SB1751 would hurt Bitcoin miners, but who does it benefit?

SB 1751 would limit Bitcoin mining demand response in Texas, and SB 6 and SB 7 would benefit peaker plants.

Three bills have been passed by the Texas Senate, and they’re all troubling for Bitcoin miners – and for anyone interested in free energy markets. SB 6, SB 7, and SB 1751 all take aim at different elements of Texas’ grid operator, ERCOT, and none of them are particularly good for Texans in general.

SB 6 gives the Texas Public Utility Commission the leeway to offer “0% interest loan for dispatchable generators,” according to Senator Charles Schwertner, the author of the bill. While free money sounds great, Texas Tax payers may not be so eager to extend such cheap credit to the Peaker plants who stand to profit from power plants designed to run only a fraction of the year, at times when Texans have to pay the most for power.

SB 7 adds oversight requirements to ERCOT for the reliability of peaker plants along with some accounting allowances for plants that will operate at a loss when severe weather doesn’t come along.

SB 1751 takes specific action against Bitcoin miners and Bitcoin miners only by:

- Capping their contributions to ERCOT’s Large Flexible Load (LFL) program at 10% of curtailed load at any given time

- Eliminating tax break that are currently available to miners and other similar businesses

- Requiring miners of 10 MW or greater to register with ERCOT

The bill would essentially preclude Bitcoin miners en masse from participating in demand response programs that help improve their bottom lines but which also (more importantly) help to stabilize the grid.

And if miners are being precluded from this program, we should ask, “why, and who benefits?” We can find the answers, of course, in SB 6 and SB 7 and with the beneficiaries of its contents.

The Texas Power Grid

But before we get to those answers, a quick primer on the operations of the Texas power grid.

After winter storm Uri, most people have at least heard of ERCOT. While the much maligned grid operator has made its mistakes, it’s at the heart of what is a deregulated energy market. This means power generators aren’t owned, operated, or strictly regulated by Texas or even ERCOT. This relationship allows for innovation and entrepreneurship in generation and distribution unlike in most other states where the price of power is regulated by state agencies.

Power operators can build generation facilities and sell that power to the market for the spot (“market”) price. Operators also have the prerogative to sell power contracts where they agree to a fixed price with consumers for a period of time, regardless of the spot price. This is how most Texans purchase power for their homes.

The general public usually overlooks how fluctuations in demand can affect power providers and grid operators. Additionally, extreme weather can stress the grid to max capacity, but upwards of 90% of the time the grid does not experience this level of demand. To prevent tragedies like winter storm Uri or lesser dangers (e.g., rolling blackouts in the summer), grid operators have to ensure there is far more power generation available to account for those seasonal and daily spikes.

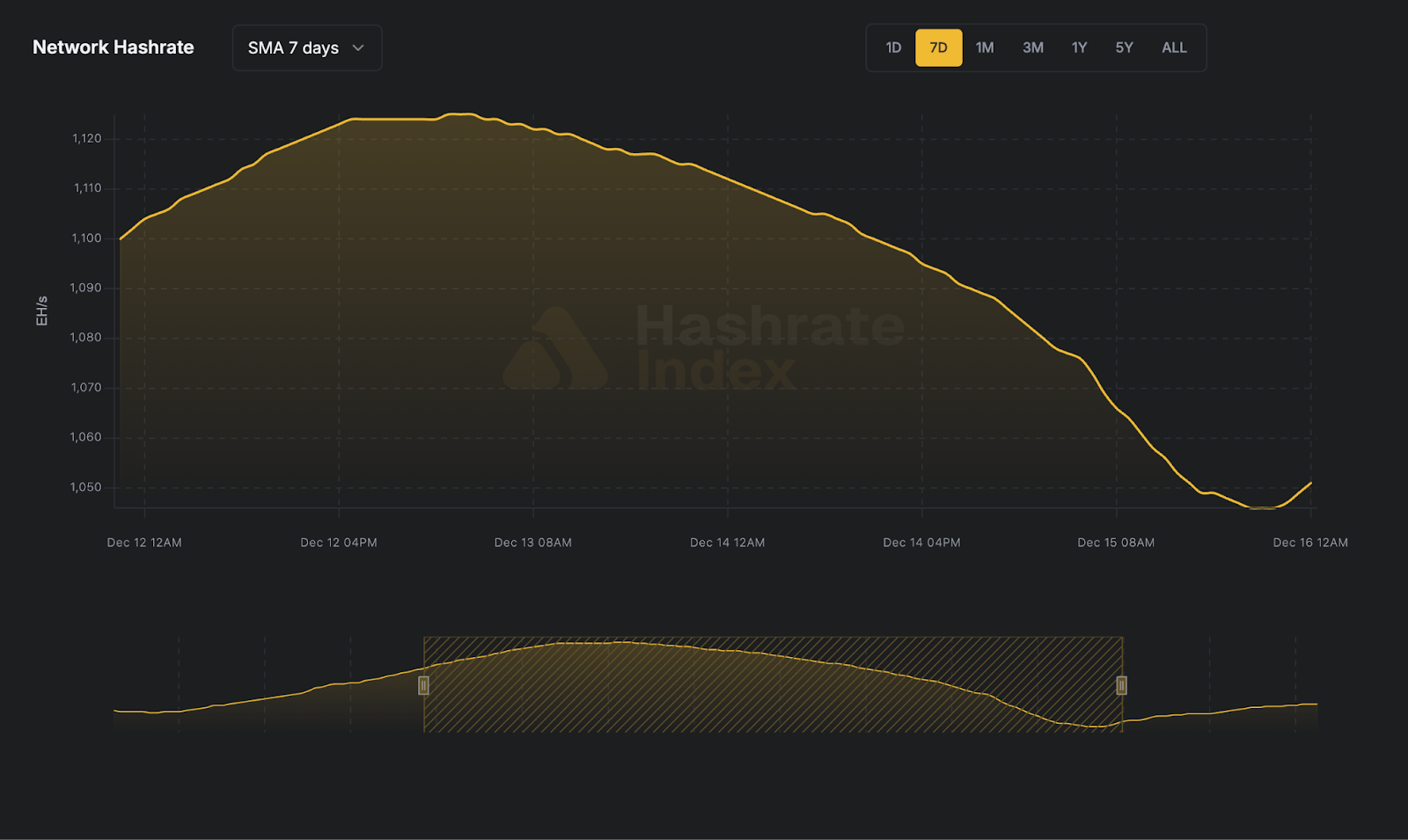

Enter peaker plants: peaker plants are usually natural gas fueled power plants that are turned off something like 95% of the year. When demand peaks (example peak graph), ERCOT calls on them to spin up and pays a hefty premium for their power. During Uri, these peaker plants had trouble starting up in the apocalyptically cold weather as natural gas was literally freezing in the pipes.

After this incident, investors such as Berkshire Hathaway (BH) saw an opportunity to invest something along the lines of $ 8 Billion dollars into peaker plants with the expectation that they would be able to capitalize on the extreme demand of egregiously cold or hot weather conditions in the coming years, and an ERCOT grid that favors investment in unreliable wind capacity in lieu of shoring up reliability of transmission & generation facilities.

On the one hand, an additional natural gas plant is welcome news to a Texas grid that now relies on nearly 25% unreliable wind energy. Texas needs all the reliable energy generation it can get in order to make up for unreliable energy being unreliable by definition, and to make up for the unpreparedness of the generation & transmission system for unlikely, yet possible cold weather extremes. However, picking winners & losers in the energy market by capping free market participants in bitcoin miners, and offering interest rate free loans reveals highly regulated command & control, and not an unregulated market that ERCOT advertises compared to other foreign, and domestic grids.

Bitcoin Mining, Large Flexible Loads, and Demand Response

Since Uri, ERCOT has been developing new tools to mitigate the risks associated with surging demand for energy when Texans need it most, specifically Large Flexible Loads (LFL).

The Large Flexible Load program is a program that empowers ERCOT to respond to excessive power demand by commanding large consumers (Seriously BIG- minimum ~400 residential homes worth of power) who are enrolled in the LFL program to curtail (reduce consumption partially or completely) to allow the current grid supply to meet the surging demand. For being compelled to turn down so rapidly, ERCOT gives participants in the LFL program power credits for curtailing, which they can use to pay down future power bills. Altruism aside, considering the participants (usually businesses) have to halt operations when they stop consuming power, the payment is only logical.

One of the quickest growing participants in the LFL program is none other than operators of Bitcoin mining data centers. The rapid computations required to operate the Bitcoin network consume enough power to play a key role in stabilizing the Texas power grid. There have been numerous instances since Uri where Bitcoin miners have curtailed in accordance with ERCOT’s LFL program, and voluntarily in many cases, due to the spot price of power. These controlled responses reduce volatility in the spot price of power, which helps to keep consumer power prices down.

While the lead may be buried here, connecting the dots only requires a pinch of imagination.

Bitcoin miners and peaker plants both compete for revenue provided by surges in power demand: miners by turning off, and peaker plants by turning on.

Mr. Buffet and his colleague, Charlie Munger, have consistently lambasted Bitcoin as having no use, but actions generally speak louder than words. The innovation of Bitcoin miners providing a clear and obvious value to Texans has forced these spring chickens to acknowledge one of Bitcoin’s many uses. This acknowledgement comes in the form of a crony capitalist attack.

Warren’s Berkshire Hathaway has been lobbying for expansion of peaker plants in Texas since at least 2021. While the lobbyists associated with Berkshire Hathaway aren’t officially recorded as lobbying for SB 1751, the bill’s benefits for the Oracle of Omaha’s holdings seem to answer the question of “Cui Bono?” for the origin of the bill.

In summary, corporatists like Berkshire Hathaway get free money, more lenient accounting practices, and competition all but eliminated from the trio of bills. It doesn’t take a Bitcoiner to recognize cantillionaires benefiting from fiat incentives while free markets turn necrotic from poisonous incentives.

SB 6, SB 7, and SB 1751 have already been passed in the Senate and will go to the House. Texas citizens should absolutely reach out to their state representatives to express opposition to these bills in their current form.

There are conversations to be had about each of these elements and how to improve the Texas grid.But targeting Bitcoin miners is in no way good for Texans, and it is in now way ethical. After all, if they can restrict features of the energy market for Bitcoiners, what’s to stop them from coming for another politicized energy consumer?

Editor’s Note: The original version of this article stated that “participants in the LFL program are paid the market rate for the amount of power they curtail,” which is not accurate. The compensation is actually the difference between the market price and their hedged price multiplied by the MWh which they reduce. Thanks to Shaun Connell of Lancium for correcting this inaccuracy.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.