Bitcoin Hashrate: A Comprehensive Guide

What Is Bitcoin's hashrate, how is it measured, and how does it secure the Bitcoin network?

Bitcoin hashrate is a critical metric for the Bitcoin network because it quantifies the total computational power of the Bitcoin network at a given time. In its most basic form, Bitcoin’s total hashrate is a measure of how many hashes Bitcoin mining hardware are generating each second in search of the next block in the Bitcoin blockchain. The higher the hashrate, the more guesses per second and (generally speaking) the more secure Bitcoin’s blockchain.

In this article, we will explore various aspects of Bitcoin hashrate, including its definition, factors affecting it, trends and analysis, its role in mining and network security, and investing in hashrate.

What is Bitcoin Hashrate?

In this section, we will provide a brief overview of what Bitcoin hashrate is and how it works.

Bitcoin hashrate is measured in hashes per second (H/s), which refers to the number of hashes a miner can produce in one second using Bitcoin’s SHA-256 hashing algorithm. A bitcoin mining ASIC produces trillions of hashes a second in an effort to guess a hash below the current difficulty target. Once the miner guesses this correct number, it mines the next block in the chain, orders transactions into this block, and broadcasts that block to the rest of the Bitcoin network. This miner earns newly minted bitcoins from this as well as transaction fees.

In order to uncover a fresh block, a mining device has to generate a particular hash that matches or is smaller than the target hash specified by the Bitcoin difficulty adjustment. Each attempt at guessing a number is referred to as a "nonce," which is a term that indicates that each number is only used once and is one-of-a-kind.

How is Bitcoin Hashrate Measured?

Similarly to how we quantify computer storage in KB, MB, GB, TB, PB, etc, miners quantify hashrate using the following measurements (miners also abbreviate it hashrate ratings with /s to signify number of hashes produced in 1 second):

- Hashes (H/s)

- Kilahashes (KH/s)

- Megahashes (GH/s)

- Gigahashes (GH/s)

- Terahashes (TH/s)

- Petahashes (PHS/s)

- Exahashes (EH/s)

- Zetahashes (ZH/s)

Check out our Bitcoin hashrate converter to easily convert between hashrate metrics like TH/s, PH/s, and EH/s.

Currently, miners use exahashes (EH/s) to measure Bitcoin's total network hashrate, while they use terahashes (TH/s) for individual mining machines. Many farms that are in the small-to-mid scale use petahashes (PH/s) to describe their operation's size.

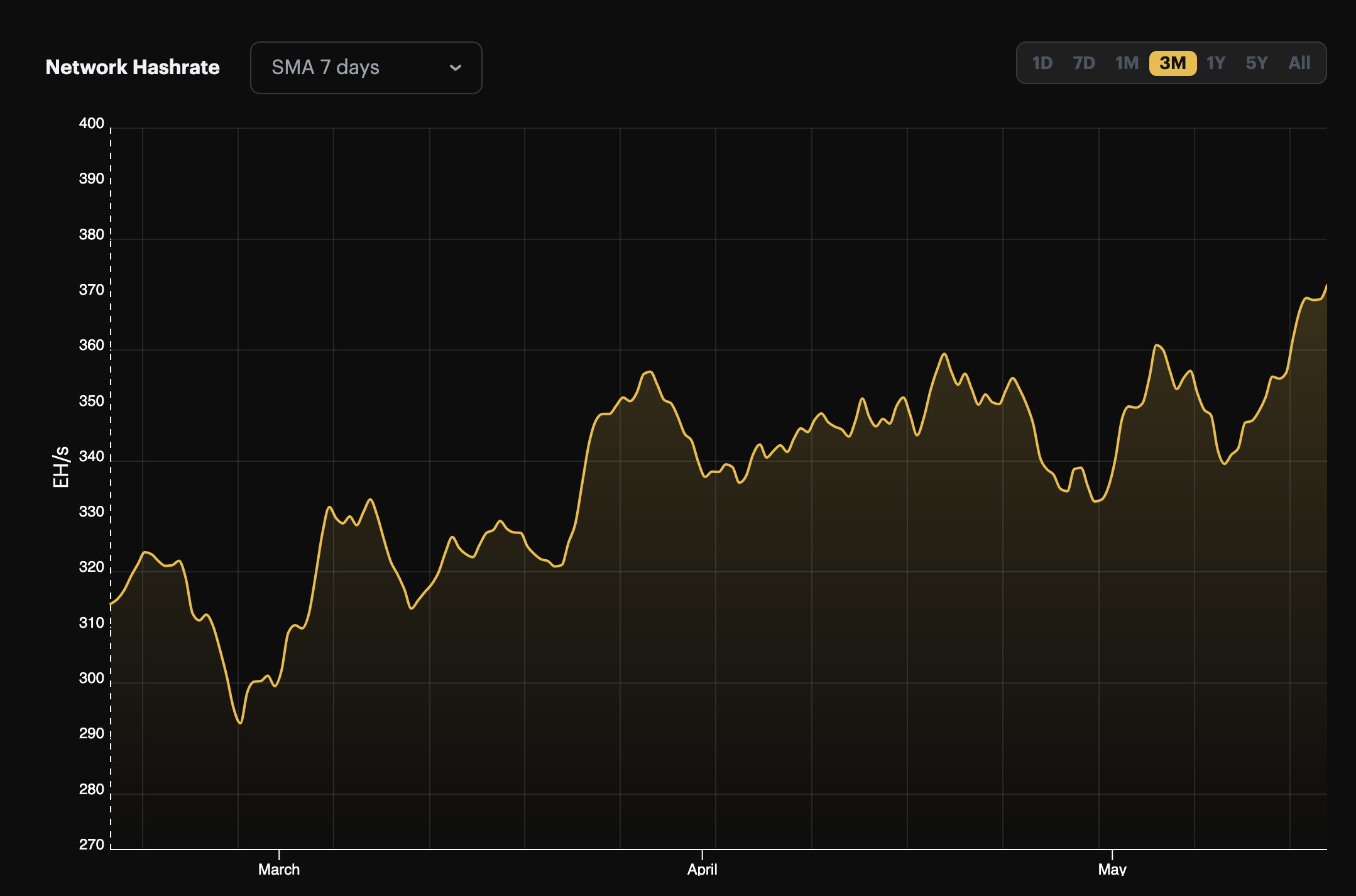

When measuring the network's total hashrate, miners typically use a 7-day average. This is because, if you try to measure real-time hashrate, you can only roughly estimate the number based on the block times in a current epoch and the current epoch's difficulty level. Block time variance can distort this real-time figure, so miners use the 7-day average to smooth our this volatility and give a more accurate picture of current hashrate.

The importance of hashrate for Bitcoin mining and network security cannot be overstated. The higher the hashrate, the more difficult and expensive it is to execute an attack on the network (like a 51% attack, which in reality could be executed with as little as 33% of the network hashrate).

What Makes Bitcoin's Hashrate Grow and Shrink?

Several factors can impact the hashrate of the Bitcoin network. We cover these in depth below, but the TLDR is: the largest determinant of Bitcoin's hashrate is Bitcoin's price (and by extension, hashprice – a metric that measures the revenue miners earn from their hashrate), but advances in mining hardware also affect Bitcoin's hashrate.

The effect of Bitcoin's price and market conditions on Bitcoin hashrate

The price of Bitcoin and is the primary determinant of the trajectory of Bitcoin’s hashrate. When the price of Bitcoin rises, more miners join the network and hashrate increases. However, if the price of Bitcoin falls, less profitable miners may exit the network and hashrate decreases.

Bitcoin bull markets in the past have also pushed forward innovation for faster hashing techniques. Price increases accelerated the adoption of GPUs and later ASICs for Bitcoin mining, hardware advances that significantly increased Bitcoin’s hashrate.

The largest determinant of Bitcoin hashrate supply globally is Bitcoin mining profitability / revenue potential. Miners wuantify this ever-fluctuating number using hashprice, a term coined by Luxor which quantifies how much money a Bitcoin miner can generate (in either USD or BTC) from a specific quantitiy of hashrate. If hashprice is high, we can expect more Bitcoin hashrate to come online than if it were lower.

To learn more about hashprice and how it affects Bitcoin hashrate, read on below.

The impact of Bitcoin’s mining difficulty on Bitcoin hashrate

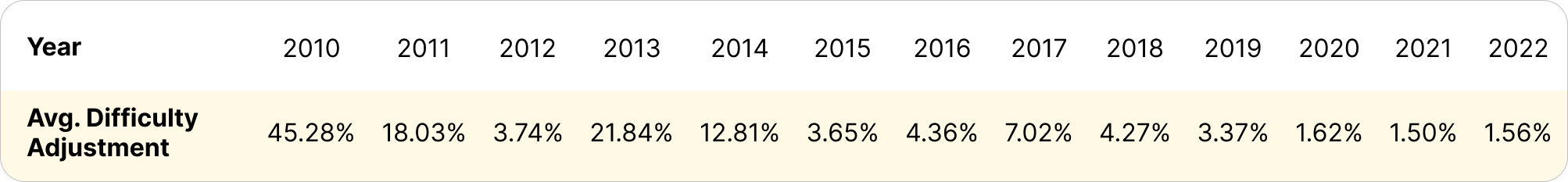

Bitcoin’s mining difficulty refers to the number that miners must guess below to win the next block in the chain. Depending on how much hashrate is on the network, Bitcoin’s code automatically adjusts difficulty every 2016 blocks (approximately every two weeks). This programmatic adjustment ensures that miners find blocks according to the Bitcoin code’s targeted 10 minute average.

Toward this goal, Bitcoin’s mining difficulty increases as more hashrate joins the network and miners find blocks faster than 10 minutes on average within a 2,016 block period; conversely, Bitcoin’s difficulty decreases when hashrate decreases and miners find blocks slower than 10 minutes on average.

When difficulty increases, miners need more hashrate to find the next block; when difficulty decreases, they need less hashrate.

To read more about Bitcoin mining difficulty, visit our Bitcoin mining difficulty guide.

The role of mining hardware and energy consumption

Mining hardware makes all the difference when determining a Bitcoin miner’s hashrate. More powerful hardware typically means higher profit margins. But powerful hardware also consumes more energy, so Bitcoin miners need to pay attention to their machine’s joule/watt per terahash rating.

In the early days of Bitcoin mining, miners would mine using their computer's central processing unit (CPU). In 2010, Laszlo Hanyeck introduced graphics card (GPU) mining and changed that Bitcoin mining game indelibly. By 2012, Bitcoin mining using application-specific-integrated-circuits (ASICs, the same chips that power computations in our phones, computers, cars, etc) entered the market, and mining would again be forever changed.

ASIC miners are the only viable computers for mining Bitcoin today.

You can view all of the latest Bitcoin ASIC miners like the Antminer S19 XP, the Whatsminer M50S++, and others on our ASICs Page.

Bitcoin Hashrate and Mining Difficulty Forecasting

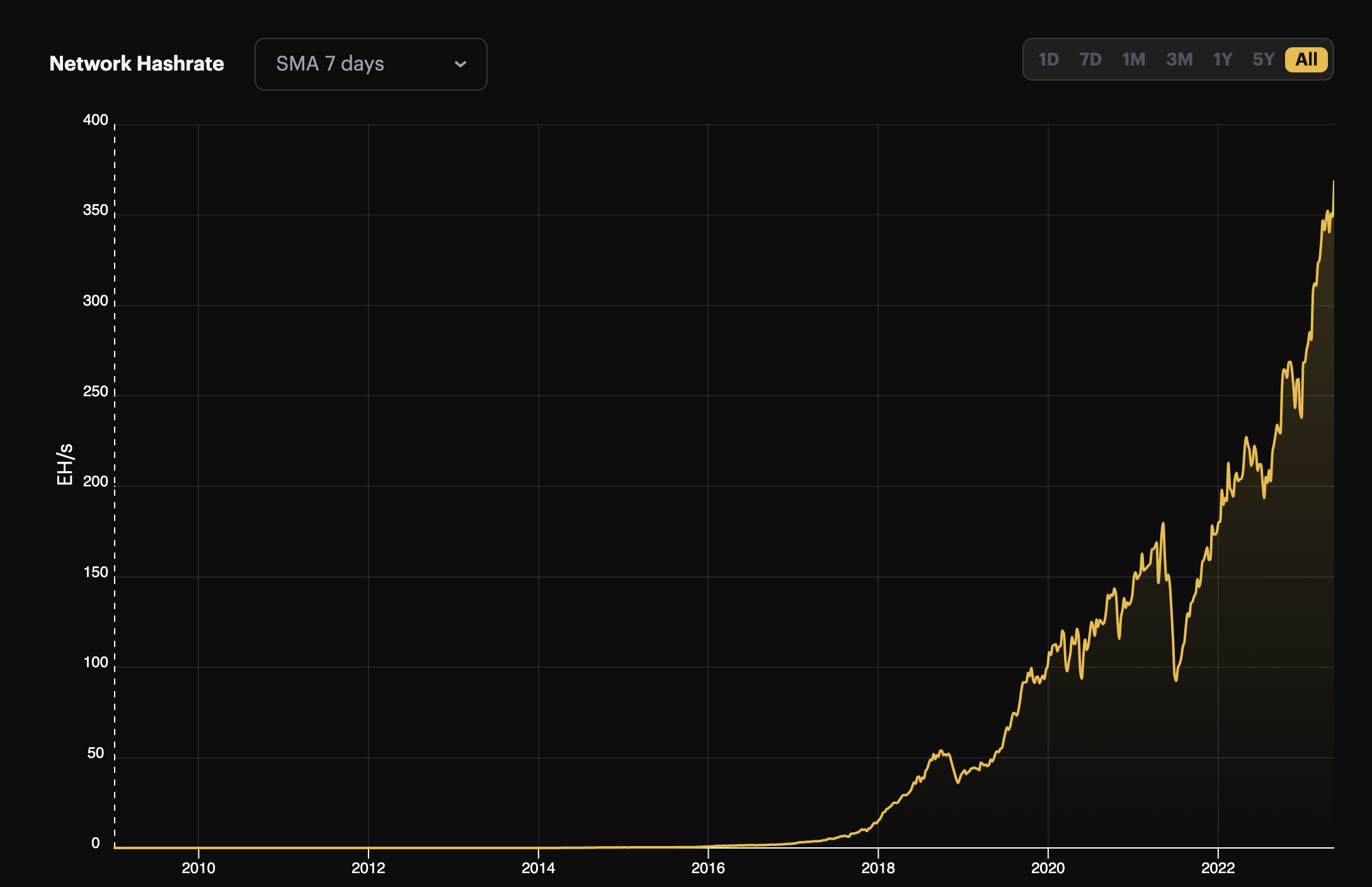

Since Bitcoin’s inception, Bitcoin’s hashrate has grown exponentially, and difficulty has followed suit. At the time of publication, it requires 48 trillion more hashes to mine a Bitcoin block today than when mining first began in 2009. Bitcoin’s difficulty has grown by 20.64% on average per month since Bitcoin’s inception.

In addition to giving a run-down on how Bitcoin's difficulty affects Bitcoin mining profitability and how miners can plan around difficulty changes.

If you would like to learn more about Bitcoin mining profitability and difficulty forecasting, check out the below report from Hashrate Index.

How Bitcoin Hashrate Keeps the Bitcoin Network Secure

In this section, we will discuss the relationship between hashrate and the security of the Bitcoin network. We will explore the potential risks of low hashrate and the importance of maintaining a high level of hashrate. Finally, we will examine the role of hashrate in preventing double-spending attacks and

Supporting Cluster Post to Include: [Insert Hyperlink for Reference]

What is a 51% attack?

A 51% attack is an attack scenario on a proof-of-work blockchain where a single entity or group controls more than 50% of the network's hashrate. This majority control would allow them to disrupt the network's normal operation.

If a miner or a group of miners controls over 50% of the network's computational power, they can reliably control the majority of block production and manipulate transaction ordering and block production to their benefit.

How Bitcoin Hashrate Prevents a 51% Attack

It's important to note, however, that carrying out a 51% attack is highly complex and expensive — this is the whole purpose of proof-of-work. It would require immense hashrate and energy to execute such an attack (about as much energy as a smaller population country in Europe consumes, like Austria or Greece). Because an attacker is competing with honest miners, it has to keep expending energy to manipulate block production, and if the attacker is executing a block reorganization, they have to consume more energy the more blocks they want to roll back.

Additionally, such an attack would likely be noticed by the community, leading to a drop in trust and a potential collapse in bitcoin's price, undermining the value of the attacker's own reward. Therefore, while theoretically possible, a 51% attack is highly unlikely and not in the best interest of miners.

This is why proof-of-work is important to keep Bitcoin secure. Bitcoin mining includes an intrinsic incentives system (new BTC and transaction fees from the block reward) to keep miners honest, and it also carries a cost (electricity). The block reward incentive and the cost to produce new Bitcoin make the cost of attacking the chain outweigh the benefits.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.