The Efficiency-Adjusted ASIC Price: A New Way to Measure ASIC Miner Value

Introducing the Efficiency-Adjusted ASIC Price metric, a new method for evaluating ASIC miner prices.

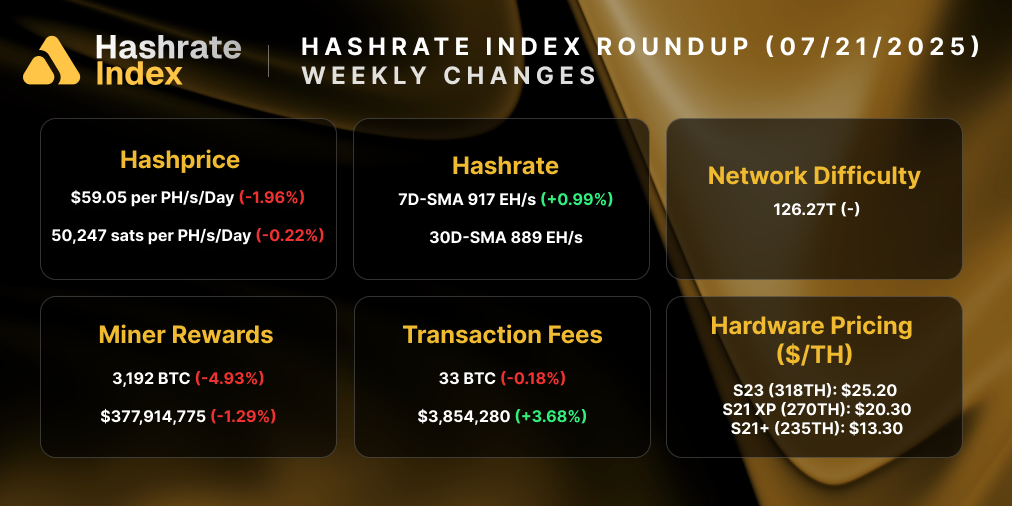

When Bitcoin miners or analysts evaluate an ASIC miner’s price, they adjust for the output of the machine. This approach makes sense; a higher hashrate ASIC model should generally have a higher price, and pricing an ASIC in dollars per terahash ($/TH) is an industry standard for valuing a machine based on its output.

While somewhat helpful, this metric fails to account for an ASIC miner’s most important specification: efficiency. And more specifically, it fails to account for how efficiently an ASIC converts electricity into hashrate. If we adjust an ASIC’s price for its hashrate, we should do the same for efficiency. An ASIC that converts electricity into hashrate at a more efficient rate should have a higher price than hardware that does so less efficiently.

To account for this metric, we propose a new way to measure an ASIC’s price: the Efficiency-Adjusted ASIC Price, which evaluates an ASIC’s hashrate-adjusted price ($/TH) per unit of efficiency (TH/kW). While it is only one variable in a complicated analysis, it can serve as a useful benchmark for ASIC traders when evaluating market opportunities.

The Old Metric: Hashrate-Adjusted ASIC Price ($/TH)

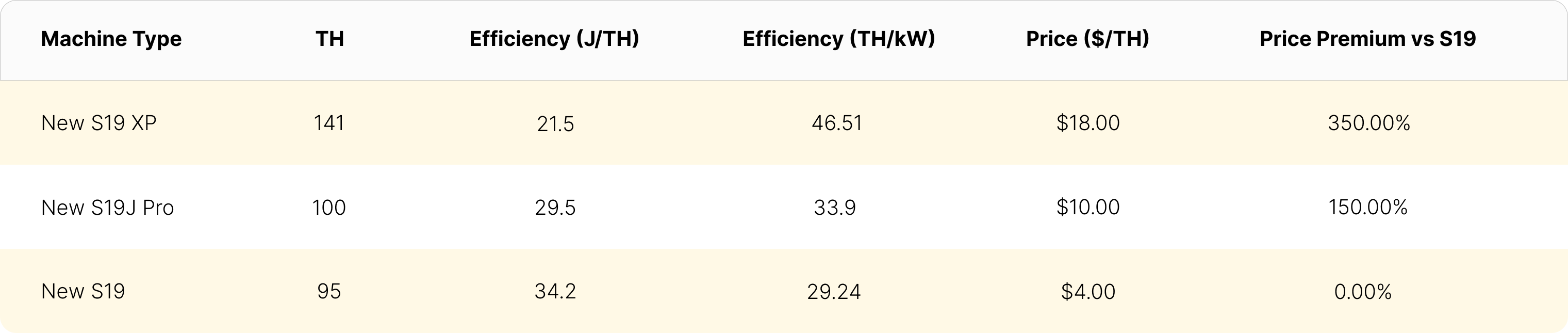

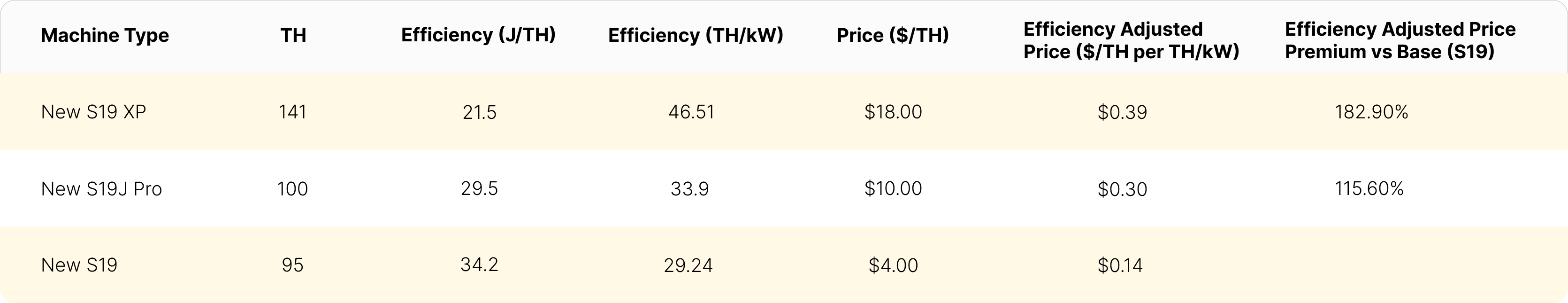

Analysts across the Bitcoin mining industry have used an ASIC miner’s price per terahash – the hashrate-adjusted ASIC price – for years. A common comparison is the $/TH percentage premium on higher-efficiency ASICs versus a lower-efficiency baseline model. As an example in the table below, we compare the dollar per terahash price of the S19 to the S19j Pro and S19 XP and the respective percentage premium of a model’s hashrate-adjusted price.

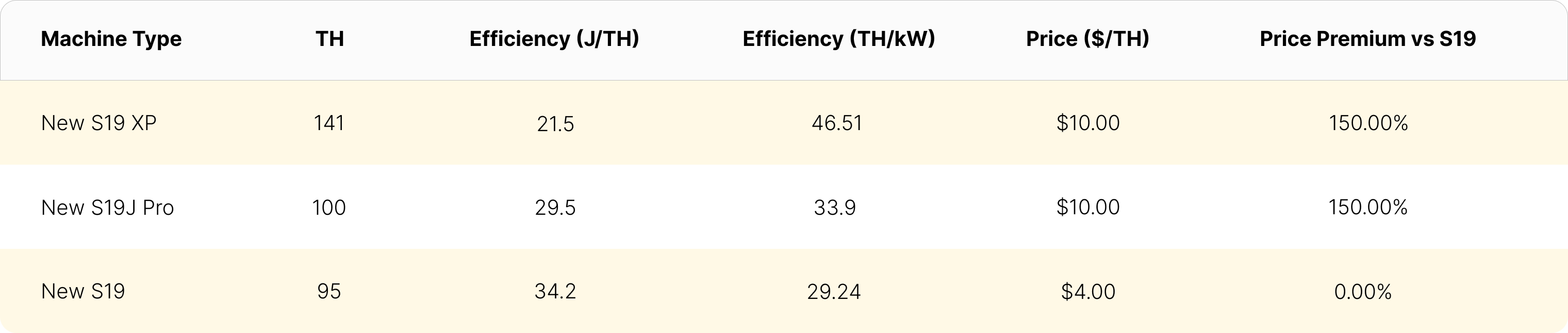

While this metric is important, it fails to directly consider efficiency – a key determinant of an ASIC miner’s economic performance. To provide an obvious example of what is missing by considering only the hashrate-adjusted price, in the table below we assume that the S19j Pro and the S19 XP are listed at the same price per terahash. In terms of the hashrate-adjusted ASIC price ($/TH), both models would be priced at an equivalent 150% premium to the S19. However, since an S19 XP has a better efficiency profile than a S19j Pro, it is clearly a much better purchase. As such, an S19 XP should demand a higher percentage premium on an efficiency adjusted basis when compared to an S19.The typical hashrate-adjusted ASIC price measure misses this completely.

The New Metric: Efficiency-Adjusted ASIC Price ($/TH per TH/kW)

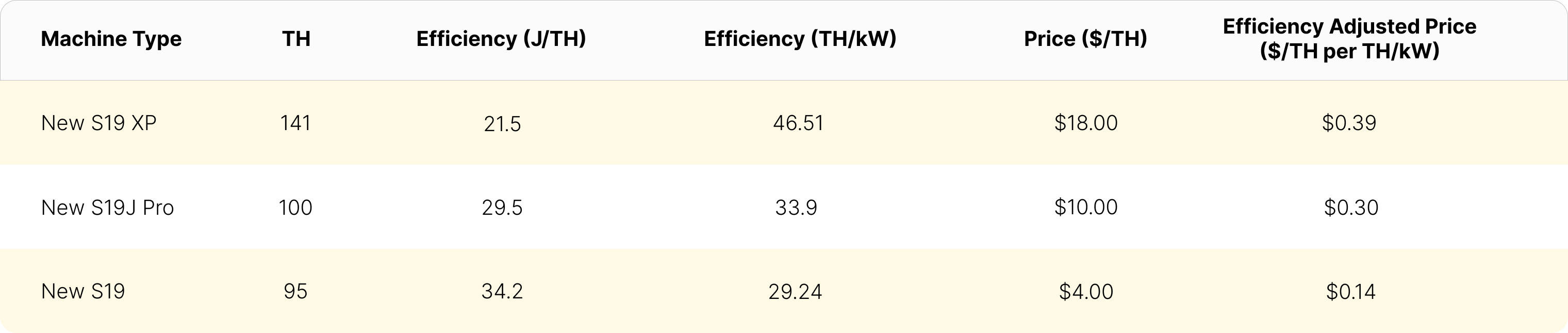

When comparing different models, you want to consider not just the upfront cost (in dollars) but also how efficiently each ASIC miner uses electricity to generate computing power for mining. To account for efficiency across models, we propose an Efficiency-Adjusted ASIC Price which looks at the dollar per terahash price ($/TH) relative to its efficiency at converting electricity into a terahash (TH/kW). The formula is as follows:

Efficiency-Adjusted ASIC Price = ($/TH) ÷ (TH/kW)

By factoring both hashrate and efficiency, we can more accurately compare different models by considering not just their upfront cost per terahash, but also how efficiently they use electricity to mine. A lower Efficiency-Adjusted ASIC Price could be better for some buyers because, all else equal, it means they’re getting more mining profit for their money, taking both hashrate and efficiency into account.

We've calculated the Efficiency-Adjusted ASIC Price for three Bitmain models based on their market value ($/TH) and efficiency denominated in TH/kW. For the S19 XP, it currently comes in at $0.39/TH per TH/kW, revealing a $0.09 premium compared to the S19J Pro and a $0.25 premium compared to the S19. This breakdown provides a straightforward comparison of the cost differences between these models, adjusted for efficiency.

This model can be refined to factor in after-market firmware such as LuxOS, that can increase efficiency of an S19J Pro to 26-27 J/TH depending on operating conditions. Some models are better suited for LuxOS-induced performance increases, and miners can factor this in when they conduct analysis.

To enhance the Efficiency Adjusted Price comparison, we can introduce a premium calculation by designating a "base" model, such as the S19 in the example below.

This allows for a clear assessment of premiums or discounts for other models in relation to the base. This approach provides valuable insights into price differentials, particularly when a newer machine with higher efficiency demonstrates a lower efficiency-adjusted price compared to an older model, signaling a potentially more favorable investment.

Any metric must be interpreted with caution. A metric may be useful for understanding the mechanics of the ASIC market and to conduct scenario or time series analysis under various assumptions. It is not a completely accurate detailed mapping of the price or economic value of a particular ASIC or prediction for the future. Different assumptions and interpretations will produce different results.

Trend Analysis: Efficiency-Adjusted ASIC Prices and Premiums

Analyzing Efficiency-Adjusted ASIC Prices and their premiums offers valuable insights into market dynamics, indicating shifts in supply and demand relative to economic profiles. We believe this metric is most powerful for trend analysis.

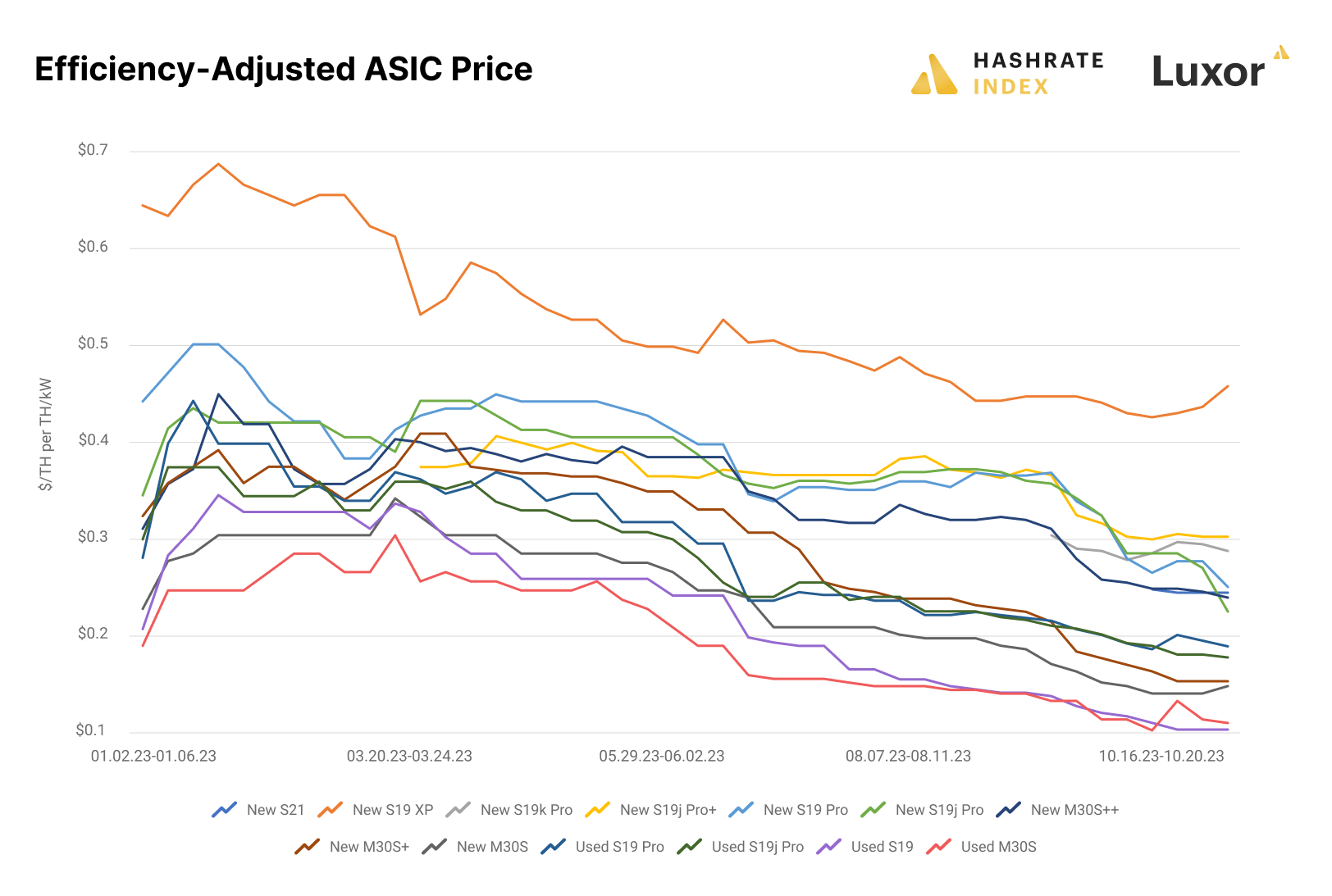

The chart below depicts the price trends of major models, showcasing a decline in values over time and offering insights into the overall market.

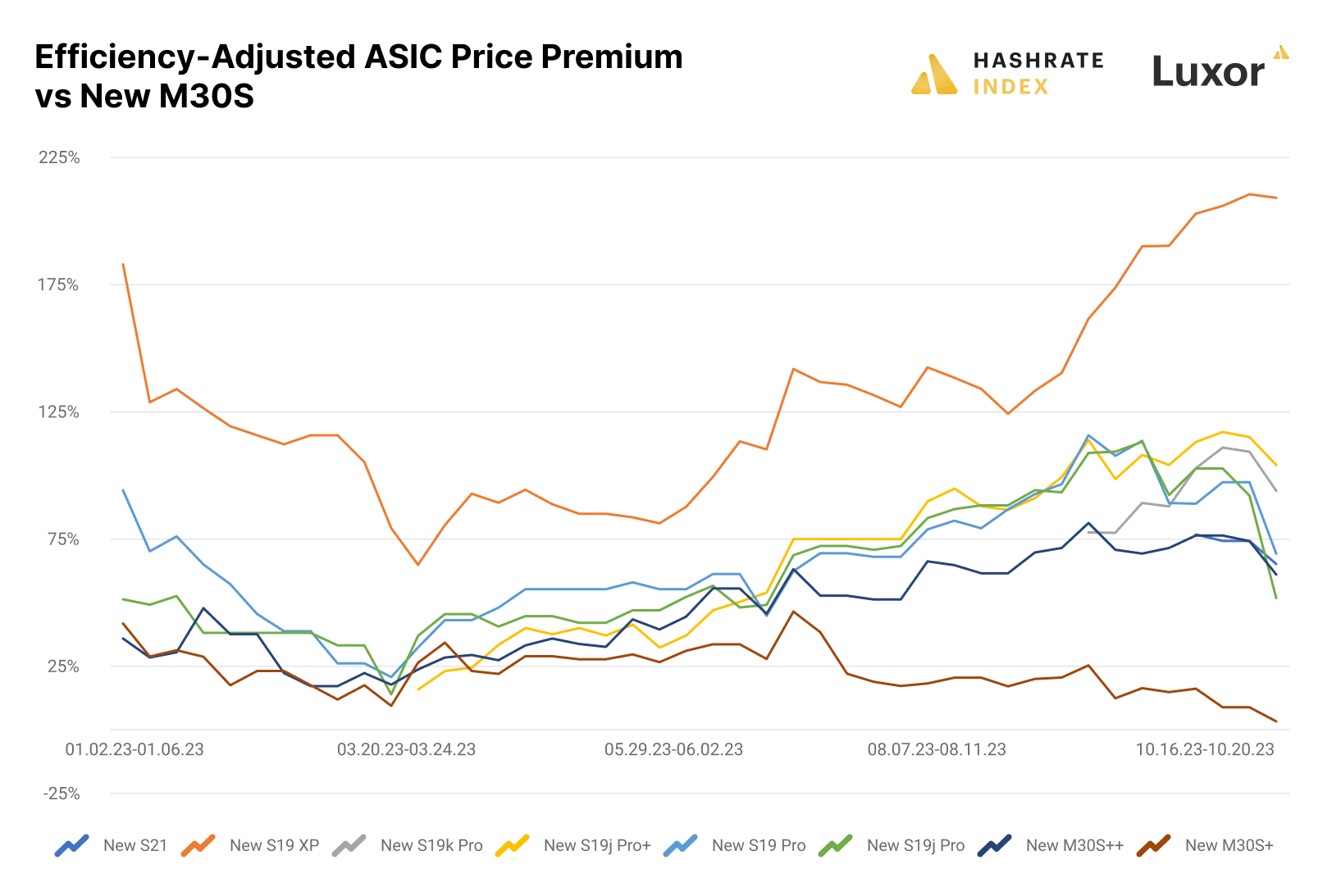

To enhance the comparison of machine prices, we conducted a trend analysis on the premium over the base model. We segmented new and used machines to minimize noise and selected the least-efficient model (M30S) as the baseline. This approach reveals intriguing trends in premiums, offering valuable information for ASIC trading decisions.

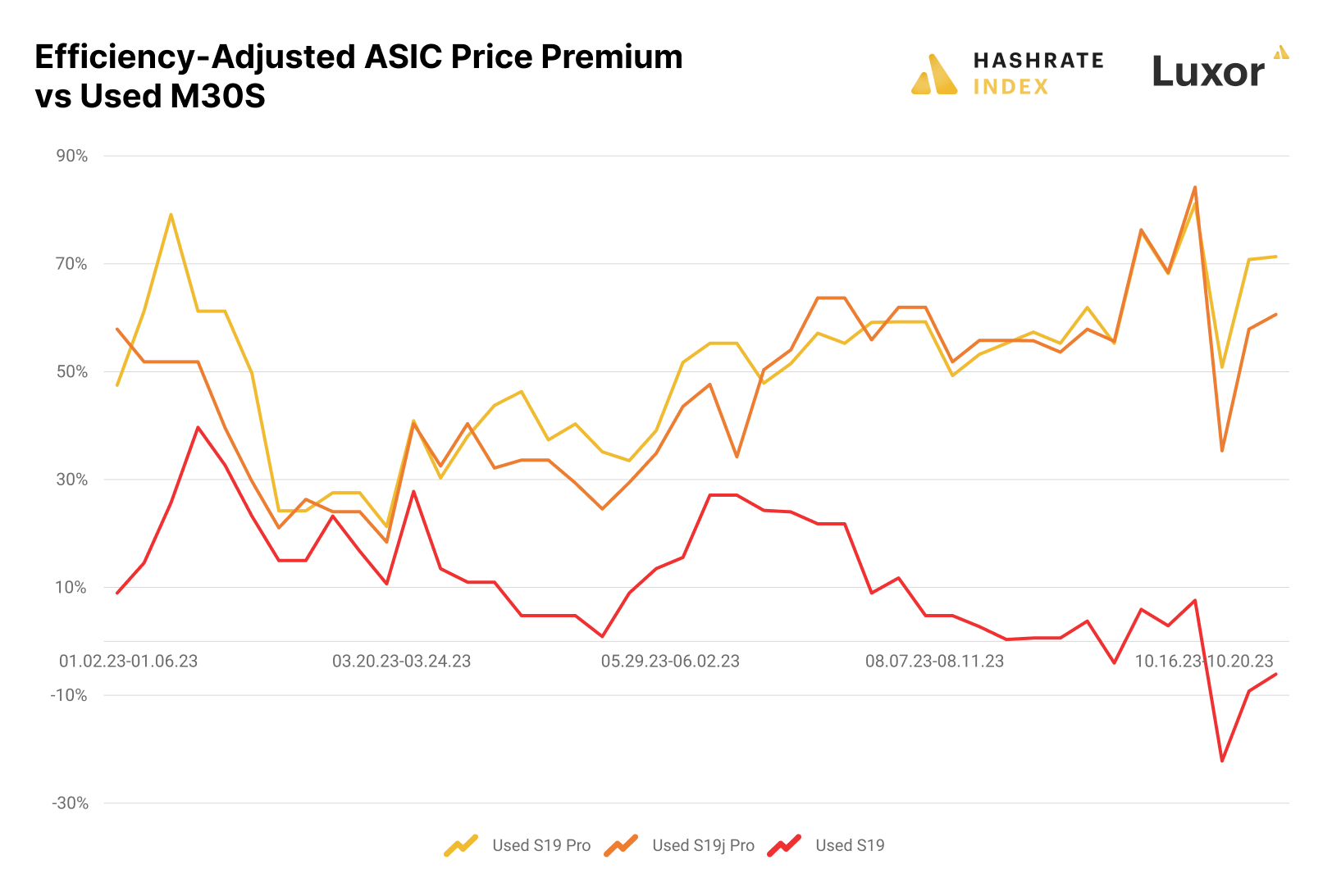

A noteworthy period emerges when the S19 becomes more cost-effective on an efficiency-adjusted basis than the M30S, signaling a potential surplus of used S19 units and presenting an attractive buying opportunity.

Efficiency-adjusted ASIC pricing can also be useful for discovering value in ASIC models that are part of the same generation. For example, both the S19 XP and S19k Pro are classified as next-generation ASIC models, the S19 XP with an efficiency of 21.5 J/TH and the S19k Pro with an efficiency of 23 J//TH. However, the S19 XP is often priced much higher on a J/TH basis since its models come with hashrate ratings of 134 TH/s and 140 TH/s, while the S19k Pro’s hashrate is 120 TH/s. Given that their efficiency ratings are close to identical, the efficiency-adjusted ASIC price conveys that pricing for the S19 XP is less attractive than the S19k Pro, which sports a much lower premium to the M30 and other new-generation models and is thus a more attractive buy.

Speaking to this metric’s usefulness when evaluating ASIC miners from the same generation, we can see that a used S19 is significantly undervalued when compared to its new-generation peers, the S19j Pro and S19 Pro.

On an efficiency-adjusted basis, the S19 appears as an attractive, undervalued buy that could offer the right miners faster returns on investment when compared to the S19 Pro and S19j Pro.

As demonstrated and depending on each miner's situation, this metric can be useful for distinguishing undervalued ASIC miners from overvalued units. We look forward to refining this metric and invite feedback for how we can improve it.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.