Mining or buying bitcoin - what is the most profitable?

This article estimates the return on investment of mining versus buying bitcoin over the next five years.

You have two choices for getting ahold of the precious orange coin - you can buy it or mine it. While most prefer the simplicity and safety of just purchasing it, some risk-tolerant investors are willing to embark on the adventurous journey of mining in the hope of accumulating even more bitcoin than if they simply bought it.

Facing this dilemma, I decided to write this article analyzing the current viability of mining as a bitcoin stacking mechanism, estimating the five-year bitcoin-denominated returns of investments in the Antminer S19j Pro and the Antminer S19 XP under six market and electricity price scenarios.

The methodology is simple. A miner purchases mining rigs based on current pricing from the Luxor RFQ Platform and plugs them in from June 1st. I calculate the bitcoin-denominated return of the investment, assuming the miner holds all the bitcoin except for the hosting fee payment. If the return of this investment exceeds 100%, the miner has recouped the bitcoin he initially spent on machines, and the investment is considered a success.

So, who will end up with the most bitcoin after a five-year investment? The buyer or the miner? Let’s find out.

Bearish scenario

My analysis employs three scenarios: bearish, neutral, and bullish. Let’s start with the bearish scenario.

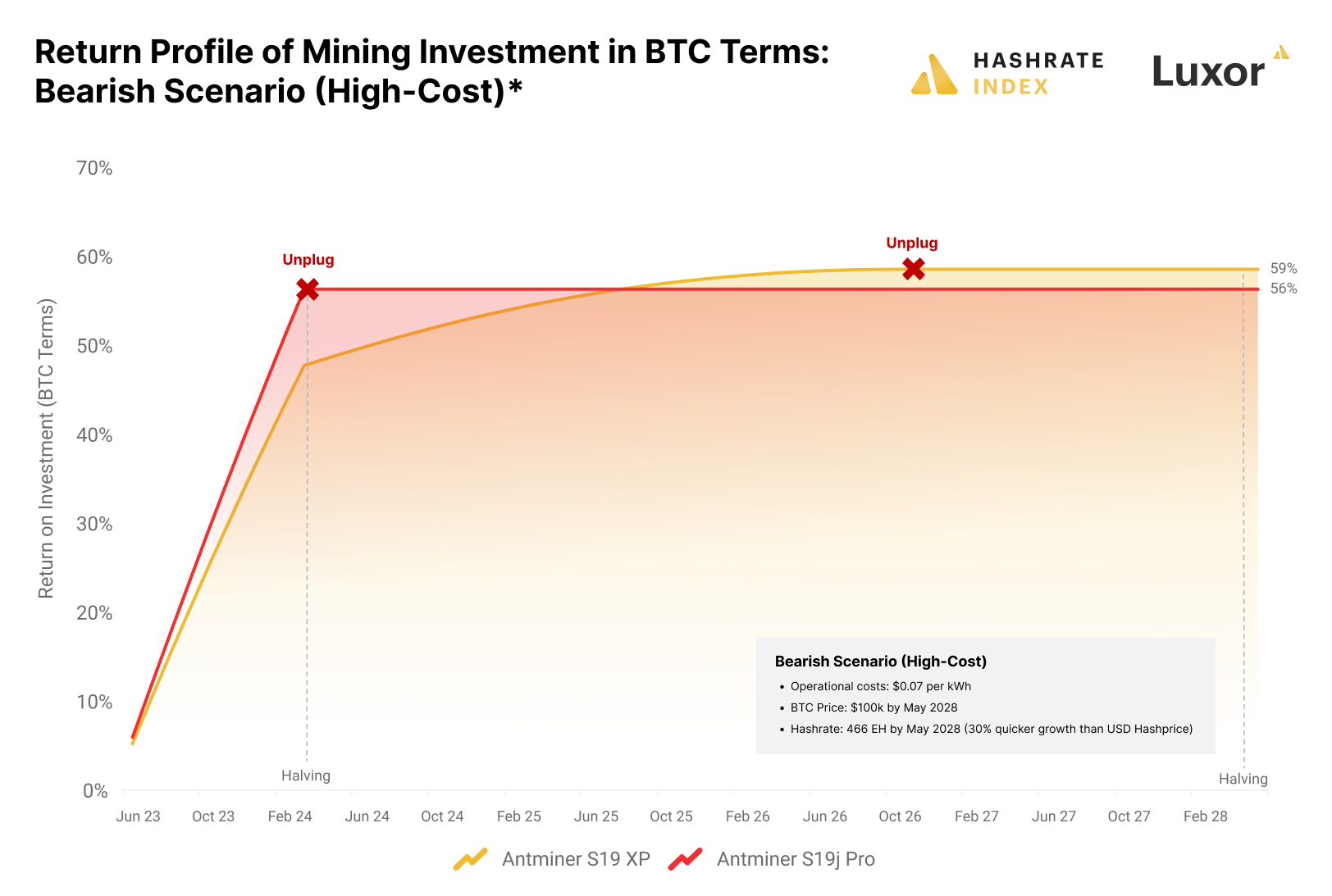

In this scenario, the bitcoin price steadily increases to $100k by May 2028. You may disagree that this scenario is bearish, but remember that this analysis is for those bullish on bitcoin in the first place. These investors would never invest in mining if they weren’t already bitcoin bulls, so employing a more pessimistic scenario is meaningless.

Hashrate tends to follow the hashprice, albeit with a lag during rapid bitcoin price increases. In this scenario, the bitcoin price increases by 30% annually, a speed that the hashrate can easily follow and even surpass. Therefore, this scenario assumes the hashrate grows 30% faster than the hashprice and ends at 466 EH/s after the halving in May 2028. Transaction fees remain unchanged from the low levels from early 2023.

In the bearish scenario, a high-cost miner with an operational cost of $0.07 per kWh has to unplug his S19j Pro after the halving in 2024, only recouping 56% of his initial investment. If this miner invested 1 BTC in mining rigs, he would only earn back 0.56 BTC by mining, losing 0.44 BTC in the process. Still, he could sell his used rig to a lower-cost player after the halving but will likely not get a significant amount for it, as the market would be flooded with rigs in such a bearish scenario.

The S19 XP only does marginally better. It is still marginally cash flow break-even after the halving but will become cash flow negative in November 2026 after only recouping 59% of the initial bitcoin investment.

For high-cost players in a bearish market environment, mining is an excellent way of ending up with less bitcoin than you started with.

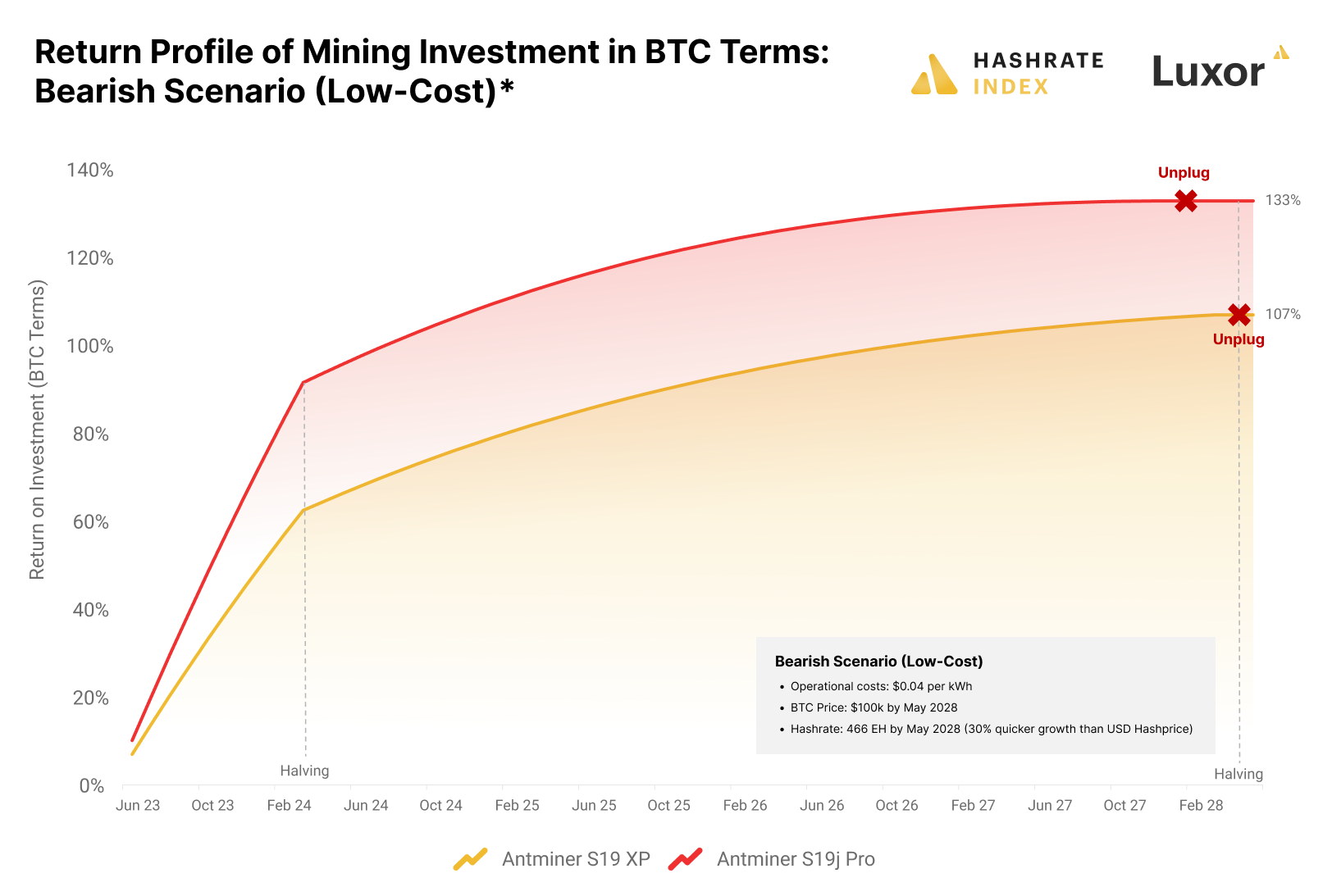

But what if you can run the rig at $0.04 per kWh? In that case, your investment looks significantly better, even in this bearish market environment. At such a low operational cost, the miner can recoup his S19j Pro investment after only a little over one year. This investment gives a return of 133%, significantly better than the S19 XP, which only recoups 107% of its investment.

Still, a 133% mining return in five years is nothing to brag about. Annualized, it only equals 6%, a poor return for taking on the high mining risks. Thus, it becomes clear that mining is only super profitable in a considerably more bullish scenario.

Neutral scenario

Let’s look at our neutral scenario. Here, the bitcoin price steadily increases to $250k by May 2028, while the hashrate grows 10% faster than the hashprice. Transaction fees remain unchanged from the low early 2023 levels.

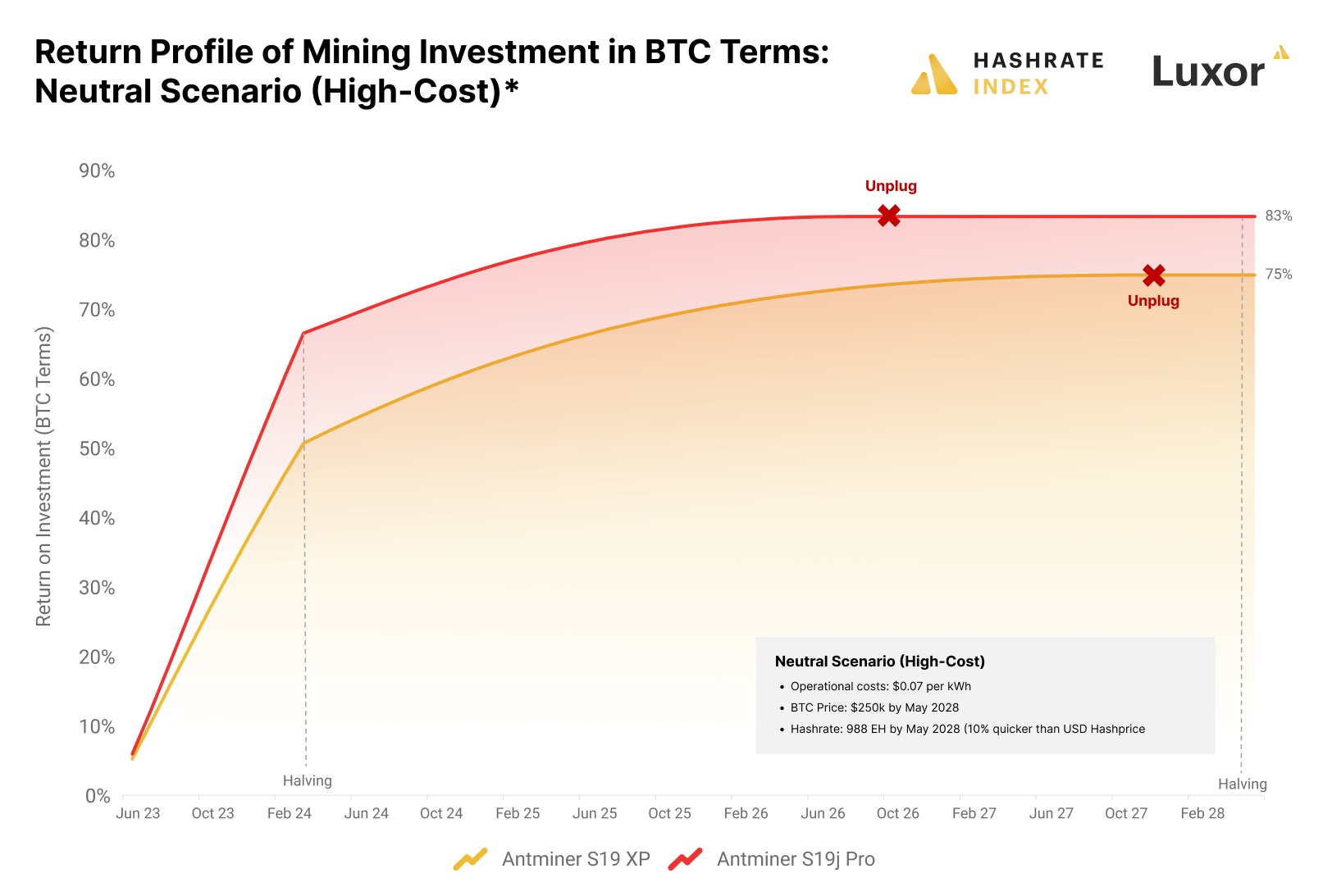

Neither in this scenario does our high-cost miner recoup his initial rig investment. The S19j Pro is also the best-performing investment, rapidly generating a return until the halving in 2024. After the halving, the returns profile gradually worsens, and the rig only recoups 83% of its initial investment.

Like in our bearish scenario, an investment in the S19 XP also performs significantly worse, only giving a return of 75%.

For a high-cost player, simply buying bitcoin instead of mining rigs is likely preferable, even if the bitcoin price increases to $250k by 2028.

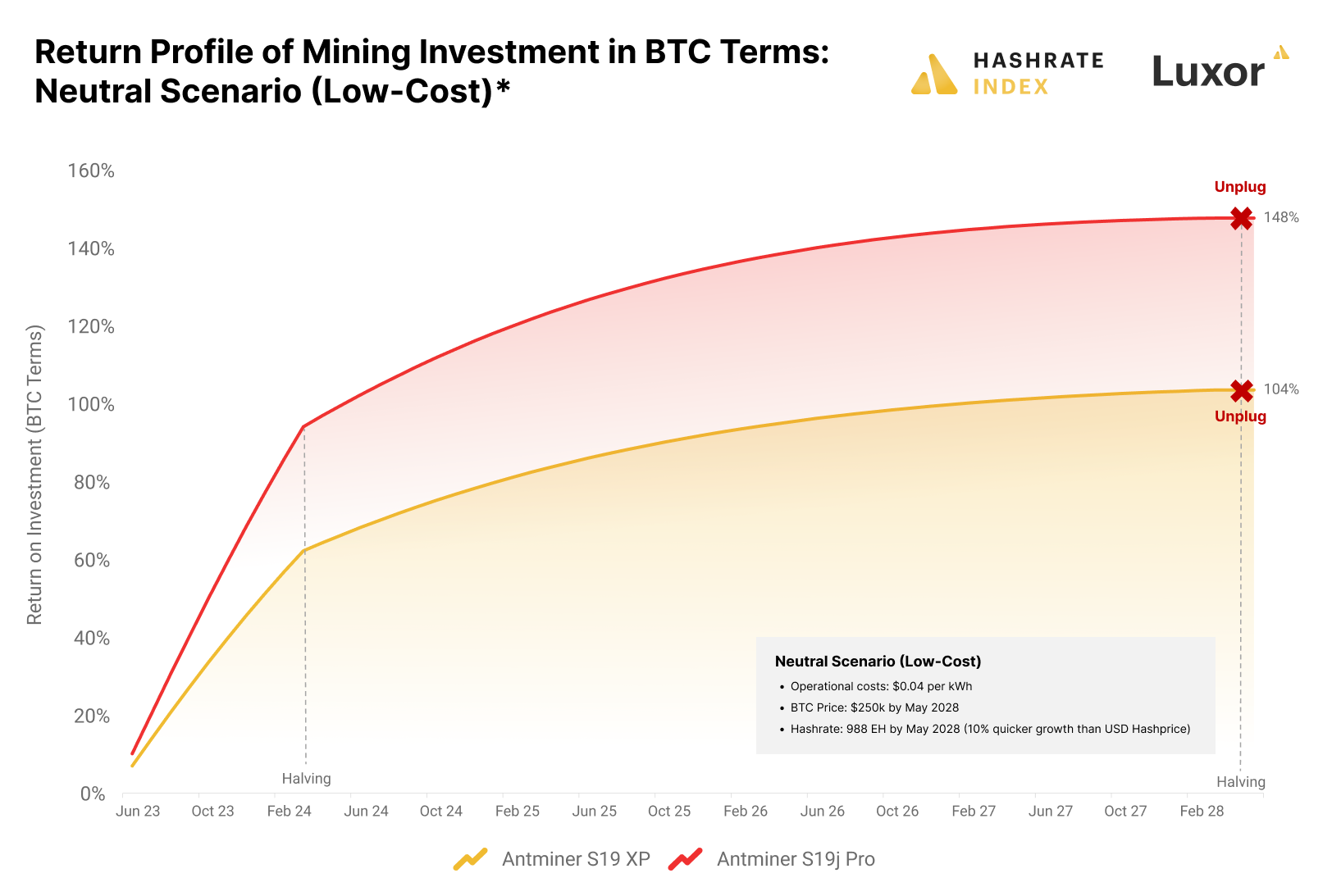

Things are looking much better for the low-cost miner. The S19j Pro and the S19 XP could remain cash flow positive until the halving in 2028 at $0.04 per kWh if they don’t fail before then. The S19j Pro gives a total bitcoin-denominated ROI of 148%, a decent yield on a five-year bitcoin investment.

The S19 XP gives a return of 104%, a relatively low risk-adjusted five-year return on a bitcoin mining investment. Once again, an investment in the relatively cheaper S19j Pro beats the S19 XP.

Bullish scenario

Let’s move to our most exciting scenario - the bullish one. Here, the bitcoin price steadily increases to $500k by May 2028, while the hashrate grows 10% slower than the hashprice. Transaction fees will here remain unchanged from the relatively low early 2023 levels.

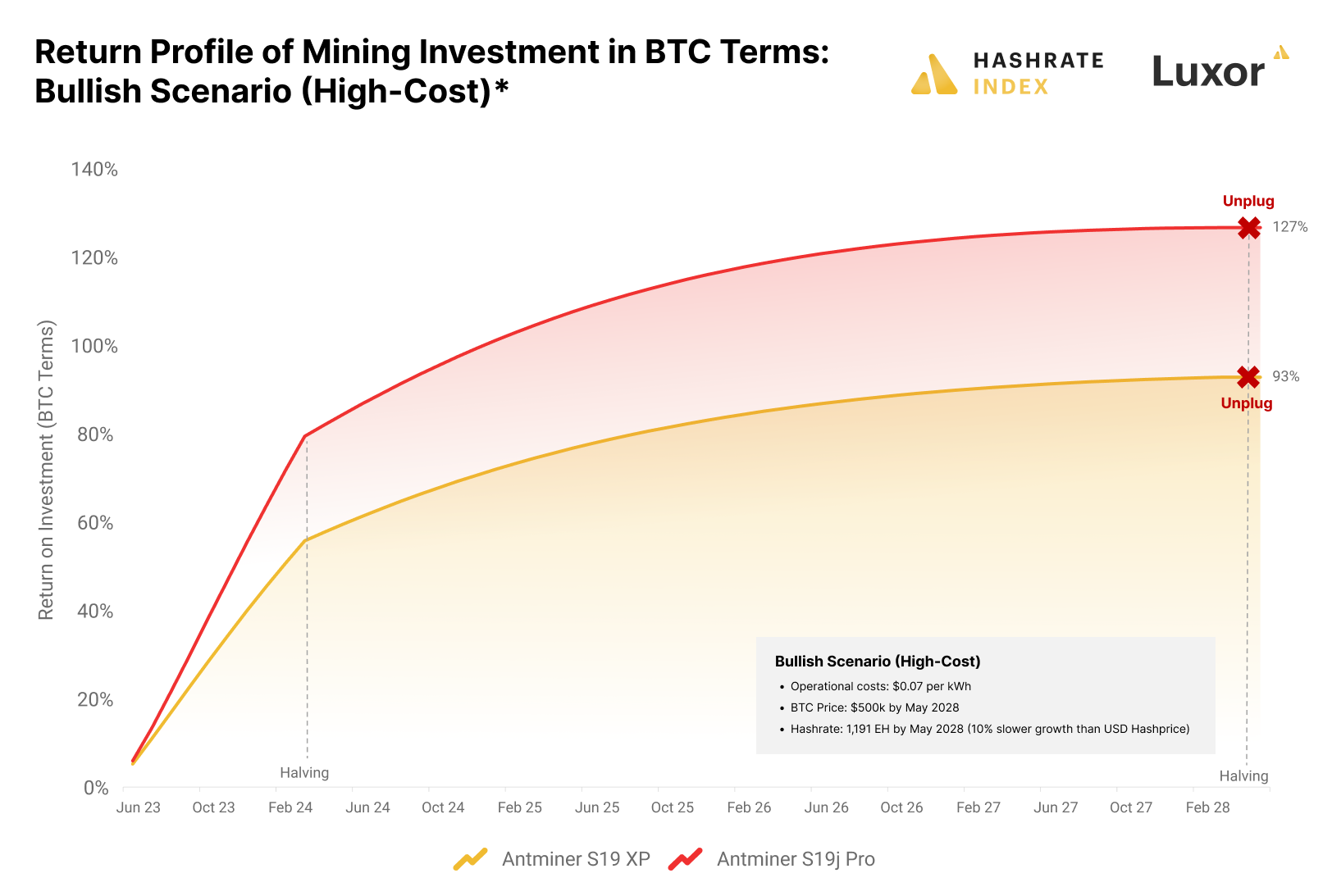

This bullish scenario lifts all the boats, even the highest-cost ones. Even the miner paying $0.07 per kWh achieves a decent bitcoin-denominated return on investment of 127% for the S19j Pro. Still, due to the declining marginal return on investment over the horizon, this miner is better off selling his machine to a lower-cost operator after the halving. In general, higher-cost operators must be prepared to take advantage of bull markets to sell their machines when valuations are high, as they risk not surviving the bear markets.

As usual, an investment in the more expensive S19 XP falls short, with a total ROI of 93% over the five-year horizon. Interestingly, even in such a bullish scenario, it would be better off simply buying bitcoin over buying an S19 XP. This machine trades at a significant premium to the less-efficient S19j Pro, and is, according to this analysis, overpriced.

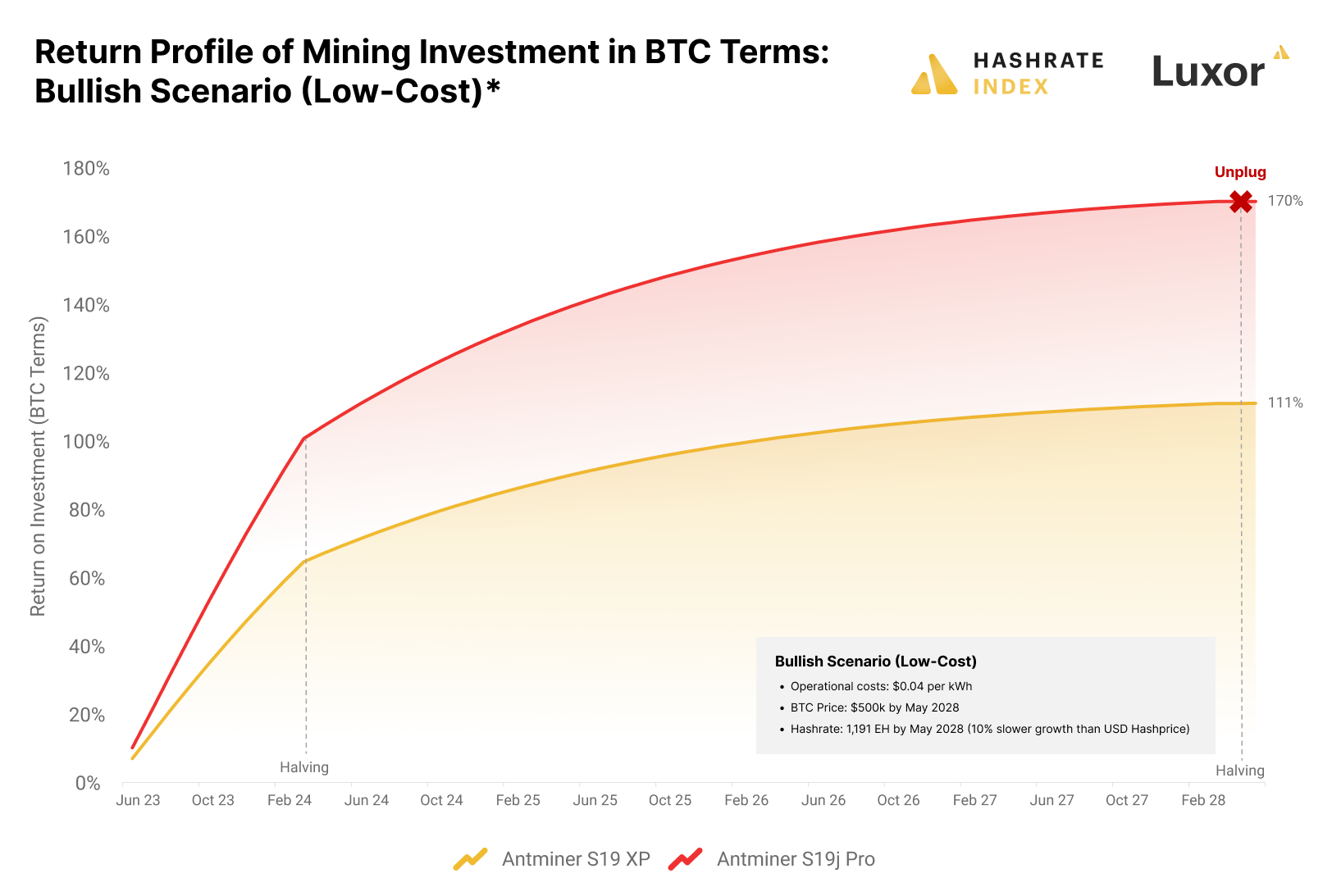

Here comes the juicy stuff. In our bullish scenario, a miner with only $0.04 per kWh operational costs will make a 170% bitcoin-denominated ROI by investing in the S19j Pro. Even if the machine is scrapped before the halving in 2028, it will likely recoup at least 150% of the bitcoin investment. The investor has thus turned his initial 1 BTC investment into 1.5 BTC in just a few years - pretty good.

Interestingly, we see that the S19 XP, once again, is a relatively poor investment, only recouping 111% of the initial bitcoin investment even in the most bullish scenario. This confirms how overpriced this machine is on the market.

Conclusion

Most investors view mining as a bitcoin accumulation mechanism. Since buying bitcoin is considerably simpler and safer than mining it, mining only makes sense if it allows you to stack more bitcoin than by simply buying. Therefore, mining investors should evaluate the potential bitcoin-denominated returns of their mining rig investments.

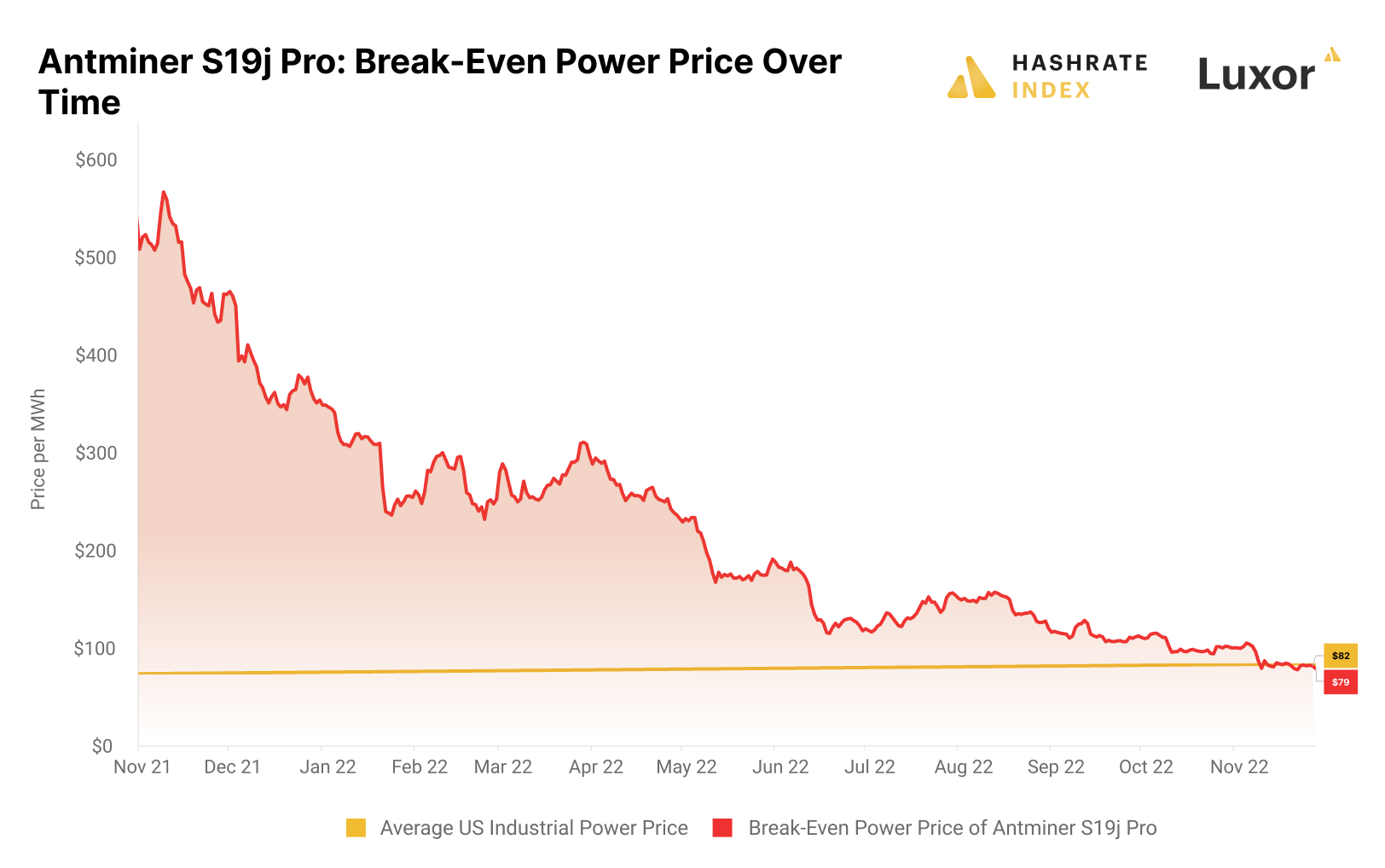

This analysis showed that buying bitcoin is preferable to mining it in most circumstances. For those with relatively high operational costs, mining only makes sense relative to buying in an extremely bullish market environment. Since electricity costs are fixed in fiat, a bitcoin price increase means you have to pay less bitcoin for electricity, ultimately giving you more to stack.

For those with sufficiently low electricity prices, on the other hand, mining the bitcoin is a superior investment compared to buying even in relatively bearish market environments. Mining is a no-brainer if you have access to electricity prices below $0.04 per kWh.

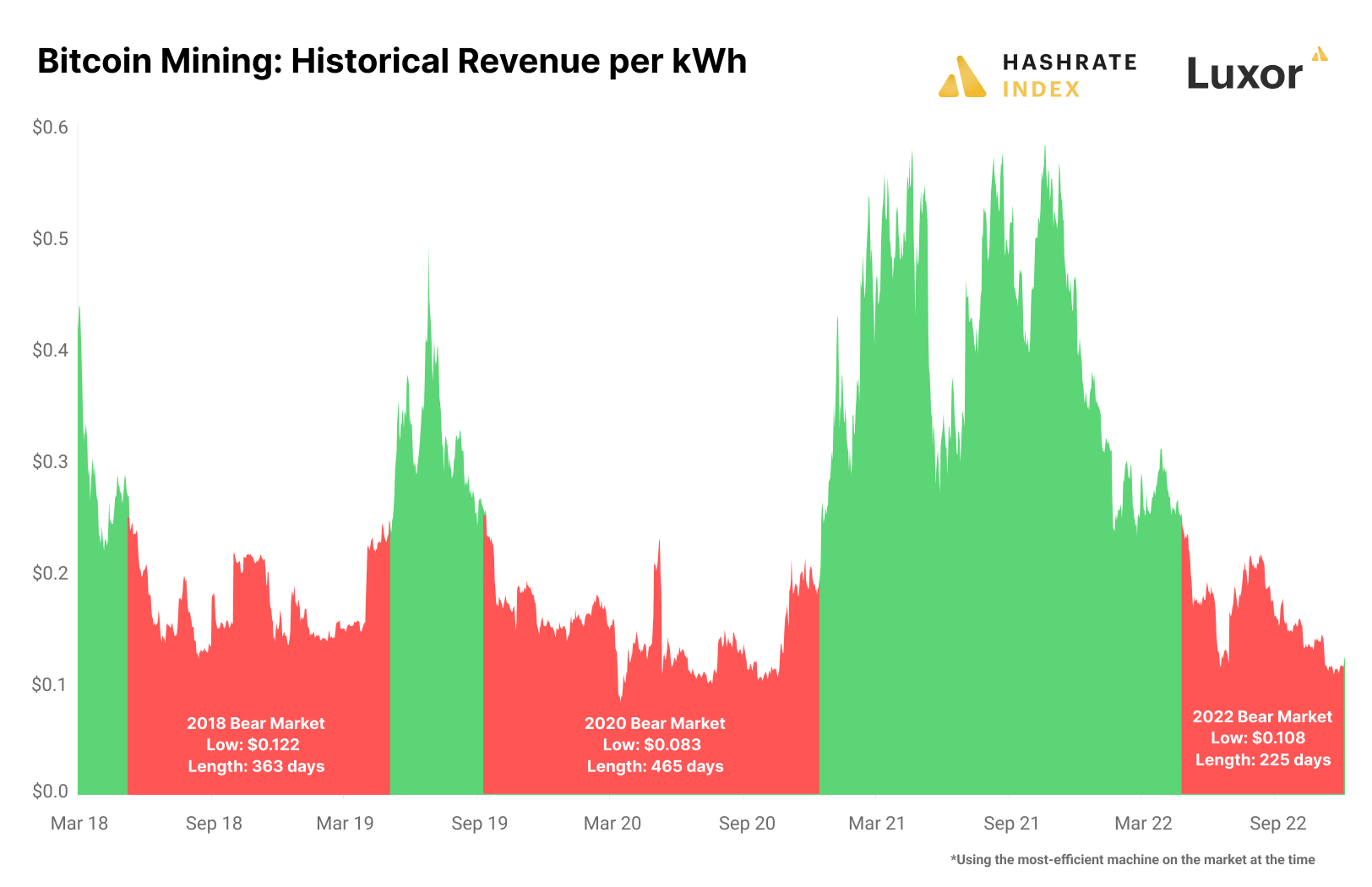

Remember that it is extremely difficult to estimate the future profitability of bitcoin mining, and these calculations come with an enormous margin of error. Events like the China ban in 2021, the recent surge in transaction fees, and the supply chain constraints holding back hashrate growth in 2021 all led to unforeseen increases in mining profitability. By having some mining rigs plugged in, you are exposed to such unforeseen profitability surges. We can thus view mining as a hashprice call option, and it might make sense to have exposure to that.

This analysis also exposed the overpricing of the Antminer S19 XP relative to the less-efficient S19j Pro. An investment in the S19 XP is only more profitable in bearish market environments, but why would you invest in mining in the first place if you are bearish?

If you want advice on purchasing mining rigs, please reach out to the Luxor ASIC Trading Desk team.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.