The Hashrace Begins: Bitcoin’s Largest Adjustment Ever Marks a New Dawn for Mining

Bitcoin's latest adjustment, the largest downward correction ever, provides a lucrative opportunity for plugged-in miners with roughly half of the network's usual competition offline.

Happy July, Luxor mining community!

We’re halfway through 2021, and there’s something poetic to us about the fact that Bitcoin is undergoing a series of historic changes right in the middle of the New Year--and so close to July 4th, the United States holiday marked by revolution and new beginnings.

Bitcoin’s network is undergoing plenty of revolutionary changes in its own right as miners flee China following provincial bans in the country. This ongoing exodus frees the Bitcoin industry from criticisms that the lifeforce of the network is concentrated in China, while also providing an unprecedented opportunity to restructure hashrate more evenly across the globe.

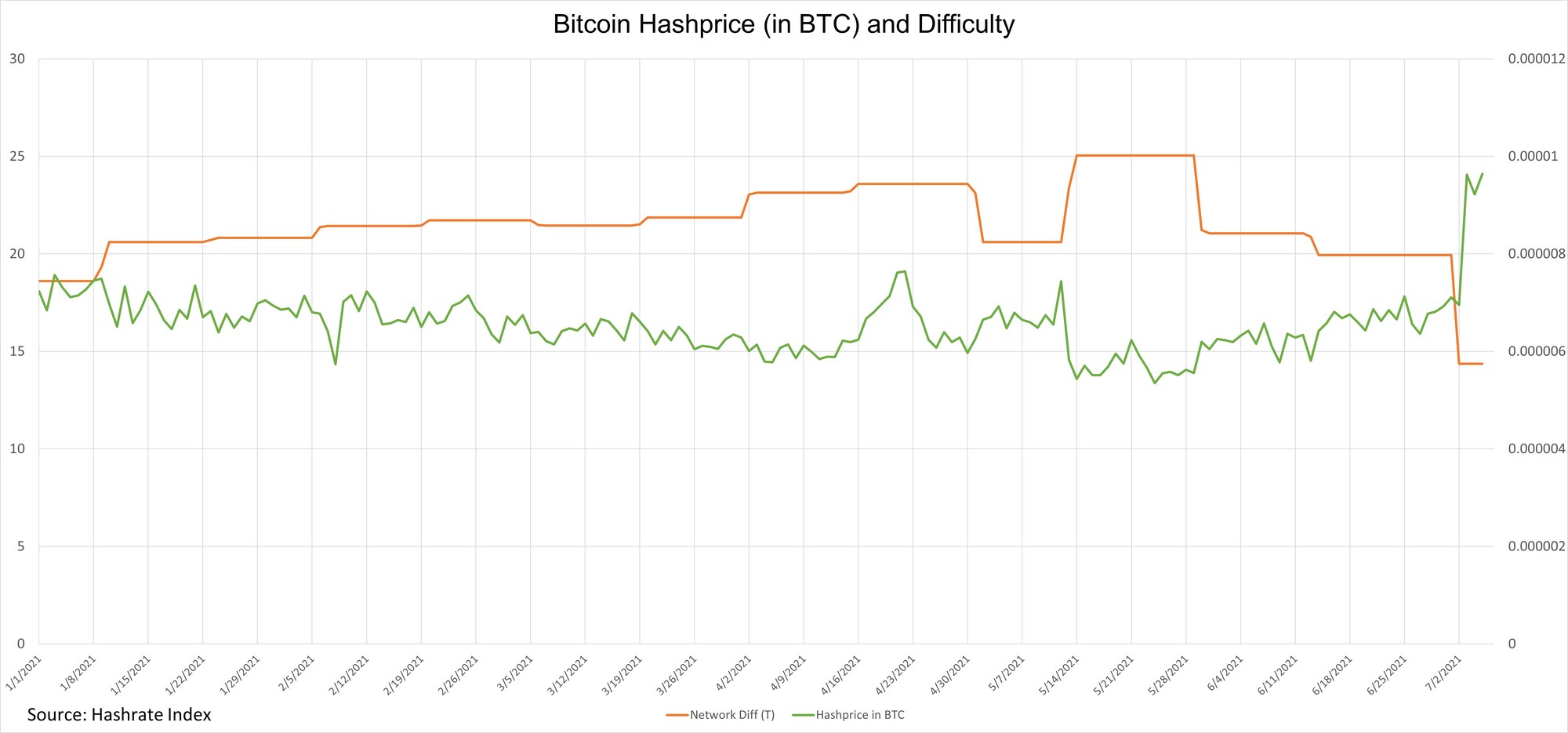

Perhaps the first great marker of this event since the ban itself, last weekend’s difficulty adjustment--the largest ever--has reset Bitcoin’s mining difficulty to its summer 2020 levels. Down from 19.93T to 14.36T, the difficulty adjustment marks the beginning of a lucrative period for Bitcoin miners who are seeing nearly half as much competition as a result of the ban.

The China mining ban (and its congenital adjustment) offers what may be a once-in-a-lifetime opportunity, and non-affected miners will be using it as a chance to grab as much market share as possible. Indeed, we’re already seeing North American mining companies move aggressively to capitalize on this unprecedented event.

Hashrate Index Data

But before we cover that news below, first some data.

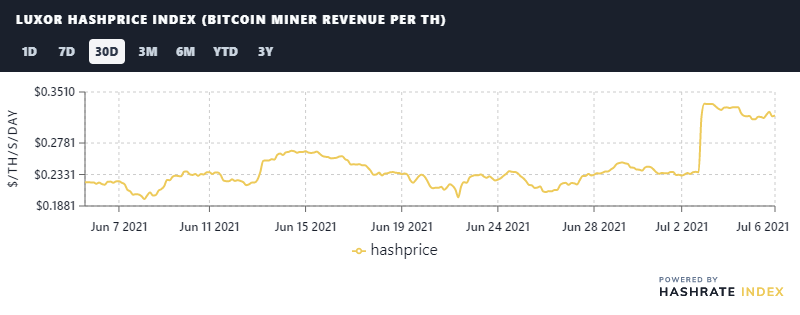

Hashprice: Bitcoin’s largest adjustment ever, a 28% drop, gave miners a 30% boost to profitability. Hashprice rose immediately after the adjustment from $0.23/TH to $0.33/TH. At the time of this newsletter, hashprice is $0.31.

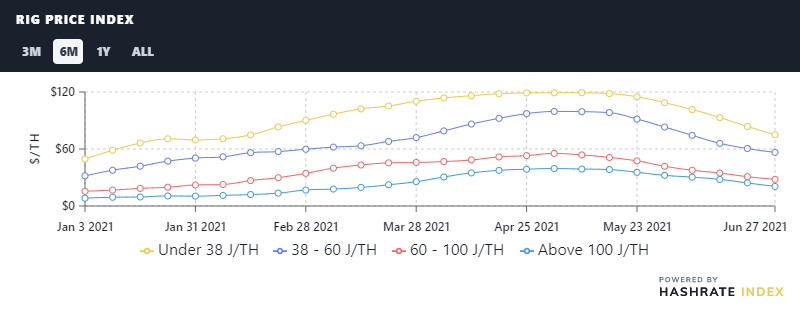

Rig Index: Rigs of all calibers continue to fall in price as machines from China hit the secondary market.

Newer and next generation machines (which consumer 38-60J/TH and 38J/TH, respectively) lost some 32% of their re-sell value over the month of June. Older machines in 60-100 J/TH also lost 32%, while the oldest machines in our index (over 100J/TH) fell the most at 36%.

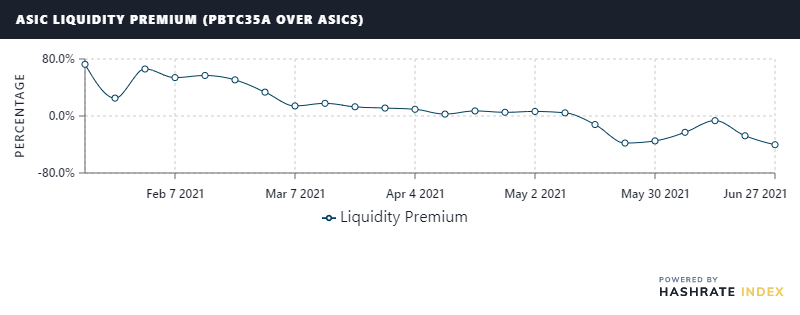

ASIC Liquidity Premium: Poolin’s hashrate token is sitting at a 40% discount over physical hardware, another ripple effect from China’s hashrate ban. Operating out of China, Poolin’s hashrate took a hit from the bans, but the pool still holds obligations to token holders based on the profitability levels it was experiencing before the ban.

With the token down over 50% since May and trading volumes waning, Poolin has suspended payouts for its BTC and ETH mining tokens.

Mining News

Bitcoin Difficulty Experiences Record 28% Adjustment

Bitcoin experienced a record-breaking adjustment this weekend.

Bitcoin’s difficulty adjustment corrected downwards on July 3, a precipitous 28% drop that underscored the severity of the miner exodus from China. The historic adjustment marks a new era for Bitcoin mining as hashrate migrates across the globe to hotspots like North America, Central Asia and Commonwealth of Independent States (CIS) countries.

With more than half of Bitcoin’s hashrate off the table (and miners now hashing at a difficulty last seen in summer 2020, when bitcoin was under $10,000), plugged-in miners should expect big profitability boosts for the rest of the year and into 2022.

Mining Companies Race to Build Out Hashrate

We’re starting to see North American mining companies capitalize on the opportunity presented by The Great Hashrate Migration. In a race against time and competitors to to secure as much exiled hashrate as possible, many big players moved this week to scoop up discounted ASICs, announce new financing, or expand their mining operations.

Toronto-based Hut8 inked a deal to buy 11,090 next gen WhatsMiners. The Canadian company hopes to have the machines online by December of this year.

TeraWulf, a newer firm based in California which plans to go public on the NASDAQ through a stock merger, made a splash in the press this week after signing a purchase agreement with Bitmain for 30,000 S19 Pros.

Greenidge mining is opening up a second shop down South. The mining firm, which owns and operates a natural gas facility in Upstate New York, says the new space in Spartanburg, South Carolina will be carbon neutral and could be open by late 2021 or early 2022.

Blockware raised $25M in fresh financing in a bid to capitalize on the ongoing miner exodus and triple its hashrate.

Argo raises $10M from Galaxy Digital to expand operations in Texas, which is perhaps the most coveted real estate in the US for miners in relocation.

North American Mining Council First Quarterly Report

The Bitcoin Mining Council, a de-facto collective of some of the industry’s biggest players, released their first quarterly mining report last week.

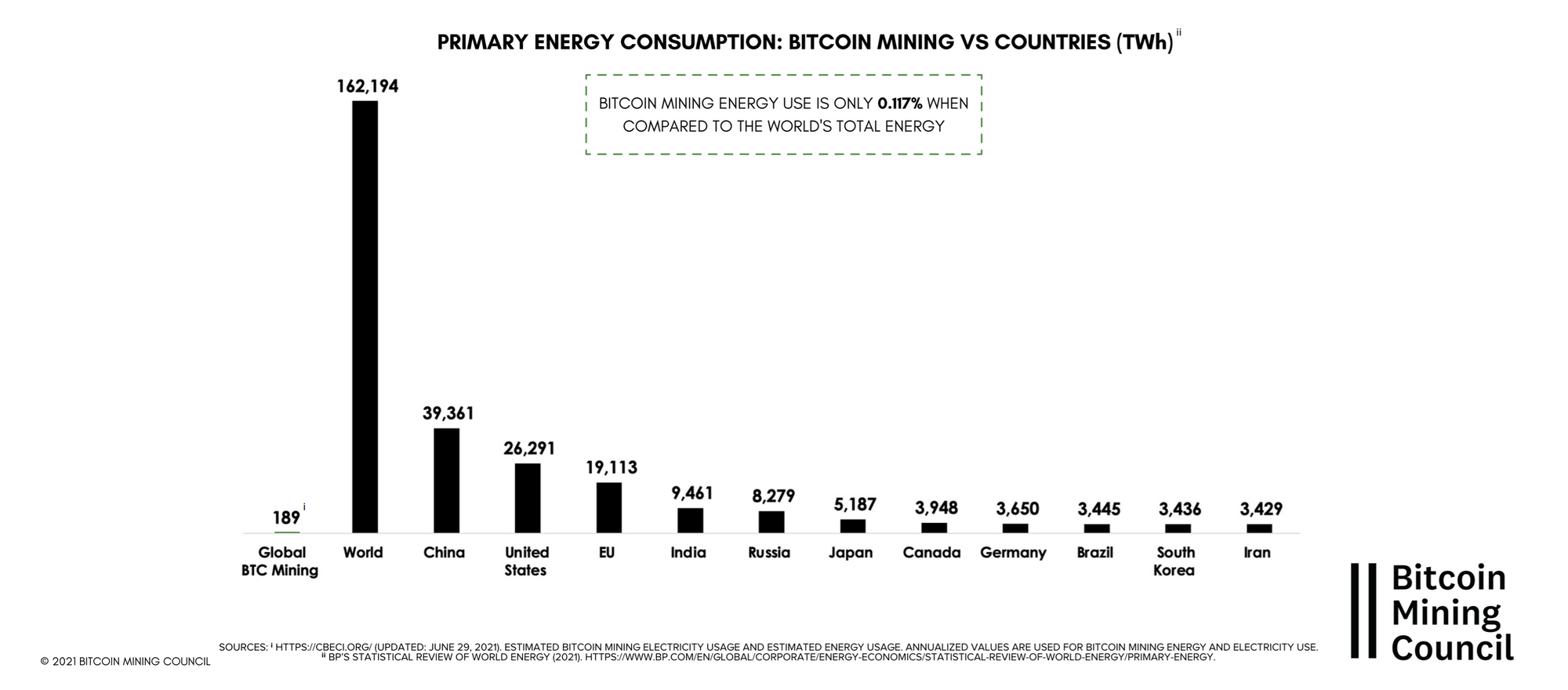

Among some of the report’s findings, the Council’s research claims that Bitcoin mining consumes 189 TWh annually, or roughly 0.117% of the world’s total energy consumption (of this, Bitcoin consumes 0.4% of all the world’s wasted/stranded energy).

Additionally, the report claims that Bitcoin mining used a mix of roughly 56% renewables in Q2 of 2021.

Kazakhstan Is Proposing a New Mining Tax

In our breakdown of the China mining ban, we forecasted that, as miners immigrate to new jurisdictions post-ban, other governments would begin crafting new legislation to regulate them; Kazakhstan, even more popular for Chinese miners now than before, is already crafting such legislation.

According to our sources in the country, the new mining tax is being seriously considered, but the finer details are not yet public.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.