Hashrate Index Roundup (December 10, 2023)

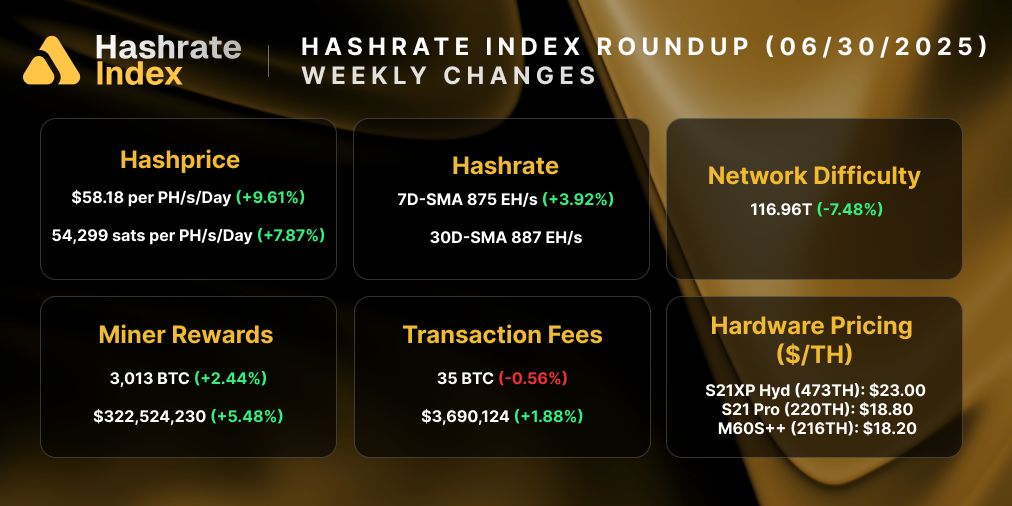

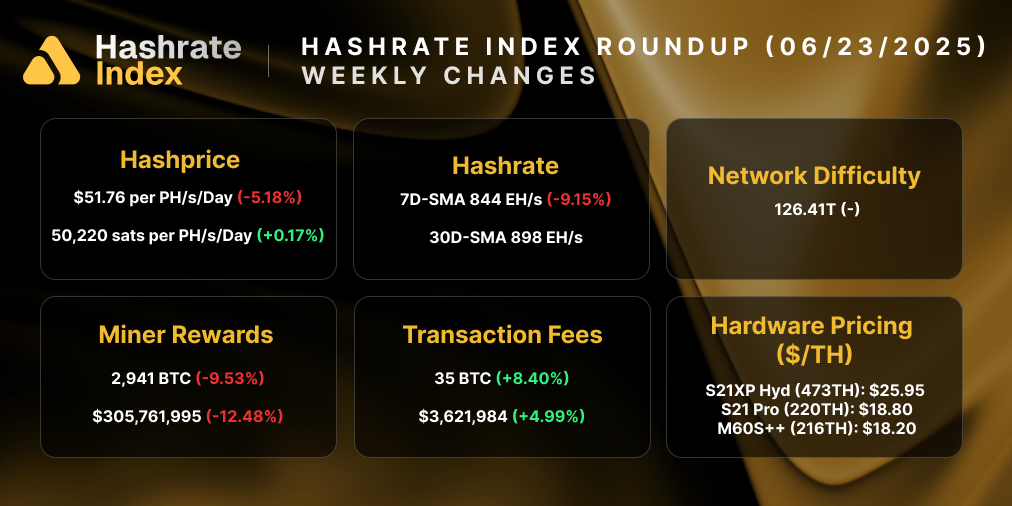

The hashprice rally accelerated last week, with hashprice hitting its highest point since May 2023.

Christmas just keeps coming early, y'all.

Each week over the last month has delivered a new yearly high for Bitcoin's price, with last week seeing Bitcoin climb to as high as $44,500. At its current price of $43,700, Bitcoin is up 17% month-over-month, 69% over the last 6 months (oh yeah), and 164% year-to-date. The current price run is being fueled by scuttlebutt and hopes that the SEC could approve a Bitcoin ETF as soon as January 2024.

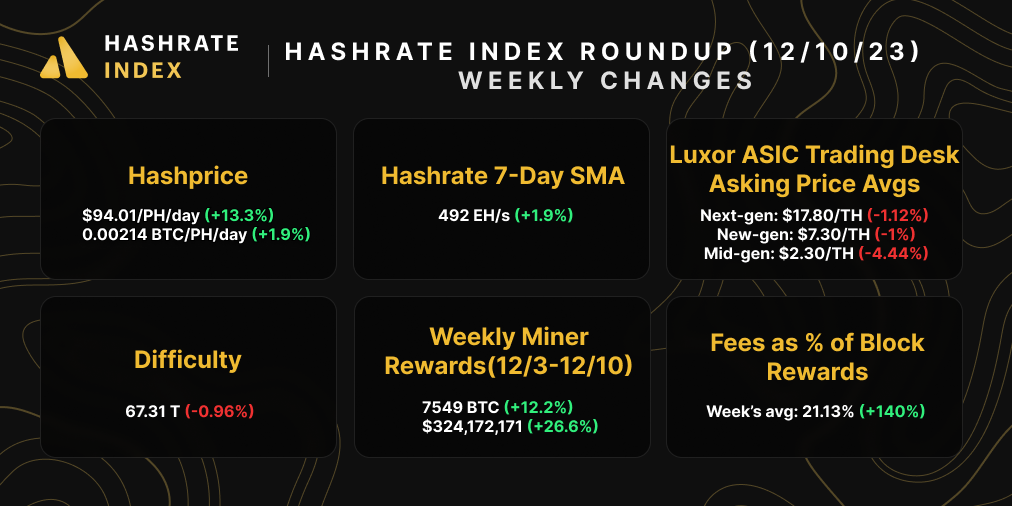

The ongoing rally continues to provide massive relief to Bitcoin miners. At $93.70/PH/day, hashprice is up 1.2% month-over-month, 37% over the last 6 months, and 56% year-to-date, and it even hit a high of $111.77/PH/day this week – the highest point since May 8 of this year.

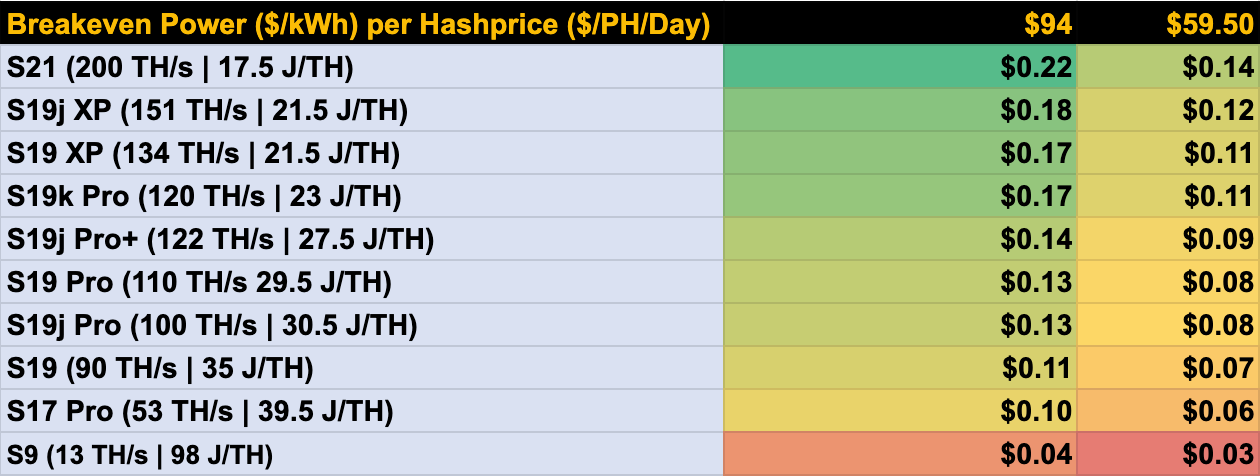

This increase is nothing shy of a godsend for the mining industry, as it has lifted plenty of miners out of breakeven/unprofitable territory. Looking at the table below, for example, the breakeven power prices for an S19 and S19j Pro at the beginning of 2023 were $0.07/kWh and $0.08/kWh, respectively; now, those breakeven prices are $0.11/kWh and $0.13/kWh.

Hashprice is getting boosted by more than just Bitcoin price, with transaction fees still elevated thanks to inscription activity. But it's also received a nice – if tiny – nudge from yesterday's negative difficulty adjustment, a 0.96% drop which lowered Bitcoin's mining difficulty to 67.31 T. This decrease snapped a sixfold streak of positive adjustments and marks the first negative difficulty adjustment since September 5 of this year.

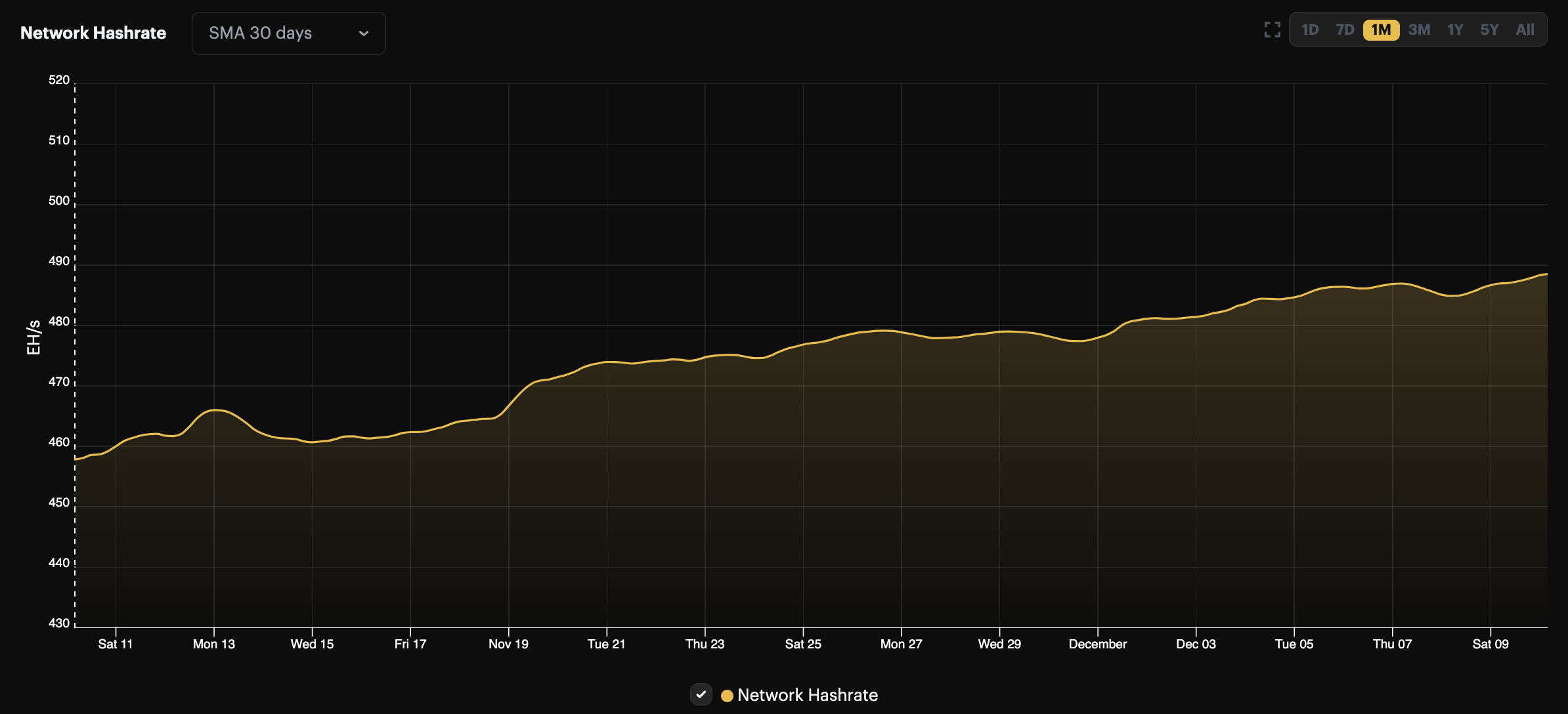

We'll see how long this difficulty reprieve last, though, because Bitcoin's 30-day average hashrate hit an all-time high of 489 EH/s this week.

Things are finally starting to look up for miners and Bitcoin in general as we finish up the year. So long as mining operations and grids don't suffer from severe weather, the current hashprice and Bitcoin rally could mean that even more hashrate comes online before the Halving as miners attempt to squeeze every last bit of block rewards before April's 50% reduction.

Sponsored by Luxor RFQ

The Antminer S21 is here, and Luxor's ASIC Trading Desk is accepting preorders for this model right now! If you'd like to place a preorder for the Antminer S21, please fill out this form. Secure your order for Bitmain's most efficient and powerful ASIC miner today!

Bitcoin Mining Market Update

Transaction fees spiked significantly this week on continued activity with ordinals and inscriptions. In the ASIC miner market, asking prices cooled down somewhat after rigs were repriced higher the week before in response to the rise in Bitcoin's price and hashprice.

Bitcoin Mining News

Here are last week's top headlines for Bitcoin mining news:

- TEXAS BITCOIN MINING OPERATION SHUT DOWN BY HOST’S ARMED SECURITY

- Bitcoin dev Luke Dashjr calls inscriptions 'spam,' community members push back

- Bitcoin Miner Wins a Round In DeWitt, but Fight Goes On

- Why Are People Spreading Falsehoods About Bitcoin’s Water Use?

Bitcoin Mining Stocks Update

Bitcoin mining stocks continued to pump over the week, adding to already terrific month-over-month gains. Over the week, our Crypto Mining Stock Index rose 8.7%, and it's up a staggering 165% year-over-year.

Weekly changes to Bitcoin mining stocks:

- RIOT: $15.83 (+4.28%)

- HUT: $10.25 (-13.50%)

- BITF: $2.59 (+34.20%)

- HIVE: $4.20 (+10.82%)

- MARA: $16.78 (+9.39%)

- CLSK: $10.34 (+16.68%)

- IREN: $5.82 (-5.52%)

- WULF: $1.83 (+9.58%)

- CIFR: $2.91 (-7.62%)

- BTDR: $6.23 (+19.81%)

- SDIG: $5.20 (-9.72%)

New From Hashrate Index

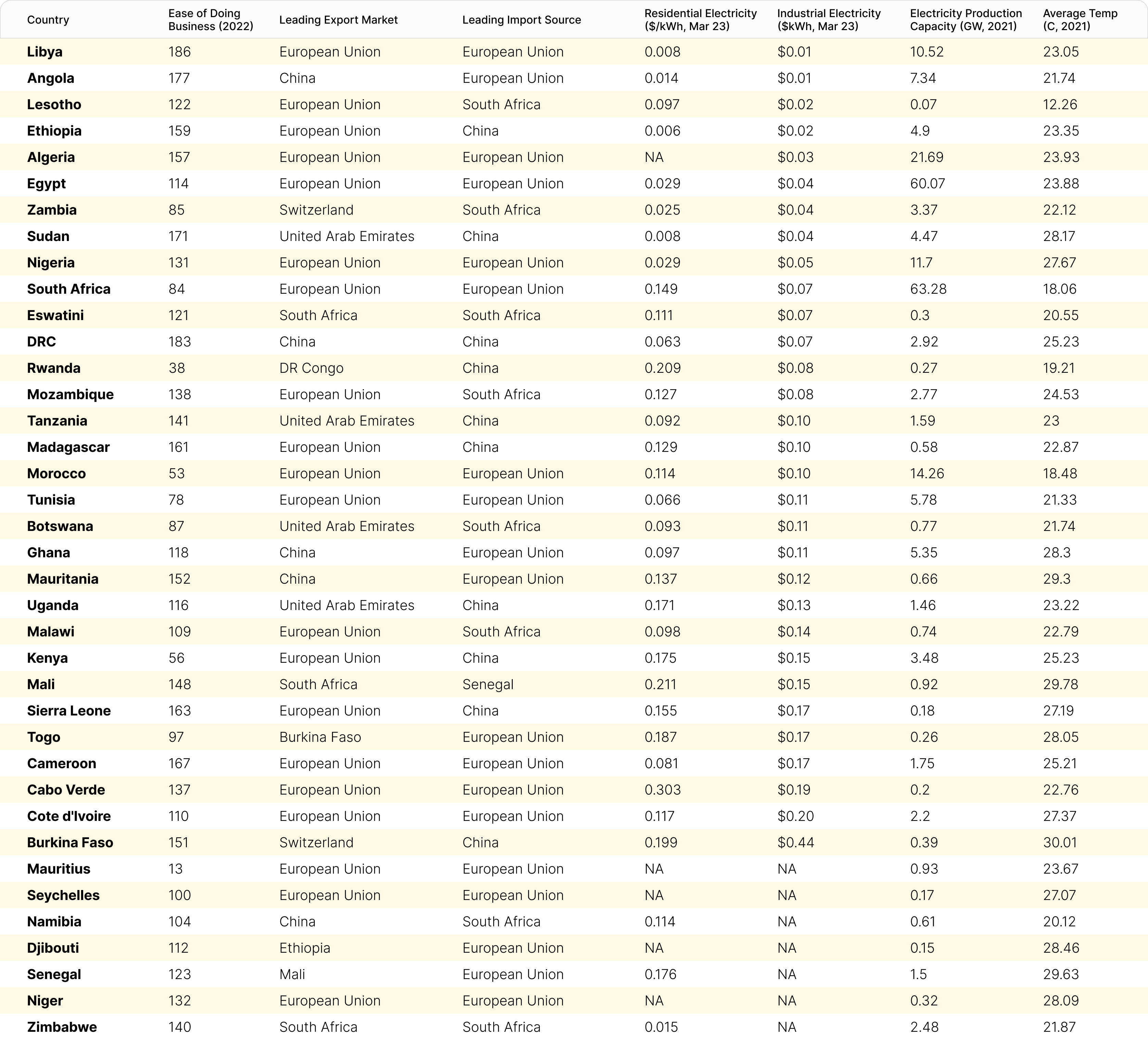

Bitcoin Mining Around the World: Africa

From Ethiopia, to Kenya, to Nigeria, and beyond, Africa is quietly emerging as a Bitcoin mining hub, and we believe that Africa could be one of the biggest regions for hashrate growth in the coming decade. In the latest addition to our Bitcoin Mining Around the World series, we provide an overview of some of the leading countries in Africa’s Bitcoin mining sector and explore areas that are promising for future growth.

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.