Global Hashrate Heatmap Update: Q4 2025

The latest update to Hashrate Index’s Global Hashrate Heatmap.

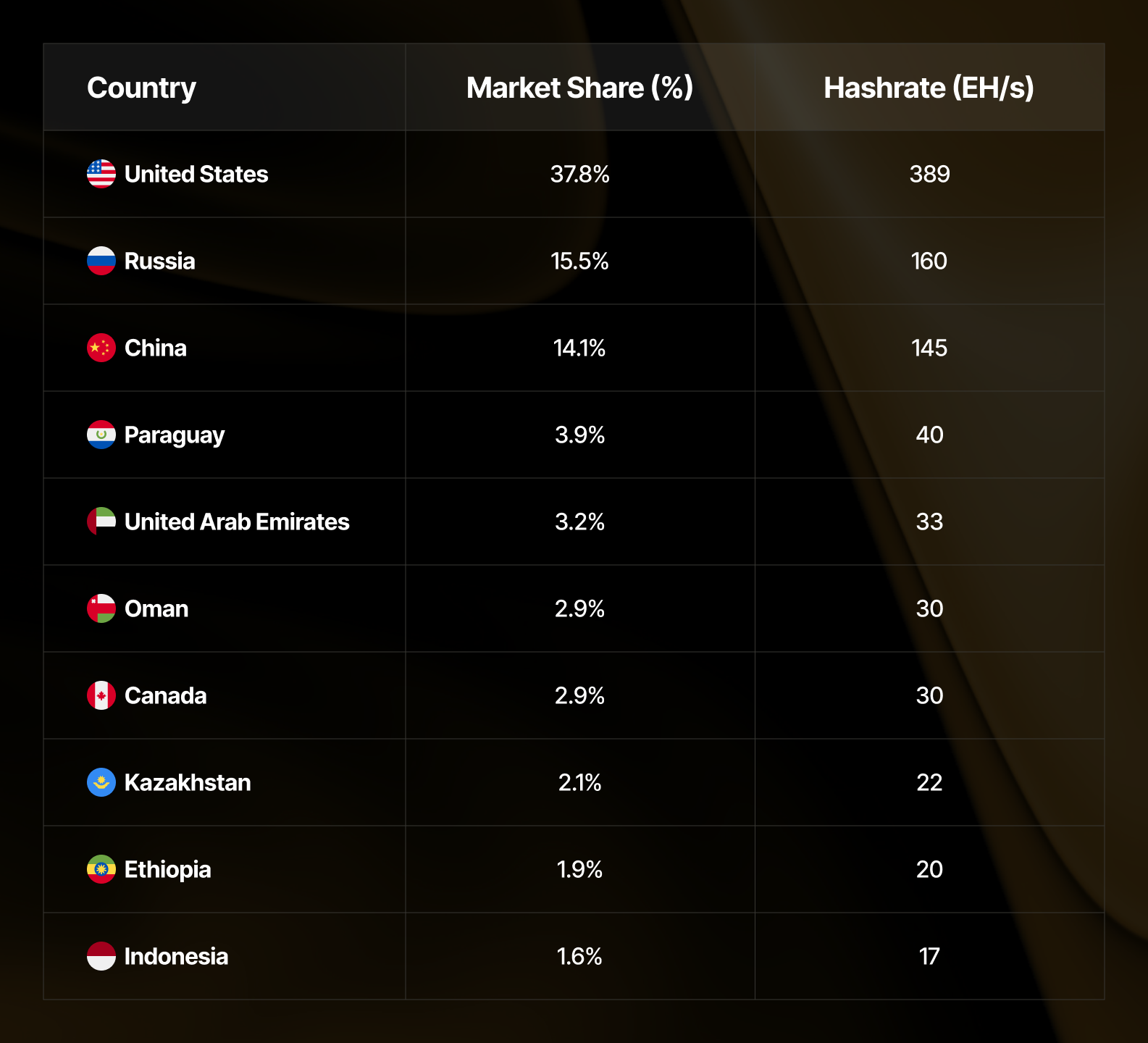

The latest update to Hashrate Index’s Global Hashrate Heatmap highlights how Bitcoin mining power continues to shift worldwide. This quarterly dataset tracks country-level market share and hashrate (EH/s), providing transparency into which regions dominate and which are emerging.

Top 10 Countries by Market Share (Q4 2025)

Bitcoin mining remains geographically concentrated, with just a handful of countries commanding most of the global hashrate:

- United States — 37.8% (~389 EH/s)

- Russia — 15.5% (~160 EH/s)

- China — 14.1% (~145 EH/s)

- Paraguay — 3.9% (~40 EH/s)

- United Arab Emirates — 3.2% (~33 EH/s)

- Oman — 2.9% (~30 EH/s)

- Canada — 2.9% (~30 EH/s)

- Kazakhstan — 2.1% (~22 EH/s)

- Ethiopia — 1.9% (~20 EH/s)

- Indonesia — 1.6% (~17 EH/s)

Together, the top three countries control ~67.5% of global hashrate, showing that concentration remains high even as new players emerge.

Quarter-over-Quarter Movers

Mining activity is dynamic. Comparing Q4 2025 vs. Q3 2025, the biggest shifts in global market share were:

Top 5 Absolute Gainers (share points):

- United States: +1.95 pp (35.8% → 37.8%)

- Laos: +0.22 pp (0.55% → 0.78%)

- China: +0.22 pp (13.8% → 14.1%)

- Bolivia: +0.21 pp (0.08% → 0.29%)

- Georgia: +0.17 pp (1.00% → 1.16%)

Top 5 Absolute Losers (share points):

- Russia: –1.09 pp (16.6% → 15.5%)

- United Arab Emirates: –0.34 pp (3.54% → 3.20%)

- Kazakhstan: –0.19 pp (2.33% → 2.13%)

- Argentina: –0.17 pp (0.55% → 0.39%)

- Norway: –0.15 pp (1.61% → 1.45%)

Biggest Callouts

- The United States posted the largest increase, gaining nearly 2 full percentage points.

- Russia saw the sharpest drop, losing more than 1 percentage point of global hashrate.

Multi-Quarter Trends (Q1 2025 → Q4 2025)

Looking across the past five reporting periods (Q1 2025 through Q4 2025):

- Consistent risers: The U.S. has steadily added share each quarter, solidifying its lead.

- Emerging growth: Countries like Paraguay, Oman, and Ethiopia have all moved into the global Top 10.

- Persistent declines: Russia remains in the #2 spot but has given up marketshare for two consecutive quarters.

Regional Dynamics

- North America: The U.S. surge keeps the region firmly in the lead, with Canada contributing a stable ~3%.

- Asia: China has stabilized after past volatility, while countries like Laos and Georgia show incremental gains.

- Middle East: The UAE and Oman remain strong hosts, though the UAE’s share slipped this quarter.

- Latin America: Paraguay continues to climb, now holding nearly 4% of global hashrate.

- Africa: Ethiopia joins the Top 10 for the first time, signaling broader diversification.

Emerging Players

Some smaller markets (<1% share) showed meaningful growth:

- Laos — grew from 0.55% → 0.78%

- Bolivia — grew from 0.08% → 0.29%

- Georgia — grew from 1.00% → 1.16%

These may seem like small percentages, but they highlight how miners are increasingly testing new regions with regulatory or energy advantages.

Key Takeaways

- The Global Hashrate Heatmap shows the U.S. pulling further ahead, now close to 38% of global hashrate.

- Russia’s decline continues, losing more than 1 percentage point of global mining marketshare QoQ. Russia did increase hashrate, but it isn’t keeping up with its top competitors—U.S. and China.

- Emerging markets like Paraguay, Ethiopia, and Laos are gaining visibility on the global mining map.

- Concentration remains high: the top three countries together account for ~68% of all Bitcoin mining.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.