21 Months Since the 2024 Halving

Fixed Pool Payouts Outperform Across the Board

Twenty one months have elapsed since April 2024’s halving which reduced Bitcoin block subsidies from 6.25 BTC to 3.125 BTC. This permanently lowered BTC-denominated hashprice and increased miner sensitivity to difficulty growth and transaction fee variability. The relevant question here is not whether miner earnings declined, but how different revenue risk management strategies performed in this post-2024-halving regime.

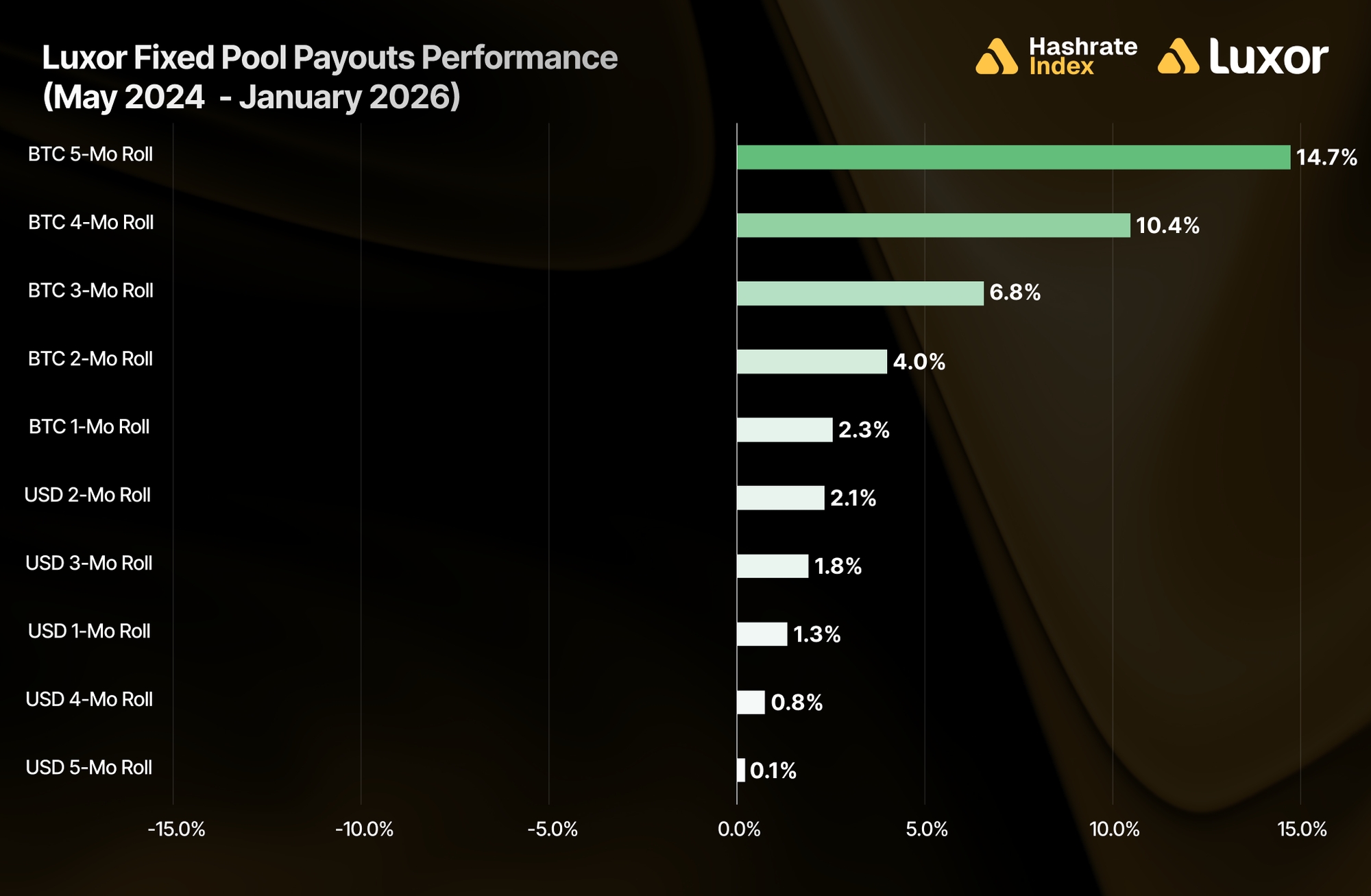

The data speak for themselves: from May 2024 through January 2026, fixed pool payouts (rolling hashrate hedges) outperformed spot (FPPS) mining across the board, regardless of contract denomination or hedge horizon.

BTC-Denominated Rolling Hedges (May 2024 – January 2026)

- BTC 5-Month Roll: +14.7%

- BTC 4-Month Roll: +10.4%

- BTC 3-Month Roll: +6.8%

- BTC 2-Month Roll: +4.0%

- BTC 1-Month Roll: +2.3%

US-Denominated Rolling Hedges (May 2024 – January 2026)

- USD 2-Month Roll: +2.1%

- USD 3-Month Roll: +1.8%

- USD 1-Month Roll: +1.3%

- USD 4-Month Roll: +0.8%

- USD 5-Month Roll: +0.1%

Note: A rolling hashrate hedge means repeatedly replacing an expiring forward contract with a new one, so future mining revenue stays continuously locked in rather than reverting back to full spot exposure.

The Structural Setup

Post-2024-halving mining economics between May 2024 – January 2026 were defined by four forces:

- The deterministic 50% reduction in block subsidy from 6.25 BTC to 3.125 BTC.

- Persistent network difficulty growth (+2.8% MoM, +71.8% total).

- Low-to-no transaction fees (-2.6% MoM, -91.7% total).

- BTC price volatility (monthly average $89,206, $19,277 standard deviation)

Under spot (FPPS) mining conditions, miners have full exposure to all other hashprice components beyond the block subsidy: changes in network difficulty, transaction fee variability, and BTC price. In a rising-difficulty, low-to-no fees, and volatile BTC price environment, miner margins got compressed, and exposure to spot (FPPS) hashprice took its toll.

Monthly USD hashprice averaged $78.43 per PH/s/Day over the twenty one months prior to the April 2024 halving, versus $50.11 per PH/s/Day over the twenty one months after.

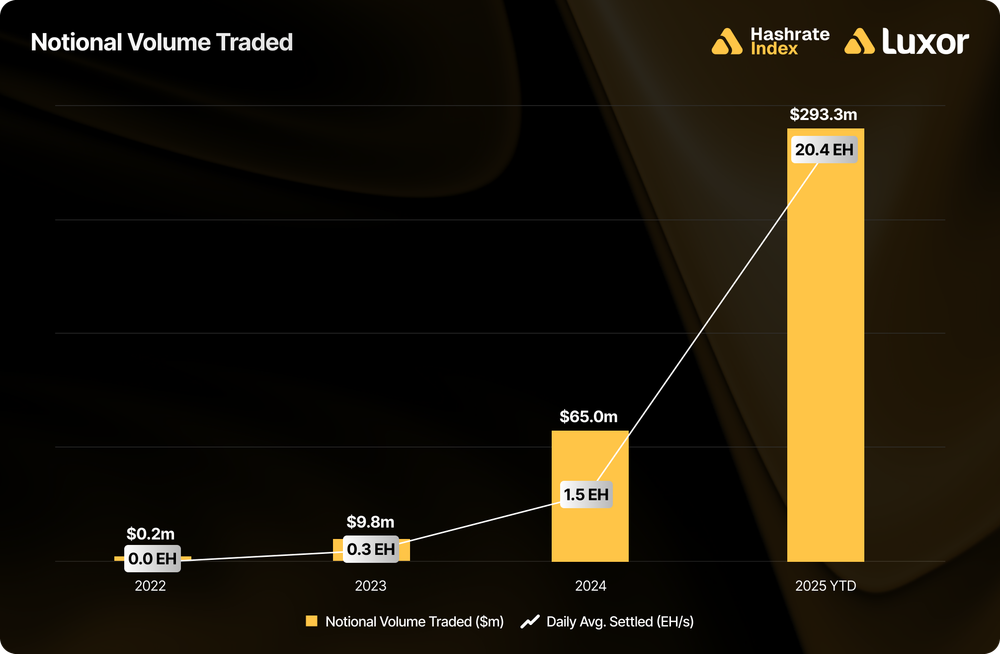

Fixed pool payouts change the game. Instead of remaining fully exposed to spot (FPPS) hashprice, miners can systematically lock in agreed-upon hashprices for their future hashrate production on Luxor Pool. As the world's largest forward hashrate marketplace with over $290 million dollars of notional volume traded in 2025, Luxor is the only mining pool offering Fixed & Upfront Payouts.

The Results

Our analysis reveals that BTC-denominated fixed pool payouts outperformed since the halving, between May 2024 – January 2026, with the strongest results coming from 5-month (+14.7%) and 4-month (+10.4%) rolling forward hashrate sales. For a 1EH/s operation, spot (FPPS) miners earned 374 BTC whereas forward hedgers using a 5-month roll received 429 BTC, an additional 55 BTC over the 21-month period. These longer-duration forward sale contracts generally benefited from locking in a higher hashprice ahead of rising network difficulty and low-to-no fees.

USD-denominated fixed pool payouts generally outperformed spot (FPPS) mining as well, by an average of +1.2%, demonstrating the value of hashrate hedging over the past 21 months.

Note: these figures are strictly for demonstration purposes and exclude fees and bid/ask spreads associated with entering into hashrate forward contracts.

A second caveat: although selling forward proved to be favorable during the timeframe shown above, it is critical to recognize that hedging is typically a cost of business rather than a revenue generation method. Hedgers willingly pay a price to buy certainty and obtain more predictable cash flows, which increases valuation, reduces cost of capital, and ultimately attracts investments.

Why Hashrate Hedgers Won

Three structural drivers explain the outperformance:

1. Persistent Difficulty Growth

Difficulty rose beyond forward hashrate market expectations through the post-2024-halving period. Spot (FPPS) miners absorbed this mismatch. Rolling hashprice hedges monetized optimistic forward expectations before incoming network difficulty growth and low-to-no fees eroded spot hashprice.

2. Low-to-no Transaction Fees

The hashrate forward curve embedded compensation for uncertainty around fee variability.

3. Hashprice Volatility

Rolling forward sales enabled a disciplined hashrate hedging program. Over a 21-month window, that discipline compounded. Fixed pool payouts reduced exposure to spot hashprice.

The hashrate forward curve underpriced hashprice compression, so systematically selling hashrate forward allowed miners to transfer network parameter (difficulty, fees) and price (hashprice, BTC price) risks to counterparties at favorable levels.

What This Means for Your Operation

- Evaluate your risk exposure: How much hashprice volatility can your operation actually handle?

- Consider systematic hedging: The data shows consistent outperformance across multiple hedge horizons.

- Plan for continued pressure: Rising difficulty and fee uncertainty aren't going away.

- Think like a commodity producer: Sophisticated miners hedge hashprice rather than speculate on it.

Looking Ahead

Since the 2024 halving, Bitcoin mining has proven to be a capital-intensive, margin-compressed commodity business. In such markets:

- Unhedged producers absorb structural volatility.

- Hedged producers monetize the forward curve.

- Systematic risk management compounds into competitive advantage over time.

The 21 months since April 2024 demonstrate that the halving forced financial discipline, and the data show that treating SHA-256 hashrate as a risk-managed compute commodity paid off.

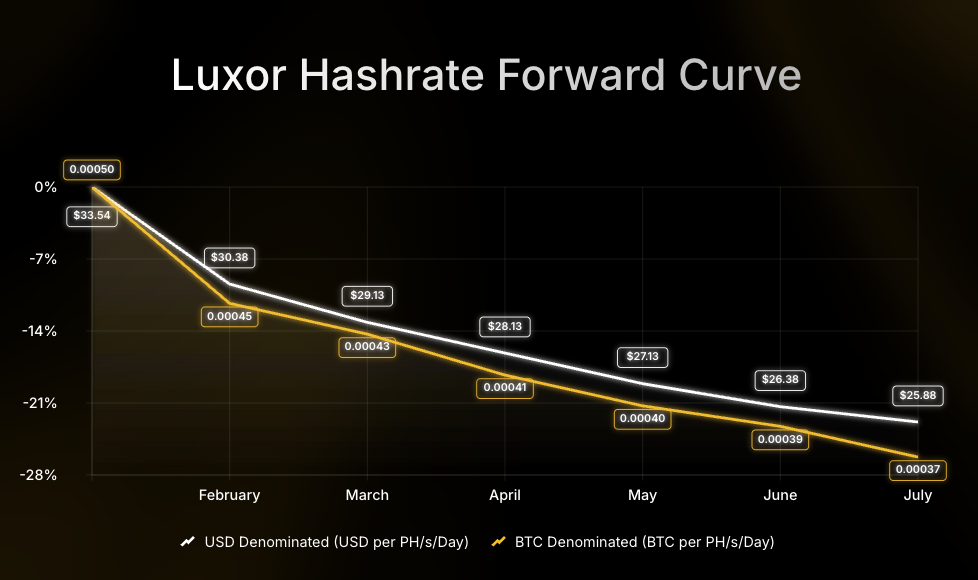

Looking forward, Luxor’s Hashrate Forward Market is pricing in an average hashprice of $27.84 or 0.00041 BTC per PH/s/day over the next six months. Sellers can currently secure this hashprice while buyers have the opportunity to lock in the same hashcost through July 2026.

If you’d like to learn more about Luxor’s Bitcoin mining derivatives, please reach out to [email protected] or visit https://www.luxor.tech/derivatives.

About Luxor Technology Corporation

Luxor delivers hardware, software, and financial services that power the global compute and energy industry. Its product suite spans Bitcoin Mining Pools, ASIC Firmware, Hardware trading, Hashrate Derivatives, Energy services, and a bitcoin mining data platform, Hashrate Index.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.