WTF are Ordinals, Inscriptions, and Digital Artifacts?

Ordinal NFTs (aka digital artifacts or inscriptions) allow users to mint non-fungible tokens onto Bitcoin's blockchain - image and all.

There’s a new way to mint non-fungible tokens (NFTs) on Bitcoin, one that involves putting the actual content of the NFT completely on-chain.

Only the creator of this standard, Casey Rodarmor, doesn’t want to call them NFTs. He thinks that the word is tainted, so instead he’s calling them “digital artifacts.” Digital artifacts – or ordinals / inscriptions, as I will also refer to them in this post – use ordinal theory to mark and track “inscriptions,” the data/content that is imbedded onto the blockchain.

An ordinal is any number that defines a position in a series (e.g, first, second, third). In this case, the ordinal is the unspent transaction output (UTXO) for a specific satoshi. This satoshi includes an inscription with the NFT’s content, which could be txt, an image, an HTML, or even an MP3 file, and the ordinal marks this inscribed sat as a special transaction so users can identify and track them. Notably, an ordering system for sequencing satoshis was proposed as early as 2012.

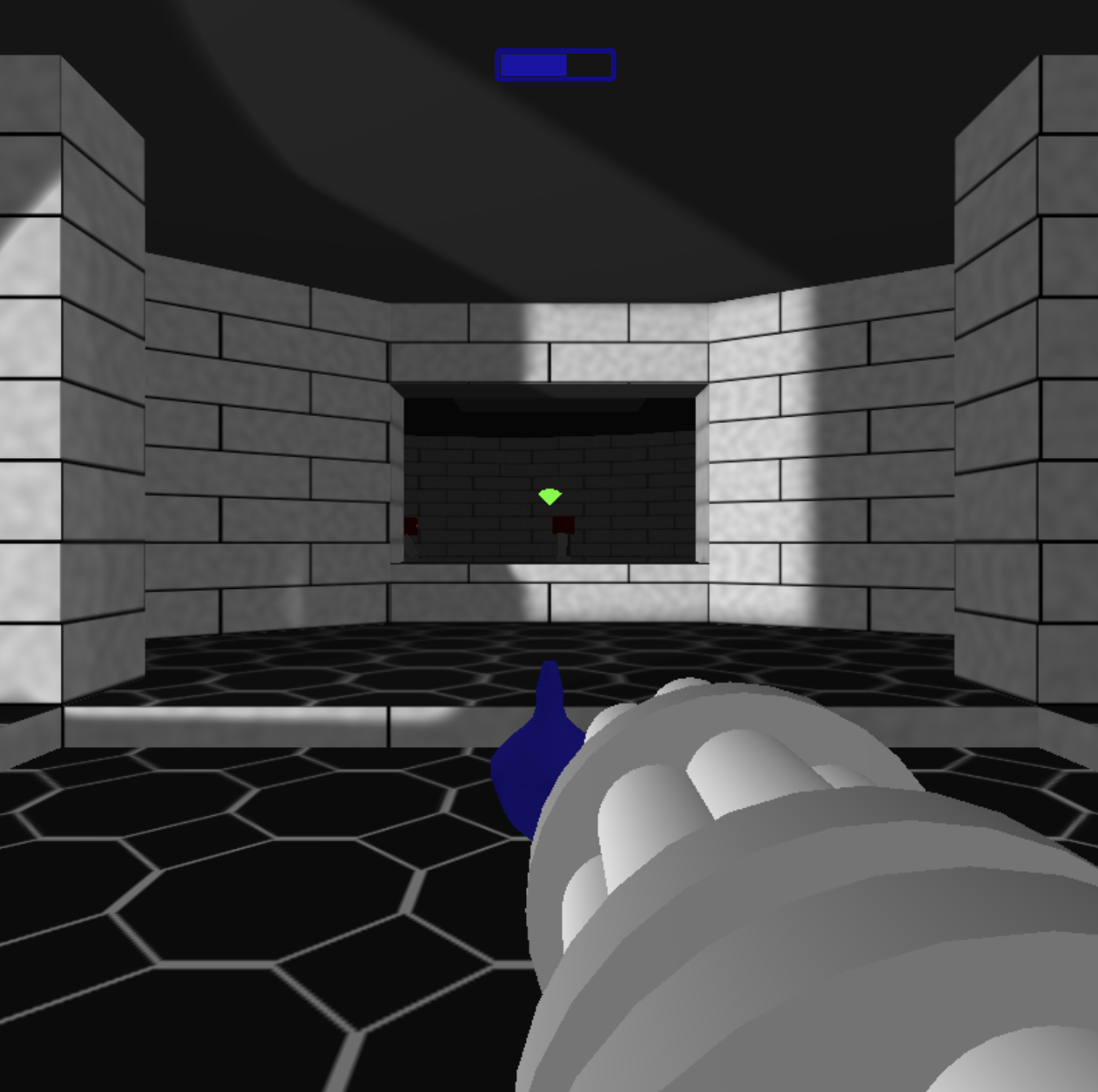

Since launching in January, over 1,000 digital artifacts are now immortalized on the Bitcoin blockchain. These inscriptions include Tweet screenshots, fledgling inscription series, an advertisement for Keet.io, and even 8-bit video games (like this clone of the classic shooter Doom, which you can play in the ordinal block explorer).

Outside of these more trivial-but-fun inscriptions for jpegs, video games, and the like, ordinal NFTs could also be used for immutable, censorship-resistant file storage for sensitive information.

Unlike other Bitcoin-based NFTs before it, ordinals do not use Bitcoin’s OP_RETURN field, which allows users to submit arbitrary data on-chain. Instead, it uses the transaction witness section of a Bitcoin block and tapscripts, the scripting function made possible by Bitcoin’s 2021 Taproot upgrade.

Inscriptions are native to Bitcoin, so they don’t require a new blockchain or token to function. They also store the entire NFT image/content on-chain, not just a link/reference to it like most other NFT standards.

The innovation has unlocked (or at the very least, lowered the barrier to entry to) new use-cases for blockspace. Naturally, this has miners hopeful that ordinal inscriptions could drive further blockspace demand and, by extension, greater fee revenue, but not everyone in Bitcoin’s sphere of influence is excited by the innovation – some in the Bitcoin maximalist camp see it as a trivial novelty at best or an attack on bitcoin as worst.

Counterparty, Rare Pepes, and the return of Bitcoin NFTs

Before we get deeper into ordinals, let’s take a walk through time at other attempts at NFTs on Bitcoin.

After all, NFTs originated on Bitcoin. Before Ethereum and Solana's pixelated punks and droopy-eyed apes became celebrity playthings, there were fantasy trading cards and Pepe the Frog.

NFTs first emerged in 2015 on Counterparty, a blockchain network that used Bitcoin’s OP_RETURN function to demarcate non-fungible assets. Robby Dermody, Adam Krellenstein, and Ouziel Slama launched Counterparty in November 2014 after the introduction of OP_RETURN in March of the same year. The platform’s first NFT series came with the introduction of a Magic-the-Gathering-esque trading card game, Spells of Genesis, in 2015.

Counterparty’s real come-up, though, came from Pepe the Frog’s immortalization in 1,774 NFTs in the Rare Pepe trading card collection. Collectors hold these NFTs in Counterparty wallets, but Counterparty uses OP_RETURN to anchor references to these NFTs onto the Bitcoin blockchain. Transaction size limits for OP_RETURN are 80 bytes, so NFTs on Counterparty were only afforded enough data to specify a description, name, and quantity. (The only limit to the data included in an ordinal NFT is the data limit on Bitcoin blocks themselves, which we’ll unpack in the next section).

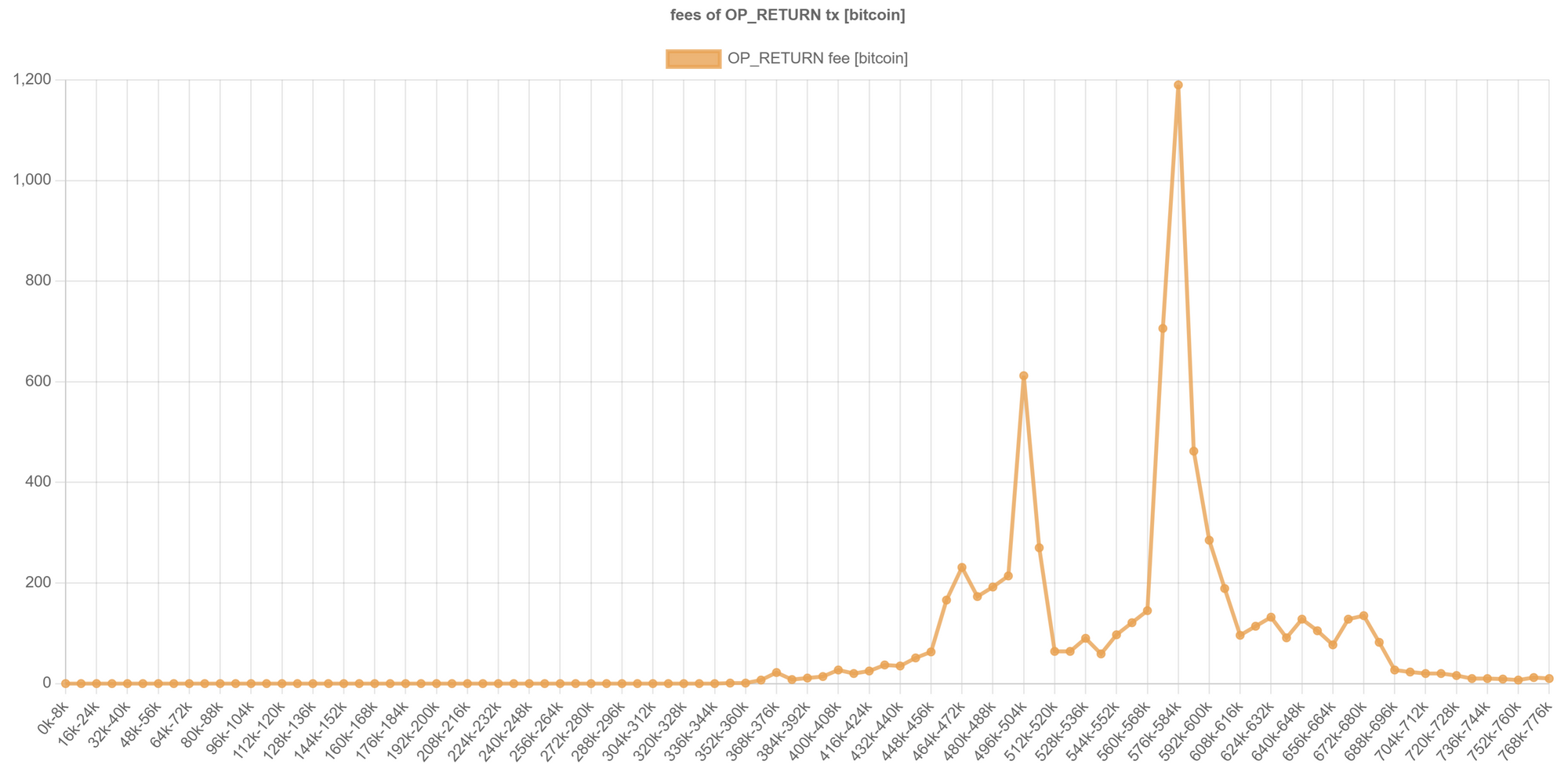

OP_RETURN transaction volume picked up in late 2018, peaked in the Spring of 2019, and petered out at the end of 2020 as OMNI (the original platform Tether used to issue USDT) and Counterparty fell to the wayside. 2019-2020 is also the timeframe that we see USDT migrate to Ethereum, as well as the seeding of early NFT projects on Ethereum.

The chart above raises an obvious question for the embryonic days of ordinal NFTs: will they follow the same trajectory or have greater impact?

What are ordinals, digital artifacts, and inscriptions?

Picking up from where we left off in the introduction, ordinal NFTs have a few primary building blocks:

- Transaction witness field: The witness field of a transaction is where the NFT’s data and content live.

- Inscription: The inscription is the NFT’s substance – the actual content being minted onto the Bitcoin blockchain and of which the NFT represents ownership. Inscriptions are engraved on the transaction witness section of a UTXO and are ascribed to the first satoshi of the first output in a transaction. You’ll also see people refer to digital artifacts/ordinals as inscriptions – the three terms have become interchangeable.

- Envelope: Inscriptions are stored in what Rodarmor calls an "envelope" that consists primarily of the Opcodes OP_IF and OP_FALSE. Like OP_RETURN, these operational codes are used to give instructions to the Bitcoin blockchain. In this case, OP_IF stores the file that is inscribed, while OP_FALSE makes sure that this data is never actually executed and pushed through the stack (so despite some maximalist fearmongering, full nodes don't need to process and validate an inscription, just the UTXO set it is tied to).

- Ordinal numbers: The mathematical theory of numeric sequencing, which in this case is used to distinguish individual satoshis as “digital artifacts” (aka, ordinal NFTs). Ordinal sequencing marks a specific satoshi of the first output of a transaction as the NFT; once marked, this satoshi can change hands and be traded like any other NFT.

Unlike Counterparty NFTs, which are limited to 80 bytes, inscriptions have no data limit besides the 4 MB data limit of the transaction witness field. So if you have a file big enough, you could theoretically mint an ordinal NFT that fills up an entire Bitcoin block on its own.

Taproot’s tapscripts and the transaction witness field established by SegWit make this work.

With the advent of SegWit in 2017, transaction signatures were moved from the ScriptSig field of a transaction to a new witness field, and this field is separated from the block’s transaction merkle tree and segregated to another part of the block (hence the name Segregated Witness, or SegWit for short).

SegWit was effectively a block size increase, as any data included in the witness field does not count toward the 1MB block size limit dictated by the Bitcoin source code. As such, the SegWit upgrade introduced a new method for measuring block size called “block weight,” wherein data included in the witness “weighs less” than data in the original block space. So the data in the witness field of a SegWit transaction is cheaper than other data in a block, an effect known as the “witness discount” and which is key to making inscriptions possible.

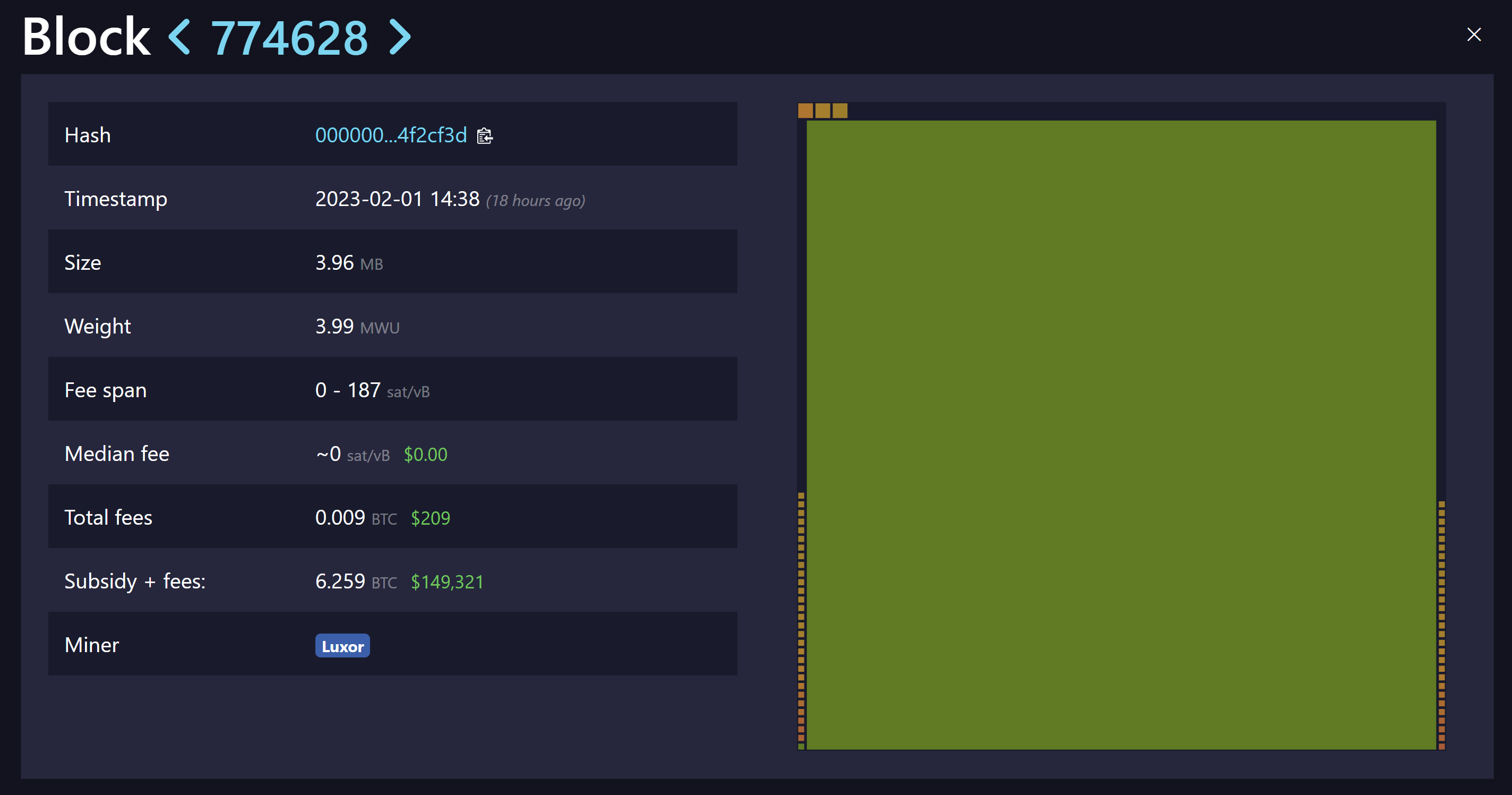

The other key is Taproot. Even with the witness discount, Segwit still placed restrictions on how much data you can pack into the witness field in a single transaction. Taproot loosened these requirements to remove the limit entirely, so you could theoretically inscribe a 4 MB NFT that would take up an entire block’s dataspace. (We actually put theory into practice at Luxor and mined a block with a 3.9 MB digital artifact, the largest block ever mined).

“The inscribed transaction is a taproot spend that reveals the tapscript and thus the contents of the inscription and a file type,” ordinals creator Casey Rodarmor said in a phone interview. “That inscription is made on the first sat of the first output in that transaction..the ordinal protocol allows you to transfer that sat using normal Bitcoin transactions.”

As Bitcoin developer Peter Todd points out, inscriptions were possible even before the advent of Segwit in August 2017. But Taproot makes them cheaper and allows for much larger file sizes. Some commentators have said that Rodarmor discovered the innovation by mistake, as though he stumbled upon it by chance.

“I wouldn’t call it an accident–I think people are surprised to find out about it,” Rodarmor said.

Bitcoin users will need a special wallet and block explorer (Ord Wallet) to index and track ordinals, but they can send and receive them with any Bitcoin address type. Since digital artifacts need Taproot to function, the Ord Wallet is Taproot enabled by default.

One more thing to note: inscribed satoshis are still fungible with other satoshis on-chain, meaning that they can be spent the same as other satoshis. Right now, you can only inscribe a satoshi once, but Rodarmor is working on an update that will allow users to re-inscribe previously inscribed satoshis (call that scribeception…).

What do ordinals and inscriptions mean for Bitcoin miners?

As much as their creator tried to avoid controversy by naming them “digital artifacts,” ordinals are already a white-hot topic among Bitcoiners.

There are basically two camps here. Pro-ordinal folks say that Bitcoin’s blockspace is a free market; if you can pay the fee, you’re entitled to the block space, no matter the size of the transaction or what the transaction contains. Anti-ordinal folks argue that NFTs (inscriptions including) are spam and could bloat block space so that trivial transactions crowd out more legitimate economic transactions like normal transfers; moreover, this “bloat” increases the bandwidth needed to download and run a Bitcoin full node.

Ordinals and inscriptions wandered into the larger debate about Bitcoin’s security budget (or whatever you want to call it). Proponents argue that a new application that could drive demand for block space could be beneficial in a future when Bitcoin’s halvings eventually dwindle the block subsidy to 0. Naturally, a debate about block space and fees intrigues miners, who used to net as much as 30% of their revenue from transaction fees but who now only receive 3% of revenue from fees on a good day.

There are just over 1,000 ordinals in circulation, so they aren’t prolific enough to make transaction fees go parabolic yet. That said, Bitcoin translation fees and blocksizes did increase significantly on the final two days of January. Some of this increase could come from Bitcoin’s hashrate falling 3% from all-time highs at the time, making block times more sluggish than usual and thus leading to longer transaction times and higher fees. But without the inscription spree for ordinal NFTs, we likely wouldn’t have seen transaction fees and blocksizes increase as much without the block space demand from inscribers.

There’s a good chance that inscriptions alone do not increase transaction fees. Well, they could increase fees, but not in the way you might think. After all, they benefit from the SegWit data discount, so theoretically a block full of digital artifacts would actually carry fewer fees than one filled entirely with ordinary Bitcoin transactions.

But if enough users start inscribing ordinal NFTs so that they seriously compete for blockspace with ordinary transactions, the users broadcasting ordinary transactions would need to increase their own fees for inclusion. In this case, miners would likely prioritize as many ordinary transactions as possible, because they have a higher fee per byte of data and they can fit more of them into a block, thus maximizing fees.

So if ordinals create transaction fee pressure, miners will likely optimize for higher fees by including as many ordinary, economic transactions as possible.

Looks rare

The real boon for miners may not come from transaction fees, though, but from minting digital artifacts themselves – specifically, rare satoshis.

In one of his blog posts on ordinals, Casey Rodarmor lays out a taxonomy of rarity for different satoshis. The taxonomy revolves around events that are essential to Bitcoin’s self-regulating proof-of-work, namely difficulty adjustments and halving events. The first satoshi in a block after a halving, for example, is classified as an “epic” sat, and assuming there’s a demand, such a sat could fetch a pretty penny from collectors.

The rare sat taxonomy:

Should a market emerge for such collectibles, miners are primed to profit from selling these rare sats to collectors. Again, this all rests on the assumption that a market for these emerges, but given that everything from monkeys, to rocks, and even dickbutts have found collectors in the carnival world of NFT trading, it’s not a stretch to assume some Bitcoiners would jump at the chance to own the first satoshi in a new halving epoch, or even the first satoshi in a new difficulty epoch.

Ordinal: ordinary or extraordinary?

Casey Rodarmor’s innovation is barely a month old, but it's already become the most contentious topic of the year in Bitcoin circles.

The pushback is so strong that Bitcoin Core contributor Luke Dashjr has put together a slapdash filter for node operators, though the efficacy or impact of such a thing is in question. After all, OP_FALSE means that the inscribed data itself doesn't need to be validated, and pruned nodes don't include the transaction witness field anyway.

On the opposite side of the isle, there are plenty of folks – both Bitcoin maximalist-adjacent and general crypto enthusiasts – who are excited about having a new, novel way to mint NFTs. Beyond jpegs and collectibles, ordinals could prove useful for publishing sensitive files that would benefit from immutable, censorship-resistance storage and replication. To borrow a phrase from Galaxy Digital’s Brandon Bailey, Bitcoin users could inscribe ordinals to curate an “immutable library.”

For miners, the innovation could lead to fatter transaction fees down the road, and also open up alternative revenue stream from mining rare sats and even miner/maximal extractable value (MEV).

At any rate, ordinals are not going away. Now, it's just a matter of how much of an impact they make, and whether or not inscriptions become big enough to attract the same NFT fervor cultivated on Ethereum and other blockchains.

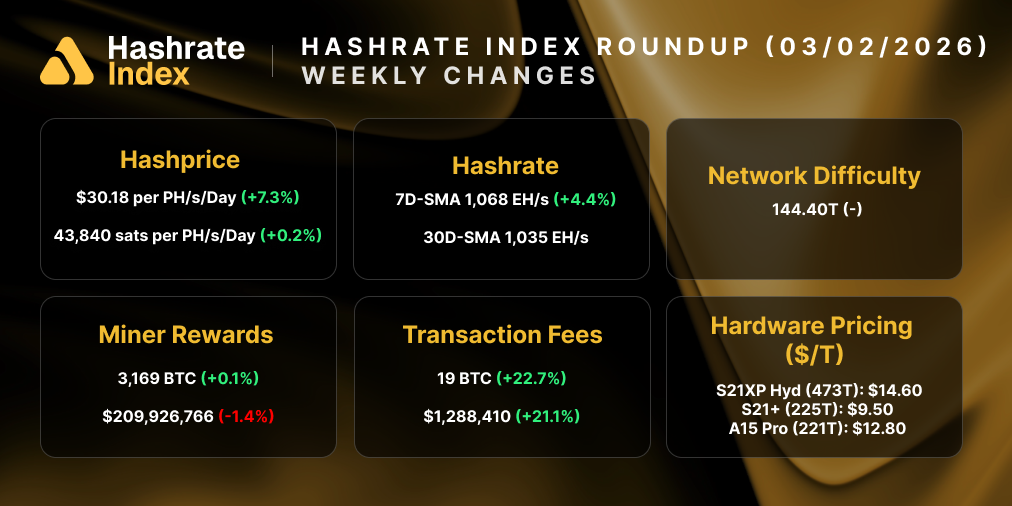

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.