Bitcoin Mining Profitability (in BTC) Slips Toward Yearly Lows

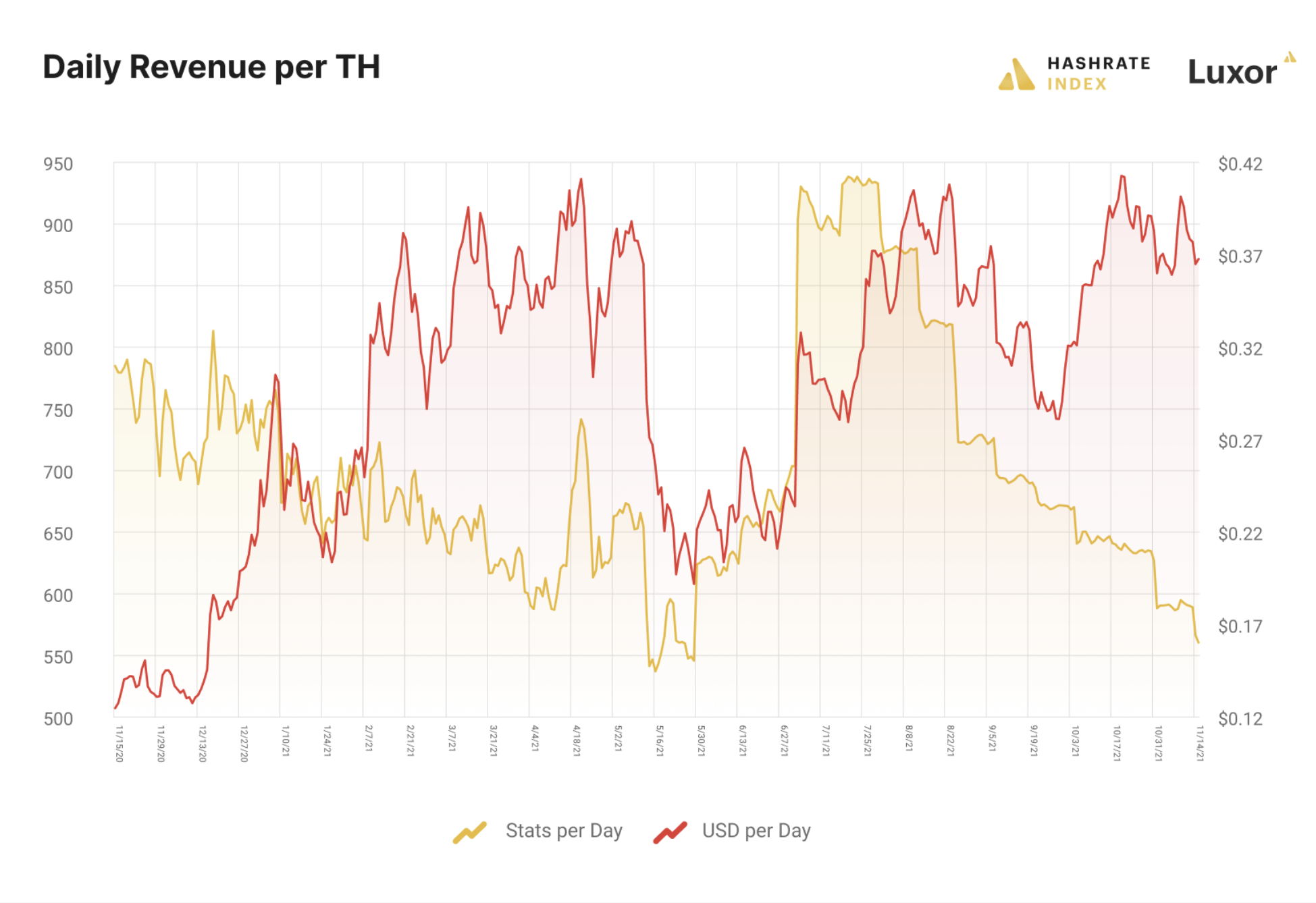

Bitcoin hashprice in terms of USD is still riding high, but bitcoin-denominated hashprice is slumping towards yearly lows.

The golden window for Bitcoin mining profitability is closing.

Following the Great Hashrate Migration from China, the summer of 2021 was a hot month for mining profits. China’s mining ban rendered half of the network’s mining competition inert nearly overnight, so plugged-in miners found themselves hashing at a depressed difficulty level, the lowest they had seen since June of 2020.

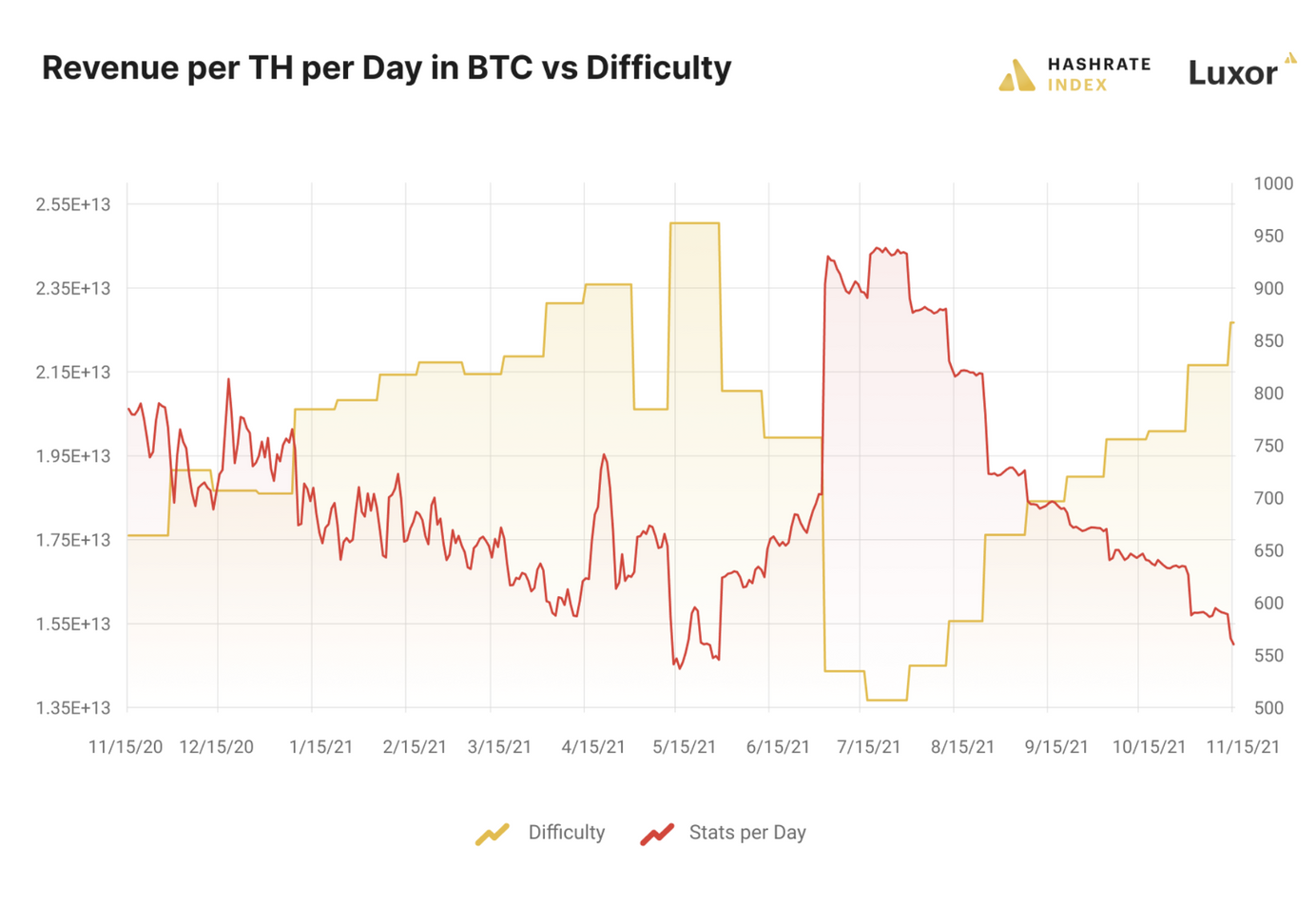

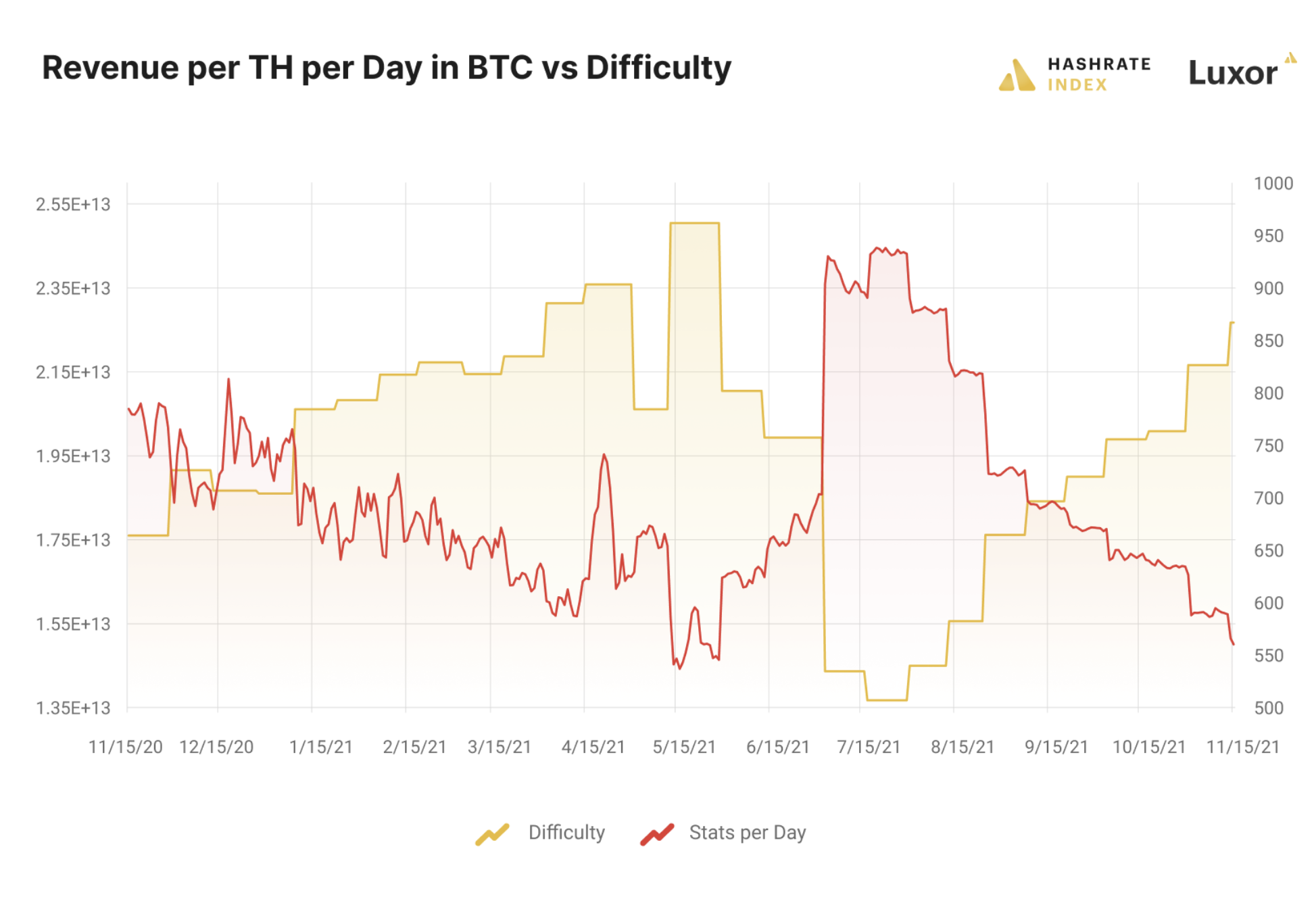

Now, bitcoin denominated hashprice is close to its yearly lows as hashrate recovers and difficulty approaches all-time high territory. On May 16 of this year, bitcoin-denominated hashprice hit a yearly low of 536 sats/TH per day; at the time of writing, bitcoin hashprice is 560 sats/TH per day, just 4.4% off the yearly low in May.

The near lows we are seeing in BTC hashprice coincide with highs in USD hashprice. On October 20, USD hashprice touched $0.4125/TH per day, fractions of a penny more than the yearly high set six month earlier on April 21.

This stems from the fact that, though Bitcoin’s price is rapidly rising, so too is its hashrate and, by extension, its difficulty. Miners are earning plenty on a USD basis, but with competition recovering from its brief lapse this summer, their BTC bottom-line is slimming down.

The hashrate blackout precipitated a difficulty slump to 13.67 T on July 17. Since then, it has risen 65% to 22.67 T. At this rate, we’ll be above the prior 25.05 T difficulty all-time high in no time, especially with how much hashrate is scheduled to come online at the end of the year and into next.

If price keeps up with this hashrate growth, then USD hashprice will remain stable or potentially grow, but for bitcoin-denominated hashprice, the only direction to go from here is down—unless we get another hashrate blackout like the one after China's mining ban.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.