Energy Markets for Bitcoin Miners: Fixed Price Power with Short Calls & Fixed Pool Payouts

How Bitcoin miners refine price volatility into predictable margins.

In the first post of this series, we explored how Bitcoin miners manage market exposure through spot and fixed-price power contracts. These hedging profiles offer different trade-offs: spot provides flexibility, while fixed-price power introduces cost certainty and the potential to monetize volatility through grid resale.

In this second post, we dig into a more advanced strategy: fixed-price power contracts overlaid with financial instruments, specifically short call options on power and fixed Bitcoin mining pool payouts. Together, these tools allow miners to lock-in and grow stable operating margins.

Recap: Fixed vs. Spot Power Strategies

Before diving in, let’s briefly revisit the basics.

- Spot power means paying real-time electricity prices and curtailing mining operations when power prices exceed energy hashprice.

- Fixed-price power means locking in a known electricity rate, giving miners cost stability and enabling them to resell power during price spikes.

Fixed-price miners often behave like call option buyers: they mine when it’s profitable and curtail when spot power prices exceed energy hashprice, earning revenue by reselling power to the grid.

This payoff structure sets the stage for the more sophisticated financial overlays discussed below.

Fixed-Price Power with a Short Call Option Overlay

A fixed-price power contract gives the miner predictable operating costs. When real-time power prices rise above energy hashprice, the miner curtails and sells power back to the grid — earning more from power sales back to the grid versus sales to the Bitcoin network. This creates a payoff structure that resembles the previously shown long call option: flat operating costs during moderate spot power prices, with upside once power prices exceed energy hashprice.

Now consider overlaying a short call option on top of this position:

By selling a call on power, the miner gives someone else the right to capture upside beyond a certain (strike) power price. In exchange, the miner receives an upfront payment (premium), which effectively reduces its power cost — widening gross mining margins in all intervals.

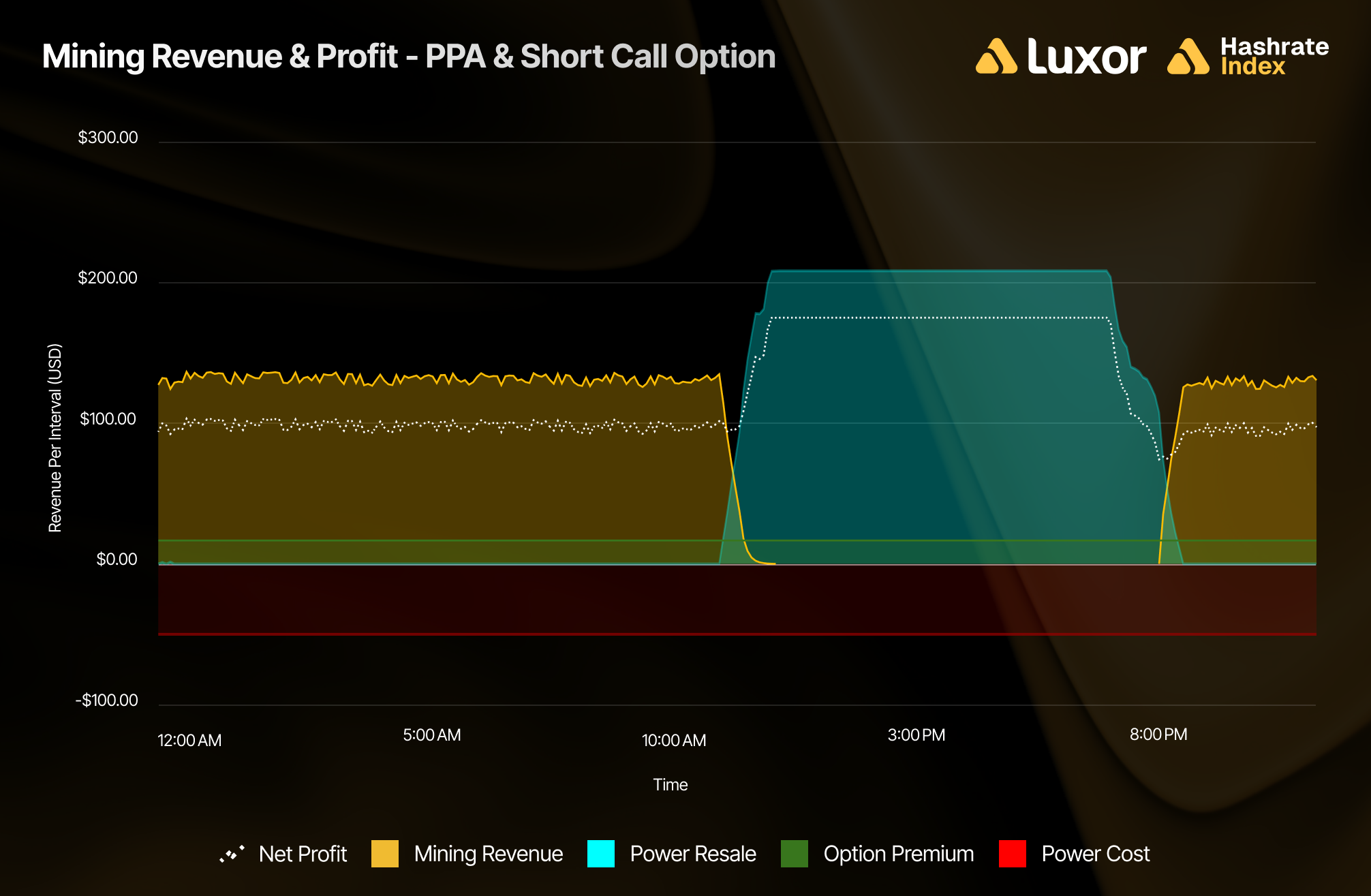

Importantly, this overlay doesn’t affect operational decisions. The load profile remains identical. Chart 1 shows that the miner still curtails when spot power exceeds energy hashprice, just as in a standard fixed-price strategy.

However, their financial outcome changes. In Chart 2, we see how the short call overlay changes the miner’s profit profile, which can be broken out into the following components:

- Mining Revenue

- Power Revenues (or optimization)

- Power Resale

- Option Premium

- Power Cost

When it is more optimal to resell power than to mine, the miner’s revenue shifts from compute to power resales, increasing the overall net profit.

However, once spot power prices exceed the strike, the miner no longer captures the full curtailment upside. Instead, that value flows to the call buyer. The result is a flattened profit curve, where extreme upside is traded off in exchange for larger returns in all other intervals.

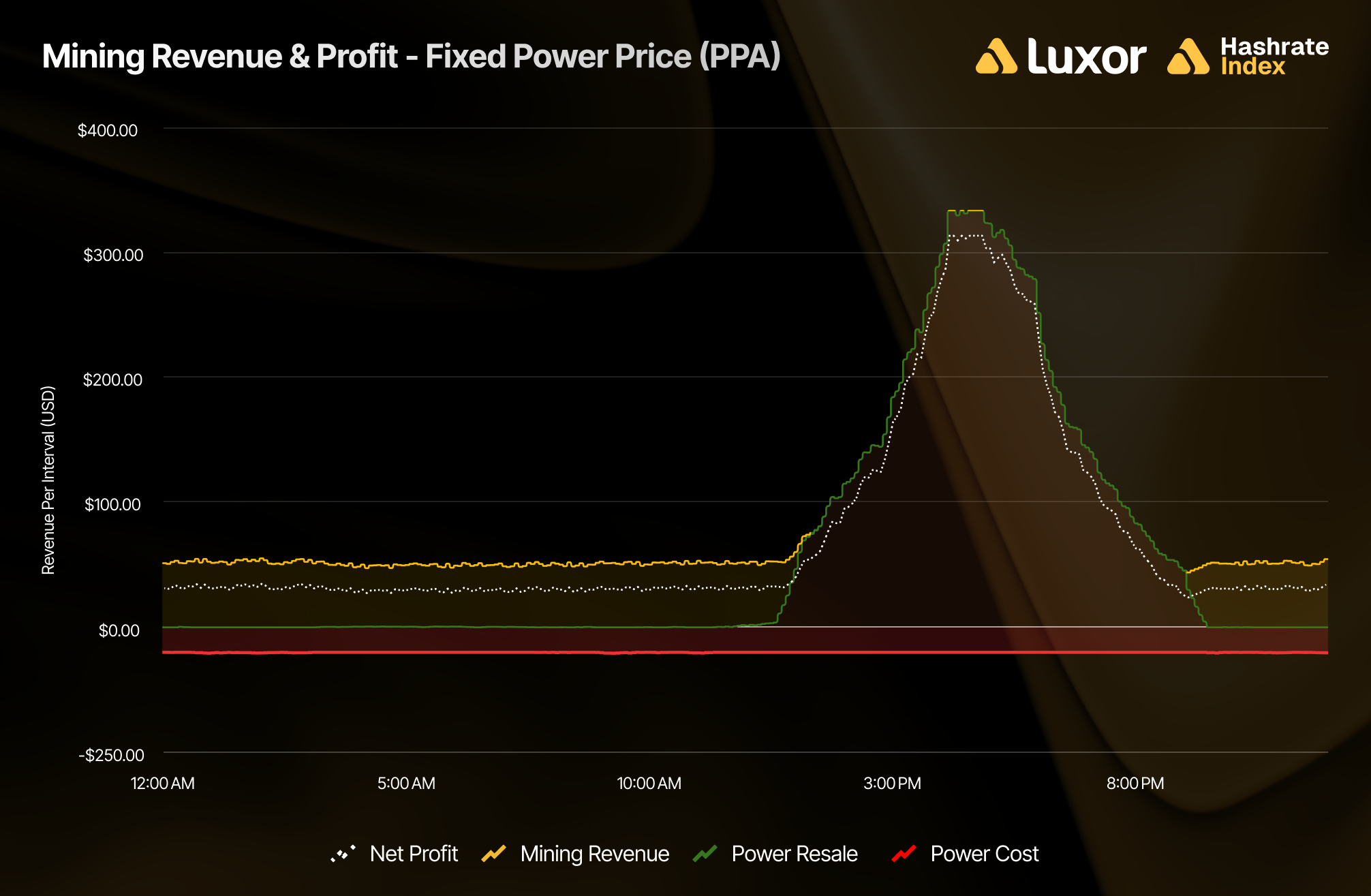

The tradeoff becomes clear when comparing the miner’s gross profit profile under a fixed-price power cost only scenario, previously covered in the first post of this series and shown below in Chart 3.

This tradeoff can be beneficial in environments where volatility is expected, but sustained price spikes are unlikely. In other words, the short call premium adds consistent value in low to moderate power price environments, in exchange for limiting the upside on power resale revenue. Some fixed-price PPAs even embed short calls by default, offering miners a lower all-in power price for agreeing to cap their resale revenue during high power price intervals.

The key idea: short calls on power allow miners to monetize electricity price volatility proactively, not just reactively. Instead of hoping for occasional power resale windfalls, miners can instead receive guaranteed premiums (while accepting a cap on the upside), which effectively reduces their overall electricity price.

The Hashspark Spread: Using Fixed Pool Payouts and Fixed-Price Power to Lock in a Mining Margin

Miners can take this strategy a step further by pairing the cost-side power hedge (i.e., a PPA) with a revenue-side hashrate forward sale (i.e., a fixed pool payout rate).

This approach — referred to as the hashspark spread — is inspired by the natural gas industry’s “spark spread”, which measures the margin between fuel cost and electricity revenue. For Bitcoin miners, the hashspark spread represents the difference between energy input costs (typically fixed) and mining revenue per MWh (typically variable), which can now be locked in using Luxor’s fixed pool payouts.

With a fixed-power price and a fixed pool payout rate, the miner effectively converts a volatile mining operation into a real-time energy arbitrage business.

Here’s what the numbers look like as of June 2025, using the Energy Hashprice metric from Hashrate Index:

By selling hashrate forward at these levels and securing a matching fixed power price, miners can fully hedge their margin for the duration of the contract. For example, a miner that locks in $130/MWh in revenue and pays $60/MWh in power costs is earning a $70/MWh gross margin, regardless of how bitcoin or power prices move.

This creates a more financeable, stable business — one that resembles a power generation plant more than a speculative mining operation.

Conclusion: Designing Scalable Mining Businesses

As energy and Bitcoin markets continue to converge, miners are increasingly seeking structures that reduce risk and smooth returns. Fixed-price PPAs provide a strong foundation, but by layering in short call options and fixed pool payouts, miners can go a step further — locking in both revenue and cost sides of the mining margin equation.

These strategies transform miners from price takers into proactive participants in both power and hashrate markets. The result is a mining operation that looks less like a gamble on price swings and more like a disciplined, mature infrastructure business.

In the next post in this series, we’ll examine how miners are tapping into ancillary services and demand response markets — turning downtime into revenue and deepening their integration with the grid.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

📙⚡ Glossary: Key Energy Terms for Bitcoin Miners

Call Option (Long)

A financial contract giving the buyer the right (but not the obligation) to purchase an asset at a set strike price on or before a specified expiration date. In the context of bitcoin mining, the fixed-price power strategy mimics a long call on power, offering upside during price spikes.

Call Option (Short)

A position where the miner sells a call option, giving someone else the right to capture upside above a defined strike. In return, the miner receives a premium, boosting earnings during stable markets while capping profit during extreme price spikes.

Breakeven Power Price

The maximum electricity cost a miner can pay while remaining profitable. Calculated based on energy hashprice. With custom firmware, this value becomes variable.

Strike Price

The predetermined price at which the holder of a call option can exercise their right to buy the underlying asset. In the context of short call overlays, it represents the price above which upside is forfeited to the option buyer.

Underlying (Asset)

The market variable on which a derivative contract is based. For power options, the underlying is spot electricity price; for hashrate derivatives, it's the Bitcoin Hashprice Index.

Premium (Option)

The upfront income earned by a miner for selling a call option. This compensates the miner for giving up any profit potential above the strike price.

Spot Power

Electricity purchased on real-time wholesale markets at variable rates. Prices fluctuate based on supply and demand.

Fixed Price Power

Electricity secured at a fixed $/MWh rate through long-term contracts such as PPAs. Offers miners cost certainty and enables resale opportunities during power price spikes.

Power Purchase Agreement (PPA)

A contractual agreement to buy a specified volume of electricity at a predetermined price over a fixed period. Commonly used in commercial and industrial energy procurement.

Curtailment

The voluntary reduction or shutdown of mining operations during uneconomic power price intervals. Can be used to participate in ancillary service markets & demand response programs.

Resale (Grid Resale)

The act of selling unused, contracted power back to the grid when it is more profitable than mining. Common under fixed-price structures.

Spark Spread

A traditional energy market concept representing the difference between fuel costs and electricity sale revenue in power generation. Used to assess generator profitability.

Hashspark Spread

A Bitcoin mining adaptation of the spark spread. It measures the margin between fixed energy costs and locked-in hashrate revenue (e.g., via forward contracts), enabling predictable gross margins.

Energy Hashprice

The revenue a miner earns per unit of electricity consumed, typically expressed in $/MWh. It accounts for both hashprice and machine efficiency, making it the foundational breakeven metric for mining operations.

Hashprice

A measure of expected miner revenue per unit of hashrate, expressed in BTC or USD per PH/s/day. It reflects market dynamics such as BTC price, transaction fees, block subsidy, and network difficulty.

Hashrate Forward

A financial instrument allowing miners to sell future hashrate at a fixed hashprice (i.e., a fixed pool payout rate), locking in top-line revenue. Often used in conjunction with fixed power contracts to hedge both revenue and cost.

Volatility (Energy)

The degree of fluctuation in electricity prices over time. Higher volatility increases risk but can also create opportunities to monetize with short options or resale mechanisms.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.