Why Should Bitcoin Miners Care About SPACs?

What are Bitcoin mining SPACs and how will they affect the bitcoin mining industry?

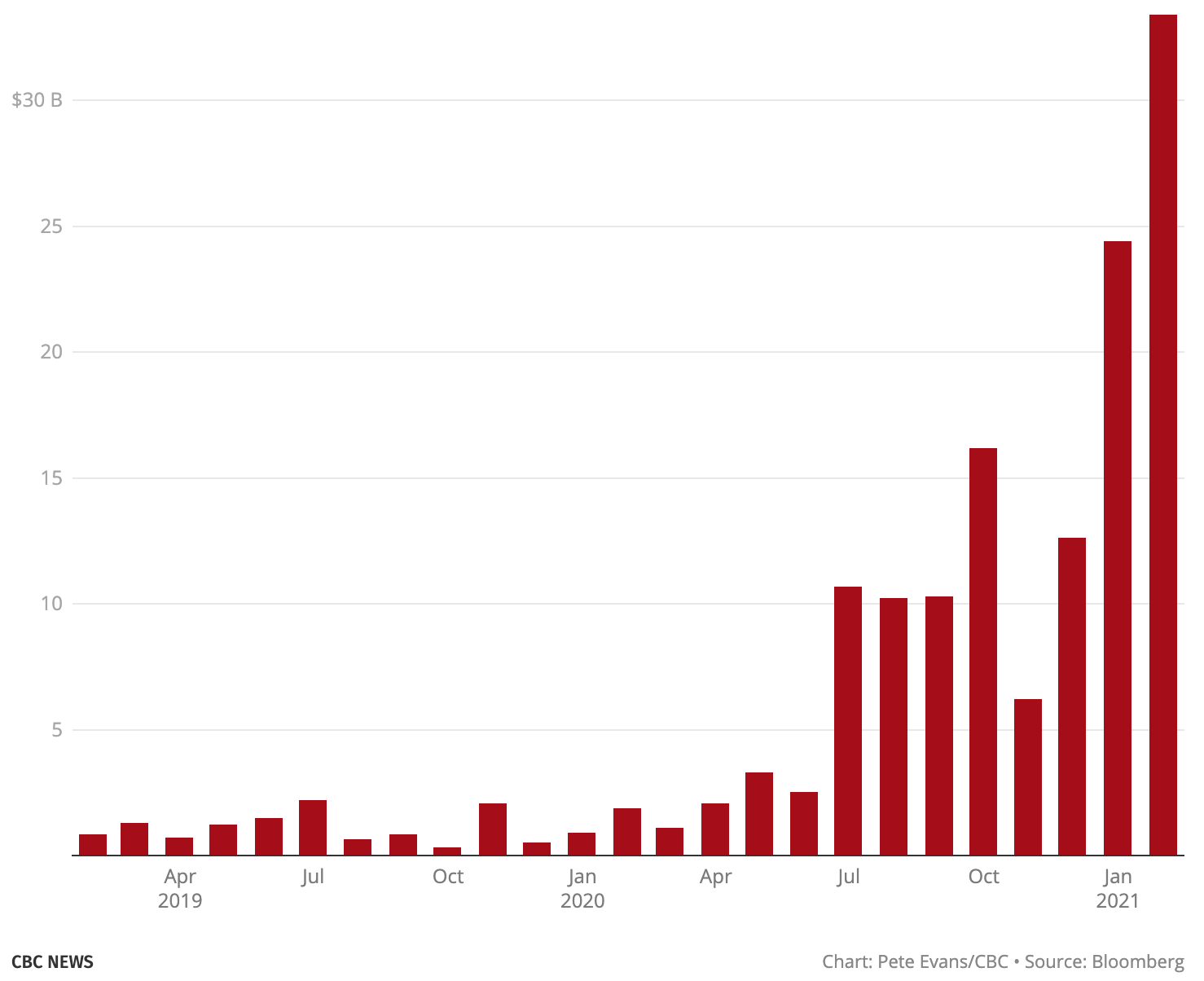

In the past year, due to raised volatility levels and extra cash being pumped into the market during the pandemic, SPACs have had a large surge in popularity. This year, we are seeing even more SPAC-led deals happening in the market with Q1 deals that are likely to exceed last year's total deal volume.

Crypto mining companies are also joining this growing wave of SPAC deals. Last month, both Cipher Mining and Greenidge Generation announced they were going public through SPAC mergers, which has set the stage for other mining companies to go public via SPACs. In this article, we discuss everything you need to know about these structures and how they relate to mining.

Public Mining Market

The surge in Bitcoin price this year not only attracted more investors to add bitcoin to their balance sheet and set up mining operations but also rekindled investors' interest in purchasing crypto mining stocks. Due to the current difficulty in procuring ASIC miners, purchasing publicly traded mining stocks is a good alternative for the general public and retail investors to get involved with bitcoin mining.

For crypto mining companies, one of many advantages of entering the public market is increased access to capital, in the current environment. For instance, Marathon Digital raised \$200 million earlier this year utilizing its at-the-market facility, a type of follow-on offering of stock commonly used by public companies in capital raising. The proceeds from this raise are used to pay for the new-gen ASIC miners that Marathon has purchased from Bitmain to significantly expand its hashrate capacity. In this case, being a public mining company provides the company a critical mechanism to raise capital and ultimately scale its mining capacity.

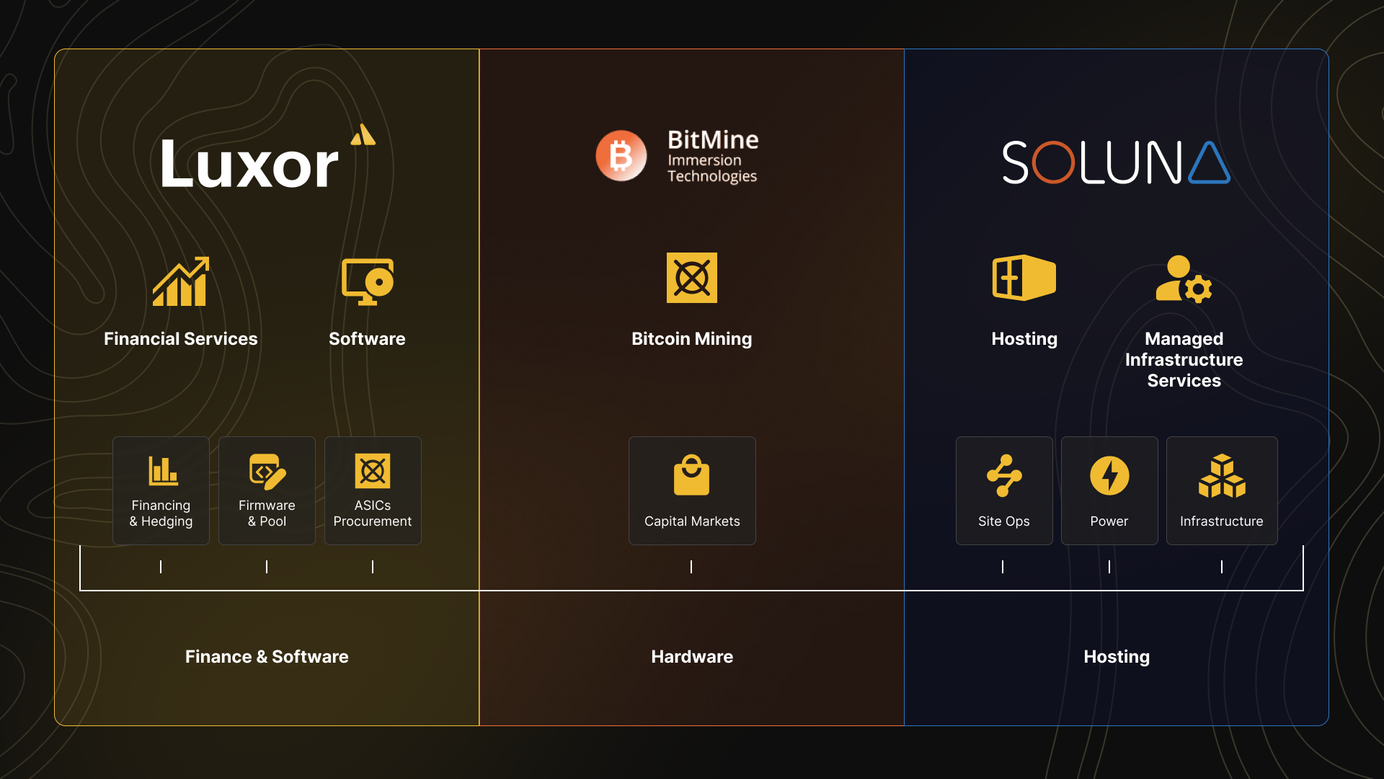

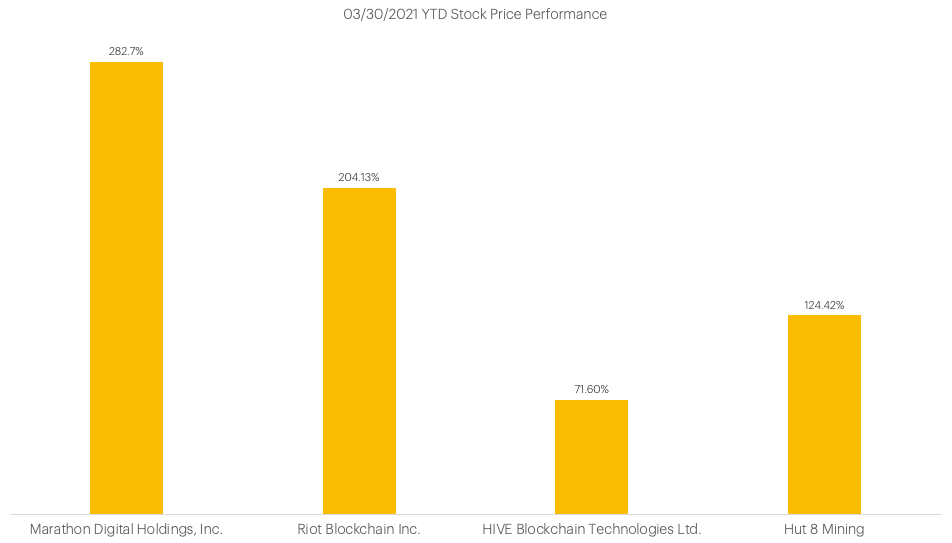

The global constraints of ASIC miners have created a favorable mining environment for public mining companies currently operating at scale. With growth expected for both bitcoin price and bitcoin mining, let's take a look at these four North American mining-focused stocks' market cap and their mining operations:

Marathon Digital Holdings, Inc. (NASDAQ: MARA), has a market cap of \$3,767mm and has ordered the largest amount of hashrate (2022 delivery). They are currently setting up their data center in Hardin, MT with a maximum power capacity of 105 Megawatts. The Company also runs machines at Compute North.

Riot Blockchain Inc. (NASDAQ: RIOT), has a market cap of \$3,467mm and has the second largest amount of hashrate on delivery. Currently Riot hosts their equipment in upstate New York with Coinmint but also has a new deal with Lancium in Texas for a pilot immersion, demand-response project.

HIVE Blockchain Technologies Ltd. (HIVE-CV), has a market cap of \$1,597mm and is the largest publicly-listed ETH miner, alongside their Bitcoin mining operations. They have operations in Canada, Sweden and Iceland.

Hut 8 Mining (HUT-CT), has a market cap of \$1,090mm and is the largest Canadian-based bitcoin miner. Hut8 runs operations in Alberta and is looking to utilize stranded gas for its next phase of expansions. Hut8 also recently announced the acquisition of ETH miners, which will make them the second-largest publicly traded ETH miner.

Introduction of SPAC

How does it work?

A special purpose acquisition company (SPAC), also known as a "blank check company", is a company with no commercial operations that is formed to raise capital through an initial public offering (IPO) to acquire an existing company. SPACs offer private companies a fast track for going public by acquiring it and then taking it to the public market quickly.

When a SPAC raises money on its IPO day, the fund raised will be placed in an interest-bearing trust account and it cannot be moved until the acquisition of the target company is completed. If a SPAC completes the acquisition of the target company, then the combined company is usually listed on one of the major stock exchanges. However, if no acquisition materializes within the agreed period (typically 18 to 24 months after the IPO date) and there isn't an extension grant, the SPAC will be liquidated and investors will get their money back.

How to raise additional capital needed for the acquisition?

When a SPAC needs to raise additional capital to close the merger, it can pursue an efficient PIPE deal. PIPE, private investment in public equity, is when a select investor or a group of investors buy stocks directly from a public company below market price in a private arrangement. The concurrent PIPE has become one of the most important parts of the overall SPAC transaction and has been increasingly deployed in conjunction with SPACs. Because PIPEs have less stringent regulatory requirements than public offerings, they save companies time and money and raise funds more quickly. In 2020, PIPEs generated $12.4 billion in supplemental capital and helped fund more than 40 SPAC mergers. On average, a corresponding PIPE will add an additional $167 million for every \$100 million in capital raised through a SPAC.

Why are SPACs favorable to private companies?

First, the target company can gain significant value from sponsors' expertise in the industry or experiences in bringing companies to the public market. Additionally, going public via a SPAC is a way to avoid the grueling IPO process and enormous fees. Lastly, SPACs usually buy private companies at a premium, which generates higher returns for the private companies' early investors and management teams.

SPAC v. Other Options

SPAC v. Reverse Merger

A reverse merger is a merger in which a private company goes public by merging with an already public company that is inactive or a corporate shell. If the combined company survives, the private company will occupy and operate in the public company's legal shell, eventually taking over its controlling ownership of the stock and management team of the public company. It is an alternative for a private company to go public when it doesn't satisfy the requirements for being listed or wants to skip the process.

From a management and employee matters' perspective, the private company in a reverse merger normally needs to address the legacy issues with the public company's employees such as reduction in force or severance arrangements; while SPAC usually has a limited team in place prior to the initial business combination, the private company in a SPAC deal will need to provide leadership for the combined company.

Additionally, a public company in a reverse merger will not be deemed as a shell company in a legal sense, which means the public company can use free writing prospectus and also rely on other communication safe harbors under the securities laws. However, a SPAC is deemed as a shell company and will continue to be considered an "ineligible issuer" for three years after filing Form 10 upon completion of the initial business combination. Since the SPAC is a shell company and an ineligible issuer, the company will not be able to use a free writing prospectus and cannot rely on certain other communication safe harbors as a public company could in a reverse merger.

SPAC v. IPO

In an IPO, a company will release a message that it's going public and then follow disclosures of numerous operations details. After that, the investors will invest in the company in exchange for shares. SPACs flip the process and require investors to pool their money first, then go public without disclosing too much, and eventually merge with a real company that wants to go public.

Being acquired by a SPAC offers business owners what is essentially a faster IPO process under the guidance of an experienced partner, with less worry about the swings in broader market sentiment. Besides this, there are many other problems that mainly arise from the fact that an IPO is a long procedure, and much of the outcome is uncertain when it is first started. There is no uncertainty about valuation: the price negotiated by the parties corresponds exactly to what the target gets. Conversely, in an IPO the process is far more convoluted, with roadshows, press scrutiny, and the need to convince multiple investors to buy at a certain price.

The performance of SPACs historically has not been as sound as the returns on IPO’s. There have been 223 SPAC IPOs since the beginning of 2015 through to July 2020. 89 have completed mergers and taken a company public. Of those 223 companies, 89 have a -18.8% return, if calculated in straight share value, this would be a median return of -36.1%. Comparing this result with traditional IPOs which have returned a positive 37.2% since 2015 we see a clear difference in return.

2021 SPAC Landscape

SPACs undoubtedly have enjoyed a sudden spike in popularity last year. Looking back at 2020, SPACs raised a record-high $73 billion, representing a 462% YoY increase in proceeds raised by blank check companies. In the first quarter of 2021 alone, SPAC-led deals have already soared past $160 billion. One notable example of a large SPAC deal was eToro, the prominent European trading app, announced it’s going public via a blank check company. The startup agreed to a valuation of \$10.4 billion as part of a merger with the FinTech Acquisition Corp, a shell company that is listed in the US.

According to a recent executive survey, more than two-thirds of 366 respondents believe the market is in a SPAC bubble yet most of the executives from the life sciences and the tech sectors expect the SPAC surge to continue. For companies, the major attraction of a SPAC is the reduction in time and disclosures needed as opposed to an IPO. With a lot of stimulus money floating around the markets, investors are looking for a place to invest their money and they find SPACs appealing due to the attractive risk-return profile.

On the other hand, some say SPACs are not worth the risk. One criticism of the SPAC is that investors can get into a company and then get burned, they won't have enough time to figure out if the target company is legit and needless to say there is a higher risk of fraud. Short-sellers are increasingly betting against SPACs. Short positions in SPACs are at $2.7 billion, more than triple the $765 million at the end of 2020.

SPACs in the Mining Industry: Cipher Mining and Greenidge

In March 2021, both Cipher Mining and Greenidge released news that they are going public through SPACs. The deals are representative of the growing investment interest in bitcoin mining companies.

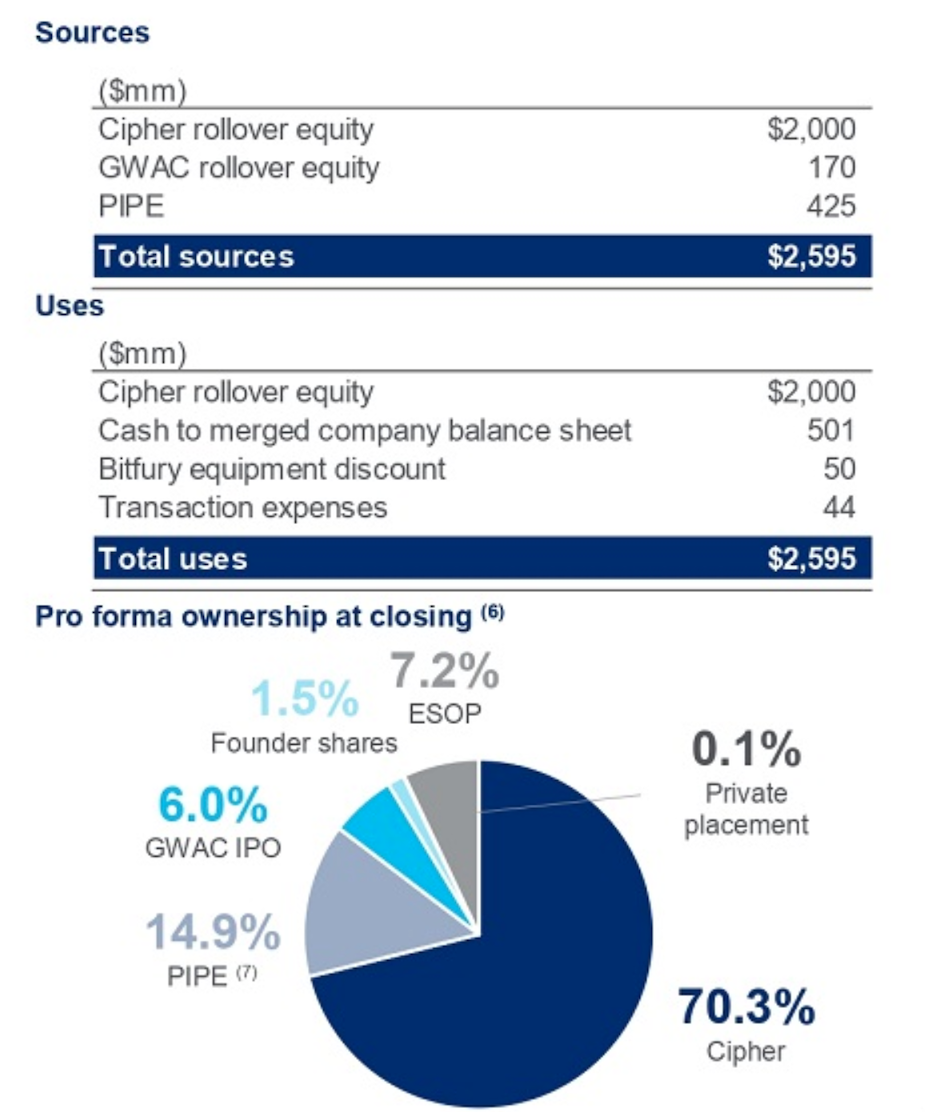

Cipher Mining Inc, a newly established subsidiary of Bitfury Group plans to go public through a SPAC by merging with Good Works Acquisition, in a deal that values the combined company at an enterprise value of $2 billion. This SPAC deal includes a $425 million fully committed PIPE, a $501 million pro forma cash (no debt), an equipment discount of $50 million from Bitfury, and no existing mining operations but a planned mining capacity of 745 MW by the end of 2025 with an average cost of electricity of $0.027/kWh. The PIPE investment includes a $50 million investment in-kind from Bitfury and is structured as a credit for future purchases of operating services and mining hardware for Cipher. Additionally, the existing shareholders will be subject to a 2-year lockup period, which seemed to be a little longer than a typical 180 days to 1-year SPAC IPO lockup. This deal is anticipated to close in Q2 2021 and the combined entity will be listed on the Nasdaq with the ticker CIFR.

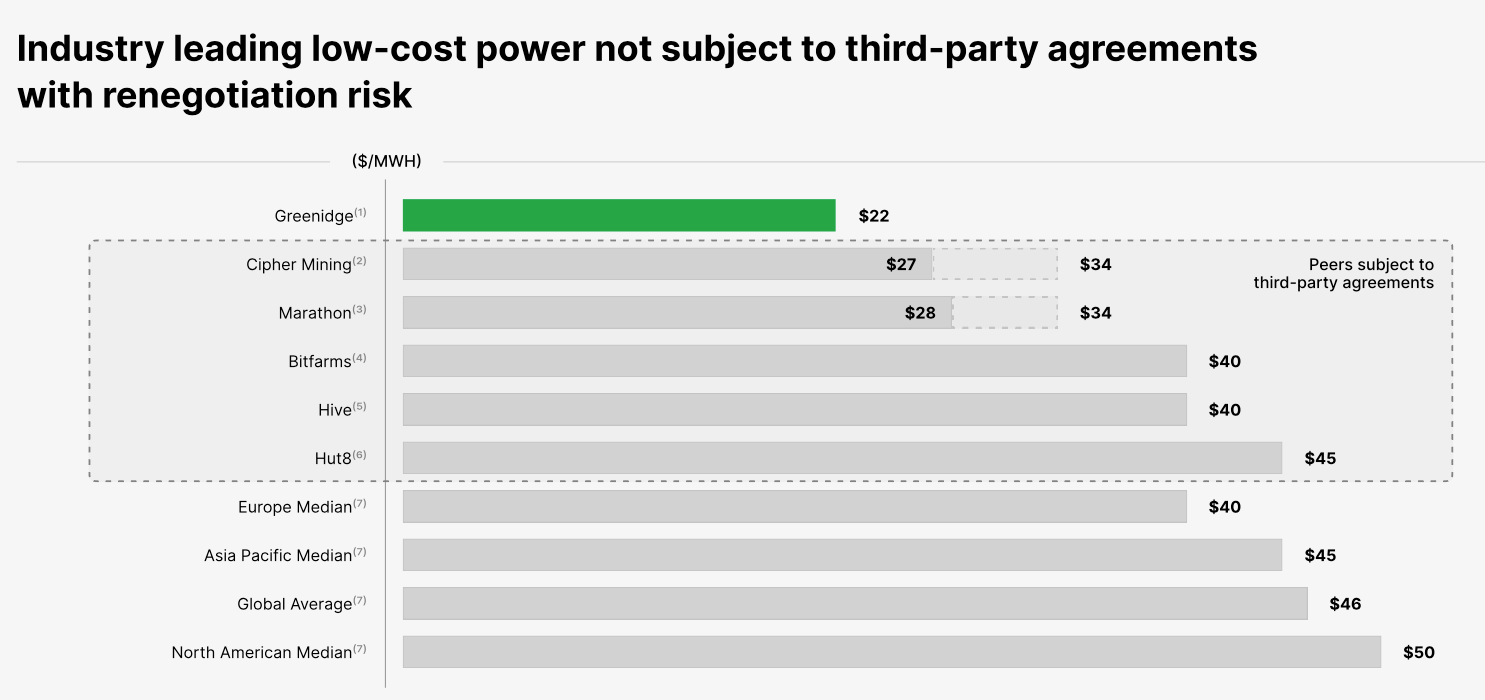

Greenidge's ongoing SPAC deal also captivated a lot of industry attention. The major advantage of Greenidge over its competitors, is its wholly-owned power plant and the industry-leading low cost of power among others.

Greenidge currently has an operating hashrate of 1.1 EH/s with a power cost of $0.022/kWh. Unlike Cipher Mining which is newly established, Greenidge has been running bitcoin mining operations with in-house experts for three years. After the merger, the Greenidge management team will continue leading the combined company and making good use of their industry expertise to expand their operations. The SPAC deal with Support.com includes over $70 million of combined net cash, growth in hashrate from 1.1 EH/s to 2.6 EH/s in one year, an expansion plan for mining capacity from 19 MW today to at least 500 MW by the end of 2025. This merger is expected to close in Q3 2021.

Outlook

If equity markets stay hot, we can expect to continue seeing more SPAC deals taking place as it provides higher efficiency to companies and a money-back guarantee to investors. For investors interested in bitcoin mining investment opportunities, it's easier for them to raise money through a SPAC and buy an operating business than purchase mining machines given the current mining hardware constraints; but from a USD per TH perspective, acquiring a mining business is much more costly.

We expect interests in bringing crypto mining companies to the public market will continue to grow, and we anticipate seeing how different strategies for going public will roll out in the crypto industry and how will those routes affect companies' business blueprints.

To get subscriber-only updates on the Bitcoin mining market, industry trends, and educational content, sign up for our biweekly delivered newsletter: Mining & Hashrate Newsletter.

Disclaimer: content is for informational purposes only, you should not construe any such information as investment advice.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.