Bitcoin Mining Predictions for 2024

Here are a few predictions for the Bitcoin mining industry in 2024.

2023 was nothing shy of a saving grace for Bitcoin miners.

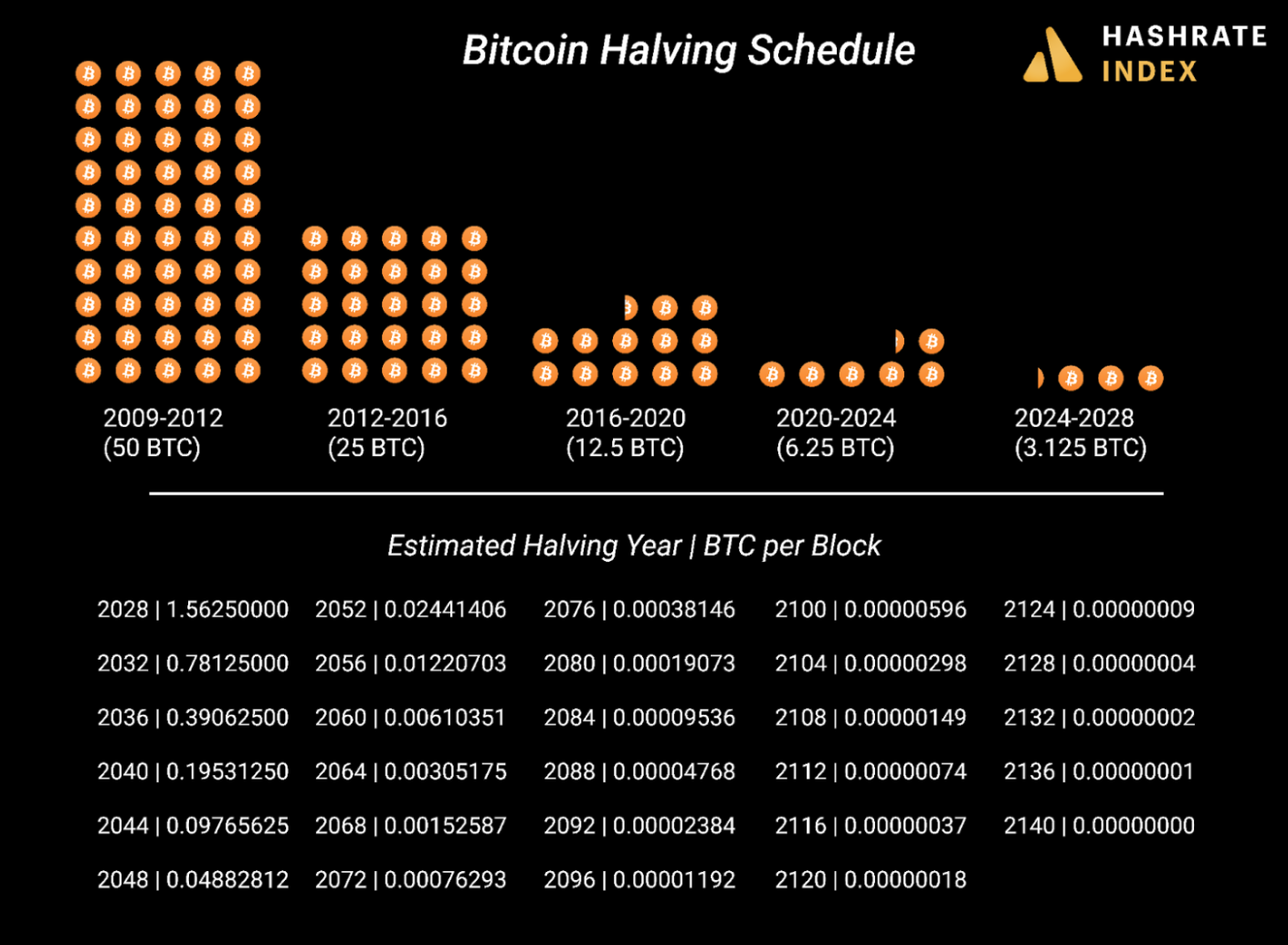

The year provided a necessary second wind for an industry that was enervated by 2022’s market downturn, but with 2024 upon us, miners have another Goliath to confront: the Fourth Halving. Bitcoin’s Fourth Halving will reduce Bitcoin’s block subsidy from 6.25 BTC to 3.125 BTC per block, thus reducing Bitcoin mining revenue by 50% in the blink of a block.

As with past Halvings, The 2024 Bitcoin Halving will no doubt leave an indelible mark on the current Bitcoin mining market and reshape its landscape.

This is an excerpt from our 2023 Bitcoin Mining Year in Review. To download the full report, please visit the article below.

While the 2020 Halving didn’t directly cause the event, China’s 2021 Bitcoin mining ban and the subsequent Great Hashrate Migration have defined the Third Halving Epoch (2020-2024) and furnished the conditions for a mining market that has been markedly different from the Second Halving Epoch (2016-2020).

We believe that the Fourth Halving Epoch (2024-2028) will bring about even greater change and could be accompanied by yet another redistribution of Bitcoin’s hashrate to new geographies. For 2024 and the coming years, we (loosely) predict the following:

Hashrate Will Become More Globally Distributed

North America’s hashrate dominance will wain. In the second halving epoch, China dominated the Bitcoin network’s hashrate share, occupying anywhere from 70-90% of total hashrate at its peak. This balance of power shifted to North America following China’s mining ban, with the US and Canada collectively capturing roughly 50% (give or take) from the summer of 2021 up to the present.

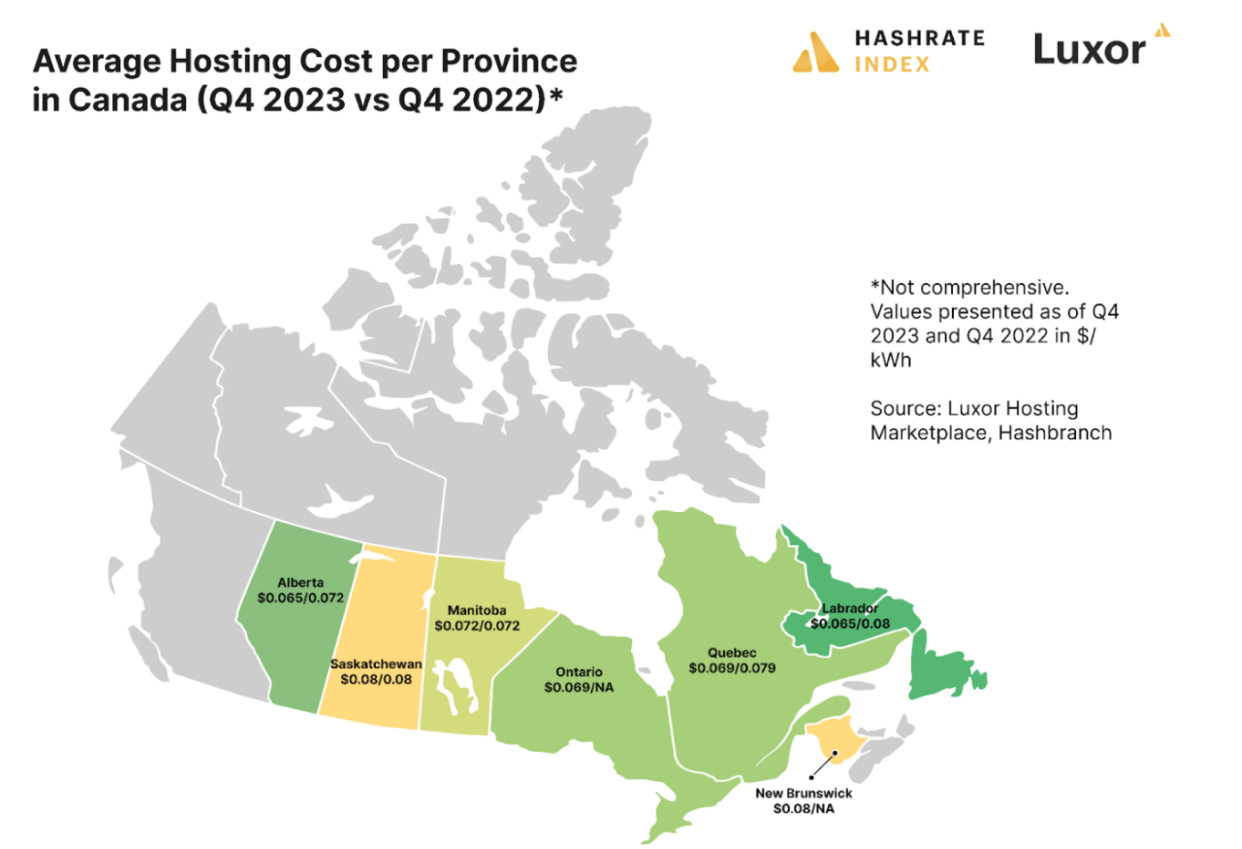

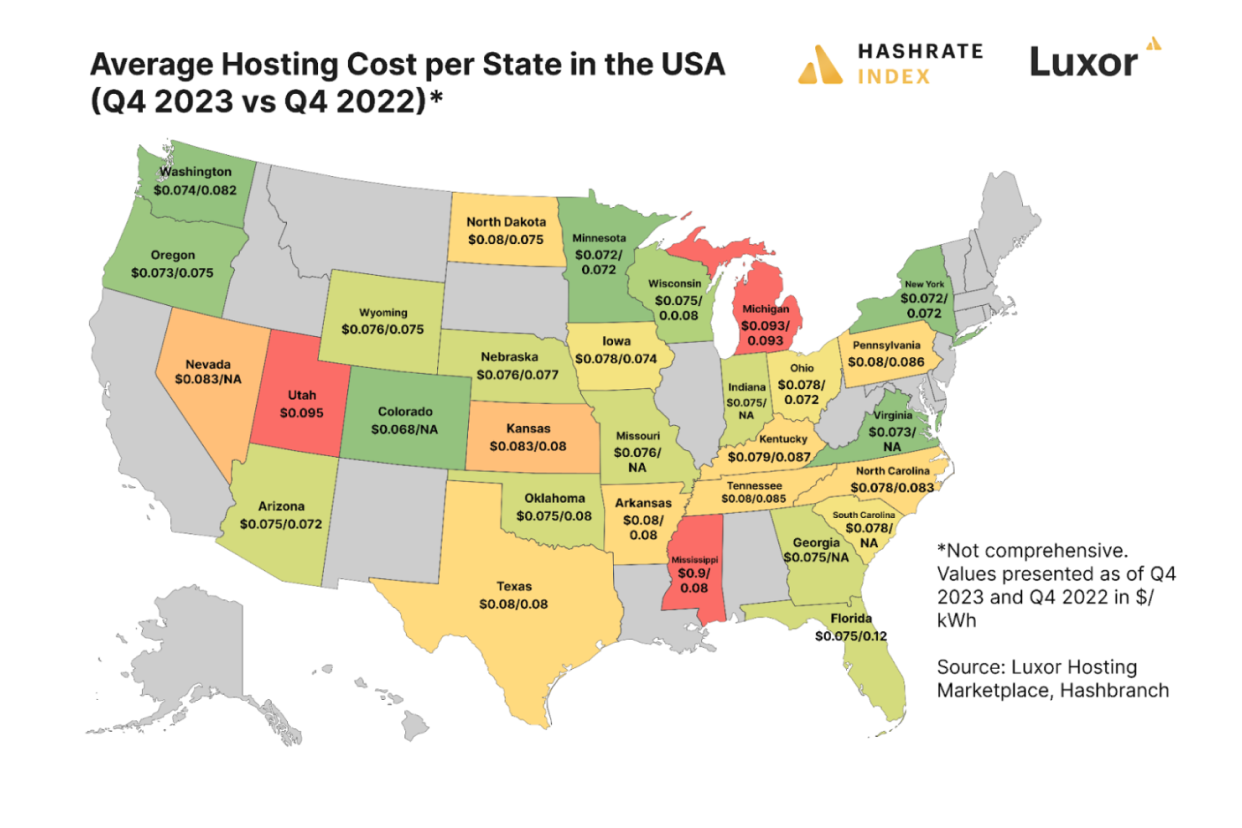

We expect that the continent’s share of the global hashrate has peaked and will recede after April 2024’s halving drops the block subsidy to 3.125 BTC. Miners will increasingly look elsewhere for cheaper electricity after their margins are compressed, with South America, Africa, and other under-explored areas primed to capture significant growth.

Hosting for Retail Will Take a Huge Hit

In North America (and elsewhere), retail hosting-as-a-service will decline as lower mining margins squeeze out both hosts and clients.

In 2o23, the average all-in hosting rate was $0.078/kWh in the US and $0.072/kWh in Canada; in Q4-2023, the average all-in rate was $0.078/kWh and $0.071/kWh, respectively.

If the halving were to happen today, January 25, hashprice would be roughly $38/PH/day, which would mean make an S19 XP's breakeven cost $69.5/MW and an S19j Pro's breakeven cost $51.5/MW.

Given post-halving mining economics, it's unlikely that hosted miners with average or higher hosting costs will be able to stay above board, meaning only those with favorable rates will survive 2024.

2024 Will Provide Bitcoin Miners With Opportunities for Acquisitions, Distressed Asset Purchases

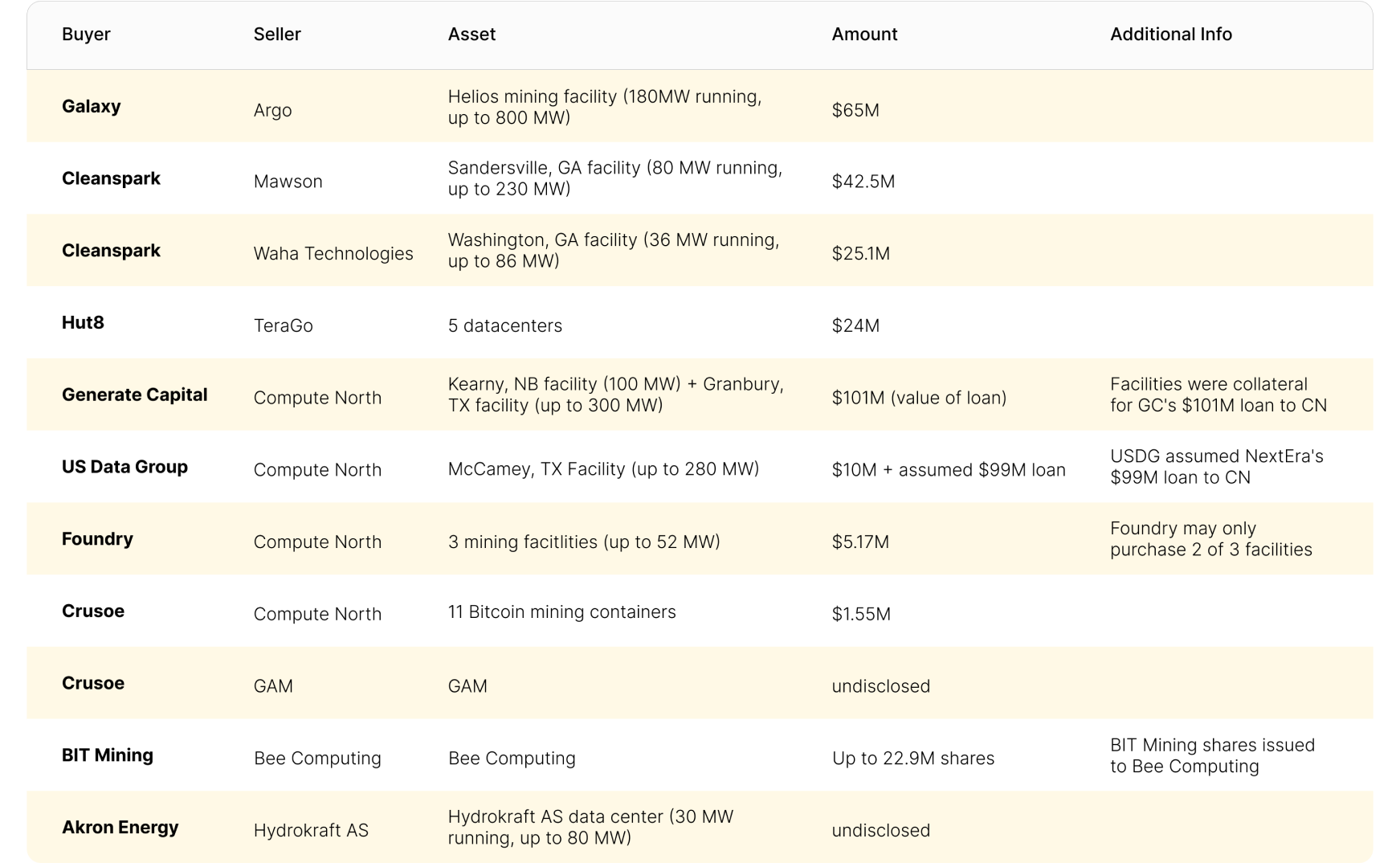

Mergers, acquisitions, and distressed asset sales will pick up in 2024 and 2025 amid a compressed hashprice environment.

2022 provided something of a prequel for what this year could bring. With hashprice dropping like a rock in 2022 and hitting an all-time low in Q4, we saw the bankruptcy and liquidation of one of Bitcoin's largest hosting providers, Compute North, as well as distressed asset sales from the likes of Argo and other miners.

2023 didn't see as much activity with distressed asset purchases and acquisitions, but it did witness the largest merger in Bitcoin mining history with Hut 8 and US Bitcoin's merger of equals. In 2024, we anticipate that acquisition activity will match or succeed 2022's levels.

Inscriptions, Alternative Block Space Use Will Continue to Boost Transaction Fees

Inscriptions and alternative uses for block space in 2024 will result in transaction fee levels that are on par – or higher – than 2023’s average

The biggest dark horse of 2023 galloped into the market on the back of a new technical standard for Bitcoin-based non-fungible tokens (NFTs): ordinals and inscriptions. This new method for creating digital artifacts / art on Bitcoin revived transaction fees as a substantial source of mining revenue.

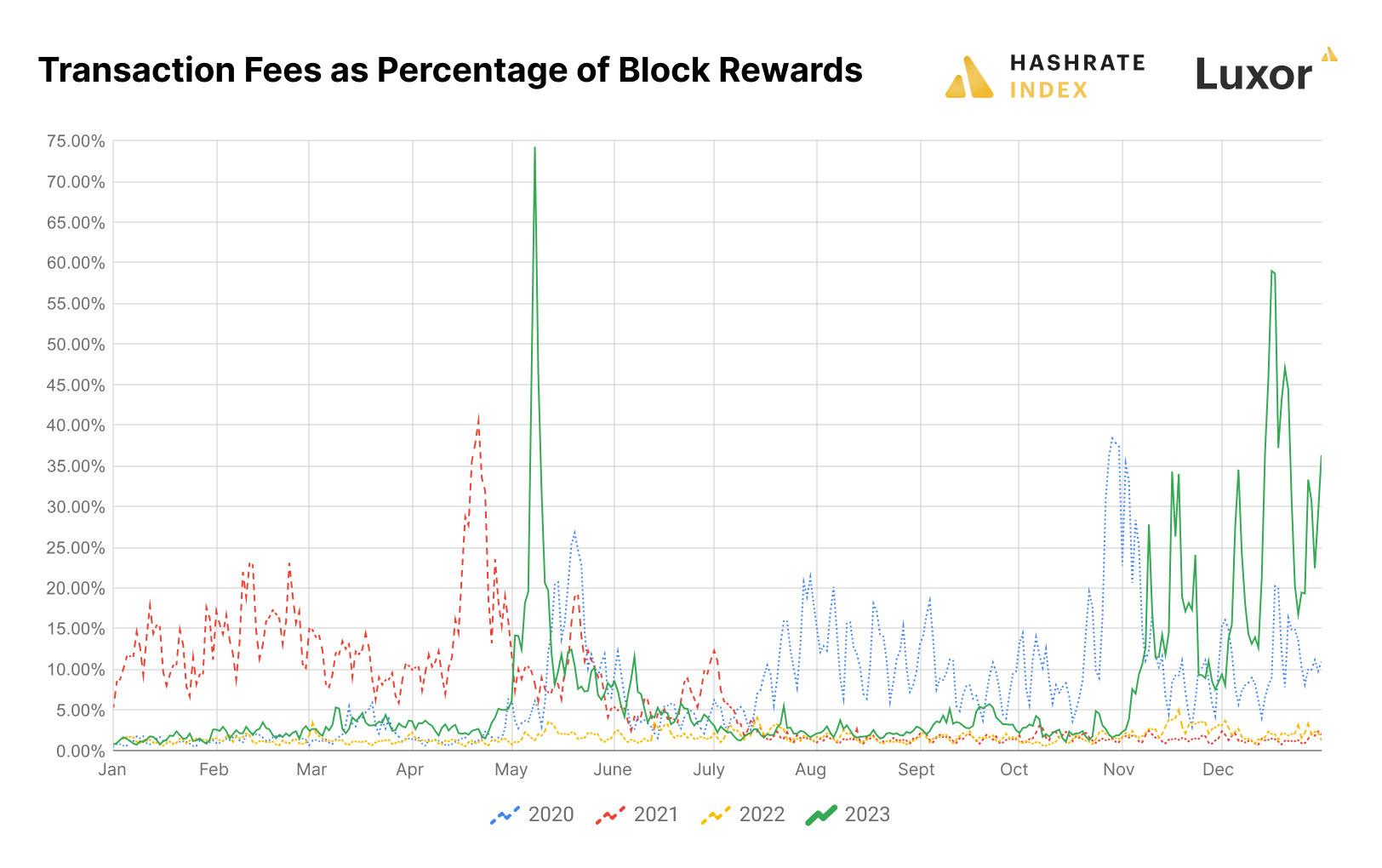

In fact, 2023 was the penultimate year for transaction fee rewards in Bitcoin’s history; miners earned $797,867,915 in transaction fees in 2023, a haul that is second only to 2021’s record of $1,019,725,113. Fees constituted 7.6% of block rewards in 2023, compared to 1.5% in 2022.

Inscriptions generated $188 million in transaction fees from December 2022 to the end of 2023, and miners accrued $129.5 million (69%) of these fees in Q4 2023. Going further, miners generated 63% of 2023’s total transaction fee rewards ($501.8 million) in Q4.

If Bitcoin continues its bull run this year, we expect there to be even more inscription activity in 2024.

Bitcoin Mining Stocks Could Lose Their Price Premiums

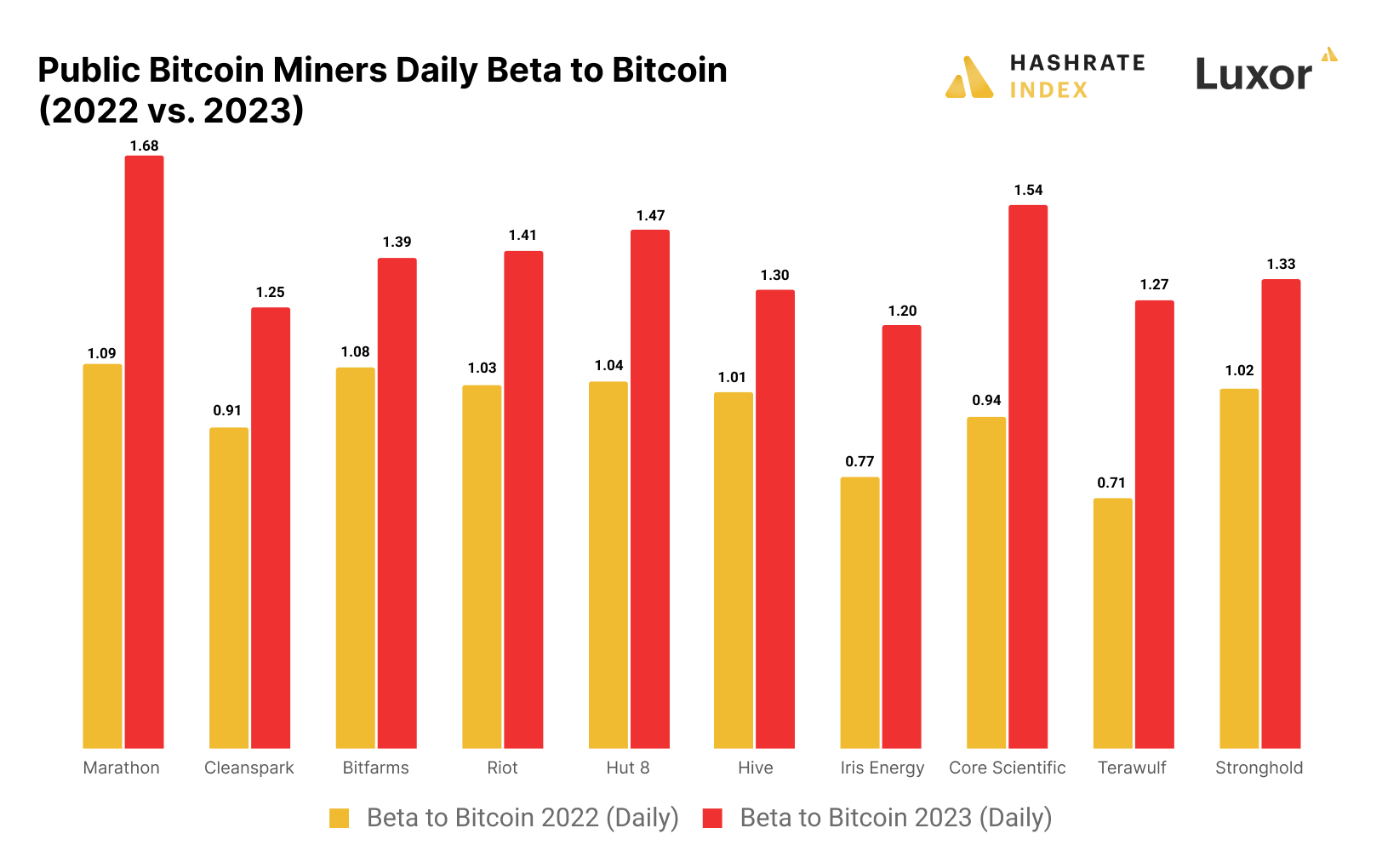

Historically, investors have traded Bitcoin mining stocks as high beta plays to bitcoin, using them both as alternative vehicles for bitcoin exposure and as assets that can produce outsized returns when bitcoin goes on a run.

Based on the beta chart analysis below, Bitcoin mining stocks show correlation trends within bull or bear markets. During bear markets, you will notice that Bitcoin mining stock pricing movements are more correlated to Bitcoin’s daily price fluctuations. In bull markets, you will notice a strong upside return to mining stocks relative to Bitcoin, as mining stocks have a strong beta to bitcoin. To time local bottoms, traders can observe that bitcoin miners have closer correlations to daily fluctuations in spot bitcoin price. As that trend breaks higher (>1.15 beta), Bitcoin miners are transitioning to a period of stronger returns.

Given the recent approval of various bitcoin ETFs, we expect that Bitcoin mining stocks will lose some of their investment premium as vehicles for bitcoin exposure, as investors will now have more direct exposure through a number of bitcoin ETFs. Investors may still treat them as high beta vehicles for exposure to Bitcoin's price, but the ETF may shave away some of the price premiums they experience.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.