Hashrate Index Roundup (November 13, 2022): Deep Fried Edition

With the worst exchange collapse in crypto history underway, mining margins are spread even thinner.

Happy Sunday, y'all!

Last week, the unthinkable happened when FTX, one of the largest crypto exchanges, went bust.

A recap for the probably very few of you who haven't been paying attention: Alameda Research, a prop trading firm started by FTX founder Sam Bankman-Fried, was dipping its hands into FTX user deposits. Alameda collateralized many of these "loans" with FTT, FTX's native exchange token.

Rumors and then reporting exposed that FTX and Alameda basically shared the same book, and the price of FTT tumbled as it became increasingly clear that FTX/Alameda were insolvent and that its operators were running a Bernie Madoff-style ponzi. Binance almost bailed out FTX with an acquisition, only to back away when CZ and company realized how f***** the situation is. Now, FTX is filing for Chapter 11 bankruptcy.

It's hard to understate how devastating and shocking FTX/Alameda's downfall has been for the wider crypto industry, especially as more damning facts continue to come to light – like the fact that Sam Bankman-Fried, founder of both FTX and Alameda, created an accounting backdoor to covertly funnel $10 billion in FTX assets into Alameda.

SBF was once touted as an industry wunderkind. In three years, he built an empire that was second only to Binance which attracted investments from the likes of Tom Brady and had the naming rights to the Miami Heat's arena. He enjoyed a parade of puffed-up media coverage as recently as this summer, which included his mug on the cover of both Fortune and Forbes.

He was the whiz-kid who couldn't lose. And then everyone found out that was because he was rigging the game.

Now his image has soured (to put it nicely) in the eyes of the public as adoration has boiled into ire. As ever in tragic circumstance, some have salved the anger with humor, nicknaming the FTX founder Sam Bankman-Fraud – or by pointing out the irony that the crypto industry was defrauded by a guy whose name is literally Bankman.

I'll do the jokes and puns one better (or perhaps worse) by saying simply that FTX's collapse has left the industry battered and fried. The whole episode is worse by an order of magnitude than the infamous Mt. Gox fiasco and is sure to set the industry back a few years as public perception chills and regulators use the event as an excuse to crack the whip.

The situation took a toll on Bitcoin's price, pushing it to local lows. Seeing as many actors had exposure to FTX/Alameda, either as investors or clients, the joint destruction is sure to cause contagion across the industry, so we'll probably see lower prices still.

For Bitcoin miners, the price decline is yet another kick in the nuts after a summer and ensuing-fall that has been nothing but hard-knock after hard-knock.

The winter of mining discontent is upon us, and it's going to get worse before it gets better.

Mining Market TLDR

- Hashprice: $0.058/TH/day (-21%) | 348 sats/TH/day (+0.6%)

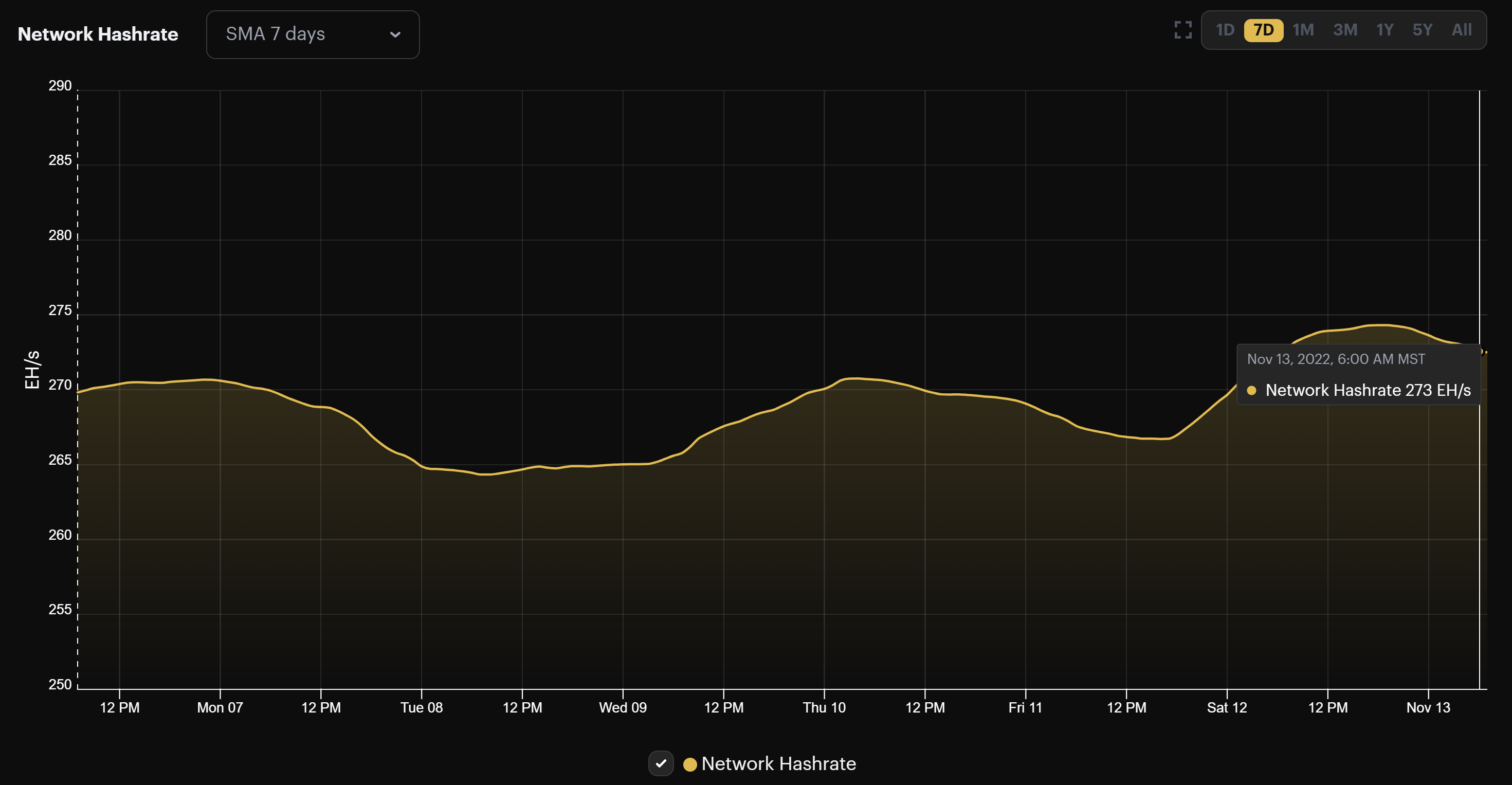

- Hashrate: 273 EH/s (+1.1%)

- Difficulty: 36.76 T (0%)

Sponsored by Luxor

Hashprice Index (November 13, 2022)

In the wake of FTX's collapse, Bitcoin sold off to fresh local lows in the ~$15,5k range. This pushed hashprice down to all-time low of $0.0554/TH/day.

Hashprice rebounded with Bitcoin's price over the week, but not by much. At the time of writing, hashprice is $0.0580/TH/day. At this level, miners who are hashing at $0.08/kWh rates with S19j pros are breakeven on their electricity costs alone, and anyone above this power cost with similar hardware is underwater.

To make matters worse, Bitcoin is projected to undergo an upward adjustment in exactly one week which will drive hashprice down even farther.

We haven't seen Bitcoin's hashrate fall yet amid these adverse mining economics, but I expect that we will see it taper later this week and/or after the next adjustment as miners react to these abysmal conditions.

Bitcoin Mining ASIC Price Index (November 13, 2022)

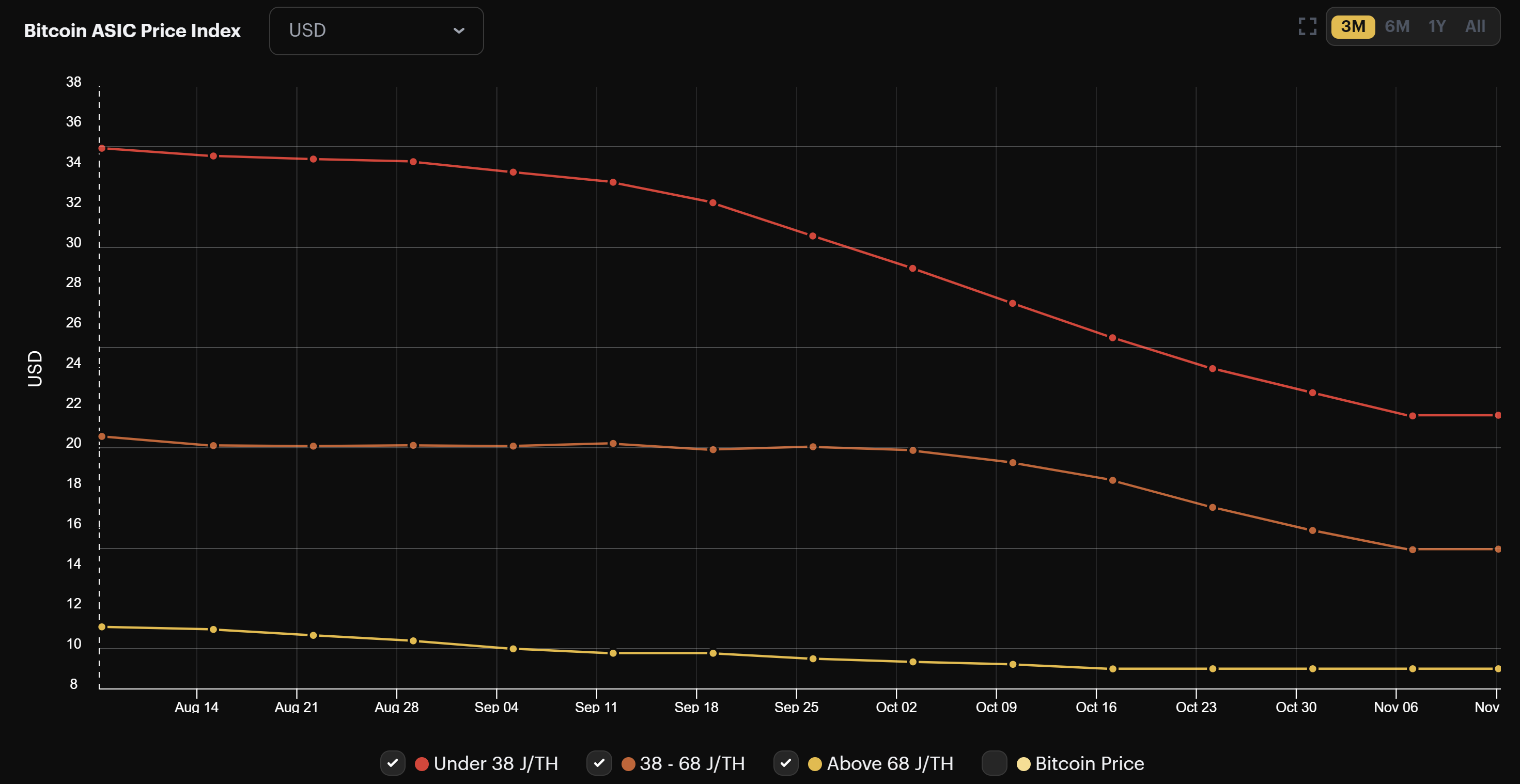

Per our ASIC Price Index, rig prices are tumbling now that hashprice is really in the shitter.

The average listing price of new-gen ASICs fell 5.2% last week to $21.63/TH, about a buck shy from their all-time low values. Mid-gen rig prices have already fallen through the floor to all-time lows, declining 6.2% over the week to $14.96/TH.

Prices will no doubt fall farther still from these lows and near-lows as miners hawk equipment and back out of machine orders.

With hashprice recently hitting new all-time lows, mining margins are getting obliterated.

When hashing at $0.07/kWh power cost, here are the current bitcoin mining profitability specs for popular mining rigs:

- Antminer S19 XP (140 TH/s): $3.0

- Whatsminer M50 (114 TH/s): $1.0

- Antminer S19j Pro (104 TH/s): $0.9

- Whatsminer M30s++ (112 TH/s): $0.6

- Antminer S19 (95 TH/s): $0.0

- Whatsminer M30s (86 TH/s): -$0.5

- Antminer S17 (56 TH/s): $-1.0

- Whatsminer M20s (68 TH/S): $-1.7

Bitcoin Mining Stocks (November 13, 2022)

Bitcoin mining stocks have begun reporting their Q3 numbers, and the data confirms what we already know: a lot of these companies are in hot water.

Marathon missed earnings estimates by $10.7 million, Riot missed earning estimates by $10 million, Hut 8 missed earnings estimates by $4.6 million, and Iris Energy has received a default notice for a $103 million loan.

Stocks were adversely affected by the FTX sell-off and, in part, by Q3 earnings reports. That said, they rebounded at the end of the week after the aggressive selling, so our Crypto Mining Stock Index only fell by 0.07%.

New From Hashrate Index

Bitcoin Mining Stocks October 2022 Updates

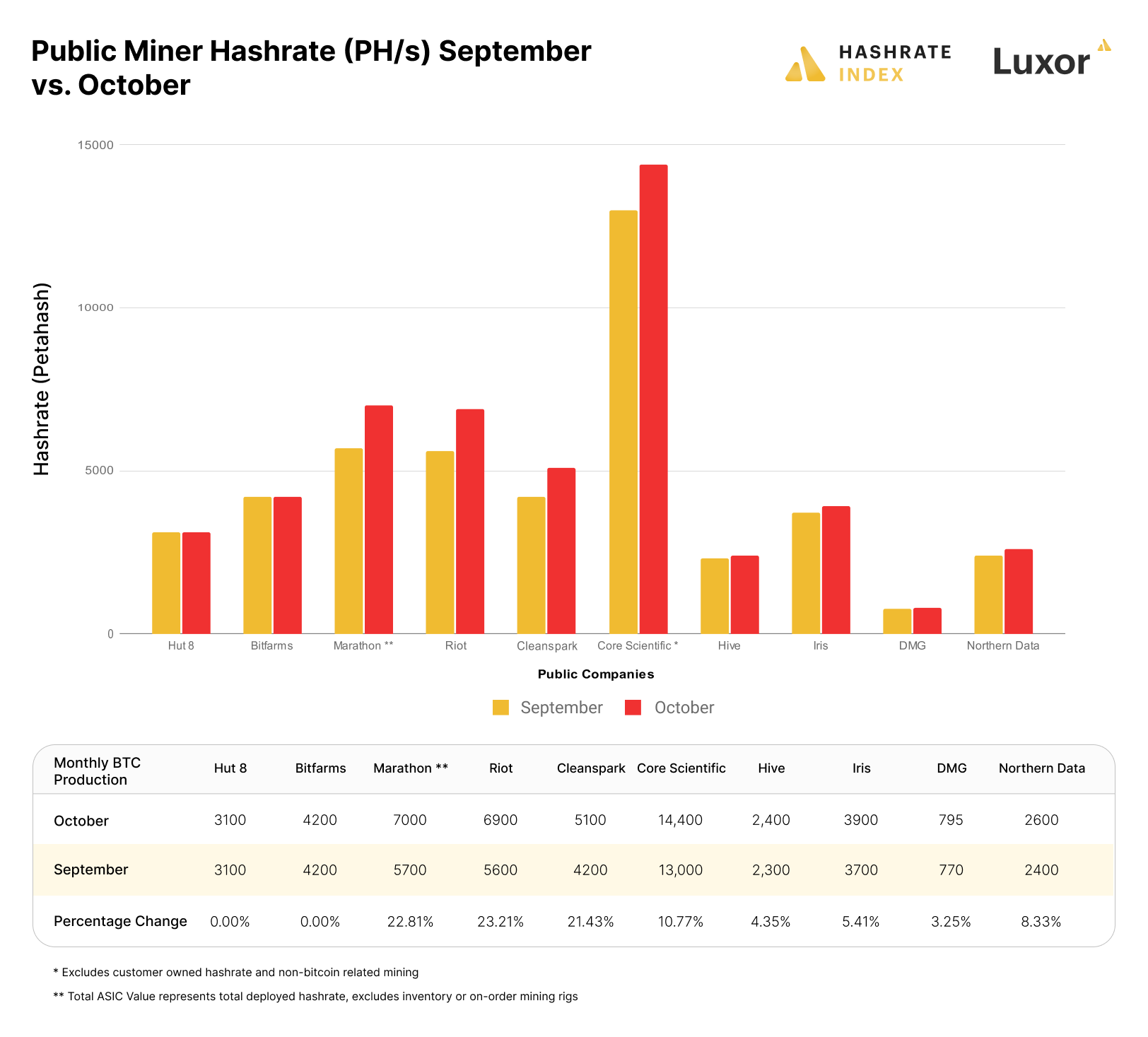

Even with the market melting down, public Bitcoin miners added hashrate in October.

In terms of adding new hashrate capacity, Marathon Digital, Cleanspark and Riot Blockchain were the clear leaders in October, growing their fleets’ hashrate by 22.8%, 21.2%, and 23.2% respectively. Notable observations in October, Hut 8 and Bitfarms did not see any real increases in their mining fleet capacities.

Marathon Digital saw more growth again month-over-month, as their Texas mining sites continue to be energized throughout October. Marathon worked through the summer to prepare all their mining containers for energization the later half of this year.

Cleanspark continued their high paced fleet growth with their recent acquisitions, and purchasing heavily discounted Bitcoin miners on the open market. Riot Blockchain continues to expand capacity at their Rockdale Texas mining facilities.

Most of the other miners grew their hashrate noticeably higher in October compared to previous months. Even with a full on bear market, miners continue to focus on their mining fleet hashrate expansion.

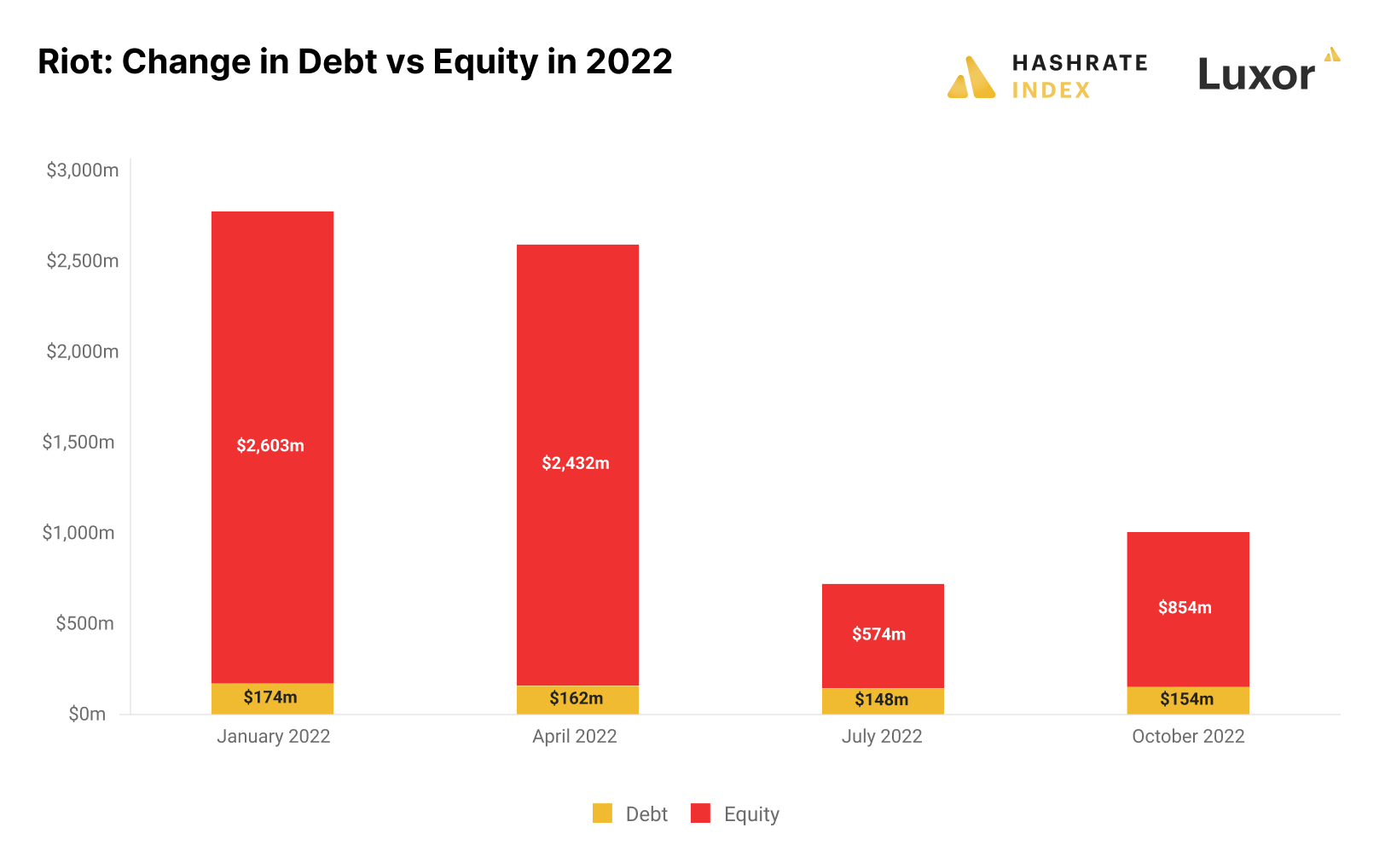

Highlights from Riot Blockchain's Q3 Report

The bitcoin mining industry is currently in crisis mode. The share prices of most public mining companies have plummeted by more than 90% from their all-time highs, and the latest icing on the cake is that several of these companies are warning they might run out of cash soon.

Things have gotten so bad that many are wondering which bitcoin miners will go bust. The more optimistic of us are framing the question the opposite way: "Which bitcoin miners are so strong that they will not only survive the bear market but could capitalize on it?"

We must dive deep into the public bitcoin miners' financial reports to answer such questions. This article goes through my main findings from Riot's Q3 report to determine how strong this company is.

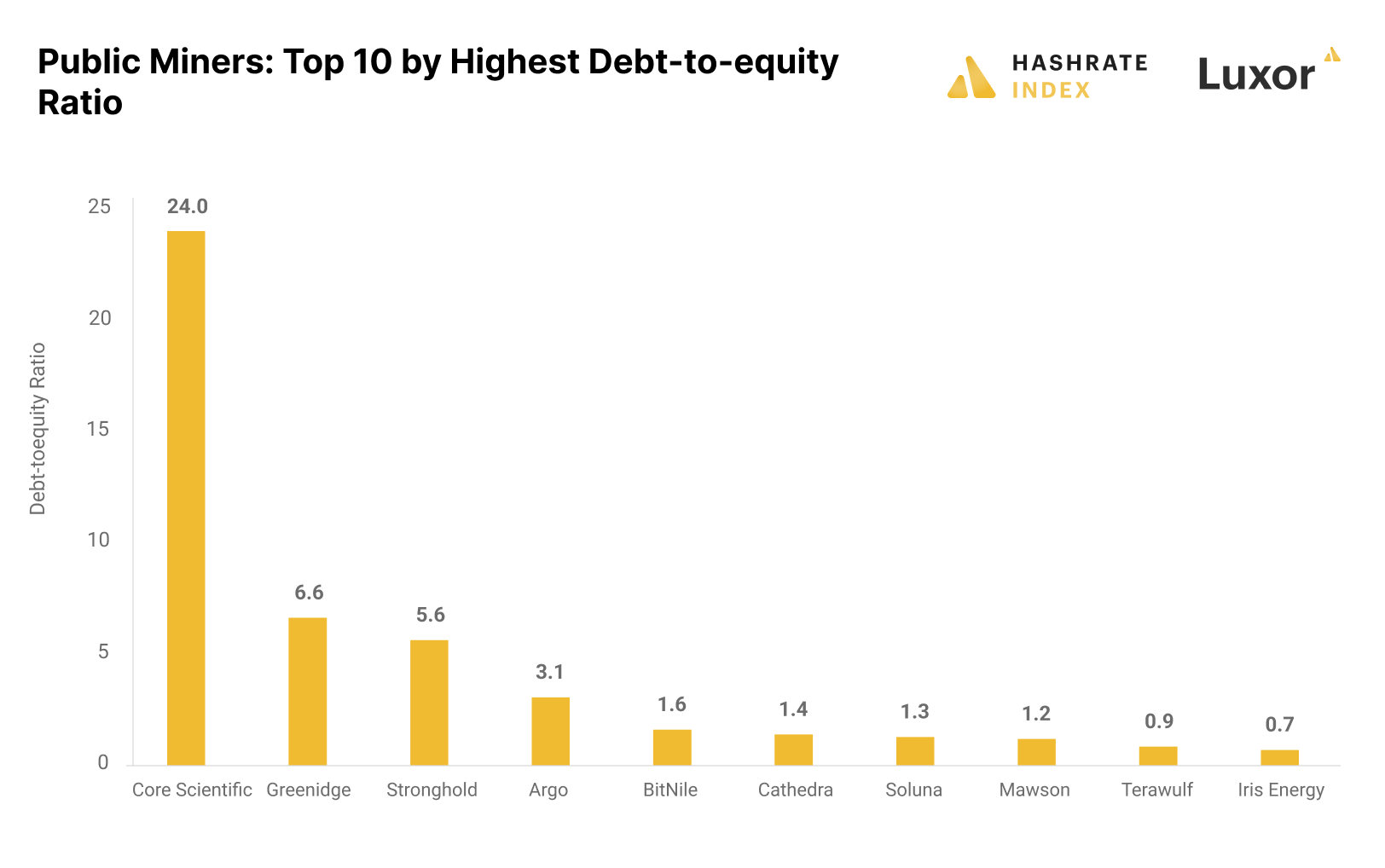

An overview of the debt burdens of the public bitcoin miners

Some public bitcoin miners are being eaten alive by the bear market, with a common trait among them being that they all have high levels of debt. This article reveals who has taken on the most debt relative to equity and who has been the most prudent in avoiding debt.

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.