Why Power Prices Surged in Some Locations in 2022 while Staying low in Others

A perfect storm of unfortunate developments hit the bitcoin mining industry in 2022. Simultaneously as hashprice went down in flames and evaporated mining revenues, many miners saw their electricity prices rise as the world grappled with an energy crisis.

Still, miners in specific electricity markets were spared from the worst price increases. What do these markets have in common? This article examines whether there is a relationship between US states' electricity sources and the states' vulnerability to global electricity price inflation. It's a direct excerpt from our recently published year-end 2022 report, which you can access below.

Some background: What caused electricity prices to rise in 2022?

A severe natural gas supply and demand imbalance is likely the leading cause of

the global energy crisis and the resulting electricity price inflation. Natural gas is the lifeblood of most electricity markets. As the most flexible primary energy source, natural gas is an exceptionally suitable fuel for peaker plants (power plants that adjust generation to accommodate spikes in electricity demand). Since natural gas-powered plants are often the last to be dispatched, they usually set the market price for electricity according to the merit-order effect.

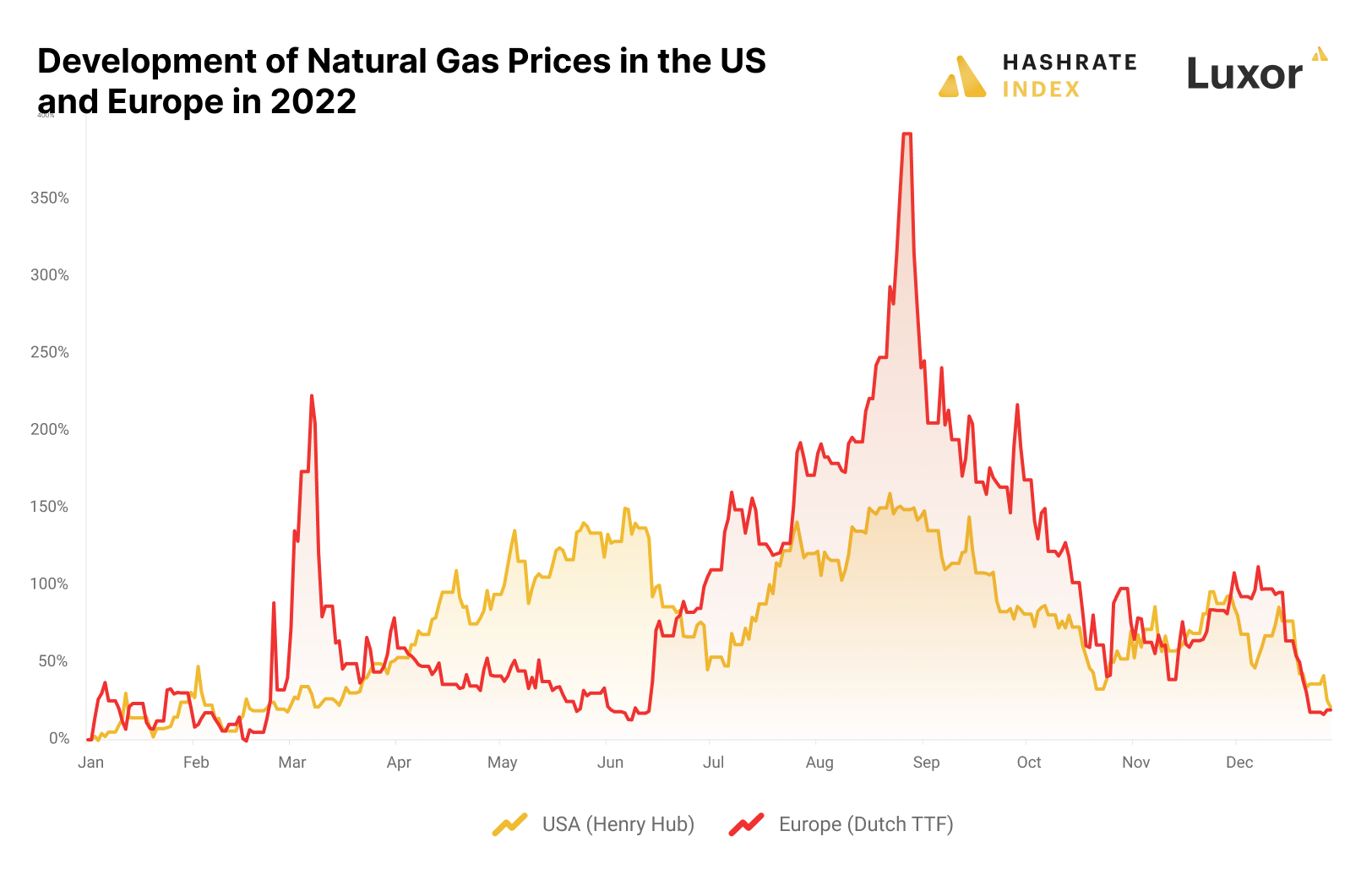

Europe has historically relied on Russia for more than 40% of its natural gas needs, so Russia’s invasion of Ukraine in February 2022 exposed the fragile state of Europe’s energy security. As the Russian tanks rolled into Ukraine, the price of the Dutch TTF – a European trading point for natural gas – surged by more than 200% in a few weeks. Prices then normalized for a few months but exploded even higher during the summer, peaking at a 400% increase from the beginning of the year.

While Europe has little domestic fuel production and highly depends on natural gas imports, North America has much better energy security thanks to domestic oil and gas production. Still, as Europe desperately attempts to break free from its addiction to Russian natural gas, it has started using North American liquefied natural gas (LNG) as a replacement. As energy-deprived Europeans bid up the price of North American natural gas, energy price inflation quickly spread across the pond to the US and Canada. However, natural gas prices are still significantly lower in North America than in Europe due to the difficulties of processing and transporting LNG.

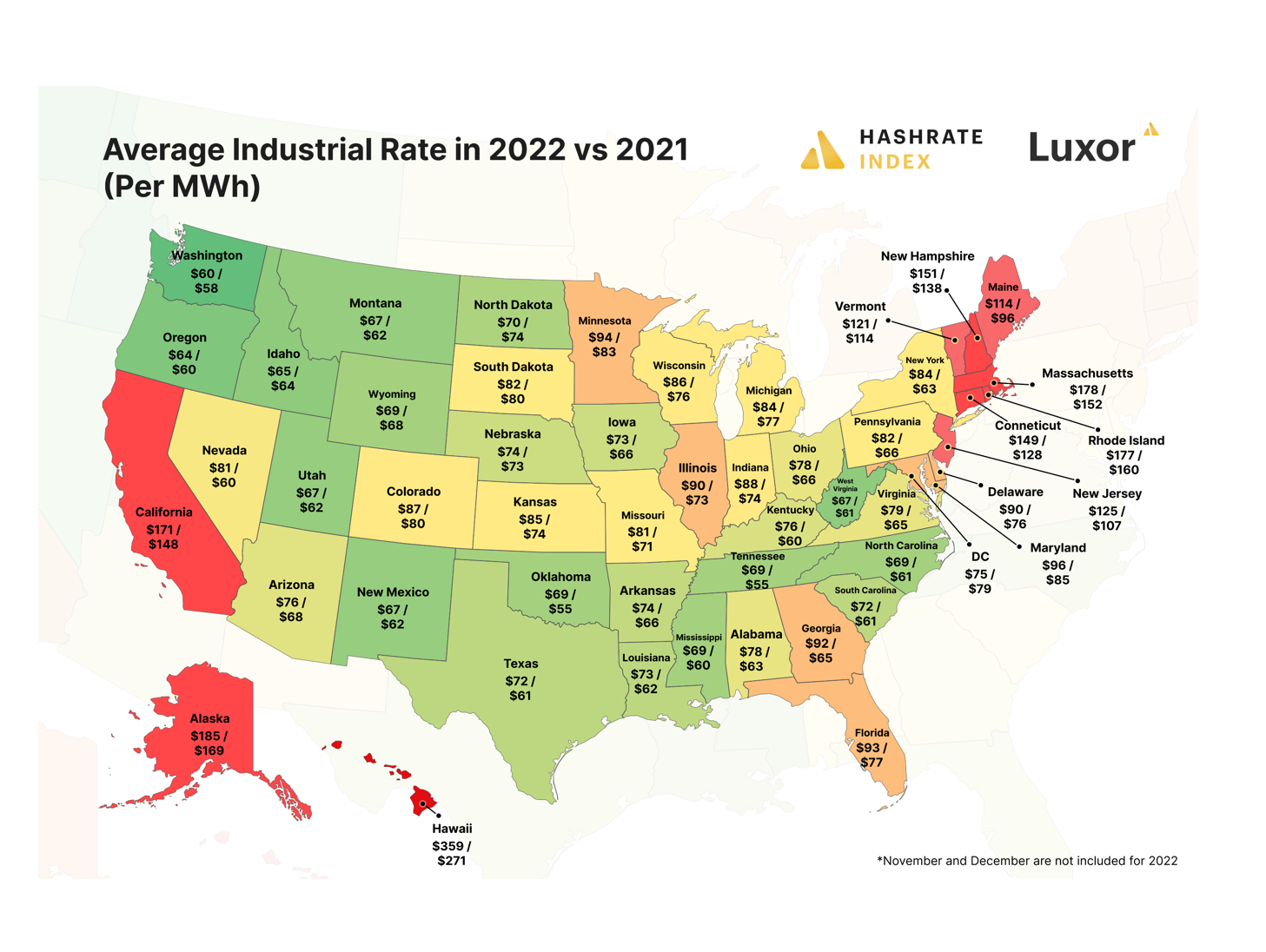

Some US states were heavily affected by rising electricity prices in 2022, others not so much

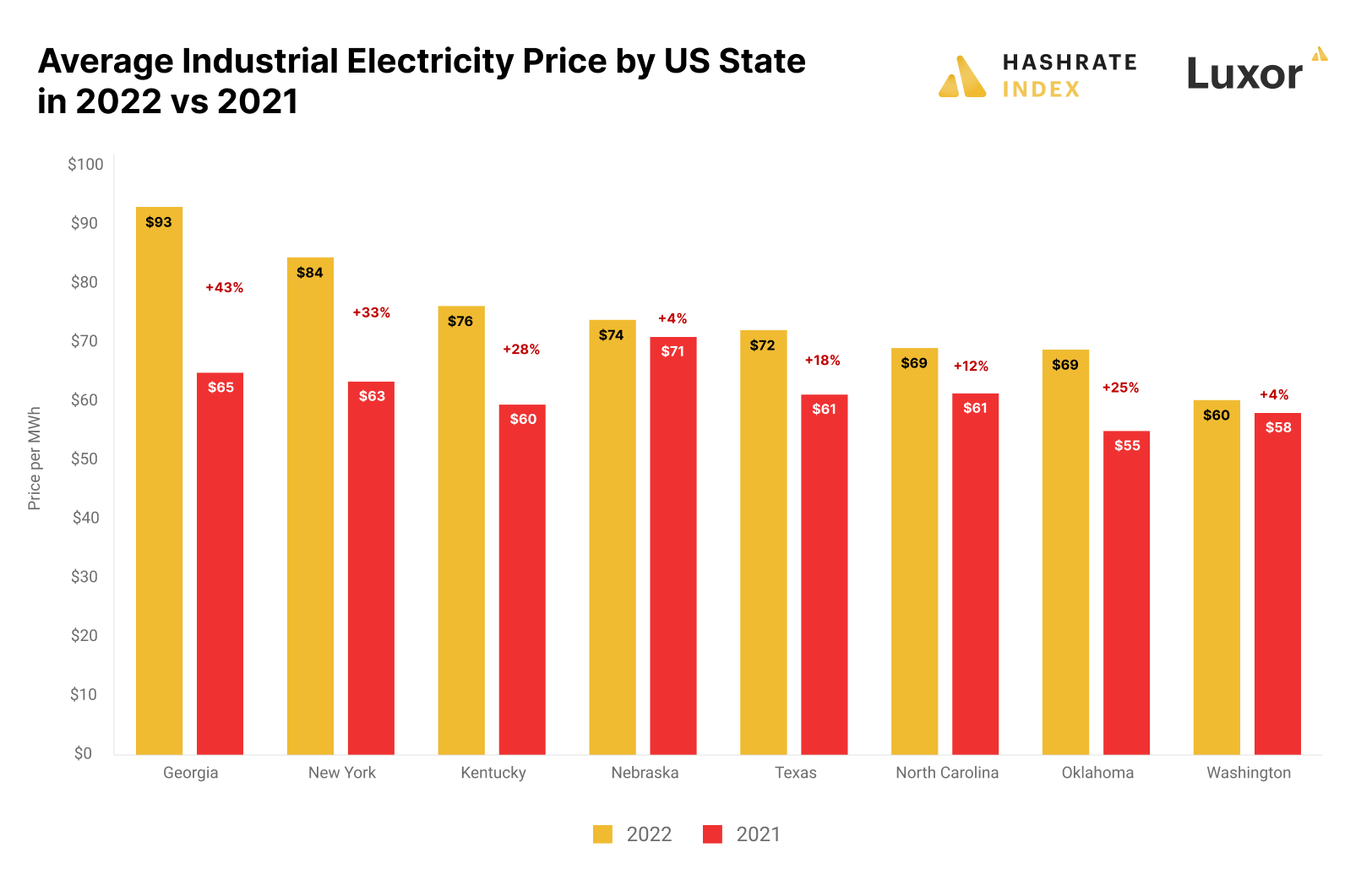

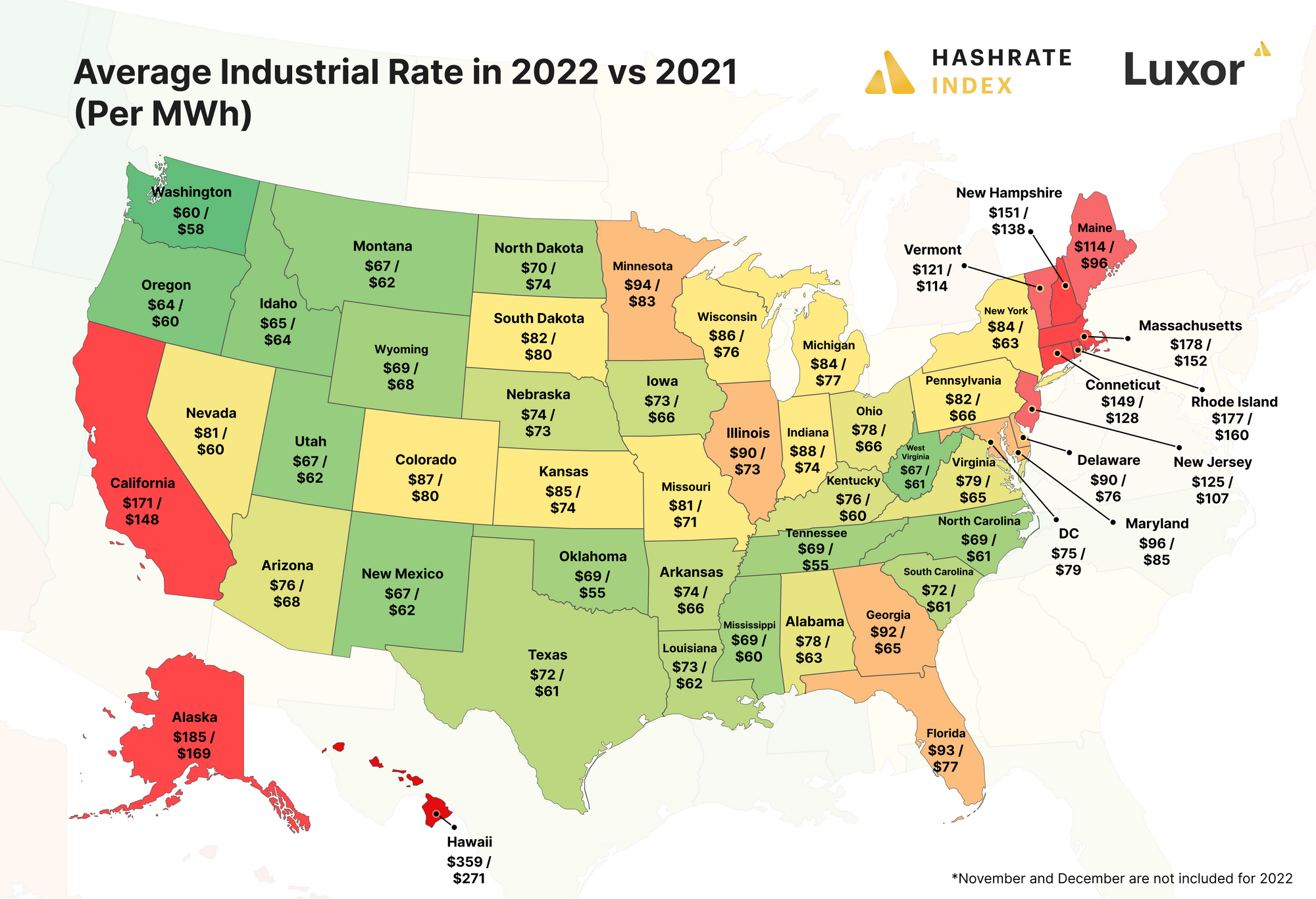

While Europe is the starting point and center of this energy crisis, the crisis crept into North America as well. The chart below compares the 2022 and 2021 average industrial electricity prices in some of the most popular US bitcoin mining states. In most of these states, industrial consumers saw their electricity rates increase by double-digit percentage points between 2021 and 2022.

Interestingly, Georgia – one of the most popular bitcoin mining states – saw the most significant price increase, with the average industrial electricity price surging by 43% from $65 to $93 per MWh between 2021 and 2022. Georgia's rise in power prices was likely a significant contributor to Core Scientific’s bankruptcy.

Texas, the home of the mega mines, has also seen its average industrial electricity price increase substantially in 2022 from $61 to $72 per MWh. This wind and solar rich state saw a massive flux of mining capacity build-out in 2021, but a considerable share of these projects are struggling under the current hashprice and electricity price environment. Argo is one example, which recently sold its newly built flagship facility to Galaxy Digital.

Meanwhile, Washington only saw a 4% increase in the average industrial electricity price from 2021 to 2022 and currently has the cheapest electricity of all US states. With an average price per MWh of $60, the hydro-powered state has slightly cheaper industrial electricity than its neighbor Oregon ($64 per MWh). Idaho, West Virginia, and Utah are also among the states with the cheapest electricity in the US (Idaho runs primarily on hydro, while Utah and West Virginia rely primarily on coal).

Not all energy is generated equally

As we explained at the beginning of this article, electricity systems need flexible primary energy sources to meet marginal demand. Like natural gas, hydro is a relatively flexible primary energy source, as power plant operators can easily adjust the electricity production of hydropower plants by changing the volume of water flowing through the turbines (low water levels and droughts complicate this process, of course). Due to this flexibility, geographic regions blessed with hydropower generally don’t require natural gas peaker plants.

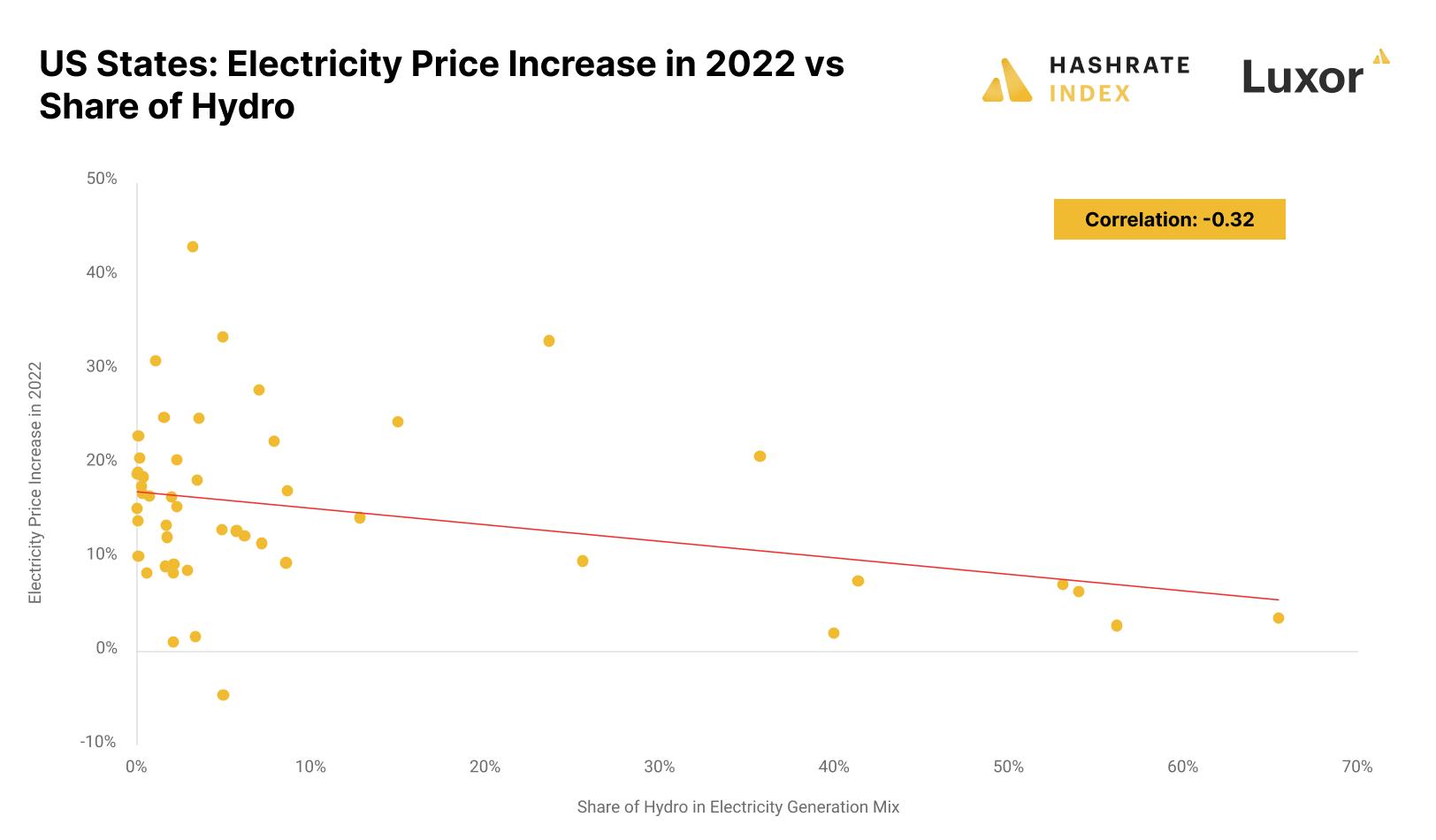

In some lucky states, their abundant hydropower and independence from increasingly expensive natural gas have shielded them from the worst electricity price rises. The chart below shows the relationship between states’ shares of hydropower and the changes in their industrial electricity prices in 2022. The inverse correlation of -0.32 signals that the hydro-rich states have seen a significantly lower increase in their electricity prices in 2022 than those with little hydro.

No state powered by more than 40% hydro saw its average industrial electricity price increase by more than 8% in 2022. Hydro-rich states like Washington, Oregon, Idaho, and Montana haven’t seen substantial increases in their electricity prices, and miners there can still access relatively cheap electricity.

The important caveat is that the hydro will only be cheap if it’s stranded or localized. If sufficient transmission capacity exists to transport the excess hydropower to a more expensive electricity market where natural gas is a price setter, customers in the expensive area will bid up the price of the hydropower. Many hydro-miners in the Nordic countries in Europe suffered from this experience in 2022.

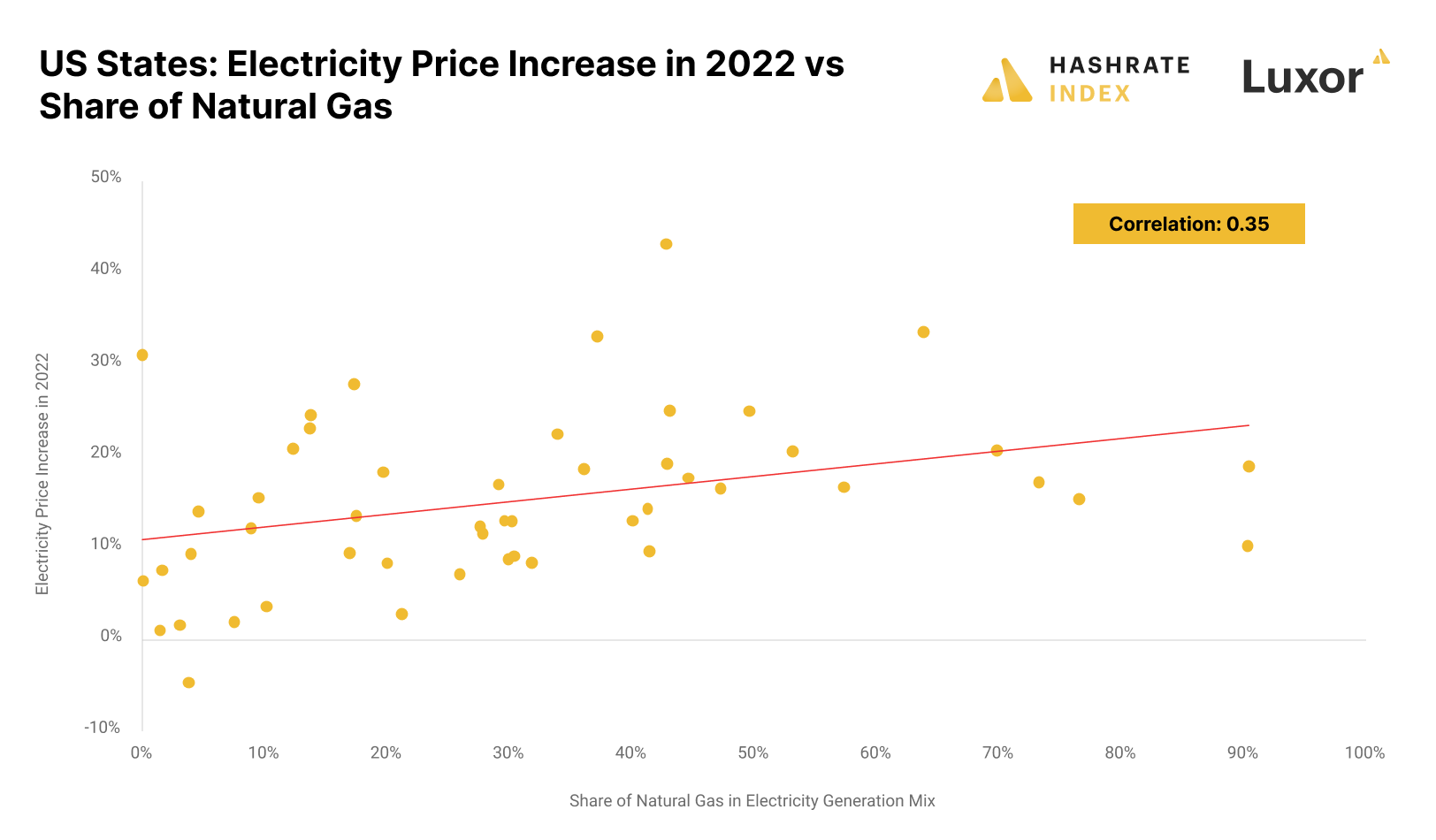

We have already found that stranded hydropower gives miners in states like Washington protection from electricity price inflation. This phenomenon works the opposite way in states with a high share of natural gas. As shown in the chart below, the correlation between states’ share of natural gas and their electricity price changes in 2022 is 0.35, indicating a relatively strong relationship.

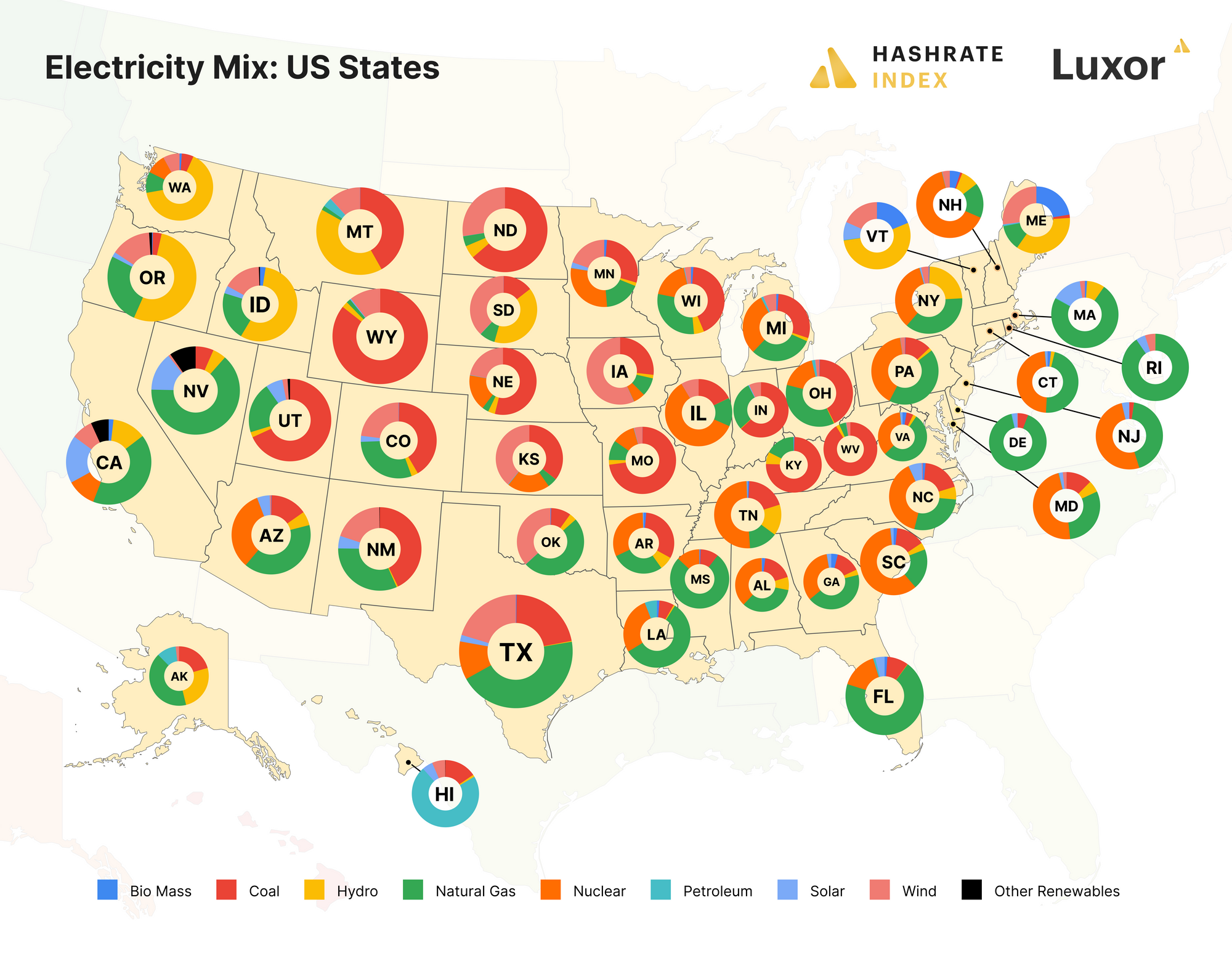

The map below shows the electricity generation mix of all US states. As you can see, the states where electricity is the cheapest - Washington, Oregon, Idaho, West Virginia, and Utah - all have relatively low shares of natural gas in the electricity generation mix. The states with the lowest power rates in 2022 were predominantly powered by either hydro or coal.

Conclusion

The electricity price inflation in 2022 impacted miners in some locations harder than in other locations.

By doing a correlation analysis between the electricity generation mix of US states and the states' electricity price increases in 2022, we found two significant relationships: 1) states predominantly powered by hydro saw lower electricity price increases in 2022, and 2) states primarily powered by natural gas saw their electricity prices rise more in 2022.

In the article, we explained the characteristics of hydropower that could protect miners in specific electricity markets from global fuel price inflation, as we saw in 2022.

Many miners learned a painful but important lesson in 2022: securing a low, long-term electricity price is vital to the mining business. Miners can achieve that by signing a long-term physical or financial hedge or accessing stranded energy uncorrelated with global fuel prices.

This article is a direct excerpt from our recently published year-end 2022 report, which you can access below.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.