What Is Bitcoin’s Hashrate and How Is Bitcoin's Hashrate Calculated?

In bitcoin mining, hashrate is a metric that measures the total computing power of all the network's bitcoin miners. Here's how to calculate Bitcoin's hashrate.

Bitcoin’s hashrate is the amount of aggregate computing power committed to mining blocks on the bitcoin network. More specifically, it gives us a way to estimate the total number of hashes miners contribute to the network every second in search of discovering a new Bitcoin block. You can think of a hash like a stand-alone, one-time guess, and the number of guesses a mining machine can produce per second equals the Bitcoin miner’s hashrate.

To discover a new block, a mining machine must produce a specific hash that is equal to or less than the target hash (number) set by Bitcoin’s difficulty adjustment. Each number that is guessed is called a "nonce," which is short for "number only used once" since each nonce is unique.

Bitcoin's hashing algorithm, the Secure Hash Algorithm 256 (SHA-256), randomly generates each nonce, which is 64 character long. In order to increase the chance of finding a block, bitcoin miners must acquire more mining machines to increase their probability of guessing the correct nonce.

How Is Bitcoin's Hashrate Calculated?

It is not possible to pinpoint the exact hashrate of the Bitcoin network; all the bitcoin miners across the world do not publicly disclose this information, and there's no way to directly gauge the metric using a Bitcoin node.

Instead, you can calculate Bitcoin’s total hashrate by taking Bitcoin’s current difficulty and its block times to get a ballpark estimate.

To estimate hashrate on the bitcoin network, you can use the following equation:

- 144: With 10 minute block times, the total number of blocks expected in a 24-hour time frame is 144.

- Difficulty * 2^32: When we multiply Bitcoin's difficulty by 2^32, this gives us the average amount of "work" (hashes) needed to slolve a block.

- 600: Hashpower is denominated in hashes per second and there are 600 seconds in a 10-minute block.

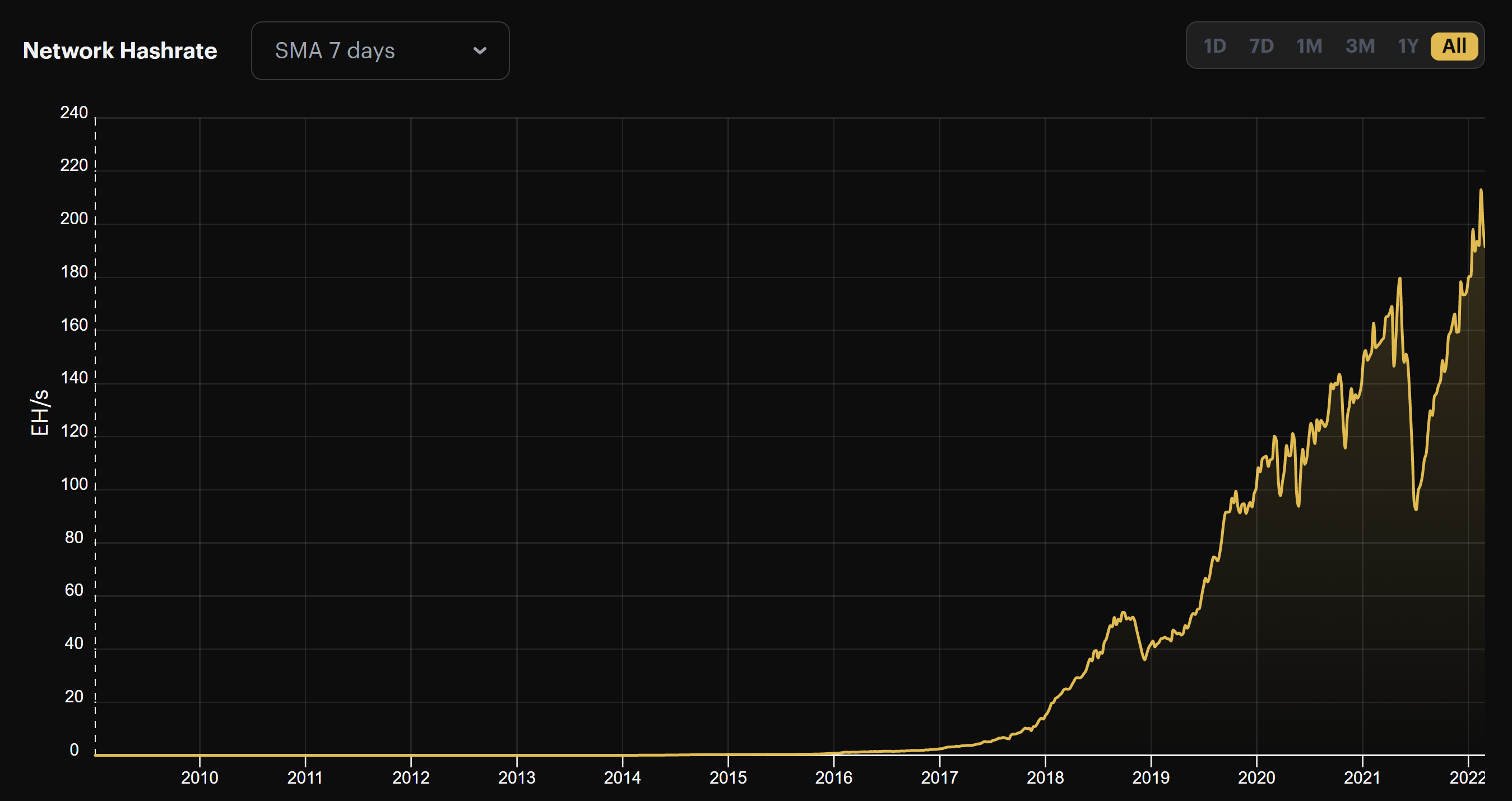

This equation, though, is not entirely accurate, because the 24 hours time frame is too short to adequately account for block time volatility. As seen below, it is better to take a moving average hashrate estimate. The most popular are 7-day average, two-week average (same timespan as Bitcoin’s difficulty epochs), or 30-day average. Because they are spread out, these averages are not distorted by faster or slower than average block times like with the 24 hour estimate.

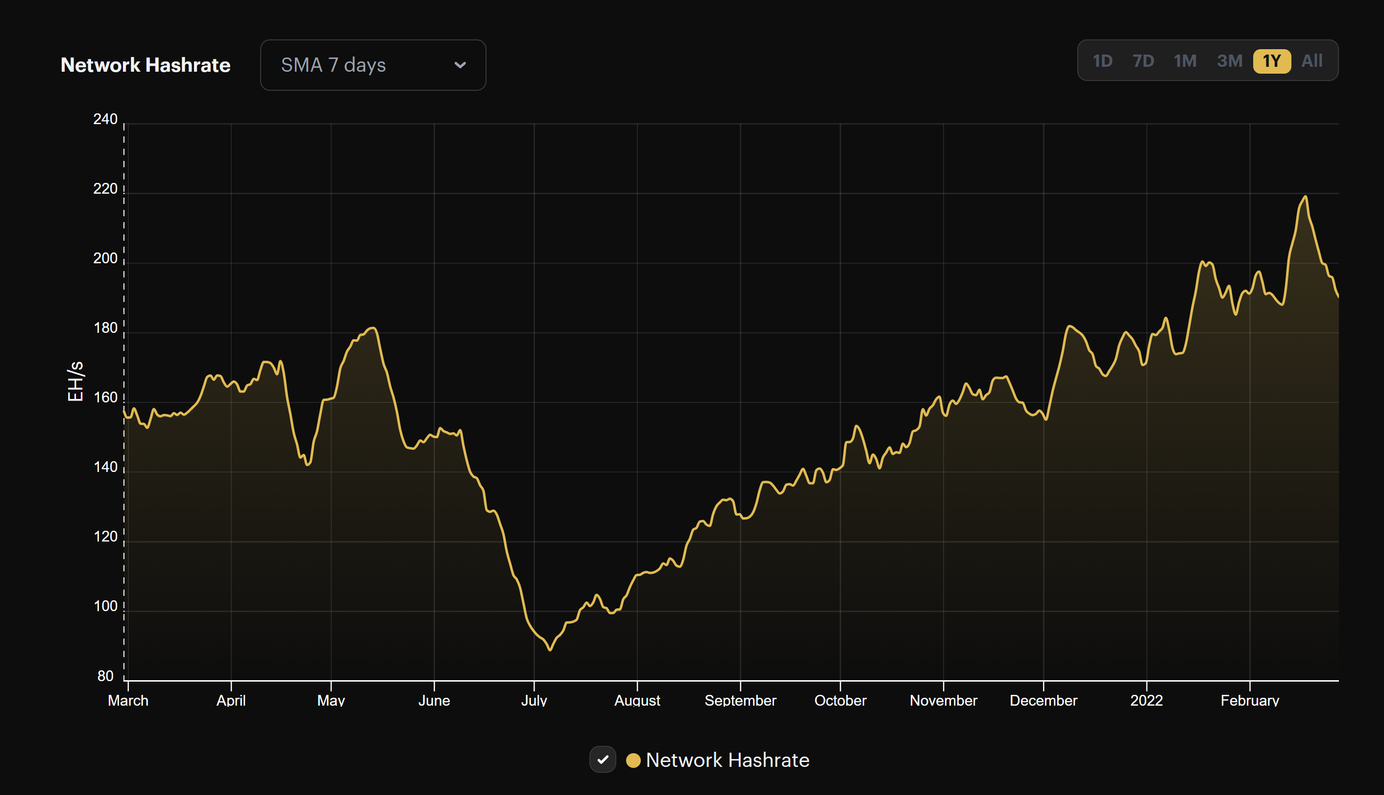

If you measure hashrate in real-time, variance in block times can create the illusion that the Bitcoin network's collective hashrate is significantly more or less than it really is. See, for example, Bitcoin's raw hashrate spiking to nearly 250 EH/s on Feb 11 (or, inversely, raw hashrate dipping to 147 EH/s on February 4, just a week before the surge to 247 EH/s)

Charting out hashrate on the 7-day smooths out these wild swings to give a closer estimate of Bitcoin's hashrate.

Bitcoin Network Security: Why Hashrate Matters

Bitcoin hashrate secure the Bitcoin network. To successfully attack the bitcoin network, an entity would need to control 51% of the overall hashrate. With every hash of computing power added to the network, Bitcoin becomes more economically intensive and logistically challenging to attack.

Bitcoin's hashrate is currently at ~200 EH/s over the last 2016 blocks, making it incredibly difficult and economically intensive to co-opt a majority of the network's mining rigs and mining infrastructure to launch an attack.

Bitcoin Hashrate is a Compute Commodity

Bitcoin itself is often classified as a digital commodity. Taking this further, Bitcoin's hashrate is something of a compute commodity: it's a raw, digitally-native material that miners produce and (usually) sell to mining pools in exchange for BTC. We quantify the value of hashrate as hashprice, where hashprice measures how much a bitcoin miner can expect to earn for a given unit of hashrate.

Looking at hashrate as a compute commodity can be helpful for understanding how hashrate can be traded between mining market participants. In the future, we anticipate that hashrate exchanges and hashrate derivatives will be a essential for the maturation of Bitcoin mining markets and for Bitcoin's growth as a blue-chip asset class.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.