Intelligent Mining — Part 4: How to Ride Real-time Power Markets

In this blog post, we dive into the race car revolution and explore strategies for riding real-time power markets.

The Intelligent Miner — a new comprehensive guide published by Luxor Technology — introduces a fundamentally different approach to bitcoin mining operations. Download the full guide to learn how your operation can transition from binary to intelligent mining.

In Part I of this series, we explored the two markets that shape profitability —hashrate and energy — and how the most advanced operators now treat them as tradable commodities.

In Part II, we turned to two elements in the software stack that make this evolution possible: firmware and fleet management.

In Part III, we made the case for and outline our vision of what intelligent mining means.

In Part IV, we dive into the race car revolution and explore dynamic gear-shift strategies for riding real-time power markets.

How to Ride Real-time Power Markets

The race car revolution extends beyond just the ability to change gears. Becoming truly price-responsive means dynamically adjusting between performance modes in response to real-time signals, which requires turning manual shifting into automatic. Real-time telemetry between integrated firmware and fleet management layers allow Intelligent Miners to calculate profitability across both sides of the mining margin: hashprice (revenue) and energy (cost), ensuring that each individual machine in the fleet operates at its precise sweet spot at every single interval.

Locking in either side of the miner’s operating margin smooths outcomes and creates certainty, but hedging does not replace the need to respond to spot economics. Operators must always make the most of the moment — failing to continuously optimize fleet performance simply leaves money on the table. In reality, profit maximization is occurring at the margin, within each spot-power-price interval. The opportunity cost of ignoring spot power price signals can be just as damaging as direct operating losses.

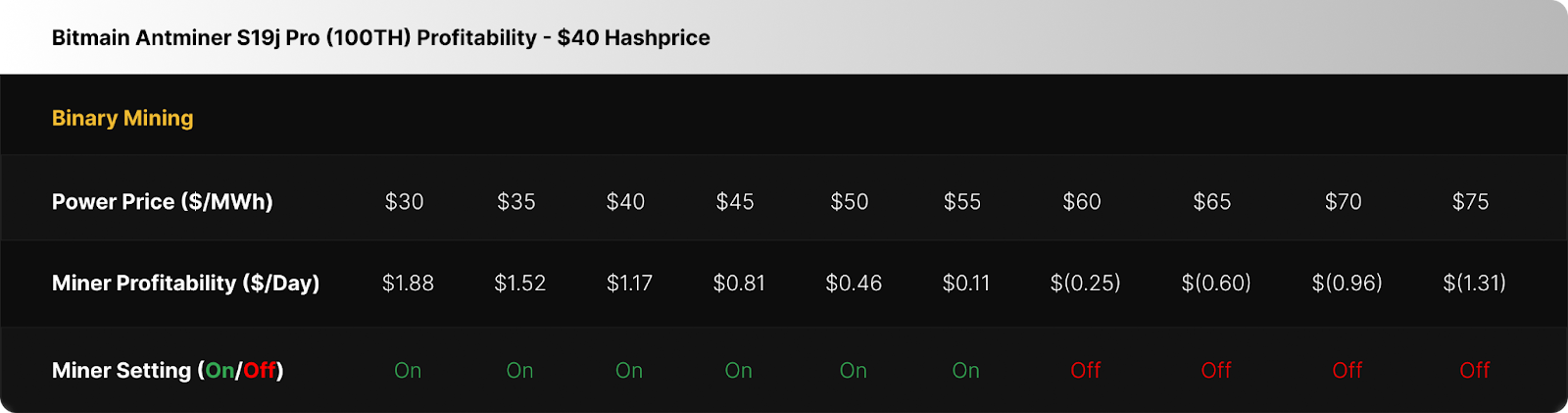

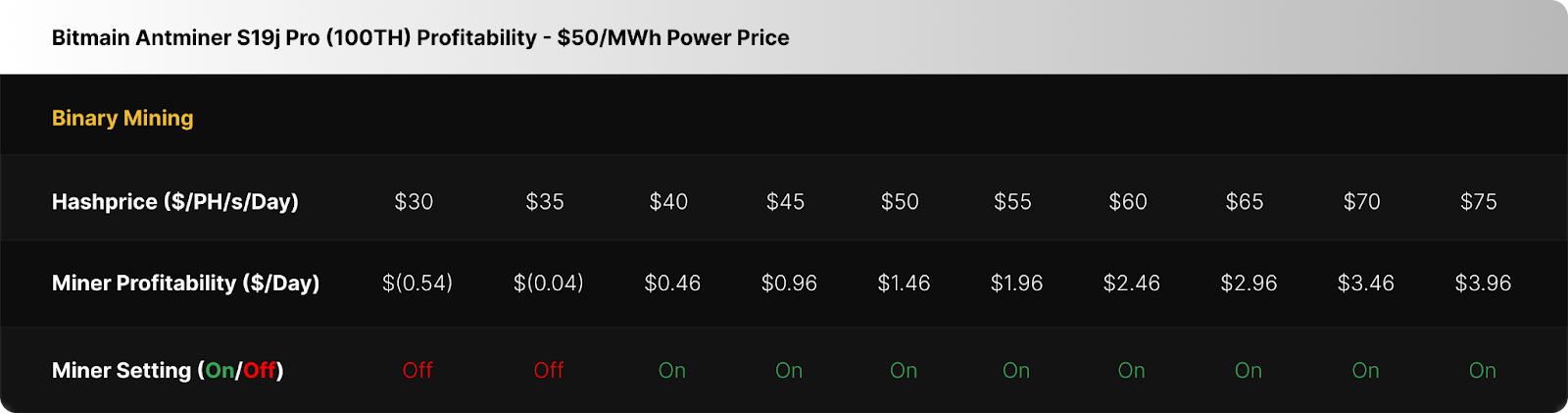

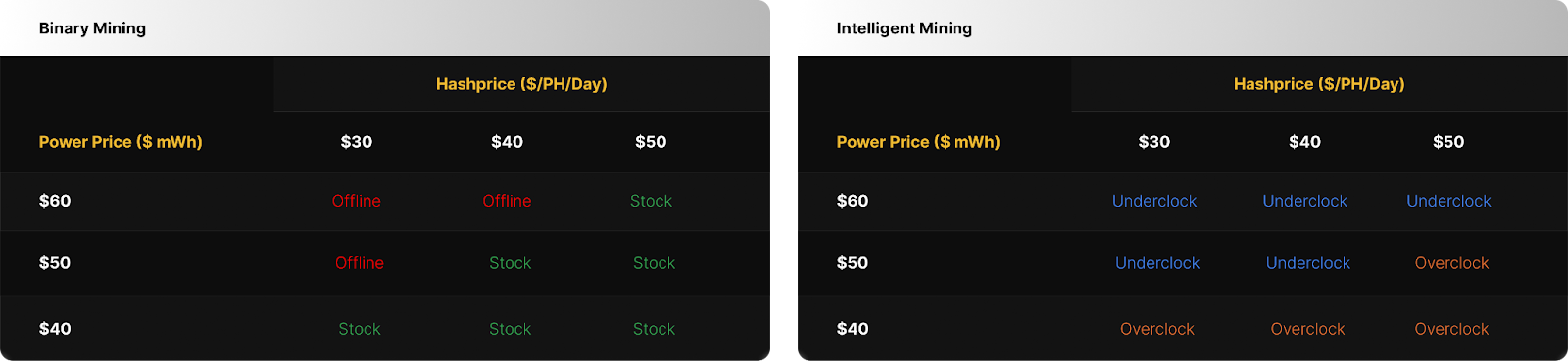

The table below shows how a binary miner responds to fluctuating power prices, holding all else equal. At a $40 per PH/s/day hashprice, the binary miner running a fleet of S19j Pro’s turns off at power prices above $60 per MWh and beyond, in order to avoid operating at a loss.

The table below shows how an Intelligent Miner would respond to the same scenario. At a $40 per PH/s/day hashprice, the operation would simply “shift gears into efficiency mode” and continue to run the fleet of S19j Pro’s at power prices above $60 per MWh, until it reaches shutdown at $75 per MWh. In this case, the change in gears is a down-shift, otherwise known as underclocking — the process of running a machine’s individual ASIC chips at a lower frequency and/or voltage versus stock settings. By dialing frequency down, the chips perform fewer hashes per second, reducing total hashrate output (TH/s). However, power draw falls proportionally more than hashrate, which means lower joules per terahash, improving efficiency (J/TH) as a result. This allows the Intelligent Miner to continue hashing and squeeze out additional revenue as it slowly declines to a stop, when necessary. Meanwhile, the binary miner is stuck in a loop between hard stops and restarts, covering less ground.

The other side of the coin is where it gets even more interesting. When hashprice is elevated or energy costs are extremely low, Intelligent Miners can shift up into "performance mode" by overclocking machines beyond stock settings. Advanced firmware like LuxOS unlocks frequencies of up to ~130% of stock levels, increasing hashrate output (albeit at the cost of higher power consumption and additional cooling requirements). This overdrive capability allows for maximizing revenue during windows of opportunity, while maintaining the flexibility to pull back down as conditions change.

At a $50 per MWh power price, the binary miner running a fleet of S19j Pro’s turns on at hashprices above $35 per PH/s/Day and beyond, in order to operate profitably.

The Intelligent Miner would respond by “shifting gears into performance mode” and overclocking the fleet of S19j Pro’s at hashprices above $35 per PH/s/Day and beyond. By dialing frequency up, the individual ASIC chips perform more hashes per second, increasing total hashrate output (TH/s).

The economic impact of Intelligent Mining becomes apparent when considering the range of market conditions miners can face. During periods of negative energy pricing, miners with advanced firmware can shift into overdrive, effectively being paid to consume electricity while producing additional bitcoin. This flexibility transforms the economics of mining operations. Instead of binary profitability decisions based on fixed performance assumptions, Intelligent Miners optimize their operations continuously across changing market conditions. The result is higher profitability, reduced risk, and the ability to actively participate in energy markets as flexible demand resources.

Layering on Ancillary Services

Intelligent Mining doesn’t stop at responding to hashprice and spot power. Sophisticated participation means tapping into grid programs and ancillary services — where miners get paid for how and when they consume electricity.

Programs like ERCOT’s 4CP transmission charge optimization, demand response, and ancillary services markets reward flexible loads for curtailing, underclocking, or even overclocking at specific times. In many cases, the compensation from these programs can exceed the value of hashing itself — paying miners hundreds of dollars per MWh.

The core principle here is revenue optionality. Every megawatt has multiple layers of potential value. Energy can drive SHA-256 hashing directly, it can be sold back into the grid during scarcity events, and it can also be monetized through ancillary services — often while hashing continues in parallel. Intelligent Miners treat energy not just as a cost center but as a revenue center, continuously evaluating which option generates the highest return.

Successfully executing on this requires operational excellence. Grid signals must flow directly into firmware and fleet management layers so that machines can curtail or ramp within seconds. Decision logic must also account for market conditions: at extreme hashprice highs, mining is likely dominant; in weak or flat periods, grid programs may deliver superior economics.

These power market programs are ultimately economic incentives to strengthen the grid — reducing peaks, absorbing excess renewables, and making the system more resilient. Miners who participate are not only improving their own economics, but also contributing to the sustainability and long-term growth of the grids they rely on.

As the mining industry matures and margins compress, the winners will be those who stack every available revenue stream, layering ancillary services on top of real-time mining optimization. Miners who master both will inevitably leave peers in the dust.

If you’d like to learn more about how to build your Intelligent Mining operation across Luxor’s full technology stack — including hashrate derivatives, firmware, and energy services — reach out to us at [email protected] or visit https://luxor.tech/energy.

About Luxor Technology Corporation

Luxor delivers hardware, software, and financial services that power the global compute and energy industry. Its product suite spans Bitcoin Mining Pools, ASIC Firmware, Hardware trading, Hashrate Derivatives, Energy services, and a bitcoin mining data platform, Hashrate Index.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.