How to Calculate Bitcoin Mining Profitability

A rundown of our Bitcoin mining profitability calculator and how to use it.

Looking for a way to estimate Bitcoin mining profitability and the return on investment for your Bitcoin mining operation?

We’ve got you covered at Hashrate index with our bitcoin mining profitability calculator, a useful tool for both veteran and green miners alike.

By the end of this article, you will understand how to use Hashrate Index’s bitcoin mining profitability calculator to model out your future (or current) bitcoin mining deployment.

What is Hashrate Index’s Bitcoin Mining Profitability Calculator?

Simply put, Hashrate Index’s bitcoin mining profitability calculator is a tool engineered to help miners estimate total Bitcoin mining costs and profit over a specific period of time.

The calculator uses the hashrate a mining rig can produce, the amount and cost of power it will consume, and other factors to estimate daily, monthly, and yearly profit / revenue and an ROI timeframe.

With Hashrate Index’s mining profitability calculator, miners can quickly model out a deployment without having to labor over a spreadsheet.

Hashrate Index Bitcoin Mining Profitability Calculator Layouts and How to Use Them

Hashrate Index’s bitcoin mining profitability calculator has two layouts: simple and advanced. We designed the calculator's advanced layout in partnership with Galaxy Digital.

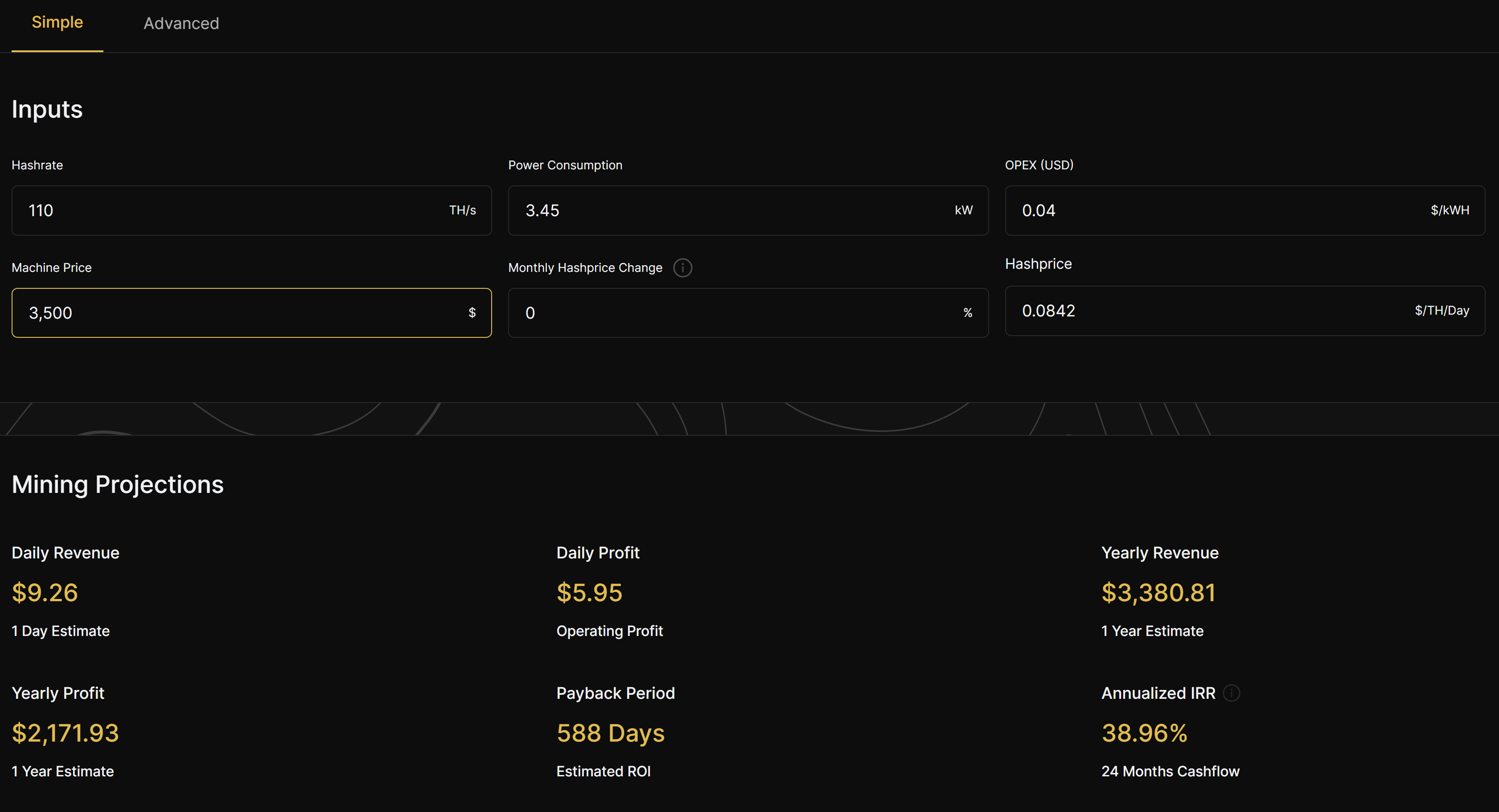

The calculator’s simple layout is newbie-friendly and are pretty straightforward. It features six data fields; below is a table that shows each function input and how to use them.

Simple Bitcoin Mining Profitability Calculator Layout

Hashrate

Every mining machine has its own hashrate (computing power). In this field, you input the total hashrate of your mining deployment.

Power Consumption

The machine's power consumption goes into this field. ASIC power consumption is measured in kilowatt hours (kWh), while GPUs are measured in watt hours (Wh). You can consult our rigs page to find a machine’s power consumption.

OpEx (USD)

OpEx stands for "operational expenses." These are monthly operating expenses, the largest of which for most miners is electricity. Since electricity is a miner’s primary cost, the simple calculator on factors in electricity costs in this field in terms of $/kWh.

Machine Price

This data input requires a miner to simply sum up the total cost of their hardware, or an estimate of the desired hardware’s price. Fill in this input with the US Dollar value of your current hardware, or the one you are making an estimate for (you can use our ASIC Price Index for reference here, if needed).

Monthly Hashprice Change

Hashprice is a measure of revenue potential for a unit of hashrate, typically measured as dollars per terahash per day ($/TH/day). Hashprice fluctuates based on Bitcoin’s price, transaction fees, and network difficulty. Type in the percentage value of the monthly change to hashprice into this field.

Hashprice

Hashprice changes by the hour, and it is automatically generated for you by the calculator based on the real-time hashprice on our index.

Advanced Bitcoin Mining Profitability Calculator Layout

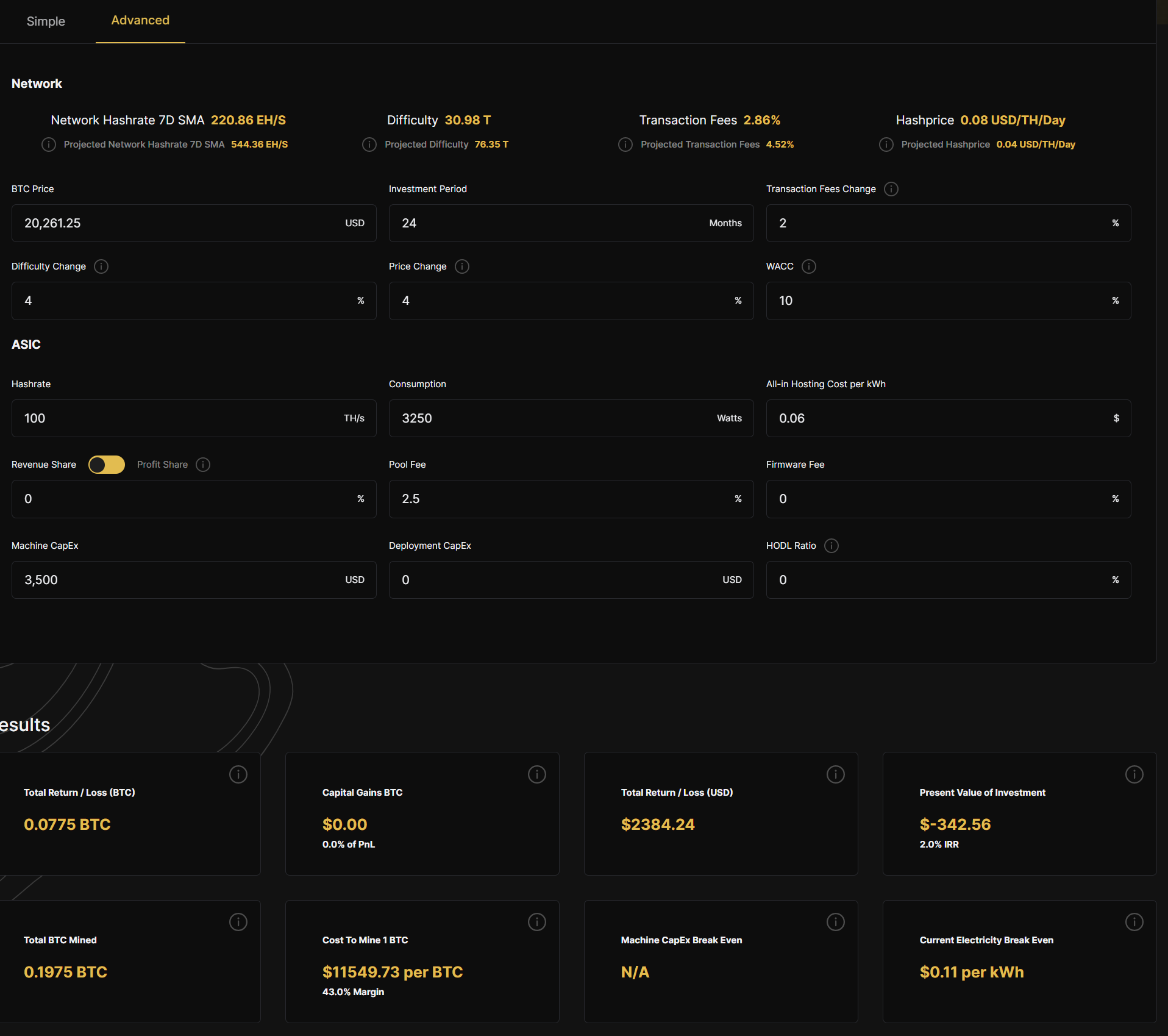

Unlike the simple functions, Hashrate Index’s bitcoin mining profitability calculator's advanced functions require more data to calculate a deployment's profitability. If you are a new miner, the myriad of inputs might make things look complicated.

However, if you spend some time studying the advanced inputs, you'll notice that they just take the inputs in the simple calculator a step farther.

The advanced calculator has two sections: the upper section has inputs related to the Bitcoin network, including bitcoin's price, difficulty, transaction fees, and other inputs related to your operation including investment period and weighted average cost of capital. The lower section collects information about your hardware, like cost and power consumption, as well as operational details like power cost, revenue share, and more.

Let’s quickly discuss these advanced functions’ inputs and how to use them.

Bitcoin Price

The calculator automatically generates the current bitcoin price in this data field. However, if you are trying to find out the profitability of another cryptocurrency (like a GPU-mined coin), you can modify the value generated by the calculator.

Investment Period

Type in the number of months for your investment timeframe in this data input field. This will affect the revenue, profit, and ROI data that the calculator produces.

Transaction Fees Change

Hashrate Index’s profitability calculator automatically generates the most recent daily average for network transaction fees. With this field, you can factor in per-month percentage changes to transaction fees.

Difficulty Change

In this field, you can factor in per-month percentage changes to Bitcoin’s difficulty. Bitcoin's difficulty changes roughly every two weeks based on block times.

Price Change

This field, like Difficulty Change, factors the expected monthly change to bitcoin's price. It is difficult to predict bitcoin price, so be sure to consider several bearish and bullish scenarios.

WACC

This field factors in the Weighted Average Cost of Capital (debt) for a miner’s investment.

Hashrate

Enter your deployment’s hashrate here.

Consumption

Just like on the calculator’s simple functions page, enter your deployment’s estimated power consumption data here.

All-in Hosting Cost per kWh

Sum up the total cost of hosting your hardware and type the number in this field.

Revenue Share

If your hosting option includes a revenue or profit sharing agreement, you can input this percentage here.

Pool Fee

Different pools may charge different fees, but they are typically 1–3% of your mining revenue. Compare fees across multiple pools, substitute them into the Pool Fee input and see how each affects long-term profitability.

Firmware Fee

These are the fees paid to companies that provide custom firmware for your machines. If your mining rig is running a custom firmware, enter the firmware dev fee (in percentage) into this field.

Machine CapEx

Machine Capital Expenditures (CapEx) are funds spent to purchase, replace, repair, and manage Bitcoin mining ASICs. Add up these costs and enter the final USD total in the CapEx field.

Deployment CapEx

Type in the USD value of other CapEx costs here, such as electrical hardware costs, real estate costs, etc.

HODL Ratio

Estimate the amount of mined bitcoin you’d want to sell or HODL and type the percentage value in this field. For example, you have a 100% HODL ratio if you do not plan to sell any of your mined bitcoin.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.