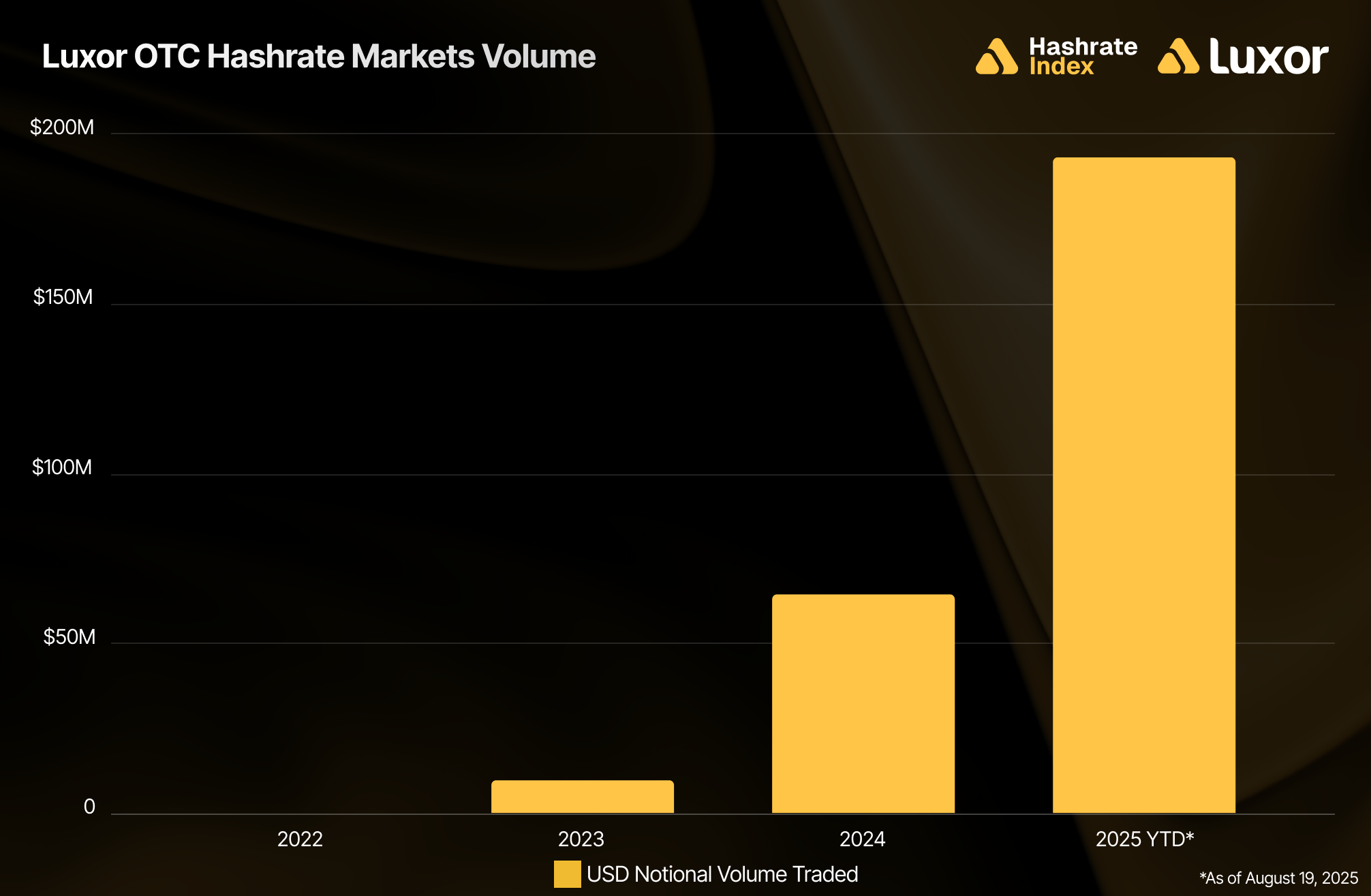

Luxor’s Hashrate Forward Market on Track for Several Hundred Million Traded in 2025

YTD volumes already nearing $200 million USD.

Luxor’s hashrate forward market is no longer a niche tool — it’s becoming a core pillar of the Bitcoin mining stack.

As of August 2025, total notional traded on Luxor’s OTC hashrate forward market has already reached nearly $200 million USD. If current trends continue, total volume could reach several hundred million dollars before year-end. This surge reflects not just higher Bitcoin prices, but a broader adoption of hashrate forward contracts across the mining industry.

What Are Hashrate Forwards?

Hashrate forwards combine a new digital commodity with a centuries-old financial instrument.

On one side, hashrate is the compute power used to mine Bitcoin. Its value is measured as hashprice — the expected revenue from 1 PH/s of hashrate per day on the Bitcoin network, quantified by Luxor’s Bitcoin Hashprice Index.

On the other side, a forward contract is an agreement between a buyer and seller to exchange a commodity on a future date at a fixed price. Forwards are a staple of traditional markets — used across energy, agriculture, metals, currencies, and many other industries.

A hashrate forward contract is simply this concept applied to Bitcoin mining: locking in a future hashprice for a fixed amount of hashrate over a set period.

Why Do Miners Use Hashrate Forwards?

Protecting Revenue & Accessing Financing

Miners can sell hashrate forward to lock in fixed pool payouts, eliminating the uncertainty of hashprice fluctuations. Luxor Pool’s Fixed Payouts guarantee a set hashprice, while Upfront Payouts provide immediate, non-dilutive capital in exchange for a forward hashrate delivery commitment. Both approaches hedge against network difficulty changes and transaction fee volatility, making cash flow forecasts more predictable.

Boosting Mining Rewards

For operators facing ASIC delivery delays, power constraints, or site build-outs, buying hashrate forwards can instantly add to managed hashrate without the lead time or complexity associated with deploying new hardware.

Why Do Financial Institutions Use Hashrate Forwards?

Gaining Exposure to Bitcoin Mining Without Operational Complexity

By purchasing hashrate forwards, institutions can participate directly in the economics of Bitcoin mining without owning ASICs, managing facilities, or securing power. This provides pure exposure to hashprice and BTC production without operational risk.

Earning a Fixed Return from Financing Bitcoin Miners

By purchasing hashrate upfront from miners and selling fixed hashprice forwards, institutions can effectively provide financing to miners in exchange for a fixed return. This creates a predictable yield profile for lenders while supporting mining operations.

Hashrate Forwards Go Mainstream

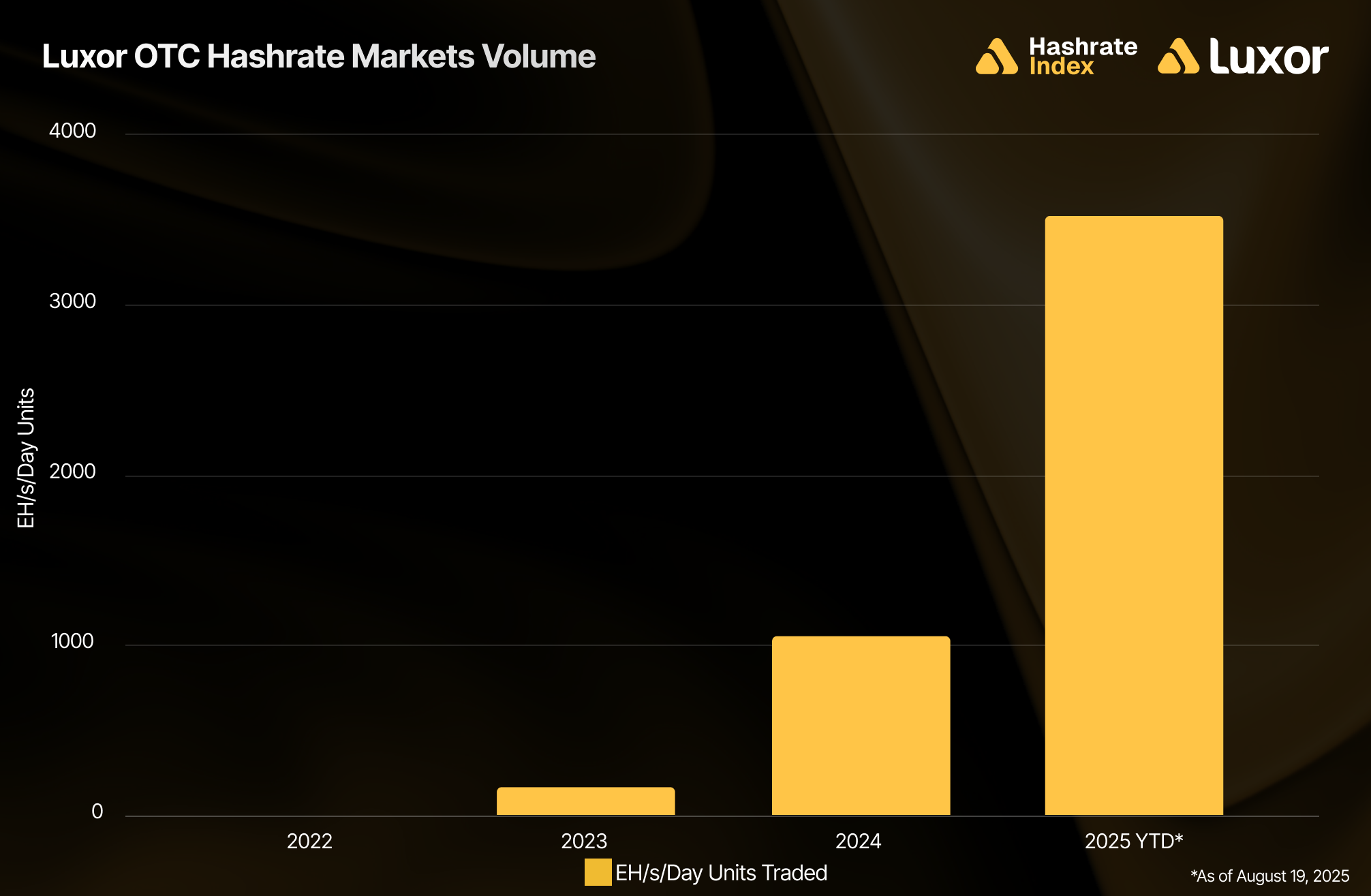

It’s tempting to assume that rising USD volumes in 2025 are just a byproduct of Bitcoin’s price rally, but that’s not the story. The April 2024 halving applied heavy downward pressure on hashprice, offsetting much of the benefit from Bitcoin’s price appreciation. The real growth driver is the increase in hashrate units traded — a sign that miners and investors are using hashrate forward contracts more frequently and at larger scale.

With daily settlement volumes up to 25 EH/s and a growing number of participants integrating forward trading into their operational strategies, the hashrate forward market is on track to become one of the most important financial markets in Bitcoin mining.

If you’d like to learn more about Luxor’s Bitcoin mining derivatives, please reach out to [email protected] or visit https://www.luxor.tech/derivatives.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.