Luxor Hashrate Lookback Series – September 2025

September 2025’s hashrate and hashprice trends, forward market participation, trading activity and contract performance.

Luxor’s Monthly Lookback Series is a deep dive into Bitcoin hashrate market activity. In this post, we cover September 2025’s hashrate market and hashprice trends, forward market participation, trading activity and contract performance.

Summary

- Bitcoin Enters the Zettahash Era: On September 2, Bitcoin’s 7-day SMA hashrate surpassed 1 ZH/s (10²¹ hashes per second), unlocking the next order of magnitude in industrial bitcoin mining.

- Difficulty’s September Surge: Average network difficulty climbed +6.7% MoM to an all-time high, driven by block times averaging 9 minutes 8 seconds — implying miners operated roughly 9.6% above target hashrate.

- Hashprice Slumps Further: Mining economics deteriorated in September as USD hashprice fell -7.8% to an average of $52.06 per PH/s/day. BTC-denominated forward sales outperformed across the board, and even a 1-month forward sale would have resulted in +7% additional BTC revenue.

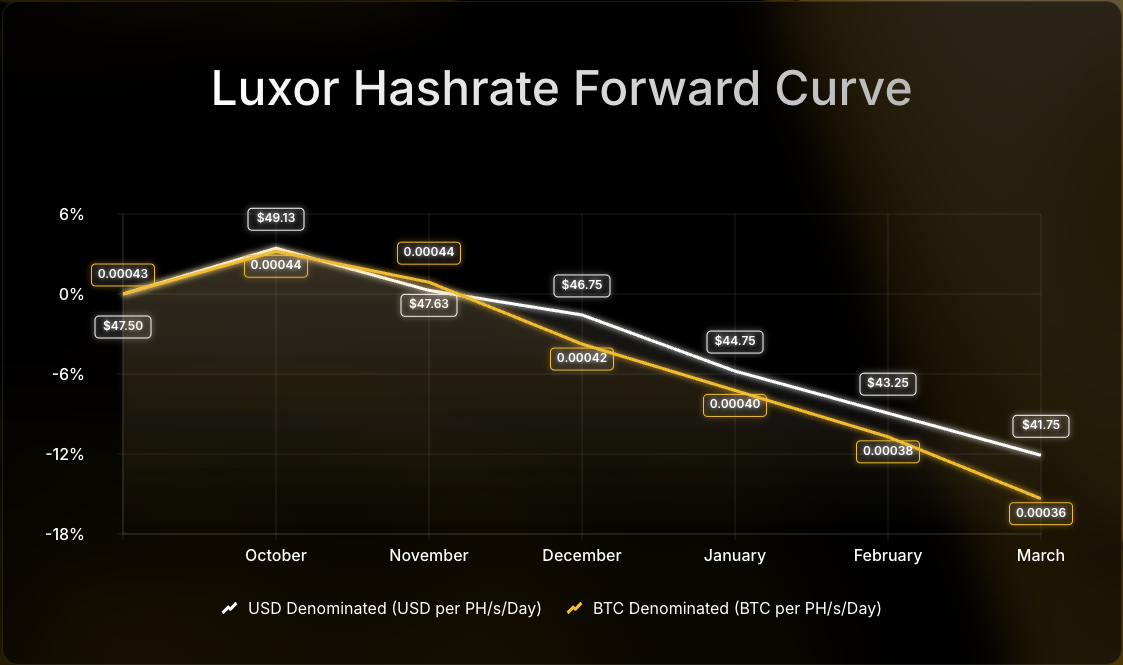

- Looking Forward: USD and BTC hashrate forwards fell month-over-month, and the next six months ahead are priced around $45.54 or 0.00041 BTC per PH/s/day, reflecting expectations of future hashrate growth and further margin compression.

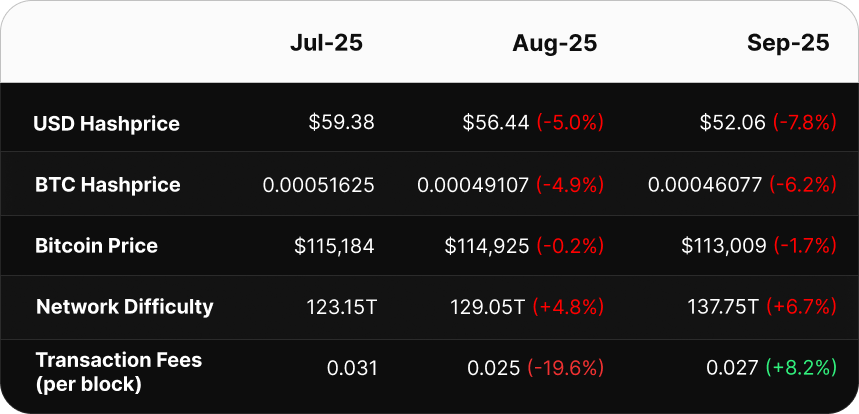

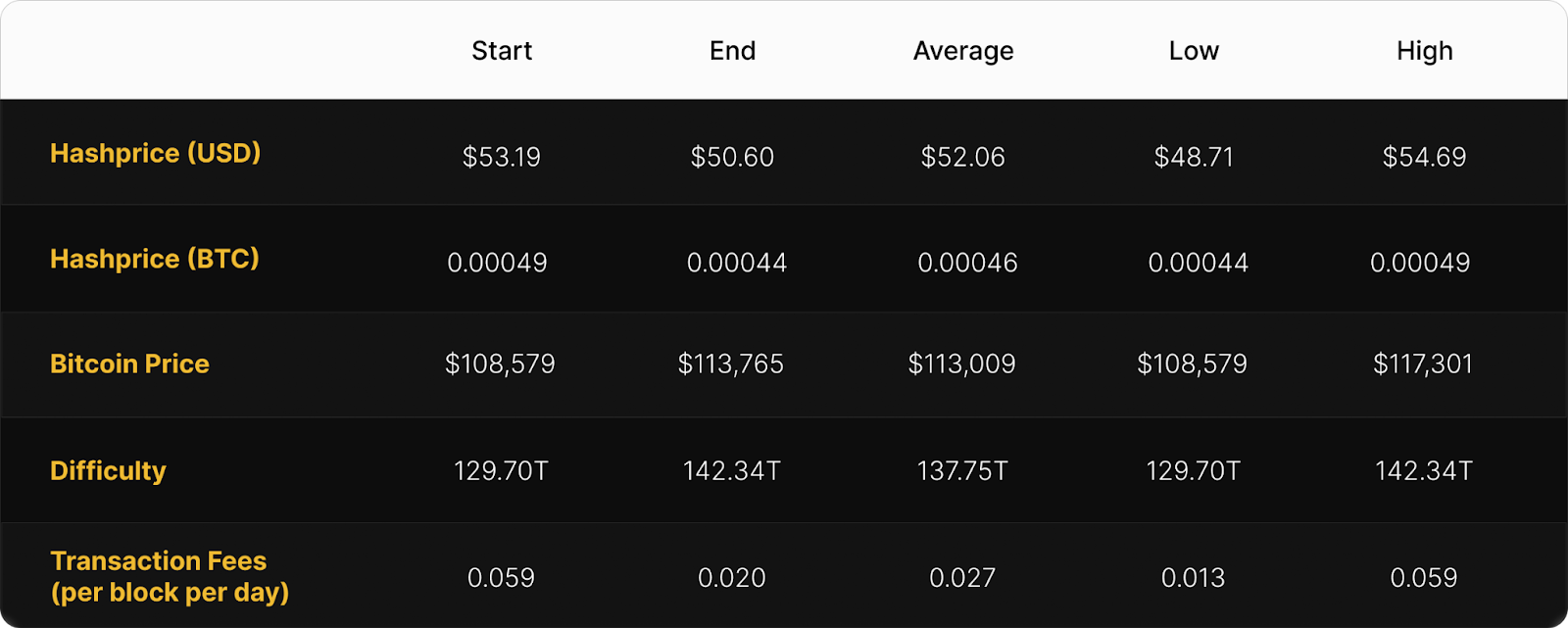

September 2025 Spot Hashprice & Its Constituents

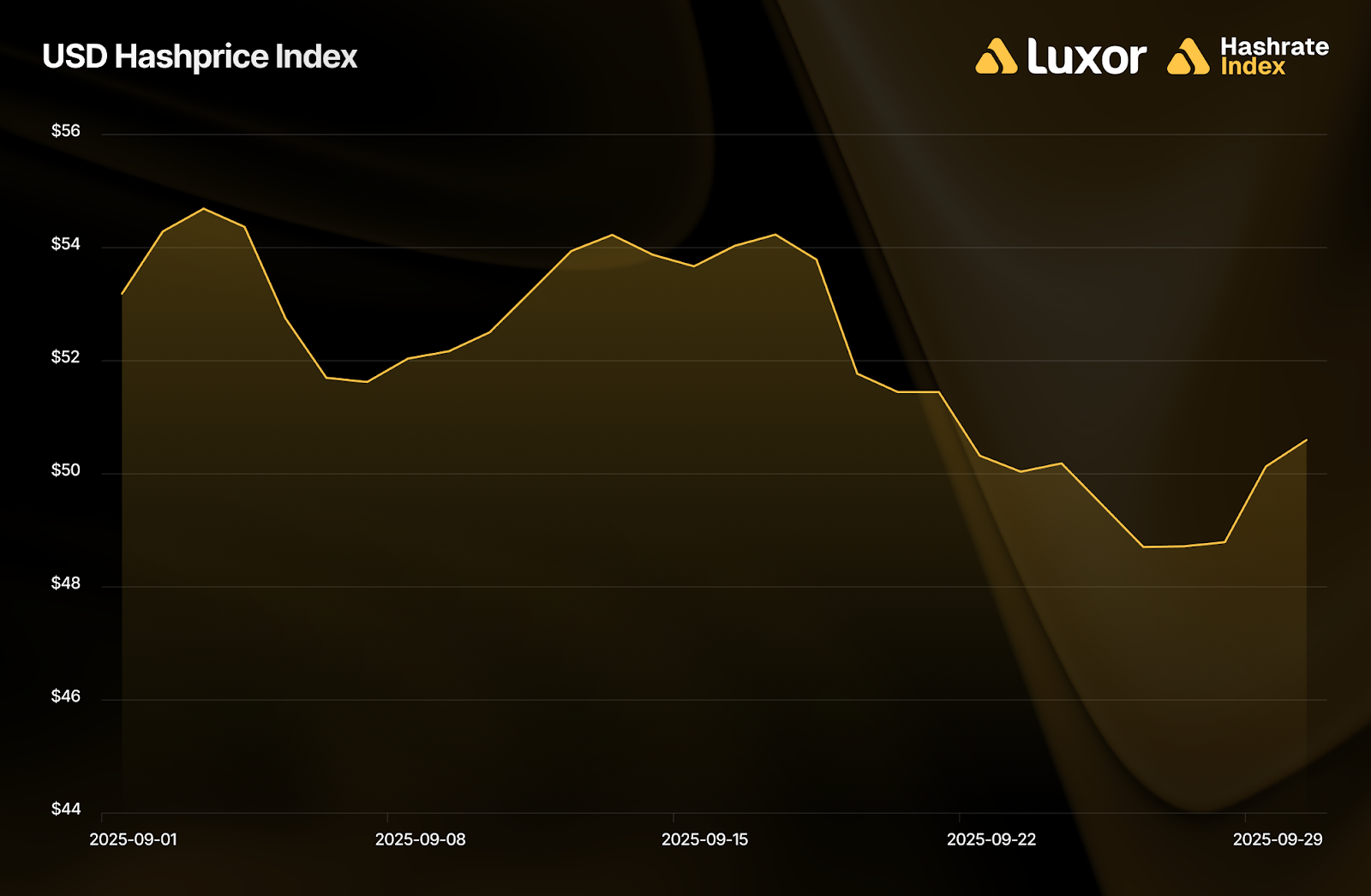

Mining economics have been trending down since July, and September saw the story continue. USD-denominated hashprice averaged $52.06 (-7.8%), and BTC-denominated hashprice averaged 0.00046 BTC (-6.2%) per PH/s/day. This was primarily fueled by an increase in monthly average network difficulty (+6.7%) to a new all-time high. On the other hand, bitcoin price action was slightly down (-1.7%), whereas transaction fees saw an increase (+8.2%), but still remain at near all-time lows in BTC terms.

USD hashprice started September at $53.19 per PH/s/day and trended down to $50.60 by month-end. It ranged between $48.71 – $54.69 and came out to a monthly average of $52.06, a 7.8% decline month-over-month.

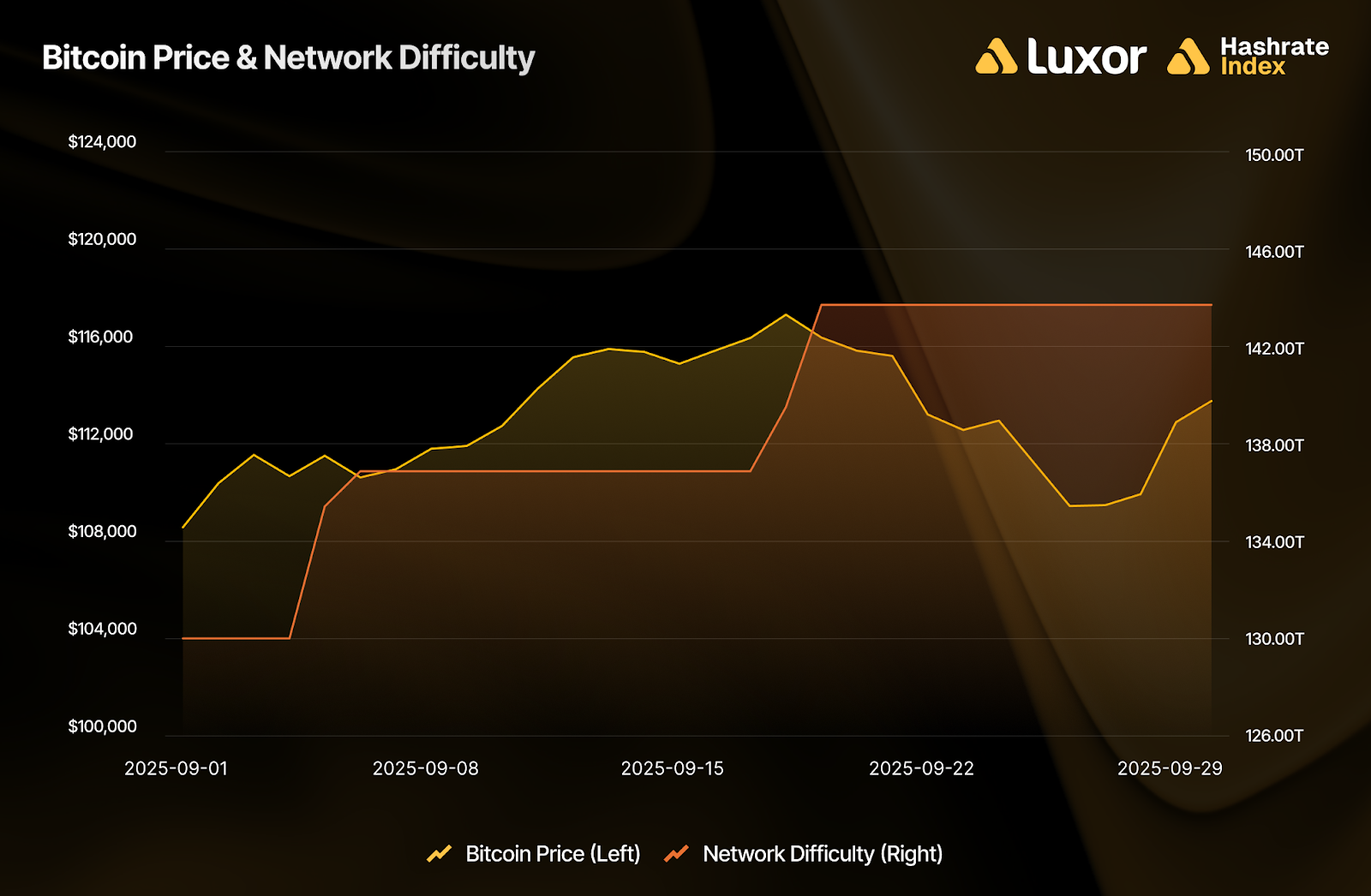

Average bitcoin price action was slightly down in September. Starting at $108,579, BTC climbed to a local peak of ~$117,301 on September 18, before declining over the second half of the period to close off at $113,765. The monthly average BTC price came in at $113,009, a 1.7% decline month-over-month.

Network difficulty continued to climb in September, breaking new ground. Following two positive adjustments on September 5 (+4.89%) and September 18 (+4.63%), difficulty increased to 142.34T, an all-time high. The monthly average for difficulty experienced by operators came in at 137.75T versus 129.05T in August, a 6.7% incline, the strongest growth seen since April.

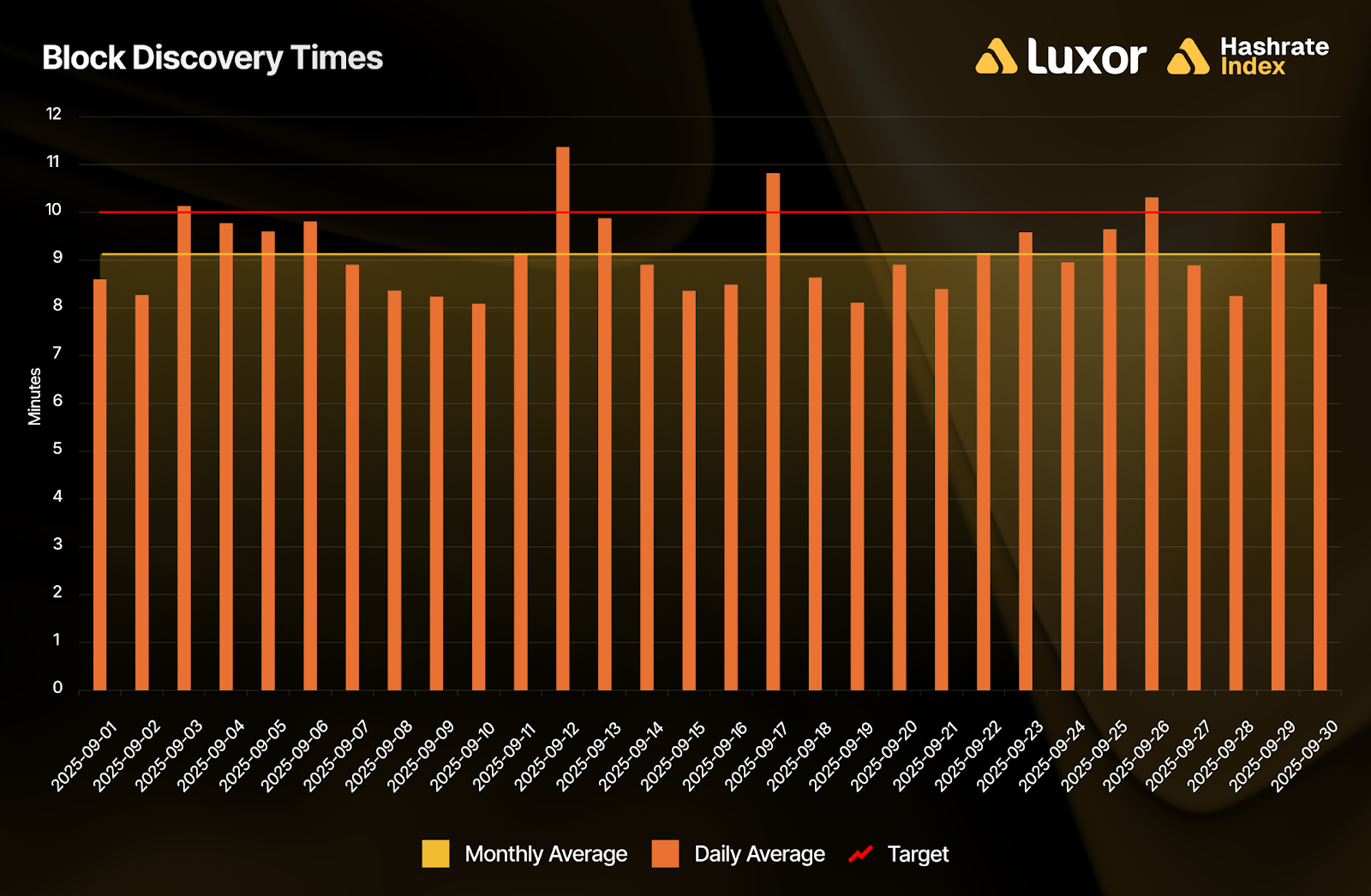

The positive difficulty adjustments were caused by quicker-than-target block times. 26 out of 30 days (87%) in September averaged block times below the 10-minute target, coming in at a monthly average of 9 minutes 8 seconds per block.

September’s fast blocks at 9 minutes 8 seconds implies that miners were running ~9.6% more hashrate than the network targeted. In other words: miners deployed machines, improved uptime & efficiency, and/or curtailed less, which triggered upward difficulty adjustments as aggregate SHA-256 computing power increased. We’ve already seen another positive adjustment occur at the turn of the month on October 1, pushing network difficulty up by +5.97% to 150.84T, a new and current all-time high.

Over the summer, ERCOT’s Four Coincidence Peaks (4CP) program was a major driver of network difficulty and hashrate. 4CP measures large industrial customers’ demand during the grid’s peak-load hours from June – September, typically late afternoons on the hottest weekdays. The benchmark for these intervals is known as the high-water mark, representing the highest observed system load each month. The higher a customer’s load during those intervals, the more they pay in transmission charges the following year. To avoid these penalties, many large miners in ERCOT curtail during potential 4CP hours, and the impact is significant: full curtailment during high-risk hours can represent ~6–7% of global network hashrate going offline over the course of a difficulty epoch.

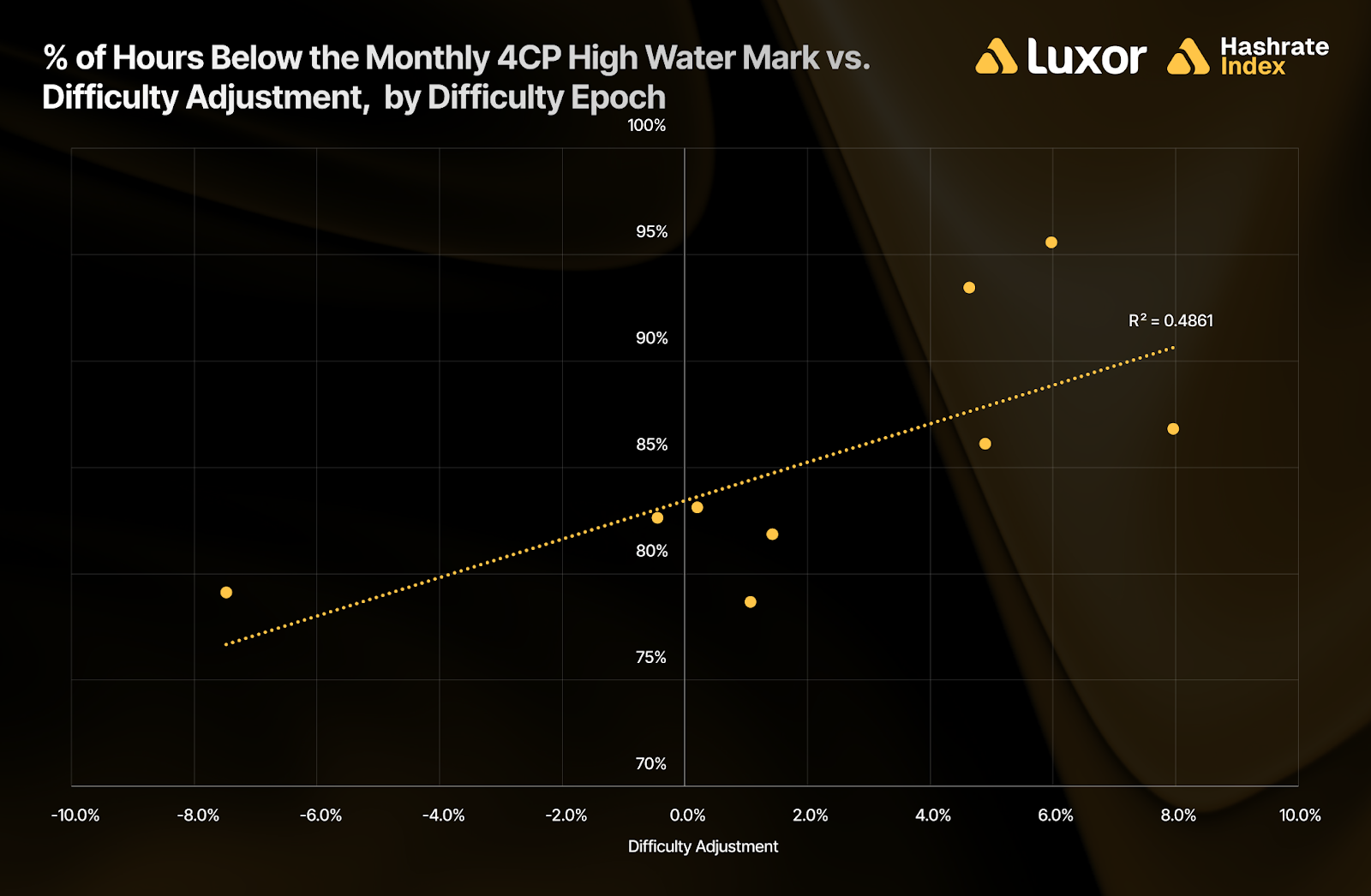

On days when grid demand runs well below the monthly 4CP high-water mark, miners often stay online (or even overclock) to maximize revenue. The chart below illustrates this dynamic:

Throughout June – September 2025, we estimate 4CP conditions explained nearly half of the variation in difficulty adjustments (R² ≈ 0.49). The more hours spent four percent or more (≥ 4%) below the rolling monthly 4CP high-water mark, the higher the subsequent difficulty adjustment was. In other words, the more time the grid spent well below the 4CP high-water mark, the more miners stayed online.

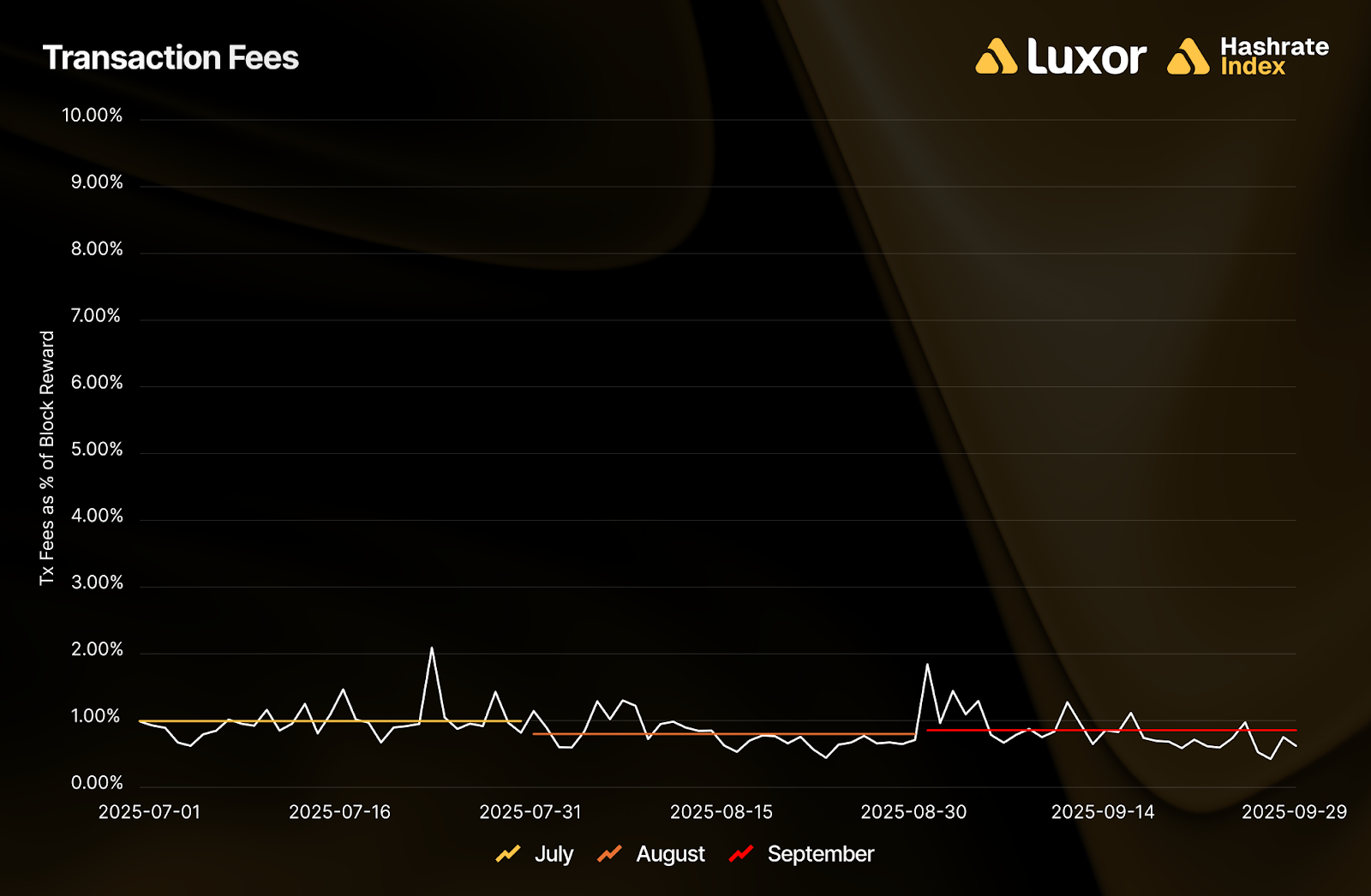

For the first time since May, transaction fees saw an uptick in September.On a BTC-denominated basis, miners collected an average of 0.027 BTC (per block per day), an 8.2% increase from August, but still the second lowest since November 2011. With a slight dip in bitcoin price action, the picture was mildly muted on a USD-denominated basis: average fee collection came out to $3,052 (versus $2,904 in August), a 5.1% increase. Overall, transaction fees constituted 0.86% of total block rewards versus 0.80% in the prior period.

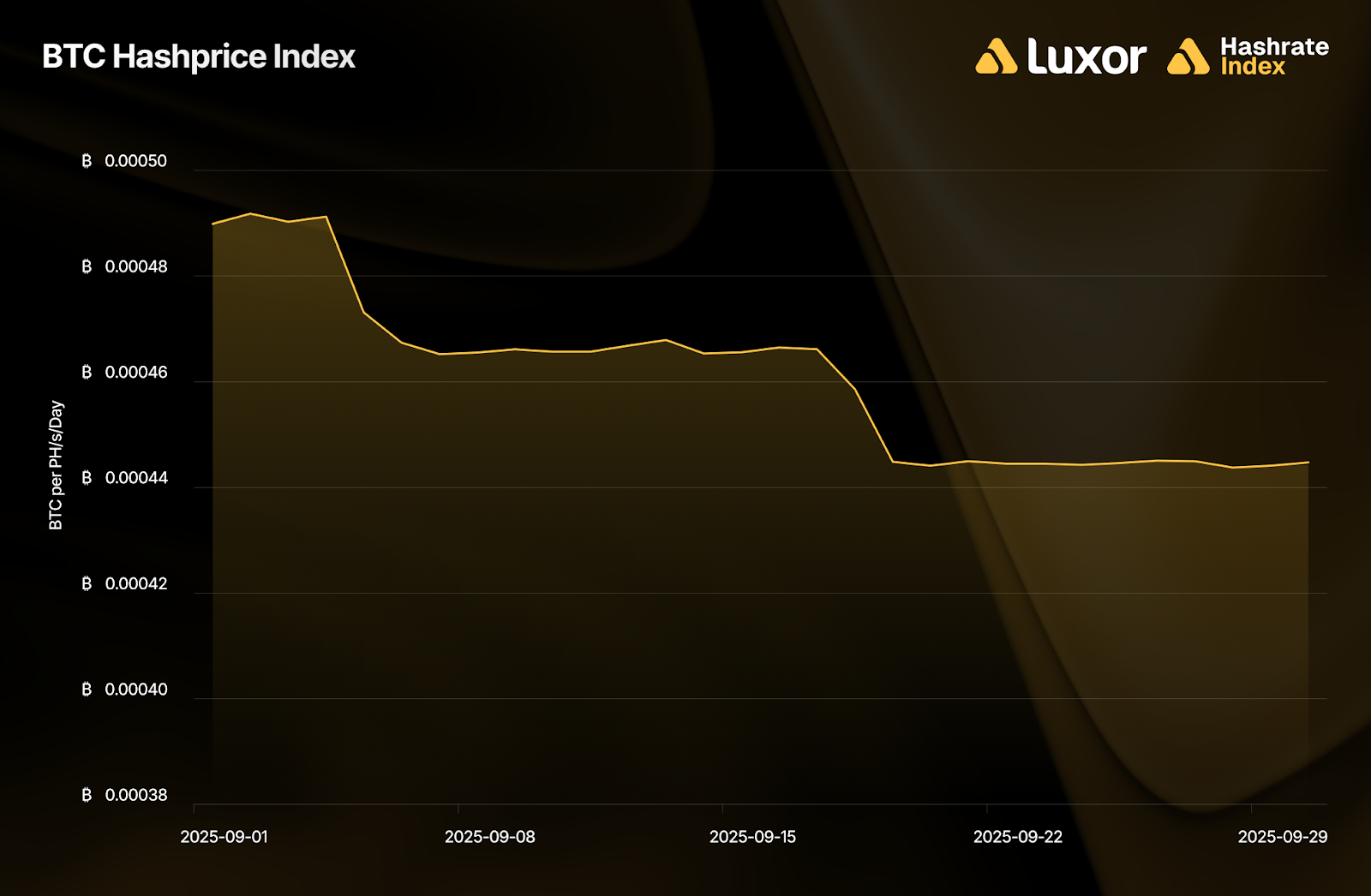

BTC-denominated hashprice mostly reflected network difficulty adjustments in September. It began at 0.00049 BTC per PH/s/day and dipped to 0.00044 BTC following the two positive difficulty adjustments on September 5 and September 18. BTC hashprice averaged 0.00046 BTC per PH/s/day, declining 6.2% month-over-month.

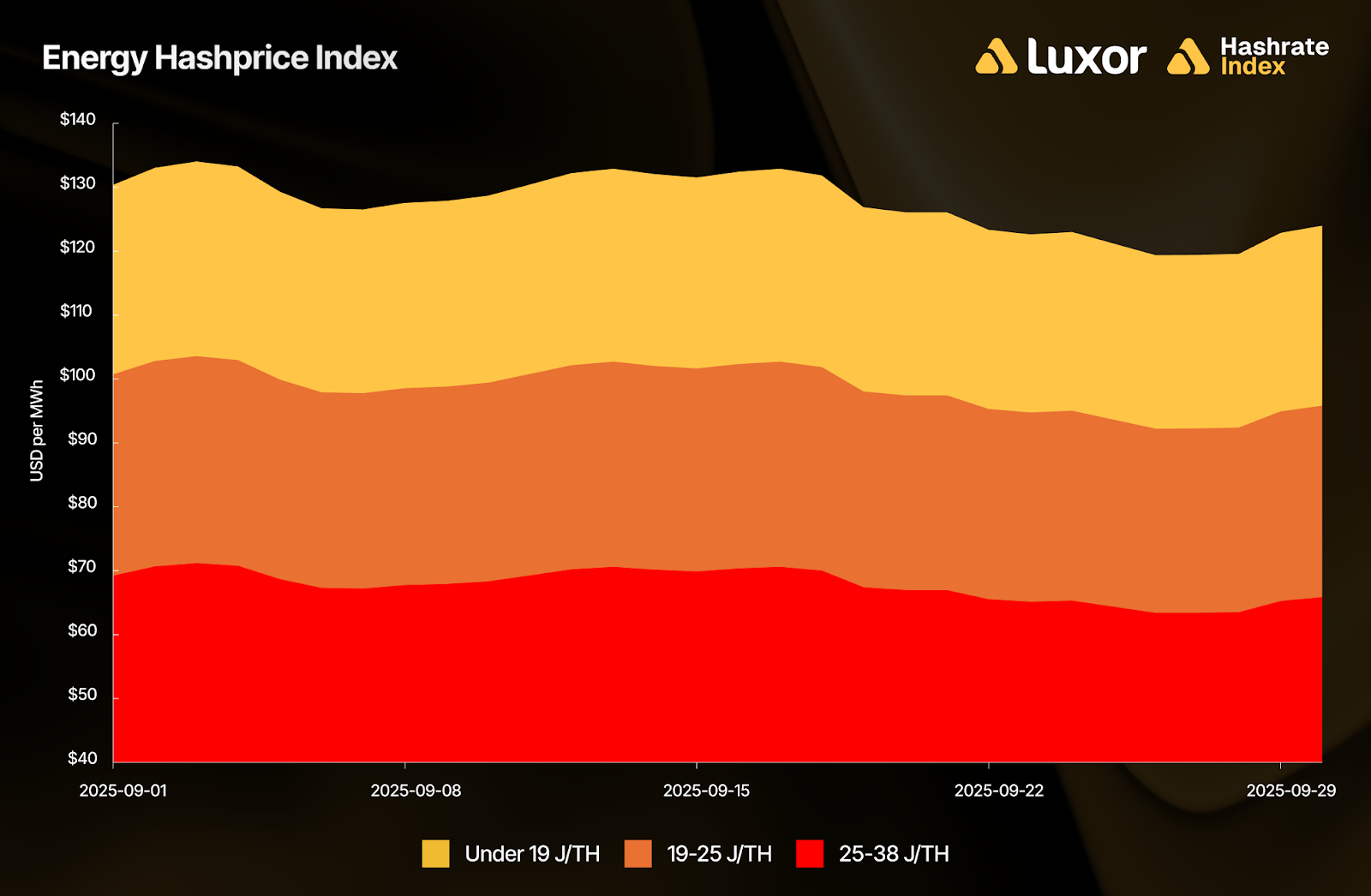

In September, operations with sub-19 J/TH fleets earned approximately $128 per MWh in mining revenues, whereas miners in the 19-25 J/TH tier earned $99 per MWh and the 25-38 J/TH tier earned $68 per MWh, respectively. Since new-generation fleets enable wider operating margins, there is a strong incentive for miners to deploy these machines from a compute revenue-per-watt perspective, which continues to contribute toward growth in network hashrate.

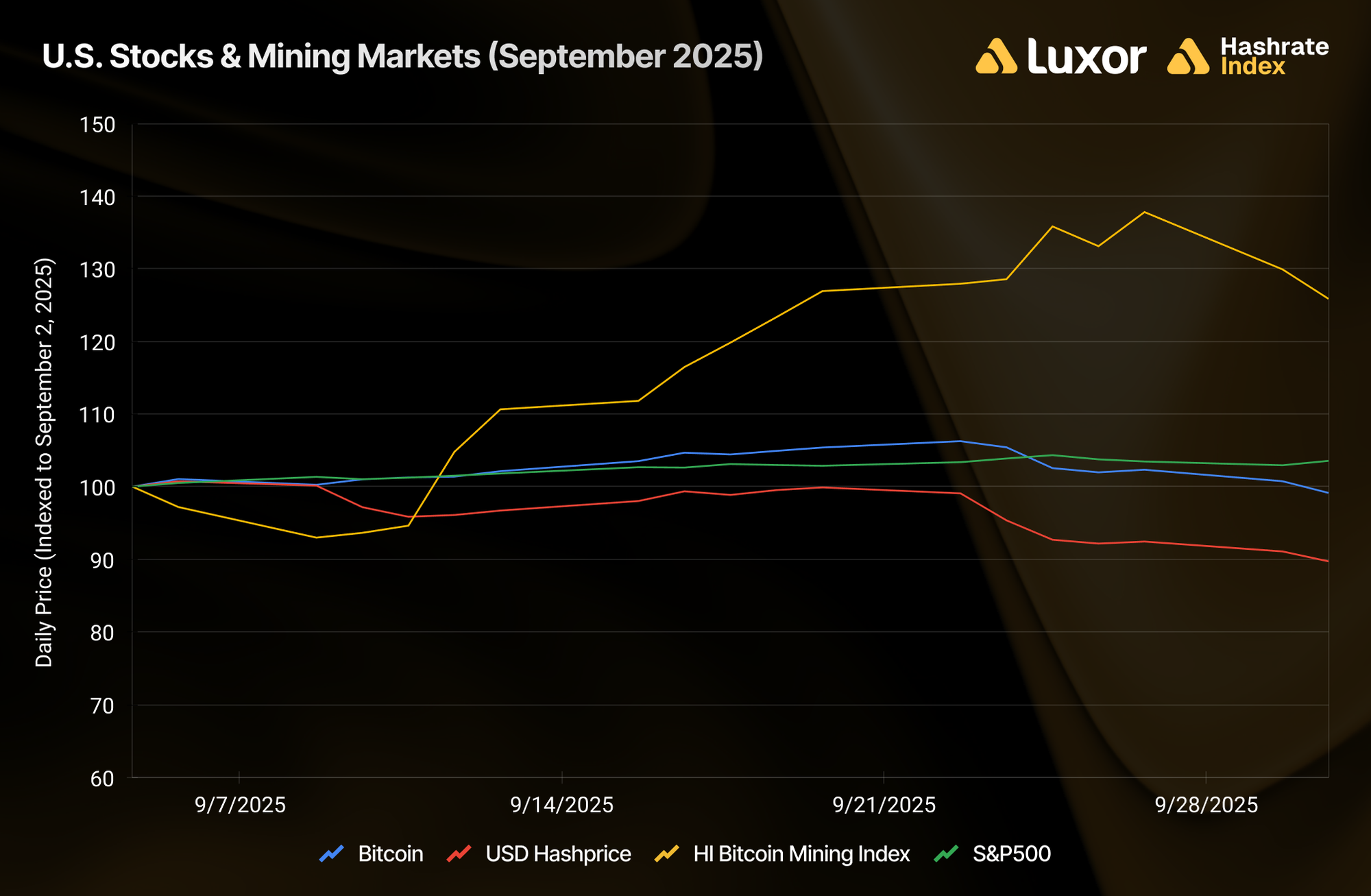

Despite the deterioration in mining economics, public mining equities were energized with newfound interest in September. A sudden rally took off which reflected on Hashrate Index’s Bitcoin Mining Stock Index starting September 9.

This move marks either a shift in sentiment, a fundamental re-pricing, or a combination of both. Since hashprice has continued to compress and network difficulty reached new highs, there may be some speculative nature to the bid, potentially fueled by rate-cut optimism and rising risk appetite across U.S. equities. However, some particular miners — especially AI/HPC plays — have seen explosive price action, pointing to a revaluation on those operators and assets.

Notably, Hashrate Index’s Bitcoin Mining Stocks Index has surpassed its 2021-era all-time high.

September 2025 Hashrate Market Activity

Our analysis of the September 2025 hashrate market focuses on two key points: how the September 2025 hashrate contract traded in previous months and how the forward curve shifted in September, based on pricing for forward hashrate during the month.

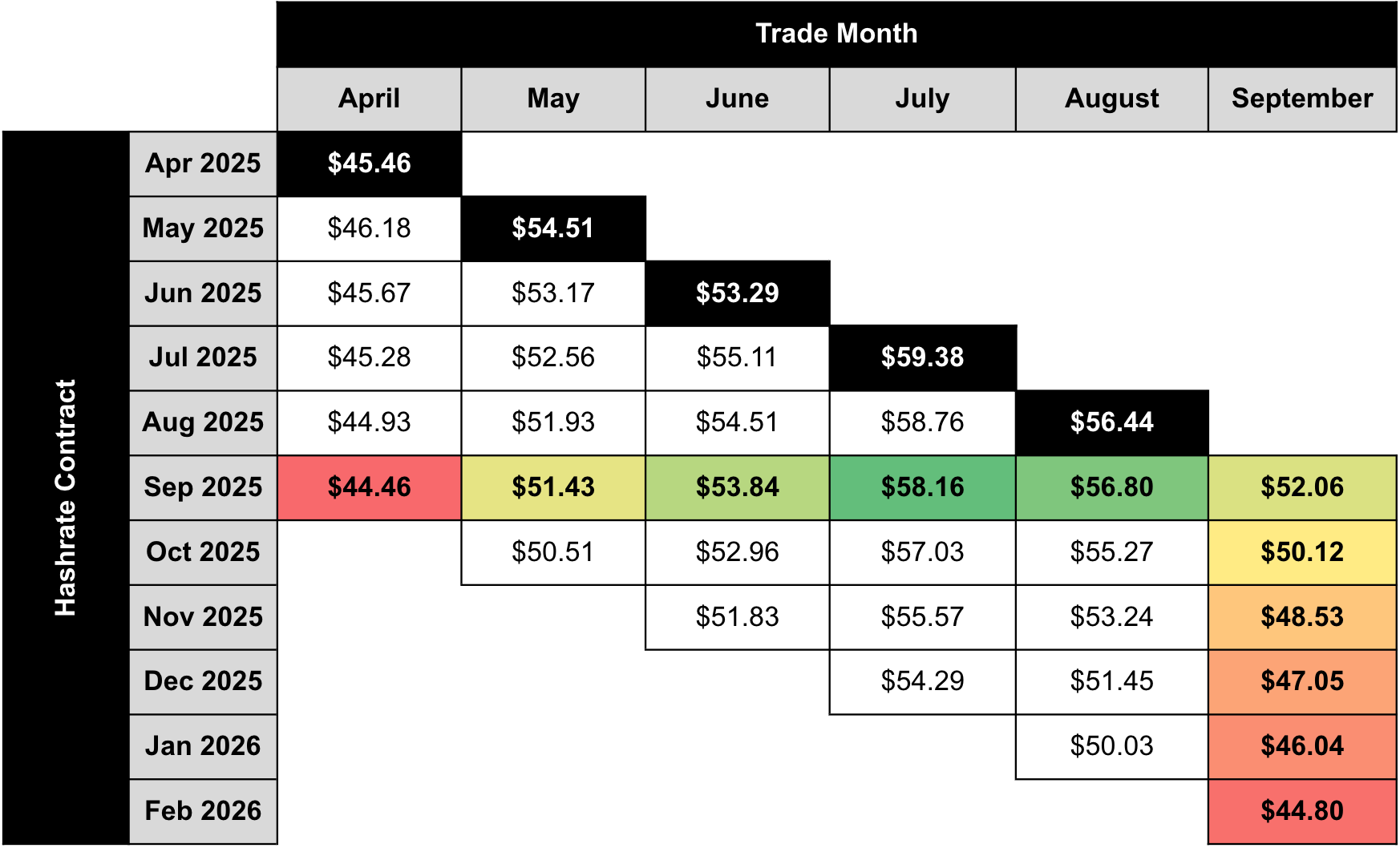

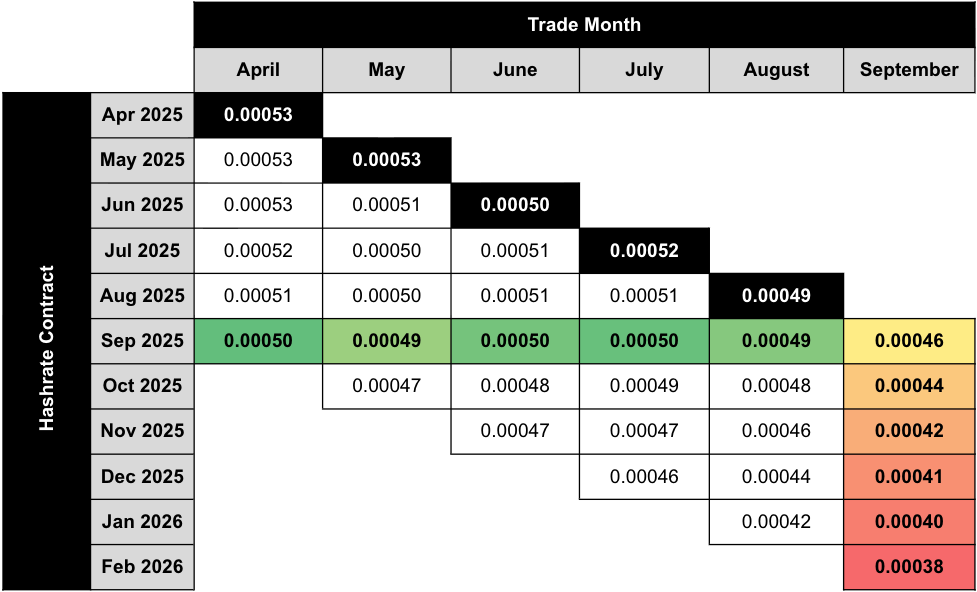

The two tables below show the evolution of Luxor’s USD and BTC denominated hashrate forward markets from April 2025 – September 2025. Rows represent specific monthly contracts, while columns represent each trading month. Cell values indicate the average monthly mid-market price — except for the bold highlighted main diagonal — which shows actual spot hashprice settlement in each month.

This table summarizes both the trading history of the September 2025 USD contract (colored row) and the forward curve in September (colored column).

This table summarizes both the trading history of the September 2025 BTC contract (colored row) and the forward curve in September (colored column).

Note: all values shown in figures represent mid-market rates, the midpoint of the best bid and ask on Luxor's Non-Deliverable Hashrate Forward market.

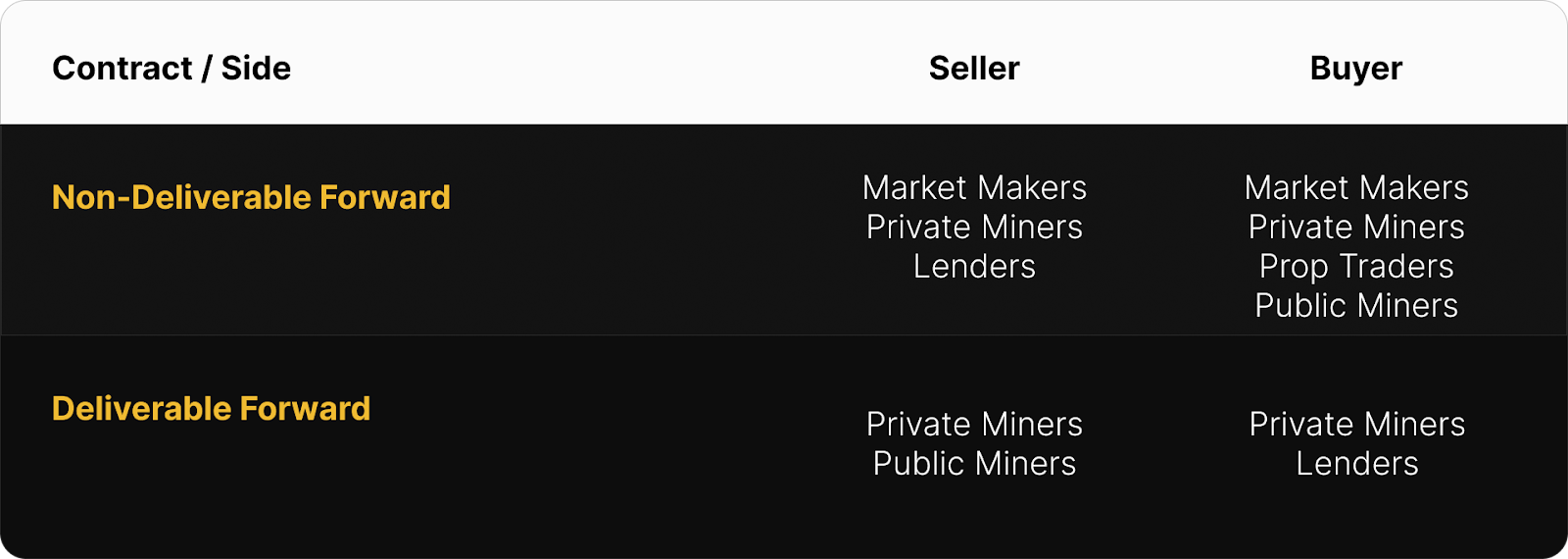

The table below shows the type of market participants on the buy and sell side of Luxor’s deliverable (DF) and non-deliverable hashrate forward (NDF) market. In September, lenders were active on the buy side of the DF market, while public and private miners used the contract to sell forward, receive financing, and expand their fleet.

Since the DF involves upfront payment, it tends to trade at a discount to the NDF, compensating the buyer for the inherent credit risk. We see the discount of DF’s relative to NDF’s as the interest rate in hashrate-based lending markets. Buyers and sellers of the DF with upfront payment can use the NDF to lock-in a fixed yield (cost of capital) instead of having exposure to hashprice uncertainty.

This strategy was used by lenders (Buy DF & Sell NDF) to earn a BTC-denominated return and by miners (Sell DF & Buy NDF) to obtain non-dilutive financing. In September 2025, that yield (cost of capital) was in the 8–13% (annualized) range.

How September 2025 Hashrate Traded

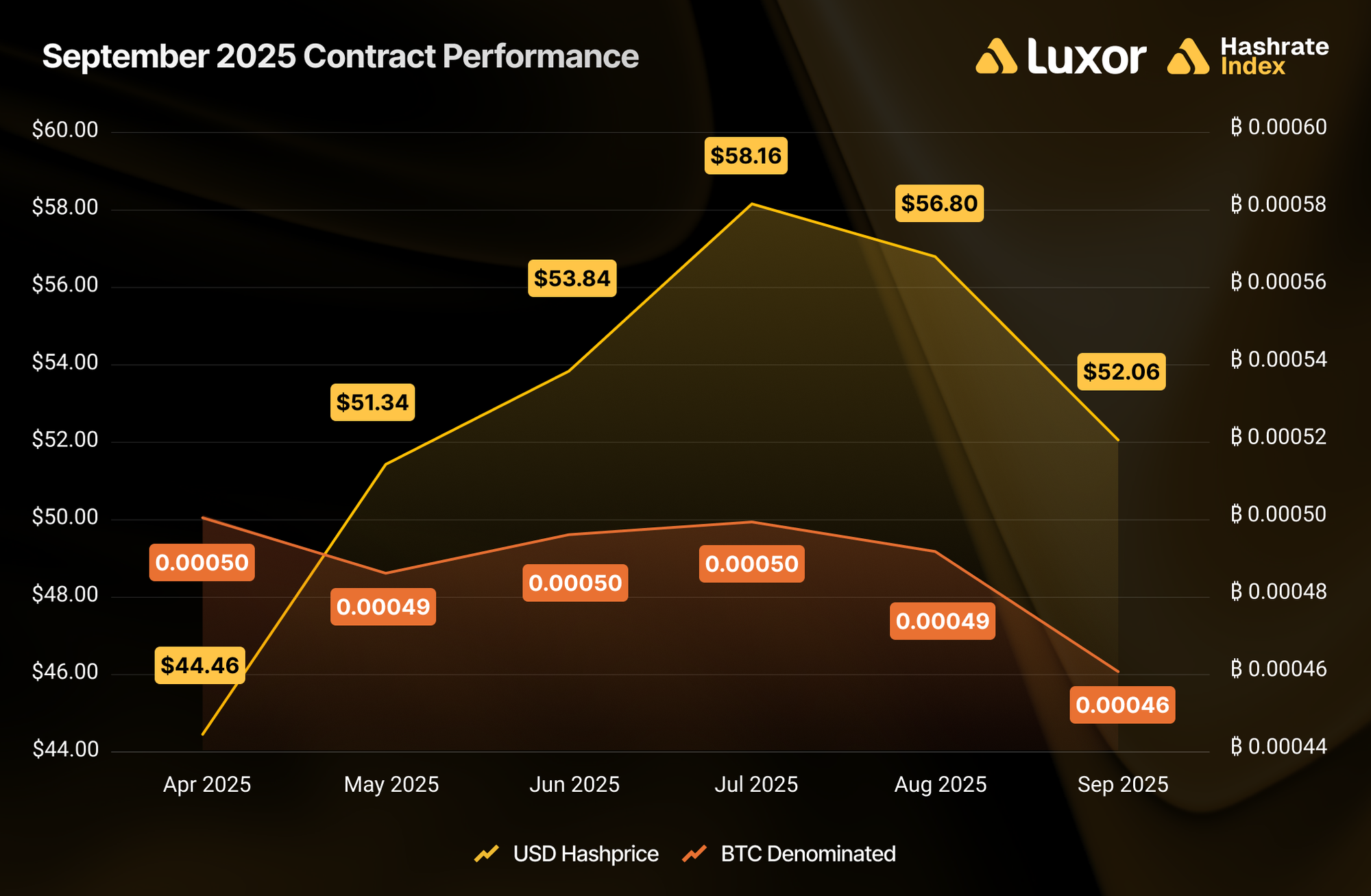

In USD terms, the September 2025 contract was a win for early buyers (4–5 months out) and recent sellers (1–3 months out). USD-denominated hashrate buyers effectively lock in a fixed hashcost. As the hashrate market rallied, participants who entered earliest (in April or May) saw the highest gains, with the September contract’s hashprice reaching $58.16 per PH/s/day in July, well above their fixed hashcosts of $44.46 – $51.43 per PH/s/day.

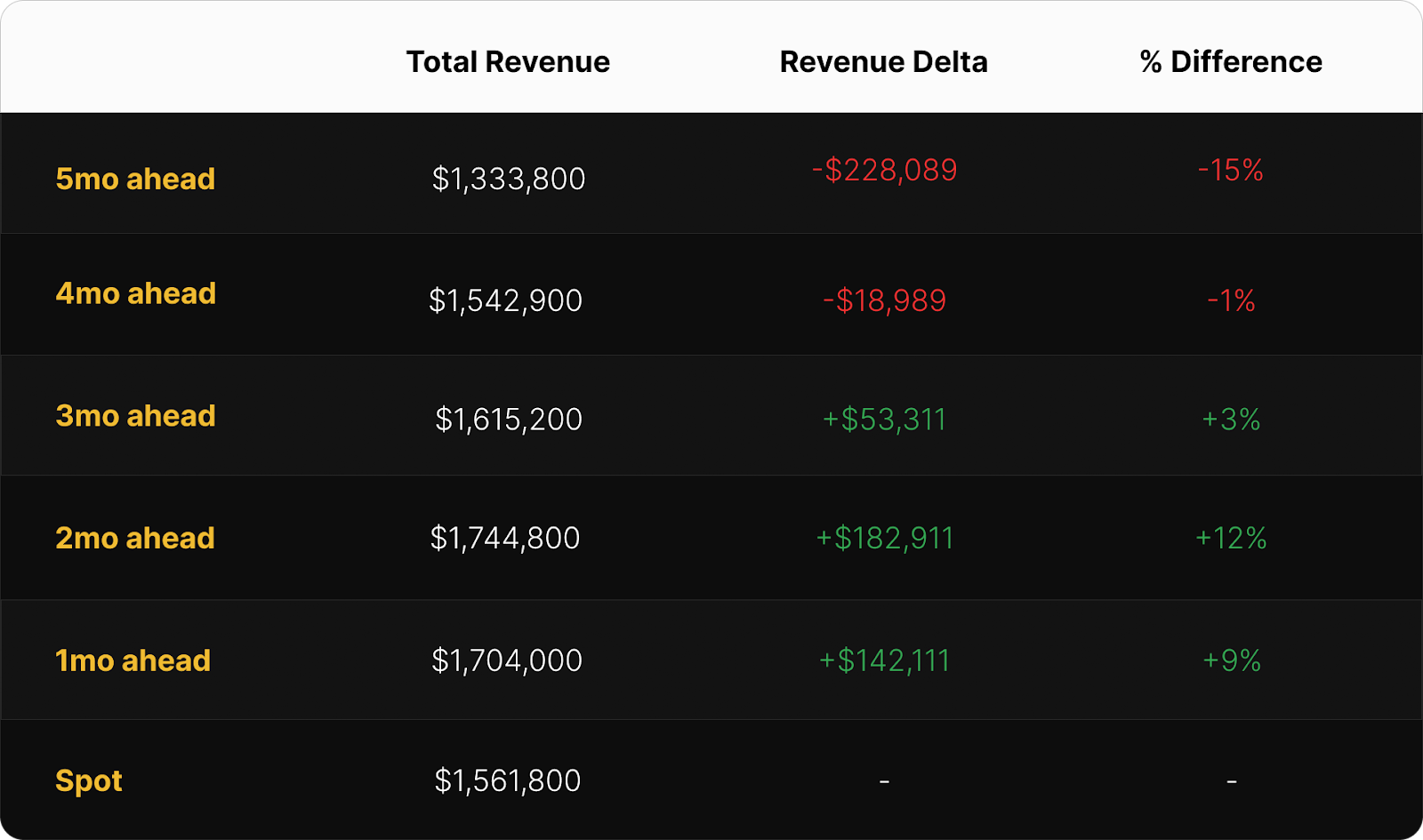

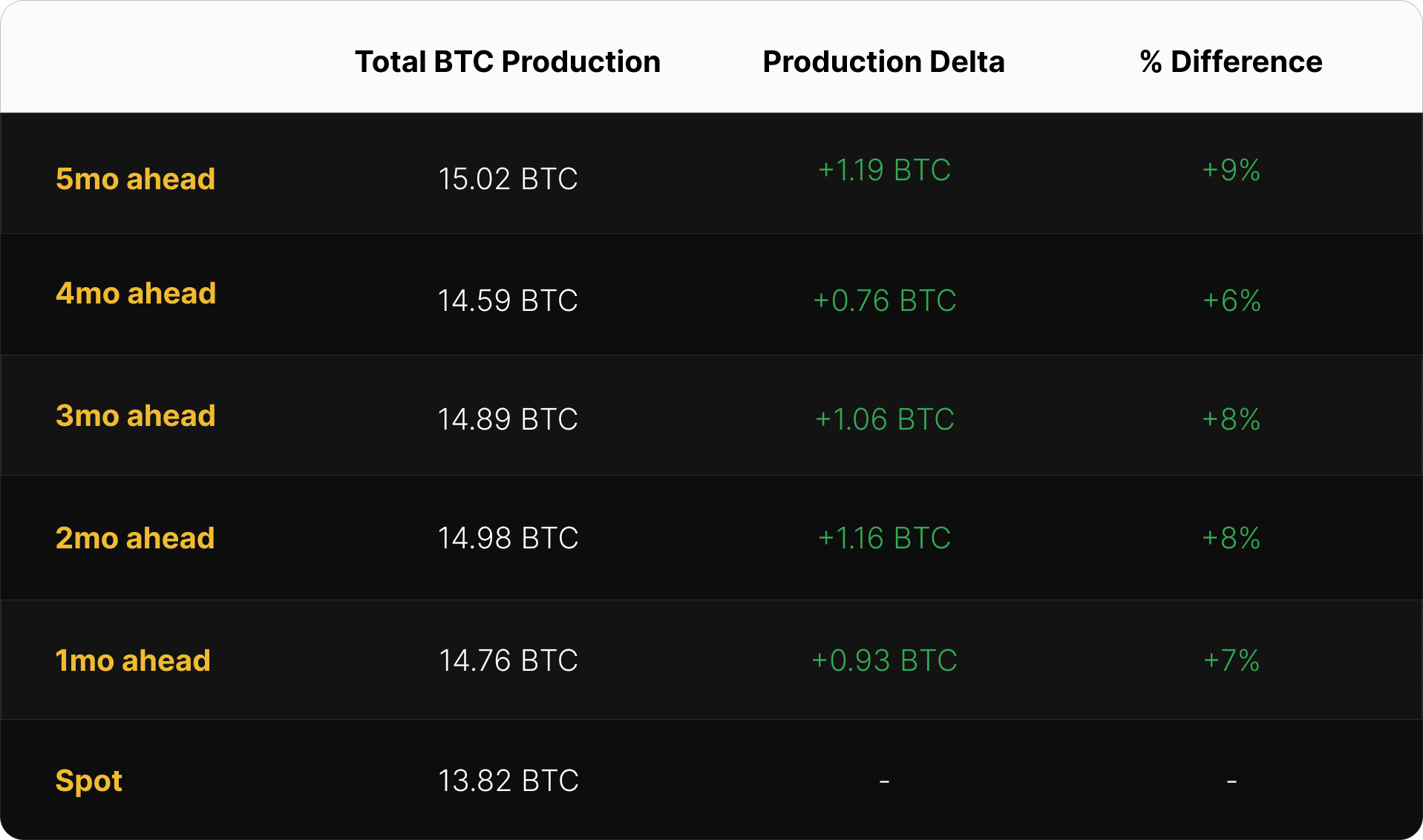

On the BTC-denominated side, sellers won across the board. Early forward sales (April) outperformed spot FPPS by a significant 9%, while later hedges (between May – August) saw healthy gains of 6–8%. Even a 1-month forward sale (in August) would have resulted in an additional +7% BTC revenue, highlighting the mismatch between expectations and reality as network difficulty and hashrate continue to grow. The best performance for BTC-denominated sellers was marked by a 5-month forward sale in April, which would have locked in fixed pool payouts at 0.00050 BTC per PH/s/day, compared to spot FPPS rates at 0.00046 BTC throughout September. Those who used upfront payouts even received immediate, non-dilutive capital in exchange for a fixed commitment to deliver hashrate over time.

The tables below summarize how a 1 EH mining operation would have performed by selling September 2025’s hashrate forward — one showing USD revenue outcomes, and the other showing total BTC production — compared to spot mining via FPPS.

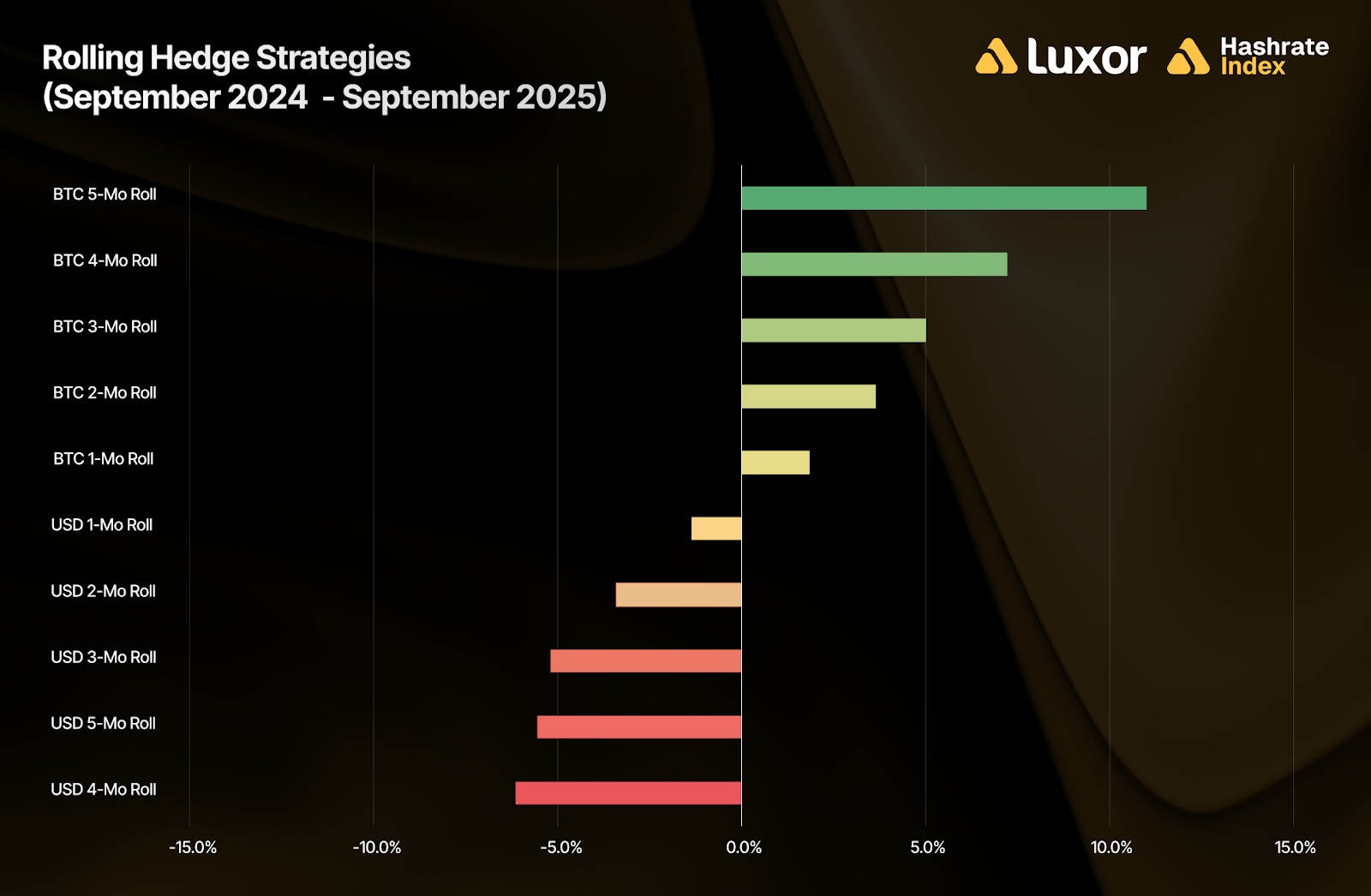

Zooming out, the following chart shows the performance for a range of rolling hedge strategies relative to spot FPPS mining, segmented by contract denomination and hedge horizon over the past year, from September 2024 – September 2025:

This comparison reveals that rolling BTC-denominated hedging strategies outperformed between September 2024 and September 2025, with the strongest results coming from 5-month (+11.5%) and 4-month forward sales (+7.7%). These longer-duration contracts benefited from being priced ahead of rising network difficulty and low fee environments, while still maintaining bitcoin price exposure. In contrast, USD-denominated hedging underperformed spot FPPS by an average of -4.3% because of rising bitcoin prices.

Miners who locked in fixed BTC pool payouts between September 2024 and September 2025 were better insulated from the hashprice decline driven by difficulty increases and weak fee activity. Those who used upfront payouts even went a step further by front-loading revenue for growth.

Note: these figures are strictly for demonstration purposes and exclude fees and bid/ask spreads associated with entering into hashrate forward contracts.

A second caveat: although selling forward proved to be favorable during timeframes shown above, it is critical to recognize that hedging is typically a cost of business rather than a revenue generation method. Hedgers willingly pay a price to buy certainty and obtain more predictable cash flows, which increases valuation, reduces cost of capital, and ultimately attracts investments.

How Future Hashrate Traded in September 2025

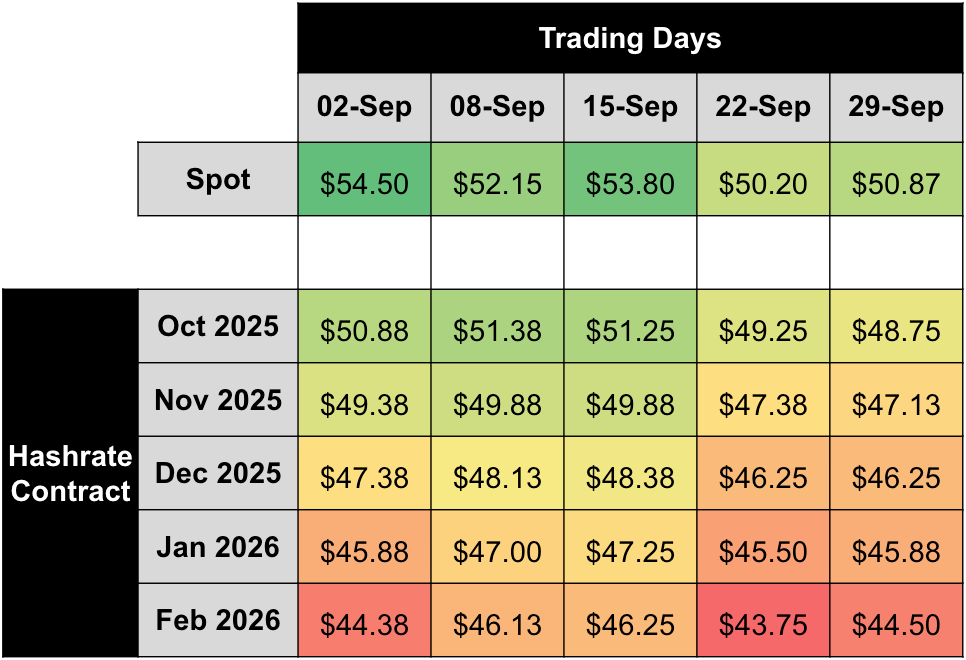

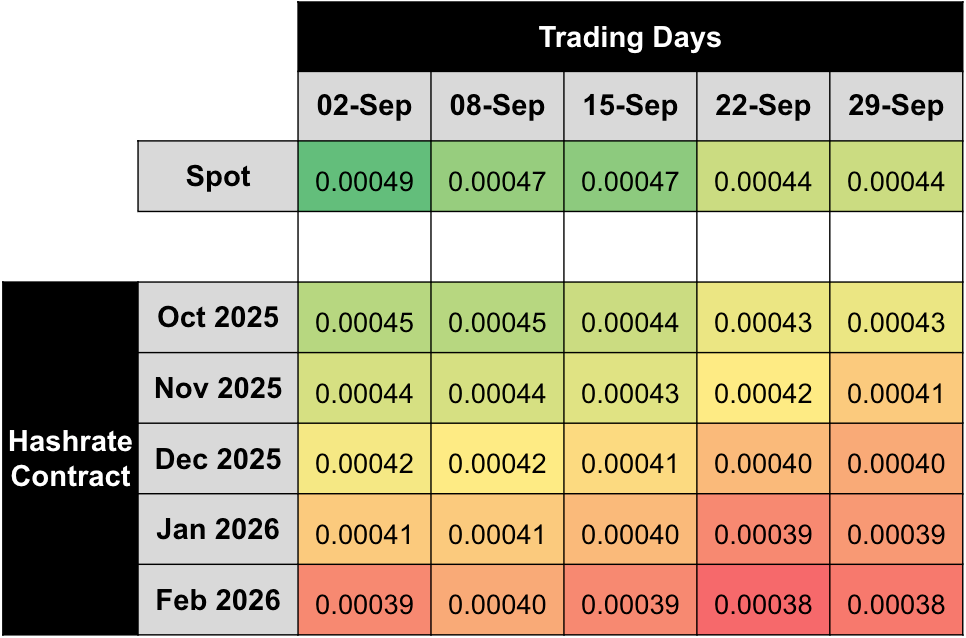

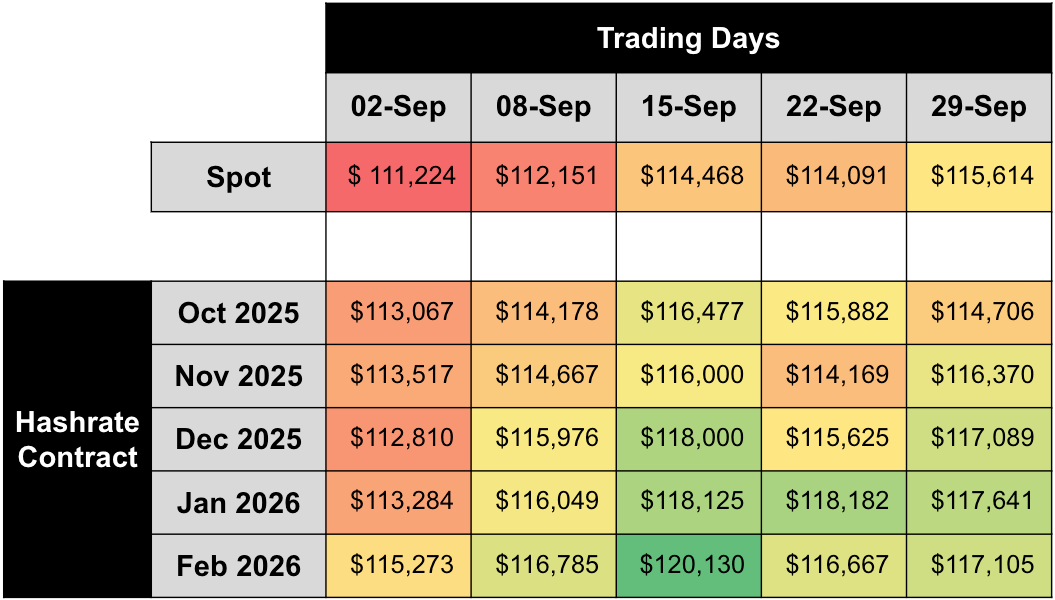

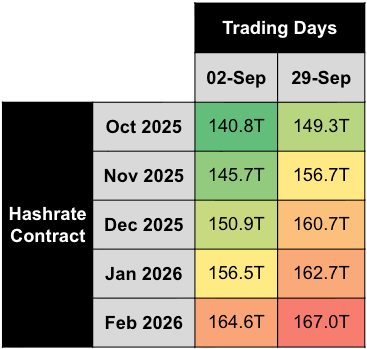

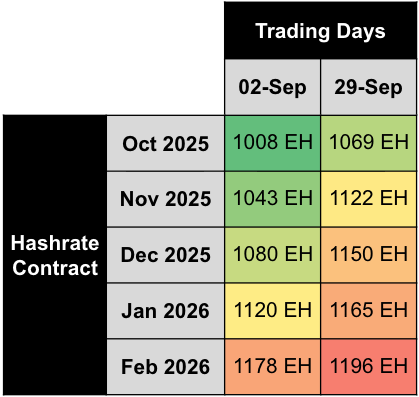

The two tables below summarize the evolution of hashrate forward markets during September 2025, for the subsequent five months from October 2025 – February 2026. Rows represent specific monthly hashrate contracts, while columns represent specific trading days. Cell values indicate the average daily mid-market price, except for spot prices.

Between September 2 and September 30, October 2025 to February 2026 USD-denominated hashrate forward contracts fell anywhere from 0–5% as bitcoin price and spot USD hashprice both declined. BTC-denominated contracts fell more aggressively, by 1–7%, reflecting the dip in BTC hashprice driven by recurring all-time highs in network difficulty. All monthly contracts traded in backwardation throughout the period.

By dividing USD contract values with BTC contract values, we can back out implied bitcoin price expectations expressed by the forward market. Throughout September, implied bitcoin price expectations traded mostly in contango and rose 1–4%, reflecting bullish sentiment for near-term price action in spot BTC markets.

If we make an assumption around transaction fees, we can also calculate changes in implied network difficulty and hashrate expectations expressed by the forward market. In the two tables below, we assume a 0.025 BTC per block transaction fee collection on September 2 and a 0.030 BTC per block on September 30, respectively:

Note: figures assume 0.025 BTC per block transaction fee collection on September 2 and 0.030 BTC per block on September 30, 2025.

Based on this simple analysis, we estimate that future hashrate expectations grew during the month of September, rising by 1–8% for the October 2025 – February 2026 contracts. The high end of this range has been disproportionately driven by the front-end of the curve (i.e., by very short-term expectations), which has since reversed. Looking further out, the February 2026 contract has risen by ~1.5%, providing clearer insight into medium-term expectations on hashrate growth.

Concluding Thoughts and Looking Ahead

On September 2, Bitcoin’s 7-day Simple Moving Average (SMA) for network hashrate crossed the unprecedented threshold of 1 ZH/s (one zettahash per second) — equivalent to one sextillion (10²¹) hashes every second. From a hashprice perspective, 1 ZH was truly “priced in” once network difficulty surpassed 139.7T on September 18 — the level at which today’s zettahash-scale hashrate became the baseline assumption for future block discovery.

This milestone underscores the relentless growth of Bitcoin’s security and the ongoing industrialization of mining. For miners, 1 ZH/s is a reminder that competitive pressures will continue to intensify, which means efficiency, scale, and financial discipline are more important than ever.

Since September, mining markets have moved significantly. A positive difficulty adjustment (+5.97%) sent network difficulty to a new all-time high of 150.84T on October 1, pushing hashprice down below $50 per PH/s/day. In true “Uptober” fashion, Bitcoin marked a new all-time high of ~$126,000 on October 6, however it has since retraced to ~$111,000. In the coming months, we anticipate network hashrate growth to continue.

Looking forward, Luxor’s Hashrate Forward Market is pricing in an average hashprice of $45.54 or 0.00041 BTC per PH/s/day over the next six months. Sellers can currently secure this hashprice while buyers have the opportunity to lock in the same hashcost through March 2026.

If you’d like to learn more about Luxor’s Bitcoin mining derivatives, please reach out to [email protected] or visit https://www.luxor.tech/derivatives.

About Luxor Technology Corporation

Luxor delivers hardware, software, and financial services that power the global compute and energy industry. Its product suite spans Bitcoin Mining Pools, ASIC Firmware, Hardware trading, Hashrate Derivatives, Energy services, and a bitcoin mining data platform, Hashrate Index.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.