Intelligent Mining — Part 3: The Binary Era is Over

In this blog post, we make the case for and outline our vision of what intelligent mining means.

The Intelligent Miner — a new comprehensive guide published by Luxor Technology — introduces a fundamentally different approach to bitcoin mining operations. Download the full guide to learn how your operation can transition from binary to intelligent mining.

In Part I of this series, we explored the two markets that shape profitability —hashrate and energy — and how the most advanced operators now treat them as tradable commodities.

In Part II, we turned to two elements in the software stack that make this evolution possible: firmware and fleet management.

In Part III, we make the case for and outline our vision of what intelligent mining means.

The On/Off Status Quo

Imagine purchasing a car that can only operate in one gear. Whether you're climbing steep hills, cruising on highways, navigating stop-and-go traffic, or driving through severe weather conditions, your vehicle will be locked into the same speed and fuel consumption profile. Such a car would be functional but dramatically suboptimal — burning excessive fuel in city driving, struggling on inclines, and providing poor performance across varying conditions. This analogy describes the current state of bitcoin mining operations using stock firmware.

The mining industry has been unintentionally limited to single-gear thinking since inception. This didn't emerge from technological constraints or strategic choice, but rather from the evolutionary path of development in bitcoin mining hardware and software. In the early days, when individuals could mine profitably with CPUs & GPUs under residential power rates, the concept of variable performance seemed unnecessary. Mining was profitable or it wasn't — machines were on or they were off — and the industry developed around this binary paradigm.

As mining evolved into more sophisticated operations dominated by industrial-scale data centers consuming megawatts to gigawatts of electricity, this ‘on/off’ mentality continued to persist despite a radical change in operational and financial considerations. Hardware manufacturers focused on maximizing peak hashrate performance, viewing their products as specialized computers that should run at full capacity whenever operational. Firmware development reflected this philosophy: stock operating systems were designed without considering dynamic hashrate and power markets. The result was an entire industry built on the premise that mining machines have binary states: running at full speed or shutdown on idle.

This mindset made sense in mining's early era when energy was cheap, competition was less fierce, and market dynamics were simpler. However, as the industry matured, competition increased, and margins compressed, the hidden costs of all-or-nothing operations became apparent.

Binary miners cannot efficiently respond to spot energy price fluctuations. They systematically miss out on revenue maximizing opportunities during low-price periods, and lack the ability to operate profitably during high-price periods, being forced to curtail instead. Single-gear fleets cannot effectively participate in lucrative ancillary services markets that require rapid performance adjustments, leaving a significant amount of money on the table.

Perhaps most critically, on/off miners operate without a margin of safety. Like a speculator, they exist at the mercy of external conditions. If energy costs spike or hashprice drops, these miners are forced to head into a loss or come to a complete stop. The consequences only compound and loom larger during periods of increased market volatility.

Just as the automobile industry has innovated over time, bitcoin mining is now turning the corner into its next stage of evolution. The binary era is over. The race car era — where gears shift with precision — has begun.

The Race Car Revolution

The Spectrum of Performance & Profitability

The race car revolution begins with a recognition that bitcoin mining ASIC machines can operate across a spectrum of performance levels optimized for specific conditions.

Advanced third-party firmware solutions like LuxOS install a sophisticated “multi-gear transmission” into your mining fleet, providing precise control over performance parameters. Taking this simple step transforms a fleet’s operational profile from ‘On/Off’ to ‘0–100’.

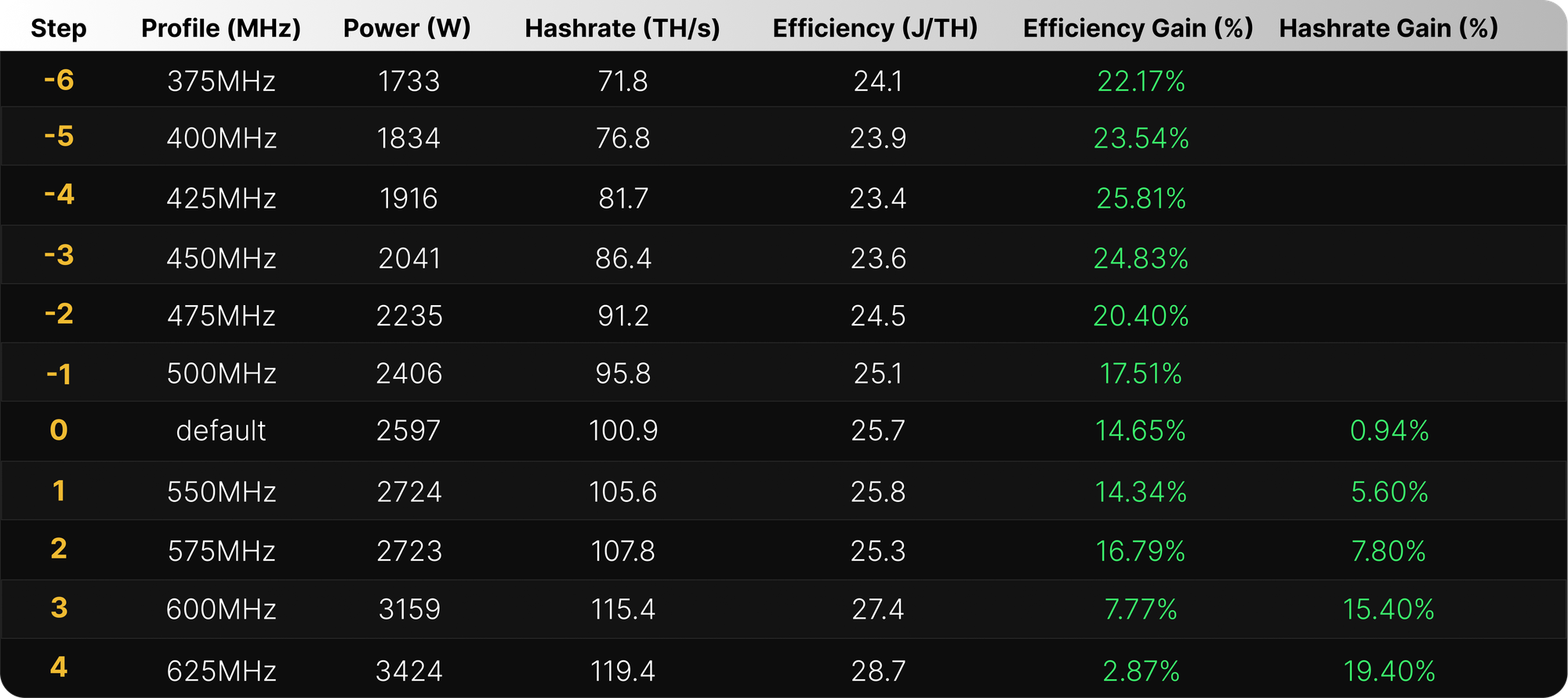

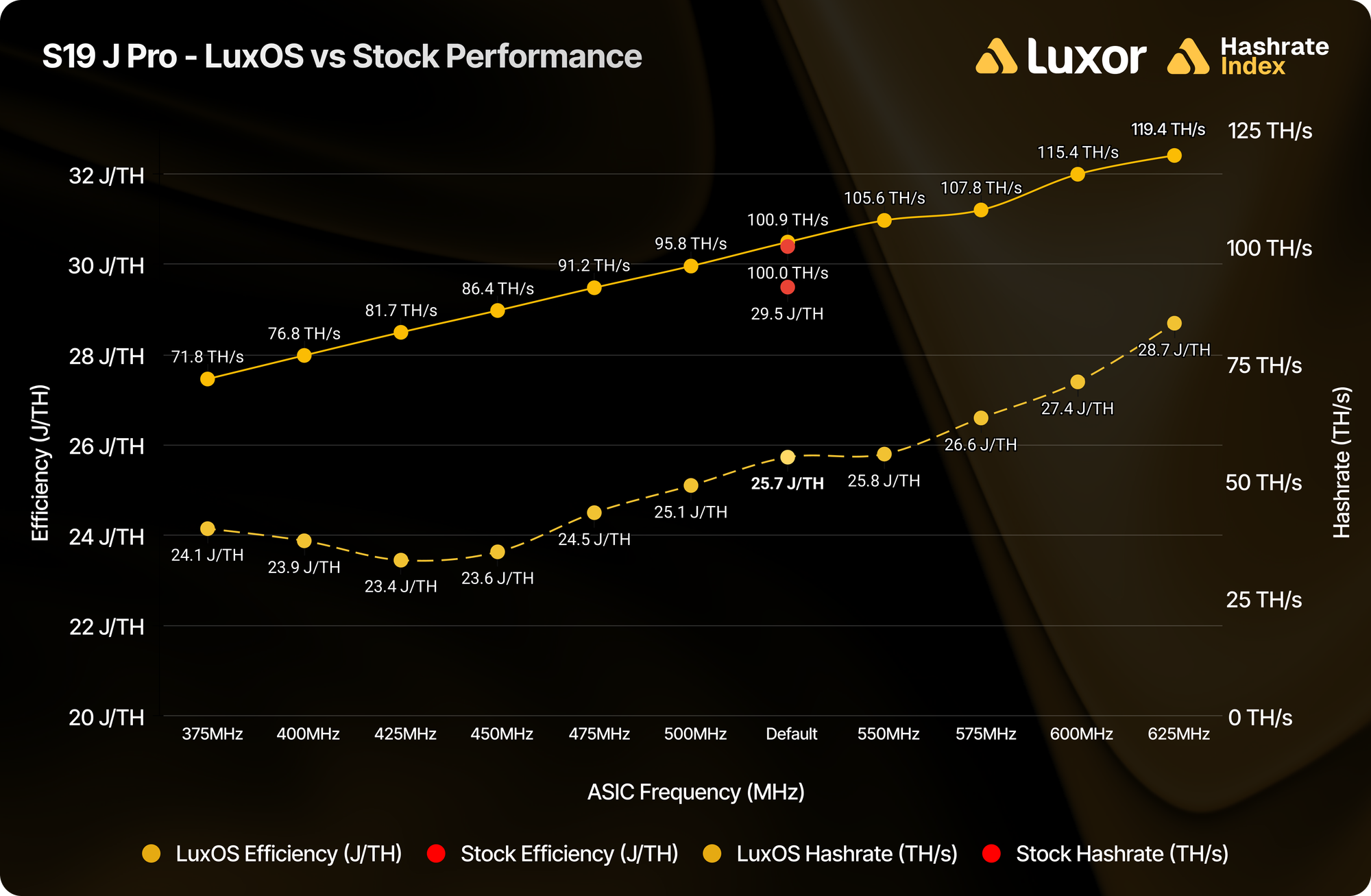

Taking the quintessential mining machine, Bitmain’s Antminer S19j Pro, as an example: running LuxOS unlocks the ability to operate this model in frequency ranges anywhere between 375MHz to 625MHz, producing hashrate outputs ranging from ~70 TH/s to ~120 TH/s, while consuming proportionally varying amounts of power.

Note: While this table displays 11 different preset profiles, LuxOS offers 25 by default. Steps shown spanning from -4 to +2 are considered as a ‘safe zone’ for operations, providing balance between efficiency, performance, and hardware safety. Miners can venture beyond this range at their discretion. Exercise caution and remain attentive to your equipment and conditions.

There are many ways to increase profitability through LuxOS. The first is through AutoTuning — a proprietary algorithm that calibrates groups (domains) of ASIC chips to their optimal frequency. Rather than applying uniform settings across an entire hashboard, autotuning adjusts performance per domain, ensuring that every joule delivers the maximum possible hashrate.

When the machine is in default AutoTune mode (not overclocking or underclocking), a direct increase in efficiency by ~15% is observed. When optimizing for maximum hashrate, moving to a heavy overclock step (+4) will increase hashrate by ~19%. If optimizing for best efficiency instead, moving to a heavy underclock step (–4) will improve efficiency by ~26%.

This stark contrast in performance profile reveals two things at once. First, the flaw in status-quo thinking: the binary miner assumes that maximum hashrate output equals maximum profitability. Second, that peak performance often occurs at frequencies well below maximum settings, as demonstrated by the S19 J Pro’s hashrate and efficiency curves.

Consider the performance profile of the machine across its operational range under LuxOS. At the –3 profile (450 MHz), the machine produces 86.4 TH/s — roughly 85% of maximum hashrate — while drawing 2041W of power, only 69% of maximum consumption. Efficiency improves to 23.6 J/TH, a 20% improvement over stock. This illustrates the non-linear relationship between power and hashrate: power draw rises steeply at higher frequencies, while hashrate scales more linearly. As a result, efficiency “sweet spots” emerge at mid-range profiles (–3 to –5), where miners capture the majority of hashrate output at significantly lower energy cost.

This efficiency gain becomes economically significant when electricity represents 60–80% of total operating (OpEx) costs. The ability to operate in "efficiency gear" during high-price intervals preserves profitability by sacrificing some hashrate production for an outsized improvement in efficiency.

A car locked in a single gear may move, but it cannot adapt to terrain or traffic. Firmware equips the miner with the full range of gears, enabling adjustments for the road ahead. Instead of getting randomly stuck at red lights, the Intelligent Miner adapts. During high-energy-cost intervals, they underclock, cutting costs while still hashing. When hashprice weakens, they avoid losses by gradually gliding down. If energy prices become cheap or negative, they adapt by kicking into heavy overdrive and maximizing hashrate.

Meanwhile, The binary miner continues to oscillate between full-speed ahead and frequent run-ins with red STOP signs.

Stay tuned for the next part in this series to explore the race car revolution.

If you’d like to learn more about how to build your Intelligent Mining operation across Luxor’s full technology stack — including hashrate derivatives, firmware, and energy services — reach out to us at [email protected] or visit https://luxor.tech/energy.

About Luxor Technology Corporation

Luxor delivers hardware, software, and financial services that power the global compute and energy industry. Its product suite spans Bitcoin Mining Pools, ASIC Firmware, Hardware trading, Hashrate Derivatives, Energy services, and a bitcoin mining data platform, Hashrate Index.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.