Hashrate Index Q2 2024 Report: The New Normal

We cover the numbers from Q2 2024 -- and how the Halving has changed everything -- in our latest report.

Hashrate Index's Q2 2024 is now available.

Bitcoin miners rang in Q2-2024 with Bitcoin’s Fourth Halving, which occurred on April 19, 2024. With Q2 in the books, we have a (nearly) full quarter of data for the new normal of a 3.125 BTC block subsidy, so we’re starting to get a feel for the immediate, near-term effects of this latest Halving epoch.

And it ain’t pretty, y’all.

You can download the free report below; if you would like to access the premium version, please head the sign up page and subscribe to Hashrate Index Premium.

For the remainder of today's newsletter, we've included a small sample of the data and analysis we packed into the report.

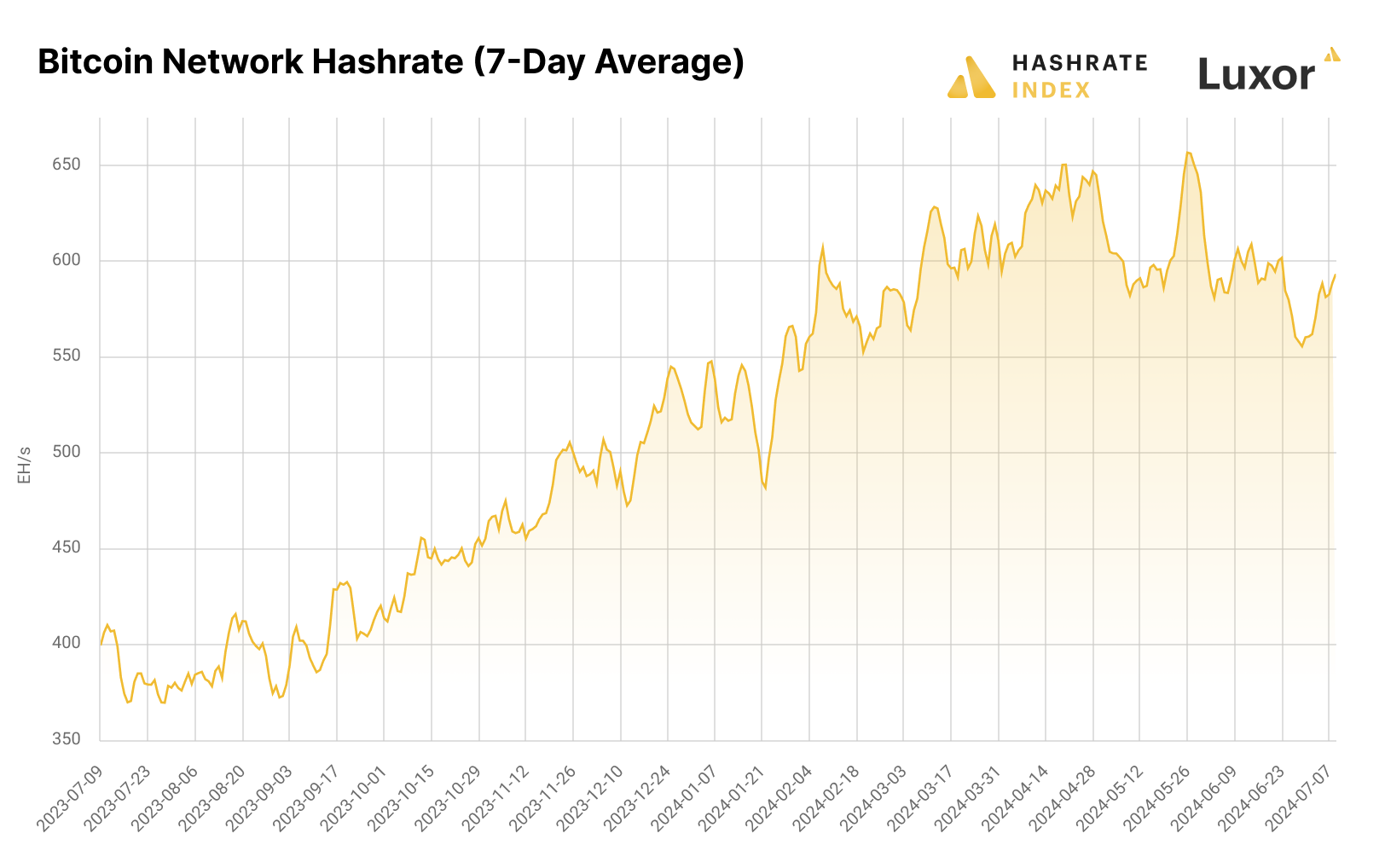

Bitcoin's Hashrate Posts Negative Growth Over Q2

Naturally, hashrate has been in decline since the Halving given the event's effect on hashprice. At the time of writing on July 17, Bitcoin’s 7-day average hashrate is 604 EH/s, a 8.2% decline from its all-time high of 658 EH/s on May 26. This late-May surge to an all-time high was an aberrant, last gasp spurt for the quarter’ hashrate growth before transaction fee volumes deflated and Bitcoin’s price took a turn for the worse; over Q2, Bitcoin hashrate fell -7.3% – a rare occurrence of negative quarter-over-quarter change.

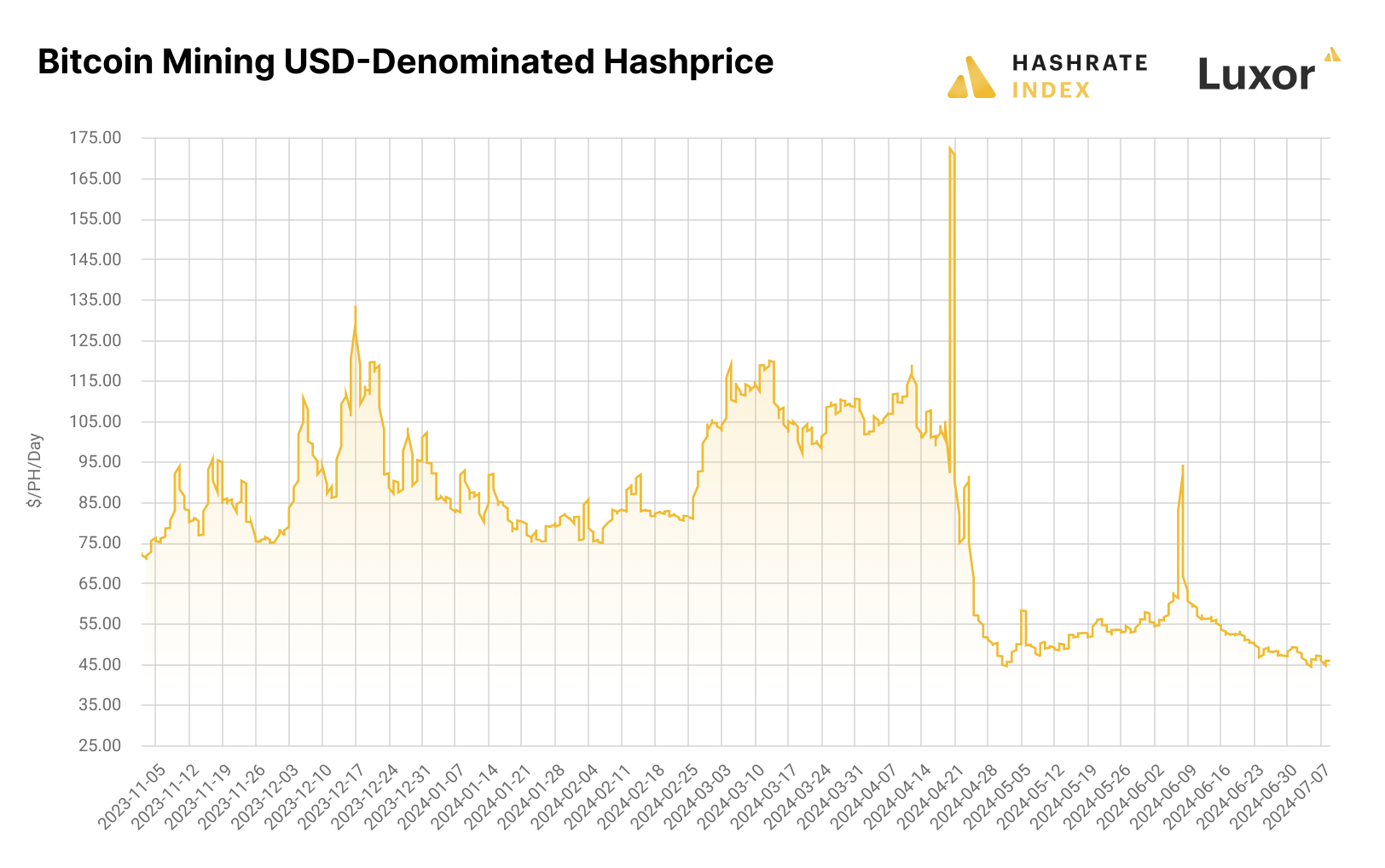

Bitcoin Halving Sends Hashprice to All-Time Low

Q2 flipped the script on what had otherwise been a better-than-expected year for Bitcoin’s hashprice.

Hashprice had a strong Q1, which cushioned the blow of the Halving’s effect on hashprice somewhat. But the pain came all the same, and hashprice hit an all-time low of $44.43/PH/day on May 1. Since then, hashprice has printed yet another all-time low of $44.31/PH/day on July 5. As of June 17, 2024, USD hashprice is $52.18/PH/Day.

Bitcoin’s USD hashprice fell 56% over Q2-2024 to $49.16/PH/Day, which was also a 53% decrease year-to-date at the close of Q2 and a 38% decrease year-over-year. On a BTC-denominated basis, hashprice fell 50% to 0.000776/BTC/PH/Day, a 68% decrease year-to-date and 70% decrease year-over-year.

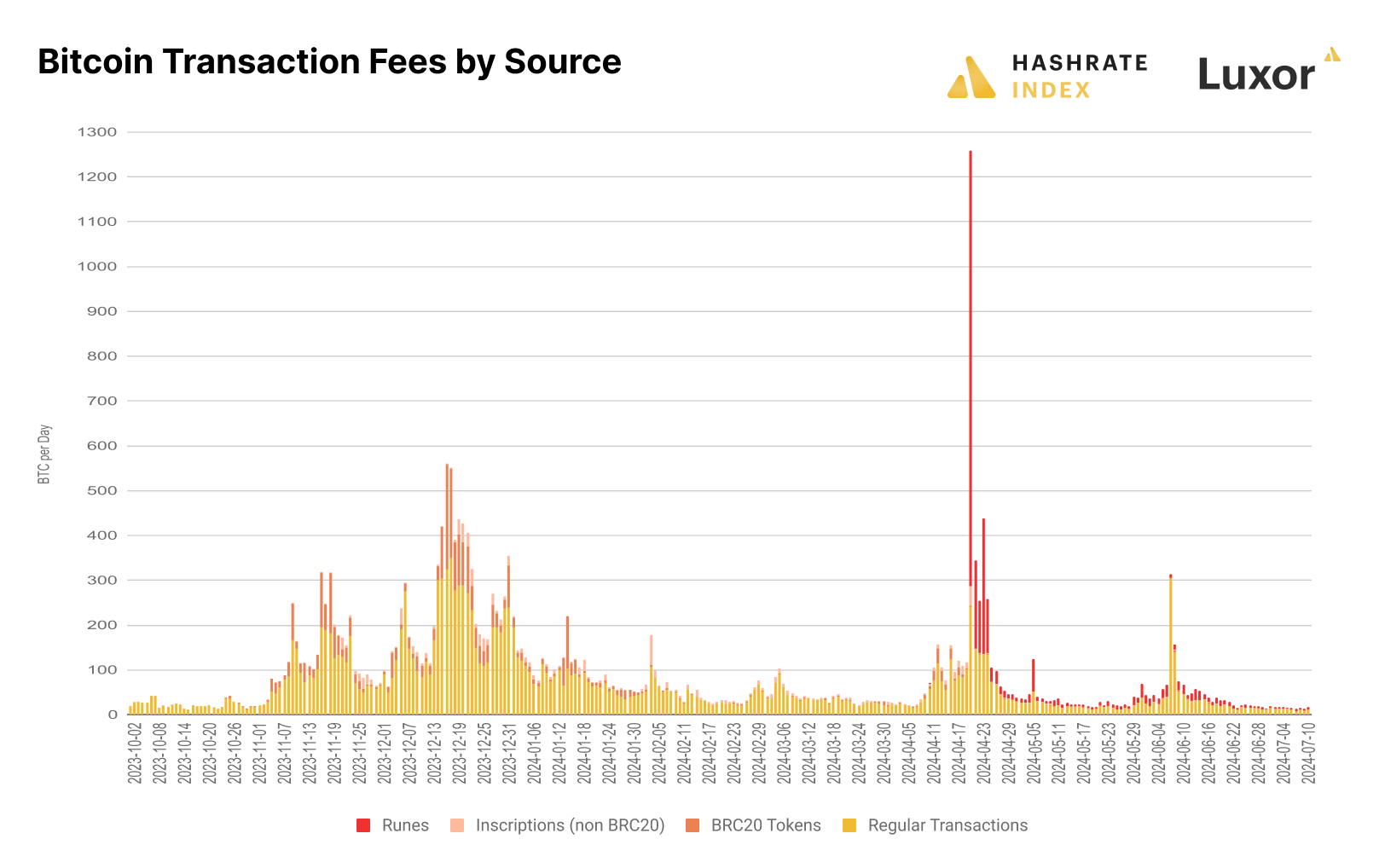

Fees From Runes, Inscriptions Have Fallen off Since the Halving

Runes made a big splash upon their introduction, but enthusiasm for the new standard dried up as quickly as it bubbled up. Runes accounted for 2,521.45 BTC over the course of Q2-2024, the bulk of which (1,822.54 BTC, or 72% of the total) occurred in April after the introduction of Runes on April 19. By comparison, transaction fees from all other sources totaled 4,283.62 BTC in Q2.

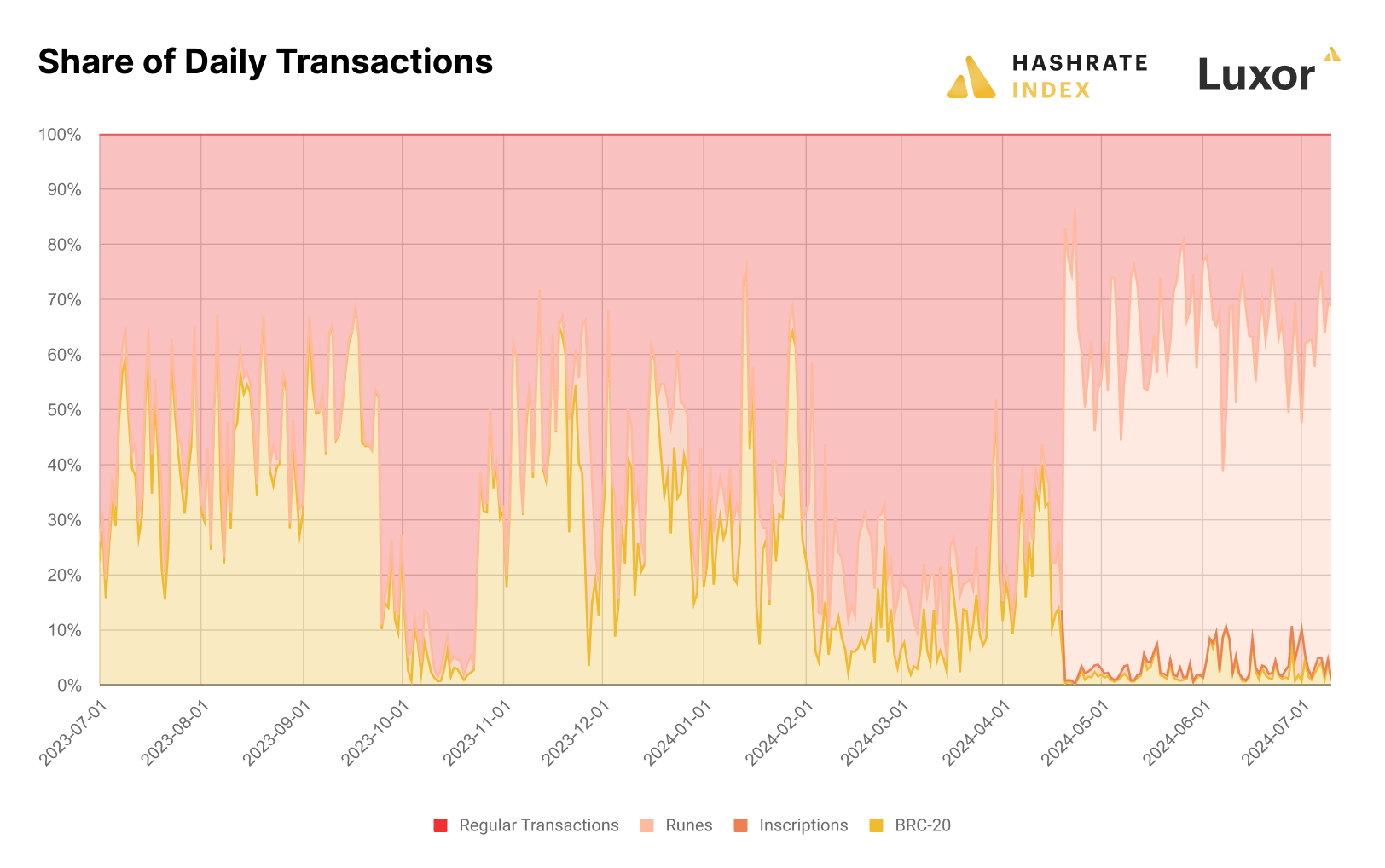

Even Though Fees Are Low, Runes Transaction Volume is High

If we zoom in on transaction fee volumes, perhaps it’s not fair to say that enthusiasm for Runes has been dying since the Halving. In fact, Runes have consistently constituted the majority of Bitcoin’s transaction fee volume since launch, but they are not creating the same pressure on Bitcoin blockspace as BRC-20 tokens and thus are not generating as many fees. BRC-20 tokens are like proto Runes; they are text based and have the same minting capabilities as Runes, although they use the Segwit data field to store token information, whereas Runes use OP_RETURN for token info. In fact, Casey Rodarmor designed Runes to be a more data-efficient, elegant alternative to BRC-20, and given that Runes minting and trading have eclipsed BRC-20 tokens without sending fees to the stratosphere, he seems to have achieved his goal.

Indeed, Runes have sucked up trading marketshare from Ordinals/Inscriptions.

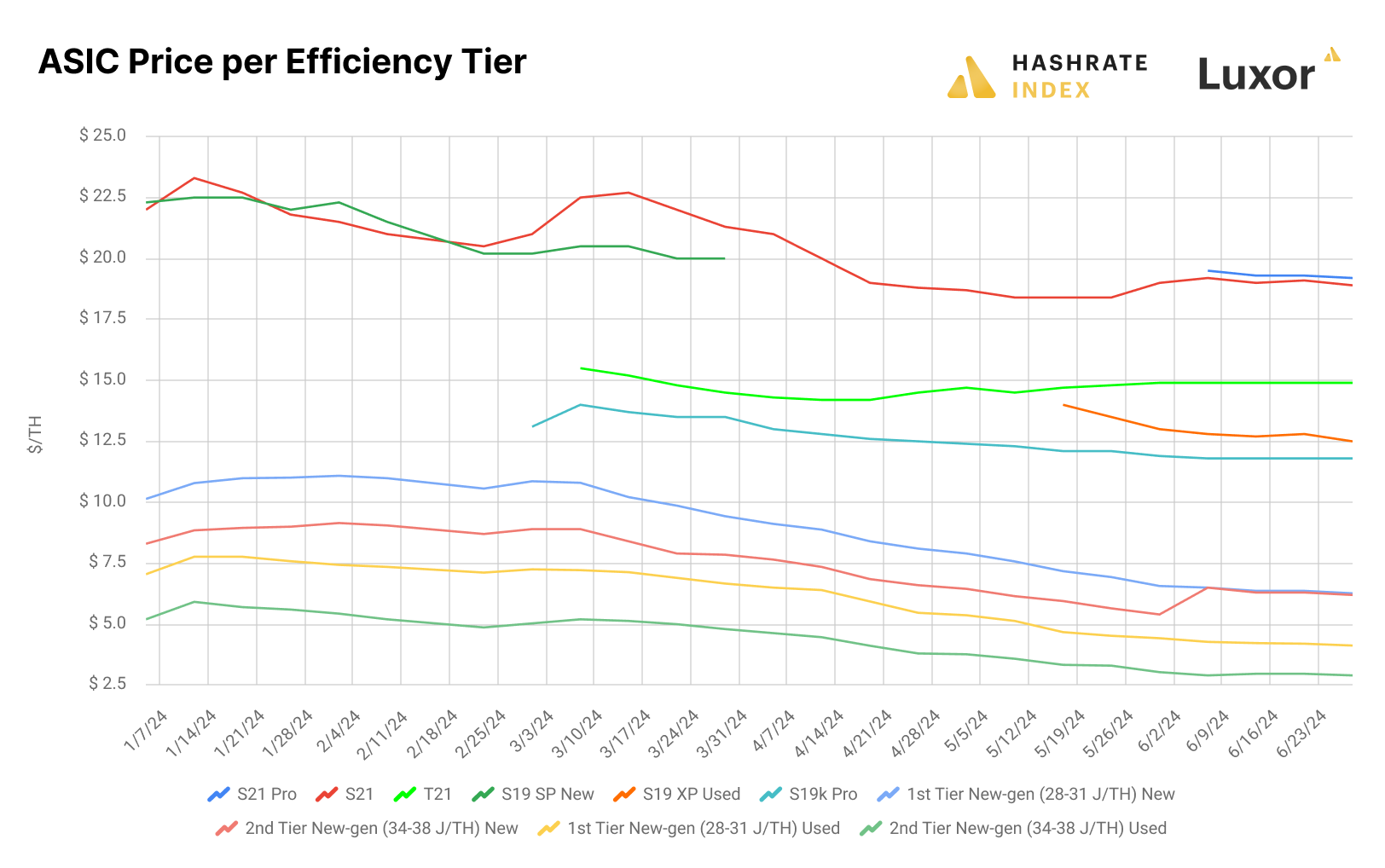

ASIC Market Undergoes Significant Repricing

Unsurprisingly, the ASIC market cooled down significantly leading up to the Halving, and after the event, it’s also unsurprising that many models experienced significant drawdowns in pricing.

The latest generation of Bitcoin miners like the S21 and T21 fared much better than others in Q2 as Bitcoin miners sought the most efficient rigs to weather the post-halving market environment. The S21 fell in price leading up to the Halving, indicating that it was overpriced despite its industry-leading efficiency at launch, but it rebounded over the remainder of the quarter; it closed Q2 in the red, but only marginally so.

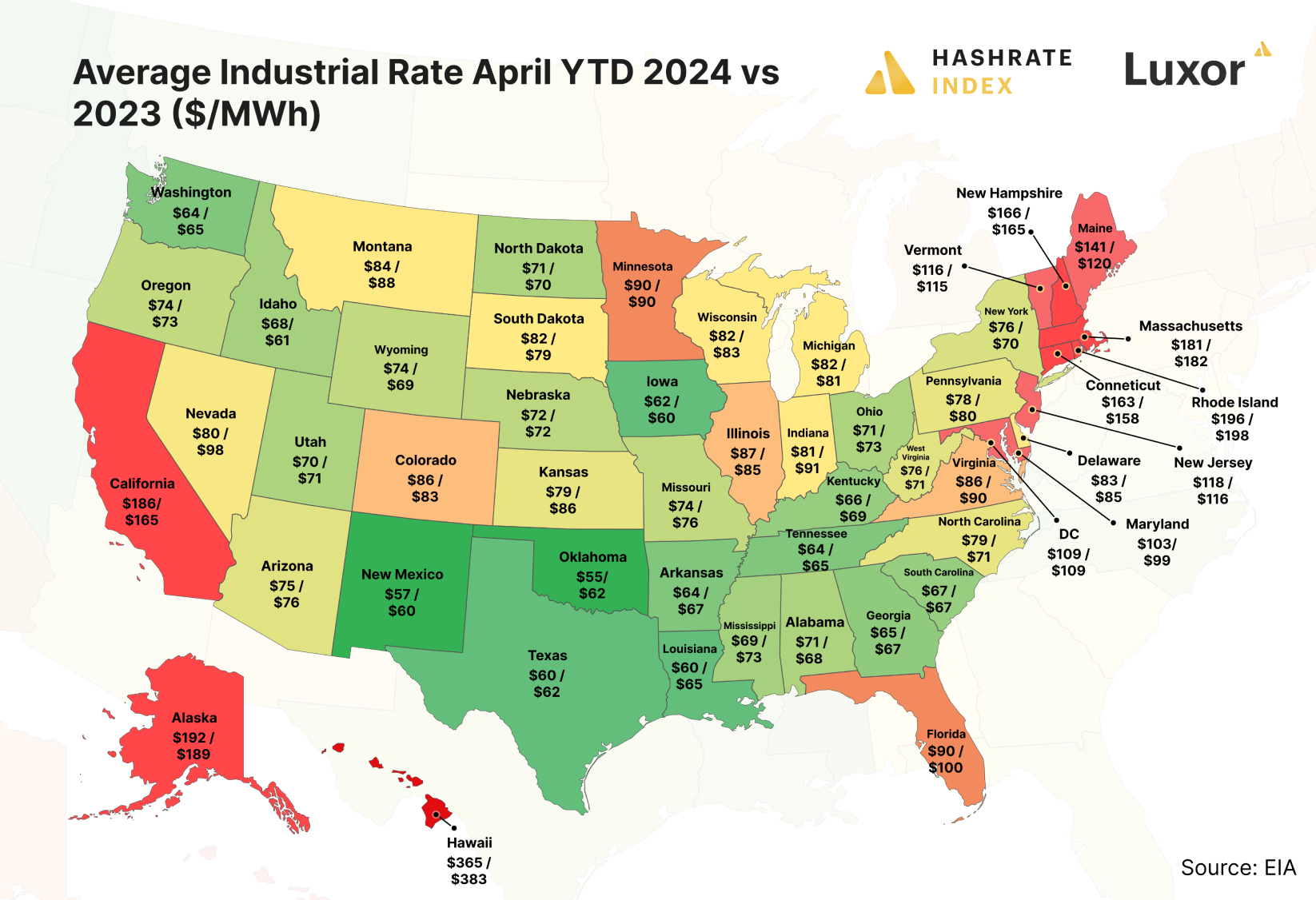

State-by-State Power Prices

Generally speaking, power prices in the US continue to cool down after the record-hot inflation the nation faced in 2022.

Year-to-date as of April 2024 (the most recent data from the EIA), industrial power rates were down year-over-year in the majority of US states. Notably, Bitcoin mining hotspots like Texas, Georgia, Ohio, and New York saw a decrease in industrial power prices.

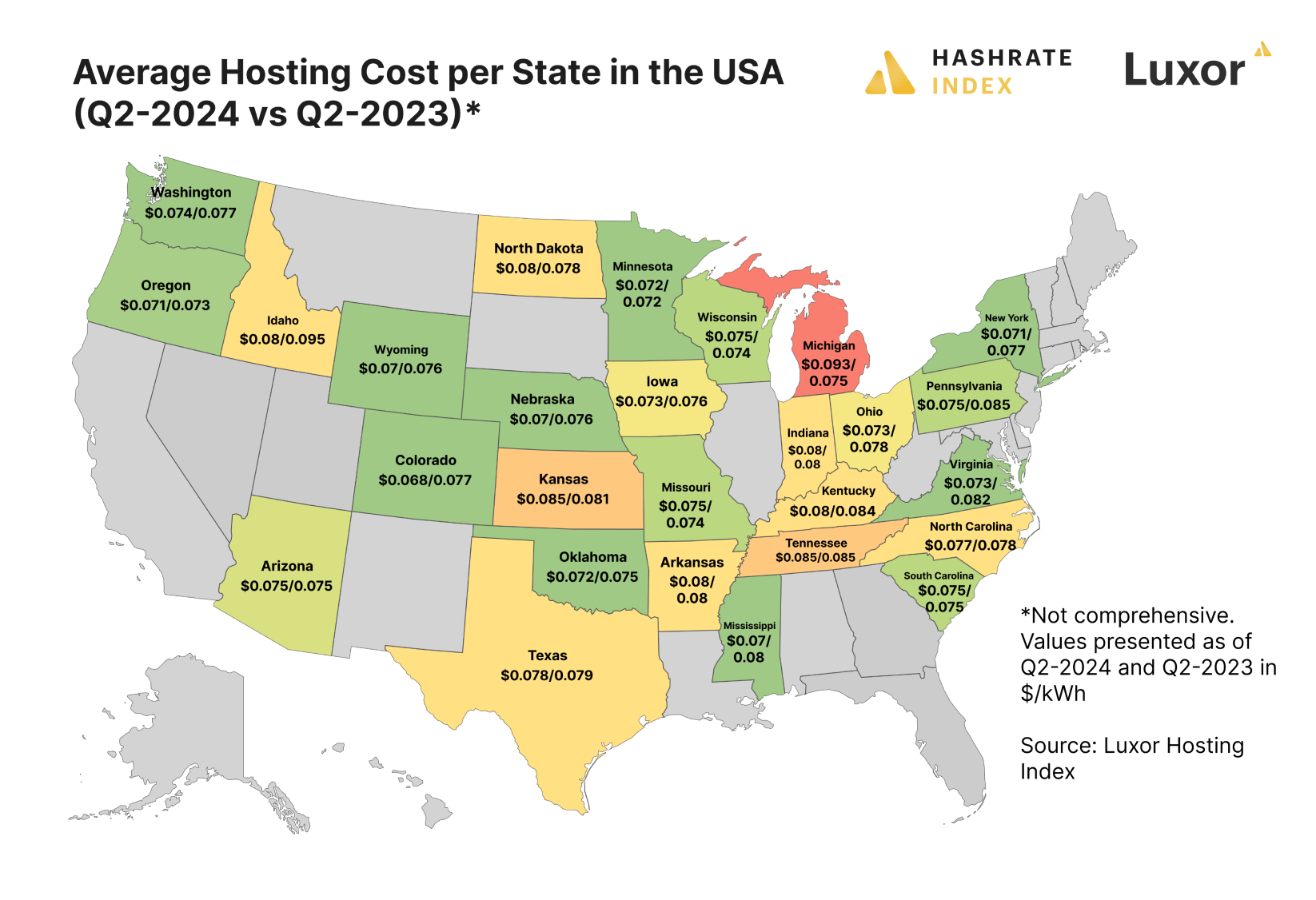

Hosting-as-a-Service Is in Limbo

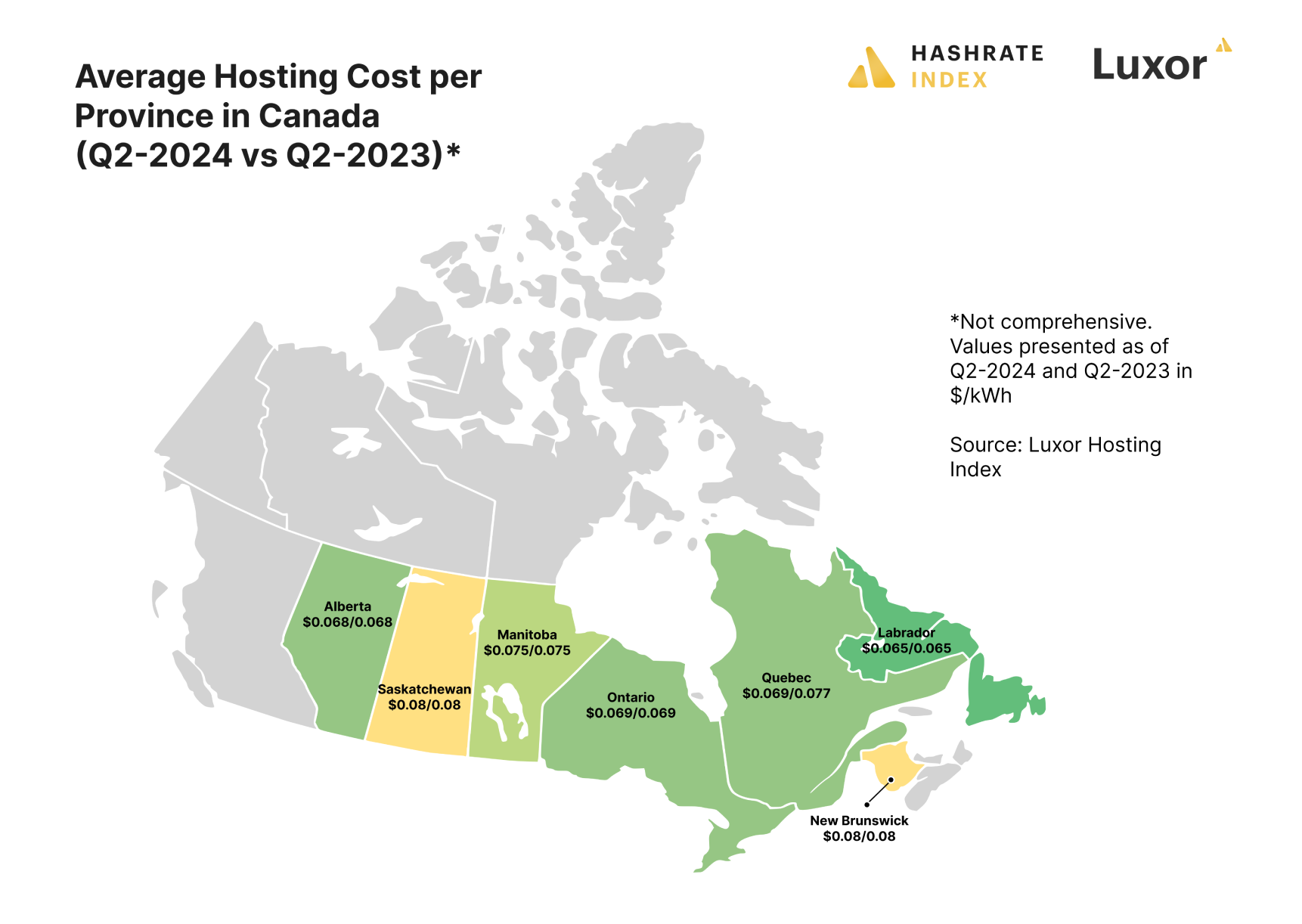

Now that the Halving has come to pass and hashprice is trading below $50/PH/Day, a big ole question mark is looming over the Bitcoin mining hosting and colocation economy, particularly in the US and Canada.

At current hashprice levels, only those miners with the latest generation ASICs are operating at comfortable profit margins. According to Luxor’s Hosting Index, in the United States, the average hosting rate in Q2-2024 was $0.076/kWh, which is down 2.7% from Q4-2023 and 3.6% from Q2-2023. In Canada, the average hosting rate in Q2-2024 was $0.072/kWh, which is up 1% from Q4-2023 and flat from Q2-2023. (We did not collect data for Q1-2024).

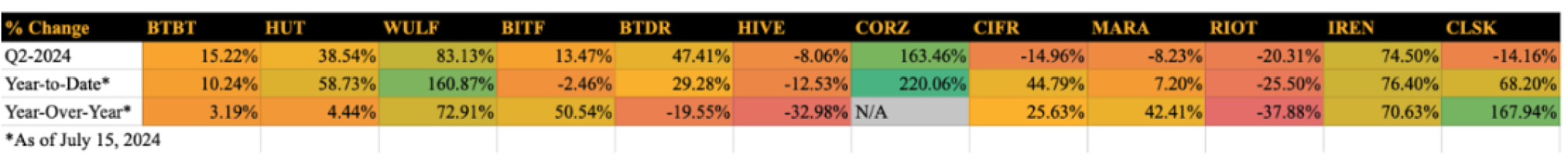

Bitcoin Mining Stocks Rebound in Q2, With AI-Focused Miners Taking Lead

The majority of the leading Bitcoin mining stocks were in the green quarter-over-quarter by the end of Q2, and as of July 15, 2024, most of them were also in the green year-to-date.

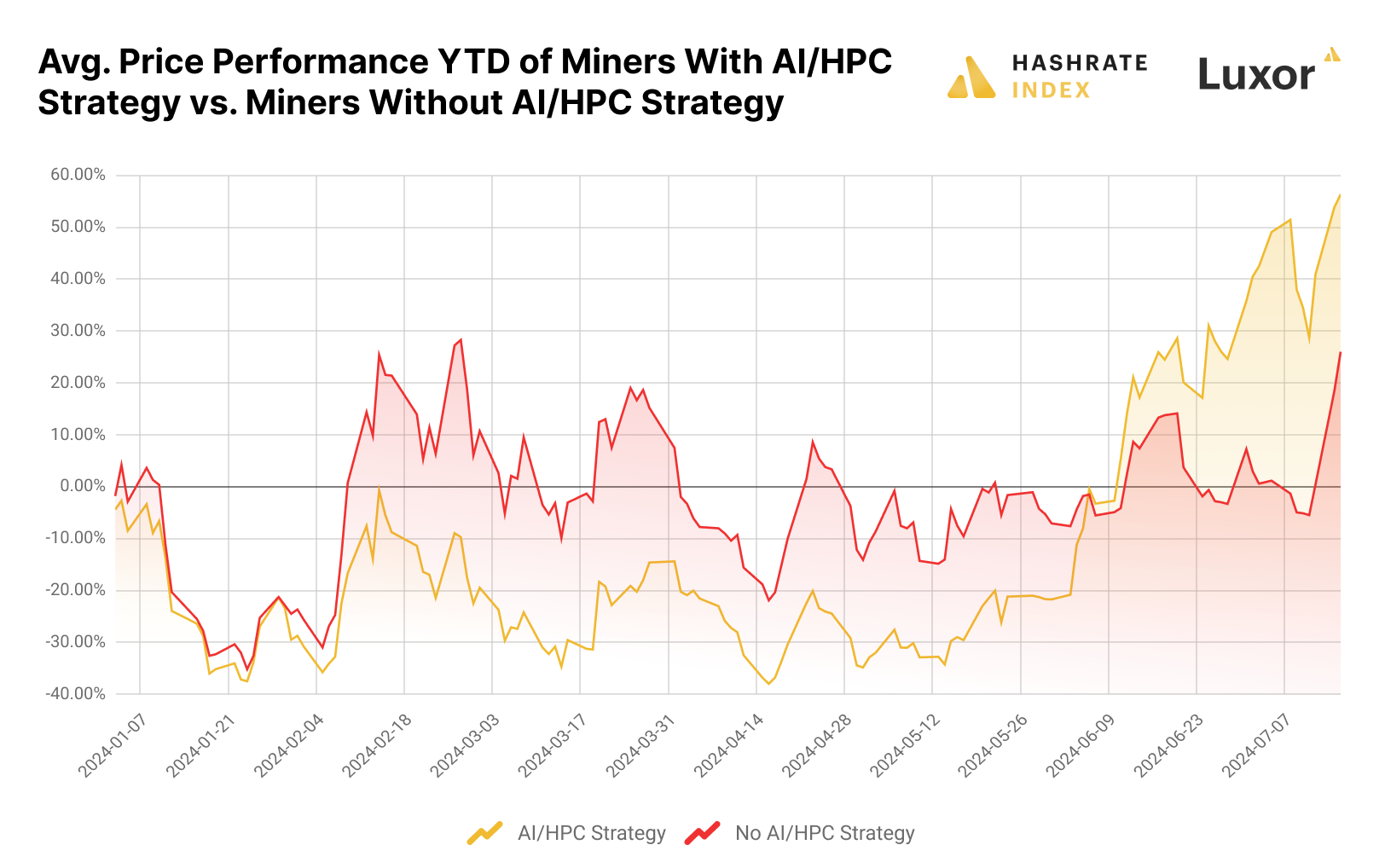

That said, there has been a clear divergence this year between Bitcoin miners that are executing or have announced an AI / high-performance compute (HPC) strategy. If we break out average returns between AI / HPC-focused and traditional miners, it becomes clear that the market is rewarding miners that are advertising nascent AI / HPC strategies. By Q2 close, AI / HPC miners were up 25% year-to-date, while traditional miners were down 3%. At the time of writing on July 15, the year-to-date returns for AI / HPC miners and traditional miners were 56% and 26%, respectively.

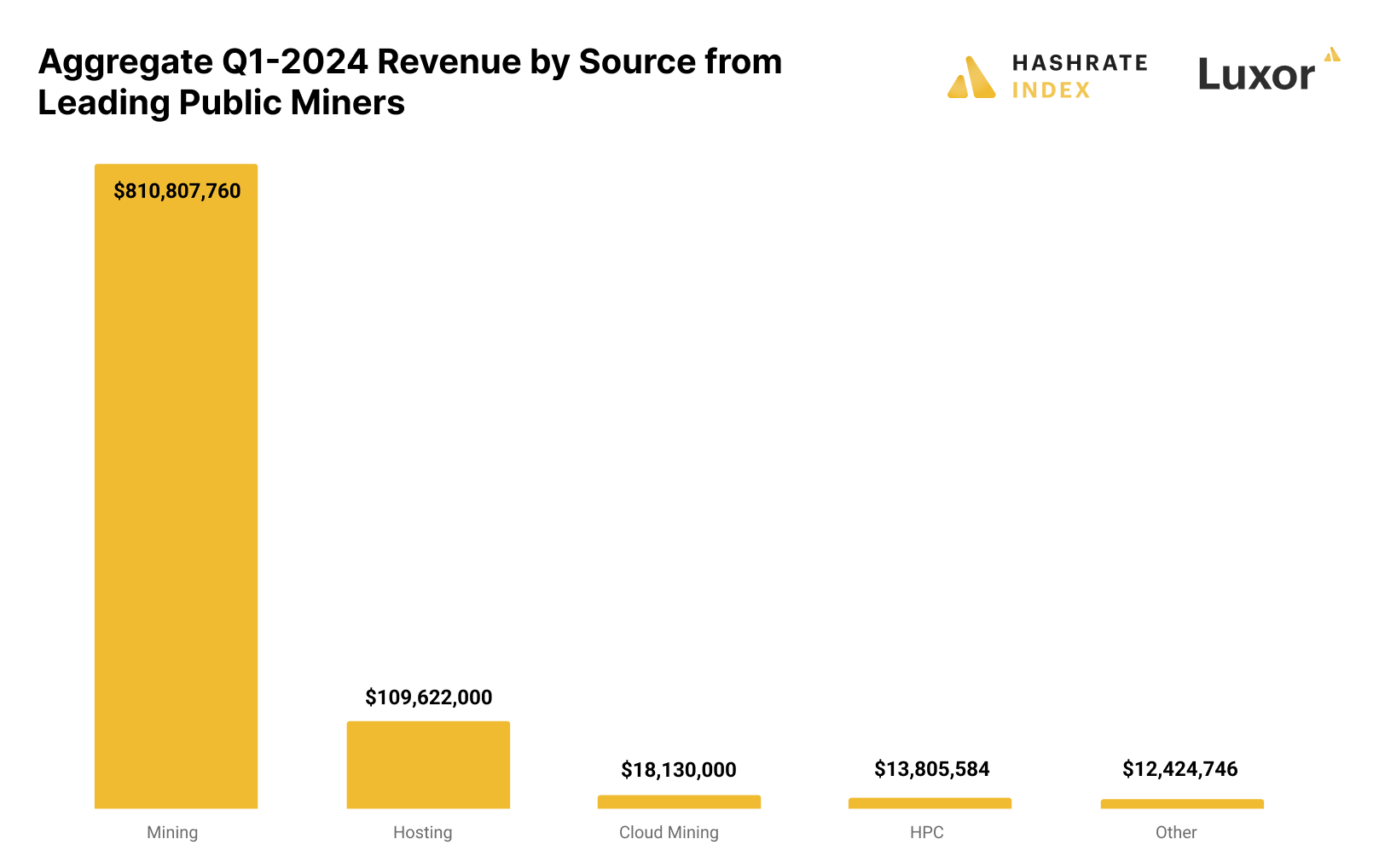

Public Miners Seek to Diversify Revenue Streams

Looking at Q1-2024 revenues, we can see that self-mining (unsurprisingly) still comprises the bulk of public miner revenue. And despite all of the chest-beating about AI and HPC strategies, these business lines make up a fraction of a fraction of overall revenue (although this could obviously change in the future, as AI / HPC business lines are still in the early innings.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.