How Much ETH Hashrate Can Ethereum Classic and Other Coins Absorb?

In a post-merge world, the vast majority of Ethereum's hashrate will have nowhere to go.

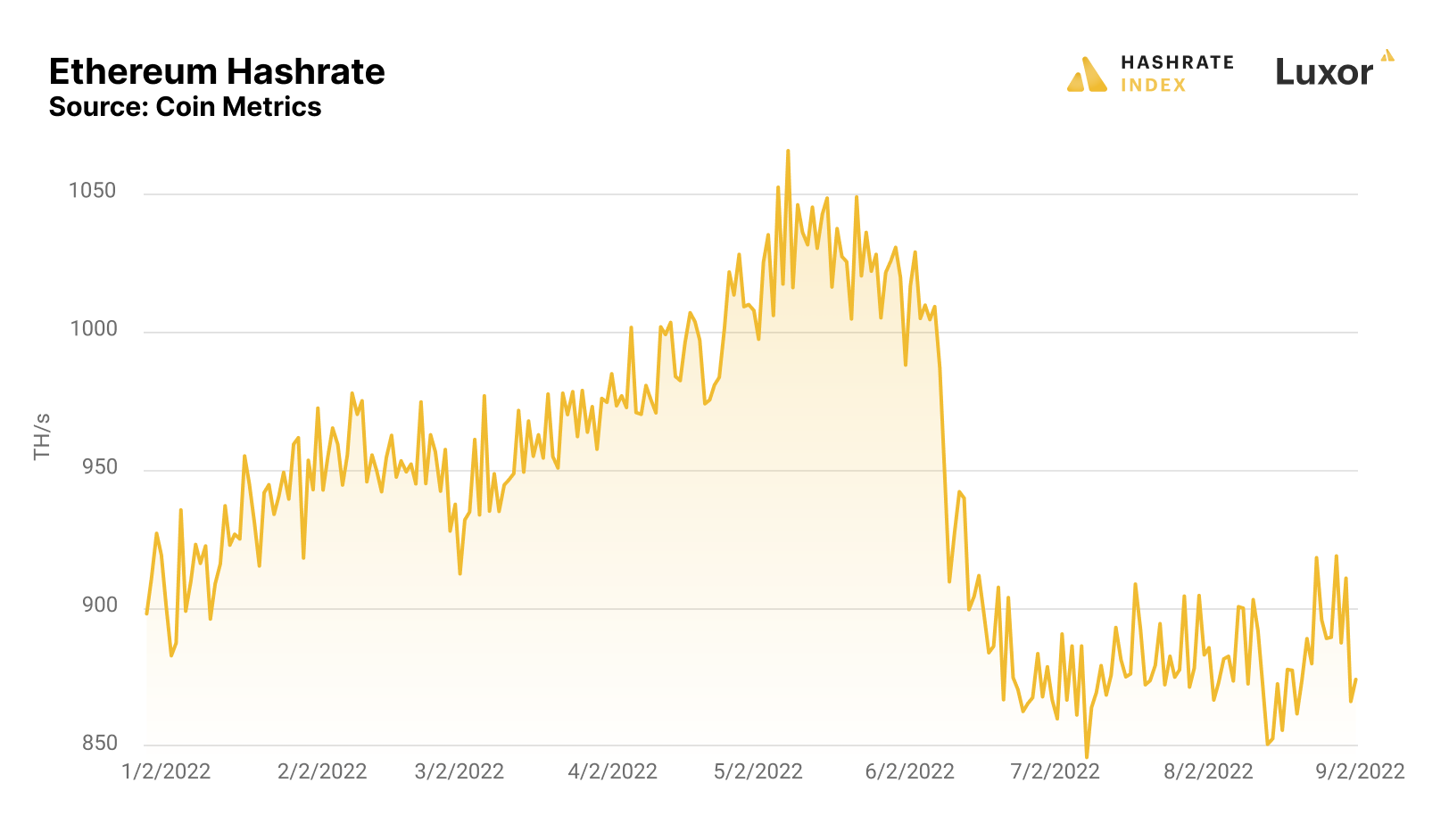

Ethereum’s merge to proof-of-stake is a week away. If it succeeds, it will mark the end of Ethereum mining as we know it, and this raises the question of what will happen to the hashrate that is currently securing the Ethereum chain.

In our first article in this series on post-merge altcoin mining, we examined the question, “What will Ethereum miners do after the merge?” The TLDR: they will start mining Ethereum Classic and other (mostly GPU-mined) proof-of-work chains, but the pickings are slim.

Today, we’re going to see just how slim they pickings are by examining how much Ethereum hashrate these alternatives can absorb based on current mining economics.

Hashrate Absorption Analysis: How Much Hashrate Can Ethereum Classic, Ravencoin Soak Up From Ethereum?

As of September 6, 2022, Ethereum’s mean network network hashrate was 874. An estimated $8 billion worth of hardware drives this hashrate.

It will be easy enough for miners to switch to Ethash alternatives and other GPU-mineable coins once the merge occurs. Problem is, there’s a limit to how much hashrate these other networks can absorb before the average miner becomes unprofitable — and it isn’t much.

More hashrate means faster blocks, which in turn means higher mining difficulty. The higher the difficulty, the fewer rewards miners can reap per unit of hashrate.

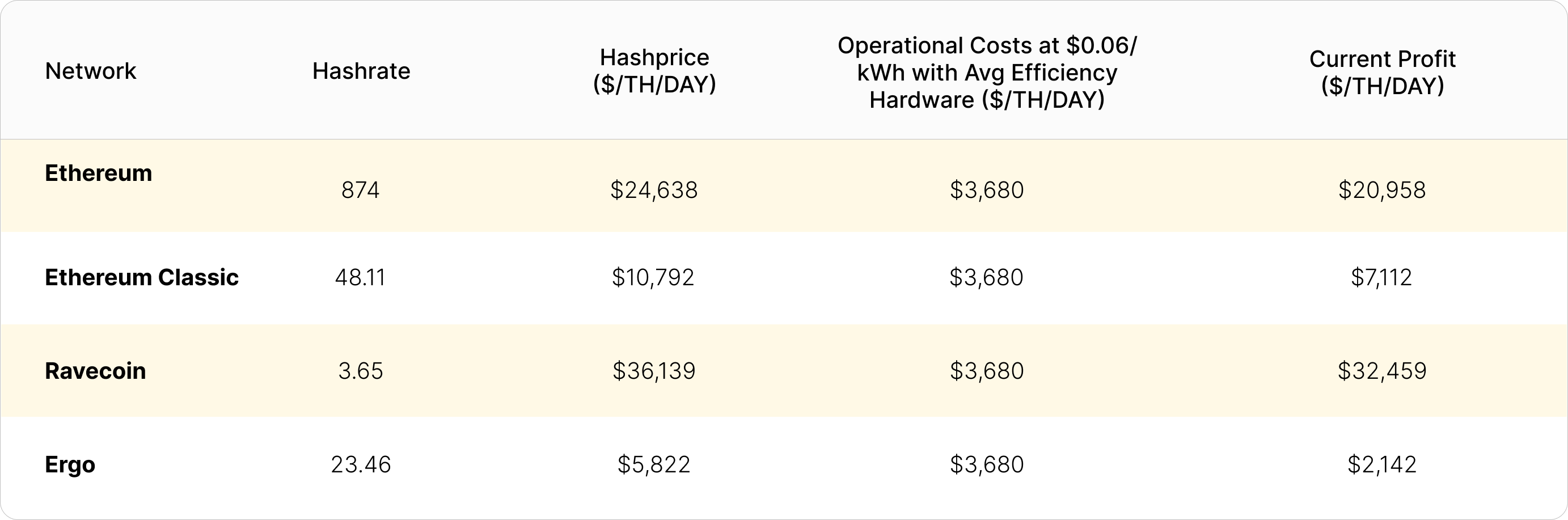

All of that to say, there are only a handful of viable PoW altcoins that can take on ETH mining hashrate after the merge, and these networks are typically much less lucrative to mine than Ethereum is currently (with the exception of Ravencoin).

(In the profitability model we unpack throughout the rest of the article, all data is current as of September 6, 2022. The model also assumes an average ETH mining hardware efficiency of 2.55 J/MH based on a weighted average calculated from Luxor business data and an average power cost of $0.06/kWh)

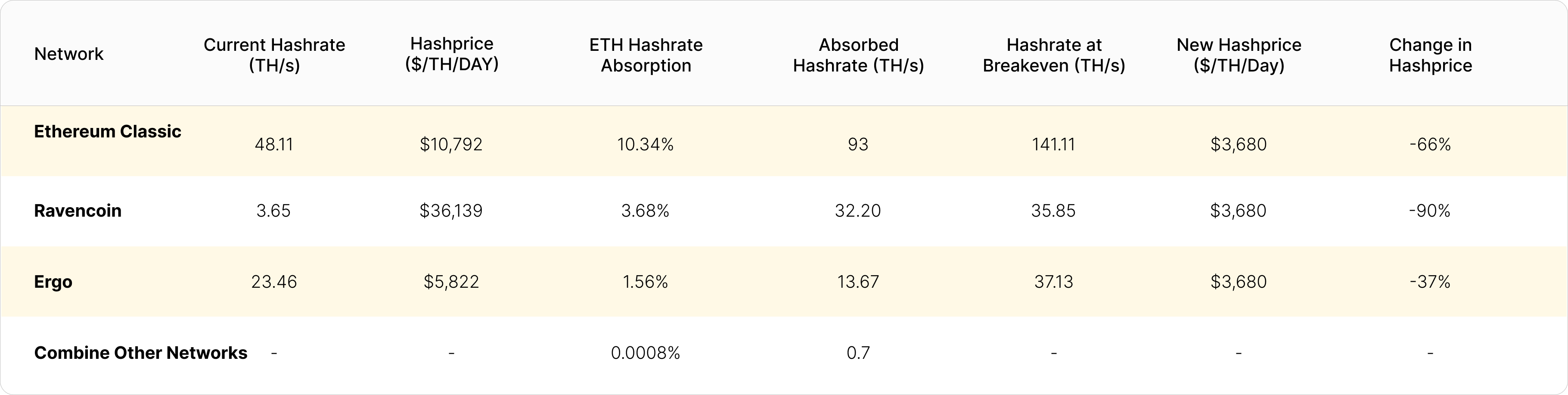

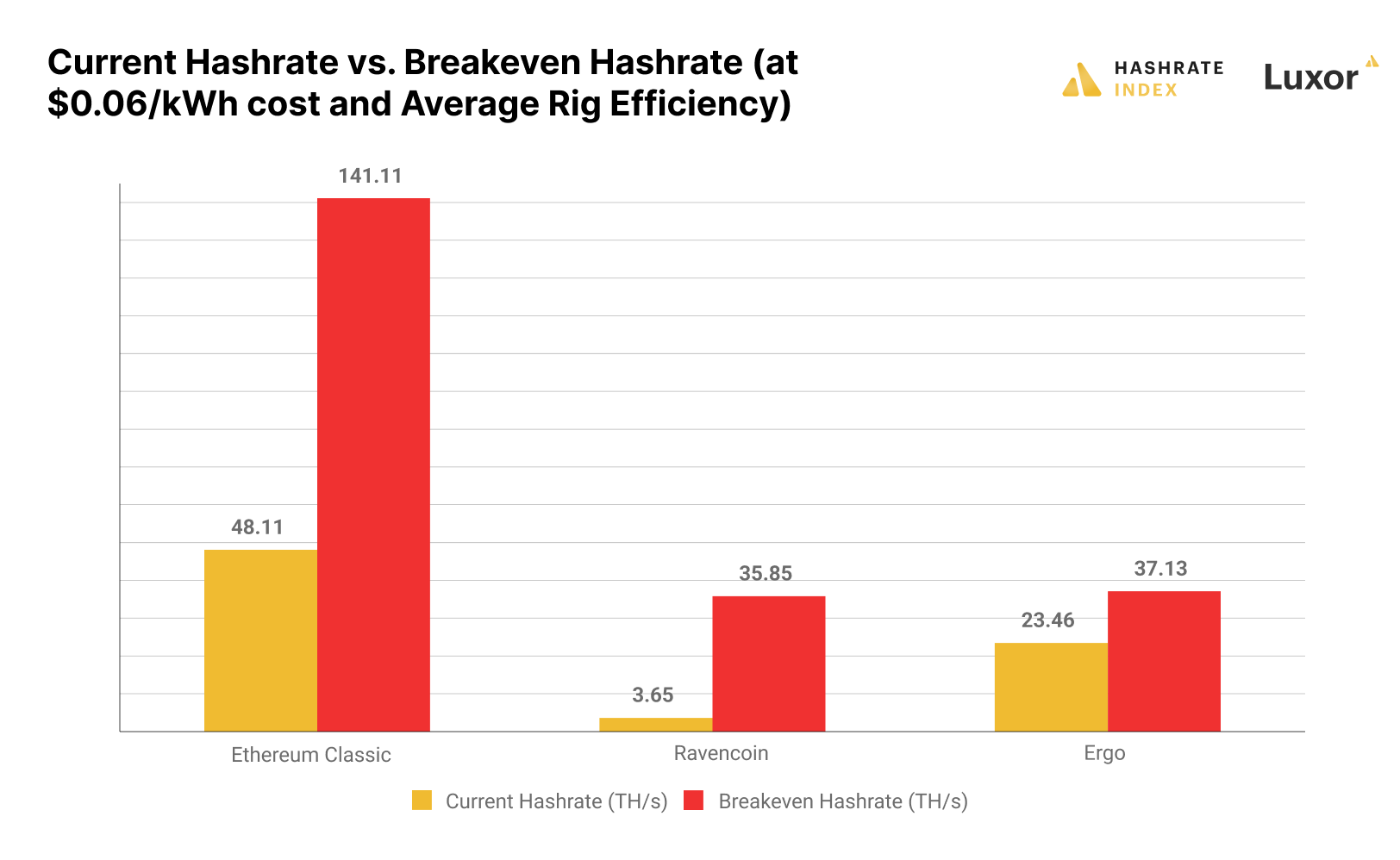

The following table examines how much hashrate Ethereum Classic, Ravencoin, and Ergo could absorb from the Ethereum network. These three networks are the best positioned to take on ETH hashrate post-merge; there are other coins that could soak up Ethereum hashrate as well, but as we demonstrate later, they are a negligible slice of the pie.

Even so, these networks collectively can only soak up 139 TH/s (15.88% of Ethereum’s current hashrate) before miners hashing at $0.06/kWh power costs with average-efficiency hardware (2.55 J/MH) will hit their gross profit breakeven point.

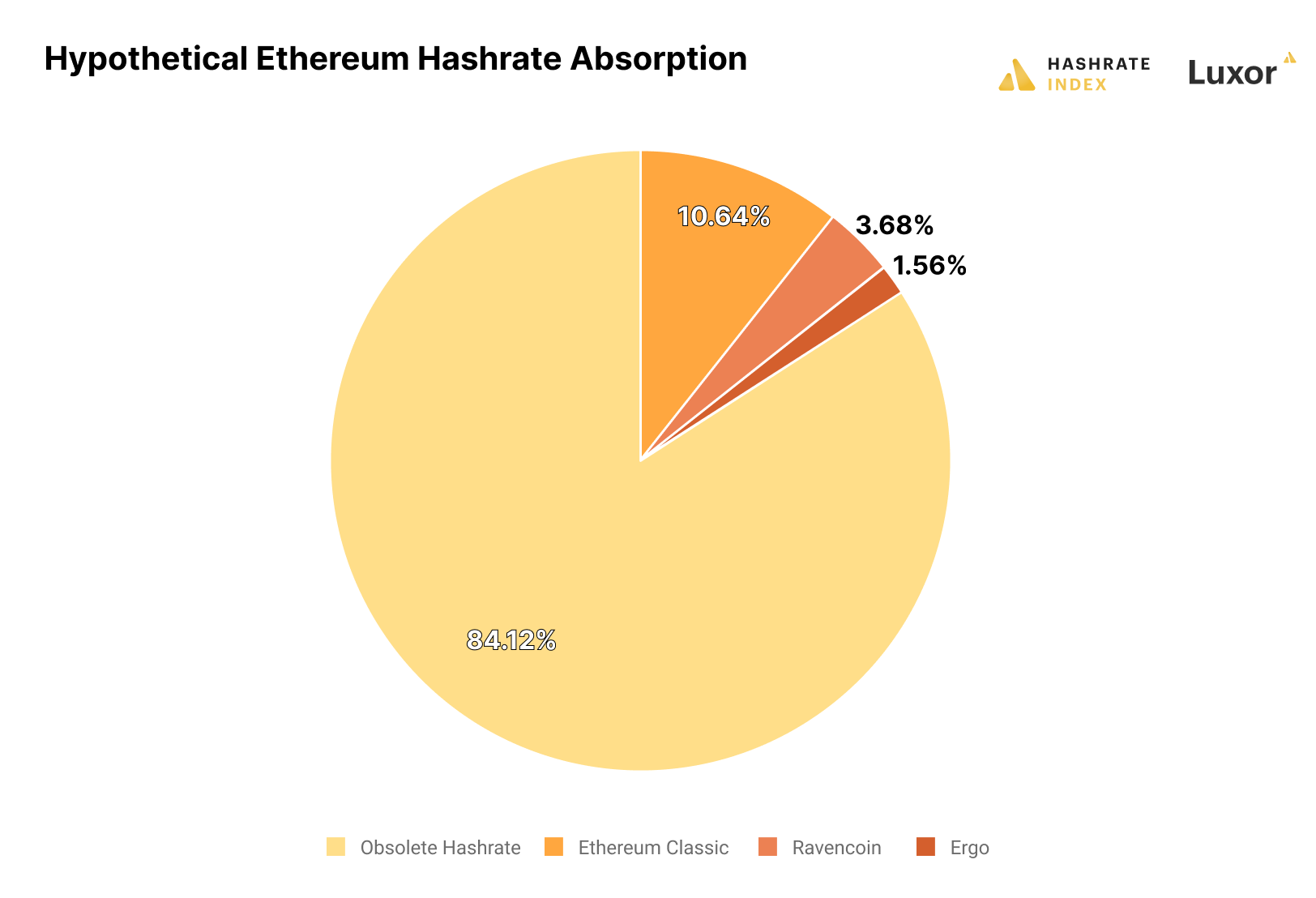

The other networks in our analysis (Beam, Bitcoin Gold, Aion, among many others) combined can barely absorb 0.7 TH/s of Ethereum hashrate.

That leaves 734.43 TH/s (84.12% of Ethereum’s hashrate) with nowhere to go, not to mention the fact that hashrate on Ethereum Classic, Ravencoin and other networks will be driven to a gross profit of $0 on average.

It’s not an overstatement, then, to call Ethereum’s merge to proof-of-stake a death knell for the GPU mining sector.

All of that said, some miners will obviously survive this profitability shakeout.

The above chart factors in an electricity cost of $0.06/kWh and a weighted average efficiency of 2.55 J/MH. Needless to say, there are miners operating at higher/lower OPEX and higher/lower efficiencies.

We expect that retail miners, most of whom are operating with residential power costs, will get squeezed out first. Unless they have the most efficient hardware available, most of these miners will not be able to turn a profit on Ethereum Classic and other alternatives (and even with the most efficient rigs, turning a profit isn't a sure bet at higher power costs).

Conversely, miners with the most efficient hardware and lowest operating costs will stay in the game longer.

In our model, for instance, an Ethereum Classic miner with $0.03/kWh power and a rig efficiency of 2.55 J/MH could withstand a total network hashrate of 282 TH/s before reaching breakeven; going further, an Ethereum Classic miner running an ASIC with an efficiency of 1.57 J/MH could withstand a hashrate of 460 TH/s.

What Will Ethereum Miners Do With Their Hardware After the Merge?

As for the scores of miners who won't be able to realize profits after the merge, what will become of their hardware?

Some may keep their rigs on the off-chance that altcoin mining economics improve, but more still will no doubt try to hawk their hardware.

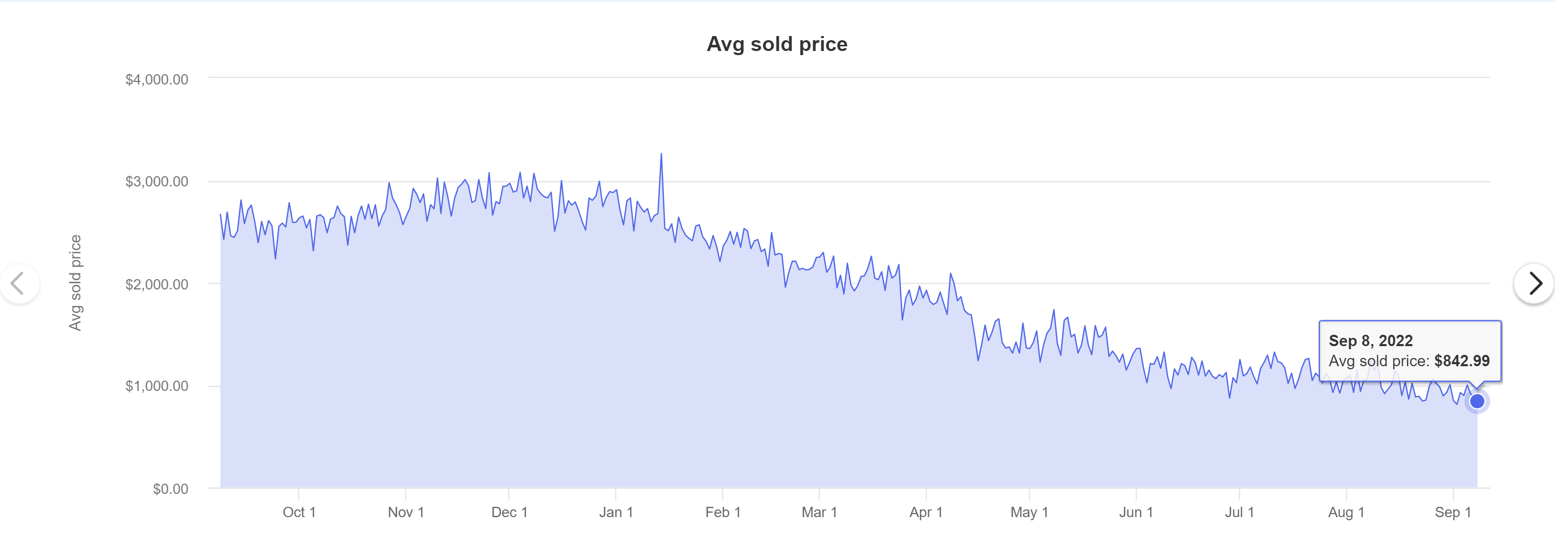

Such selling has ramped up on the used GPU market all year. The Tom's Hardware GPU Pricing Index, for instance, shows a 9.5% decrease from July to August for the average price on eBay for a Nvidia GeForce RTX 3090.

Looking at eBay’s own data for analyzing market trends, the average price for the same model is down 68% year-over-year.

We expect prices to drop even more drastically after the merge. After all, in addition to a global chip shortage, Ethereum's mining gold rush played a role in inflating GPU prices over the past year or two.

GPU Mining in a Post-Merge World

If it's successful, Ethereum's merge to proof-of-stake will indelibly alter the altcoin mining landscape. As hashrate migrates from Ethereum to other networks, most of this hashrate will become obsolete as only the most efficient, low-cost miners will survive the migrations' profitability squeezes.

We will be keeping our eyes on this situation as it evolves, both for how a post-merge world will affect hashprice on altcoin networks and GPU prices.

For our next article in this series, be on the lookout for a follow-up that looks at historic correlations between GPU prices and the hashprices of Ethereum/other GPU-mineable coins.

This article has been updated to correct the pie chart for hypothetical ETH hashrate absorption.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.