Antminer S19 XP Prices Finally Cool Off After Carrying Huge Premium in Q1

The S19 XP and other next-gen rigs were largely overpriced in Q1-2023.

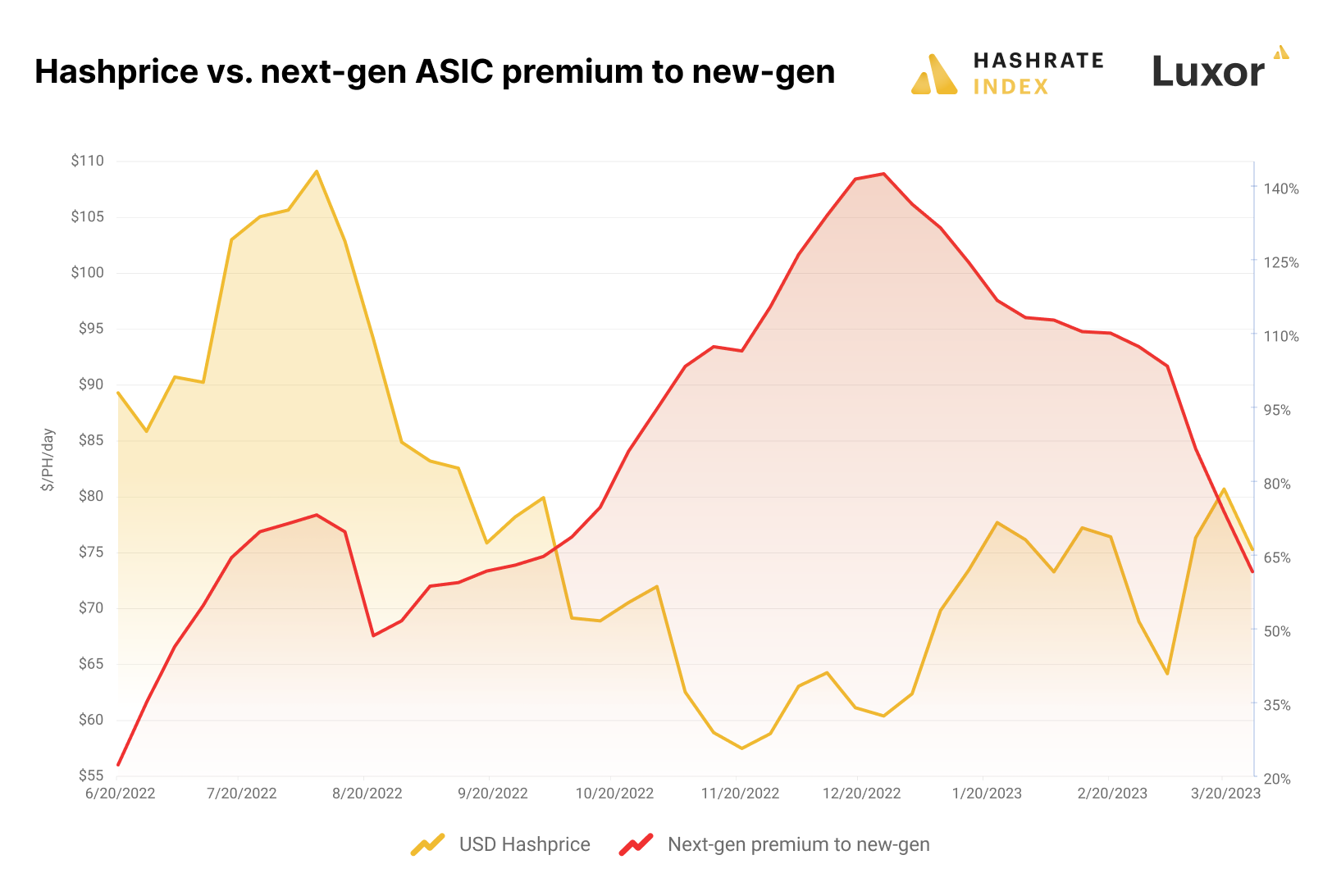

Even though ASIC prices have plummeted in the last year, next-generation Bitcoin mining ASICs like the Antminer S19 XP were relatively expensive last quarter. Over Q1 in fact, they carried a 112% premium on average to new-generation models like the S19j Pro and M30S++.

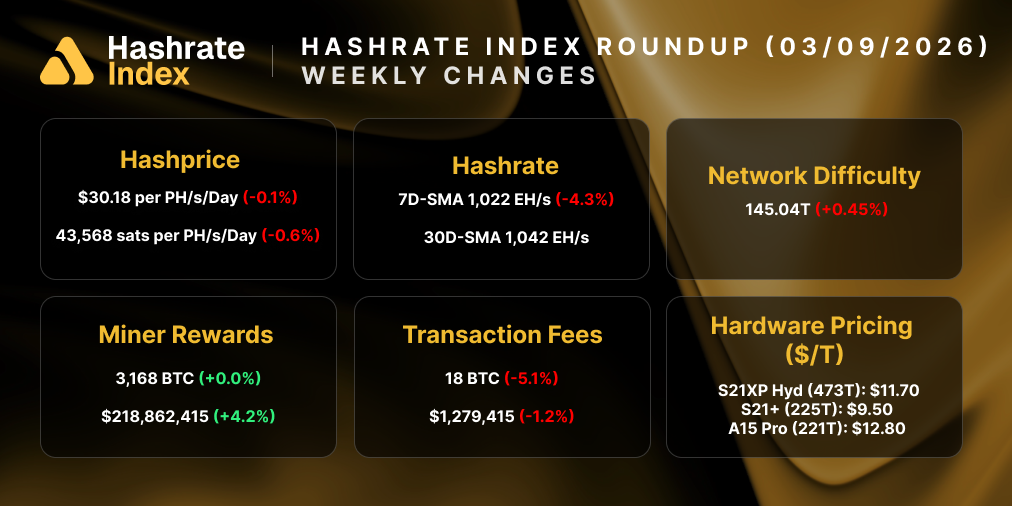

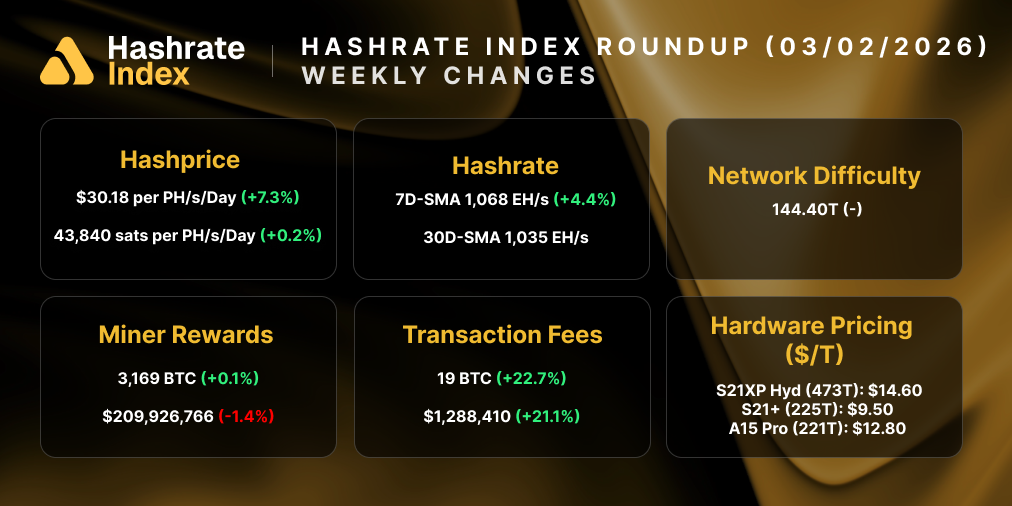

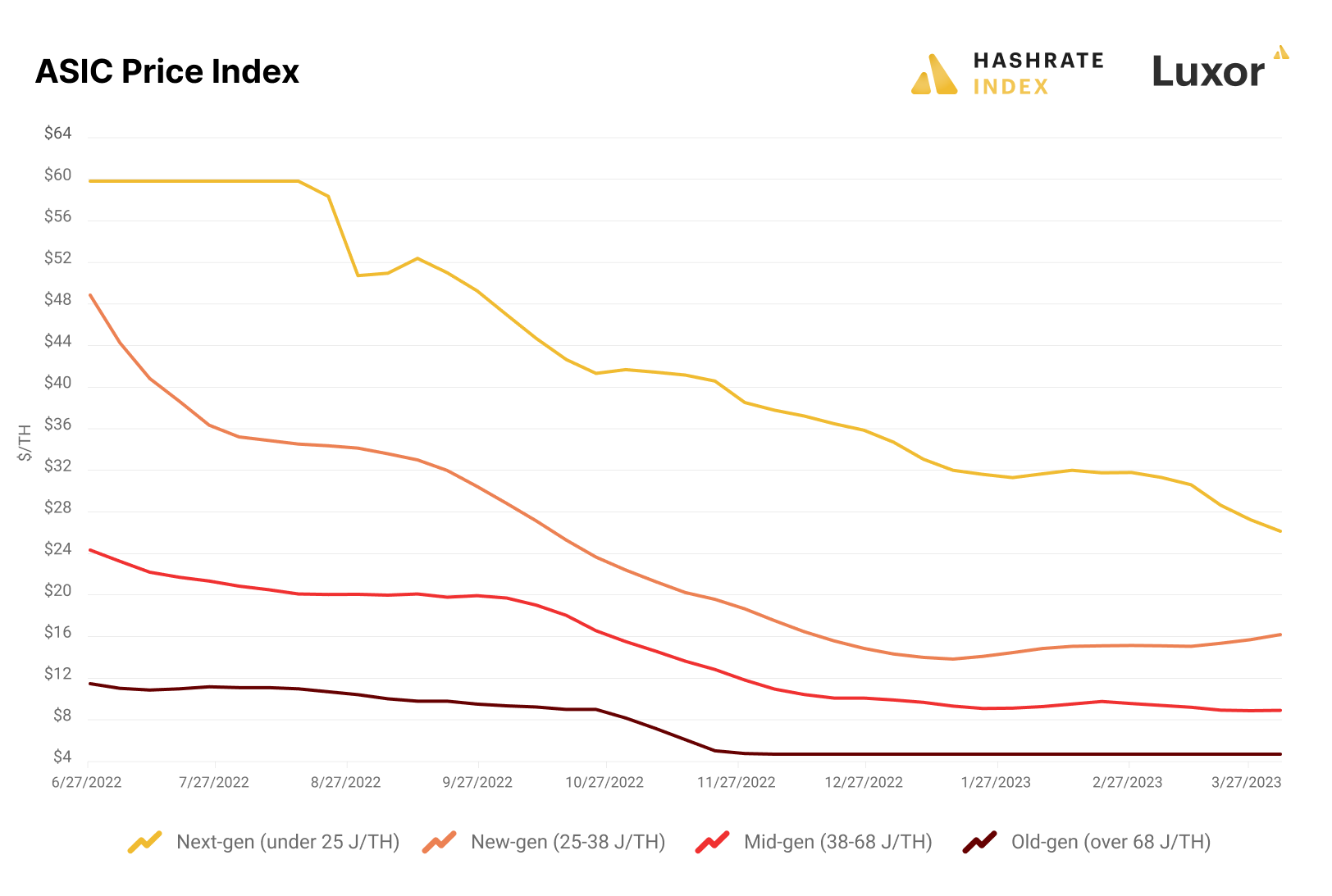

We just updated our ASIC Price Index to include next-generation ASICs like the Antminer S19 XP and the Whatsminer M50S+ (classified as under 25 J/TH). You can view the updated index below.

The average premium of next-gen-to-new-gen ASICs per quarter has been growing since Bitmain started shipping the Antminer S19 XP in the summer of 2022:

- Q1-2023: 112%

- Q4-2022: 99%

- Q3-2022: 59%

In Q3-2022, next-gen rig premiums were well below the other two quarter’s levels. The first deliveries of the S19 XP in North America came in July and August, so the orders for many S19 XPs purchased on the secondary market in Q3 likely had longer lead times.

This shipping delay could partially explain the slimmer premium – since miners had to wait longer to deploy the hashrate, they would want a better price. Hashprice was also higher on average in Q3-2022, so miners weren’t as desperate for efficiency gains to shore up margins.

Q4-2022 changed all that. The S19 XP became more readily available, hashprice hit an all-time low, the premium climbs from there. The premium tapered off some at the end of Q1-2023 as prices for the S19 XP and other next-gen ASICs came back to earth, and it's starting to look like miners are finally getting a fair shake on next-gen hardware as it becomes more affordable.

As hashprice dropped in 2022, Antminer S19 XP premiums increased

As Bitcoin's bear market took hold in 2022, Bitcoin mining ASIC prices started bleeding. New-gen ASICs lost 86% of their value over the year as hashprice dwindled. By the end of 2022, ASIC prices mostly flatlined, but Bitcoin’s price rise over Q1 pumped a (albeit faint) pulse back into the ASIC market – at least for new-gen ASICs, something we'll touch on more later in the next section).

Editors note: nex-gen refers to models with under 25 joules-per-terahash (J/TH) power efficiency like the S19 XP, new-gen refers to models with 25-38 J/TH efficiency like the S19j Pro, mid-gen refers to models with 38-68 J/TH efficiency like the S17, and old-gen refers to models with over 68 J/TH efficiency like the S9. Joules is interchangeable with watts, so a machine that has an efficiency of 25 J/TH consumes 25 watts (aka joules) per terahash of hashrate produced.

While ASIC prices cratered in 2022, The Antminer S19 XP and Whatsminer M50 series came to market, as well. As Bitcoin’s bear market went from bad-to-worse in 2022, margin-starved miners started seeking these rigs out for power efficiency and hashrate gains, and the premiums rose.

We can see from the chart below that the premiums become particularly pronounced in November and December of 2022 – the collapse and fallout of FTX and a time when Bitcoin was at a multi-year low and hashprice was at an all-time low. These rigs became all-the-more coveted as margins shrunk by the end of the year (around this time, an S19j Pro's breakeven was $0.08/kWh).

Next-gen rig prices rang in the New Year on a high, and the premium peaked at 143% on January 2, 2023. It gradually fell for the rest of the quarter but still remained relatively elevated until the end of the quarter when next-gen prices (particularly, the S19 XP) began falling sharply in price.

Antminer S19 XP, next-gen rigs were less sensitive to price changes until the end of Q1-2023

As Q4-2022 and Q1-2-23's premiums suggest, next-gen rigs were more resilient to hashprice changes at the end of 2022, particularly in November. This trend changed by the end of Q3-2023, though and now next-generation rigs are falling in the face of rising hashprice – the opposite of what you'd expect.

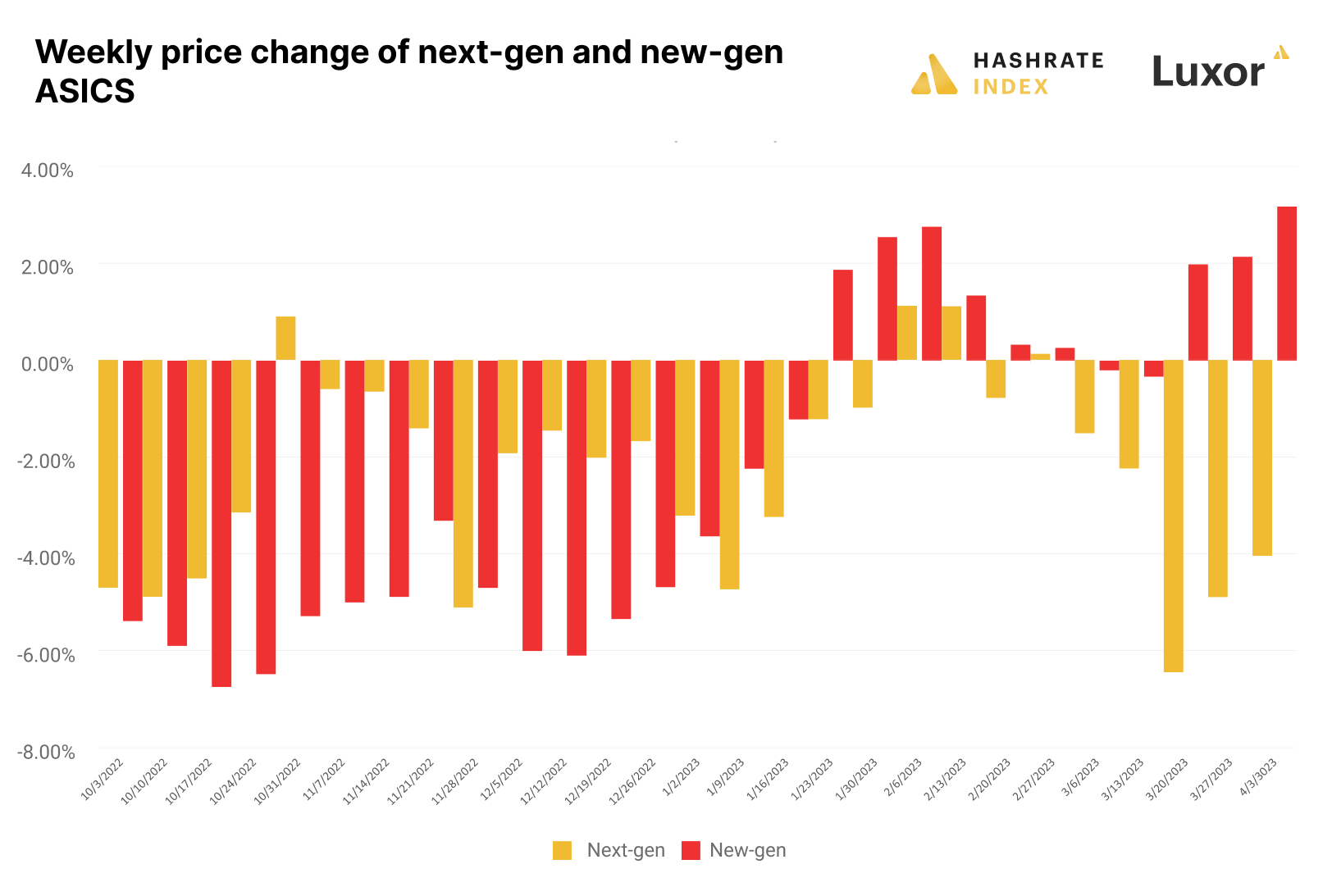

To start unpacking this, let's take a look at weekly price changes for next-gen and new gen ASICs over the last two quarter.

We can see that next-gen rig prices fell by fewer percentage points than new-gen ASICs when hashprice crater in Q4 of last year. Next-gen ASICs were less sensitive to changes in hashprice from September through December, and they were particularly strong in November and December, when hashprice was at all-time lows.

With hashprice lower than it had ever been, next-gen ASICs like the S19 XP and M50S+ were clearly in demand at the end of last year. They still are in demand, of course, but prices seem to finally start correcting at the end of March as we can see from the % changes week-by-week in 2023.

Something to highlight here: at the end of March, next-gen ASIC prices started coming down even while hashprice was going up.

The surprise growth of hashprice in March, in fact, could have helped chip away some points from this premium (when margins are thicker, miners don’t need to scramble for the most efficient machines). Corroborating this, so far this year, next-gen rigs have been more sensitive to hashprice changes on the downside and less sensitive on the upside. At the start of the year, next-gen prices fell by a greater degree than new-gen prices, and they even fell at a time when new-gen prices were rising. Case in point, next-gen rigs fell 20% over March, while new-gen rigs rose 4%.

All that said, there's a strong chance that next-gen prices are dropping because S19 XP resellers are reacting to new hardware coming to market.

Per information from Luxor's ASIC Trading Desk, Bitmain will soon start selling ~$20/TH orders of its forthcoming S19 ePro, a new rig which is darn close to the XP in terms of efficiency and hashrate. Additionally, high-volume orders of the S19j Pro+ (122 TH/s and 27.5 J/TH) sold for under $15/TH in March (a handful of closed trades on Luxor's RFQ for the S19j Pro+ sold between $13.50-14.40/TH, for example).

Given the attractive pricing and competitive efficiency of these new models, they likely contributed to shaving off premiums for the S19 XP and other next-gen rigs.

S19 XP price changes flip ROI timeframes from unfavorable to favorable in Q3-2023

To give an idea of how this repricing is affecting ROI timelines for next-generation hardware, take a look at the projected ROI for an S19 XP and S19j Pro purchased on the last -week of December and deployed on January 1, 2023:

- S19 XP: ~563 day ROI

- S19j Pro: ~254 day ROI

Now compare that with the projected ROI of an S19 XP and S19j Pro purchased on the last week March and deployed on April 1, 2023:

- S19 XP: ~501 day ROI

- S19j Pro: ~587 day ROI

Before prices dropped, the S19 XP had a much longer ROI time than new-gen rigs like the S19j Pro. But now the S19 XP has a lower projected ROI now, indicating that pricing for next-generation models have come back to reality and could even be considered favorable.

Are the S19 XP, M50S+, and other new-gen rigs still overpriced?

Right now, the market is searching for appropriate pricing for next-gen rigs amid many unknown variables, including hashprice trajectory and equipment repricing from major manufacturers.

Those who purchased S19 XPs and M50Ss at the end of last year almost certainly overpaid for the bleeding-edge hardware. Many of these miners, of course, are preparing for the next halving roughly a year out, so the premium may have seemed justified.

Looking back at Bitcoin mining ASIC pricing trends around the last halving could give us a clue as to where next-gen and new-gen rig prices are headed.

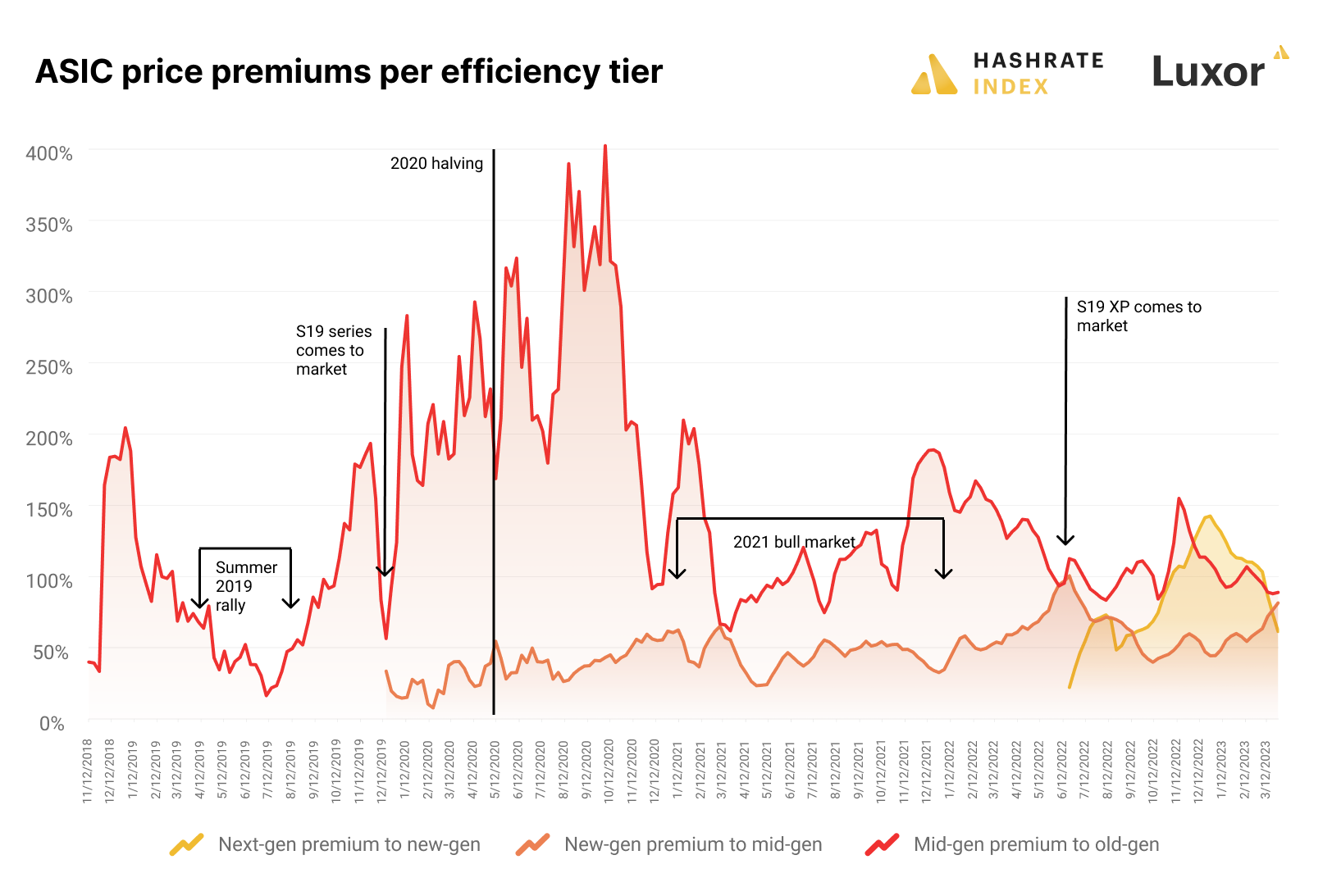

Peeping this historical data, we can see clearly that cutting-edge hardware premiums aren’t unique to next-gen rigs like the S19 XP and M50S+. Every time a new Bitcoin mining ASIC comes to market, it carries a premium per terahash to the older models.

A few observations from the above chart:

- Premiums across the board decrease during bullish price action as mining margins increase and inefficient hardware becomes more profitable.

- The premiums have become less severe over time, probably by combination of ASIC market maturation and lesser efficiency gains for each successive generation of Bitcoin mining rigs.

- These premiums typically decrease drastically (at least in the near-term) when a new, more efficient generation of Bitcoin mining ASICs come to market. For reference in the chart above, see Late 2019 when the mid-to-old-gen premium decreases upon the introduction of new-gen models, and mid-2022 when new-to-mid-gen premiums fell with the advent of next-gen hardware like the Antminer S19 XP.

- Historically, when new hardware comes to market, its price premium to the prior generation has been lower than that prior generation’s premium to its own predecessor. For example, the premium of new-to-mid-gen rigs has always been lower than the premium of mid-to-old-gen rigs. Next-gen hardware bucked this trend. In the early days of S19 XP trading, next-to-new-gen premiums were lower than new-to-mid-gen premiums, but this trend flipped in mid-September 2022. As next-gen prices came back to earth at the end of March 2023, next-to-new-gen premiums fell back below new-to-mid-gen premiums.

You can see that mid-to-old-gen premiums rise substantially leading up to the May 2020 halving but they plummet directly afterward for the rest of 2020 and into 2021; at the same time, new-to-mid-gen premiums rose steadily from 2020 on as the S19 and M30 series became the gold standard post-2020 halving.

As S19 XP prices react to the S19e an S19 Pro+, you can't help but think that, if Bitmain releases an even more efficient miner in the next year, maybe we could see next-gen rig prices go the same way as mid-gen rig prices last halving.

That said, the recent price cuts to the S19 XP and other next-gen hardware make them more attractive price-wise now than ever, so if you're in the market, now is not a bad time to start looking.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.