What Will Ethereum Miners Do After the Merge to Ethereum 2.0?

If Ethereum finally merges to Ethereum 2.0, miners will have to make a choice: mine other altcoins like ETC, put their trust in an opaque ETHPoW fork, or get out of the game entirely.

Ethereum’s pending merge to proof-of-stake is raising an expensive question: what will Ethereum miners do after Ethereum 2.0 launches?

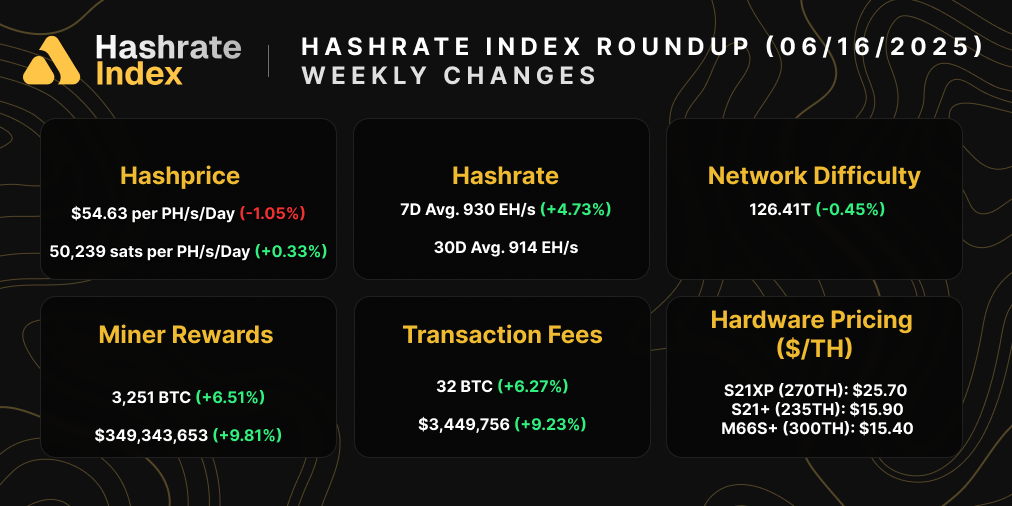

There’s tens of billions of dollars in hardware and mining profits riding on the question. And now with the merge scheduled for roughly September 15-16, ETH miners are preparing for the day when their hashrate becomes worthless on the new proof-of-stake (PoS) chain.

Presently, there are two main camps for Ethereum miners in a post-merge world:

- The (mostly Chinese) contingent who want to fork Ethereum to maintain a proof-of-work chain

- Those who will migrate to other blockhains – namely, Ethereum Classic (ETC)

The first option is controversial, obviously, and even heretical for the wider Ethereum community who are in favor of PoS. There are also a few red flags that will likely scare ETH miners away from this option, like the decision to send transaction fees to a multi-signature wallet.

On the flip side, though, altcoins like Ethereum Classic don’t harbor enough value to support all ETH miners, the largest mining contingent outside of Bitcoin’s own.

Lacking a bulletproof alternative, many Ethereum mining pools are playing a wait and see game. Most have not publicly announced their post-merge plan, because frankly, they are so accustomed to delays for ETH 2.0 that they are waiting to make a decision until they absolutely have to.

For our part, Luxor Technologies has created an advocacy group to lobby the Ethereum Foundation to keep Ethereum on proof-of-work. Others, like f2pool (via a new entity, stakefish) and Ethermine will be switching to staking services on Ethereum 2.0.

The situation is a complex, delicate, hundred-billion-dollar game of chicken. And as much as we'd rather see Ethereum stay with its tried-and-tested consensus mechanism, it's worth exploring ETH mining alternatives in a post-merge world, their consequences, and the practicalities of these alternatives.

Now with all of that in mind, let's dig in.

Same, But Different, But Still the Same: The Proof-of-Work Fork (ETHW / ETHPoW)

We’ll start with unpacking the proof-of-work fork (ETHW, also referred to as ETHPoW), because it’s the most complicated, controversial, and most consequential of the proposals on the table.

Our story begins with Ethereum Classic, oddly enough. Or more accurately, it begins with one of the principal architects of the Ethereum Classic fork: Chandler Guo.

On July 27, Guo tweeted “I fork Ethereum once, I fork again!” Of course, like with Ethereum Classic, he’s not acting alone – he’s just become the front man for the operation.

These plans have long been percolating on ETH miner Wechat and Telegram groups, and now, the group has an official Twitter page. On August 10, in a Tweet thread which likened the fork to the Biblical Exodus, the ETHPoW organizers claimed the following tenets for their initiative (which they included in the project’s manifesto):

- The fork is a fair launch with no premine or additional issuance

- Proof-of-work will be the only consensus mechanism on the forked chain

- Remove EIP-1559, removing the fee-burning mechanism in the current Ethereum

- Uphold decentralized values with no “gods” or masters

- Disband the team behind the fork within 3 years

As to whether or not they will uphold these tenets, only time knows.

1/x [ a long long thread ]

— EthereumPoW (ETHW) Official #ETHW #ETHPoW (@EthereumPoW) August 10, 2022

The Manifesto of Proof-of-Work: An Open Letter to the Ethereum Community

“He who fights too long against dragons becomes a dragon himself; and if you gaze too long into the abyss, the abyss will gaze into you.”

- Friedrich Nietzsche pic.twitter.com/rywLMQVbTw

The project has its own linktree, website, as well as a GitHub repository with code copied from the Go Ethereum implementation.

According to the project's code, the fork will come sometime on or around September 8th. In a recent Medium post, the team claims that “the codebase is ready and the testnet imminent,” while also stating that they have defused Ethereum's difficulty bomb, added replay protection, and updated ETHPoW’s chain ID.

More recently, the ETHPoW camp released the initial version of the fork. Most notably – and controversially – the team indicated that fees would no longer be burned (as they have been since EIP-1559); instead, these fees will go to a multi-sig wallet “managed by miners and the community,” the team claims. The fork’s difficulty will also be adjusted downward upon launch.

To put it mildly, the multi-sig fee treasury is a brazen choice that will no doubt be a deal breaker for many miners. At best, this choice inspires skepticism; at worst, it makes the fork look like outright chicanery.

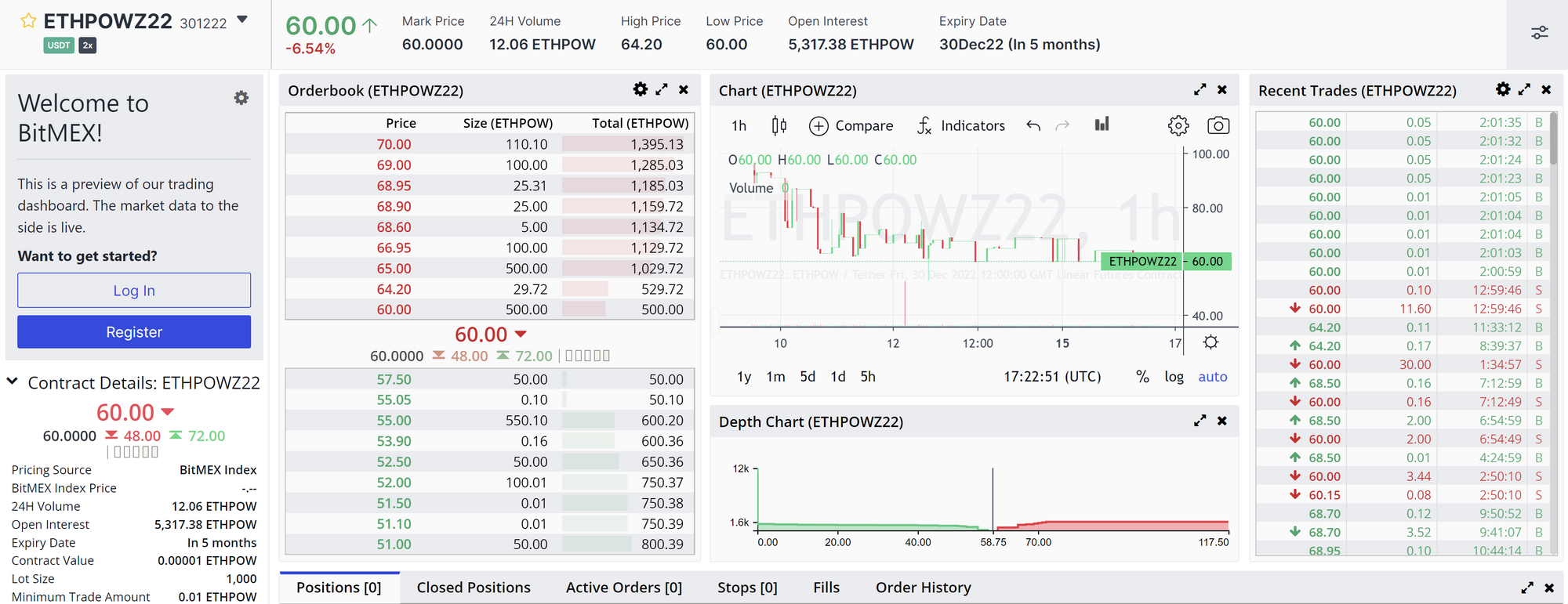

Exchanges Open Their Books to ETHPoW

I’m sure you’re all familiar with the adage, “Never let a crisis go to waste.” Well, for crypto’s casinos exchanges, that phrase could be modified to say, “Never let a fork go to waste.”

Some of the most influential exchanges have pledged support for ETHPoW (or have said that they may consider supporting it in the future). For those who have pledged outright support immediately, this means creating futures markets for the coin which will turn into spot listings should the fork succeed.

Poloniex was the first exchange to signal such support. And like gravity toppling a row of dominoes, game theory is taking care of the rest: since Poloniex made its announcement, BitMEX, Gate.io, and MEXC announced support. Additionally, Binance, Huobi, and OKEx stated that they may list forked tokens if they pass an evaluation.

With support (and potential support) from the above exchanges (and probably more to come), proof-of-work Ethereum has a playing field on which it can compete with proof-of-stake Ethereum.

But ETHPoW doesn’t just need a stadium if it wants to be competitive. It also needs fans.

What’s Past is Prologue: What ETC, BCH Can Teach Us About ETHPoW

A hard fork like ETHPoW needs economic support if it’s ever going to rise to even a fraction of the prominence of its parent chain.

Put another way, if no one buys it, it ain’t worth much, is it?

I know that’s obvious, but it’s especially important here given the fact that this fork is trying to supplant the millions of dollars in daily revenue miners reap on Ethereum. If they want even a fraction of this bounty, then ETHPoW is going to need some serious economic weight behind it.

A lot of this weight can – and will initially, at least – come from traders looking to profit from the ensuing chaos that precipitates from the fork (we examine how in a section below). But for the chain to be worth mining in the long term, you need more than short term trading. You need economic buy in, real belief in the forked chain from market participants and developers.

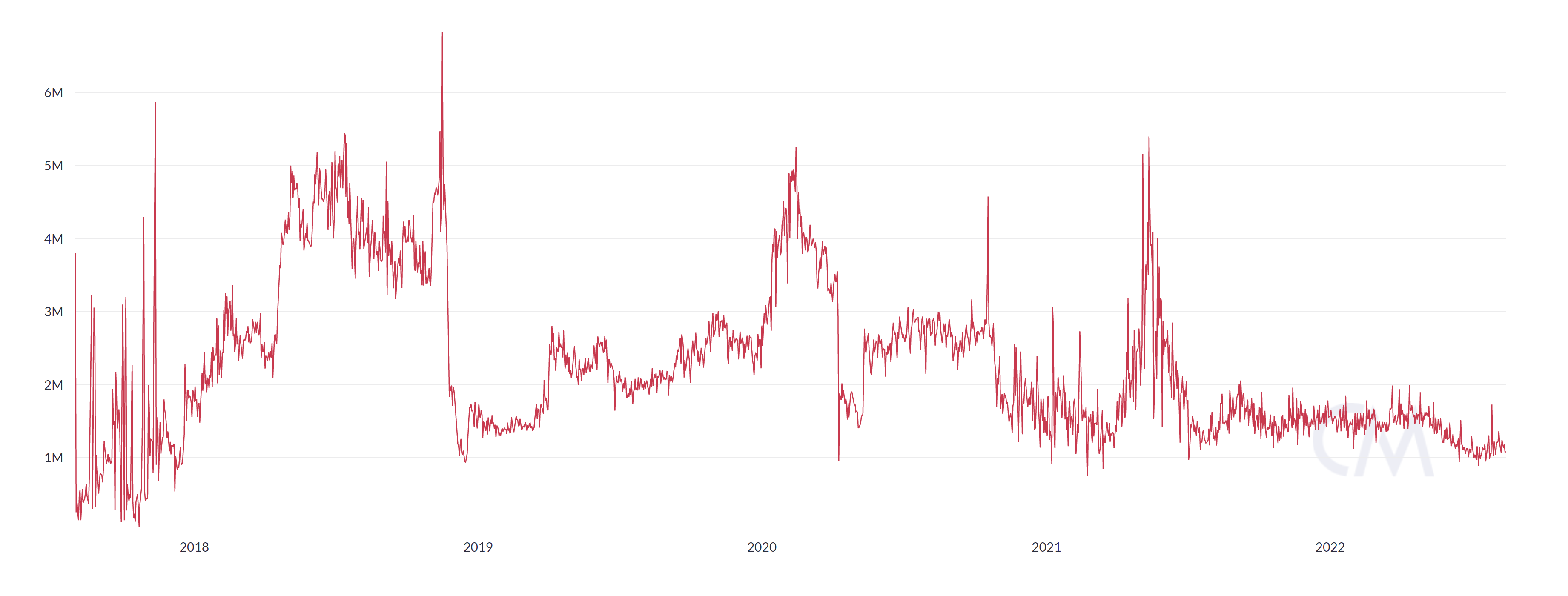

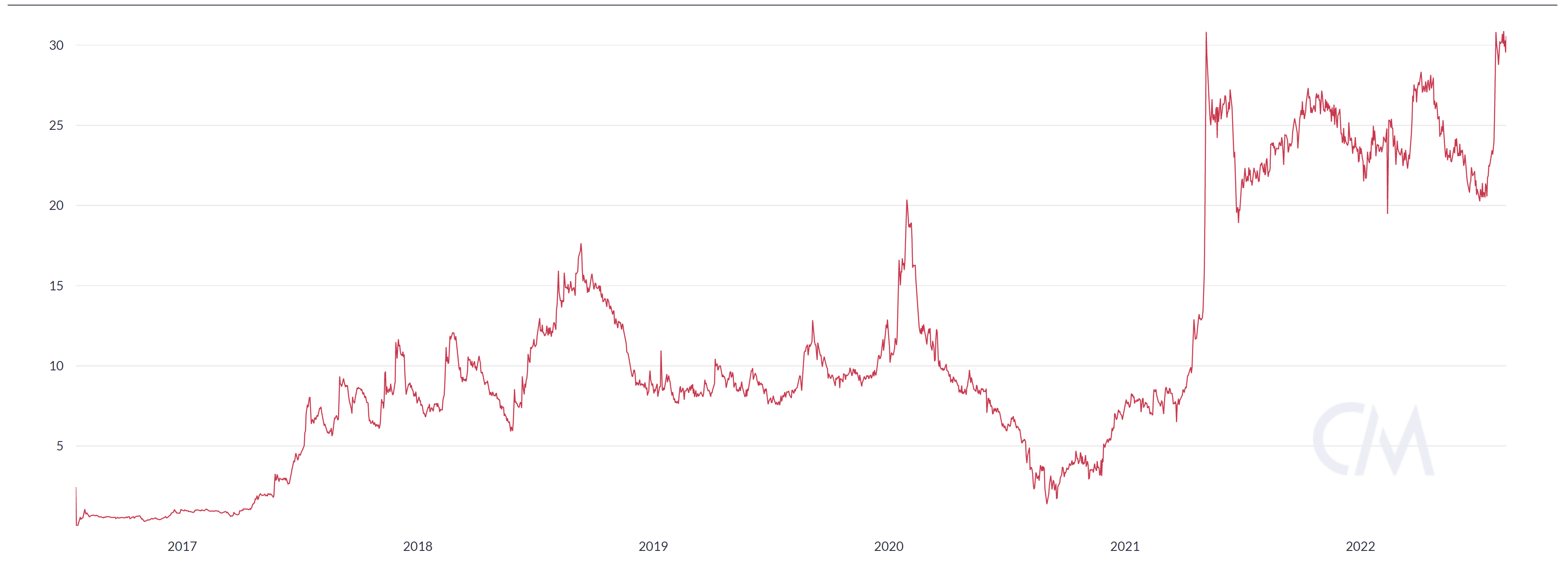

The Bitcoin Cash (BCH) hard fork and the Ethereum Classic hard fork are both good corollaries here. When Bitcoin Cash forked from Bitcoin in 2017, in the immediate aftermath of the fork, BCH’s price skyrocketed; at the peak, 1 BCH would get you 0.28 BTC! Similarly, ETC’s value surged directly after its hard fork, peaking at 1 ETC for 0.33 ETH before falling.

Both coins hit their all-time highs against their parent chains in the immediate aftermath of the forks, and both have done nothing but recede into irrelevance since. Naturally, this means that their hashrate hasn't kept up with their parent chains. For Bitcoin Cash, hashrate has only shrunk overtime; Ethereum Classic's hashrate, however, receded in the 2020/2021 bull market after Ethereum became so lucrative to mine, but it has grown nearly 6 fold since as miners prepare for the ETH 2.0 merge.

If ETHPoW miners don’t want this forked chain to go the way of these predecessors, then they’ll need to garner support from the Ethereum community and its developers.

If You Build it, They Will Come…But Who’s Going to Build It?

Indeed, the reason Ethereum has been so lucrative to mine in recent years is the thriving ecosystem of so-called DeFi applications that are built on top of it.

Without those applications, miners won’t have nearly as much revenue to capture from transaction fees or miner extracted value (MEV). Build these applications, though, and the users will follow.

Problem is, we have no indication so far that projects and developers will support this fork.

In fact, we have the exact opposite. Chainlink, the most popular oracle on Ethereum and a critical piece of infrastructure for the DeFi landscape, unequivocally announced that it would stick with PoS Ethereum.

Similarly, USDC and USDT, the largest stablecoins in the game, have both announced their intention to stick with PoS. Stablecoins are in a trickier position than other Ethereum tokens. Something like Chainlink’s LINK token, or a governance token like UNI for Uniswap, can be replicated on both chains, and their respective applications can exist in both realms.

I meant that we plan to support ETH2.

— Paolo Ardoino 🕳🥊 (@paoloardoino) July 31, 2022

But stablecoins cannot, because Circle and Tether are obligated to redeem USDC and USDT on a 1-to-1 basis; if USDC and USDT exist on both chains, they have to pick one chain to honor, and they are sticking with PoS.

Stablecoins have become so central to DeFi on Ethereum that it’s almost impossible to imagine a successful ETHPoW chain without one. Justin Sun (who owns Poloniex, by the way) is rumored to be building a stablecoin on ETHPoW.

Assuming this is built, it could help the ETHPOW cause, but the chain will also need DeFi applications and users providing sufficient liquidity for the chain to be economically viable long term. Any Joe Schmoe, anime-profile-pic Twitter anon with the know-how could technically maintain something like Uniswap or Compound Finance on the ETHPoW fork if they wanted to, but we haven't seen any efforts to do so yet; even so, you still need traders and liquidity providers to keep the liquidity pools running on these applications if they are going to be useful on ETHPoW.

Further, there’s basically no chance that popular wallets like MetaMask will support the fork (MetaMask, a ConsenSys project, has no incentive to do so). That said, these wallets would be trivial to replicate if someone really wanted to. Additionally, any ETH that has been locked up in the Beacon Chain will be inaccessible (without additional technical maneuvering), and so-called “liquid staking tokens” will be rendered useless, as well.

Chaos Theory At Its Finest

Still, even if ETHPoW doesn’t get all of the bells and whistles that have made Ethereum so popular, that doesn’t mean that it wouldn’t be profitable to mine/trade at least in the short term.

No doubt, the market melee that would follow the ETHPoW fork could be insanely lucrative for traders and miners who choose to play the fork.

The fork will copy the entire blockchain state of Ethereum, meaning that all of the applications and assets that currently exist on Ethereum will also exist on ETHPoW. This means that liquidity pools for decentralized exchanges and automated market makers like Uniswap, Compound Finance, and others will be completely replicated.

It’s highly probably that traders and miners will plunder these liquidity pools within minutes of the fork. Reason being, ETHPoW users will have plenty of non-duplicatable assets like stablecoins and wrapped bitcoin (WBTC), which do not hold value on the forked chain because their custodians will not redeem them (as we discussed above). So users will trade these assets for ETHPoW. Additionally, miners will have juicy MEV opportunities to capitalize on such trades.

(It's worth pointing out that only users with technical proficiency who run their own nodes will be able to execute these trades; there won't be any frontends for DeFi applications on ETHPoW unless someone builds them, so it's likely that all of this trading would happen on the backend).

While traders will probably want to scoop up as much ETHPoW in the immediate aftermath of the fork, it's likely that there will be immense immediate sell pressure after the cash grab. Ethereum PoS supports will sell the forked ETHPoW as quickly as possible to cash in on the forked coin. Outside of the economic incentive to capture as much value before a decline in ETHPoW’s price, any PoS supporters will also have an ideological incentive to put sell pressure on a chain they view as adversarial.

Now with all of that covered, let's shift our focus to existing blockhains that miners can mine in lieu of ETHPoW.

Ethereum Classic and the PoW Altcoin Remnant

Rather than join a new forked chain, some miners want to keep it classic post merge – Ethereum Classic, that is.

Doesn’t take a genius to figure this one, y’all. The original Ethereum chain (which split from present-day Ethereum in 2016 after the DAO hack and subsequent fracas) was probably the first thing on miner’s minds when thinking about where they would go in a post-merge world. It uses a slightly modified version of Ethereum's Ethash algorithm, and so it would be a trivial change for miners to swap their hashrate to this coin after the merge.

Antpool (Bitmain’s mining pool) is leading the effort here. The team is committing $10 million to the ETC ecosystem to develop DeFi applications – a bid to replicate the financial tools that have made Ethereum so popular in recent years, and so also replicate the mining revenues these applications have created.

Just like with the ETHPOW fork, miners will need these applications and investors/users if they hope to make up the difference in mining reward value between ETH and ETC.

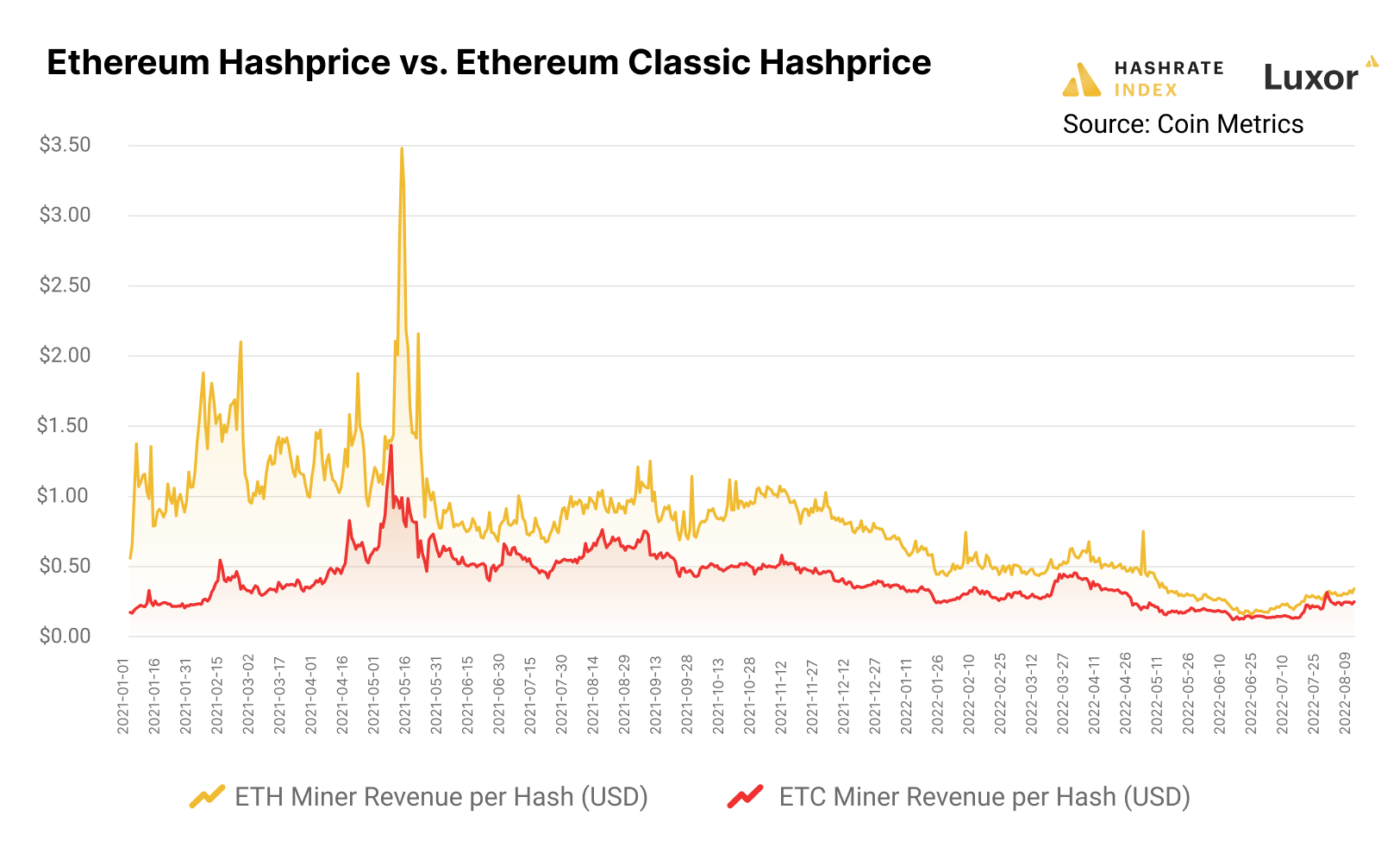

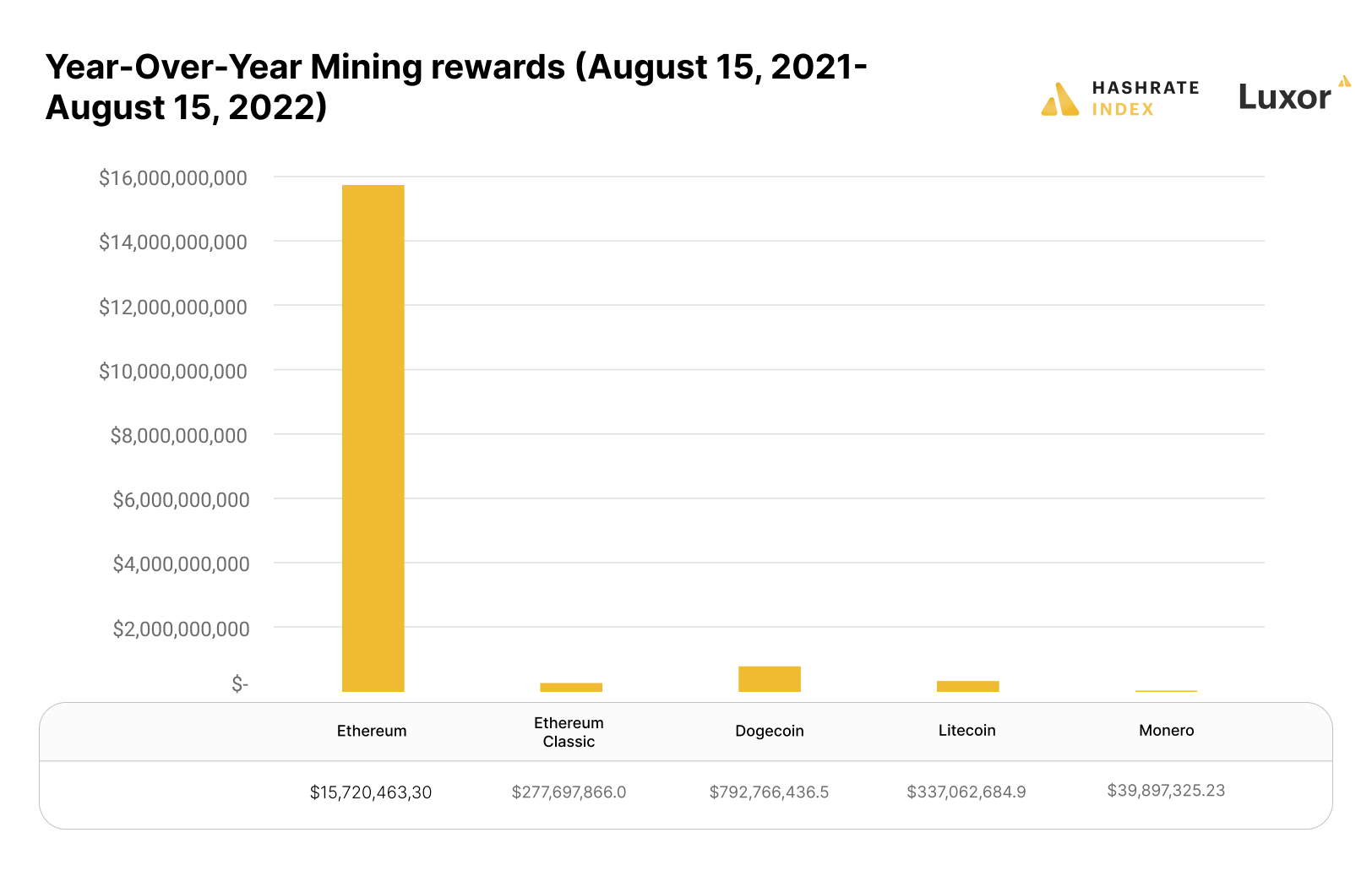

To spell out the discrepancy here: last year, Ethereum miners made $18.4 BILLION in revenue, while Ethereum Classic miners made $318.7 MILLION. That’s nearly a 60-fold difference.

The gap in total hashrate is even larger: at the time of writing, Ethereum’s real-time hashrate is 900 TH/s; Ethereum Classic’s is 30 TH/s, a 30 fold difference.

When we look at this gap in Ethereum Classic’s reward value vs Ethereum’s rewards and the difference in hashrate between both chains, it becomes clear that Ethereum Classic cannot support all of Ethereum's hashrate. There are simply not enough ETC rewards to go around.

In fact, ETC’s price would need to 50x to support all of the miners currently hashing on Etheruem.

As such, we expect that miners will converge on other coins (DOGE, RVN, LTC, to name a few) in a search for rewards. These chains, as evidenced by the chart above, will also struggle to support the second-largest mining community in crypto, however, so the best case scenario involves equal diffusion of hashrate across all of these chains (unlikely, but miners can dream).

You Can’t Go Home Again

The unfortunate fact is that, once Ethereum hash becomes homeless, there won’t be a “good” alternative for relocation.

There’s too much uncertainty with the ETHPoW fork, not to mention centralization and transparency concerns; it may be profitable in the short run, but it's unlikely to be a sustainable revenue source in the long run. For existing PoW blockchains, they don't produce enough value in mining rewards to support all of the Ethereum miners.

The best scenario for miners would be a balanced migration across various altcoins. This could happen naturally as miners search for the best yield, but even if hashrate becomes equally diffused across all of the PoW altcoin alternatives, there won’t be enough revenue to match what these miners were earning on Ethereum.

Ethereum's merge to PoS will truly be the end of an era. Without getting too dramatic about it, it will be a death knell for a large portion of the altcoin mining industry and will indelibly alter the altcoin mining landscape.

An early version of this article included an inaccurate estimate for the total value of Ethereum's mining hardware market. We have updated the article to correct this error

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.