Luxor Miner Financing: A Better Way for Bitcoin Miners to Access Capital

YTD notional volume already exceeding $200 million, with daily settlement volumes up to 25 EH/s.

Financing has always been a big challenge for Bitcoin miners. Hardware refreshes, site expansions, and opportunistic purchases all require large amounts of capital, but miners have historically struggled to find structures that fit the unique risk profile of the industry.

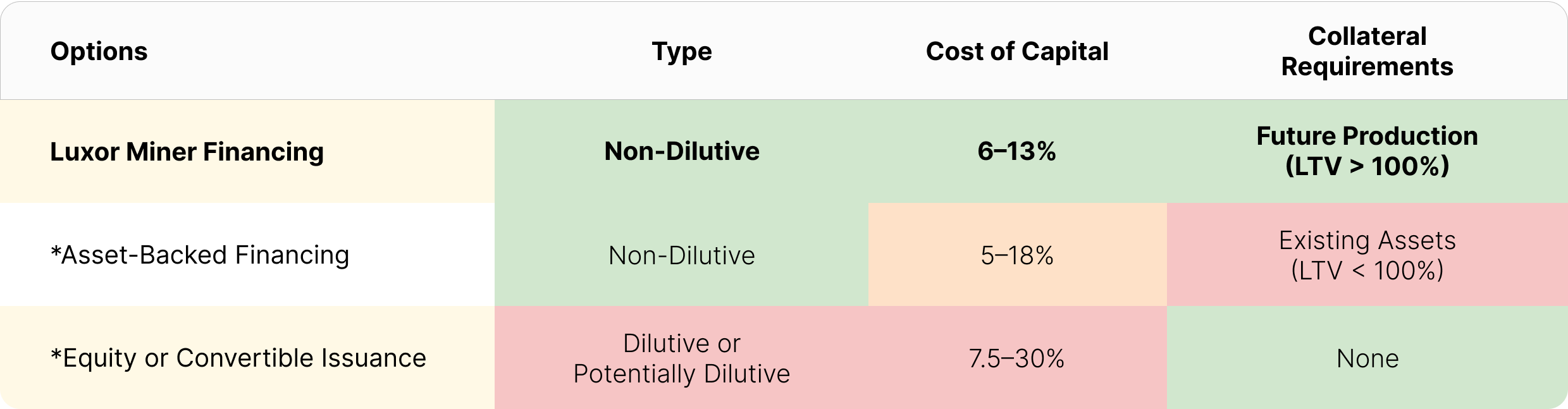

Until recently, miners had to choose between dilutive equity issuance, collateral-intensive debt, or alternative structures that didn’t properly account for a Bitcoin miner’s day-to-day operations. Luxor’s Miner Financing changes the status-quo.

A Look Back: Traditional Access to Financing for Bitcoin Miners

Historically, miners have relied on two main types of financing:

- Equity or Convertible Debt Issuance

- Raising equity has been the default option for many public miners, but it comes with one obvious drawback: dilution. Convertible notes soften the blow but are still “potentially dilutive” if converted. Both carry a high cost of capital, often 7.5% or more.

- Asset-Backed Financing

- Another option is to pledge bitcoin, ASICs or other assets as collateral. These loans are non-dilutive, but lenders apply conservative loan-to-value (LTV) ratios, usually below 100%. That means miners need to over-collateralize, reducing flexibility and capital efficiency. Asset-backed loans also carry relatively high interest rates, typically in the range of 5–18 %.

The result has been a miner financing landscape defined by this dilution-versus-collateral trade-off.

A Comparison: Luxor Miner Financing

Financing based on future hashrate output has long been a logical solution for miners — monetizing tomorrow’s production to fund today’s fleet upgrades and expansions. However, the volatility of hashprice has made this model nearly impossible to implement in practice. Without liquid derivatives and forward markets, future mining revenues are simply too unpredictable for lenders to underwrite at scale.

That dynamic has shifted. Over the past three years, hashrate markets have matured dramatically, with forward contracts, fixed payout pools, and other derivative instruments providing both liquidity and price discovery. Year-to-date (YTD) notional volume traded on Luxor’s OTC hashrate forward market has already surpassed $200 million, with daily settlement volumes up to 25 EH/s.

These tools give lenders the ability to model and hedge future mining revenue with far greater confidence, transforming hashprice from an unmanageable variable into a quantifiable risk. At the same time, Luxor has developed the infrastructure to embed financing directly into mining operations. By integrating repayment into Luxor Pool, loan servicing is handled automatically through block rewards, reducing operational friction and mitigating counterparty risk.

Taken together, these developments make cashflow-based financing not only viable, but structurally superior to the dilutive equity raises and collateral-heavy debt that miners have traditionally relied on. Luxor Miner Financing is the first product to deliver on this model, giving miners the best of both worlds: non-dilutive capital with efficient collateral requirements.

*Cost of capital estimates for asset-backed financing are derived from reported rates in publicly available company filings (e.g., 10-Ks and related disclosures). Estimates for equity and convertible note issuance reflect the all-in economic cost of contractual financing terms (coupons, fees, cap-call overlays) and the impact of shareholder dilution. Convertible debt is assumed to carry a cost of capital in between pure debt and equity, in line with financial theory.

How Miners Can Get Started

The onboarding process is designed to be simple:

- Reach out to Luxor Derivatives here.

- Provide basic inputs: use of funds, total financing target amount, desired repayment duration, current operational hashrate capacity and location.

- Receive indicative terms: Luxor’s Derivatives team models liquidity conditions and tailors a financing package to your operations.

Financing has long been a pain point for miners — dilutive equity raises, expensive debt, and underutilized cash-flow models all left gaps in the market. Luxor’s Miner Financing fills them in.

By combining non-dilutive terms, competitive rates, and low collateral requirements, all while leveraging Luxor Pool’s integrated infrastructure, hashrate-backed financing represents a step-change for miners in accessing capital. Timing, efficiency, and scale are everything in Bitcoin mining, and Luxor’s Miner Financing is becoming the new standard.

If you’d like to learn more about Luxor’s Bitcoin mining derivatives, please reach out to [email protected] or visit https://www.luxor.tech/derivatives.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.