Colder Weather in the USA Leads to Warmer Hashrate Markets

Over the past couple of weeks, it was cold weather in the United States which moved hashrate markets. Here’s how.

Hashrate markets seem to be impacted by everything but the kitchen sink: Bitcoin price is impacted by global trends in macroeconomics and digital assets, transaction fees are determined by blockspace demand, network hashrate (i.e., difficulty) is influenced by energy and computer hardware markets… and so much more. Over the past couple of weeks, it was cold weather in the United States which moved hashrate markets. Here’s how.

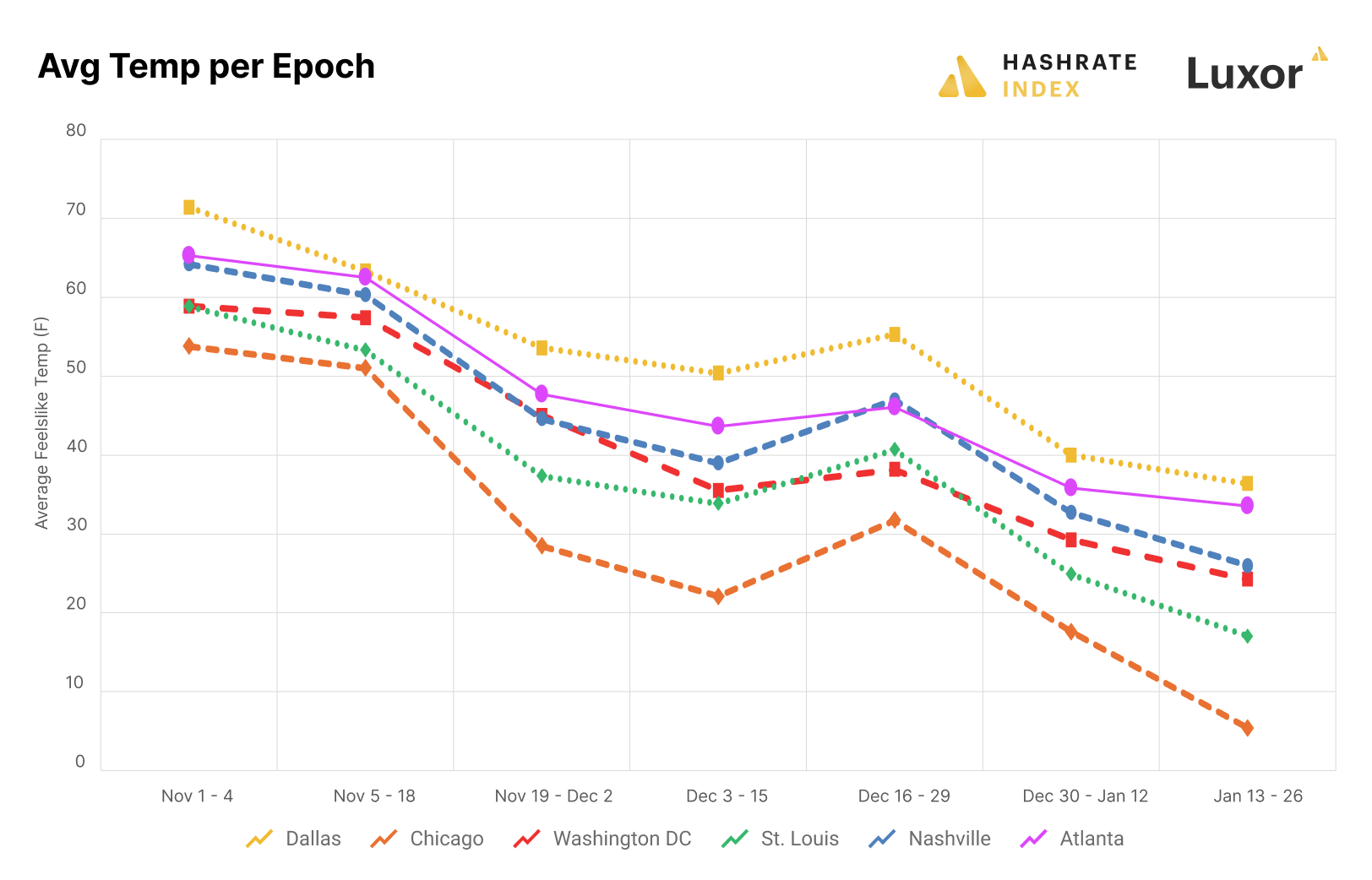

U.S. Temperatures Drop

In January, Arctic air swept across the USA, sharply dropping temperatures from the Midcontinent to the Southeast. The front brought freezing conditions and rare snow to areas like Texas and the Deep South.

U.S. Energy Prices Rise

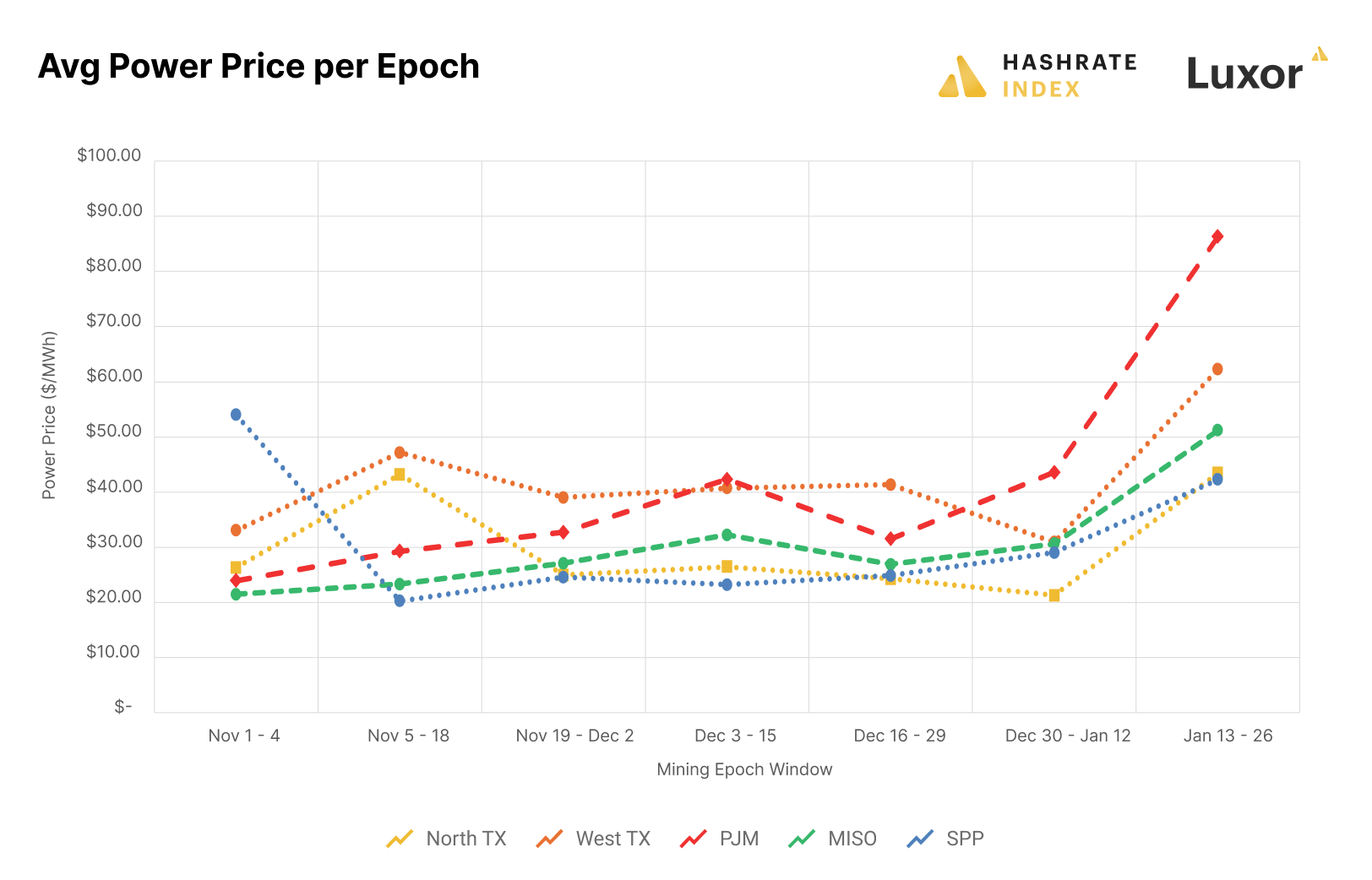

The January 2025 Arctic blast sharply increased U.S. natural gas demand for heating and power. Storage withdrawals reached 258 billion cubic feet (Bcf) for the week ending January 10 — more than double the five-year average of 128 Bcf.

Natural gas prices surged (particularly in the Northeast) with daily rates at Algonquin Citygate and Transco Zone 5 exceeding $30/MMBtu, reflecting strains on supply from the cold snap.

Natural gas plays a vital role in powering much of the U.S., meaning higher natural gas prices directly translate to higher electricity costs. During cold snaps, power demand surges as households rely more on electric heating. At the same time, winter storms can disrupt power generation — wind turbines may freeze, solar panels can be buried under snow, and thermal plants risk outages if not properly winterized.

Rising fuel costs, higher demand, and reduced supply drove up power prices across Central and Eastern U.S. markets. Texas, SPP, MISO, and PJM all experienced significant increases in average real-time prices during the Jan 13-26 mining epoch.

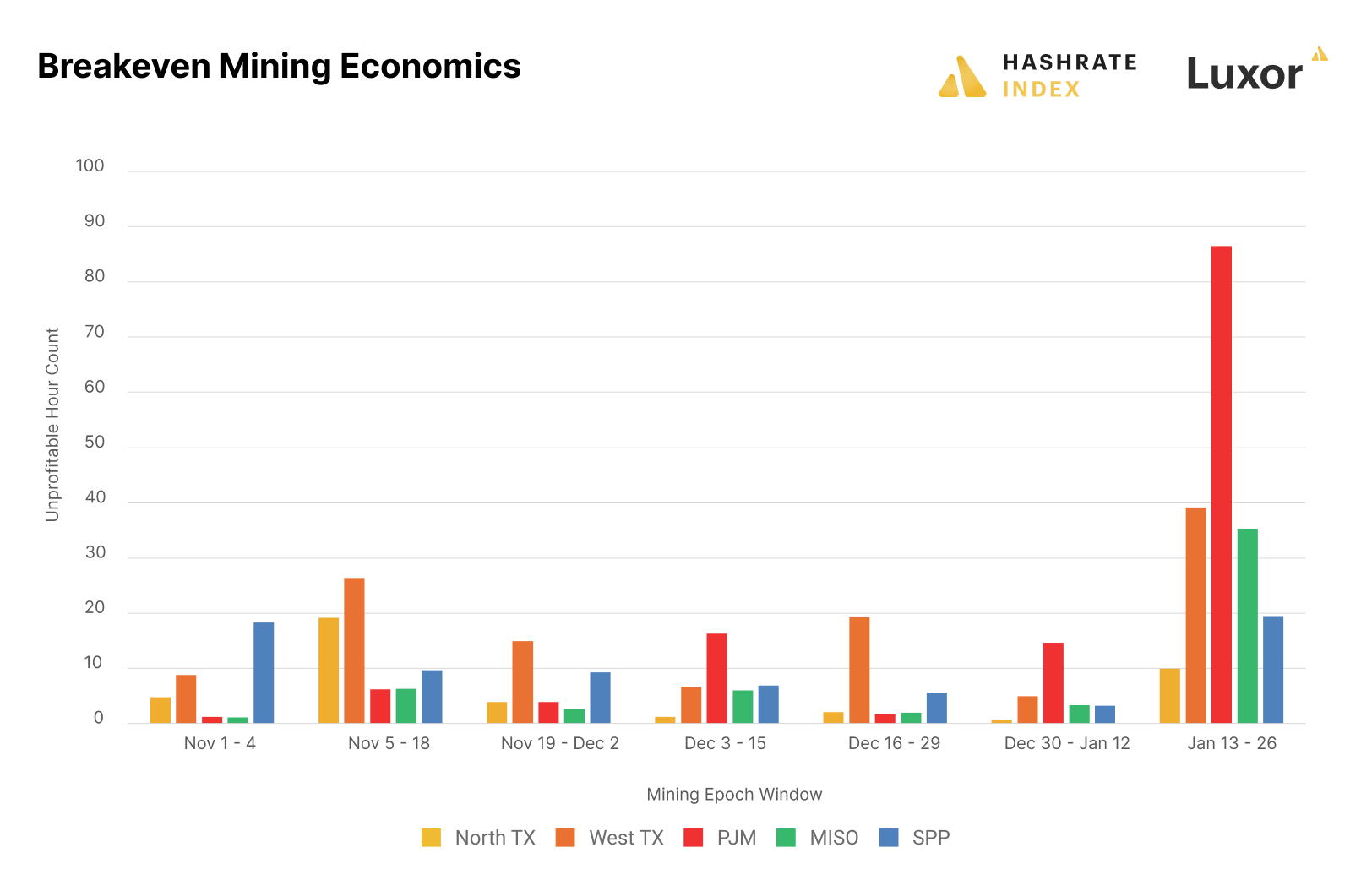

U.S. Bitcoin Miners Curtail

Higher power prices led to more uneconomic mining hours, as cold weather drove up energy costs and reduced mining uptime (particularly in the East, Southeast, and Texas).

The chart below shows Luxor’s estimates for uneconomic mining hours (i.e., negative gross mining margins) based on real-time power prices, hashprice, and hardware efficiency*.

*25.4 J/TH assumption based on Luxor’s estimate of the global network’s overall efficiency.

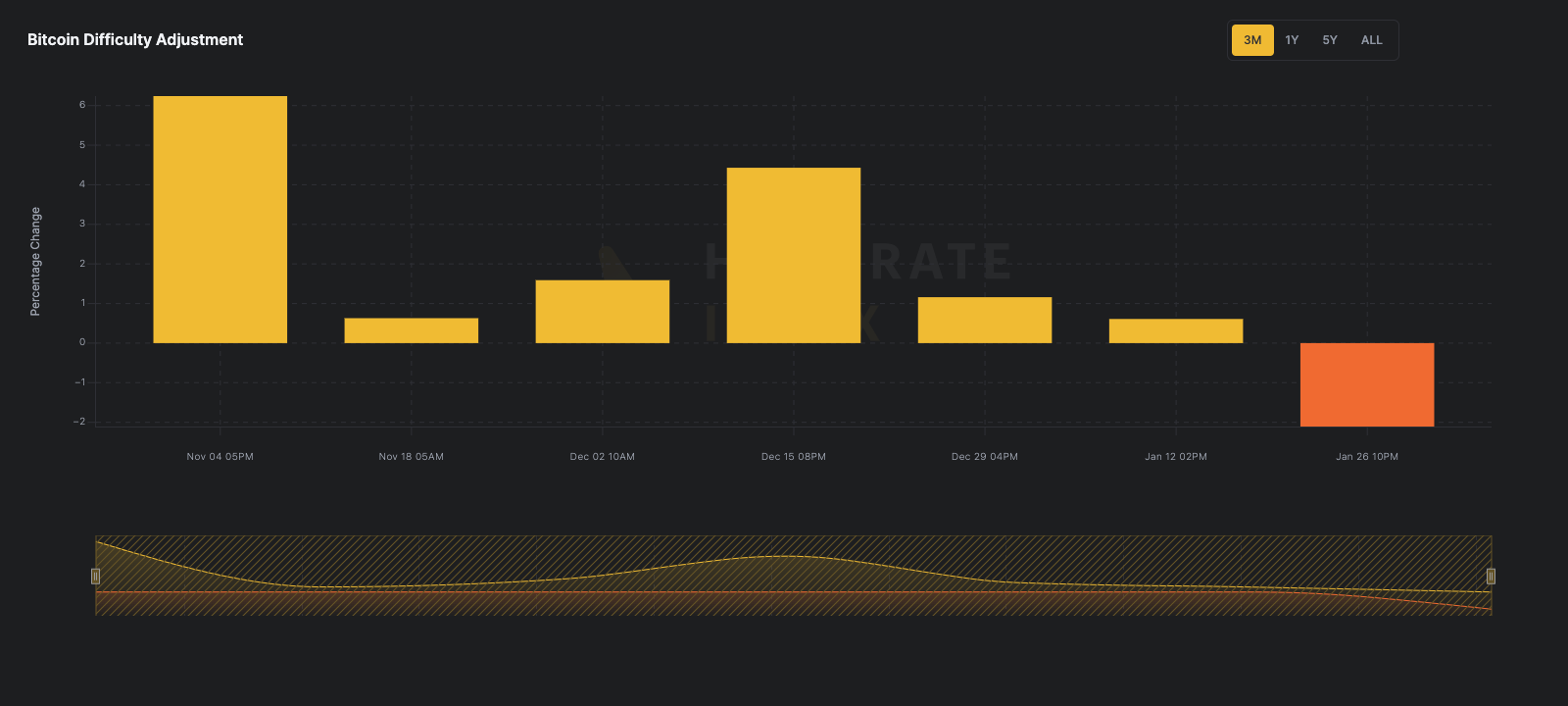

Global Hashrate Markets Warm

As of January 2025, Luxor estimates that the United States accounts for 36% of global Bitcoin mining hashrate, with Texas contributing ~17% alone. When mining becomes less profitable in regions with significant network hashrate, the likelihood of a negative difficulty adjustment rises. This occurred on January 26th, as weather-driven economic curtailment led to the first negative adjustment in four months.

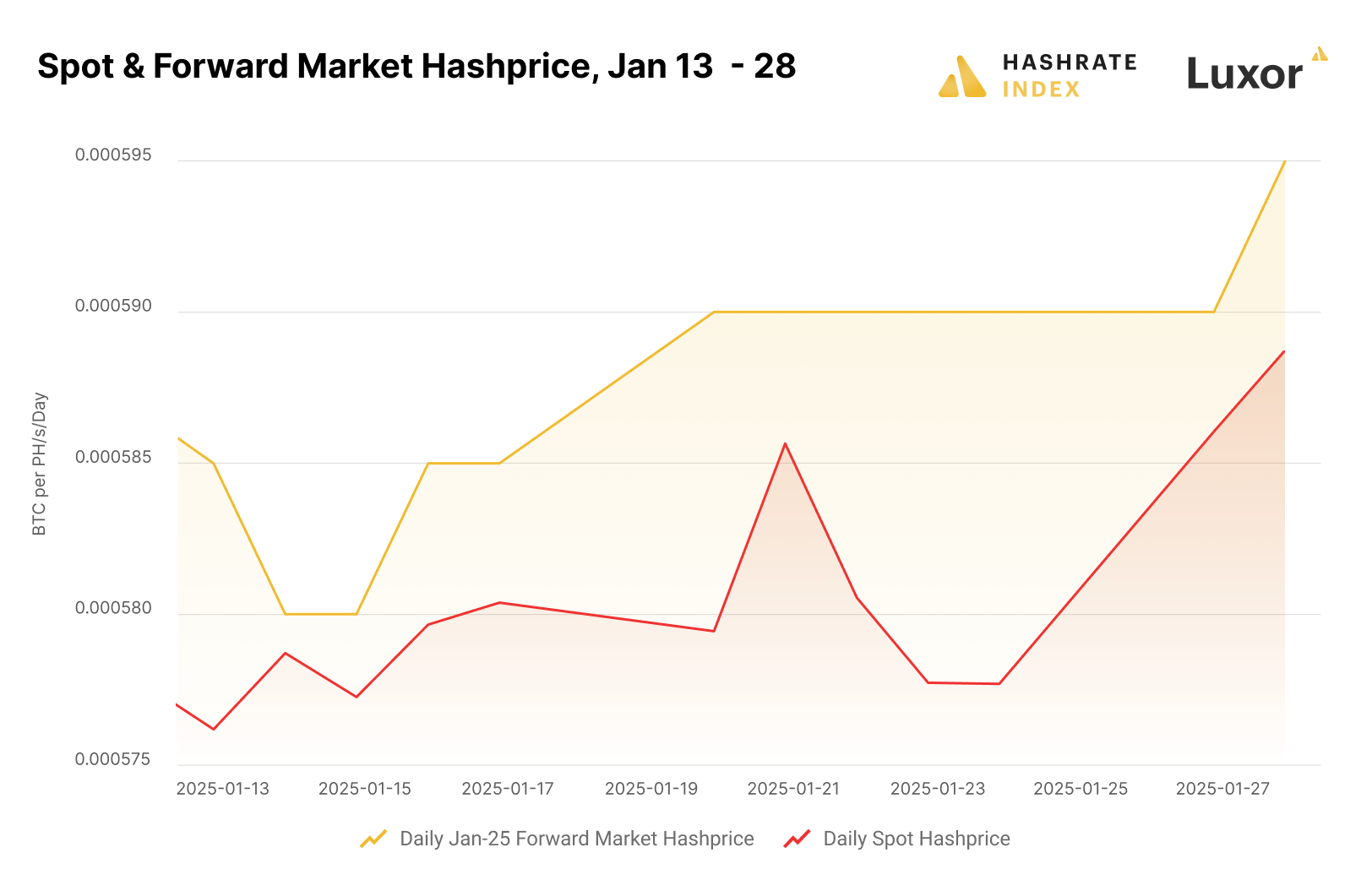

Forward hashrate markets anticipated this negative difficulty adjustment well in advance. As the winter storm swept across the U.S., Luxor's over-the-counter (OTC) Jan-25 forward hashrate contract began reflecting the expected drop in difficulty, adjusting forward hashprice accordingly.

Looking Ahead

Colder weather in the U.S. is a temporary disruption, and we expect hashrate stability to improve as temperatures normalize. Luxor's forward hashrate market is the key indicator to watch for changes in mining economics, with the Feb-25 contract currently priced at 0.000585 BTC per PH/s/Day.

This weather event underscores the importance of monitoring and participating in the forward hashrate market. Miners and traders anticipating weather or power price fluctuations in regions with significant Bitcoin mining hashrate can express their insights in the forward market.

If you’d like to learn more about Luxor’s Bitcoin mining derivatives, please reach out to [email protected] or visit https://www.luxor.tech/derivatives.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.