The Halving Since The Halving: Growing Bitcoin Network Difficulty

How Difficulty Cuts Miner Revenue Per Compute Over Time

Most casual observers of the Bitcoin mining industry are familiar with the block subsidy halving: the infamous programmatic event that reduces new BTC issuance every 210,000 blocks (roughly every four years). But miners face another halving-like force that creeps up much faster — network difficulty.

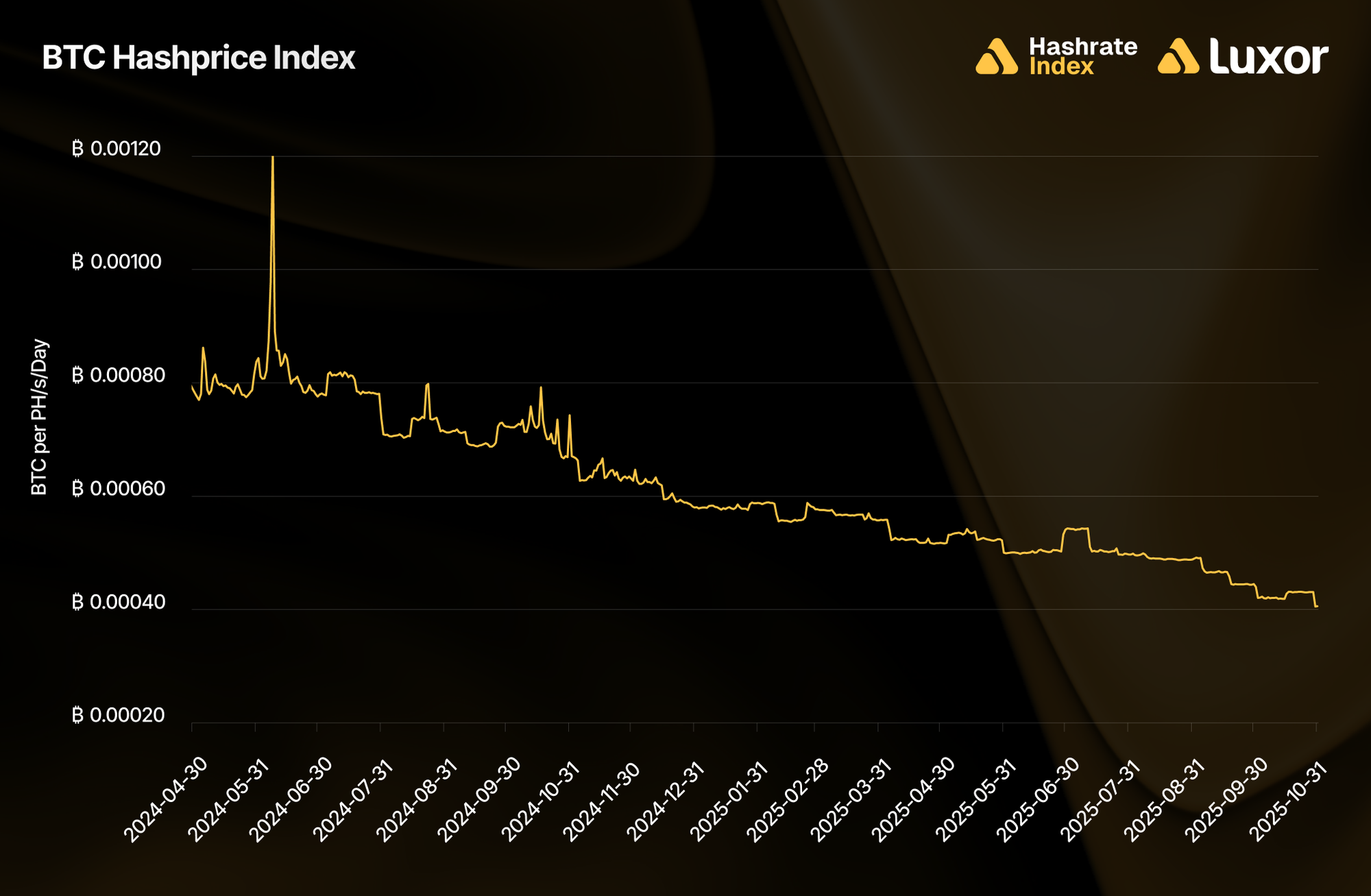

As new-generation hardware joins the network and more hashrate chases the same block reward, network difficulty climbs, cutting BTC-denominated mining revenue per unit of compute. Since the 2024 halving, BTC-denominated Hashprice has already been sliced in half* from roughly 0.0008 to 0.0004 BTC per PH/s/day.

* Lower transaction fees also contributed modestly to this decline.

Growing Network Hashrate Cuts Miner Revenue

Bitcoin’s dynamic network difficulty adjustment was one of Satoshi Nakamoto’s key innovations. It ensures that block times and monetary issuance remain steady, regardless of global computing capacity. Every two weeks, the protocol recalibrates the probability of finding a block and earning the associated rewards to maintain a ten-minute (average) block time. When hashrate leaves the network, difficulty declines and hashprice rises proportionally; when hashrate increases, difficulty rises and hashprice falls. The outcome is a predictable monetary schedule, but volatile miner revenues.

Over Bitcoin’s history, network hashrate and difficulty have grown significantly for two key reasons. The first is technological innovation: efficiency gains in ASIC hardware design, measured in lower joules per terahash (J/TH) and following Moore’s Law, allow miners to deploy more hashrate using the same amount of energy. The second is economic incentives: broader Bitcoin adoption and long-term BTC price appreciation has attracted new entrants to the network, intensifying competition among miners.

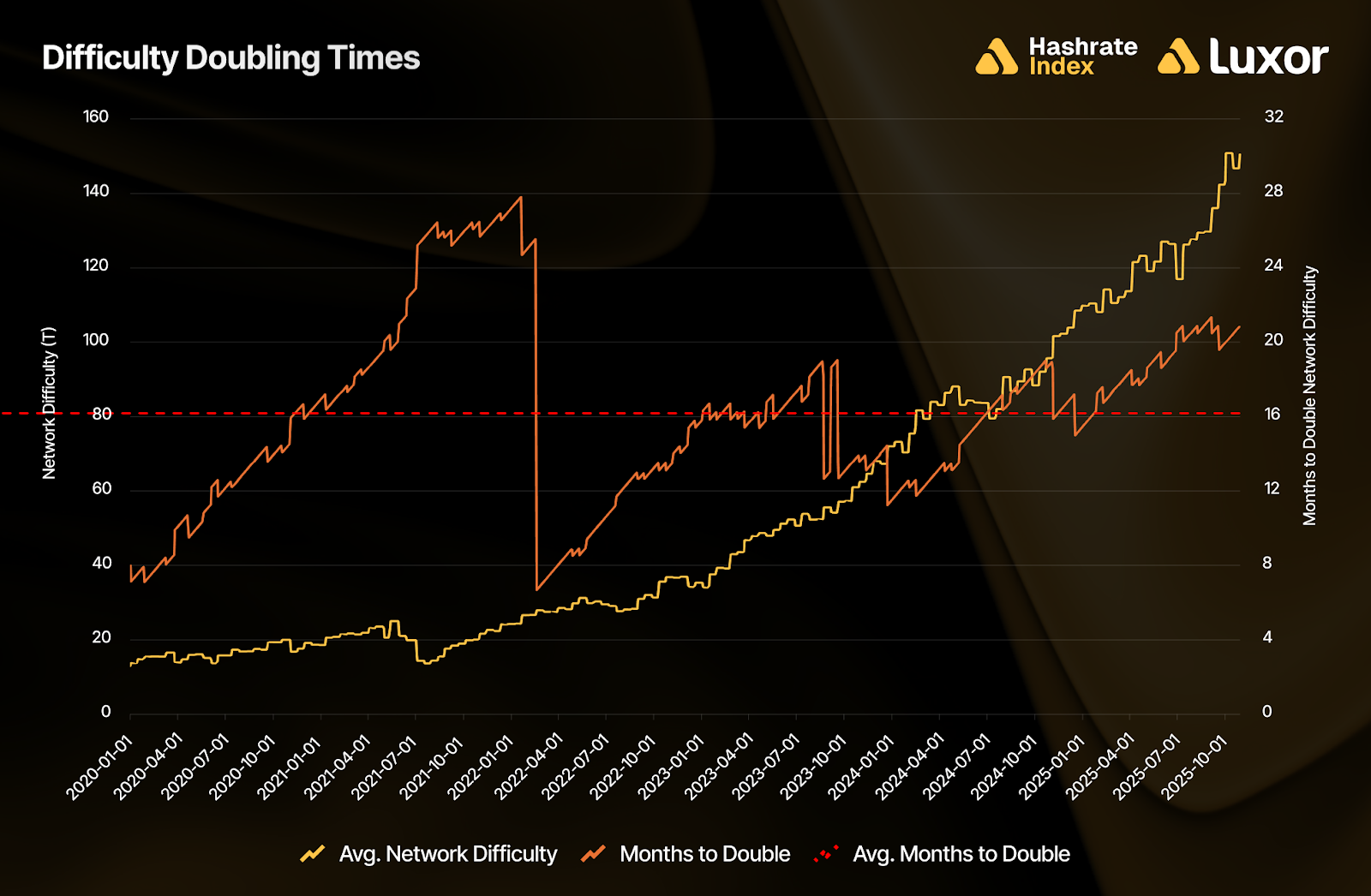

This growth trend has occasionally stalled. Policy shocks such as China’s mining ban, market events like the FTX collapse, and seasonal energy price changes in regions like Texas have each slowed network expansion temporarily. Over the long term however, growth has been exponential, and when network hashrate (i.e., difficulty) doubles, a miner’s BTC-denominated output per unit of compute is effectively halved.

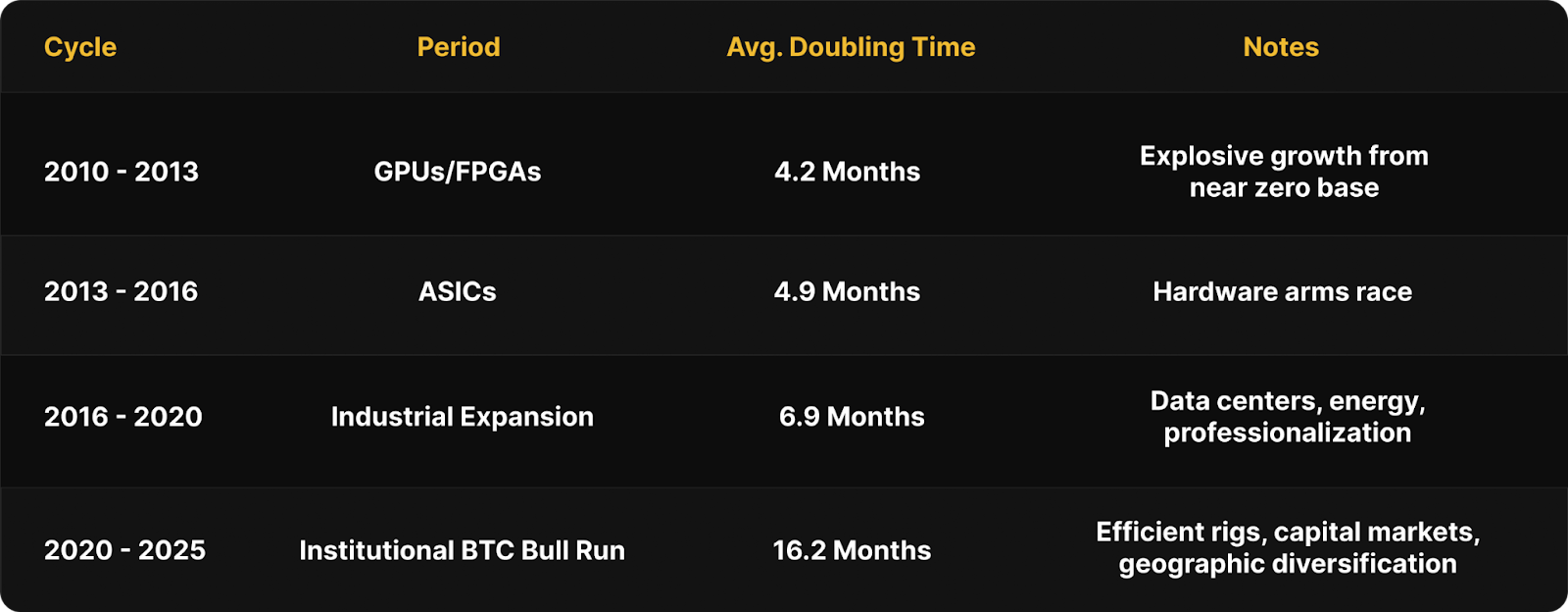

Since 2010, the network has roughly doubled at the following intervals:

The net effect: roughly every 16 months since 2020, a fixed unit of hashrate earns half as much bitcoin, driven purely by rising network competition.

The Bright Side: It Isn’t All Bad News

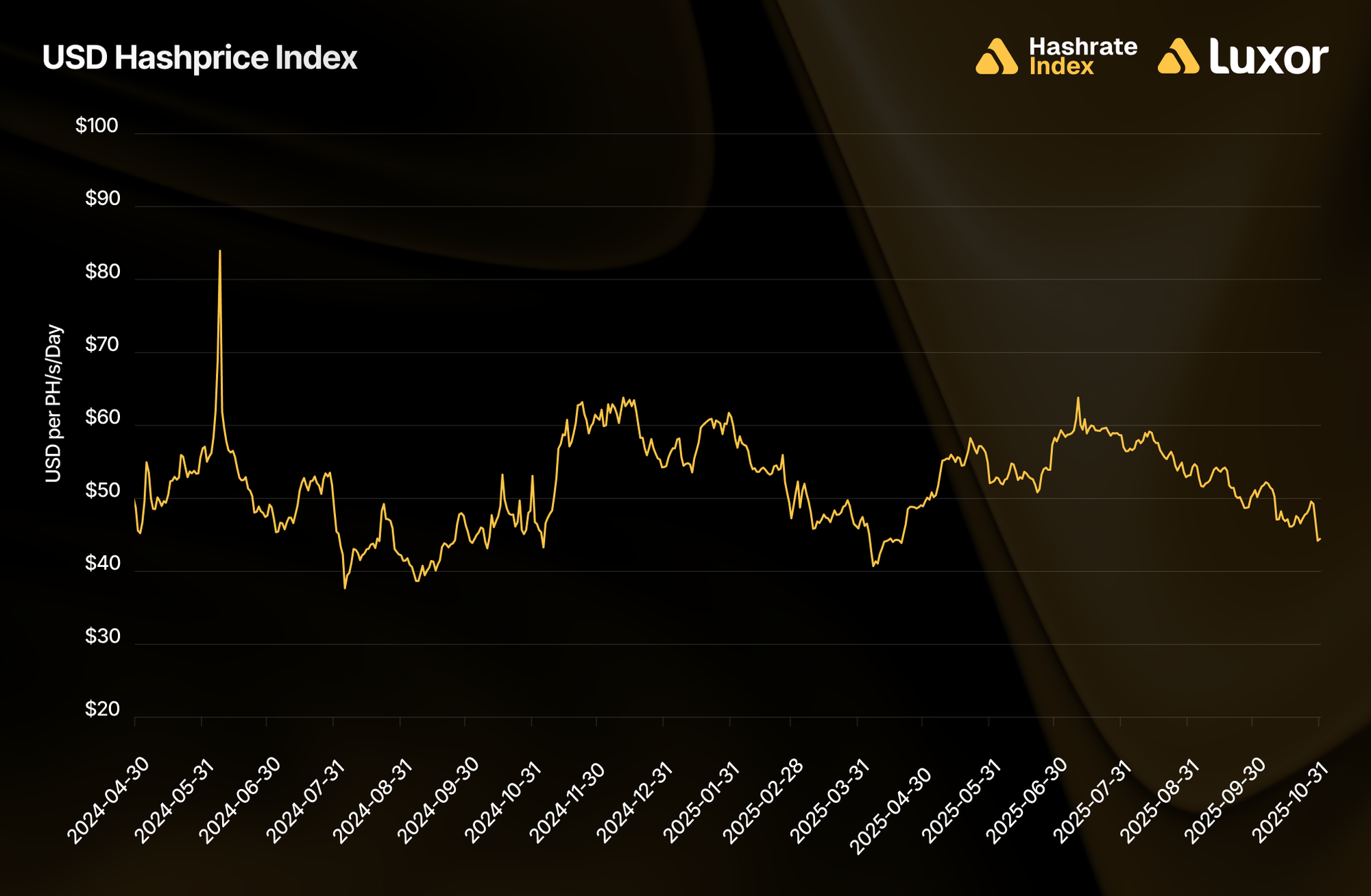

Just like the block subsidy halving, difficulty-driven declines in BTC-denominated rewards don’t always translate to lower USD revenue. When Bitcoin’s price rises alongside difficulty, miner profitability can hold steady or even improve. Since the 2024 halving, USD-denominated hashprice is roughly flat at $45 per PH/s/Day.

More importantly, difficulty halvings differ from subsidy halvings: the former reduces output per unit of compute, while the latter cuts revenue across the entire Bitcoin mining industry. Miners can offset higher network difficulty by deploying newer-generation ASICs that deliver more hashes per unit of energy. Still, the revenue of older hardware remains highly vulnerable as difficulty climbs.

Protection in the Forward Market

How can miners protect their revenue from rising network difficulty? By leveraging Luxor’s fixed and upfront pool payouts. The chart below illustrates the performance of various fixed pool payout contracts — effectively BTC-denominated rolling hedge strategies — compared to spot mining (FPPS) between May 2024 and October 2025.

The numbers speak for themselves: Luxor’s fixed pool payouts have meaningfully outperformed spot mining (FPPS) since the 2024 halving, led by 5-month (+15.8%) and 4-month forward sales (+11.4%). These longer contracts captured value by locking in prices ahead of rising difficulty and a low-fee environment, while still preserving BTC exposure.

Miners who consistently locked in fixed BTC pool payouts since the halving have been better protected from the hashprice decline driven by difficulty growth. Those using upfront payouts went even further, front-loading revenue and accelerating fleet upgrades relative to peers. To explore these strategies and secure predictable BTC-denominated returns, contact Luxor’s Derivatives Desk.

Note: these figures are strictly for demonstration purposes and exclude fees and bid/ask spreads associated with entering into hashrate forward contracts.

A second caveat: although selling forward proved to be favorable during timeframes shown above, it is critical to recognize that hedging is typically a cost of business rather than a revenue generation method. Hedgers willingly pay a price to buy certainty and obtain more predictable cash flows, which increases valuation, reduces cost of capital, and ultimately attracts investments.

If you’d like to learn more about Luxor’s Bitcoin mining derivatives, please reach out to [email protected] or visit https://www.luxor.tech/derivatives.

About Luxor Technology Corporation

Luxor delivers hardware, software, and financial services that power the global compute and energy industry. Its product suite spans Bitcoin Mining Pools, ASIC Firmware, Hardware trading, Hashrate Derivatives, Energy services, and a bitcoin mining data platform, Hashrate Index.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.