How Much Energy Does Bitcoin Mining Use? Bitcoin Mining Council Provides New Data in Q4 2021 Update

The Bitcoin Mining Council's Q4 update provides updates on how much energy Bitcoin mining uses and how much of this energy is renewable.

On January 18th, the Bitcoin Mining Council held its Q4 2021 review, outlining the current renewable energy usage mix, electricity consumption, and overall efficiency of its members as well as providing an update on bitcoin mining industry trends.

Some quick notes and statistics from the presentation:

- Bitcoin Mining Council members now account for 46% of Bitcoin’s hashrate.

- Mining consumes roughly 0.142% of total global energy production & still uses significantly less energy than most major industries including household appliances in the US, aviation, & more.

- Mining consumes 220 tera-watt hours (TWh) of the world’s on-grid energy. This is a tiny fraction (0.44%) of the 50,000 TWh lost every year from global grid inefficiencies.

- The sustainable energy mix of council members stayed relatively stagnant quarter-over-quarter, increasing from 65.9% to 66.1% from Q3 to Q4.

- Member mining efficiency was also relatively stagnant, increasing slightly from 21.9 PH/MW to 22.1 PH/MW from Q3 to Q4..

Along with analyzing qualitative data collected from members and estimating overall network data, the hour and a half long presentation covered bitcoin mining misconceptions, the burgeoning of bitcoin mining by energy providers, and the industry’s capacity for creating new jobs in North America.

How Much Energy Does Bitcoin Mining Use? Tackling Misinformation About Bitcoin's Energy Appetite

There are still many misconceptions about Bitcoin mining in the mainstream, and Blockcap and Core Scientific Founder Darin Feinstein is keeping receipts. In his presentation, he dove into two 2017 articles from the World Economic Forum and Newsweek that claimed bitcoin mining would use all of the world's energy by 2020. A statistic that proved astoundingly wrong, as mining currently consumes a minuscule 0.142% of all global energy.

Yet, some current reports detailing bitcoin mining's environmental impact are equally uninformed.

Feinstein and Castle Island Ventures co-founder Nic Carter both keyed in on false claims from “Bitcoin’s growing e-waste problem,” a 2021 report authored by Alex de Vries and Christian Stoll, which assigned mining machines a 1.29-year life cycle and estimated that bitcoin’s annual e-waste adds up to 30.7 metric tons.

Assigning machines a 1.29-year life cycle is simply an unfounded timeline as most public miners have a minimum 3-year depreciation schedule for machines. A growing percentage of large public miners such as Core Scientific have also instituted a 100% reuse and recycle policy for chips and hash boards while some have plans to relocate older-gen machines to areas where energy is practically free, according to Marathon CEO Fred Thiel.

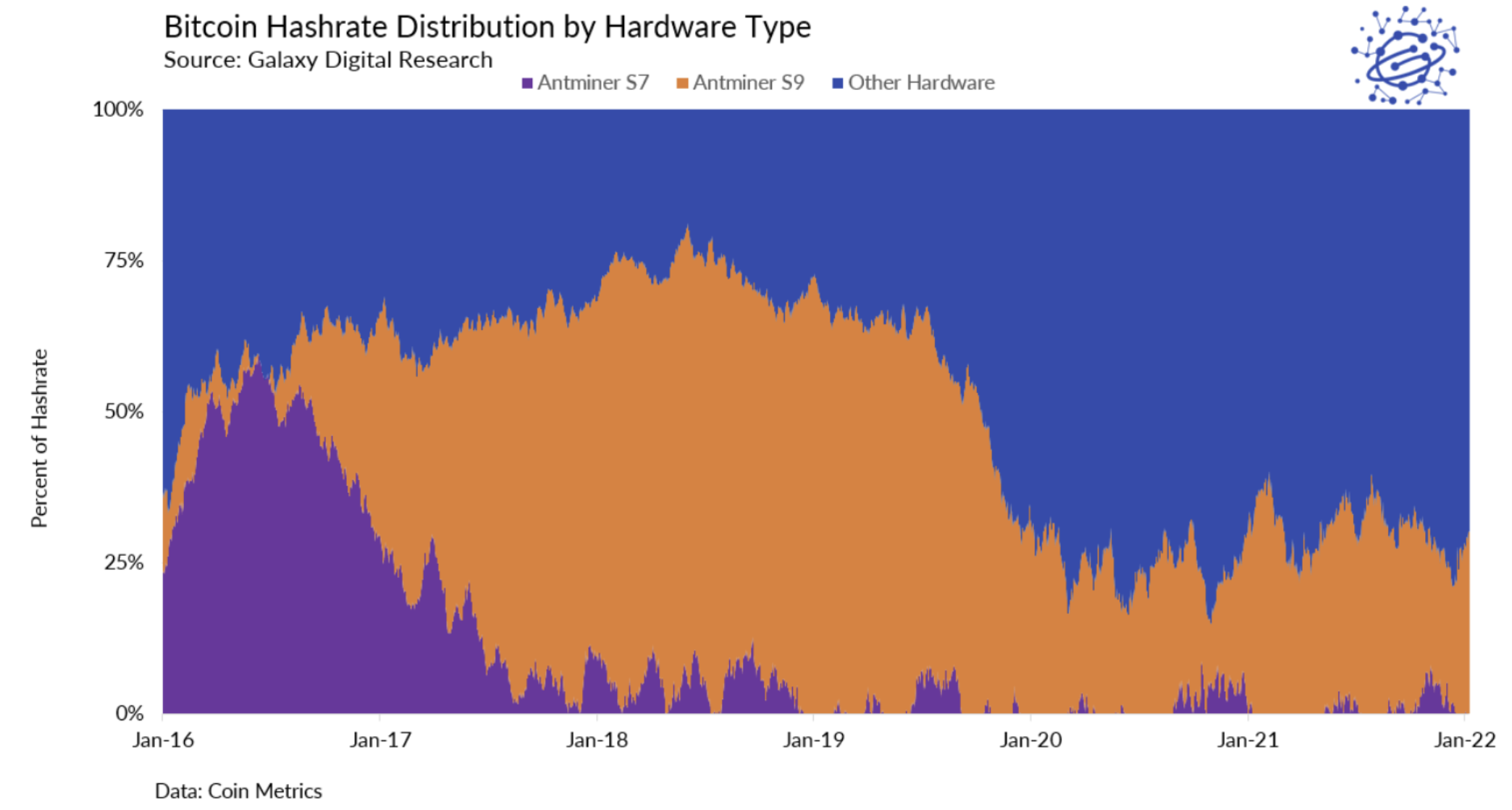

As seen below, the Antminer S9, which was released in 2016, still makes up ~25% of the network hashrate, giving it a lifecycle that is over 4x longer than the report’s estimates.

Along with this, de Vries and Stoll declared that an average bitcoin transaction generates 272g of e-waste. The entire basis of this claim misunderstands one of mining’s core functions: to secure the underlying ledger. The number of transactions is not correlated to energy usage; on-chain transactions can include thousands of outputs, and the Lightning Network can settle thousands more off-chain.

The most alarming consequence of de Vries and Stoll’s study is that the above e-waste statistics were cited by the House of Representatives Committee on Energy and Commerce in their most recent hearing analyzing the energy usage of cryptocurrencies.

The industry still has a long way to go before it secures proper and accurate representation in the US government.

Strategic Partners: Renewable Energy Companies & Bitcoin Miners

With major western nations turning towards grids that are powered by intermittent renewable energy, bitcoin mining has the potential to become a unique time-flexible load resource that can strengthen demand response programs for grid operators.

In the image below, Fred Thiel details the levels of curtailed wind and solar energy (essentially wasted) throughout the past 7 years in California, a number that continues to rise as the state installs more wind and solar power capacity.

When solar panels overproduce energy during daytime hours, if this energy is not used quickly, it is curtailed and wasted. Wind power production is highly irregular, so if massive charges of wind power are available to the grid but there’s little demand, it must be curtailed, leading to negative power prices in some parts of the state as supply outpaces demand. Vice versa, if demand is incredibly high and renewables are not producing enough electricity, grid operators are forced to shut down or limit consumer power.

Miners have the ability to become the buyer of first and last resort for grid operators, making mining the ideal controllable load response vehicle. Acting as consistent and predictable energy buyers, miners will continue to purchase renewable power during times of excess production, and inversely, they can be vital in times when demand is high because grid operators can buy back power from these miners (or shut them down if needed) rather than restrict energy to residential consumers, strengthening the overall grid.

As the western world shifts towards grids that are powered by less-reliable renewable energy sources such as solar and wind, bitcoin mining could play a synergistic role with energy providers in order to prevent consumer brownouts and blackouts.

Bitcoin Mining as a Force for Job Creation

Shifting away from the focus on the environmental consequences of mining, Jason Les, the CEO of Riot, dove into the benefits mining has presented to the community of Rockdale, Texas, where the company is in the process of building out the massive, 750 MW Whinstone facility.

The construction of the facility has revived the small community that was once home to a large aluminum smelting plant as Riot has ~160 full-time employees on-site with ~300 contractors. Riot’s engagement with the community has brought swaths of both blue-collar and white-collar jobs to this region.

This engagement has both strengthened the local energy grid and the community, a stark contrast to past instances in the US where mining operations did not engage with local communities and were inevitably shut down.

Final Thoughts

The Bitcoin Mining Council data represents less than half of Bitcoin's overall hashrate but it is still one of the best data set available to analyze the energy mix of bitcoin mining. The survey this quarter was completely anonymous and did not include renewable energy credits as counting towards a member's sustainable energy mix.

The Bitcoin Mining Council will most likely continue to expand as hashrate continues to migrate to North America and regulatory scrutiny regarding the network's energy usage is continually put under the microscope.

Photo by Matthew Henry via Unsplash

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.