Highlights from CleanSpark's Annual Report

CleanSpark just revealed the state of its finances and operations in its latest annual report. How is it going with this fast-moving bitcoin miner? Find out in this article.

Things have never looked worse for the public bitcoin miners. What was just one year ago a promising growth sector attracting billions of dollars of investments has now been reduced to a collection of penny stocks barely scraping by. Some are wondering which public miners will go bust, while the more optimistic of us are trying to find out which miners are so strong that they will not only survive the bear market but could capitalize on it.

The only way to find the answer to these questions is to dive deep into the public miners' financial reports. After having looked into the finances of Core Scientific, Riot, Hut 8, Bitfarms, Marathon, and Hive, we now analyze CleanSpark's latest quarterly report. We examine the company's balance sheet strength, cost structure, and recent expansion activities.

CleanSpark has a solid balance sheet with little debt

The most critical determinant for a bitcoin miner's ability to weather the bear market is its balance sheet strength. In recent months, many miners have become painfully aware that amassing the necessary liquidity to service debts can be burdensome as cash flows dwindle due to the weak mining economics of the bear market. Trapped under mountains of debts, some miners may eventually have to restructure their balance sheets by selling assets. This situation creates a power dynamic where the financially strong players can purchase weaker players' assets for cents on the dollar.

As I will come back to later in the article, CleanSpark has been feasting on distressed assets during this bear market. The company has been able to do so thanks to its solid balance sheet. With a debt-to-equity ratio of only 0.3, CleanSpark is one of the least indebted public miners. Its interest-bearing debt of only $21 million consists primarily of an equipment financing deal maturing in 2025 with yearly payments of only around $5 million.

CleanSpark's balance sheet is not only solid but also relatively liquid. With $20 million of cash and $11 million worth of bitcoin, the company has a total liquidity of $31 million. Still, as I will explain later in the article, the company's ongoing expansion efforts will require it to raise substantial capital from investors.

There are two main reasons why CleanSpark has such a strong balance sheet. Firstly, while many of its competitors refused to sell any bitcoin during the bull market as part of their hodl strategies, CleanSpark has always eagerly sold most of its bitcoin production. Meanwhile, many competitors instead sourced liquidity by taking on bitcoin or machine-collateralized loans that are now plaguing them. In addition, CleanSpark has historically favored financing its capital expenditures with equity over debt. Still, as I will explain later in the article, CleanSpark's equity financing comes at a price: dilution.

CleanSpark has higher costs than most of its competitors

After balance sheet strength, cost control is the most critical factor in a bear market. As mining revenues fall, the importance of having low costs become increasingly evident. The miners with the lowest costs will generate the most cash flow from operations, which they can use to strengthen their balance sheet or to purchase distressed assets from struggling competitors. For a bitcoin miner, costs mainly consist of electricity, but compensation to on-site personnel and executives can also be substantial. Let's have a look at CleanSpark's cost structure.

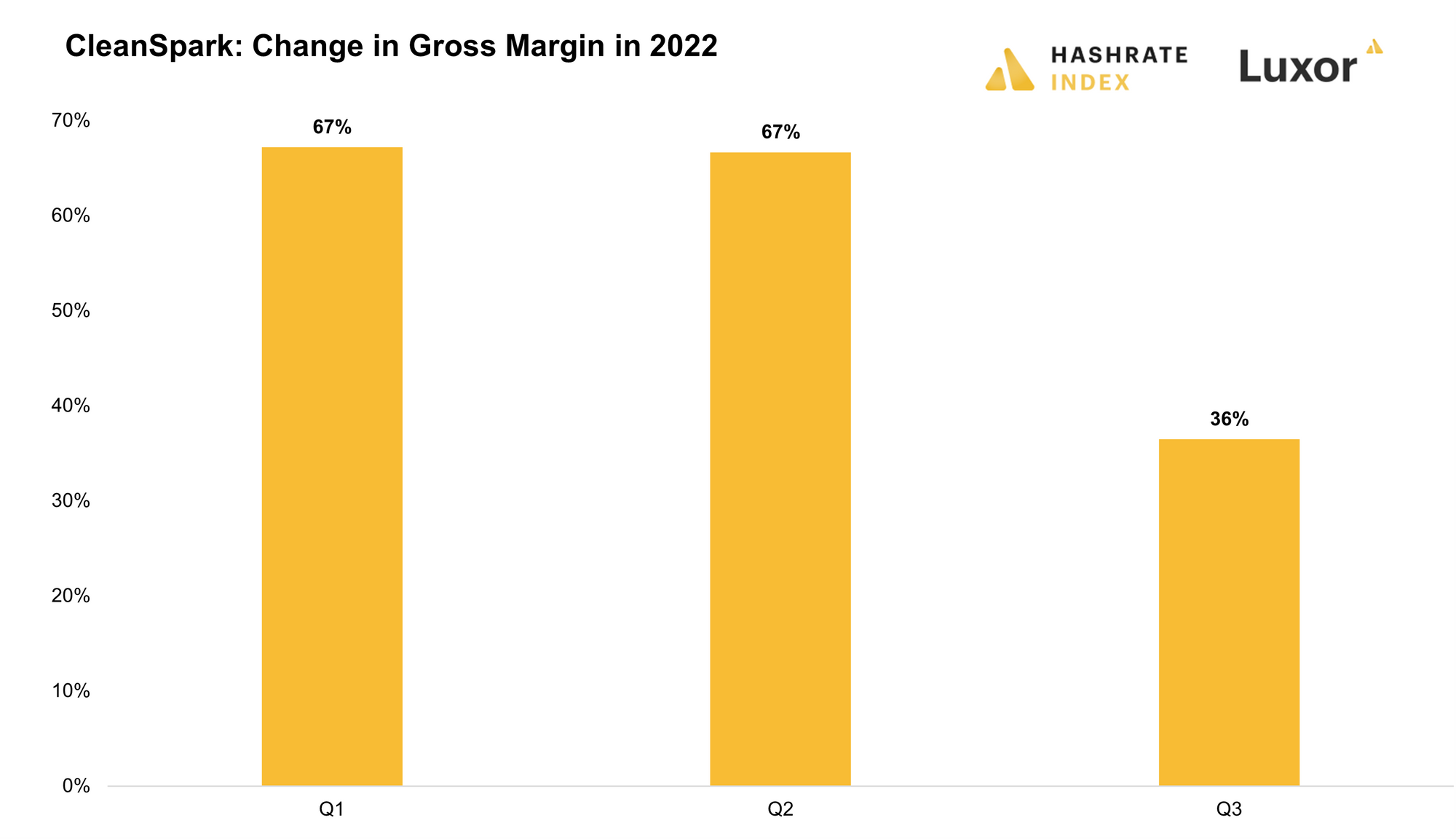

The chart below shows the development in CleanSpark's gross margin quarter-over-quarter in 2022. A bit simplified, the gross margin is the company's profit margin after electricity costs. We see that in Q1 and Q2, CleanSpark achieved a 67% gross margin, which fell to only 36% in Q3. Most of CleanSpark's competitors had a higher gross margin in Q3.

CleanSpark's gross margin has likely fallen toward 25%, as the bitcoin price has substantially declined since Q3. The company operates in Georgia, which has been suffering among the worst energy price inflation in the US this year. Even though CleanSpark is a massive electricity buyer and can achieve relatively low prices compared to most other consumers, it still saw a weighted-average cost of power at just above $0.05 per kWh in Q3. This electricity cost is not far from the break-even of an Antminer S19 Pro, which is $0.08 per kWh and doesn't allow for a substantial gross margin.

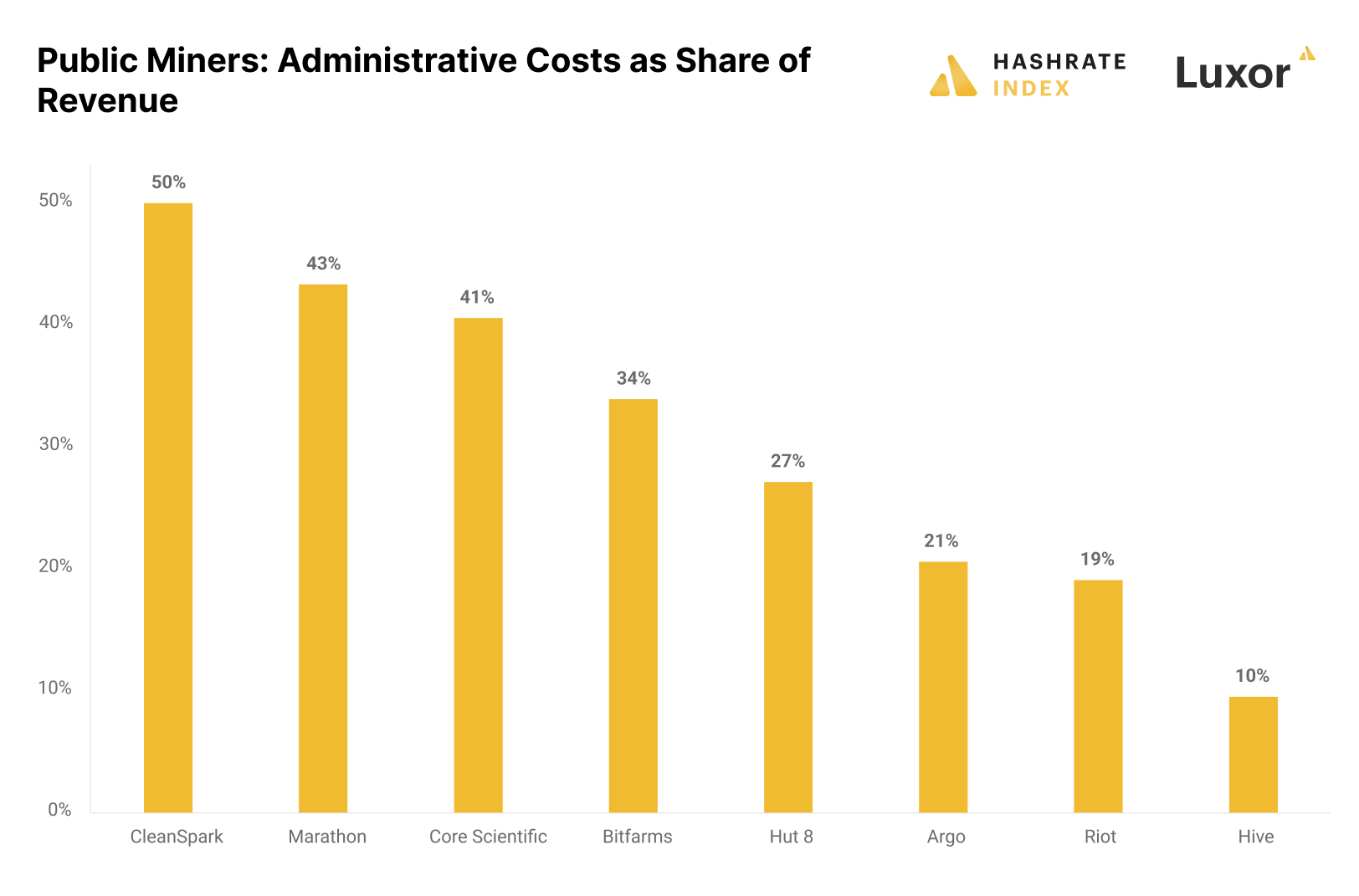

On top of its relatively high operating costs, CleanSpark has been a big spender on administrative expenses. In the first three quarters of 2022, the company spent $47 million on administration, of which $41 million was in payroll expenses. With 121 full-time employees, this is equivalent to $300k per employee. Still, $32 million of the payroll expenses was stock-based compensation, a non-cash cost that isn't affecting the company's liquidity.

As you can see on the chart above, CleanSpark has spent a higher share of its revenue on administrative expenses during this bear market than its competitors. Although most of this spending is non-cash stock compensation, it is still a cost the company's other shareholders feel in the form of dilution. CleanSpark has had a tremendous year and wanted to reward its executives with extra shares. Still, I hope they will reduce their administrative spending in the next quarters, as spending 50% of revenues on administration is not sustainable for any business.

CleanSpark has rapidly expanded during the bear market

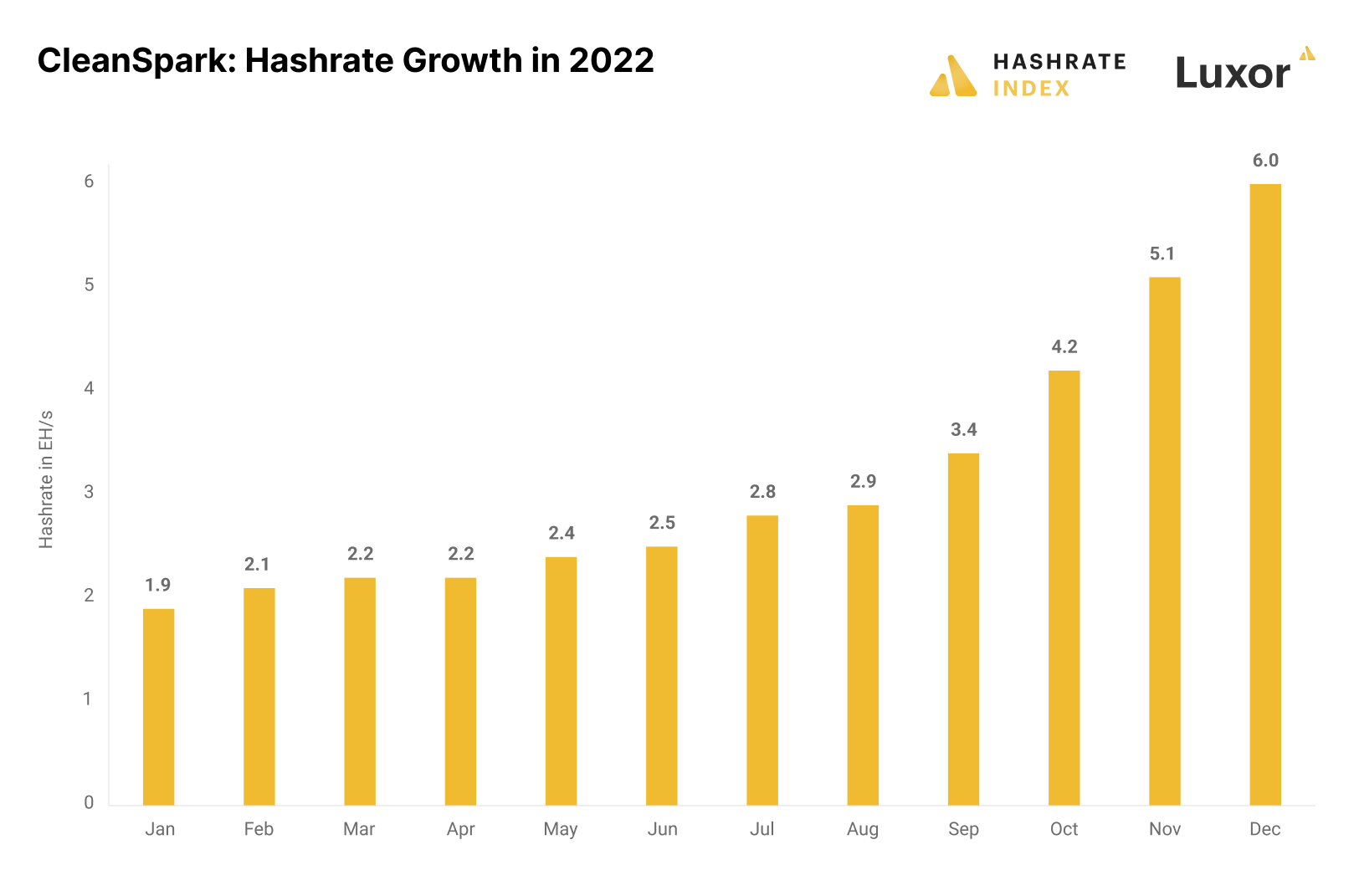

At the beginning of this article, I mentioned how CleanSpark's solid balance sheet allowed the company to purchase distressed assets at fire sale prices during the bear market. This strategy has quickly made CleanSpark one of the biggest publicly traded miners by hashrate. At the start of 2022, CleanSpark only operated two facilities generating 1.9 EH/s. By the end of the year, CleanSpark had more than tripled its hashrate to 6 EH/s.

While most other public miners had overestimated their abilities to grow their capacities in 2022, CleanSpark grew much faster than anyone anticipated. As you can see on the chart above, CleanSpark steadily increased its hashrate from January to August by filling up its existing two facilities in Georgia. In September, the company saw a significant bump in its hashrate as it acquired already operating mining facilities.

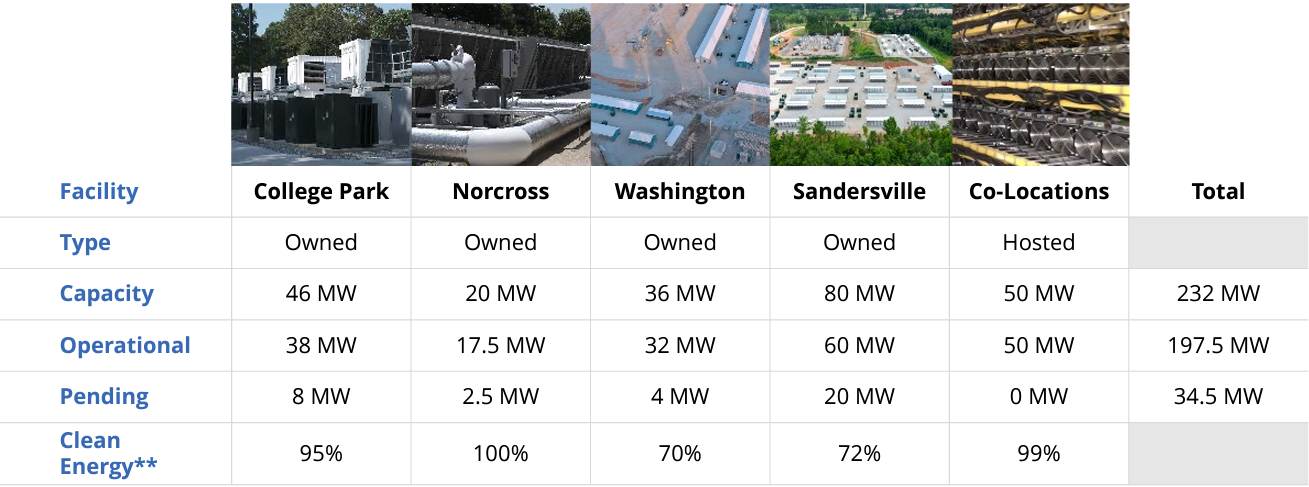

This bear market has led to a relatively robust supply of distressed mining assets, including machines, electrical infrastructure, and in some cases, entire facilities. CleanSpark has sought to exploit these opportunities, particularly in Georgia, where it has acquired two mining facilities and thousands of machines. In August, the company purchased a 36 MW facility in Washington before buying an 80 MW site in Sandersville in October.

CleanSpark plans to expand its Washington site by 50 MW and its Sandersville facility by 150 MW, giving it a total expansion capacity of 200 MW. This expansion could double its total capacity from 232 MW to 432 MW, allowing the company to reach its year-end 2023 hashrate goal of 16 EH/s.

CleanSpark originally planned to reach 22.4 EH/s by year-end 2023 but had to revise it due to Lancium, its hosting provider, struggling with the buildout of its Texas facilities. The Lancium facilities were supposed to provide 200 MW of hosting capacity for CleanSpark, which may not be ready until at least year-end 2023.

In addition to planning to expand its facilities, CleanSpark continues to be on the lookout for new acquisition targets. The company's management has publicly stated that they believe the best acquisition strategy during the bear market is to "dollar-cost-average" into mining machines and sites. I agree with this strategy. There is a buyer's market for mining assets now, and the solid secondary supply makes it possible to make continuous, smaller purchases to lower price risk.

CleanSpark has significantly diluted shareholders to fund its expansion

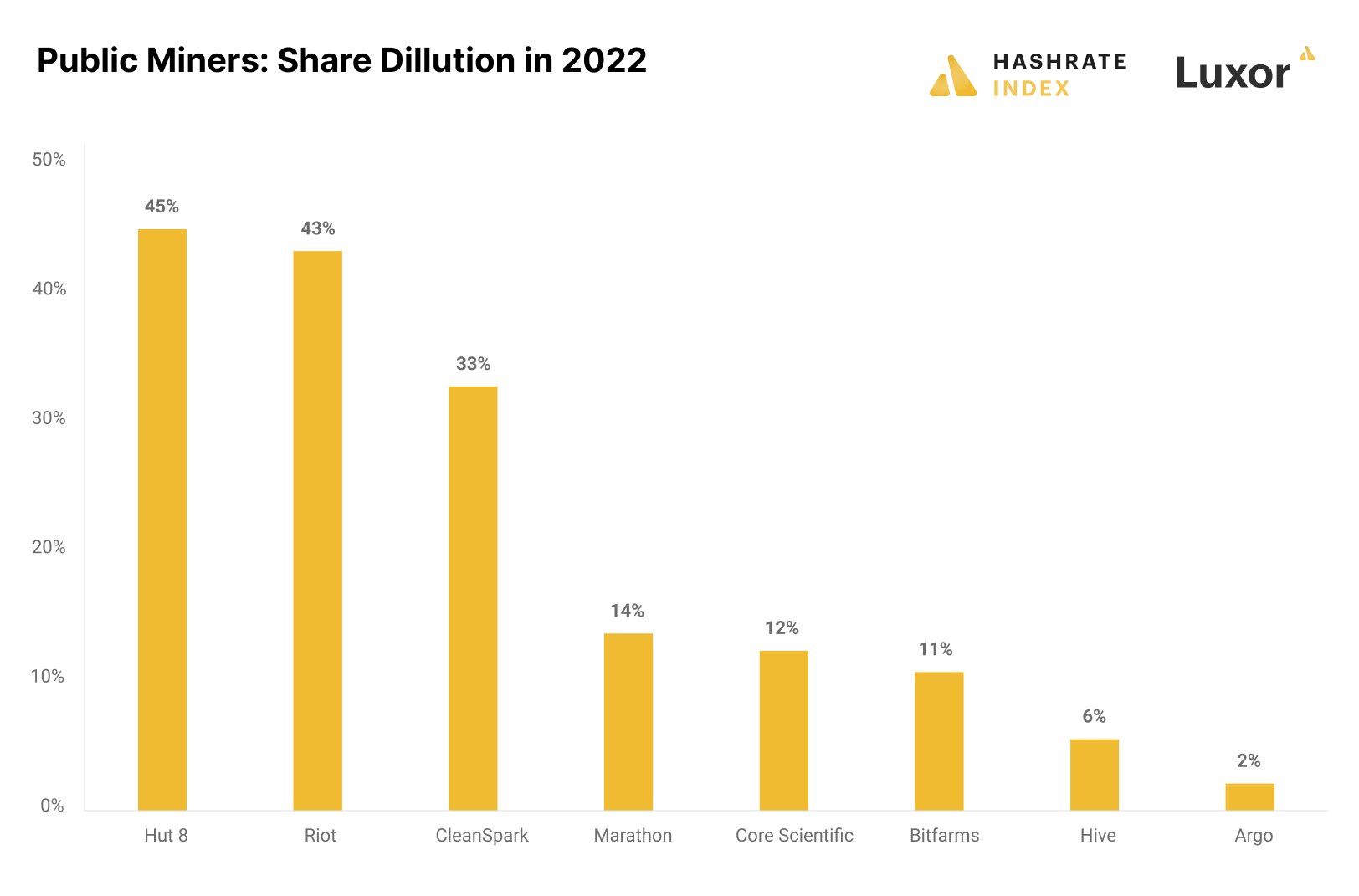

As explained, CleanSpark has a solid balance sheet primarily financed by equity. While equity is a safer form of capital than debt, it comes at the cost of dilution. To shore up the necessary equity to fund its heavy expansion during this bear market, CleanSpark has been forced to dilute its shareholders significantly.

CleanSpark has sold shares worth $125 million in 2022 to fund its expansions, diluting its shareholders by 33%. As you can see on the chart above, only Hut 8 and Riot have diluted shareholders more.

The company will likely have to continue diluting its shareholders to shore up the necessary equity to pay for its growth. The expansions of the Washington and Sandersville facilities still require $70 million in funding. In addition, CleanSpark also needs approximately 95,000 machines to fill its facilities and reach its year-end 2023 hashrate goal of 16 EH/s, which at current prig prices of $15 per TH equals roughly $140 million. CleanSpark lacks about $210 million, which it will likely attempt to raise by selling even more shares.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.