Hashrate Index Roundup (December 3, 2023)

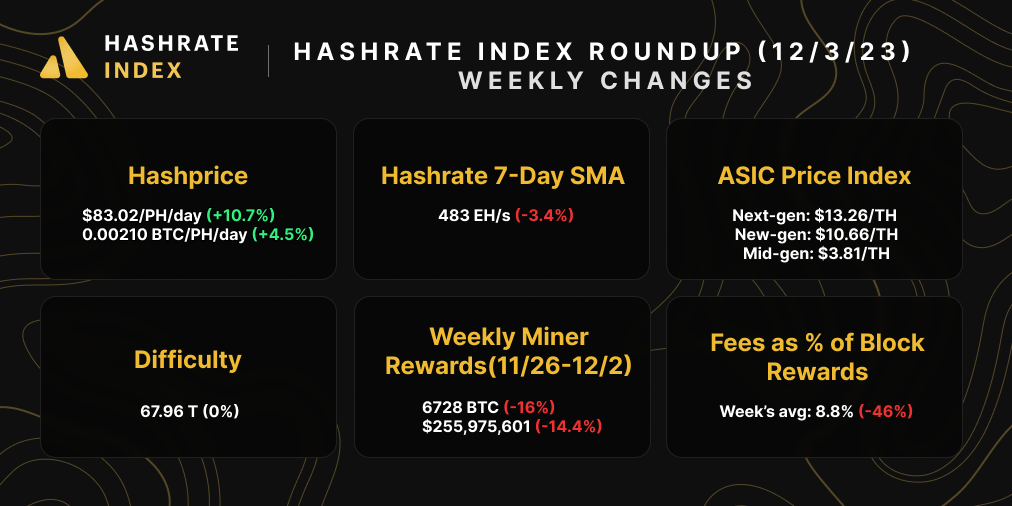

Bitcoin just hit a yearly high, hashprice is above $80/PH/day, and hashrate is falling.

December is here y'all, and we're starting out the final month of the year on multiple high notes.

The first of these high notes, of course, comes from the king himself. Bitcoin's price saw yet another surge this week, rising 6% to a yearly high of $39,500 and leaving everyone and their grandmother licking their chops for $40,000+.

As ever, miners in particular would love to see the rally extended. This week's price action threw hashprice back above $80/PH/day, an increase that has been partially aided by fee pressure from inscriptions/ordinals.

Unlike Bitcoin's price, the current hashprice isn't a yearly high (that high was $128/PH/day on May 8, courtesy of the BRC-20 inscriptions craze). But at $83/PH/day, hashprice is 38% higher than it was on December 3 last year – a massive gain that most miners probably thought unfathomable when Bitcoin's price was in the pits at the end of 2022.

Now to see how long it will hold. As long as Bitcoin's price stays sturdy, this elevated level of Bitcoin mining profitability could stick around for longer than not, because our difficulty adjustment estimator just turned negative. The estimator is only forecasting a -0.17% change currently, but even if small, it would still be a break from the 6-in-a-row positive difficulty adjustments the network experienced from mid-September through November (which, by the way, has been the longest streak since the network experienced 9 positive adjustments in a row from July 30 to November 13, 2021 – the aftermath of the China Mining Ban).

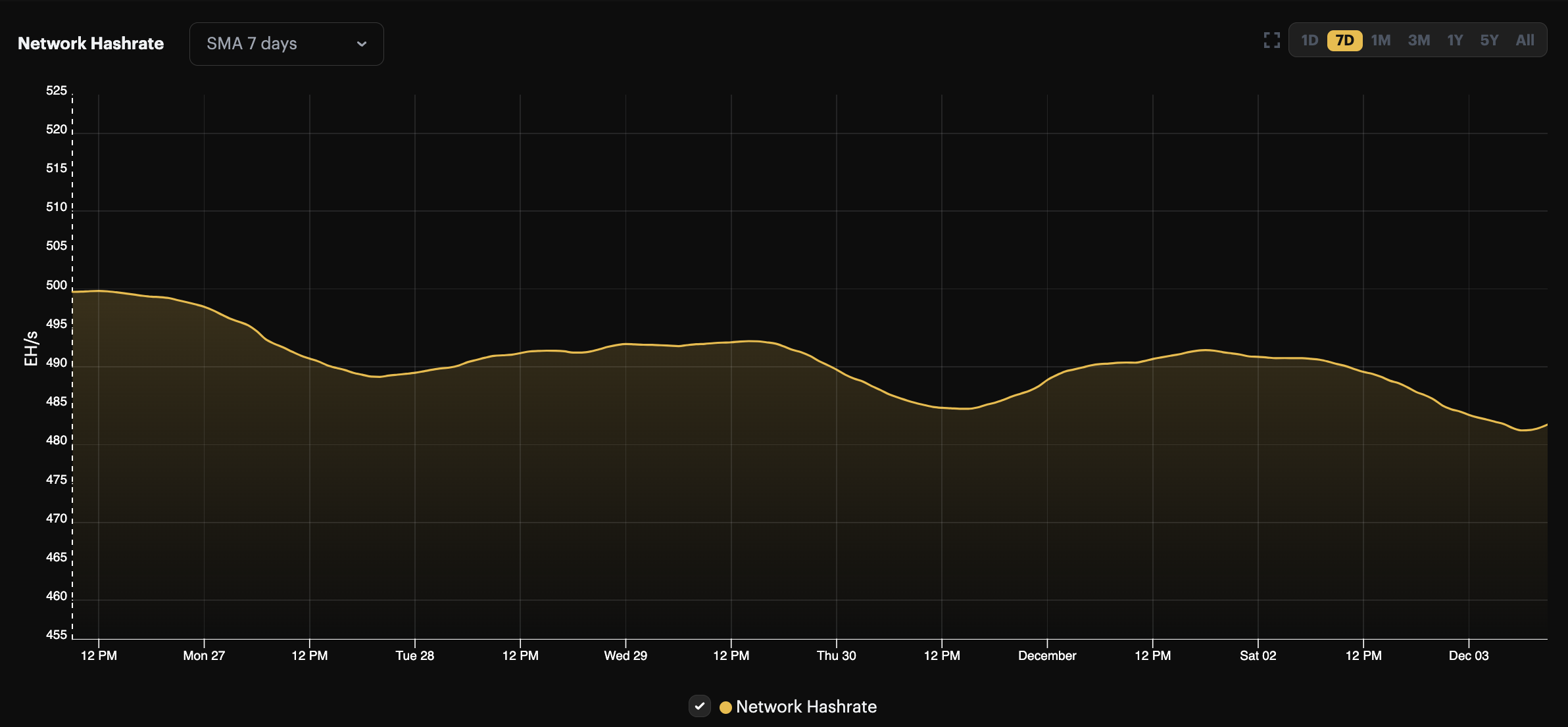

Taking a look at hashrate, Bitcoin's 30-day hashrate hit an all-time high this week of 482 EH/s, but week-over-week, it's fallen precipitously on the 7-day average to 483 EH/s.

As we enter winter, we'll be keeping an eye on the network to see if the cold weather has a positive impact on hashrate growth like we've seen in the past.

Sponsored by Luxor RFQ

The Antminer S21 is here, and Luxor's ASIC Trading Desk is accepting preorders for this model right now! If you'd like to place a preorder for the Antminer S21, please fill out this form. Secure your order for Bitmain's most efficient and powerful ASIC miner today!

Bitcoin Mining Market Update

Transaction fees waned once again last week, but they are still well above the 2022 average of 1.64%. In the ASIC miner market, there were no substantive changes to asking prices.

Bitcoin Mining News

Here are last week's top headlines for Bitcoin mining news:

- Hut 8 and USBTC Announce Completion of Business Combination

- Crypto stocks set to start December on high note as bitcoin hits near 19-month high

- GRID SPAC Merger Approved by SPAC Shareholders

- Cornell: Bitcoin could support renewable energy development

- Celsius Network faces roadblocks in pivot to bitcoin mining

Bitcoin Mining Stocks Update

Bitcoin mining stocks ripped last week, with miners who recently made next-generation machine orders (namely, Bitfarms and Iris) leading the pack. As a testament to the positive week for mining stocks, our Crypto Mining Stock Index rose an eye-popping 16.1%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $13.77 (+19.71%)

- HUT: $2.27 (+22.04%)

- BITF: $1.66 (+56.60%)

- HIVE: $3.47 (+19.69%)

- MARA: $13.70 (+25.46%)

- CLSK: $5.87 (+10.55%)

- IREN: $5.57 (+59.14%)

- WULF: $1.37 (+12.30%)

- CIFR: $2.94 (+12.21%)

- BTDR: $5.00 (+19.05%)

- SDIG: $5.15 (+23.21%)

New From Hashrate Index

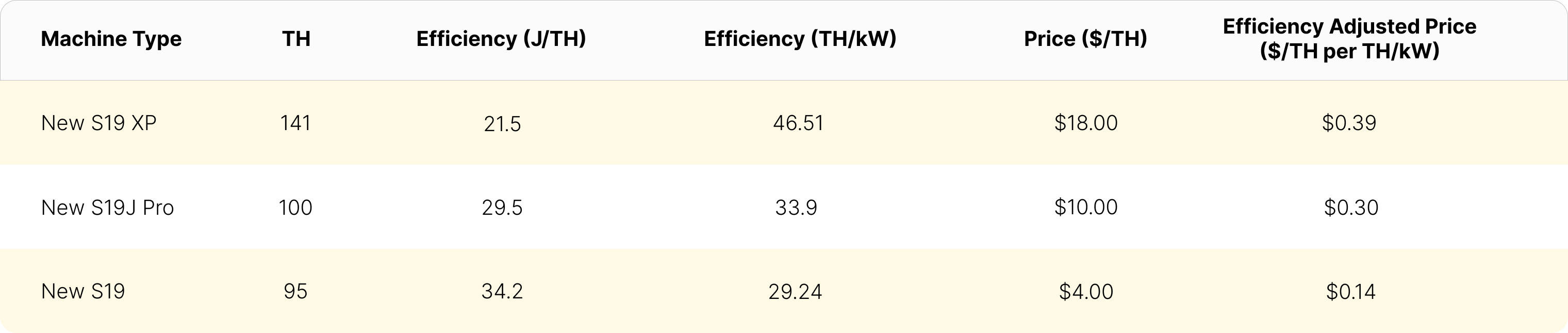

The Efficiency-Adjusted ASIC Price: A New Way to Measure ASIC Miner Value

In this article, we propose a new method for measuring an ASIC’s price: the Efficiency-Adjusted ASIC Price, which evaluates an ASIC’s hashrate-adjusted price ($/TH) per unit of efficiency (TH/kW). While it is only one variable in a complicated analysis, it can serve as a useful benchmark for ASIC traders when evaluating market opportunities.

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.