Unsustainable Bitcoin Mining Debt Led to Record Defaults, Buyouts in 2022

Miners took on mountains of debt in 2020 and 2021 leading to record defaults, bankruptcies, and acquisitions in 2022.

Debt fed much of the Bitcoin mining sector's growth in the 2020-2021 bullrun. As margins went from fat to thin in 2022, some miners struggled to pay the piper, making the year the most active yet for defaults, distressed asset sales, and acquisitions.

Driven by public market incentives, many public miners fattened their hashrate with growth-at-all-cost strategies in 2021. They fed operations with a goulash of fundraising that included equity sales, traditional borrowing, and equipment-financing.

This article is a modified excerpt from our 2022 year-end report, which you can download below.

Servicing debt became difficult for some of these miners in 2022, particularly those with outsized, high-interest equipment financing loans. We estimate that there is between $2-4 billion worth of ASIC financing debt on private and public miner balance sheets.

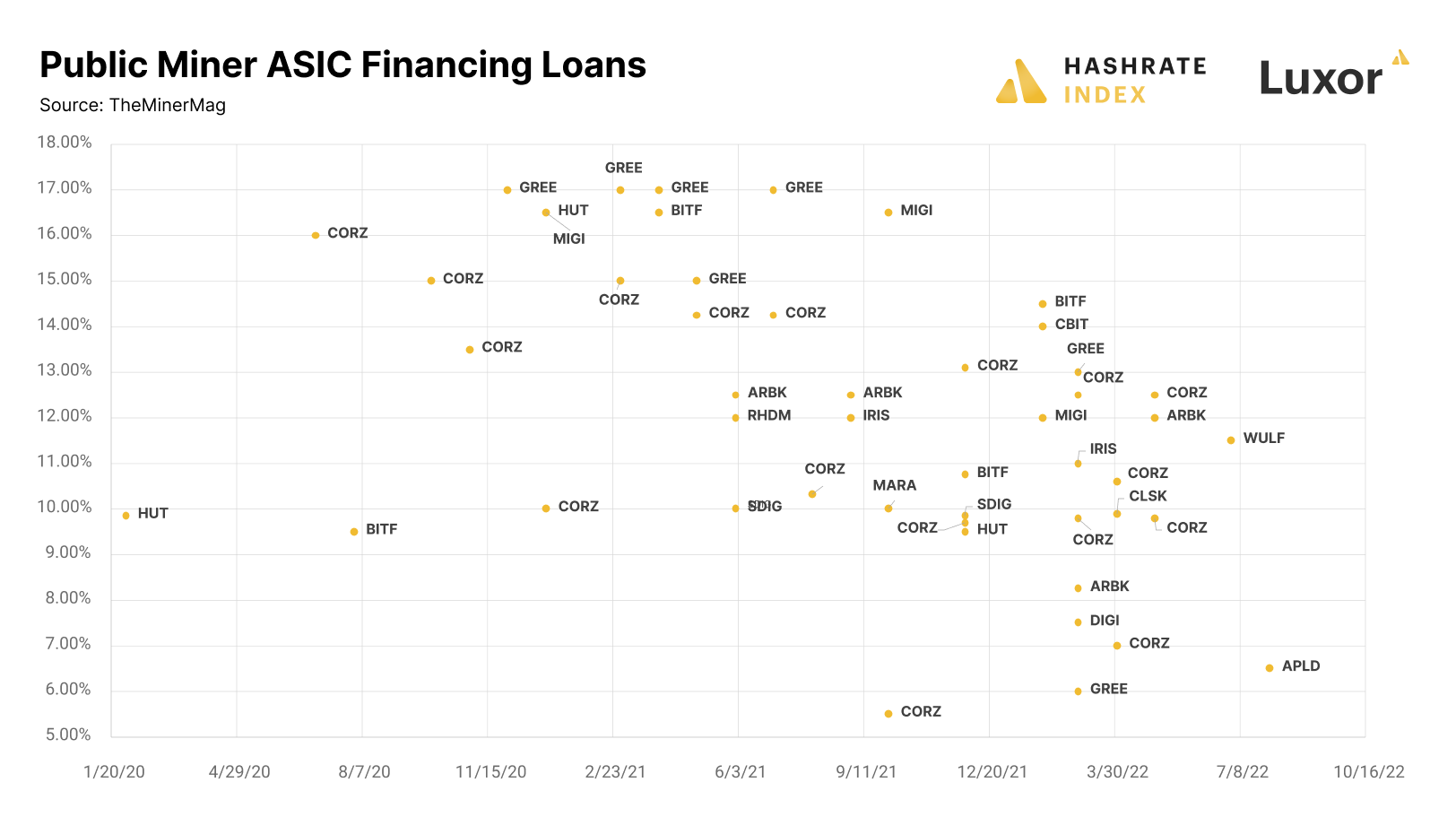

Courtesy of TheMinerMag, the below chart shows ASIC financing deals for public miners from 2020 to present. 6 ASIC financing deals were executed in 2020 worth $47.84 million, while 2021 saw the lion’s share of deals at 26 worth $662.25 million. There were 18 deals in 2022 worth $641.80 million, 16 ($576.80 million) of which were made in the first half of the year, as deal flow dried up in the second half as market conditions went from bad to horrendous.

More equipment financiers have entered the game since 2020, and this has driven down the average interest rate from 12.77% in 2020 and 12.82% in 2021 to 10.46% in 2022. Even so, 2022’s average is still steep for a capital intensive industry with thinning margins.

No doubt, as margins thinned and payments came due in 2022, a number of miners defaulted on these loans. Our tally (of known defaults from public miners) puts the total default amount at $227.4 million on the low end and $238.4 million on the high end. In the case of default, the financed ASICs end up in the hands of their financiers, as many of these loans are collateralized with the ASICs themselves.

Indeed, ASIC financiers themselves clawed back several exahashes worth of equipment in 2022. Rather than let this equipment idle, firms like NYDIG, Galaxy, and Foundry are putting it to use. Foundry, for example, purchased two facilities (and potentially a third) in Compute North’s bankruptcy auction, and Galaxy acquired Argo’s Helios facility as well.

Just as 2022 will likely serve as a case study for how not to manage a BTC treasury, it should also cause ASIC financiers to rethink equipment loans. We expect that such loans in the future will favor more liquid and robust collateral than ASICs.

ASIC loan analysis: many borrowers are underwater on payments

To evaluate the health of theoratical ASIC-backed loans, Luxor analyzed hypothetical debt service coverage ratios (DSCRs) for loans underwritten since the beginning of 2021. DSCR is a common metric used to assess a borrower’s ability to meet its debt obligations based on their cash flow.

A DSCR above 1.00x indicates that cash flow is sufficient to cover debt costs, while a ratio below 1.00x indicates a borrower needs to use balance sheet funds (or raise additional capital) to pay for debt costs.

Monthly DSCRs were calculated using the below formulas:

DSCR=Miner Margin ÷Debt Service

Miner Margin=$ Hashprice × Machine TH/s-Machine kW*24 Hours× Electricity Rate×30 Days

Debt Service= $ per TH Machine Price × Loan to Value %÷Tenor+Interest Rate÷12 ×Loan Balance

For miner margin, we used machine specifications for the S19 Pro (100 TH, 3.25 kW) and an electricity rate of $0.05 per kWh. Machine pricing from the Hashrate Indx ASIC Price Index and a 75% loan-to-value were used to calculate debt amounts. Debt matured over 18-months with equal monthly amortization payments. Finally, interest expense was calculated by applying a 15% interest rate to the average loan balance between the beginning and end of the month. The results using these assumptions are shown in the table below.

(1) Date refers to the month in which the loan was issued; (2) Indicates the average $/TH price for machines during the month of loan issuance

DSCRs remained healthy across all months in 2021. In early 2022, DSCRs for loans issued in months where machine prices were above 100 $/TH began to dip below 1.00x, indicating miners were unable to service the larger loans they received to buy machines during peak pricing periods. After hashprice nosedived in June 2022, all loans fell below the 1.00x DSCR mark (with the exception of a single datapoint in August).

In essence, this means that any miners with a similar loan profile as the one in our model (75% LTV, 15% interest rate, 18 month tenor) are unable to service the laon’s debt using mining revenue. They would need to come up with the cash elsewhere, or default on the loan to wipe away the debt.

As defaults occur, operators on more sound financial footing will be well-positioned to scoop up machines at bargain prices as lenders liquidate collateral to recover what funds they can. With this in mind, it’s reasonable to expect more distressed asset sales in 2023. Based on our ASIC Trading desk data, distressed assets usually sell for 10-25% less than fair-market-value if the seller needs to liquidate a large volume into the market with an immediate sale.

Acquisitions and distressed asset sales

Miners came under significant financial stress in 2022, and for some, this ended in distressed asset sales. The most consequential of these asset sales include Compute North’s 363 asset sale, which saw Compute North’s datacenters divided up between its creditors; Galaxy’s $65 million purchase of Argo’s immersion-outfitted Helios facility in Texas; and Cleanspark’s acquisition of a Mawson facility in Sandersville, GA and Waha Technology’s Washington, GA facility.

The above table is not exhaustive, as there were no doubt more acquisitions between private miners that went unannounced, not to mention smaller deals that didn’t merit publicity.

Additionally, a handful of investment funds surfaced in 2022 to invest in distressed mining assets, including one from DCG and another from Jihan Wu. We expect that acquisitions, distressed asset sales, and merger will be a recurring trend in 2023 as market conditions flush-out inefficient operators. These sales could help set a price floor for secondary market ASIC prices. As with 2022, the most coveted assets will be turn-key Bitcoin mining facilities.

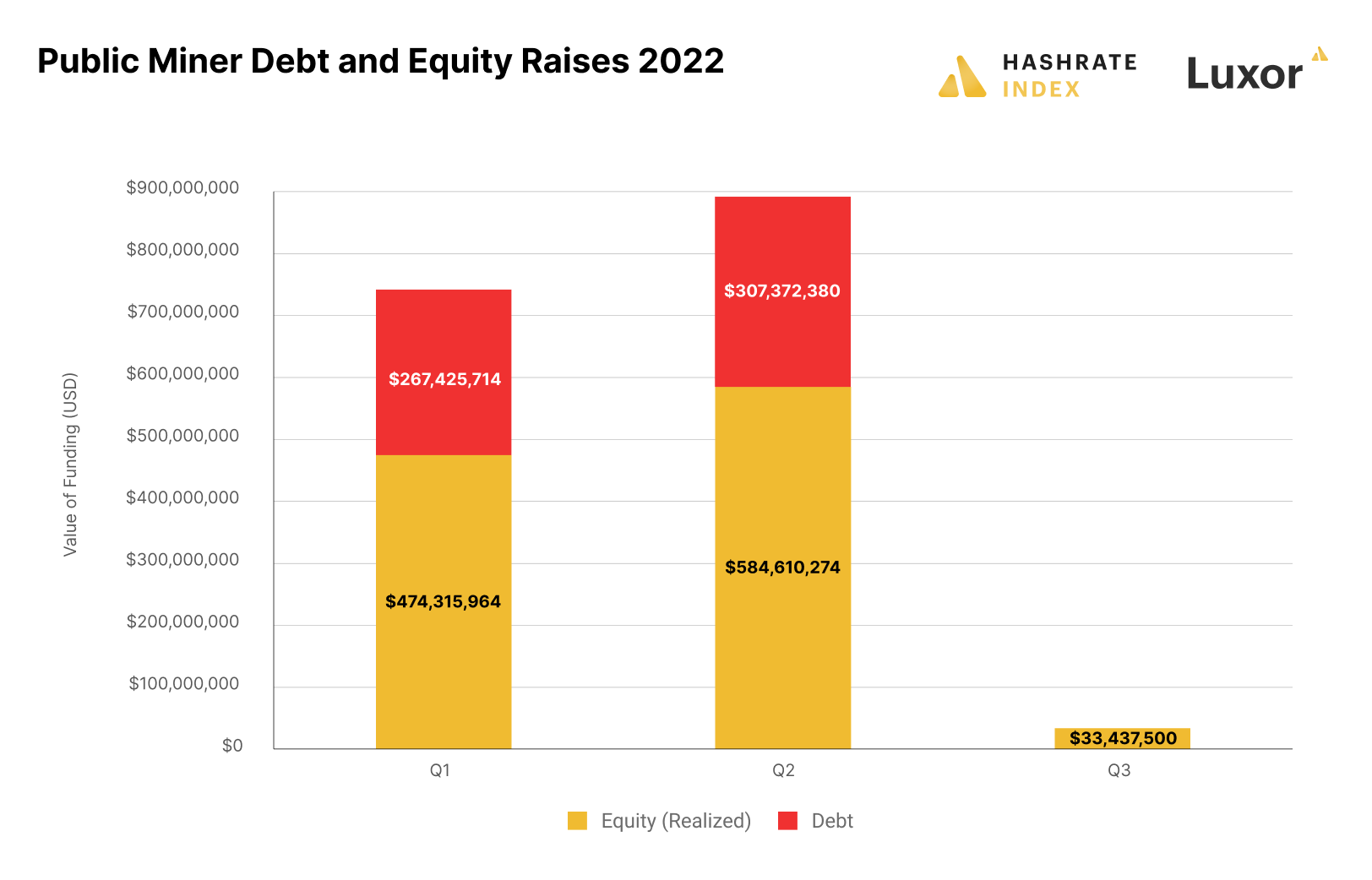

Part of the reason why public miners started to struggle in 2022 was that their capital tap was shut off. For the past two years, the public miners became accustomed to strong equity and debt markets. As you can see on the chart below, public miners raised $750 million in Q1 2022 and $900 million in Q2 2022, mostly consisting of equity. In Q3, they only managed to raise $33 million.

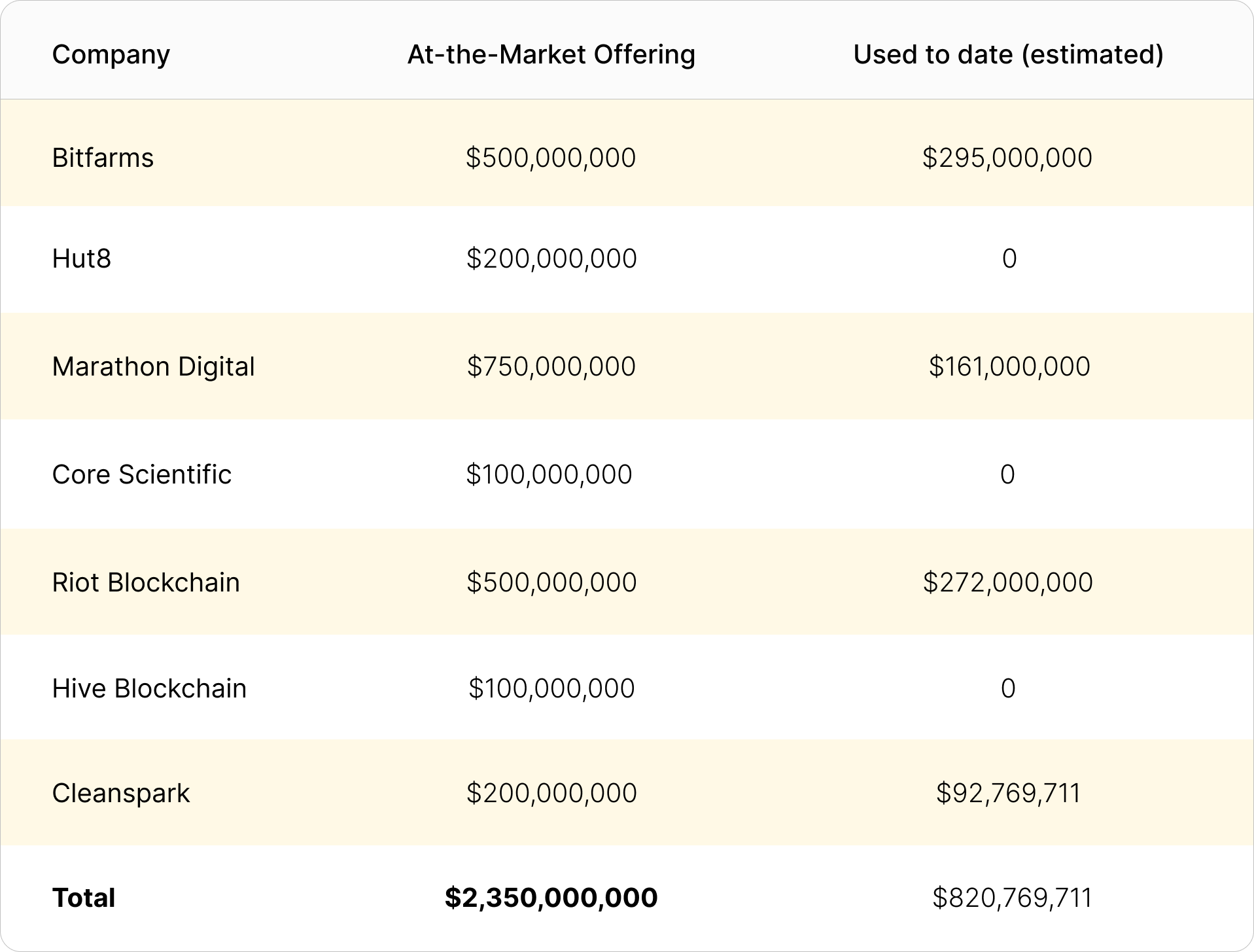

Once the bear market came into effect by June, financing deals immediately dried up. Bitcoin miners were no longer able to get cheap debt capital as the Federal Reserve started tightening. As an alternative for the last half of the year, Bitcoin miners announced At-the-market offerings en masse to shore up their liquidity. These equity offerings are like a revolving line of credit, wherein a company creates an open offer that investors can buy into until the ATM reaches a certain cap or expires. Major public Bitcoin miners secured these types of financing arrangements at the detriment of long-term equity investors who suffered from dilution. As the crypto winter continues into 2023, more unused ATM equity facilities will be used to build-up and survive the winter.

Recently, Cleanspark raised more ATM equity funding through an $500 MM offering from HC Wainwright. Entering 2023, there is at least $2 billion in potential equity funding available to the top public Bitcoin miners. Based on public disclosures, the following table shows the significant amount of funding available through ATM shelf offerings for public Bitcoin miners, as well as an estimate based on filing information for how much ATM funding public miners have tapped.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.