Top Investment Bankers in Bitcoin Mining in 2023

2023 saw a flurry of capital activity for Bitcoin miners. Here are the top investment bankers who made it possible.

With more Bitcoin mining companies going public and making strategic asset acquisitions in 2023, a handful of investment bankers have positioned themselves as the go-to deal makers for companies seeking financing/fundraising and which want to execute strategic M&A in the Bitcoin mining sector.

Mining operators value the specialized knowledge of these advisors. Rather than a one-size-fits-all approach, mining companies want tailored guidance on high-stakes deals. Through strong deal execution and consistent capital financing support, these boutique investment bankers have become trusted partners for Bitcoin miners when raising capital.

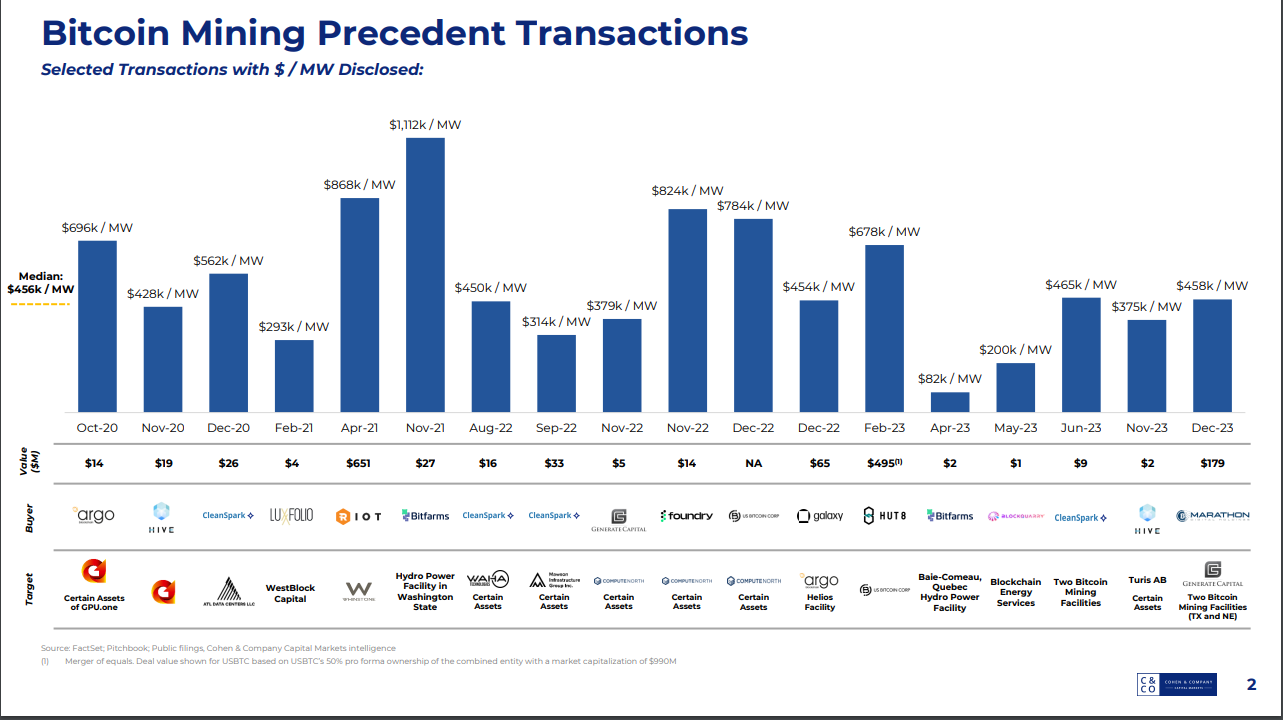

2023 Bitcoin Mining Merger and Acquisition Deals

In 2023, miners acquired a few large assets in the late stages of the year. Marathon Digital recently purchase Bitcoin mining sites from Generate Capital for $458k per MW. Hut 8 completed their merger of equals with US Bitcoin Corp for a total value of about $678k per MW. Hut 8 also purchased Validus Power assets in concert with Macquerie Finance for $46m USD.

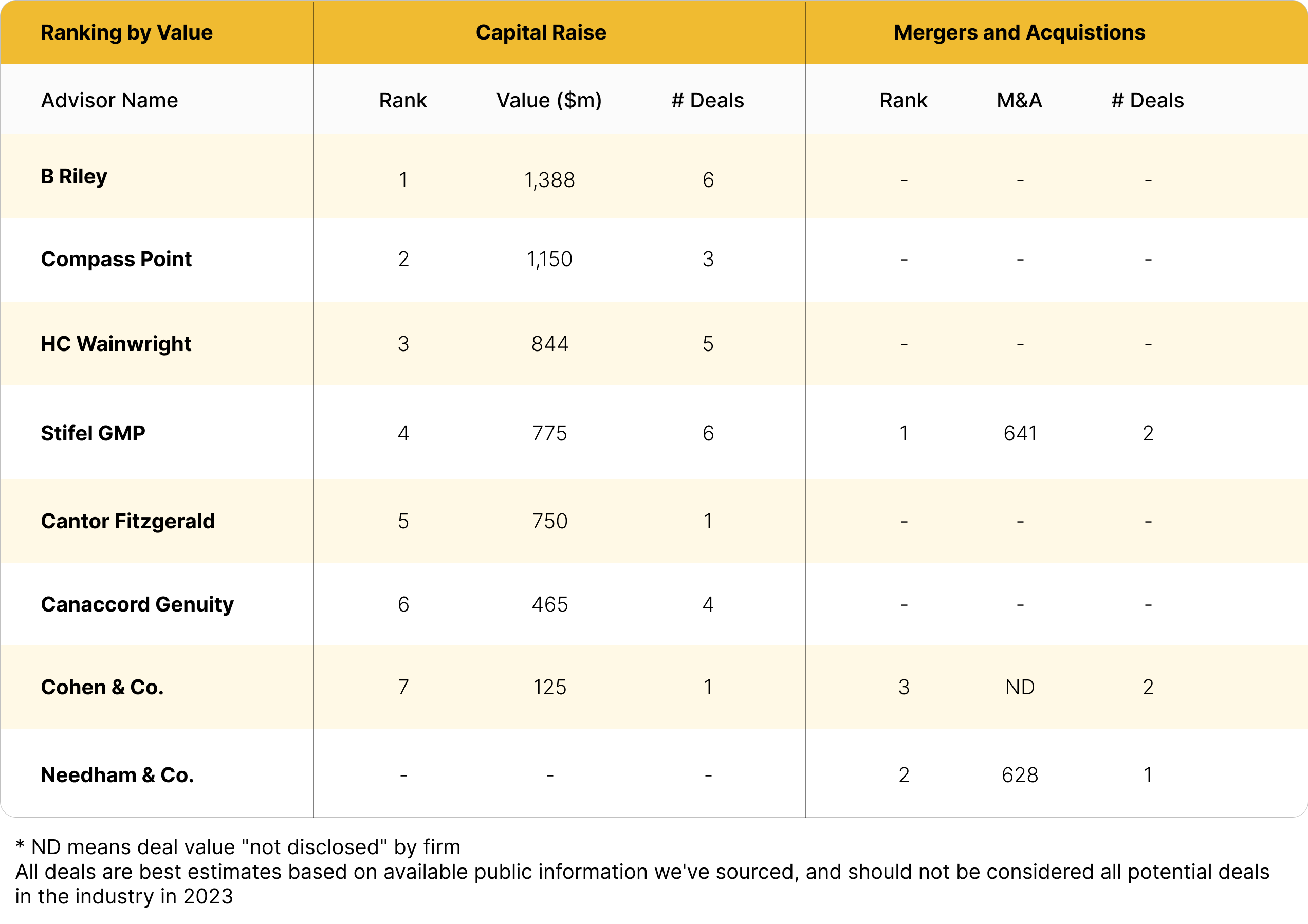

Stifel Financial Corporation advised both the US Bitcoin and Validus Power deals, making the firm one of the leads in Bitcoin mining M&A this year. Details of bitcoin mining capital raises and M&A from the most active investment banks in the industry are shown below.

Investment Banks - Deal Values for Bitcoin Mining Companies

Now, let's take a look at the faces behind the deals. For the rest of the article, we recognize the leading investment bankers who help broker some of the largest deals in the Bitcoin mining industry in 2023.

1. Christian Lopez | Cohen & Company

Christian Lopez is the head of blockchain and digital assets at Cohen & Company Capital Markets. Christian has 5+ years experience advising fintech companies on merger and acquisitions. He brings a depth of knowledge advising fintech clients on strategic transactions including new capital raises and has been part of some of the largest public offerings in Bitcoin mining. Christian holds an MBA from the Columbia School of Business.

Deals in 2023:

- Advised on Northern Data 300 MW mining site in Corpus Cristi Texas.

- Advised Arkon Energy's acquisition of a 200 MW site in Ohio

- Blockstream $125m convertible debt offering

Historical Deals:

- Cipher mining $425 million go-public SPAC deal

2. Ruben Sahakyan | Stifel GMP

Ruben Sahakyan is a director of investment banking at Stifel Financial Corp. Ruben has been the go-to banker for Canadian and US Bitcoin miners raising capital and has advised on a number of strategic transactions. He holds an Honours Bachelor of Commerce degree from the University of Toronto and is a CFA Chartholder.

Deals in 2023:

- Financial Advisor to Hut 8's $595 million merger with US Bitcoin and Validus Power asset purchase

- Riot Platforms $750 million at-the-market offering

- Hive Blockchain $100 million at-the-market offering

- Hive Blockchain amended $90 million at-the-market offering on Nasdaq

- Hive Blockchain $25 million bought deal warrant offering

- Financial Advisors to unsecured creditors in Core Scientific bankruptcy

Historical Deals:

- Argo Blockchain sale of Helios site to Galaxy Digital

- Hut 8 Mining acquisition of TeraGo for $30 million

- Argo Blockchain IPO for $112 million

- Voyager Digital private placement ($146 million gross proceeds)

- Joe Nardini | B. Riley Securities

Joe Nardini is senior managing director at B. Riley Securities. Joe brings over 20 years of investment banking experience. As the acting head of cryptocurrency investment banking at B. Riley, he advises Fintech growth companies on potential strategic or go-public opportunities. Joe and his team have been at the top of the charts for helping American Bitcoin mining companies raise capital. Joe holds an MBA from American University.

Deals in 2023:

- Bitdeer $150 million capital raise SPAC IPO

- Iris Energy $300 million at-the-market equity offering

- Riot Platforms $750 million at-the-market equity offering

- Core Scientific $70 million restructuring DIP financing

- Applied Digital $50 million promissory note

- Canaan $68 million at-the-market equity offering

Historical Deals:

- Greenidge buy-side advisor merger with Support.com to go-public valued at $2.1 billion

- Terawulf $200 million at-the-market offering

- Greenidge 8.50% senior unsecured debt note raise for $55.2 million

- Core Scientific $75 million debt offering

- Argo Blockchain 8.75% senior unsecured note raise for $40 million

4. Craig Schwabe | H.C. Wainwright

Craig Schwabe is a managing director at H.C. Wainwright, who has helped lead the firm into blockchain and Bitcoin mining for the past decade. He is another go-to for American mining companies looking to do capital raises and also has raised the most PIPE structures within the Bitcoin mining space.

Deals in 2023:

- Marathon Digital $750 million at-the-market offering

- Bitfarms $60 million private placement offering

- Stronghold Digital Mining $15 million at-the-market offering

- Marathon Digital $14 million private placement offering

- Mawson Infrastructure follow-on offering for $5 million

Historical Deals:

- Advised Cleanspark on $33 million purchase of Mawson's Sanderville site

- Mawson Infrastructure $45 million go-public offering.

- Cleanspark $500 million at-the-market equity facility

- Canaan $750 million at-the-market equity facility

- Marathon Digital US $650 million 1% convertible note debt raise

5. Jason Partenza | Canaccord Genuity

Jason Partenza has 20+ years of experience advising leading growth companies and their investors on capital raising and strategic transactions, and he has advised a number of Bitcoin mining companies on capital raises. Jason holds a Bachelor of Science in Finance from Georgetown University.

Deals in 2023:

- Hive Blockchain $25 million bought deal warrant offering

- Co-agent for Cipher mining's $250 million at-the-market offering

- Hut 8 $100 million at-the-market offering

- Hive Blockchain $90 million at-the-market offering

Historical Deals:

- Iris Energy IPO funding deal worth $232 million

Investment Bank Honorable Mentions

Compass Point Trading and Research

Compass made notable gains into the Bitcoin mining sector, supporting a fair number of at-the-market offerings in 2023. The firm led as co-managers in some of the largest known at-the-market offerings during the year.

Top Deals:

- Co-manager for Riot Platforms' $750 million at-the-market offering

- Co-manager of Terawulf's $200 million at-the-market offering

- Co-manager of Cipher Mining's $200 million at-the-market offering

Cantor Fitzgerald & Co.

Known for their expertise across various industries, Cantor continued advising and supporting at-the-market offerings in 2023.

Top Deals:

Riot Platforms $750 million at-the-market offering

Other Notable Transactions in 2023

Hut 8 purchased assets of Validus Power in partnership with Macquarie Finance for $46 million. Four power plants were acquired with an available capacity of 310 MW.

Marathon Digital bought Generate Capital assets to expand their proprietary mining and break into hosting. The deal is worth $179 million cash consideration for 390 MW of mining capacity.

Cipher Mining acquired large mining site Black Pearl in Texas to expand it to a 300 MW mining facility. Mining site will come online in 2025

Northern Data bought a 300 MW datacenter site in Corpus Cristi, Texas. Northern Data expanded into AI compute in 2023 with a large purchase of NVIDIA GPUs using $610 million debt financing from Tether.

Millennium Power bought Gibbon Creek power facility in Texas to support expansion of their datacenter operations.

Research Analysts Covering the Mining Space

Finally, we'd also like to recognize the research analysts that have provided exemplary financial coverage of the Bitcoin mining industry this year. In no particular order, the table below showcases the top Bitcoin mining analysts for investment firms.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.