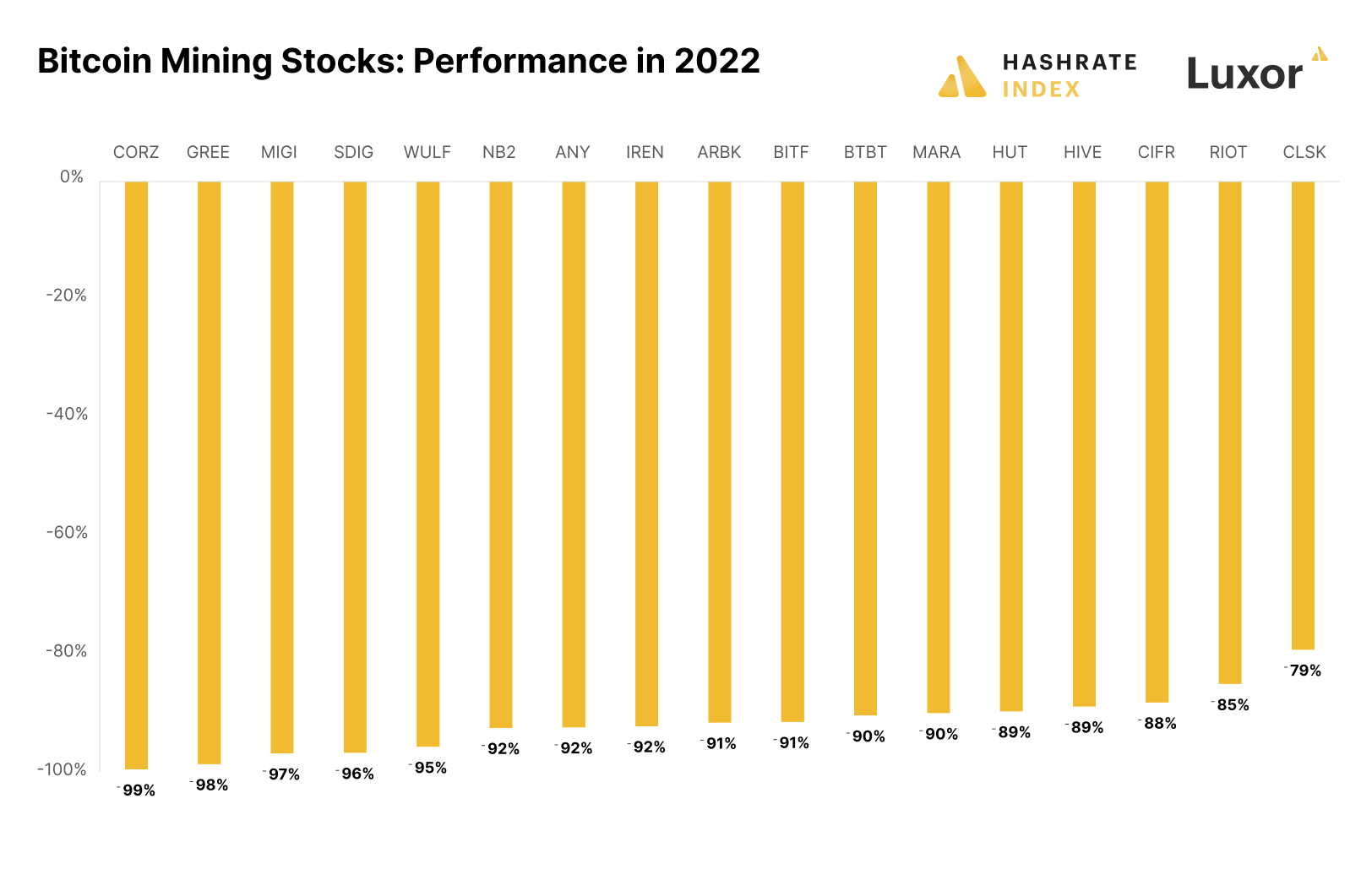

As shown in the chart below, most pure-play bitcoin mining stocks fell by 90% or more in 2022. Core Scientific (CORZ) performed the worst, with its stock plummeting by 99%. The company is currently going through a Chapter 11 bankruptcy. The second-worst performer was Greenidge Generation (GREE), a natural-gas power plant operator turned bitcoin miner. Its stock plunged by 98% as the company struggled under a mountain of high-interest-rate machine collateralized debt.

All bitcoin mining stocks performed horribly in 2022. The “best” performer was

CleanSpark (CLSK), whose stock fell by 79%. During this bear market, CleanSpark has expanded heavily by buying ASICs and facilities from distressed companies at bear market valuations. Even though the company has been one of the biggest diluters in 2022, its stock has performed the best, signaling that shareholders believe in the company’s bear market growth strategy.

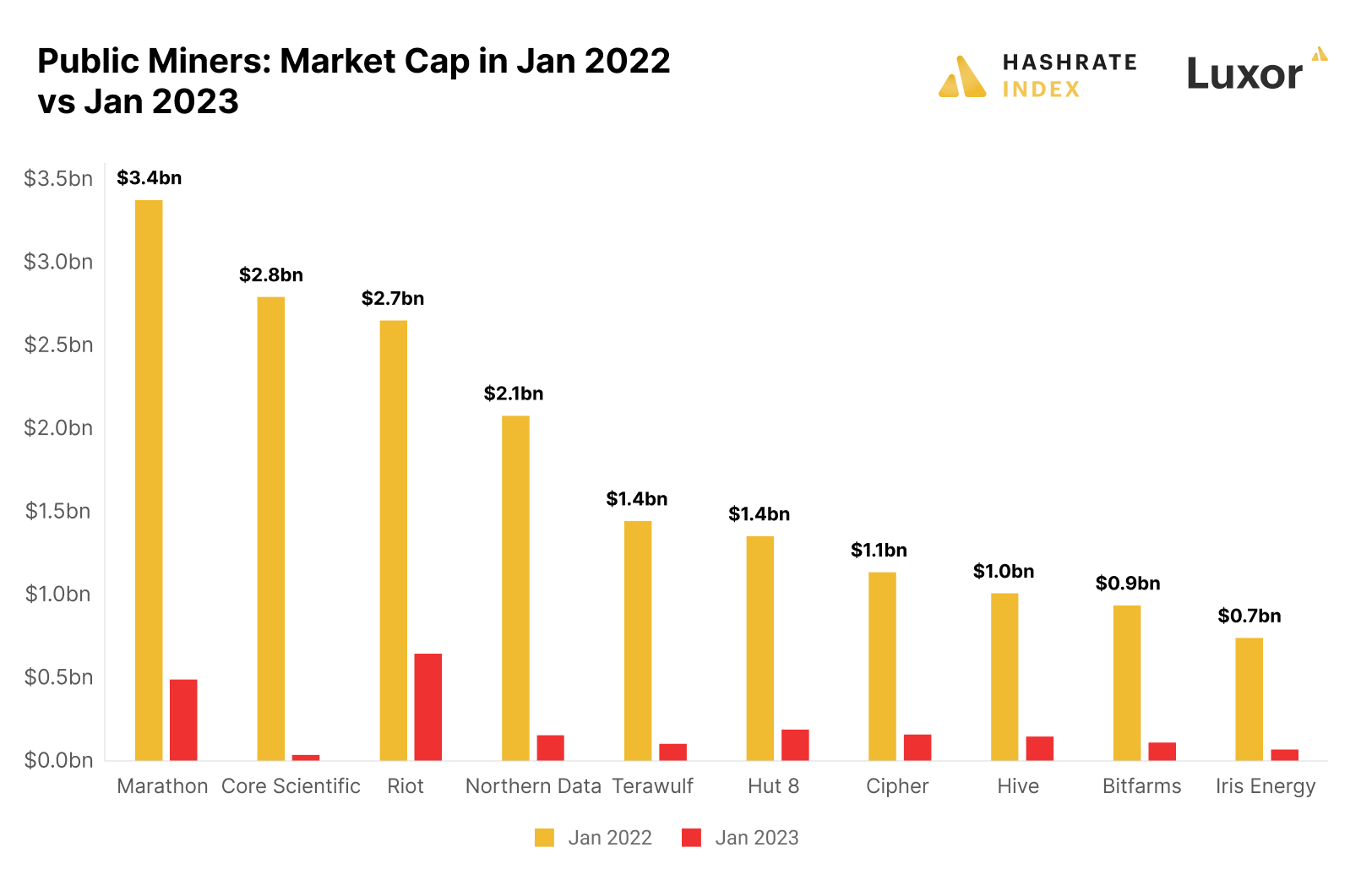

The once mighty valuations of bitcoin mining companies evaporated as stock prices plummeted. At the peak of the bull market in November 2021, the total market cap of bitcoin mining stocks stood at more than $30 billion. Currently, this number sits below $3 billion, revealing the massive capital destruction that took place in the bitcoin mining industry in 2022.

As 2022 kicked off, some public miners were in the process of making a name for

themselves. Marathon had a market cap of $3.4 billion, which is higher than the current total market cap of all bitcoin mining stocks. Back then, now-bankrupt Core Scientific had a market cap of $2.8 billion, while Riot’s market cap was $2.7 billion.

After a year of enormous capital destruction for the public miners, Riot and Marathon are now the only mining stocks with relatively significant market caps. All other mining stocks have been reduced to micro caps (below $300 million market cap). Many of these stocks exited 2022 below Nasdaq’s listing requirement of $1 per share, including Core Scientific, Bitfarms, Stronghold, Cipher, Greenidge, Sphere 3D, Terawulf, Bit Digital, Hut 8, and Mawson. Unless mining conditions significantly improve in the near future, we expect Nasdaq to delist some of these miners. Certain public miners might also voluntarily go private to lower administrative costs and ease their burden of having to satisfy a larger public investor base. We unpack this prediction, and several more, in this article.

Public miners expanded as quickly as possible in 2022

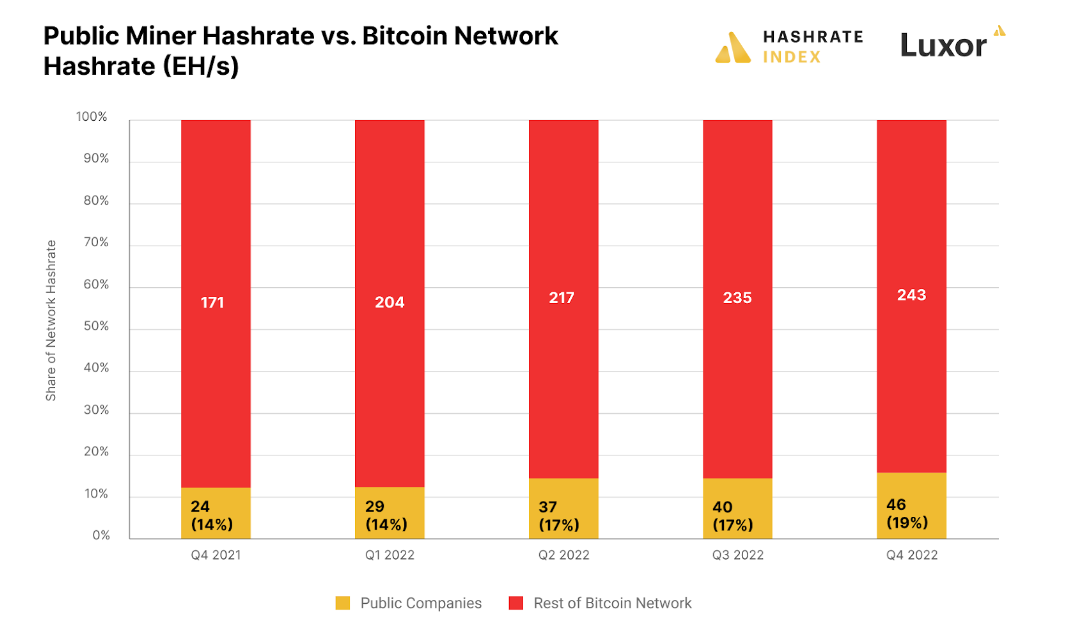

Driven by market incentives, public miners expanded as quickly as possible in 2022, mostly with hardware that was pre-ordered in 2021. As you can see on the chart below, public miners started the year producing 14% of Bitcoin’s hashrate, and ended the year at 19%. This increase in their share of global hashrate means that they expanded capacity much faster than the private miners in 2022. The public miners increased their cumulative hashrate by 59% in 2022, compared to private miners’ 19% hashrate growth.

Why did public miners expand so much faster than private miners in 2022? It all comes down to cost of capital. Elevated mining margins in 2021 combined with a general stock market boom gave public miners the opportunity to raise huge amounts of capital in 2021 from mining stock investors that demanded growth. The public miners did as the market demanded, and spent the raised capital on enormous future machine orders that were delivered in 2022. Since the private miners were not able to tap into the historically hot equity markets in 2021, they were spared from making the same enormous machine orders as the public miners.

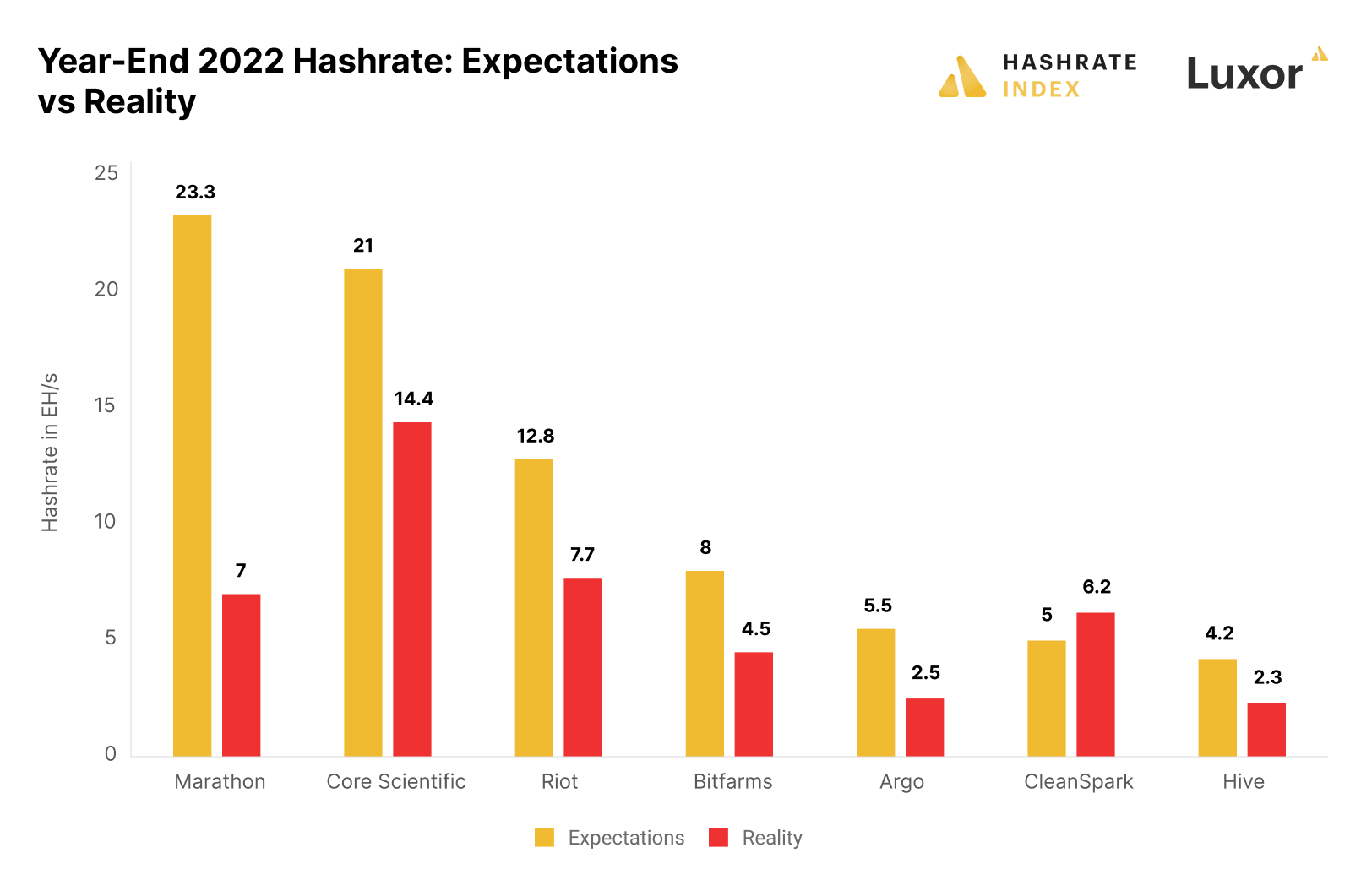

In 2023, we expect the public miners’ share of the Bitcoin hashrate to keep increasing. Most of these miners came nowhere close to reaching their capacity expansion plans for 2022, leading them to push these plans to mid-2023. Rising energy costs, build-out delays, and other disruptions hampered hashrate growth for certain public miners in 2022.

The chart above compares the public miners’ stated hashrate goals for year-end 2022 with their actual hashrate at this time. All the miners in the chart, except for CleanSpark, were far from reaching their 2022 hashrate goals. Marathon was the furthest away from reaching its goal, as it aimed to have 23.3 EH/s plugged in by year-end 2022 but only achieved 7 EH/s.

These massive divergences between hashrate expansion plans and actual results should teach investors how challenging it is to grow a mining operation. Many things can go wrong when developing and operating the physical infrastructure necessary to support a mining operation, particularly for miners of this scale, particularly when relying on many third-parties. Marathon’s self-proclaimed asset-light strategy, which centers around hosting, has shown its weaknesses as the company has struggled getting their ASICs up and running due to problems with hosting partners, including the bankruptcy of Compute North.

Public miners held the top in 2021, and (basically) sold the bottom in 2022

The hodl strategy is a mining treasury strategy centered around holding as much mined bitcoin as possible. This strategy became popular for public miners during the bull market of 2021, as there was a strong market demand for publicly listed bitcoin investment vehicles. Many investors invested in public miners as a way to get bitcoin exposure.

The hodl strategy worked well in 2021 when the bitcoin price increased and miners could tap into historically strong equity and debt markets to pay for investments and operating expenses without selling bitcoin. Most public miners followed this strategy and built up enormous bitcoin treasuries consisting of thousands of bitcoin. Bitfarms even went as far as buying 1,000 bitcoin in early 2022.

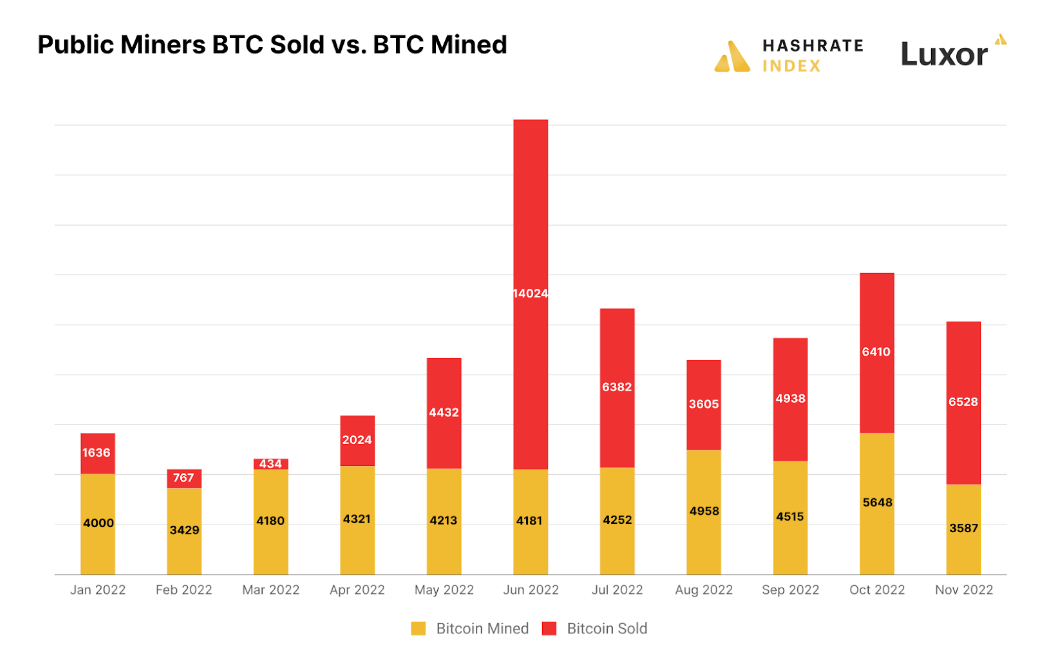

As the bitcoin price fell in 2022, the hodl strategy started showing its downsides. Miners didn’t have access to the same equity and debt financing as in 2021, and suddenly we saw several of the seemingly strongest hodlers offload their bitcoin holdings. Companies like Core Scientific and Bitfarms dumped thousands of bitcoin from May and outwards.

As shown on the chart above, public miners started dumping their holdings in May, the first month they sold more bitcoin than they produced. In June, a time when Bitcoin broke through $30,000 and down to $20,000, the selling took off: public miners dumped more than 14,000 bitcoin, well over 3 times their monthly production of 4,181 bitcoin. This was forced selling to pay down equipment loans and other debt burdens.

As the year went on, public miners kept draining their holdings, selling more bitcoin than they generated. Between January and November, the public miners offloaded 51,180 bitcoin, while producing 47,284 bitcoin.

Only a small group of miners were able to keep their stacks in place. Hut 8, Riot, Hive, DMG, and Marathon were the core group of miners that kept their bitcoin treasuries mostly in-tact (Hut 8 was the only miner that didn’t sell any BTC last year).

2022 should serve as a painful case study for miners on how to not manage a bitcoin treasury. We expect treasury management to be a key focus for professional miners in 2023 and beyond. As part of a holistic risk management strategy, which is common in more mature commodity producing industries, many miners will consider hedging hashprice as the necessary derivatives solutions are now available.

Many public miners are struggling with weak balance sheets

The biggest challenge for most public miners in 2022 was their massive debt levels relative to equity. These companies seemed to have their debt burdens under control at the start of the year, as their equity valuations were high and they generated solid cash flows from operations. As the year went on with deteriorating market conditions and plummeting equity valuations, the seemingly low debt levels of these companies suddenly became elevated relative to their equity.

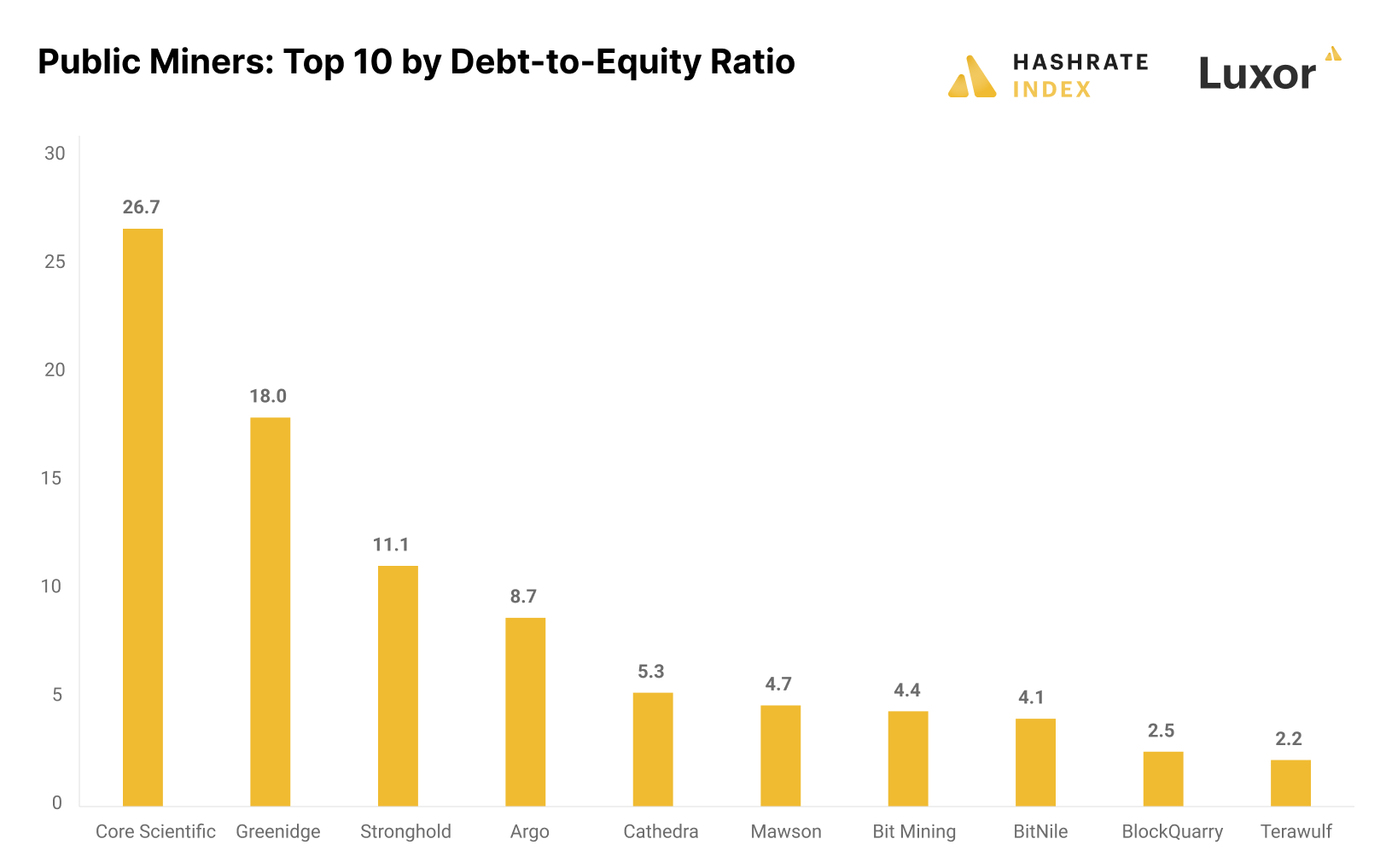

The chart below shows the top 10 public miners by debt-to-equity ratio. As you can see, a handful of miners have debt-to-equity ratios above 5. In most industries, 2 is considered a high debt-to-equity ratio. Core Scientific and Greenidge have the highest debt-to-equity ratios of 26.7 and 18. Consequently, Core Scientific is now bankrupt and Greenidge has undergone debt restructuring.

As 2022 came to a close, companies with high debt-to-equity ratios were ravaged by falling hashprice. All but one of the miners listed above had to reorganize their business by the end of the year. The one that didn’t, Core Scientific, became insolvent by December and filed for Chapter 11 shortly thereafter. Stronghold defaulted on their equipment loans. By defaulting on their equipment loan, Stronghold was required to return over 26,000 miners to NYDIG. Argo Blockchain was at risk of filing for Chapter 11, as their free cash flow was not able to cover large equipment loans. Fortunately, Galaxy Digital Mining stepped in, acquiring their Helios facility in Texas. WithArgo Blockchain bagging $65 million in cash and a $35 million loan in the deal, they averted a likely Chapter 11 reorganization.

Mining stock valuations have plummeted as the bear market has handicapped stock prices. We can use several metrics to track the valuations of bitcoin mining stocks, and one of our favorites is based on the market value of the ASICs these companies hold. At its core, a bitcoin mining company owns ASICs and attempts to operate them as cheaply as possible to generate bitcoin at a profit.

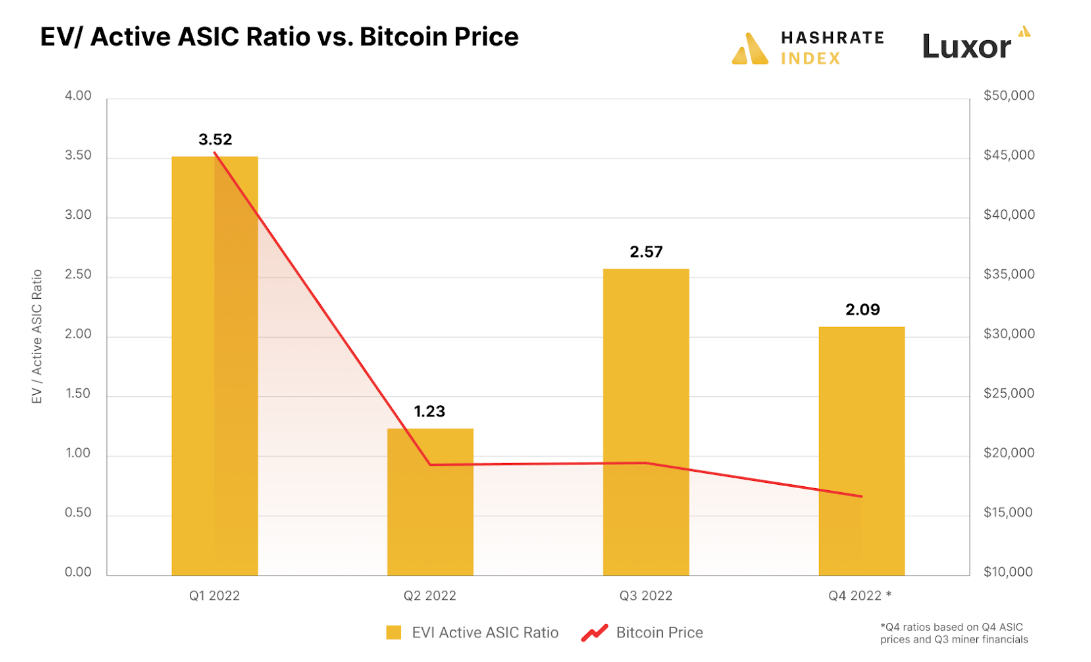

In 2022 we introduced a new metric called the EV/Total ASIC Value ratio. The purpose of this ratio is to provide a clearer operational value relative to the debt and cash on a miner’s balance sheet. If the ratio is trending down, it means investors are pricing in lower expected values due to bitcoin price and difficulty changes, and lower values for mining rigs. If the ratio is trending higher, investors are expecting better mining margins and likely higher bitcoin prices.

Based on the chart above, investors can see the various upwards and downward adjustments quarter over quarter. During the first half of the year, the bitcoin price was much higher and investors placed higher expected values on mining stocks, with the EV/Total ASIC Value sitting at 3.52. As the bear market clawed its path in Q2 2022, the EV/Total ASIC ratio hit 1.23, its lowest level of the year. As the bear market continued the rest of the year, the ratio adjusted a bit higher reflecting cash on hand being used for fleet growth, while simultaneously seeing mining rig values fall sharply.

Capital dries up for public miners

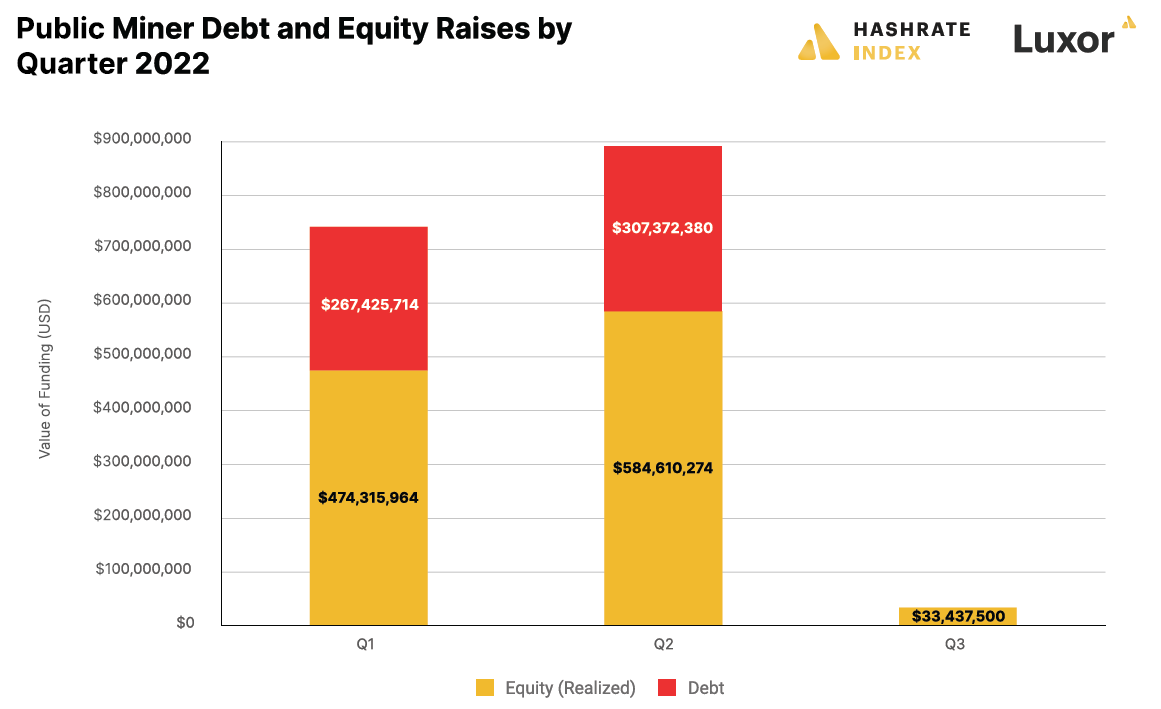

Part of the reason why public miners started to struggle in 2022 was that their capital tap was shut off. For the past two years, the public miners became accustomed to strong equity and debt markets. As you can see on the chart below, public miners raised $750 million in Q1 2022 and $900 million in Q2 2022, mostly consisting of equity. In Q3, they only managed to raise $33 million.

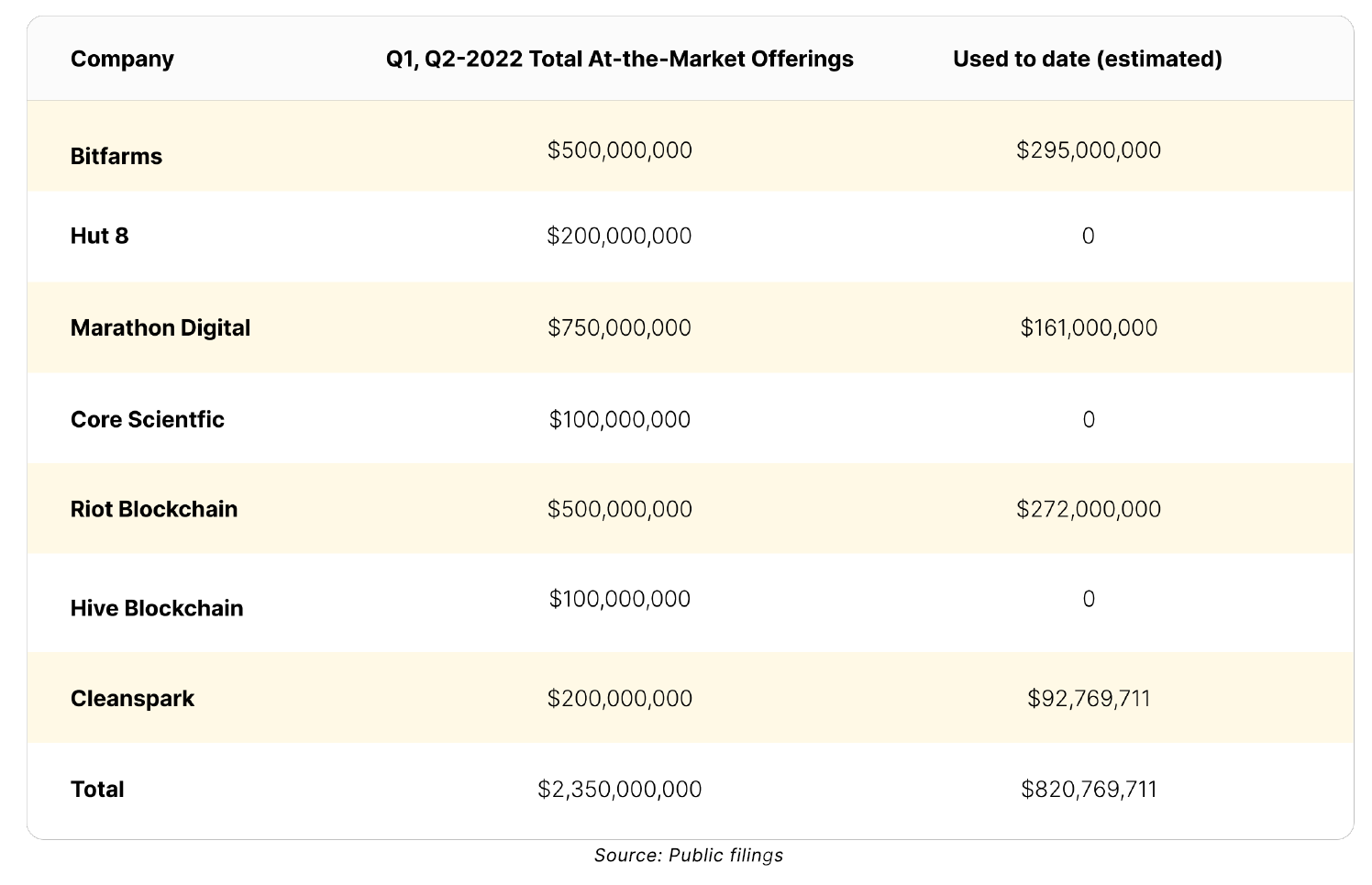

Once the bear market came into effect by June, financing deals immediately dried up. Bitcoin miners were no longer able to get cheap debt capital as the Federal Reserve started tightening. As an alternative for the last half of the year, Bitcoin miners announced At-the-market offerings en masse to shore up their liquidity. These equity offerings are like a revolving line of credit, wherein a company creates an open offer that investors can buy into until the ATM reaches a certain cap or expires. Major public Bitcoin miners secured these types of financing arrangements at the detriment of long-term equity investors who suffered from dilution. As the crypto winter continues into 2023, more unused ATM equity facilities will be used to build-up and survive the winter.

Recently, Cleanspark raised more ATM equity funding through an $500 MM offering from HC Wainwright. Entering 2023, there is at least $2 billion in potential equity funding available to the top public Bitcoin miners. Based on public disclosures, the following table shows the significant amount of funding available through ATM shelf offerings for public Bitcoin miners, as well as an estimate based on filing information for how much ATM funding public miners have tapped.

This was an excerpt from our recently published 70-page year-end bitcoin mining report. Read the full report here:

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.